Community Trust Bancorp, Inc. (NASDAQ: CTBI):

Earnings Summary

(in thousands except per share data)

3Q

2010

2Q

2010

3Q

2009

9 Months

2010

9 Months

2009

Net income $ 8,450 $ 8,553 $ 5,584 $ 23,794 $ 18,101 Earnings per

share $ 0.55 $ 0.56 $ 0.37 $ 1.56 $ 1.20 Earnings per

share--diluted $ 0.55 $ 0.56 $ 0.37 $ 1.56 $ 1.19 Return on

average assets 1.04% 1.06% 0.72% 1.00% 0.80% Return on average

equity 9.95% 10.40% 6.94% 9.62% 7.65% Efficiency ratio 59.52%

60.41% 61.67% 59.79% 64.59% Tangible common equity 8.58% 8.43%

8.51% 8.58% 8.51% Dividends declared per share $ 0.305 $

0.30 $ 0.30 $ 0.905 $ 0.90 Book value per share $ 22.10 $ 21.69 $

21.04 $ 22.10 $ 21.04 Weighted average shares 15,239 15,228

15,145 15,223 15,116 Weighted average shares--diluted

15,275 15,305 15,198

15,260 15,207

Community Trust Bancorp, Inc. (NASDAQ: CTBI) reports earnings

for the third quarter 2010 of $8.5 million or $0.55 per basic share

compared to $5.6 million or $0.37 per basic share earned during the

third quarter of 2009 and $8.6 million or $0.56 per basic share

earned during the quarter ended June 30, 2010. Earnings for the

nine months ended September 30, 2010 were $23.8 million or $1.56

per basic share compared to $18.1 million or $1.20 per basic share

for the nine months ended September 30, 2009.

CTBI continues to maintain a significantly higher level of

capital than required by regulatory authorities to be designated as

well-capitalized. On September 30, 2010, our Tangible Common

Equity/Tangible Assets Ratio remained considerably higher than our

peer institutions at 8.58%, our Tier 1 Leverage Ratio of 10.22% was

522 basis points higher than the 5.00% required, our Tier 1

Risk-Based Capital Ratio of 13.37% was 737 basis points higher than

the required 6.00%, and our Total Risk-Based Capital Ratio of

14.62% was 462 basis points higher than the 10.00% regulatory

requirement for this designation.

Third Quarter 2010 Highlights

- CTBI's quarterly basic earnings per

share increased $0.18 per share from third quarter 2009 but

decreased $0.01 per share from second quarter 2010. Year-to-date

basic earnings per share increased $0.36 per share from prior year.

Year-to-date earnings were positively impacted by increased net

interest income, partially offset by decreased noninterest income

and increased noninterest expense.

- CTBI experienced significant

improvement in our net interest margin year over year; however, our

net interest margin for the quarter decreased 5 basis points from

second quarter 2010.

- As problem loans continued to work

through the collection process, nonperforming loans increased from

the $45.2 million at September 30, 2009 to $56.6 million but

decreased $5.7 million during the third quarter 2010 compared to

$62.3 million at June 30, 2010. The linked quarter decrease in

nonperforming loans was in the nonaccrual classification.

Nonperforming assets increased $15.9 million from prior year third

quarter but decreased $4.8 million from prior quarter-end.

- The loan loss provision for the quarter

decreased $2.1 million from prior year same quarter but increased

$0.6 million from prior quarter. The loan loss provision for the

nine months ended September 30, 2010 increased $0.2 million from

prior year.

- Net loan charge-offs for the quarter

ended September 30, 2010 of $5.6 million, or 0.91% of average loans

annualized, was an increase from the $5.2 million, or 0.87%,

experienced for the second quarter 2009 and from prior quarter’s

$1.8 million, or 0.30%, as previously identified problem credits

work through the liquidation process.

- Our loan loss reserves as a percentage

of total loans outstanding at September 30, 2010 were 1.40%

compared to 1.33% at September 30, 2009 and 1.48% at June 30, 2010

as specific reserves were utilized in the liquidation of previously

identified problem credits.

- Noninterest income increased for the

quarter ended September 30, 2010 compared to same period 2009 and

prior quarter as a result of increased gains on sales of loans and

the change in the fair value of our mortgage servicing rights

portfolio. Year-to-date noninterest income decreased $1.1 million

due to declines in gains on sales of loans and the fair value of

mortgage servicing rights, partially offset by increases in trust

revenue and deposit service charges.

- Our loan portfolio increased $42.8

million year over year and $4.3 million, an annualized rate of

0.7%, during the quarter with increases in the commercial and

residential loan portfolios offset partially by a decline in the

consumer loan portfolio.

- Our investment portfolio increased

$38.2 million from prior year but declined $20.4 million during the

quarter.

- Our tangible common equity/tangible

assets ratio remains strong at 8.58%.

- CTBI has received both LaFollette

First National Corporation shareholder approval and regulatory

approval for its acquisition of LaFollette First National

Corporation and First National Bank of LaFollette, the wholly-owned

subsidiary of LaFollette Corporation. CTBI anticipates the

acquisition will be completed in November 2010.

Net Interest Income

CTBI saw improvement in its net interest margin of 37 basis

points for the first nine months of 2010 and 14 basis points for

the third quarter 2010 compared to 2009; however, we saw a 5 basis

point decline from prior quarter. Net interest income for the

quarter increased 8.6% from prior year third quarter and 0.3% from

prior quarter with average earning assets increasing 4.4% and 0.4%,

respectively, for the same periods. The yield on average earning

assets decreased 29 basis points from prior year third quarter and

10 basis points from prior quarter as higher yielding investment

opportunities are limited. The cost of interest bearing funds

decreased 56 basis points and 5 basis points, respectively, for the

same periods. Net interest income for the nine months ended

September 30, 2010 increased 14.4% from prior year.

Noninterest Income

Noninterest income for the quarter ended September 30, 2010

increased 14.9% and 11.0% from prior year third quarter and prior

quarter, respectively. Year-to-date noninterest income declined

3.4% from prior year. The decrease in noninterest income was

significantly impacted by decreased gains on sales of loans as 2009

was a period of significant refinancing of residential real estate

loans, as well as a $1.2 million decline in the fair value of our

mortgage servicing rights. The decline in these noninterest income

sources was partially offset by increases in trust and brokerage

revenue and deposit service charges.

Noninterest Expense

Noninterest expense for the quarter increased 6.3% from prior

year third quarter and 1.5% from prior quarter. Noninterest expense

for the first nine months of 2010 increased 1.6% from 2009 as

increased personnel expenses were offset by a decrease in FDIC

insurance premiums and special assessment.

Balance Sheet Review

CTBI continues to experience internal growth of its banking

franchise. Total assets at $3.2 billion increased 6.5% from the

third quarter 2009 and an annualized 2.8% during the quarter. Loans

outstanding at September 30, 2010 were $2.4 billion with a 1.8%

growth from prior year and an annualized 0.7% growth from June 30,

2010. Loan growth during the quarter of $4.7 million in the

commercial loan portfolio and $9.8 million in the residential loan

portfolio was partially offset by a decline in the consumer loan

portfolio of $10.1 million. CTBI's investment portfolio increased

$38.2 million over prior year third quarter but decreased $20.4

million from prior quarter as CTBI continues to experience growth

in its deposit base while loan demand remains weak. Deposits,

including repurchase agreements, at $2.8 billion increased 6.9%

from September 30, 2009 and an annualized 1.3% from prior quarter

end.

Shareholders’ equity at September 30, 2010 was $336.8 million

compared to $318.6 million at September 30, 2009 and $330.3 million

at June 30, 2010. CTBI's annualized dividend yield to shareholders

as of September 30, 2010 was 4.50%.

Asset Quality

CTBI's total nonperforming loans were $56.6 million at September

30, 2010, an increase from the $45.2 million at September 30, 2009

but a decrease from the $62.3 million at June 30, 2010. The quarter

over quarter decrease in nonperforming loans is primarily

attributable to the liquidation process of one large coal-related

credit and one hotel/motel credit discussed in prior earnings

releases. Both loans had specific reserves in place that were more

than adequate to cover the amounts charged-off. Loans 30-89 days

past due at $29.9 million increased $10.3 million from September

30, 2009 and $6.3 million during the quarter. The quarter over

quarter increase in 30-89 days past due loans is a result of two

commercial real estate secured credit relationships. One

relationship is secured by income-producing properties while the

second is secured by 1-4 family properties. Both loans are

well-secured based upon current property valuations. Our loan

portfolio management processes focus on the immediate

identification, management, and resolution of problem loans to

maximize recovery and minimize loss.

Our level of foreclosed properties increased to $41.1 million

for the third quarter 2010 compared to $36.6 million at September

30, 2009 and $40.1 million at June 30, 2010. Sales of foreclosed

properties for the nine months ended September 30, 2010 totaled

$5.1 million while new foreclosed properties totaled $9.1 million.

Our nonperforming loans and foreclosed properties remain primarily

concentrated in our Central Kentucky Region.

Net loan charge-offs for the quarter were $5.6 million, or 0.91%

of average loans annualized, an increase from prior year third

quarter's $5.2 million or 0.87% and prior quarter’s $1.8 million or

0.30%. Of the total net charge-offs for the quarter, $4.3 million

was in commercial loans, $0.8 million was in indirect auto loans,

and $0.3 million was in residential real estate mortgage loans.

Specific reserves covered 94.8% of the commercial loan charge-offs.

Allocations to loan loss reserves were $3.7 million for the quarter

ended September 30, 2010 compared to $5.8 million for the quarter

ended September 30, 2009 and $3.1 million for the quarter ended

June 30, 2010. Our loan loss reserves as a percentage of total

loans outstanding at September 30, 2010 was 1.40% compared to 1.33%

at September 30, 2009 and 1.48% at June 30, 2010. Although there

was an increase in net charge-offs during the quarter, management

believes the current loan loss reserve is adequate. The adequacy of

our loan loss reserves is analyzed quarterly and adjusted as

necessary with a focus on maintaining appropriate reserves for

potential losses. The analysis includes an individual loan review

including current valuation of the collateral. Specific reserves

are allocated to address any identified shortfalls in collateral

while additional reserves address many other considerations,

including but not limited to historical losses, loss trends, and

current economic conditions, for adequate reserve coverage.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as "believe,"

"expect," "anticipate," "intend," "estimate," "may increase," "may

fluctuate," and similar expressions or future or conditional verbs

such as "will," "should," "would," and "could." These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations’ savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI’s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.2 billion, is

headquartered in Pikeville, Kentucky and has 70 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, and five trust

offices across Kentucky.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) September 30, 2010 (in thousands except per

share data and # of employees)

Three Three Three Nine Nine Months Months Months Months Months

Ended Ended Ended Ended Ended September 30, 2010 June 30, 2010

September 30, 2009 September 30, 2010 September 30, 2009 Interest

income $ 38,315 $ 38,444 $ 38,756 $ 115,256 $ 114,357 Interest

expense 8,938 9,166 11,711

27,256 37,429 Net interest

income 29,377 29,278 27,045 88,000 76,928 Loan loss provision 3,676

3,106 5,772 12,504 12,275 Gains on sales of loans 575 337

341 1,354 3,581 Deposit service charges 5,920 5,949 5,721 17,166

16,187 Trust revenue 1,492 1,458 1,345 4,374 3,756 Loan related

fees 862 46 525 1,748 2,767 Securities gains - - (1 ) - 514 Other

noninterest income 1,748 1,752

1,295 5,238 4,129 Total

noninterest income 10,597 9,542 9,226 29,880 30,934

Personnel expense 11,560 11,632 10,296 34,637 32,214 Occupancy and

equipment 2,675 2,701 2,948 8,100 8,854 FDIC insurance premiums

1,118 1,140 1,086 3,257 4,832 Amortization of core deposit

intangible 72 159 159 390 476 Other noninterest expense

8,573 8,023 8,090 24,710

23,578 Total noninterest expense 23,998

23,655 22,579 71,094

69,954 Net income before taxes 12,300

12,059 7,920 34,282 25,633 Income taxes 3,850

3,506 2,336 10,488 7,532

Net income $ 8,450 $ 8,553 $ 5,584 $

23,794 $ 18,101 Memo: TEQ interest income $

38,659 $ 38,780 $ 39,097 $ 116,277 $ 115,321 Average shares

outstanding 15,239 15,228 15,145 15,223 15,116 Diluted average

shares outstanding 15,275 15,305 15,198 15,260 15,207 Basic

earnings per share $ 0.55 $ 0.56 $ 0.37 $ 1.56 $ 1.20 Diluted

earnings per share $ 0.55 $ 0.56 $ 0.37 $ 1.56 $ 1.19 Dividends per

share $ 0.305 $ 0.30 $ 0.30 $ 0.905 $ 0.90

Average

balances: Loans, net of unearned income $ 2,441,432 $ 2,440,353

$ 2,396,918 $ 2,439,646 $ 2,367,577 Earning assets 2,981,517

2,970,867 2,855,199 2,940,679 2,831,555 Total assets 3,238,075

3,222,645 3,069,950 3,194,600 3,040,342 Deposits 2,588,941

2,582,042 2,426,908 2,555,046 2,399,331 Interest bearing

liabilities 2,347,844 2,349,394 2,245,748 2,324,037 2,223,960

Shareholders' equity 336,772 329,888 319,387 330,701 316,370

Performance ratios: Return on average assets 1.04 % 1.06 %

0.72 % 1.00 % 0.80 % Return on average equity 9.95 % 10.40 % 6.94 %

9.62 % 7.65 % Yield on average earning assets (tax equivalent) 5.14

% 5.24 % 5.43 % 5.29 % 5.45 % Cost of interest bearing funds (tax

equivalent) 1.51 % 1.56 % 2.07 % 1.57 % 2.25 % Net interest margin

(tax equivalent) 3.95 % 4.00 % 3.81 % 4.05 % 3.68 % Efficiency

ratio (tax equivalent) 59.52 % 60.41 % 61.67 % 59.79 % 64.59 %

Loan charge-offs $ 6,449 $ 2,617 $ 5,987 $ 13,382 $ 13,557

Recoveries (855 ) (793 ) (750 ) (2,473

) (2,418 ) Net charge-offs $ 5,594 $ 1,824 $ 5,237 $ 10,909

$ 11,139

Market Price: High $ 28.00 $ 31.56 $ 28.49 $

31.56 $ 37.17 Low 24.50 24.89 25.15 22.15 22.55 Close 27.09 25.10

26.17 27.09 26.17

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2010

(in thousands except per share data and #

of employees)

As of As of As of September 30, 2010 June 30, 2010 September

30, 2009

Assets: Loans, net of unearned $ 2,445,507 $

2,441,222 $ 2,402,697 Loan loss reserve (34,238 )

(36,156 ) (31,957 ) Net loans 2,411,269 2,405,066 2,370,740

Loans held for sale 1,223 1,466 754 Securities AFS 332,235 352,616

278,961 Securities HTM 1,662 1,662 16,687 Other equity investments

29,057 29,054 29,051 Other earning assets 157,258 122,728 77,978

Cash and due from banks 71,149 71,196 63,122 Premises and equipment

47,805 48,403 50,172 Goodwill and core deposit intangible 65,318

65,390 65,865 Other assets 114,764 111,711

82,046

Total Assets $ 3,231,740

$ 3,209,292 $ 3,035,376

Liabilities and

Equity: NOW accounts $ 19,500 $ 18,553 $ 19,329 Savings

deposits 635,056 631,990 628,954 CD's >=$100,000 583,884 608,952

493,911 Other time deposits 817,796 816,731

799,664 Total interest bearing deposits

2,056,236 2,076,226 1,941,858 Noninterest bearing deposits

519,059 494,901 462,096 Total

deposits 2,575,295 2,571,127 2,403,954 Repurchase agreements

188,164 183,287 180,348 Other interest bearing liabilities 94,047

89,865 93,880 Noninterest bearing liabilities 37,390

34,682 38,554 Total liabilities

2,894,896 2,878,961 2,716,736 Shareholders' equity 336,844

330,331 318,640

Total

Liabilities and Equity $ 3,231,740 $ 3,209,292 $

3,035,376 Ending shares outstanding 15,239 15,228

15,146 Memo: Market value of HTM securities $ 1,667 $ 1,662 $

16,865 30 - 89 days past due loans $ 29,935 $ 23,677 $

19,635 90 days past due loans 20,252 16,857 15,685 Nonaccrual loans

36,329 45,435 29,476 Restructured loans (excluding 90 days past due

and nonaccrual) 6,377 5,196 - Foreclosed properties 41,083 40,105

36,607 Other repossessed assets 193 226 176 Tier 1 leverage

ratio 10.22 % 10.12 % 10.25 % Tier 1 risk based ratio 13.37 % 13.20

% 12.92 % Total risk based ratio 14.62 % 14.46 % 14.17 % Tangible

equity to tangible assets ratio 8.58 % 8.43 % 8.51 % FTE employees

980 992 987

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2010

(in thousands except per share data and #

of employees)

Community Trust Bancorp, Inc. reported earnings for the

three and nine months ending September 30, 2010 and 2009 as

follows: Three Months Ended Nine Months

Ended

September 30 September 30 2010 2009

2010 2009 Net income $ 8,450 $ 5,584 $ 23,794 $ 18,101 Basic

earnings per share $ 0.55 $ 0.37 $ 1.56 $ 1.20 Diluted

earnings per share $ 0.55 $ 0.37 $ 1.56 $ 1.19 Average

shares outstanding 15,239 15,145 15,223 15,116 Total assets

(end of period) $ 3,231,740 $ 3,035,376 Return on average

equity 9.95 % 6.94 % 9.62 % 7.65 % Return on average assets

1.04 % 0.72 % 1.00 % 0.80 % Provision for loan losses $

3,676 $ 5,772 $ 12,504 $ 12,275 Gains on sales of loans $

575 $ 341 $ 1,354 $ 3,581

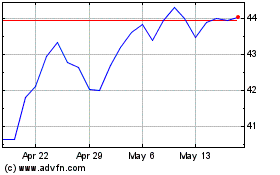

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

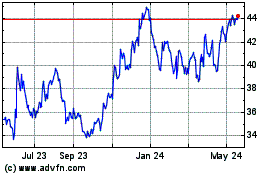

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024