Community Trust Bancorp, Inc. (NASDAQ: CTBI)

Earnings Summary

(in thousands

except per share data)

3Q2013

2Q2013

3Q2012

9 Months2013

9 Months2012

Net income $12,653 $11,942 $10,209 $36,415 $34,310 Earnings

per share $0.81 $0.77 $0.66 $2.34 $2.22 Earnings per share -

diluted $0.81 $0.76 $0.66 $2.33 $2.21 Return on average

assets 1.38% 1.31% 1.11% 1.33% 1.26% Return on average equity

12.39% 11.76% 10.26% 11.99% 11.89% Efficiency ratio 54.80% 55.21%

58.19% 55.89% 56.95% Tangible common equity 9.57% 9.35% 9.22%

Dividends declared per share $0.320 $0.315 $0.315 $0.950

$0.935 Book value per share $26.03 $25.56 $25.38 Weighted

average shares 15,594 15,565 15,491 15,566 15,450 Weighted

average shares - diluted 15,688 15,641

15,555 15,647 15,501

Community Trust Bancorp, Inc. (NASDAQ: CTBI) reports earnings

for the third quarter 2013 of $12.7 million, or $0.81 per basic

share, compared to $10.2 million, or $0.66 per basic share, earned

during the third quarter 2012 and $11.9 million, or $0.77 per basic

share, earned during the second quarter 2013. Earnings for the nine

months ended September 30, 2013 were $36.4 million, or $2.34 per

basic share, compared to $34.3 million, or $2.22 per basic share

for the nine months ended September 30, 2012.

3rd Quarter 2013 Highlights

- CTBI’s basic earnings per share for the

quarter increased $0.15 per share from the third quarter 2012 and

$0.04 per share from the second quarter 2013. Year-to-date basic

earnings per share increased $0.12 per share from prior year.

- Net interest income for the quarter

increased 3.3% from prior year third quarter and 2.4% from prior

quarter as our net interest margin increased 11 basis points and 8

basis points, respectively, for those time periods. Average earning

assets remained relatively stable from third quarter 2012 but

decreased 0.6% from prior quarter. Net interest income for the nine

months ended September 30, 2013 increased 2.4% from prior

year.

- Nonperforming loans at $42.3 million

increased $8.2 million from September 30, 2012 and $0.7 million

from June 30, 2013. Nonperforming assets at $84.7 million decreased

$4.9 million from September 30, 2012 but increased $0.1 million

from June 30, 2013.

- Net loan charge-offs for the quarter

ended September 30, 2013 were $1.7 million, or 0.26% of average

loans annualized, compared to $2.9 million, or 0.45%, experienced

for the third quarter 2012 and $3.5 million, or 0.54%, for the

second quarter 2013. Year-to-date net charge-offs were $6.6

million, or 0.34%, compared to $6.5 million, or 0.34%, for the nine

months ended September 30, 2012.

- Our loan loss provision for the quarter

decreased $0.8 million from prior year third quarter and $1.5

million from prior quarter. Year-to-date provision expense of $7.3

million is $0.8 million higher than 2012.

- Our loan loss reserve as a percentage

of total loans outstanding remained at 1.30% from September 30,

2012 to September 30, 2013. Our reserve coverage (allowance for

loan loss reserve to nonperforming loans) at September 30, 2013 was

80.5% compared to 97.5% at September 30, 2012 and 80.8% at June 30,

2013.

- Noninterest income increased 11.4% for

the quarter ended September 30, 2013 compared to the same period in

2012 but decreased 9.1% from prior quarter. Noninterest income for

the nine months ended September 30, 2013 increased 9.6%. The

increase year over year in noninterest income included increases in

gains on sales of loans, deposit service charges, trust revenue,

loan related fees, and bank owned life insurance income, offset

slightly by a decrease in securities gains; although, each of these

areas saw declines quarter over quarter except deposit service

charges.

- Noninterest expense for the quarter

ended September 30, 2013 decreased 0.9% from prior year third

quarter and 1.5% from prior quarter. Noninterest expense for the

nine months ended September 30, 2013 increased 2.9% from prior

year. The year over year increase from prior year resulted

primarily from increases in personnel expense, data processing

expense, and other real estate owned expense. The quarter over

quarter decrease is primarily due to decreased other real estate

owned expense.

- Our loan portfolio increased $64.8

million from September 30, 2012 and $31.6 million during the

quarter.

- Our investment portfolio increased

$42.7 million from September 30, 2012 but declined $23.4 million

during the quarter.

- Deposits, including repurchase

agreements, declined $41.3 million from September 30, 2012 and

$37.9 million during the quarter.

- Other interest bearing liabilities

increased $30 million at the end of the quarter due to an FHLB

advance which matured and was paid on October 2, 2013.

- Our tangible common equity/tangible

assets ratio remains strong at 9.57%.

Net Interest Income

Net interest income for the quarter increased $1.1 million from

prior year third quarter and $0.8 million from prior quarter as our

net interest margin increased 11 basis points and 8 basis points,

respectively. Average earning assets remained relatively stable

from third quarter 2012 but decreased 0.6% from prior quarter. The

yield on average earning assets decreased 13 basis points but

increased 6 basis points for these respective time periods. Loans

represented 77.0% of our average earning assets for the quarter

ended September 30, 2013 compared to 75.4% for the quarter ended

September 30, 2012 and 75.6% for the quarter ended June 30, 2013.

The cost of interest bearing funds decreased 31 basis points from

prior year third quarter and 2 basis points from prior quarter. Net

interest income for the nine months ended September 30, 2013

increased $2.3 million from prior year with average earning assets

increasing 1.1% and our net interest margin increasing 5 basis

points.

Noninterest Income

Noninterest income increased 11.4% for the quarter ended

September 30, 2013 compared to the same period in 2012 but

decreased 9.1% from prior quarter. Noninterest income for the nine

months ended September 30, 2013 increased 9.6%. The increase year

over year in noninterest income included increases in gains on

sales of loans, deposit service charges, trust revenue, loan

related fees, and bank owned life insurance income, offset slightly

by a decrease in securities gains; although, each of these areas

saw declines quarter over quarter except deposit service charges.

Loan related fees were impacted by a $0.3 million positive variance

year over year in fair value adjustments to our mortgage servicing

rights.

Noninterest Expense

Noninterest expense for the third quarter 2013 decreased 0.9%

from prior year third quarter and 1.5% from prior quarter.

Noninterest expense for the nine months ended September 30, 2013

increased 2.9% from prior year. The year over year increase from

prior year resulted primarily from a $0.9 million increase in

personnel expense, a $0.7 million increase in data processing

expense, and a $1.2 million increase in other real estate owned

expense. The quarter over quarter decrease is primarily due to a

$0.3 million decrease in other real estate owned expense.

Balance Sheet Review

CTBI’s total assets at $3.6 billion increased $2.3 million, or

0.1%, from September 30, 2012 and $5.6 million, or an annualized

0.6%, during the quarter. Loans outstanding at September 30, 2013

were $2.6 billion, increasing $64.8 million, or 2.5%, from

September 30, 2012 and $31.6 million, or an annualized 4.8%, during

the quarter. We experienced loan growth during the quarter of $22.7

million in the commercial loan portfolio, $4.8 million in the

residential loan portfolio, and $4.1 million in the consumer loan

portfolio. CTBI’s investment portfolio increased $42.7 million, or

6.9%, from September 30, 2012 but decreased $23.4 million, or an

annualized 13.5%, during the quarter. Deposits, including

repurchase agreements, at $3.1 billion decreased $41.3 million, or

1.3%, from September 30, 2012 and $37.9 million, or an annualized

4.8%, from prior quarter. Deposits in other banks declined $22.8

million during the quarter and $107.1 million from September 30,

2012 as a result of loan growth and a decline in deposits. Other

interest bearing liabilities increased $30 million at the end of

the quarter due to an FHLB advance which matured and was paid on

October 2, 2013.

Shareholders’ equity at September 30, 2013 was $408.7 million

compared to $396.1 million at September 30, 2012 and $400.3 million

at June 30, 2013. CTBI’s annualized dividend yield to shareholders

as of September 30, 2013 was 3.15%.

Asset Quality

CTBI’s total nonperforming loans were $42.3 million at September

30, 2013, a 24.2% increase from the $34.0 million at September 30,

2012 and a 1.7% increase from the $41.6 million at June 30, 2013.

The increase for the quarter included a $2.6 million increase in

the 90+ days past due category partially offset by a $1.9 million

decrease in nonaccrual loans. Loans 30-89 days past due at $23.3

million is an increase of $1.7 million from September 30, 2012 and

$6.8 million from June 30, 2013. Our loan portfolio management

processes focus on the immediate identification, management, and

resolution of problem loans to maximize recovery and minimize loss.

Impaired loans, loans not expected to meet contractual principal

and interest payments other than insignificant delays, at September

30, 2013 totaled $63.3 million, compared to $60.9 million at

September 30, 2012 and $63.4 million at June 30, 2013.

Our level of foreclosed properties at $42.5 million at September

30, 2013 was a decrease from $55.6 million at September 30, 2012

and $43.1 million at June 30, 2013. Sales of foreclosed properties

for the nine months ended September 30, 2013 totaled $8.7 million

while new foreclosed properties totaled $6.2 million. At September

30, 2013, the book value of properties under contracts to sell was

$4.3 million; however, the closings had not occurred at

quarter-end.

Net loan charge-offs for the quarter ended September 30, 2013

were $1.7 million, or 0.26% of average loans annualized, compared

to $2.9 million, or 0.45%, experienced for the third quarter 2012

and $3.5 million, or 0.54%, for the second quarter 2013. Of the

total net charge-offs for the quarter, $0.7 million were in

commercial loans, $0.5 million were in indirect auto loans, and

$0.3 million were in residential real estate mortgage loans.

Year-to-date net charge-offs were $6.6 million, or 0.34%, compared

to $6.5 million, or 0.34%, for the nine months ended September 30,

2012. Allocations to loan loss reserves were $2.1 million for the

quarter ended September 30, 2013 compared to $2.9 million for the

quarter ended September 30, 2012 and $3.7 million for the quarter

ended June 30, 2013. Our loan loss reserve as a percentage of total

loans outstanding has remained at 1.30% from September 30, 2012 to

September 30, 2013.

Recent Form 8-K Filing

On October 11, 2013, CTBI filed an 8-K to disclose that the

Federal Reserve has made requests for information and is currently

investigating Community Trust Bank’s (“CTB”) overdraft

fee assessment methodology. On October 7, 2013, representatives of

the Federal Reserve informed CTB that Federal Reserve staff is

recommending that the Federal Reserve Division of Consumer and

Community Affairs cite CTB for a violation based on an unfair and

deceptive practice. CTBI continues to believe that CTB’s practices

are neither unfair nor deceptive and are consistent with

methodologies prevalent in the banking industry. If the Federal

Reserve takes such action, it would likely result in material

adverse consequences to CTBI and its affiliates. Such adverse

consequences may be material to the financial position of CTBI or

its results of operations. CTBI expects to recognize an accrual

against earnings with respect to this matter, but cannot reasonably

estimate the amount of such accrual until additional information is

received from the Federal Reserve.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “may increase,” “may

fluctuate,” and similar expressions or future or conditional verbs

such as “will,” “should,” “would,” and “could.” These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations’ savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI’s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.6 billion, is

headquartered in Pikeville, Kentucky and has 71 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp,

Inc.Financial Summary (Unaudited)September 30,

2013(in thousands except per share data and # of employees)

Three Three

Three Nine

Nine Months Months Months Months Months Ended

Ended Ended Ended Ended September 30, 2013

June 30, 2013 September 30, 2012

September 30, 2013 September 30, 2012 Interest

income $ 37,455 $ 36,783 $ 38,450 $ 111,014 $ 115,631 Interest

expense 3,305 3,441

5,404

10,325 17,260 Net

interest income 34,150 33,342 33,046 100,689 98,371 Loan loss

provision 2,129 3,661 2,919 7,349 6,504 Gains on sales of

loans 653 755 660 2,805 1,982 Deposit service charges 6,349 6,182

6,038 18,298 17,865 Trust revenue 2,005 2,023 1,734 6,028 5,169

Loan related fees 1,088 1,496 631 3,532 2,528 Securities gains (23

) (8 ) - (31 ) 819 Other noninterest income 1,999

2,826 1,775

6,633 5,651

Total noninterest income 12,071 13,274 10,838 37,265

34,014 Personnel expense 13,248 13,214 13,285 39,444 38,500

Occupancy and equipment 2,865 2,960 2,926 8,730 8,551 FDIC

insurance premiums 624 637 643 1,863 1,913 Amortization of core

deposit intangible 53 53 53 160 160 Other noninterest expense

8,801 9,123

8,906 27,680

26,587 Total noninterest expense

25,591 25,987 25,813 77,877 75,711 Net income before taxes

18,501 16,968 15,152 52,728 50,170 Income taxes 5,848

5,026 4,943

16,313

15,860 Net income $ 12,653

$ 11,942 $ 10,209

$ 36,415 $ 34,310 Memo:

TEQ interest income $ 37,905 $ 37,230 $ 38,922 $ 112,356 $ 117,007

Average shares outstanding 15,594 15,565 15,491 15,566

15,450 Diluted average shares outstanding 15,688 15,641 15,555

15,647 15,501 Basic earnings per share $ 0.81 $ 0.77 $ 0.66 $ 2.34

$ 2.22 Diluted earnings per share $ 0.81 $ 0.76 $ 0.66 $ 2.33 $

2.21 Dividends per share $ 0.320 $ 0.315 $ 0.315 $ 0.950 $ 0.935

Average balances: Loans $ 2,596,805 $ 2,566,536 $

2,542,832 $ 2,572,096 $ 2,547,890 Earning assets 3,372,755

3,393,342 3,371,420 3,386,571 3,348,807 Total assets 3,638,742

3,665,249 3,650,422 3,654,547 3,635,890 Deposits, including

repurchase agreements 3,121,466 3,139,180 3,145,049 3,132,032

3,138,332 Interest bearing liabilities 2,578,567 2,597,011

2,611,981 2,591,766 2,614,379

Shareholders’ equity

405,043 407,203 395,902 405,930 385,526

Performance

ratios: Return on average assets 1.38 % 1.31 % 1.11 % 1.33 %

1.26 % Return on average equity 12.39 % 11.76 % 10.26 % 11.99 %

11.89 % Yield on average earning assets (tax equivalent) 4.46 %

4.40 % 4.59 % 4.44 % 4.67 % Cost of interest bearing funds (tax

equivalent) 0.51 % 0.53 % 0.82 % 0.53 % 0.88 % Net interest margin

(tax equivalent) 4.07 % 3.99 % 3.96 % 4.03 % 3.98 % Efficiency

ratio (tax equivalent) 54.80 % 55.21 % 58.19 % 55.89 % 56.95 %

Loan charge-offs $ 2,519 $ 4,115 $ 3,664 $ 8,822 $ 8,997

Recoveries (802 ) (662 )

(800 ) (2,241 )

(2,511 ) Net charge-offs $ 1,717 $ 3,453 $ 2,864 $

6,581 $ 6,486

Market Price: High $ 41.54 $ 36.60 $

36.92 $ 41.54 $ 36.92 Low $ 35.80 $ 32.15 $ 33.15 $ 32.15 $ 29.13

Close $ 40.59 $ 35.62 $ 35.53 $ 40.59 $ 35.53

Community Trust Bancorp,

Inc.Financial Summary (Unaudited)September 30,

2013(in thousands except per share data and # of employees)

As of As of

As of September 30, 2013

June 30, 2013 September 30, 2012

Assets: Loans $ 2,616,365 $ 2,584,801 $ 2,551,537 Loan loss

reserve (34,013 ) (33,601 )

(33,189 ) Net loans 2,582,352 2,551,200

2,518,348 Loans held for sale 768 2,991 771 Securities AFS 663,916

687,362 621,230 Securities HTM 1,662 1,662 1,662 Other equity

investments 30,559 30,559 30,558 Other earning assets 46,156 63,071

153,663 Cash and due from banks 74,252 56,100 59,480 Premises and

equipment 51,898 52,703 55,068 Goodwill and core deposit intangible

66,234 66,287 66,447 Other assets 126,057

126,316 134,304

Total Assets $ 3,643,854

$ 3,638,251 $ 3,641,531

Liabilities and Equity: NOW accounts $ 26,889 $

28,191 $ 22,200 Savings deposits 864,073 874,800 848,068

CD’s >=$100,000

627,347 641,979 647,433 Other time deposits 739,179

752,752

794,159 Total interest bearing deposits 2,257,488

2,297,722 2,311,860 Noninterest bearing deposits

616,796 624,451

599,984 Total deposits 2,874,284 2,922,173

2,911,844 Repurchase agreements 214,755 204,735 218,511 Other

interest bearing liabilities 106,590 76,763 71,634 Noninterest

bearing liabilities 39,548

34,236 43,445

Total liabilities 3,235,177 3,237,907 3,245,434

Shareholders’ equity

408,677 400,344

396,097

Total Liabilities and

Equity $ 3,643,854 $ 3,638,251

$ 3,641,531 Ending shares

outstanding 15,698 15,665 15,604 Memo: Market value of HTM

securities $ 1,614 $ 1,621 $ 1,664 30 - 89 days past due

loans $ 23,274 $ 16,507 $ 21,539 90 days past due loans 25,133

22,562 15,928 Nonaccrual loans 17,131 19,012 18,098 Restructured

loans (excluding 90 days past due and nonaccrual) 42,630 42,181

28,493 Foreclosed properties 42,481 43,080 55,551 Other repossessed

assets - - 25 Tier 1 leverage ratio 11.29 % 11.01 % 10.51 %

Tier 1 risk based ratio 15.71 % 15.52 % 14.86 % Total risk based

ratio 16.96 % 16.77 % 16.12 % Tangible equity to tangible assets

ratio 9.57 % 9.35 % 9.22 % FTE employees 1,026 1,045 1,032

Community Trust Bancorp,

Inc.Financial Summary (Unaudited)September 30,

2013(in thousands except per share data and # of employees)

Community Trust Bancorp, Inc. reported earnings for the

three and nine months ending September 30, 2013 and 2012 as

follows: Three Months Ended

Nine Months Ended September 30

September 30 2013

2012 2013 2012 Net

income $ 12,653 $ 10,209 $ 36,415 $

34,310 Basic earnings per share $ 0.81 $ 0.66 $ 2.34 $ 2.22

Diluted earnings per share $ 0.81 $ 0.66 $ 2.33 $ 2.21

Average shares outstanding 15,594 15,491 15,566 15,450

Total assets (end of period) $ 3,643,854 $ 3,641,531

Return on average equity 12.39 % 10.26 % 11.99 % 11.89 %

Return on average assets 1.38 % 1.11 % 1.33 % 1.26 %

Provision for loan losses $ 2,129 $ 2,919 $ 7,349 $ 6,504

Gains on sales of loans $ 653 $ 660 $ 2,805 $ 1,982

Community Trust Bancorp, Inc.Jean R. Hale, 606-437-3294Chairman,

President, and C.E.O.

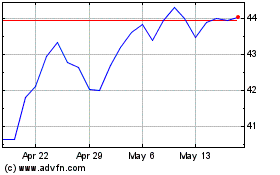

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

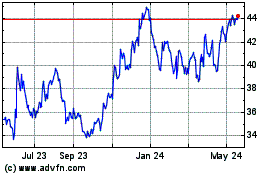

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024