Community Trust Bancorp, Inc. (NASDAQ:CTBI): � � � � � � � � � � �

Earnings Summary (in thousands except per share data) � 2Q 2007 �

1Q 2007 � 2Q 2006 � 6 Months 2007 � 6 Months 2006 Net income $

8,858 $ 8,022 $ 9,892 $ 16,880 $ 19,660 Earnings per share $ 0.58 $

0.53 $ 0.66 $ 1.11 $ 1.31 Earnings per share (diluted) $ 0.57 $

0.52 $ 0.65 $ 1.09 $ 1.29 � Return on average assets 1.18% 1.09%

1.33% 1.13% 1.35% Return on average equity 12.16% 11.33% 15.02%

11.75% 15.14% Efficiency ratio 58.22% 64.68% 55.73% 61.40% 56.95% �

Dividends declared per share $ 0.27 $ 0.27 $ 0.26 $ 0.54 $ 0.52

Book value per share $ 19.17 $ 18.93 $ 17.54 $ 19.17 $ 17.54 �

Weighted average shares 15,216 15,191 15,051 15,203 15,031 Weighted

average shares (diluted) � � 15,448 � � 15,437 � � 15,274 � �

15,421 � � 15,246 Community Trust Bancorp, Inc. (NASDAQ:CTBI)

reports earnings for the quarter ended June 30, 2007 of $8.9

million or $0.58 per basic share compared to $8.0 million or $0.53

per share earned during the quarter ended March 31, 2007 and $9.9

million or $0.66 per share earned during the second quarter of

2006. Earnings for the six months ended June 30, 2007 were $16.9

million or $1.11 per share compared to $19.7 million or $1.31 per

share earned for the first six months of 2006. Second Quarter 2007

Highlights The Company's basic earnings per share for the second

quarter 2007 increased 9.4% from prior quarter but decreased 12.1%

from prior year second quarter. Year-to-date earnings per share

have decreased 15.3% from the six months ended June 30, 2006. Both

the prior quarter and YTD earnings comparisons are impacted by the

one-time expense associated with the refinancing of the Company's

trust preferred securities during the first quarter 2007. Core

earnings for the quarter and YTD 2007 continue to reflect the

pressure on the Company's net interest margin as deposits grew

during the first six months of 2007 more quickly than the Company

has been able to deploy them into higher yielding loans versus

short-term investments. During 2006, the Company's loans repriced

more quickly than its deposits resulting in a stronger net interest

margin than the Company has experienced in 2007 as deposit

repricing continued. The Company's net interest margin increased 2

basis points from prior quarter but has declined 17 basis points

from prior year second quarter as the Company continues operating

within the inverted yield curve environment. Our year-to-date net

interest margin has declined 18 basis points from the first six

months of 2006. Since deposit repricing has been through a 12-month

cycle, management anticipates that the margin will continue to

improve incrementally during the remainder of 2007 in the current

stable rate environment. The Company's loan portfolio grew at an

annualized rate of 8.0% during the quarter and 3.6% from June 30,

2006. Nonperforming loans as a percentage of total loans at June

30, 2007 were 1.08%, an increase of $6.0 million over prior quarter

and a $6.9 million increase from same period prior year. The

increase in nonperforming loans is primarily in smaller commercial

loans with collateral. These loans are reviewed for impairment and

specific reserves are established when appropriate. CTBI's

year-to-date efficiency ratio improved during the second quarter

2007 and is anticipated to continue to improve for the remainder of

2007 as the first quarter was impacted by the one-time charge for

the redemption and refinancing of the Company's trust preferred

securities. Net Interest Income Our net interest margin for the

second quarter 2007 was 3.86% compared to 3.84% for the first

quarter 2007, an improvement of 2 basis points, and a decline of 17

basis points compared to the 4.03% for the second quarter 2006. The

year-to-date net interest margin decline was 18 basis points. As

deposits have completed a 12-month repricing cycle, management

anticipates incremental improvement in the net interest margin for

the remainder of 2007 in the current stable rate environment. Net

interest income increased 2.8% from prior quarter but decreased

2.2% from prior year second quarter. Year-to-date net interest

income has decreased 2.0% compared to the first six months of 2006.

Average earning assets as a percentage of total assets of 92.8% for

the quarter ended June 30, 2007 have remained relatively stable

compared to prior quarter and prior year second quarter of 92.7%

and 92.3%, respectively. Year-to-date average earning assets have

increased 2.6% compared to the six months ended June 30, 2006.

Noninterest Income Noninterest income for the second quarter 2007

was a 5.6% increase from the quarter ended March 31, 2007,

primarily due to increased deposit service charges. Noninterest

income increased 11.4% for the second quarter compared to same

period prior year and 10.6% for the six months ended June 30, 2007

compared to the first six months of 2006. Year over year increases

resulted primarily from increases in trust revenue and loan related

fees. Noninterest Expense Noninterest expense for the quarter

decreased 6.9% from prior quarter as a result of the first quarter

charge from unamortized debt issuance costs with the redemption of

trust preferred securities, but increased 5.4% over prior year

second quarter. Noninterest expense for the six months ended June

30, 2007 increased 8.7% from the six months ended June 30, 2006,

with increases in personnel, data processing expenses, and the

nonrecurring redemption expense. Balance Sheet Review The Company�s

total assets decreased $98.0 million or 3.2% from prior quarter,

$59.5 million of which was the decrease in federal funds sold

associated with the first quarter refinance of our trust preferred

capital securities. However, total assets have increased $33.8

million or 1.1% year over year. Loans outstanding at June 30, 2007

were $2.2 billion reflecting a $43.6 million, annualized 8.0%,

increase during the quarter, and a $76.2 million or 3.6% increase

year over year. The Company's investment portfolio decreased $17.5

million, an annualized 13.8%, and $54.8 million or 10.1%,

respectively, from prior quarter and prior year second quarter.

Deposits, including repurchase agreements, declined $42.0 million,

an annualized 6.6%, during the quarter as the Company focused on

managing its deposit growth and pricing controls due to its

liquidity position resulting from deposit growth during the first

quarter. Deposits have increased 1.6% year over year. Shareholders�

equity of $291.7 million on June 30, 2007 was an annualized

increase of 5.4% from the $287.8 million on March 31, 2007 and a

10.2% increase from the $264.6 million on June 30, 2006. The

Company's annualized dividend yield to shareholders as of June 30,

2007 was 3.34%. Asset Quality Nonperforming loans at June 30, 2007

were $23.9 million compared to $17.9 million at March 31, 2007 and

$17.0 million at June 30, 2006. The increase in nonperforming loans

was primarily smaller commercial loans with collateral that are

individually reviewed with specific reserves established when

appropriate. Foreclosed properties at June 30, 2007 of $3.9 million

were a $0.4 million increase from the $3.5 million on March 31,

2007 and a $1.1 million decrease from the $5.0 million on June 30,

2006. Net loan charge-offs for the quarter of $1.2 million, or

0.23% of average loans annualized, was an increase from prior

quarter's 0.17% of average loans annualized but a decrease from the

0.31% from prior year second quarter. Our reserve for losses on

loans as a percentage of total loans outstanding at June 30, 2007

decreased to 1.25% from the 1.30% at June 30, 2006. The adequacy of

our reserve for losses on loans is analyzed quarterly and adjusted

as necessary. Additional Information Community Trust Bancorp, Inc.

entered into an agreement and plan of merger with Eagle Fidelity,

Inc. on May 31, 2007. On June 21, 2007, a third party made a tender

offer with certain conditions to the shareholders of Eagle

Fidelity, Inc. to purchase their stock for $45 cash per share. The

outcome of this action is unknown at this time. Forward-Looking

Statements Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. The Company�s

actual results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as "believe,"

"expect," "anticipate," "intend," "estimate," "may increase," "may

fluctuate," and similar expressions or future or conditional verbs

such as "will," "should," "would," and "could." These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors� pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations� savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

the Company of an FFIEC policy that provides guidance on the

reporting of delinquent consumer loans and the timing of associated

credit charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect the Company�s results. These statements are

representative only on the date hereof, and the Company undertakes

no obligation to update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.0 billion, is

headquartered in Pikeville, Kentucky and has 74 banking locations

across eastern, northeast, central, and south central Kentucky,

five banking locations in southern West Virginia, and five trust

offices across Kentucky. Additional information follows. Community

Trust Bancorp, Inc. Financial Summary (Unaudited) June 30, 2007 (in

thousands except per share data and # of employees) � Three

MonthsEndedJune 30, 2007 Three MonthsEndedMarch 31, 2007 Three

MonthsEndedJune 30, 2006 Six MonthsEndedJune 30, 2007 � Six

MonthsEndedJune 30, 2006 � Interest income $ 50,085 $ 49,179 $

47,189 $ 99,264 $ 91,577 Interest expense � 23,474 � 23,289 �

19,983 � 46,763 � 38,014 Net interest income 26,611 25,890 27,206

52,501 53,563 Loan loss provision 1,846 470 1,350 2,316 1,350 �

Gains on sales of loans 316 296 316 612 620 Deposit service charges

5,330 4,804 5,309 10,134 9,861 Trust revenue 1,180 1,199 861 2,379

1,742 Loan related fees 867 1,021 488 1,888 1,112 Other noninterest

income � 1,281 � 1,178 � 1,080 � 2,459 � 2,462 Total noninterest

income 8,974 8,498 8,054 17,472 15,797 � Personnel expense 11,100

11,114 10,823 22,214 21,788 Occupancy and equipment 2,875 2,989

2,967 5,864 5,953 Amortization of core deposit intangible 158 159

158 317 317 Other noninterest expense � 6,805 � 8,234 � 5,919 �

15,039 � 11,886 Total noninterest expense � 20,938 � 22,496 �

19,867 � 43,434 � 39,944 � Net income before taxes 12,801 11,422

14,043 24,223 28,066 Income taxes � 3,943 � 3,400 � 4,151 � 7,343 �

8,406 Net income $ 8,858 $ 8,022 $ 9,892 $ 16,880 $ 19,660 � Memo:

TEQ interest income $ 50,463 $ 49,571 $ 47,580 $ 100,034 $ 92,358 �

Average shares outstanding 15,216 15,191 15,051 15,203 15,031 Basic

earnings per share $ 0.58 $ 0.53 $ 0.66 $ 1.11 $ 1.31 Diluted

earnings per share $ 0.57 $ 0.52 $ 0.65 $ 1.09 $ 1.29 Dividends per

share $ 0.27 $ 0.27 $ 0.26 $ 0.54 $ 0.52 � Average balances: Loans,

net of unearned income $ 2,199,233 $ 2,165,510 $ 2,124,485 $

2,182,465 $ 2,110,740 Earning assets 2,801,966 2,774,634 2,746,069

2,788,376 2,717,183 Total assets 3,020,931 2,994,535 2,974,836

3,007,806 2,943,728 Deposits 2,379,683 2,358,675 2,291,822

2,369,237 2,283,250 Interest bearing liabilities 2,275,637

2,260,472 2,244,540 2,268,097 2,215,491 Shareholders' equity

292,096 287,204 264,181 289,664 261,803 � Performance ratios:

Return on average assets 1.18% 1.09% 1.33% 1.13% 1.35% Return on

average equity 12.16% 11.33% 15.02% 11.75% 15.14% Yield on average

earning assets (tax equivalent) 7.22% 7.25% 6.95% 7.23% 6.85% Cost

of interest bearing funds (tax equivalent) 4.14% 4.18% 3.57% 4.16%

3.46% Net interest margin (tax equivalent) 3.86% 3.84% 4.03% 3.85%

4.03% Efficiency ratio (tax equivalent) 58.22% 64.68% 55.73% 61.40%

56.95% � Loan charge-offs $ 1,843 $ 1,650 $ 2,555 $ 3,494 $ 4,916

Recoveries � (608) � (731) � (895) � (1,340) � (1,874) Net

charge-offs $ 1,235 $ 919 $ 1,660 $ 2,154 $ 3,042 � Market Price:

High $ 37.98 $ 41.50 $ 35.50 $ 41.50 $ 35.90 Low 31.40 33.87 31.50

31.40 30.60 Close 32.30 36.23 34.93 32.30 34.93 Community Trust

Bancorp, Inc. Financial Summary (Unaudited) June 30, 2007 (in

thousands except per share data and # of employees) � As ofJune 30,

2007 As ofMarch 31, 2007 As ofJune 30, 2006 Assets: Loans, net of

unearned $ 2,215,057 $ 2,171,484 $ 2,138,817 Loan loss reserve �

(27,688) � (27,077) � (27,814) Net loans 2,187,369 2,144,407

2,111,003 Loans held for sale 3,899 893 2,140 Securities AFS

425,058 440,587 472,678 Securities HTM 36,689 38,655 44,550 Other

equity investments 28,038 28,032 27,325 Other earning assets 69,072

195,968 51,226 Cash and due from banks 78,214 78,324 81,185

Premises and equipment 54,369 55,148 57,230 Goodwill and core

deposit intangible 67,293 67,452 66,391 Other assets � 50,829 �

49,320 � 53,324 Total Assets $ 3,000,830 $ 3,098,786 $ 2,967,052 �

Liabilities and Equity: NOW accounts $ 16,470 $ 14,910 $ 25,296

Savings deposits 669,598 698,783 629,022 CD's >=$100,000 445,725

447,914 412,700 Other time deposits � 796,443 � 796,402 � 774,606

Total interest bearing deposits 1,928,236 1,958,009 1,841,624

Noninterest bearing deposits � 436,702 � 435,023 � 448,842 Total

deposits 2,364,938 2,393,032 2,290,466 Repurchase agreements

154,531 168,441 188,224 Other interest bearing liabilities 157,871

219,614 199,161 Noninterest bearing liabilities � 31,833 � 29,901 �

24,641 Total liabilities 2,709,173 2,810,988 2,702,492

Shareholders' equity � 291,657 � 287,798 � 264,560 Total

Liabilities and Equity $ 3,000,830 $ 3,098,786 $ 2,967,052 � Ending

shares outstanding 15,217 15,203 15,083 Memo: Market value of HTM

securities $ 35,314 $ 37,371 $ 42,002 � 90 days past due loans $

7,684 $ 4,270 $ 5,644 Nonaccrual loans 16,159 13,605 10,697

Restructured loans 43 55 693 Foreclosed properties 3,898 3,514

5,000 � Tier 1 leverage ratio 9.71% 9.62% 9.06% Tier 1 risk based

ratio 12.32% 12.11% 11.51% Total risk based ratio 13.52% 13.28%

12.72% FTE employees 1,012 1,014 1,019 Community Trust Bancorp,

Inc. Financial Summary (Unaudited) June 30, 2007 (in thousands

except per share data and # of employees) � Community Trust

Bancorp, Inc. reported earnings for the three and six months ending

June 30, 2007 and 2006 as follows: � Three Months Ended Six Months

Ended June 30 June 30 � 2007 � 2006 � 2007 � 2006 Net income $

8,858 $ 9,892 $ 16,880 $ 19,660 � Basic earnings per share $ 0.58 $

0.66 $ 1.11 $ 1.31 � Diluted earnings per share $ 0.57 $ 0.65 $

1.09 $ 1.29 � Average shares outstanding 15,216 15,051 15,203

15,031 � Total assets (end of period) $ 3,000,830 $ 2,967,052 �

Return on average equity 12.16% 15.02% 11.75% 15.14% � Return on

average assets 1.18% 1.33% 1.13% 1.35% � Provision for loan losses

$ 1,846 $ 1,350 $ 2,316 $ 1,350 � Gains on sales of loans $ 316 $

316 $ 612 $ 620

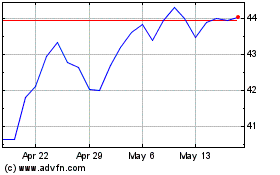

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

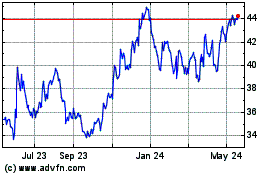

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024