Community Trust Bancorp, Inc. Announces Termination of Merger Agreement with Eagle Fidelity, Inc.

August 14 2007 - 4:36PM

Business Wire

Community Trust Bancorp, Inc. (Nasdaq: CTBI) announced today that

it has terminated its Agreement and Plan of Merger dated May 31,

2007 with Eagle Fidelity, Inc. On August 10, 2007, CTBI was

informed that the Eagle Board of Directors had determined that a

third party had made a �superior proposal� for the acquisition of

Eagle. CTBI�s Board of Directors determined that it would not

increase the consideration under the merger agreement. CTBI has

requested payment of the maximum termination fee under the merger

agreement of $1.25 million. Jean R. Hale, Chairman, President and

Chief Executive Officer of CTBI, stated, �Our Board of Directors�

decision to terminate the merger agreement is consistent with

CTBI�s disciplined approach to acquisitions. CTBI does not pursue

acquisitions which would be unduly dilutive to earnings. However,

CTBI remains committed to growth both through acquisitions and

denovo branching. CTBI considers its stock a good investment and

anticipates that it will begin repurchasing shares under its

existing stock repurchase authorization.� Forward-Looking

Statements Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI�s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as �believe,�

�expect,� �anticipate,� �intend,� �estimate,� �may increase,� �may

fluctuate,� and similar expressions or future or conditional verbs

such as �will,� �should,� �would,� and �could.� These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors� pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations� savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI�s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made. Community Trust

Bancorp, Inc., with assets of $3.0 billion, is headquartered in

Pikeville, Kentucky and has 74 banking locations across eastern,

northeast, central, and south central Kentucky, five banking

locations in southern West Virginia, and five trust offices across

Kentucky.

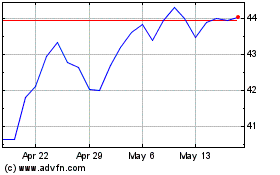

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

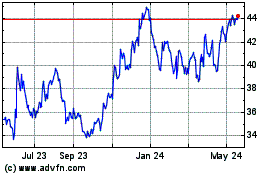

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024