false

0001822791

0001822791

2024-07-08

2024-07-08

0001822791

clnn:CommonStock00001ParValueCustomMember

2024-07-08

2024-07-08

0001822791

clnn:WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShareCustomMember

2024-07-08

2024-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 8, 2024

CLENE INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39834

|

85-2828339

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

| |

|

|

|

6550 South Millrock Drive, Suite G50

Salt Lake City, Utah

|

|

84121

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(801) 676-9695

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

CLNN

|

|

The Nasdaq Capital Market

|

|

Warrants, to acquire one-half of one share of Common Stock for $11.50 per share

|

|

CLNNW |

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

--12-31

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On July 8, 2024, Clene Inc. (the “Company”) filed a Certificate of Amendment (the “Certificate”) to the Company’s Fourth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) with the Secretary of State of the State of Delaware, to effect a 1-for-20 reverse stock split (the “Reverse Stock Split”) of the Company’s issued and outstanding shares of common stock, par value $0.0001 per share (“Common Stock”), effective at 12:01 a.m. Eastern Time on July 11, 2024 (the “Effective Date”). Beginning with the opening of trading on July 11, 2024, the Company’s Common Stock is expected to begin trading on the Nasdaq Capital Market (“Nasdaq”) on a split-adjusted basis under a new CUSIP number 185634201. The CUSIP number for the Company’s publicly traded warrants will not change.

As a result of the Reverse Stock Split, each 20 shares of the Company’s Common Stock issued and outstanding will be automatically combined and converted into 1 validly issued, fully paid and non-assessable share of Common Stock, without any action on the part of the holders. No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders will receive, in lieu of any fractional shares, an amount in cash (without interest) equal to: (i) the number of shares of Common Stock held by such stockholder before the Reverse Stock Split that would otherwise have been exchanged for such fractional shares multiplied by (ii) the closing price of the Company’s Common Stock on Nasdaq on the trading day immediately preceding the Effective Date.

The Reverse Stock Split will not reduce the total number of authorized shares of Common Stock or preferred stock, par value $0.0001 per share (“Preferred Stock”), or change the par values of the Company’s Common Stock or Preferred Stock. The Reverse Stock Split will affect all stockholders uniformly and will not affect any stockholder’s ownership percentage of the Company’s shares of Common Stock (except to the extent that the Reverse Stock Split would result in some of the stockholders receiving cash in lieu of fractional shares). All outstanding stock options, warrants, rights to restricted stock awards, convertible debt, and contingent earn-out shares entitling their holders to purchase or receive shares of Common Stock will be adjusted as a result of the Reverse Stock Split, in accordance with the terms of each such security. In addition, the number of shares reserved for issuance pursuant to the Company’s Amended 2020 Stock Plan will also be appropriately adjusted.

The foregoing description of the Certificate does not purport to be complete and is qualified in its entirety by reference to the text of the Certificate, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

As a result of the Reverse Stock Split and immediately following the effectiveness of the Reverse Stock Split, the number of issued and outstanding shares of Common Stock will be adjusted from approximately 128.7 million shares to approximately 6.4 million shares.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements for purposes of the federal securities laws. These forward-looking statements include, but are not limited to, statements related to the Reverse Stock Split and the timing thereof. As a result of a number of known and unknown risks and uncertainties, the performance of the Reverse Stock Split may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause performance to differ include those relating to general market conditions as well as other risks detailed from time to time in the Company’s Securities and Exchange Commission filings, including in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024. These forward-looking statements represent the Company’s views only as of the date of this Current Report on Form 8-K and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date.

Item 7.01 Regulation FD Disclosure.

On July 9, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filings, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

| |

CLENE INC.

|

| |

|

|

Date: July 9, 2024

|

By:

|

/s/ Robert Etherington

|

| |

|

Robert Etherington

|

| |

|

President and Chief Executive Officer

|

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE FOURTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

CLENE INC.

(Pursuant to Sections 242 of the

General Corporation Law of the State of Delaware)

Clene Inc., a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the “General Corporation Law”), does hereby certify as follows:

1. The name of this corporation is Clene Inc. This corporation was originally incorporated pursuant to the General Corporation Law on August 12, 2020 under the name Chelsea Worldwide Inc.

2. The Board of Directors of this corporation duly adopted resolutions proposing to amend the Fourth Amended and Restated Certificate of Incorporation of this corporation, declaring said amendment to be advisable and in the best interests of this corporation and its stockholders, and authorizing the appropriate officers of this corporation to solicit the consent of the stockholders therefor, which resolution setting forth the proposed amendment is as follows.

RESOLVED, that the Fourth Amended and Restated Certificate of Incorporation of this corporation be amended by amending and restating Section 4.1 to read in its entirety as follows:

“Section 4.1 Capitalization. The total number of shares of all classes of stock that the Corporation is authorized to issue is 601,000,000 shares, consisting of (i) 1,000,000 shares of Preferred Stock, par value $0.0001 per share (“Preferred Stock”), and (ii) 600,000,000 shares of Common Stock, par value $0.0001 per share (“Common Stock”). The number of authorized shares of Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares of such class or series then outstanding) by the affirmative vote of the holders of a majority in voting power of the stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL (or any successor provision thereto), and no vote of the holders of any of the Common Stock or Preferred Stock voting separately as a class shall be required therefor, unless a vote of any such holder is required pursuant to this Certificate of Incorporation or any certificate of designation relating to any series of Preferred Stock. The filing of this Certificate of Incorporation shall occur on the closing date of the transactions contemplated by that certain Merger Agreement, dated as of September 1, 2020, by and among Clene Nanomedicine, Inc., Fortis Advisors LLC, Tottenham Acquisition I Ltd., the Corporation (formerly known as Chelsea Worldwide Inc.) and Creative Worldwide Inc.

Upon the filing and effectiveness (the “Effective Time”) pursuant to the DGCL of this Certificate of Amendment to the Certificate of Incorporation of the Corporation, each 20 shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock (the “Reverse Stock Split”). No fractional shares shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock shall be entitled to receive cash (without interest or deduction) from the Corporation’s transfer agent in lieu of such fractional share interests upon the submission of a transmission letter by a stockholder holding the shares in book-entry form and, where shares are held in certificated form, upon the surrender of the stockholder's Old Certificates (as defined below), in an amount equal to the product obtained by multiplying (a) the closing price per share of the Common Stock as reported on the Nasdaq Capital Market as of the date of the Effective Time, by (b) the fraction of one share owned by the stockholder. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”), shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above.”

3. This Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation was approved by its stockholders at its annual meeting of stockholders on May 29, 2024 and duly executed by an authorized officer of the corporation pursuant to Section 103 of the General Corporation Law.

4. This Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation, which amends the provisions of this corporation’s Amended and Restated Certificate of Incorporation, has been duly adopted in accordance with Sections 242 of the General Corporation Law.

5. This Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation shall be effective as of 12:01 a.m. Eastern Time on July 11, 2024.

IN WITNESS WHEREOF, this Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation has been executed by a duly authorized officer of this corporation on this 8th day of July, 2024.

| |

/s/ Robert Etherington |

|

| |

Robert Etherington |

|

| |

President & Chief Executive Officer |

|

Exhibit 99.1

Clene Announces 1-for-20 Reverse Stock Split

SALT LAKE CITY, July 9, 2024 -- Clene Inc. (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine Inc., a clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including amyotrophic lateral sclerosis (ALS) and multiple sclerosis (MS), today announced that it will effect a 1-for-20 reverse stock split at 12:01 a.m. Eastern Time, on July 11, 2024. Beginning with the opening of trading on July 11, 2024, Clene’s common stock will trade on the Nasdaq Capital Market on a split-adjusted basis under a new CUSIP number 185634201 and the Company’s existing trading symbol “CLNN.” The CUSIP number for the Company’s publicly traded warrants will not change.

The reverse stock split is intended to enable Clene to regain compliance with the $1.00 minimum closing bid price required for continued listing on the Nasdaq Capital Market.

At the 2024 Annual Meeting of Stockholders held on May 29, 2024, Clene’s stockholders approved the proposal to authorize Clene’s Board of Directors to file an amendment to Clene’s amended and restated certificate of incorporation (“Certificate of Incorporation”) to effect the reverse stock split at a ratio to be determined by the Board, ranging from 1-for-5 to 1-for-20. The specific 1-for-20 ratio was subsequently approved by Clene’s Board of Directors and the reverse stock split will be effected by filing a Certificate of Amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware. No further action is required by any stockholders in connection with approving or effecting the reverse stock split.

The reverse stock split will affect all issued and outstanding shares of Clene’s common stock. At the effective time of the reverse stock split, the number of shares of common stock issued and outstanding will be reduced from approximately 128.7 million shares to approximately 6.4 million shares. All outstanding stock options, warrants, rights to restricted stock awards, convertible debt, and contingent earn-out shares entitling their holders to purchase or receive shares of Common Stock will be adjusted as a result of the reverse stock split, as required by the terms of each security. In addition, the number of shares reserved for issuance pursuant to the Company’s Amended 2020 Stock Plan will also be appropriately adjusted. The reverse stock split will affect all stockholders uniformly and will not affect any stockholder's ownership percentage of Clene’s shares (except to the extent that the reverse stock split would result in some of the stockholders receiving cash in lieu of fractional shares). Stockholders will receive cash in lieu of fractional shares based on the closing price per share of Clene’s common stock as quoted on the Nasdaq Capital Market on July 10, 2024. The reverse stock split will not reduce the number of authorized shares of common stock or preferred stock or change the par values of Clene’s common stock (which will remain at $0.0001 per share) or preferred stock (which will remain at $0.0001 per share).

Equiniti Trust Company, LLC, (“Equiniti”) is acting as the exchange agent and transfer agent for the reverse stock split. Equiniti will provide instructions to stockholders with physical certificates regarding the process for exchanging their pre-split stock certificates for post-split shares in book-entry form and receiving payment for any fractional shares.

Additional information about the reverse stock split can be found in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission (“SEC”) on April 16, 2024. The Definitive Proxy Statement is available at www.sec.gov or at Clene’s website at invest.clene.com.

About Clene

Clene Inc., (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine Inc., is a late clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including amyotrophic lateral sclerosis, Parkinson’s disease and multiple sclerosis. CNM-Au8® is an investigational first-in-class therapy that improves central nervous system cells’ survival and function via a mechanism that targets mitochondrial function and the NAD pathway while reducing oxidative stress. CNM-Au8 is a federally registered trademark of Clene Nanomedicine, Inc. The company is based in Salt Lake City, Utah, with R&D and manufacturing operations in Maryland. For more information, please visit www.clene.com or follow us on X (formerly Twitter) and LinkedIn.

Forward Looking Statements:

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the “safe harbor” provisions created by those laws. Clene’s forward-looking statements include, but are not limited to, statements regarding the timing, consummation, and impact of the reverse stock split, the Company’s ability to regain compliance with Nasdaq’s minimum bid price requirement, and the actions of third parties, including Equiniti, with respect to the reverse stock split. In addition, any statements that refer to characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements represent our views as of the date of this press release and involve a number of judgments, risks and uncertainties. We anticipate that subsequent events and developments will cause our views to change. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. As a result of a number of known and unknown risks and uncertainties, the timing, consummation and impact of the reverse stock split, the Company’s ability to regain compliance with Nasdaq’s minimum bid price requirement and the actions of third parties, including Equiniti, may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include general market conditions, our ability to maintain compliance with Nasdaq’s continued listing standards, and other risks and uncertainties set forth in “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to rely unduly upon these statements. All information in this press release is as of the date of this press release. The information contained in any website referenced herein is not, and shall not be deemed to be, part of or incorporated into this press release.

| Contacts: |

|

|

| |

|

|

| Media Contact |

|

Investor Contact |

| Ignacio Guerrero-Ros, Ph.D., or David Schull |

|

Kevin Gardner |

| Russo Partners, LLC |

|

LifeSci Advisors |

| Ignacio.guerrero-ros@russopartnersllc.com |

|

kgardner@lifesciadvisors.com |

| David.schull@russopartnersllc.com |

|

617-283-2856 |

| (858) 717-2310 |

|

|

v3.24.2

Document And Entity Information

|

Jul. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CLENE INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39834

|

| Entity, Tax Identification Number |

85-2828339

|

| Entity, Address, Address Line One |

6550 South Millrock Drive, Suite G50

|

| Entity, Address, City or Town |

Salt Lake City

|

| Entity, Address, State or Province |

UT

|

| Entity, Address, Postal Zip Code |

84121

|

| City Area Code |

801

|

| Local Phone Number |

676-9695

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001822791

|

| CommonStock00001ParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CLNN

|

| Security Exchange Name |

NASDAQ

|

| WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, to acquire one-half of one share of Common Stock for $11.50 per share

|

| Trading Symbol |

CLNNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=clnn_CommonStock00001ParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=clnn_WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

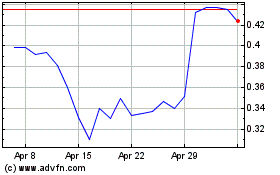

Clene (NASDAQ:CLNN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clene (NASDAQ:CLNN)

Historical Stock Chart

From Nov 2023 to Nov 2024