false

0001822791

0001822791

2024-02-22

2024-02-22

0001822791

clnn:CommonStock00001ParValueCustomMember

2024-02-22

2024-02-22

0001822791

clnn:WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShareCustomMember

2024-02-22

2024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

CLENE INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39834

|

85-2828339

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification No.)

|

| |

|

|

|

6550 South Millrock Drive, Suite G50

Salt Lake City, Utah

|

|

84121

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(801) 676-9695

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

CLNN

|

|

The Nasdaq Capital Market

|

|

Warrants, to acquire one-half of one share of Common Stock for $11.50 per share

|

|

CLNNW |

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

In connection with the press release discussed under Item 8.01 in this Current Report on Form 8-K, on February 22, 2024, Clene Inc. (the “Company”) released a presentation (the “Presentation”) on its website, invest.clene.com. The Presentation discusses a significant survival benefit with CNM-Au8 treatment in the Company’s amyotrophic lateral sclerosis (“ALS”) compassionate use expanded access programs (“EAPs”). A copy of the Presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filings, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On February 22, 2024, the Company issued a press release announcing a significant survival benefit with CNM-Au8® treatment in its ALS EAP compassionate use programs. A copy of the press release is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

| |

CLENE INC.

|

| |

|

|

Date: February 22, 2024

|

By:

|

/s/ Robert Etherington

|

| |

|

Robert Etherington

|

| |

|

President and Chief Executive Officer

|

Exhibit 99.1

Exhibit 99.2

CLENE REPORTS SIGNIFICANT SURVIVAL BENEFIT

WITH CNM-Au8® TREATMENT IN ALS EAP

COMPASSIONATE USE PROGRAMS

|

●

|

Two “Compassionate Use” Expanded Access Programs (EAPs) provided access to treatment with CNM-Au8 to more than 250 people living with amyotrophic lateral sclerosis (ALS).

|

|

●

|

A significant survival benefit (p=0.0001) was observed in EAP participants treated with CNM-Au8 compared to historical ALS disease progression controls (participants untreated with CNM-Au8) in two independent analyses: a 68% decreased risk of all-cause mortality compared to PRO-ACT matched controls, and a 57% decreased risk of all-cause mortality compared to ALS Natural History Consortium matched controls.

|

|

●

|

CNM-Au8 30 mg treatment was well-tolerated, without a single serious adverse event attributed to CNM-Au8, and no significant safety findings reported.

|

SALT LAKE CITY, Feb. 22, 2024 – Clene Inc. (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine, Inc., a clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including ALS and multiple sclerosis (MS), today reported new, significant survival results from two independent analyses of the pooled data from the intermediate-size EAPs supported by Clene. People living with ALS who were generally too advanced in their disease to qualify for clinical trials received daily oral CNM-Au8® 30 mg for up to four years to date.

A pooled survival analysis of EAP participants treated with CNM-Au8 30 mg was compared to two independent datasets derived from PRO-ACT and the ALS/MND Natural History Consortium. The EAP dataset was comprised of 256 participants with ALS of which 220 EAP participants had all baseline values available for matching. These participants were matched for similar baseline characteristics compared to each non-CNM-Au8 treated control.

The results in the EAP participants versus the matched controls demonstrated a significant survival benefit for each comparison:

|

●

|

The PRO-ACT dataset is the largest publicly available repository of longitudinal ALS clinical trial data, containing more than 12,000 records of trial participants:

|

| |

○

|

CNM-Au8 EAP vs. PRO-ACT matched controls: The baseline risk-adjusted hazard ratio demonstrated a 68% decreased risk of all-cause mortality with CNM-Au8 treatment (HR: 0.320, 95% CI: 0.178 – 0.575, p = 0.0001).

|

|

●

|

The ALS/MND Natural History Consortium data set contained approximately 1,700 records of people living with ALS from researchers across nine academic sites collecting recent real-world data:

|

| |

○

|

CNM-Au8 EAP vs. ALS/MND Natural History Consortium matched controls: The baseline risk-adjusted hazard ratio demonstrated a 57% decreased risk of all-cause mortality with CNM-Au8 treatment (HR: 0.433, 95% CI: 0.282 – 0.663, p = 0.0001). |

Analyses including all 256 EAP participants compared to the 220 matched controls also showed statistically significant survival benefits with log-rank p-values of p < 0.0001 and p=0.006 for the PRO-ACT and ALS/MND Natural History Consortium matched controls, respectively.

“The long-term safety and survival data from the CNM-Au8 expanded access programs add to the available data supporting CNM-Au8 moving rapidly to Phase 3 testing in ALS,” said Merit Cudkowicz, MD, MSc, an internationally renowned clinician in the treatment of ALS and Chair of Neurology, Director of the Sean M. Healey and AMG Center for ALS at Mass General Hospital and the Julieanne Dorn Professor of Neurology at Harvard Medical School. “This is one of a few therapies with positive Phase 2 data that must go forward to Phase 3 trials.”

“These EAP results help us better understand how people living with more advanced disease respond to treatment,” said Richard S. Bedlack Jr., MD, PhD, MS Stewart, Hughes and Wendt Distinguished Professor, Neurology, Neuromuscular Disease at Duke University School of Medicine, and a member of the EAP02 steering committee. “Collecting data of peoples’ experience beyond clinical trials is extremely important in rare diseases like ALS. These data warrant consideration to be included in Clene’s discussions about CNM-Au8 with regulatory agencies.”

An EAP is an FDA-regulated pathway that allows patients with a serious or immediately life-threatening condition to gain access to an investigational drug outside of clinical trials when no comparable or satisfactory alternative therapy is available.

The Sean M. Healey & AMG Center for ALS at Massachusetts General Hospital and Clene supported the first EAP (EAP01) launched in 2019. EAP01 was initiated by Dr. Cudkowicz as the principal investigator. EAP01 is a single-site, intermediate sized EAP that allows individuals with ALS who are otherwise unable to qualify for CNM-Au8 in clinical trials access to CNM-Au8. This is currently the longest running intermediate-sized EAP in ALS.

The second EAP (EAP02) was started in 2021 for people living with ALS who did not qualify for participation in the concurrent HEALEY ALS Platform Trial, which is a perpetual multi-center, randomized, double-blind, placebo-controlled clinical trial program designed to evaluate the efficacy and safety of multiple investigational products in people living with ALS. EAP02 is sponsored by Clene and is presently available at 16 clinical sites across the U.S. associated with the Northeast ALS Consortium (NEALS).

Clene was also part of a consortium that was recently awarded a four-year grant totaling $45.1 million from the National Institute of Neurological Disorders and Stroke (NINDS), a division of the National Institutes of Health (NIH), to conduct a third EAP in ALS. Consortium partners include Synapticure and Columbia University. This EAP is expected to commence enrollment in the first half of 2024.

As previously announced, treatment with CNM-Au8 produced consistent survival and delayed time to ALS clinical worsening data in two independent Phase 2, randomized, placebo-controlled, double-blind ALS trials and their open-label extensions. The Phase 2 HEALEY ALS Platform Trial in the U.S. and the RESCUE-ALS Trial in Australia studied 285 participants with ALS at specialty clinics. CNM-Au8 was well-tolerated in all its clinical studies. No serious adverse events have been associated with CNM-Au8 treatment in any Phase 1 or Phase 2 study conducted, including all those involving ALS participants.

About Clene

Clene Inc., (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine Inc., is a late clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including amyotrophic lateral sclerosis, Parkinson’s disease and multiple sclerosis. CNM-Au8® is an investigational first-in-class therapy that improves central nervous system cells’ survival and function via a mechanism that targets mitochondrial function and the NAD pathway while reducing oxidative stress. CNM-Au8® is a federally registered trademark of Clene Nanomedicine, Inc. The company is based in Salt Lake City, Utah, with R&D and manufacturing operations in Maryland. For more information, please visit www.clene.com or follow us on X (formerly Twitter) and LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the “safe harbor” provisions created by those laws. Clene’s forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding our future operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements represent our views as of the date of this press release and involve a number of judgments, risks and uncertainties. We anticipate that subsequent events and developments will cause our views to change. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include our ability to demonstrate the efficacy and safety of our drug candidates; the clinical results for our drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; our ability to achieve commercial success for our drug candidates, if approved; our limited operating history and our ability to obtain additional funding for operations and to complete the development and commercialization of our drug candidates; and other risks and uncertainties set forth in “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to rely unduly upon these statements. All information in this press release is as of the date of this press release. The information contained in any website referenced herein is not, and shall not be deemed to be, part of or incorporated into this press release.

| Media Contact |

Investor Contact |

| Ignacio Guerrero-Ros, Ph.D., or David Schull |

Kevin Gardner |

| Russo Partners, LLC |

LifeSci Advisors |

| Ignacio.guerrero-ros@russopartnersllc.com |

kgardner@lifesciadvisors.com |

| David.schull@russopartnersllc.com |

617-283-2856 |

| (858) 717-2310 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CLENE INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 22, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39834

|

| Entity, Tax Identification Number |

85-2828339

|

| Entity, Address, Address Line One |

6550 South Millrock Drive, Suite G50

|

| Entity, Address, City or Town |

Salt Lake City

|

| Entity, Address, State or Province |

UT

|

| Entity, Address, Postal Zip Code |

84121

|

| City Area Code |

801

|

| Local Phone Number |

676-9695

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001822791

|

| CommonStock00001ParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CLNN

|

| Security Exchange Name |

NASDAQ

|

| WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, to acquire one-half of one share of Common Stock for $11.50 per share

|

| Trading Symbol |

CLNNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=clnn_CommonStock00001ParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=clnn_WarrantsToAcquireOnehalfOfOneShareOfCommonStockFor1150PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

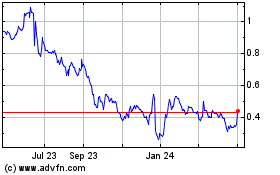

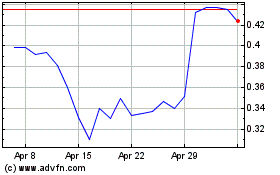

Clene (NASDAQ:CLNN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clene (NASDAQ:CLNN)

Historical Stock Chart

From Nov 2023 to Nov 2024