Community Trust Bancorp, Inc. (NASDAQ:CTBI): Earnings Summary � � �

� � (in thousands except per share data) � 3Q 2008 � 2Q 2008 � 3Q

2007 � 9 Months 2008 � 9 Months 2007 Net income/(loss) $ (577) $

8,620 $ 10,476 $ 16,588 $ 27,356 Earnings/(loss) per share $ (0.04)

$ 0.58 $ 0.69 $ 1.11 $ 1.80 Earnings/(loss) per share (diluted) $

(0.04) $ 0.57 $ 0.68 $ 1.09 $ 1.77 � Return on average assets

(0.08)% 1.19% 1.39% 0.76% 1.22% Return on average equity (0.74)%

11.21% 14.04% 7.16% 12.53% Efficiency ratio 58.63% 57.25% 52.36%

57.43% 58.30% � Dividends declared per share $ 0.29 $ 0.29 $ 0.27 $

0.87 $ 0.81 Book value per share $ 20.26 $ 20.43 $ 19.62 $ 20.26 $

19.62 � Weighted average shares 15,011 14,989 15,183 15,000 15,186

Weighted average shares (diluted) � � 15,263 � � 15,152 � � 15,342

� � 15,153 � � 15,417 Community Trust Bancorp, Inc. (NASDAQ:CTBI)

reports earnings of $16.6 million or $1.11 per basic share

year-to-date through September 30, 2008, although it had an

operating loss of $0.6 million for the third quarter of 2008

commensurate with the actions of the federal government placing

Freddie Mac and Fannie Mae into conservatorship and the market

concerns related to this action. CTBI continues to maintain

significantly higher capital than required for a well-capitalized

designation. CTBI had a loss for the quarter ended September 30,

2008 of $0.04 per basic share. At June 30, 2008, CTBI held $14.9

million in Freddie Mac and Fannie Mae pass-through auction rate

securities which had an unrealized loss of $0.5 million. On

September 7, 2008, the U.S. Treasury placed Freddie Mac and Fannie

Mae into conservatorship. This action created market uncertainty of

the future value of Freddie Mac and Fannie Mae securities and the

value of these investments decreased materially resulting in a

$13.5 million other than temporary impairment charge to earnings on

these securities. Also, as a result of this action, CTBI recorded a

$0.8 million charge relative to trust activity for which it had

financial responsibility. CTBI maintains a significantly higher

level of capital than required by regulatory authorities to be

designated as well-capitalized. On September 30, 2008, our Tier 1

Leverage Ratio of 10.45% was 545 basis points higher than the 5.00%

required, our Tier 1 Risk-Based Capital Ratio of 13.11% was 711

basis points higher than the required 6.00%, and our Total

Risk-Based Capital Ratio of 14.36% was 436 basis points higher than

the 10.00% regulatory requirement for this designation. CTBI's

normalized earnings, which are considered to be core earnings,

continue to be within expected profitability levels as we execute

our business plan during the current global economic crisis. CTBI

has not been a participant in the types of lending and derivative

investments which have been the focus of the current financial

crisis. Financial results normalized for the other than temporary

impairment charges are shown below: Earnings Summary � � � � � (in

thousands except per share data) � 3Q 2008 � 2Q 2008 � 3Q 2007 � 9

Months 2008 � 9 Months 2007 Net income/(loss) as reported $ (577) $

8,620 $ 10,476 $ 16,588 $ 27,356 Impact of FHLMC/FNMA securities

impairment charge $ 9,386 $ - $ - $ 9,386 $ - Net income as

adjusted $ 8,809 $ 8,620 $ 10,476 $ 25,974 $ 27,356 Earnings per

share $ 0.59 $ 0.58 $ 0.69 $ 1.73 $ 1.80 Earnings per share

(diluted) $ 0.58 $ 0.57 $ 0.68 $ 1.71 $ 1.77 � Return on average

assets 1.20% 1.19% 1.39% 1.19% 1.22% Return on average equity

11.24% 11.21% 14.04% 11.22% 12.53% Efficiency ratio 56.30% 57.25%

52.36% 56.64% 58.30% � Dividends declared per share $ 0.29 $ 0.29 $

0.27 $ 0.87 $ 0.81 Book value per share $ 20.86 $ 20.43 $ 19.62 $

20.88 $ 19.62 � Weighted average shares 15,011 14,989 15,183 15,000

15,186 Weighted average shares (diluted) � � 15,263 � � 15,152 � �

15,342 � � 15,153 � � 15,417 Third Quarter 2008 Highlights CTBI's

basic earnings per share for the third quarter 2008 normalized for

the other than temporary impairment charge for auction rate

securities increased 1.7% from prior quarter but decreased 14.5%

from prior year third quarter primarily due to the increased

provision for loan losses. Year-to-date basic earnings per share

normalized decreased 3.9% from prior year. Our net interest margin

for the nine months ended September 30, 2008 increased 9 basis

points from prior year. However, net interest income decreased $0.6

million from prior year as average earning assets decreased by

$93.7 million. Noninterest income for the third quarter and

year-to-date 2008 were both impacted by the $13.5 million other

than temporary impairment charge for auction rate securities.

Normalized noninterest income for the first nine months of 2008

increased 1.9% from prior year with increases in gains on sales of

loans, deposit service charges, and trust revenue offset by a

decrease in the fair value of mortgage servicing rights. CTBI

established a tax strategy to offset the capital loss resulting

from the other than temporary impairment charge for auction rate

securities whereby the losses would be offset against capital gains

during the next five years. This strategy was available prior to

the Emergency Economic Stabilization Act of 2008 which provides for

the treatment of the losses as ordinary losses. Noninterest expense

was also impacted commensurate with the conservatorship action with

a $0.8 million charge relative to trust activity for which CTBI had

financial responsibility. Normalized noninterest expense for the

first nine months of 2008 has decreased 3.0%. Nonperforming loans

increased $5.2 million at September 30, 2008 to $49.3 million

compared to $44.2 million at prior quarter-end and $31.5 million

for prior year quarter ended September 30, 2007. The majority of

our nonperforming loans continue to be in our Central Kentucky

Region; however, all regions have seen an increase during the past

quarter with the changes in national economic conditions,

particularly the price of gasoline. Our loan portfolio increased an

annualized 7.4% during the quarter with $42.4 million in growth.

Loan growth from prior year third quarter was $81.5 million. Our

investment portfolio decreased $24.0 million for the quarter,

primarily as a result of the other than temporary impairment charge

for auction rate securities discussed above. Our investment

portfolio declined $74.9 million year over year primarily resulting

from the use of the liquidity in the portfolio to fund loan growth

and manage the net interest margin. Net Interest Income Our

quarterly net interest margin increased 9 basis points from prior

quarter and 11 basis points from prior year third quarter, and our

net interest margin for the nine months ended September 30, 2008

increased 9 basis points compared to the same period in 2007. Net

interest income for the quarter increased 3.2% from prior quarter

but declined 0.4% from prior year third quarter as average earning

assets decreased 0.3% and 2.9%, respectively, for the same periods.

Net interest income for the nine months ended September 30, 2008

decreased $0.6 million from prior year as the cost of interest

bearing funds decreased 103 basis points while the yield on average

earning assets decreased 80 basis points and average earning assets

declined $93.7 million. Noninterest Income The significant decline

in noninterest income occurred as a result of the $13.5 million

other than temporary impairment charge for the auction rate

securities. Normalized noninterest income for the third quarter

2008 decreased 2.0% from prior quarter and 4.5% from prior year

third quarter. Normalized noninterest income for the first nine

months of 2008 increased 1.9% from prior year with increases in

gains on sales of loans, deposit service charges, and trust revenue

offset by a decrease in the fair value of mortgage servicing

rights. Noninterest Expense Noninterest expense for the quarter

increased 4.2% from prior quarter and 10.2% from prior year third

quarter. Commensurate with the U.S. Treasury placing Freddie Mac

and Fannie Mae into conservatorship on September 7, 2008, CTBI

recorded a $0.8 million charge relative to trust activity for which

it had financial responsibility. Normalized noninterest expense for

the first nine months of 2008 has decreased 3.0%. Balance Sheet

Review CTBI�s total assets at $2.9 billion increased an annualized

4.2% from prior quarter but decreased 0.7% from prior year third

quarter. Loans outstanding at September 30, 2008 were $2.3 billion

reflecting an annualized 7.4% growth during the quarter and a 3.6%

growth from September 30, 2007. CTBI's investment portfolio,

however, decreased 7.1% from prior quarter and 19.4% from September

30, 2007 as a result of the use of the liquidity in our investment

portfolio to fund loan growth and the other than temporary

impairment charge for auction rate securities. Deposits, including

repurchase agreements, at $2.4 billion increased an annualized 1.9%

from prior quarter but are 1.9% below prior year third quarter.

CTBI's use of the liquidity in the investment portfolio to fund

loan growth versus growing deposits helped manage and increase the

net interest margin. Shareholders� equity at September 30, 2008 was

$305.0 million compared to $306.2 million at June 30, 2008 and

$294.9 at September 30, 2007. CTBI's annualized dividend yield to

shareholders as of September 30, 2008 was 3.37%. Asset Quality

Economic conditions continue to be challenging for both our

business and individual customers as gasoline prices have increased

and uncertainty has developed on main street with the current

credit crisis. Nonperforming loans increased during the third

quarter by $5.2 million with increases in all of our regions.

CTBI's total nonperforming loans at September 30, 2008 were $49.3

million compared to $44.2 million at June 30, 2008 and $31.5

million at September 30, 2007. Our loan portfolio management

processes focus on maintaining appropriate reserves for potential

losses. Foreclosed properties increased during the third quarter

2008 to $9.4 million from the $9.1 million at June 30, 2008 and the

$6.6 million at September 30, 2007. Sales of foreclosed properties

during the first nine months of 2008 totaled $4.2 million while new

foreclosed properties totaled $5.9 million. Net loan charge-offs

for the quarter of $2.1 million, or 0.36% of average loans

annualized, was a decrease from prior quarter's 0.38% of average

loans annualized but an increase from the 0.30% for prior year

third quarter. Allocations to loan loss reserve were $2.9 million

for the quarter ended September 30, 2008 compared to $2.6 million

for the quarter ended June 30, 2008 and $1.9 million for the

quarter ended September 30, 2007. Our loan loss reserve as a

percentage of total loans outstanding at September 30, 2008

increased to 1.29% compared to 1.28% at June 30, 2008 and 1.25% at

September 30, 2007. The adequacy of our loan loss reserve is

analyzed quarterly and adjusted as necessary. Significant Industry

Changes On October 3, 2008, the Emergency Economic Stabilization

Act of 2008 (EESA) was signed into law. This legislation was

designed to address the credit and liquidity crisis affecting the

financial system in the United States. A number of provisions of

the EESA address efforts to mitigate home foreclosures and to

further assist homeowners facing foreclosure. The EESA also

provides for a temporary increase in the standard maximum deposit

insurance amount from $100,000 to $250,000 through December 31,

2009. Another significant change as a result of the EESA related to

a change in the tax treatment of losses on the preferred stock of

Freddie Mac and Fannie Mae held by financial institutions. Under

the EESA, these securities are afforded ordinary gain and loss

treatment and a tax benefit is allowed for such losses. The EESA

was designed to provide the U.S. Treasury with a wide array of

options to facilitate an economic recovery. This was evidenced on

September 13, 2008 when the U.S. Treasury announced its intention

to make equity investments in "healthy" banks as a means to inject

capital into the credit markets. As the economy and global markets

react, it is anticipated that the Treasury's plan will continue to

evolve. Forward-Looking Statements Certain of the statements

contained herein that are not historical facts are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act. CTBI�s actual results may differ materially from those

included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

"believe," "expect," "anticipate," "intend," "estimate," "may

increase," "may fluctuate," and similar expressions or future or

conditional verbs such as "will," "should," "would," and "could."

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors� pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations� savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI�s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made. Community Trust

Bancorp, Inc., with assets of $2.9 billion, is headquartered in

Pikeville, Kentucky and has 71 banking locations across eastern,

northeast, central, and south central Kentucky, six banking

locations in southern West Virginia, and five trust offices across

Kentucky. Additional information follows. Community Trust Bancorp,

Inc. Financial Summary (Unaudited) September 30, 2008 (in thousands

except per share data and # of employees) � � � � �

ThreeMonthsEndedSeptember 30, 2008 ThreeMonthsEndedJune 30, 2008

ThreeMonthsEndedSeptember 30, 2007 NineMonthsEndedSeptember 30,

2008 NineMonthsEndedSeptember 30, 2007 Interest income $ 41,704 $

41,670 $ 49,719 $ 128,054 $ 148,983 Interest expense � 15,205 � �

15,988 � � 23,127 � � 49,565 � � 69,890 � Net interest income

26,499 25,682 26,592 78,489 79,093 Loan loss provision 2,875 2,648

1,915 7,892 4,231 � Gains on sales of loans 292 494 384 1,332 996

Deposit service charges 5,739 5,503 5,302 16,341 15,436 Trust

revenue 1,260 1,298 1,240 3,749 3,619 Loan related fees 686 1,079

606 2,064 2,494 Securities gains (13,461 ) - - (13,511 ) - Other

noninterest income � 1,515 � � 1,307 � � 2,402 � � 4,480 � � 4,861

� Total noninterest income (3,969 ) 9,681 9,934 14,455 27,406 �

Personnel expense 10,287 10,600 9,604 31,598 31,818 Occupancy and

equipment 2,803 2,822 2,843 8,304 8,707 Amortization of core

deposit intangible 159 159 159 476 476 Other noninterest expense �

8,051 � � 6,862 � � 6,718 � � 21,366 � � 21,757 � Total noninterest

expense � 21,300 � � 20,443 � � 19,324 � � 61,744 � � 62,758 � �

Net income before taxes (1,645 ) 12,272 15,287 23,308 39,510 Income

taxes � (1,068 ) � 3,652 � � 4,811 � � 6,720 � � 12,154 � Net

income $ (577 ) $ 8,620 � $ 10,476 � $ 16,588 � $ 27,356 � � Memo:

TEQ interest income $ 42,046 $ 42,015 $ 50,098 $ 129,108 $ 150,132

� Average shares outstanding 15,011 14,989 15,183 15,000 15,186

Basic earnings per share $ (0.04 ) $ 0.58 $ 0.69 $ 1.11 $ 1.80

Diluted earnings per share $ (0.04 ) $ 0.57 $ 0.68 $ 1.09 $ 1.77

Dividends per share $ 0.29 $ 0.29 $ 0.27 $ 0.87 $ 0.81 � Average

balances: Loans, net of unearned income $ 2,291,722 $ 2,264,175 $

2,222,451 $ 2,265,265 $ 2,195,940 Earning assets 2,688,752

2,697,670 2,770,100 2,688,498 2,782,217 Total assets 2,909,419

2,915,382 2,989,727 2,908,448 3,001,713 Deposits 2,291,996

2,301,477 2,356,589 2,294,120 2,364,974 Interest bearing

liabilities 2,112,403 2,137,503 2,233,762 2,130,630 2,256,526

Shareholders' equity 311,665 309,269 296,001 309,307 291,799 �

Performance ratios: Return on average assets (0.08 %) 1.19 % 1.39 %

0.76 % 1.22 % Return on average equity (0.74 %) 11.21 % 14.04 %

7.16 % 12.53 % Yield on average earning assets (tax equivalent)

6.22 % 6.26 % 7.18 % 6.41 % 7.21 % Cost of interest bearing funds

(tax equivalent) 2.86 % 3.01 % 4.11 % 3.11 % 4.14 % Net interest

margin (tax equivalent) 3.97 % 3.88 % 3.86 % 3.95 % 3.86 %

Efficiency ratio (tax equivalent) 58.63 % 57.25 % 52.36 % 57.43 %

58.30 % � Loan charge-offs $ 2,658 $ 2,818 $ 2,311 $ 7,886 $ 5,804

Recoveries � (593 ) � (667 ) � (641 ) � (1,846 ) � (1,980 ) Net

charge-offs $ 2,065 $ 2,151 $ 1,670 $ 6,040 $ 3,824 � Market Price:

High $ 46.32 $ 31.96 $ 33.46 $ 46.32 $ 41.50 Low 15.99 26.25 26.47

15.99 26.47 Close 34.40 26.26 30.01 34.40 30.01 Community Trust

Bancorp, Inc. Financial Summary (Unaudited) September 30, 2008 (in

thousands except per share data and # of employees) � � � � As

ofSeptember 30, 2008 � As ofJune 30, 2008 � As ofSeptember 30, 2007

Assets: Loans, net of unearned $ 2,316,020 $ 2,273,646 $ 2,234,494

Loan loss reserve � (29,908 ) � (29,096 ) � (27,933 ) Net loans

2,286,112 2,244,550 2,206,561 Loans held for sale 2,175 1,494 1,719

Securities AFS 284,913 306,869 352,973 Securities HTM 27,219 29,296

34,107 Other equity investments 29,036 28,703 28,041 Other earning

assets 28,790 10,994 45,993 Cash and due from banks 77,996 84,169

83,804 Premises and equipment 51,890 52,448 53,650 Goodwill and

core deposit intangible 66,500 66,658 67,134 Other assets � 54,297

� � 53,163 � � 55,160 � Total Assets $ 2,908,928 � $ 2,878,344 � $

2,929,142 � � Liabilities and Equity: NOW accounts $ 17,780 $

17,939 $ 17,942 Savings deposits 625,377 625,574 664,561 CD's

>=$100,000 436,234 434,352 436,833 Other time deposits � 757,698

� � 752,581 � � 787,171 � Total interest bearing deposits 1,837,089

1,830,446 1,906,507 Noninterest bearing deposits � 452,678 � �

447,677 � � 426,368 � Total deposits 2,289,767 2,278,123 2,332,875

Repurchase agreements 142,238 142,453 146,876 Other interest

bearing liabilities 142,285 120,030 117,762 Noninterest bearing

liabilities � 29,650 � � 31,587 � � 36,713 � Total liabilities

2,603,940 2,572,193 2,634,226 Shareholders' equity � 304,988 � �

306,151 � � 294,916 � Total Liabilities and Equity $ 2,908,928 � $

2,878,344 � $ 2,929,142 � � Ending shares outstanding 15,055 14,989

15,032 Memo: Market value of HTM securities $ 27,065 $ 29,157 $

33,090 � 90 days past due loans $ 18,145 $ 15,651 $ 12,261

Nonaccrual loans 31,162 28,501 19,192 Restructured loans - - 61

Foreclosed properties 9,409 9,076 6,624 � Tier 1 leverage ratio

10.45 % 10.52 % 9.88 % Tier 1 risk based ratio 13.11 % 13.40 %

12.75 % Total risk based ratio 14.36 % 14.65 % 13.99 % FTE

employees 991 1,006 999 Community Trust Bancorp, Inc. Financial

Summary (Unaudited) September 30, 2008 (in thousands except per

share data and # of employees) � Community Trust Bancorp, Inc.

reported earnings for the three and nine months ending September

30, 2008 and 2007 as follows: � � � � � � Three Months Ended Nine

Months Ended September 30 September 30 2008 2007 2008 2007 Net

income $ (577 ) $ 10,476 $ 16,588 $ 27,356 � Basic earnings per

share $ (0.04 ) $ 0.69 $ 1.11 $ 1.80 � Diluted earnings per share $

(0.04 ) $ 0.68 $ 1.09 $ 1.77 � Average shares outstanding 15,011

15,183 15,000 15,186 � Total assets (end of period) $ 2,908,928 $

2,929,142 � Return on average equity -0.74 % 14.04 % 7.16 % 12.53 %

� Return on average assets -0.08 % 1.39 % 0.76 % 1.22 % � Provision

for loan losses $ 2,875 $ 1,915 $ 7,892 $ 4,231 � Gains on sales of

loans $ 292 $ 384 $ 1,332 $ 996

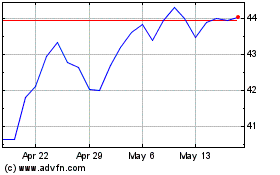

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

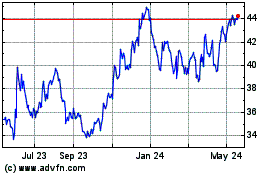

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024