Mutual Fund Summary Prospectus (497k)

January 31 2013 - 3:01PM

Edgar (US Regulatory)

Summary Prospectus Supplement

January 31, 2013

Morgan Stanley Institutional Fund Trust

Supplement dated January 31, 2013 to the Morgan Stanley Institutional Fund Trust Summary Prospectus dated January 31, 2013 of:

Mid Cap Growth Portfolio

(the "Portfolio")

The Board of Trustees of Morgan Stanley Institutional Fund Trust (the "Fund") has approved (i) the imposition of a maximum initial sales charge of 5.25% on purchases of Class P shares of the Portfolio; (ii) a decrease in the minimum initial investment amount for Class P shares of the Portfolio from $1,000,000 to $1,000; and (iii) a decrease in the minimum initial investment amount for Class L shares of the Portfolio from $25,000 to $1,000. As a result, the following changes to the Summary Prospectus are effective as of February 25, 2013:

The first paragraph in section of the Summary Prospectus entitled "Fees and Expenses" is hereby deleted and replaced with the following:

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. For shareholders of Class P and Class H shares, you may qualify for sales charge discounts if the cumulative net asset value ("NAV") of Class P or Class H shares of the Portfolio purchased in a single transaction, together with the NAV of all Class P or Class H shares of a portfolio of Morgan Stanley Institutional Fund Trust (the "Fund") or of a portfolio of Morgan Stanley Institutional Fund, Inc. held in related accounts, amounts to $25,000 or more with respect to Class P and $50,000 or more. More information about these and other discounts is available from your financial adviser and in the "Purchasing Class P and Class H Shares" section on page 12 of the Prospectus.

***

The following replaces the "Shareholder Fees" table with respect to Class P shares only in the section of the Summary Prospectus entitled "Fees and Expenses:"

|

|

|

Class P

|

|

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price)

|

|

|

5.25

|

%

|

|

***

The following table replaces the "Example" table with respect to Class P shares only in the section of the Summary Prospectus entitled "Example:"

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

Class P

|

|

$

|

618

|

|

|

$

|

815

|

|

|

$

|

1,028

|

|

|

$

|

1,641

|

|

|

***

The following table replaces the "Average Annual Total Returns For Periods Ended December 31, 2012" table with respect to Class P shares only in the section of the Summary Prospectus entitled "Performance Information—Average Annual Total Returns For Periods Ended December 31, 2012:"

|

|

|

Past

One Year

|

|

Past

Five Years

|

|

Past

Ten Years

|

|

Class P

(commenced operations on 1/31/97)†

Return before Taxes

|

|

|

3.44

|

%

|

|

|

1.39

|

%

|

|

|

11.42

|

%

|

|

† The historical performance of Class P shares has been restated to reflect the current maximum initial sales charge of 5.25%.

***

The second, third and fourth paragraphs under the section of the Summary Prospectus entitled "Purchase and Sale of Fund Shares" is hereby deleted and replaced with the following:

The minimum initial investment generally is $5,000,000 for Class I shares, $25,000 for Class H and $1,000 for each of Class L and Class P shares of the Portfolio. You may not be subject to the minimum investment requirements under certain circumstances. For more information, please refer to the "Purchasing Class I and Class L Shares—Share Class Arrangements," "—Other Purchase Information" and "Purchasing Class P and Class H Shares" sections beginning on pages 10, 11 and 12, respectively, of the Prospectus.

Class I and Class L shares may be purchased or sold on any day the New York Stock Exchange ("NYSE") is open for business directly through Morgan Stanley Institutional Fund Trust (the "Fund") by mail (c/o Morgan Stanley Services Company Inc., P.O. Box 219804, Kansas City, MO 64121-9804) or by telephone (1-800-548-7786) or by contacting your financial intermediary. For more information, please refer to the "Purchasing Class I and Class L Shares" and "Redeeming Shares" sections beginning on pages 10 and 15, respectively, of the Prospectus.

Class P and Class H shares of the Portfolio may be purchased or redeemed by contacting your authorized financial representative. For more information, please refer to the "Purchasing Class P and Class H Shares" and "Redeeming Shares" sections beginning on pages 12 and 15, respectively, of the Prospectus.

Please retain this supplement for future reference.

IFTMCGSUMSPT1 1/13

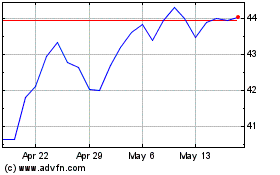

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

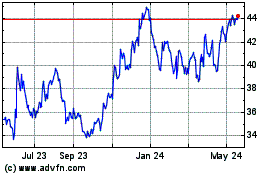

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024