Community Trust Bancorp, Inc. (NASDAQ:CTBI):

Earnings Summary (in thousands except per share data)

3Q

2012

2Q

2012

3Q

2011

9 Months

2012

9 Months

2011

Net income $10,209 $12,232 $10,665 $34,310 $28,939 Earnings per

share $0.66 $0.79 $0.70 $2.22 $1.89 Earnings per share - diluted

$0.66 $0.79 $0.70 $2.21 $1.89 Return on average assets 1.11%

1.35% 1.20% 1.26% 1.11% Return on average equity 10.26% 12.77%

11.75% 11.89% 10.99% Efficiency ratio 58.19% 54.94% 58.10% 56.95%

60.25% Tangible common equity 9.22% 8.99% 8.44% 9.22% 8.44%

Dividends declared per share $0.315 $0.310 $0.310 $0.935 $0.920

Book value per share $25.38 $24.88 $23.44 $25.38 $23.44

Weighted average shares 15,491 15,451 15,318 15,450 15,307 Weighted

average shares - diluted 15,555 15,501

15,339 15,501 15,331

Community Trust Bancorp, Inc. (NASDAQ:CTBI) reports earnings for

the third quarter 2012 of $10.2 million, or $0.66 per basic share,

compared to $10.7 million, or $0.70 per basic share, earned during

the third quarter 2011 and $12.2 million, or $0.79 per basic share,

earned during the second quarter 2012. Earnings for the nine months

ended September 30, 2012 were $34.3 million, or $2.22 per basic

share, a 18.6% increase from the $28.9 million, or $1.89 per basic

share earned during the first nine months of 2011.

3rd Quarter 2012 Highlights

- CTBI's basic earnings per share for the

quarter decreased $0.04 per share from third quarter 2011 and $0.13

per share from second quarter 2012. Year-to-date basic earnings per

share, however, increased $0.33 per share from prior year. The

year-to-date increase in earnings was supported by increased

noninterest income and decreased provision for loan loss and

noninterest expense.

- Net interest income for the quarter

decreased slightly from prior year third quarter but increased $0.7

million from prior quarter as our net interest margin declined 15

basis points and increased 3 basis points, respectively, for those

time periods. Year-to-date net interest income decreased $0.2

million as our net interest margin declined 20 basis points.

- Nonperforming loans at $34.0 million

decreased $3.5 million from September 30, 2011 and $1.3 million

from June 30, 2012. Nonperforming assets at $89.6 million decreased

$6.0 million from prior year and $1.6 million from prior

quarter.

- Net loan charge-offs for the quarter

ended September 30, 2012 were $2.9 million, or 0.45% of average

loans annualized, compared to $2.7 million, or 0.41%, experienced

for the third quarter 2011 and prior quarter’s $2.5 million, or

0.39%. Year-to-date net charge-offs for the nine months ended

September 30, 2012 were $6.5 million compared to $10.0 million for

the nine months ended September 30, 2011.

- Our loan loss provision for the quarter

increased $0.4 million from prior year third quarter and $0.5

million from prior quarter. Our loan loss provision for the first

nine months of 2012 was $3.7 million below the first nine months of

2011 as net charge-offs declined $3.5 million and loans declined

$22.0 million.

- Our loan loss reserve as a percentage

of total loans outstanding remained at 1.30% from June 30, 2012 to

September 30, 2012, a decrease from the 1.36% at September 30,

2011. Our reserve coverage (allowance for loan loss reserve to

nonperforming loans) at September 30, 2012 was 97.5% compared to

93.3% at September 30, 2011 and 93.8% at June 30, 2012.

- Noninterest income decreased 0.9% for

the quarter ended September 30, 2012 compared to the same period in

2011 and 9.6% from prior quarter. However, noninterest income for

the first nine months of 2012 has increased 5.4% as a result of

increased gains on sales of loans, trust revenue, and loan related

fees, as well as a $0.8 million net securities gain in the second

quarter.

- Noninterest expense for the quarter

ended September 30, 2012 decreased slightly from prior year third

quarter but increased 6.9% from prior quarter. Year-to-date

noninterest expense decreased 4.8% from prior year as a result of

decreases in FDIC insurance premiums, legal fees, other real estate

owned expense, and repossession expense, partially offset by an

increase in personnel expense.

- Our loan portfolio decreased $22.0

million from prior year but increased $4.1 million during the

quarter.

- Our investment portfolio increased

$157.6 million from prior year but decreased $8.0 million during

the quarter.

- Deposits, including repurchase

agreements, increased $92.5 million from prior year but declined

$12.2 million from prior quarter.

- Our tangible common equity/tangible

assets ratio remains strong at 9.22%.

Net Interest Income

Net interest income for the quarter decreased slightly from

prior year but increased $0.7 million from prior quarter with

average earning assets increasing 4.3% and 0.5% and our net

interest margin declining 15 basis points and increasing 3 basis

points for the same periods. The yield on average earning assets

decreased 33 basis points from prior year third quarter and 6 basis

points from prior quarter. Loans represented 75.4% of our average

earning assets for the quarter ended September 30, 2012 compared to

79.7% for the quarter ended September 30, 2011 and 75.8% for the

quarter ended June 30, 2012. The cost of interest bearing funds

decreased 21 basis points from prior year third quarter and 10

basis points from prior quarter. Net interest income for the first

nine months of 2012 decreased 0.2% as our net interest margin

declined 20 basis points and average earning assets increased 5.0%.

The increased cost of our Hoops CD product resulting from the

University of Kentucky’s national championship win increased our

cost of interest bearing funds and decreased our net interest

margin by approximately 7 basis points during the second quarter

and 6 basis points in the third quarter 2012. The fourth quarter

2012 impact is expected to be 2 basis points as the CDs begin to

mature. The impact to the net interest margin for the year 2012 as

a result of the rate increase is expected to be approximately 4

basis points.

Noninterest Income

Noninterest income decreased 0.9% for the quarter ended

September 30, 2012 compared to the same period in 2011 and 9.6%

from prior quarter. Noninterest income for the first nine months of

2012 has increased 5.4% as a result of increased gains on sales of

loans, trust revenue, and loan related fees, partially offset by a

decline in deposit service charges. Loan related fees were impacted

by $0.5 million in adjustments to the fair value of our mortgage

servicing rights for the first nine months of the year. Noninterest

income was also impacted by a $0.8 million net securities gain in

the second quarter 2012.

Noninterest Expense

Noninterest expense decreased slightly from prior year third

quarter but increased 6.9% from prior quarter primarily due to an

increase in the incentive compensation accrual and other real

estate owned expense. Year-to-date noninterest expense decreased

4.8% from prior year as a result of decreases in FDIC insurance

premiums, legal fees, other real estate owned expense, and

repossession expense, partially offset by an increase in personnel

expense.

Balance Sheet Review

CTBI’s total assets at $3.6 billion increased $84.9 million, or

2.4%, from September 30, 2011 and $5.8 million, or an annualized

0.6%, during the quarter. Loans outstanding at September 30, 2012

were $2.6 billion, decreasing $22.0 million, or 0.9%, from

September 30, 2011, but increasing $4.1 million, or an annualized

0.6%, during the quarter. Loan growth during the quarter of $2.6

million in the commercial loan portfolio and $14.1 million in the

residential loan portfolio was partially offset by a decline of

$12.5 million in the consumer loan portfolio, primarily in our

indirect auto lending area. CTBI's investment portfolio increased

$157.6 million, or 33.9%, from September 30, 2011 but decreased

$8.0 million, or an annualized 5.1%, during the quarter. Deposits,

including repurchase agreements, at $3.1 billion increased $92.5

million, or 3.0%, from September 30, 2011 but decreased $12.2

million, or an annualized 1.5%, from prior quarter.

Shareholders’ equity at September 30, 2012 was $396.1 million

compared to $361.3 million at September 30, 2011 and $387.3 million

at June 30, 2012. CTBI's annualized dividend yield to shareholders

as of September 30, 2012 was 3.55%.

Asset Quality

CTBI's total nonperforming loans were $34.0 million at September

30, 2012, a 9.3% decrease from the $37.5 million at September 30,

2011 and a 3.6% decrease from the $35.3 million at June 30, 2012.

The decrease for the quarter included a $2.4 million decrease in

nonaccrual loans partially offset by a $1.1 million increase in the

90+ days past due category. Loans 30-89 days past due at $21.5

million is a decline of $4.6 million from September 30, 2011 but a

$4.5 million increase from prior quarter. Our loan portfolio

management processes focus on the immediate identification,

management, and resolution of problem loans to maximize recovery

and minimize loss. Impaired loans, loans not expected to meet

contractual principal and interest payments other than

insignificant delays, at September 30, 2012 totaled $60.9 million,

compared to $56.0 million at September 30, 2011 and $64.4 million

at June 30, 2012.

Our level of foreclosed properties at $55.6 million at September

30, 2012 was a decrease from $58.0 million at September 30, 2011

and $55.9 million at June 30, 2012. Sales of foreclosed properties

for the nine months ended September 30, 2012 totaled $11.0 million

while new foreclosed properties totaled $10.7 million. At September

30, 2012, the book value of properties under contracts to sell was

$7.3 million; however, the closings had not occurred at

quarter-end.

Net loan charge-offs for the quarter were $2.9 million, or 0.45%

of average loans annualized, compared to prior year third quarter's

$2.7 million, or 0.41%, and prior quarter’s $2.5 million, or 0.39%.

Of the total net charge-offs for the quarter, $1.7 million were in

commercial loans, $0.5 million were in indirect auto loans, and

$0.4 million were in residential real estate mortgage loans.

Allocations to loan loss reserves were $2.9 million for the quarter

ended September 30, 2012 compared to $2.5 million for the quarter

ended September 30, 2011 and $2.4 million for the quarter ended

June 30, 2012. Year-to-date net charge-offs of $6.5 million, or

0.34% of average loans annualized, was a $3.5 million decrease from

the $10.0 million, 0.52% of average loans annualized, for the nine

months ended September 30, 2011. Our loan loss reserve as a

percentage of total loans outstanding was 1.30% at September 30,

2012 and June 30, 2012 compared to 1.36% at September 30, 2011. Our

reserve coverage was 97.5% at September 30, 2012.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as "believe,"

"expect," "anticipate," "intend," "estimate," "may increase," "may

fluctuate," and similar expressions or future or conditional verbs

such as "will," "should," "would," and "could." These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations’ savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI’s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.6 billion, is

headquartered in Pikeville, Kentucky and has 71 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) September 30, 2012 (in thousands except per

share data and # of employees)

Three Three Three Nine Nine Months Months Months Months

Months Ended Ended Ended Ended Ended September 30, 2012 June 30,

2012 September 30, 2011 September 30, 2012 September 30, 2011

Interest income $ 38,450 $ 38,355 $ 39,708 $ 115,631 $ 119,409

Interest expense 5,404 6,036

6,613 17,260 20,862 Net interest

income 33,046 32,319 33,095 98,371 98,547 Loan loss provision 2,919

2,425 2,515 6,504 10,222 Gains on sales of loans 660 705 438

1,982 1,166 Deposit service charges 6,038 5,955 6,681 17,865 18,999

Trust revenue 1,734 1,822 1,597 5,169 4,790 Loan related fees 631

610 250 2,528 1,609 Securities gains - 819 - 819 - Other

noninterest income 1,775 2,078

1,976 5,651 5,709 Total

noninterest income 10,838 11,989 10,942 34,014 32,273

Personnel expense 13,285 12,402 12,240 38,500 37,041 Occupancy and

equipment 2,926 2,854 3,021 8,551 8,824 FDIC insurance premiums 643

613 591 1,913 2,554 Amortization of core deposit intangible 53 54

53 160 160 Other noninterest expense 8,906

8,225 9,922 26,587 30,941

Total noninterest expense 25,813 24,148

25,827 75,711 79,520

Net income before taxes 15,152 17,735 15,695 50,170

41,078 Income taxes 4,943 5,503

5,030 15,860 12,139 Net income $

10,209 $ 12,232 $ 10,665 $ 34,310 $

28,939 Memo: TEQ interest income $ 38,922 $ 38,821 $

40,122 $ 117,007 $ 120,569 Average shares outstanding 15,491

15,451 15,318 15,450 15,307 Diluted average shares outstanding

15,555 15,501 15,339 15,501 15,331 Basic earnings per share $ 0.66

$ 0.79 $ 0.70 $ 2.22 $ 1.89 Diluted earnings per share $ 0.66 $

0.79 $ 0.70 $ 2.21 $ 1.89 Dividends per share $ 0.315 $ 0.310 $

0.310 $ 0.935 $ 0.920

Average balances: Loans $

2,542,832 $ 2,542,344 $ 2,577,585 $ 2,547,890 $ 2,585,172 Earning

assets 3,371,420 3,355,155 3,232,322 3,348,807 3,188,404 Total

assets 3,650,422 3,647,002 3,516,394 3,635,890 3,470,311 Deposits

2,940,138 2,940,244 2,819,166 2,926,848 2,791,900 Interest bearing

liabilities 2,611,981 2,625,760 2,542,397 2,614,379 2,522,441

Shareholders' equity 395,902 385,231 360,273 385,526 352,208

Performance ratios: Return on average assets 1.11 % 1.35 %

1.20 % 1.26 % 1.11 % Return on average equity 10.26 % 12.77 % 11.75

% 11.89 % 10.99 % Yield on average earning assets (tax equivalent)

4.59 % 4.65 % 4.92 % 4.67 % 5.06 % Cost of interest bearing funds

(tax equivalent) 0.82 % 0.92 % 1.03 % 0.88 % 1.11 % Net interest

margin (tax equivalent) 3.96 % 3.93 % 4.11 % 3.98 % 4.18 %

Efficiency ratio (tax equivalent) 58.19 % 54.94 % 58.10 % 56.95 %

60.25 % Loan charge-offs $ 3,664 $ 3,207 $ 3,360 $ 8,997 $

12,088 Recoveries (800 ) (744 ) (692 )

(2,511 ) (2,060 ) Net charge-offs $ 2,864 $ 2,463 $ 2,668 $

6,486 $ 10,028

Market Price: High $ 36.92 $ 33.68 $

28.82 $ 36.92 $ 30.35 Low 33.15 30.25 22.64 29.13 22.64 Close 35.53

33.49 23.29 35.53 23.29

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2012

(in thousands except per share data and #

of employees)

As of As of As of September 30, 2012 June 30, 2012 September

30, 2011

Assets: Loans $ 2,551,537 $ 2,547,436 $ 2,573,557

Loan loss reserve (33,189 ) (33,134 ) (34,999

) Net loans 2,518,348 2,514,302 2,538,558 Loans held for sale 771

1,040 826 Securities AFS 621,230 629,242 463,610 Securities HTM

1,662 1,662 1,662 Other equity investments 30,558 30,557 30,556

Other earning assets 153,663 130,282 192,300 Cash and due from

banks 59,480 71,010 73,236 Premises and equipment 55,068 54,855

55,168 Goodwill and core deposit intangible 66,447 66,500 66,660

Other assets 134,304 136,277

134,085

Total Assets $ 3,641,531 $ 3,635,727

$ 3,556,661

Liabilities and Equity: NOW

accounts $ 22,200 $ 18,970 $ 19,701 Savings deposits 848,068

861,211 734,660 CD's >=$100,000 647,433 646,243 631,991 Other

time deposits 794,159 803,211

820,409 Total interest bearing deposits 2,311,860 2,329,635

2,206,761 Noninterest bearing deposits 599,984

611,080 602,061 Total deposits 2,911,844

2,940,715 2,808,822 Repurchase agreements 218,511 201,850 229,000

Other interest bearing liabilities 71,634 70,845 99,344 Noninterest

bearing liabilities 43,445 34,984

58,217 Total liabilities 3,245,434 3,248,394

3,195,383 Shareholders' equity 396,097 387,333

361,278

Total Liabilities and Equity $

3,641,531 $ 3,635,727 $ 3,556,661

Ending shares outstanding 15,604 15,569 15,415 Memo: Market value

of HTM securities $ 1,664 $ 1,662 $ 1,663 30 - 89 days past

due loans $ 21,539 $ 17,067 $ 26,177 90 days past due loans 15,928

14,811 9,543 Nonaccrual loans 18,098 20,500 27,986 Restructured

loans (excluding 90 days past due and nonaccrual) 22,745 22,532

21,347 Foreclosed properties 55,551 55,884 58,004 Other repossessed

assets 25 34 58 Tier 1 leverage ratio 10.51 % 10.32 % 10.00

% Tier 1 risk based ratio 14.86 % 14.54 % 13.65 % Total risk based

ratio 16.12 % 15.82 % 14.92 % Tangible equity to tangible assets

ratio 9.22 % 8.99 % 8.44 % FTE employees 1,032 1,034 1,019

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2012

(in thousands except per share data and #

of employees)`

Community Trust Bancorp, Inc. reported earnings for the

three and nine months ending September 30, 2012 and 2011 as

follows: Three Months Ended Nine

Months Ended

September 30 September 30

2012 2011 2012 2011 Net income $ 10,209 $ 10,665 $ 34,310 $ 28,939

Basic earnings per share $ 0.66 $ 0.70 $ 2.22 $ 1.89

Diluted earnings per share $ 0.66 $ 0.70 $ 2.21 $ 1.89

Average shares outstanding 15,491 15,318 15,450 15,307 Total

assets (end of period) $ 3,641,531 $ 3,556,661 Return on

average equity 10.26 % 11.75 % 11.89 % 10.99 % Return on

average assets 1.11 % 1.20 % 1.26 % 1.11 % Provision for

loan losses $ 2,919 $ 2,515 $ 6,504 $ 10,222 Gains on sales

of loans $ 660 $ 438 $ 1,982 $ 1,166

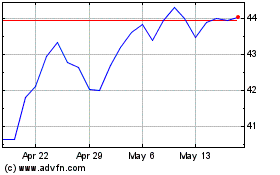

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

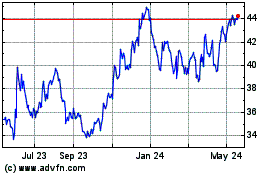

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024