Community Trust Bancorp, Inc. Announces Issuance of $59.5 Million in Trust Preferred Capital Securities and Redemption of Outsta

April 02 2007 - 6:04PM

Business Wire

Community Trust Bancorp, Inc. (Nasdaq: CTBI) announced today that

it issued $59.5 million in aggregate liquidation amount of capital

securities in a private placement to institutional investors

through a Delaware statutory trust subsidiary. The capital

securities, which mature in 30 years but are redeemable at par at

the Company's option after five years, require quarterly payments

to the holders of the capital securities at a rate of 6.52% until

June 1, 2012, and thereafter at a floating rate based on the

three-month LIBOR. The proceeds of the capital securities were used

to fund the redemption on March 31, 2007 of all the Company's

outstanding 9.0% and 8.25% trust preferred securities in the total

amount of $59.5 million. The Company previously announced that it

expected to incur a pre-tax charge from unamortized debt issuance

costs of approximately $1.9 million in the first quarter of 2007 as

a result of the redemption of the trust preferred securities.

However, based on the Company's election to early adopt FASB

Statement No. 159 effective January 1, 2007, with respect to the

then-outstanding trust preferred securities, the Company will not

incur the pre-tax charge to earnings. Instead the unamortized debt

issuance costs were included in the cumulative effect adjustment

related to adopting FASB Statement No. 159 and were recorded to the

January 1, 2007 opening balance of retained earnings. The Company

estimates that the combined effect of the issuance of the capital

securities and the redemption of trust preferred securities will

reduce the Company's interest expense by approximately $1.1 million

in 2007 and $1.4 million annually thereafter through 2011.

Forward-Looking Statements Certain of the statements contained

herein that are not historical facts are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act.

The Company�s actual results may differ materially from those

included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

"believe," "expect," "anticipate," "intend," "estimate," "may

increase," "may fluctuate," and similar expressions or future or

conditional verbs such as "will," "should," "would," and "could."

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors� pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations� savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

the Company of an FFIEC policy that provides guidance on the

reporting of delinquent consumer loans and the timing of associated

credit charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect the Company�s results. These statements are

representative only on the date hereof, and the Company undertakes

no obligation to update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.0 billion, is

headquartered in Pikeville, Kentucky and has 74 banking locations

across eastern, northeast, central, and south central Kentucky,

five banking locations in southern West Virginia, and five trust

offices across Kentucky.

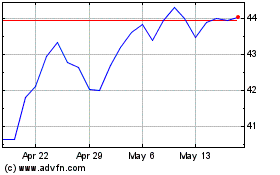

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

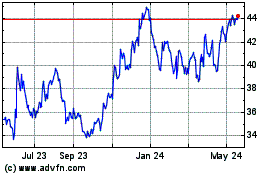

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024