Converted Organics Regains Compliance With Nasdaq Stockholder Equity Listing Rule

December 13 2010 - 9:00AM

Company Raises Stockholder Equity Above Required

Minimum Prior to Grace Period Deadline

Expects to Receive Extension on Nasdaq Minimum

Bid Requirement

Converted Organics Inc. (Nasdaq:COIN) was notified that the Company

has regained compliance regarding the minimum $2.5 million

stockholders' equity requirement, as determined by Nasdaq Listing

Rule 5550(b)(1), and required for continued stock listing. The

Company was informed by letter that the Nasdaq Staff determined

that Converted Organics meets the minimum stockholders' equity

requirements as set forth in the Listing Rules. The letter also

states that the Company must evidence continued compliance with

Listing Rule 5550(b)(1) upon filing its next periodic report;

otherwise, it may be subject to delisting.

In addition, because the Company was successful in increasing

stockholder equity in excess of the Listing Rules' $5 million

Nasdaq Capital Market initial listing requirement, the Company

believes that Nasdaq will grant an additional 180 day grace period

for the Company to raise its closing bid price of its common stock

to $1.00 per share or greater for 10 consecutive business days. On

June 29, 2010, the Company received notification that its stock

price had fallen below the $1.00 minimum bid price for 30

consecutive business days and it was therefore not in compliance

with Listing Rule 5550(a)(2). Nasdaq granted the Company a 180

day grace period to regain compliance with the Listing

Rule. The initial 180 day grace period expires on December 27,

2010, and the Company believes that at such time a second 180 day

grace period may be granted by Nasdaq.

"We are pleased to have regained positive standing under

Nasdaq's stockholder equity Listing Rule, and feel that efforts to

re-gain favorable standing are evidenced by our increased

stockholders' equity," said Edward J. Gildea, President of

Converted Organics. "We hope to receive notification from Nasdaq

later this month, that we have been granted a second 180 day grace

period to raise our stock price above the $1.00 minimum bid

requirement, and upon such notice we will continue to work

diligently to regain 100% compliance with Nasdaq's Listing

Rules."

About Converted Organics Inc.

Converted Organics (Nasdaq:COIN)

(www.convertedorganics.com), based in Boston, MA, is

dedicated to producing high-quality, all-natural, organic soil

amendment and fertilizer products through food waste recycling. The

Company uses its proprietary High Temperature Liquid Composting

(HTLC) system, a proven, state-of-the-art microbial digestion

technology, to process various biodegradable food wastes into dry

pellet and liquid concentrate organic fertilizers that help grow

healthier food and improve environmental quality. Converted

Organics sells and distributes its environmentally-friendly

fertilizer products in the retail, professional turf management,

and agribusiness markets.

The Converted Organics Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=7431

This press release contains forward-looking statements that are

subject to risks and uncertainties. Forward-looking statements in

this release include, without limitation, the granting of a second

180-day grace period by Nasdaq in connection with the Company's

bid-price deficiency. These forward-looking statements include

information about possible or assumed future results of our

business, financial condition, liquidity, results of operations,

plans and objectives. In some cases, you may identify

forward-looking statements by words such as "may," "should,"

"plan," "intend," "potential," "continue," "believe," "expect,"

"predict," "anticipate" and "estimate," the negative of these words

or other comparable words. These statements are only predictions.

One should not place undue reliance on these forward-looking

statements. The forward-looking statements are qualified by their

terms and/or important factors, many of which are outside the

Company's control, involve a number of risks, uncertainties and

other factors that could cause actual results and events to differ

materially from the statements made. The forward-looking statements

are based on the Company's beliefs, assumptions and expectations of

our future performance, taking into account information currently

available to the Company. These beliefs, assumptions and

expectations can change as a result of many possible events or

factors, including those events and factors, not all of which are

known to the company, described most recently in the "Risk Factors"

section in the Company's most recently filed annual report on Form

10-K. Neither the Company nor any other person assumes

responsibility for the accuracy or completeness of these

statements. The Company will update the information in this press

release only to the extent required under applicable securities

laws. If a change occurs, the company's business, financial

condition, liquidity and results of operations may vary materially

from those expressed in the aforementioned forward-looking

statements.

COIN-G

CONTACT: PR Financial Marketing

Jim Blackman

713-256-0369

jim@prfmonline.com

Converted Organics Inc.

Public Relations Contact:

(617)624-0111

info@convertedorganics.com

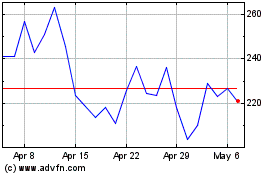

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jul 2023 to Jul 2024