Community Trust Bancorp, Inc. (NASDAQ: CTBI):

Earnings Summary (in thousands except per share data)

2Q

2010

1Q

2010

2Q

2009

6 Months

2010

6 Months

2009

Net income $ 8,553 $ 6,791 $ 5,937 $

15,344 $ 12,517 Earnings per share $ 0.56 $ 0.45 $ 0.39 $

1.01 $ 0.83 Earnings per share--diluted $ 0.56 $ 0.45 $ 0.39 $ 1.01

$ 0.82 Return on average assets 1.06% 0.88% 0.78% 0.98%

0.83% Return on average equity 10.40% 8.47% 7.54% 9.44% 8.02%

Efficiency ratio 60.41% 59.45% 64.25% 59.93% 66.08% Tangible common

equity 8.43% 8.36% 8.38% 8.43% 8.38% Dividends declared per

share $ 0.30 $ 0.30 $ 0.30 $ 0.60 $ 0.60 Book value per share $

21.69 $ 21.35 $ 20.80 $ 21.69 $ 20.80 Weighted average

shares 15,228 15,202 15,127 15,215 15,101 Weighted average

shares--diluted 15,305 15,235 15,219 15,252 15,194

Community Trust Bancorp, Inc. (NASDAQ-CTBI) reports earnings for

the second quarter 2010 of $8.6 million or $0.56 per basic share

compared to $6.8 million or $0.45 per basic share earned during the

quarter ended March 31, 2010 and $5.9 million or $0.39 per basic

share earned during the second quarter of 2009. Earnings for the

six months ended June 30, 2010 were $15.3 million or $1.01 per

basic share compared to $12.5 million or $0.83 per basic share for

the six months ended June 30, 2009.

CTBI continues to maintain a significantly higher level of

capital than required by regulatory authorities to be designated as

well-capitalized. On June 30, 2010, our Tangible Common

Equity/Tangible Assets Ratio remained significantly higher than our

peer institutions at 8.43%, our Tier 1 Leverage Ratio of 10.12% was

512 basis points higher than the 5.00% required, our Tier 1

Risk-Based Capital Ratio of 13.20% was 720 basis points higher than

the required 6.00%, and our Total Risk-Based Capital Ratio of

14.46% was 446 basis points higher than the 10.00% regulatory

requirement for this designation.

Second Quarter 2010 Highlights

- As announced on June 8, 2010,

CTBI has entered into an acquisition agreement and plan of share

exchange with LaFollette First National Corporation and First

National Bank of LaFollette, the wholly-owned subsidiary of

LaFollette Corporation.

- CTBI's quarterly basic earnings

per share increased $0.11 per share from first quarter 2010 and

$0.17 per share from second quarter 2009. Year-to-date basic

earnings per share increased $0.18 per share from prior year.

Year-to-date earnings were positively impacted by increased net

interest income; however, this was partially offset by an increased

provision for loan losses.

- CTBI experienced significant

improvement in our net interest margin year over year; however, our

net interest margin for the quarter decreased 20 basis points from

first quarter 2010.

- Nonperforming loans increased

$7.4 million during the second quarter 2010 to $62.3 million

compared to $54.9 million at prior quarter end and $59.6 million at

June 30, 2009. The linked quarter increase in nonperforming loans

was in the nonaccrual classification. Nonperforming assets

increased $8.7 million from prior quarter-end and $22.5 million

from prior year second quarter.

- The loan loss provision for the

six months ended June 30, 2010 increased $2.3 million from prior

year to support the increase in nonperforming loans year over year

per CTBI’s robust loan portfolio management process and loan loss

reserve analysis. This increase resulted in an increase in the loan

loss reserve ratio to 1.48% from 1.32% at June 30, 2009.

- Net loan charge-offs for the

quarter ended June 30, 2010 of $1.8 million, or 0.30% of average

loans annualized, was a reduction from prior quarter’s 0.58% and

from the 0.63% experienced for the second quarter 2009.

- Noninterest income decreased for

the period ended June 30, 2010 compared to same period 2009 as a

result of decreased gains on sales of loans and loan related fees.

The decrease in loan related fees resulted from a $0.7 million

decline in the fair value of our mortgage servicing rights

portfolio. The decline in these noninterest income sources,

however, was partially offset by increases in trust revenue and

deposit service charges.

- Our loan portfolio increased

$12.3 million, an annualized rate of 2.0%, during the quarter with

increases in the commercial and residential loan portfolios offset

partially by a decline in the consumer loan portfolio.

- Our investment portfolio

increased $32.9 million during the quarter as deposit growth

continued to be stronger than loan demand.

- Our tangible common

equity/tangible assets ratio remains strong at 8.43%.

Net Interest Income

CTBI saw improvement in its net interest margin of 49 basis

points for the first six months of 2010 and 38 basis points for the

second quarter 2010 compared to 2009; however, we saw a 20 basis

point decline from prior quarter due to the increase in deposits

during a time of weak loan demand and limited alternative

investment opportunities. Net interest income for the quarter

decreased 0.2% from prior quarter but increased 15.2% from prior

year second quarter with average earning assets increasing 3.6% and

4.2%, respectively, for the same periods. The yield on average

earning assets decreased 26 basis points from prior quarter and 14

basis points from prior year second quarter as higher yielding

investment opportunities are limited. The cost of interest bearing

funds decreased 7 basis points and 68 basis points, respectively,

for the same periods. Net interest income for the six months ended

June 30, 2010 increased 17.5% from prior year.

Noninterest Income

Noninterest income for the quarter ended June 30, 2010 decreased

2.0% and 12.9% from prior quarter and prior year second quarter,

respectively. Year-to-date noninterest income declined 11.2% from

prior year. The decrease in noninterest income was significantly

impacted by decreased gains on sales of loans as 2009 was a period

of significant refinancing of residential real estate loans, as

well as a $0.7 million decline in the fair value of our mortgage

servicing rights. The decline in these noninterest income sources

was partially offset by increases in trust and brokerage revenue

and deposit service charges.

Noninterest Expense

Noninterest expense for the quarter increased 0.9% from prior

quarter and 0.3% from prior year second quarter. Noninterest

expense for the first six months 2010, however, decreased 0.6% from

2009 as increased personnel expenses were offset by a decrease in

FDIC insurance premiums and special assessment.

Balance Sheet Review

CTBI continues to experience internal growth of its banking

franchise. Total assets at $3.2 billion increased an annualized

5.1% during the quarter and 5.7% from the second quarter 2009.

Loans outstanding at June 30, 2010 were $2.4 billion with an

annualized 2.0% growth from March 31, 2010 and 2.6% growth from

prior year. Loan growth during the quarter of $16.9 million in the

commercial loan portfolio and $6.9 million in the residential loan

portfolio was partially offset by a decline in the consumer loan

portfolio of $11.5 million. CTBI's investment portfolio increased

$32.9 million over prior quarter and $36.4 million from prior year

second quarter as CTBI continues to experience good growth in its

deposit base while loan demand remains weak. Deposits, including

repurchase agreements, at $2.8 billion increased an annualized 5.5%

from prior quarter and 8.2% from June 30, 2009.

Shareholders’ equity at June 30, 2010 was $330.3 million

compared to $324.9 million at March 31, 2010 and $314.8 million at

June 30, 2009. CTBI's annualized dividend yield to shareholders as

of June 30, 2010 was 4.78%.

Asset Quality

CTBI's total nonperforming loans were $62.3 million at June 30,

2010, an increase from the $54.9 million at March 31, 2010 and

$59.6 million at June 30, 2009. The $7.4 million increase in

nonperforming loans is primarily attributable to three commercial

loan relationships, a $4.1 million motel loan, and $2.9 million in

two residential real estate development loans in Central Kentucky.

Loans 30-89 days past due decreased $12.5 million including the

$7.4 million movement of loans into nonperforming status. Loans

past-due 30-89 days at June 30, 2010 were $23.7 million, a decrease

from the $36.2 million at March 31, 2010 but an increase from the

$20.4 million at June 30, 2009. Our loan portfolio management

processes focus on the immediate identification, management, and

resolution of problem loans to maximize recovery and minimize

loss.

Our level of foreclosed properties increased to $40.1 million

for the second quarter 2010 compared to the $38.6 million at March

31, 2010 and $20.4 million at June 30, 2009. Sales of foreclosed

properties for the six months ended June 30, 2010 totaled $3.5

million while new foreclosed properties totaled $6.5 million. Our

nonperforming loans and foreclosed properties remain primarily

concentrated in our Central Kentucky Region.

Net loan charge-offs for the quarter were $1.8 million, or 0.30%

of average loans annualized, a decline from prior quarter’s $3.5

million or 0.58% and prior year second quarter's $3.7 million or

0.63%. Of the total net charge-offs for the quarter of $1.8

million, $0.6 million was in commercial loans, $0.5 million was in

indirect auto loans, and $0.4 million was in residential real

estate mortgage loans. Specific reserves covered 77.0% of the

commercial loan charge-offs. Allocations to loan loss reserves were

$3.1 million for the quarter ended June 30, 2010 compared to $5.7

million for the quarter ended March 31, 2010 and $4.5 million for

the quarter ended June 30, 2009. Our loan loss reserves as a

percentage of total loans outstanding at June 30, 2010 increased to

1.48% from 1.44% at March 31, 2010 and 1.32% at June 30, 2009. The

adequacy of our loan loss reserves is analyzed quarterly and

adjusted as necessary with a focus on maintaining appropriate

reserves for potential losses. The analysis includes an individual

loan review including current valuation of the collateral. Specific

reserves are allocated to address any identified shortfalls in

collateral while additional reserves address many other

considerations, including but not limited to historical losses,

loss trends, and current economic conditions, for an adequate

reserve coverage.

Pending Acquisition

On June 8, 2010, CTBI announced that it had entered into an

Agreement and Plan of Share Exchange (the “Agreement”) with

LaFollette First National Corporation, a Tennessee corporation

(“LaFollette Corporation”) and First National Bank of LaFollette,

the wholly-owned subsidiary of LaFollette Corporation (“LaFollette

Bank”). The Agreement calls for CTBI to acquire all outstanding

shares of LaFollette Corporation in a share exchange (“Share

Exchange”) for $650 per share, or a total of approximately $16.1

million. Following the Share Exchange, LaFollette Corporation will

be merged into CTBI and LaFollette Bank will be merged into

Community Trust Bank, Inc., the wholly-owned subsidiary of CTBI.

The Agreement is subject to certain conditions, including the

receipt of regulatory approval and the approval of LaFollette

Corporation shareholders.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as "believe,"

"expect," "anticipate," "intend," "estimate," "may increase," "may

fluctuate," and similar expressions or future or conditional verbs

such as "will," "should," "would," and "could." These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations’ savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI’s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.2 billion, is

headquartered in Pikeville, Kentucky and has 70 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, and five trust

offices across Kentucky.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) June 30, 2010 (in thousands except per share

data and # of employees)

Three Three Three Six Six Months Months Months Months Months Ended

Ended Ended Ended Ended June 30, 2010 March 31, 2010 June 30, 2009

June 30, 2010 June 30, 2009 Interest income $ 38,444 $ 38,497 $

37,925 $ 76,941 $ 75,601 Interest expense 9,166

9,152 12,516 18,318

25,718 Net interest income 29,278 29,345 25,409

58,623 49,883 Loan loss provision 3,106 5,722 4,522 8,828 6,503

Gains on sales of loans 337 442 1,309 779 3,240 Deposit

service charges 5,949 5,297 5,517 11,246 10,466 Trust revenue 1,458

1,424 1,249 2,882 2,411 Loan related fees 46 840 1,494 886 2,242

Securities gains (losses) - - (4 ) - 515 Other noninterest income

1,752 1,738 1,390

3,490 2,834 Total noninterest income 9,542

9,741 10,955 19,283 21,708 Personnel expense 11,632 11,445

10,650 23,077 21,918 Occupancy and equipment 2,701 2,724 2,983

5,425 5,906 FDIC insurance premiums 1,140 999 2,250 2,139 3,746

Amortization of core deposit intangible 159 159 158 318 317 Other

noninterest expense 8,023 8,114

7,537 16,137 15,488 Total

noninterest expense 23,655 23,441

23,578 47,096 47,375

Net income before taxes 12,059 9,923 8,264 21,982 17,713

Income taxes 3,506 3,132 2,327

6,638 5,196 Net income $ 8,553

$ 6,791 $ 5,937 $ 15,344 $ 12,517

Memo: TEQ interest income $ 38,780 $ 38,838 $ 38,257

$ 77,618 $ 76,224 Average shares outstanding 15,228 15,202

15,127 15,215 15,101 Diluted average shares outstanding 15,305

15,235 15,219 15,252 15,194 Basic earnings per share $ 0.56 $ 0.45

$ 0.39 $ 1.01 $ 0.83 Diluted earnings per share $ 0.56 $ 0.45 $

0.39 $ 1.01 $ 0.82 Dividends per share $ 0.30 $ 0.30 $ 0.30 $ 0.60

$ 0.60

Average balances: Loans, net of unearned

income $ 2,440,353 $ 2,437,105 $ 2,353,145 $ 2,438,738 $ 2,352,664

Earning assets 2,970,867 2,868,409 2,851,832 2,919,921 2,819,537

Total assets 3,222,645 3,121,801 3,058,241 3,172,502 3,025,292

Deposits 2,582,042 2,493,102 2,407,260 2,537,818 2,385,314 Interest

bearing liabilities 2,349,394 2,274,064 2,235,108 2,311,937

2,212,885 Shareholders' equity 329,888 325,317 315,991 327,615

314,837

Performance ratios: Return on average assets

1.06 % 0.88 % 0.78 % 0.98 % 0.83 % Return on average equity 10.40 %

8.47 % 7.54 % 9.44 % 8.02 % Yield on average earning assets (tax

equivalent) 5.24 % 5.49 % 5.38 % 5.36 % 5.45 % Cost of interest

bearing funds (tax equivalent) 1.56 % 1.63 % 2.25 % 1.60 % 2.34 %

Net interest margin (tax equivalent) 4.00 % 4.20 % 3.62 % 4.10 %

3.61 % Efficiency ratio (tax equivalent) 60.41 % 59.45 % 64.25 %

59.93 % 66.08 % Loan charge-offs $ 2,617 $ 4,316 $ 4,511 $

6,933 $ 7,570 Recoveries (793 ) (825 ) (812 )

(1,618 ) (1,668 ) Net charge-offs $ 1,824 $ 3,491 $

3,699 $ 5,315 $ 5,902

Market Price: High $ 31.56 $

28.32 $ 31.29 $ 31.56 $ 37.17 Low 24.89 22.15 25.62 22.15 22.55

Close 25.10 27.07 26.75 25.10 26.75

As of As of As of June 30, 2010 March 31, 2010 June 30, 2009

Assets: Loans, net of unearned $ 2,441,222 $ 2,428,934 $

2,380,255 Loan loss reserve (36,156 ) (34,874 )

(31,422 ) Net loans 2,405,066 2,394,060 2,348,833 Loans held

for sale 1,466 330 600 Securities AFS 352,616 311,038 298,006

Securities HTM 1,662 10,291 19,875 Other equity investments 29,054

29,052 29,048 Other earning assets 122,728 130,193 86,586 Cash and

due from banks 71,196 69,534 70,544 Premises and equipment 48,403

49,159 51,096 Goodwill and core deposit intangible 65,390 65,548

66,024 Other assets 111,711 109,851

65,355

Total Assets $ 3,209,292 $

3,169,056 $ 3,035,967

Liabilities and

Equity: NOW accounts $ 18,553 $ 17,481 $ 19,364 Savings

deposits 631,990 645,090 644,568 CD's >=$100,000 608,952 551,711

477,467 Other time deposits 816,731 807,250

789,390 Total interest bearing deposits

2,076,226 2,021,532 1,930,789 Noninterest bearing deposits

494,901 508,702 463,164 Total

deposits 2,571,127 2,530,234 2,393,953 Repurchase agreements

183,287 186,894 152,290 Other interest bearing liabilities 89,865

99,058 141,749 Noninterest bearing liabilities 34,682

27,991 33,201 Total liabilities

2,878,961 2,844,177 2,721,193 Shareholders' equity 330,331

324,879 314,774

Total

Liabilities and Equity $ 3,209,292 $ 3,169,056 $

3,035,967 Ending shares outstanding 15,228 15,217

15,134 Memo: Market value of HTM securities $ 1,662 $ 10,300 $

20,409 30 - 89 days past due loans $ 23,677 $ 36,199 $

20,408 90 days past due loans 16,857 17,589 20,064 Nonaccrual loans

45,435 37,327 39,511 Restructured loans (excluding 90 days past due

and nonaccrual) 5,196 528 - Foreclosed properties 40,105 38,612

20,369 Other repossessed assets 226 396 185 Tier 1 leverage

ratio 10.12 % 10.30 % 10.23 % Tier 1 risk based ratio 13.20 % 13.02

% 12.92 % Total risk based ratio 14.46 % 14.27 % 14.17 % Tangible

equity to tangible assets ratio 8.43 % 8.36 % 8.38 % FTE employees

992 982 1,007 Community Trust Bancorp, Inc. reported

earnings for the three and six months ending June 30, 2010 and 2009

as follows: Three Months Ended

Six Months Ended

June 30 June 30 2010

2009 2010 2009 Net income $ 8,553 $ 5,937 $ 15,344 $ 12,517

Basic earnings per share $ 0.56 $ 0.39 $ 1.01 $ 0.83 Diluted

earnings per share $ 0.56 $ 0.39 $ 1.01 $ 0.82 Average

shares outstanding 15,228 15,127 15,215 15,101 Total assets

(end of period) $ 3,209,292 $ 3,035,967 Return on average

equity 10.40 % 7.54 % 9.44 % 8.02 % Return on average assets

1.06 % 0.78 % 0.98 % 0.83 % Provision for loan losses $

3,106 $ 4,522 $ 8,828 $ 6,503 Gains on sales of loans $ 337

$ 1,309 $ 779 $ 3,240

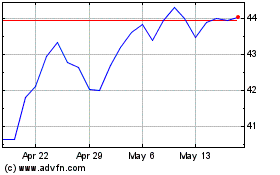

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

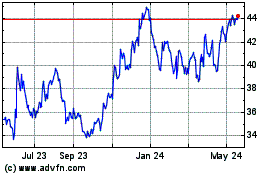

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024