ClearPoint Neuro, Inc. (Nasdaq: CLPT) (the “Company”), a global

device, cell, and gene therapy-enabling company offering precise

navigation to the brain and spine, today announced financial

results for its second quarter ended June 30, 2024.

Second Quarter Highlights

- Reported quarterly

revenue of $7.9 million, a 32% year-over-year increase;

- Product revenue

across all segments more than doubled, and grew 112% to $4.9

million;

- Increased Biologics and Drug Delivery

revenue to $4.3 million, a 28% year-over-year increase;

- Full market release of SmartFrame OR™

platform and ClearPoint Prism® Laser Therapy System contributing to

record navigation and device revenue of $2.6 million and 34% growth

versus the prior quarter;

- Activated six new global centers in the

second quarter for a total of fourteen new centers so far this

year;

- Partners advancing through preclinical

and clinical review with seven pharmaceutical partners receiving

expedited FDA review designation;

- Approval of SmartFlow® Cannula for

commercial use in Taiwan by the Taiwan Food and Drug

Administration;

- Operational cash

burn reduced to $2.7 million, a 47% year-over-year decrease;

- Cash and cash equivalents totaled $32.8

million as of June 30, 2024.

“This has been the strongest quarter in our history both from a

financial standpoint as well as continued execution of our

four-pillar growth strategy,” commented Joe Burnett, President and

CEO at ClearPoint Neuro. “In the second quarter of 2024, we were

excited to achieve double-digit growth from all four pillars

including Biologics and Drug Delivery, Neurosurgery Navigation,

Therapy and Access Products, and achieving global scale through

capital placements and customer activations. This has led to record

quarterly revenue of $7.9 million, record product revenue of $4.9

million, gross margins rising to 63%, and an operating cash burn

reduction of 47% year over year. We expect to be well poised to

continue this growth across all of our segments as we:

- Expand our biologics and drug delivery

services and customers,

- Add long-term strategic agreements with

pharmaceutical partners,

- Assist our biotech partners as they

continue first-in-human study initiations,

- Continue our expansion into the

operating room with SmartFrame OR,

- Expand our installed base of the PRISM

Laser Therapy System under full market release, and

- Activate new capital customers by

working through our sizable funnel of prospective customers.

As a result of our strong first half of 2024, we are raising our

revenue guidance to between $30.0 and $33.0 million for the year

2024.”

Business Outlook

The Company is raising its full year 2024

revenue outlook to between $30.0 and $33.0 million.

Financial Results – Quarter Ended

June 30, 2024

Total revenue was $7.9 million for the three

months ended June 30, 2024, and $6.0 million for the three

months ended June 30, 2023, which represents an increase of

$1.9 million, or 32%.

Biologics and Drug Delivery revenue, which

includes sales of services and disposable products related to

customer-sponsored preclinical and clinical trials utilizing our

products, increased 28% to $4.3 million for the three months ended

June 30, 2024, from $3.4 million for the same period in 2023.

This increase is attributable to a $1.3 million increase in product

revenue as a result of increased demand for disposables as multiple

partners progress in their trials, partially offset by a decrease

of $0.4 million in service and other revenue, during the three

months ended June 30, 2024, compared to the same period in

2023.

Neurosurgery Navigation and Therapy revenue,

which primarily consists of disposable product commercial sales

related to cases utilizing the ClearPoint system, increased 17% to

$2.6 million for the three months ended June 30, 2024, from

$2.2 million for the same period in 2023. The increase is driven by

higher product revenue of $0.8 million as a result of increased

case volume, new capital placements, and new product offerings

(SmartFrame OR and Prism) during the three months ended

June 30, 2024, compared to the same period in 2023. This is

partially offset by a decrease of $0.4 million in service and other

revenue primarily as a result of pausing a co-development program

with one of our Brain Computer Interface partners, during the three

months ended June 30, 2024, compared to the same period in

2023.

Capital equipment and software revenue,

consisting of sales of ClearPoint reusable hardware and software,

and of related services, increased 148% to $0.9 million for the

three months ended June 30, 2024, from $0.4 million for the

same period in 2023 due to an increase in the placements of

ClearPoint navigation capital and software and Prism laser

units.

Gross margin for the three months ended

June 30, 2024, was 63% compared to a gross margin of 53% for

the three months ended June 30, 2023. The increase in gross

margin was primarily due to lower costs for the three months ended

June 30, 2024 due to the transition to the new manufacturing

facility which was occurring in 2023, and higher volumes for the

three months ended June 30, 2024.

Operating expenses for the second quarter of

2024 were $9.7 million, compared to $10.3 million for the second

quarter of 2023. The decrease was mainly driven by lower product

development costs and bad debt expense, partially offset by higher

sales and marketing personnel expense.

At June 30, 2024, the Company had cash and

cash equivalents totaling $32.8 million as compared to $23.1

million at December 31, 2023, with the increase resulting from

the net proceeds from the public offering of common stock of $16.2

million in the first quarter, partially offset by the use of cash

in operating activities of $6.5 million in the six month period

ending June 30, 2024.

Teleconference Information

Investors and analysts are invited to listen to a live broadcast

review of the Company's 2024 second quarter on Wednesday,

August 7, 2024 at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) which may be accessed online here:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=u0rzWezB.

Investors and analysts who would like to participate in the

conference call via telephone may do so at (888) 428-7458, or at

(862) 298-0702 if calling from outside the U.S. or Canada.

For those who cannot access the live broadcast, a replay will be

available shortly after the completion of the call until September

7, 2024, by calling (877) 660-6853 or (201) 612-7415 if calling

from outside the U.S. or Canada, and then entering conference I.D.

number 413671. An online archive of the broadcast will be available

on the Company's Investor website at

https://ir.clearpointneuro.com/.

About ClearPoint Neuro

ClearPoint Neuro is a device, cell, and gene

therapy-enabling company offering precise navigation to the brain

and spine. The Company uniquely provides both established clinical

products as well as preclinical development services for controlled

drug and device delivery. The Company’s flagship product, the

ClearPoint Neuro Navigation System, has FDA clearance and is

CE-marked. ClearPoint Neuro is engaged with healthcare and research

centers in North America, Europe, Asia, and South America. The

Company is also partnered with the most innovative

pharmaceutical/biotech companies, academic centers, and contract

research organizations, providing solutions for direct CNS delivery

of therapeutics in preclinical studies and clinical trials

worldwide. To date, thousands of procedures have been performed and

supported by the Company’s field-based clinical specialist team,

which offers support and services to our customers and partners

worldwide. For more information, please visit

www.clearpointneuro.com.

Forward-Looking Statements

Statements in this press release and in the teleconference

referenced above concerning the Company’s plans, growth and

strategies may include forward-looking statements within the

context of the federal securities laws. Statements regarding the

Company's future events, developments and future performance, the

size of total addressable markets or the market opportunity for the

Company’s products and services, the Company’s expectation for

revenues, operating expenses, the adequacy of cash and cash

equivalent balances to support operations and meet future

obligations, as well as management's expectations, beliefs, plans,

estimates or projections relating to the future, are

forward-looking statements within the meaning of these laws. These

forward-looking statements are based on management’s current

expectations and are subject to the risks inherent in the business,

which may cause the Company's actual results to differ materially

from those expressed in or implied by forward-looking statements.

Particular uncertainties and risks include those relating to:

global and political instability, supply chain disruptions, labor

shortages, and macroeconomic and inflationary conditions; future

revenue from sales of the Company’s products and services; the

Company’s ability to market, commercialize and achieve broader

market acceptance for new products and services offered by the

Company; the ability of our biologics and drug delivery partners to

achieve commercial success, including their use of the Company’s

products and services in their delivery of therapies; the Company’s

expectations, projections and estimates regarding expenses, future

revenue, capital requirements, and the availability of and the need

for additional financing; the Company’s ability to obtain

additional funding to support its research and development

programs; the ability of the Company to manage the growth of its

business; the Company’s ability to attract and retain its key

employees; and risks inherent in the research, development, and

regulatory approval of new products. More detailed information on

these and additional factors that could affect the Company’s actual

results are described in the “Risk Factors” section of the

Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, and the Company’s Quarterly Report on Form

10-Q for the three months ended March 31, 2024, both of which have

been filed with the Securities and Exchange Commission, and the

Company’s Quarterly Report on Form 10-Q for the three months ended

June 30, 2024, which the Company intends to file with the

Securities and Exchange Commission on or before August 14, 2024.

The Company does not assume any obligation to update these

forward-looking statements.

|

|

|

CLEARPOINT NEURO, INC. |

|

Consolidated Statements of Operations |

|

(Unaudited) |

|

(in thousands, except for share and per share

data) |

| |

| |

For The Three Months

EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

Product revenue |

$ |

4,944 |

|

|

$ |

2,337 |

|

|

Service and other revenue |

|

2,914 |

|

|

|

3,613 |

|

|

Total revenue |

|

7,858 |

|

|

|

5,950 |

|

| Cost of revenue |

|

2,870 |

|

|

|

2,824 |

|

|

Gross profit |

|

4,988 |

|

|

|

3,126 |

|

| Research and development

costs |

|

3,120 |

|

|

|

3,605 |

|

| Sales and marketing

expenses |

|

3,834 |

|

|

|

3,474 |

|

| General and administrative

expenses |

|

2,773 |

|

|

|

3,178 |

|

|

Operating loss |

|

(4,739 |

) |

|

|

(7,131 |

) |

| Other expense: |

|

|

|

|

Other income (expense), net |

|

5 |

|

|

|

(2 |

) |

|

Interest income, net |

|

326 |

|

|

|

81 |

|

| Net loss |

$ |

(4,408 |

) |

|

$ |

(7,052 |

) |

| Net loss per share

attributable to common stockholders: |

|

|

|

|

Basic and diluted |

$ |

(0.16 |

) |

|

$ |

(0.29 |

) |

| Weighted average shares used

in computing net loss per share: |

|

|

|

|

Basic and diluted |

|

27,468,378 |

|

|

|

24,583,712 |

|

| |

For The Six Months

EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

Product revenue |

$ |

8,579 |

|

|

$ |

4,967 |

|

|

Service and other revenue |

|

6,918 |

|

|

|

6,416 |

|

|

Total revenue |

|

15,497 |

|

|

|

11,383 |

|

| Cost of revenue |

|

5,984 |

|

|

|

5,055 |

|

|

Gross profit |

|

9,513 |

|

|

|

6,328 |

|

| Research and development

costs |

|

5,745 |

|

|

|

6,628 |

|

| Sales and marketing

expenses |

|

7,124 |

|

|

|

6,407 |

|

| General and administrative

expenses |

|

5,614 |

|

|

|

6,136 |

|

|

Operating loss |

|

(8,970 |

) |

|

|

(12,843 |

) |

| Other expense: |

|

|

|

|

Other expense, net |

|

(21 |

) |

|

|

(13 |

) |

|

Interest income, net |

|

437 |

|

|

|

195 |

|

| Net loss |

$ |

(8,554 |

) |

|

$ |

(12,661 |

) |

| Net loss per share

attributable to common stockholders: |

|

|

|

|

Basic and diluted |

$ |

(0.32 |

) |

|

$ |

(0.52 |

) |

| Weighted average shares used

in computing net loss per share: |

|

|

|

|

Basic and diluted |

|

26,460,237 |

|

|

|

24,583,439 |

|

|

|

|

|

|

|

|

|

|

|

CLEARPOINT NEURO, INC. |

|

Consolidated Balance Sheets |

|

(in thousands, except for share and per share data) |

| |

| |

June 30,2024 |

|

December 31,2023 |

| |

(Unaudited) |

|

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

32,845 |

|

|

$ |

23,140 |

|

|

Accounts receivable, net |

|

3,475 |

|

|

|

3,211 |

|

|

Inventory, net |

|

8,031 |

|

|

|

7,911 |

|

|

Prepaid expenses and other current assets |

|

2,205 |

|

|

|

1,910 |

|

|

Total current assets |

|

46,556 |

|

|

|

36,172 |

|

| Property and equipment,

net |

|

1,545 |

|

|

|

1,389 |

|

| Operating lease, right-of-use

assets |

|

3,330 |

|

|

|

3,564 |

|

| Software license

inventory |

|

236 |

|

|

|

386 |

|

| Licensing rights |

|

758 |

|

|

|

1,041 |

|

| Other assets |

|

149 |

|

|

|

109 |

|

|

Total assets |

$ |

52,574 |

|

|

$ |

42,661 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

822 |

|

|

$ |

393 |

|

|

Accrued compensation |

|

2,996 |

|

|

|

2,947 |

|

|

Other accrued liabilities |

|

1,302 |

|

|

|

1,053 |

|

|

Operating lease liabilities, current portion |

|

516 |

|

|

|

424 |

|

|

Deferred product and service revenue, current portion |

|

1,079 |

|

|

|

2,613 |

|

|

2020 senior secured convertible note payable, net |

|

9,979 |

|

|

|

— |

|

|

Total current liabilities |

|

16,694 |

|

|

|

7,430 |

|

| Operating lease liabilities,

net of current portion |

|

3,302 |

|

|

|

3,568 |

|

| Deferred product and service

revenue, net of current portion |

|

446 |

|

|

|

541 |

|

| 2020 senior secured

convertible note payable, net |

|

— |

|

|

|

9,949 |

|

|

Total liabilities |

|

20,442 |

|

|

|

21,488 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.01 par value; 25,000,000 shares authorized;

none issued and outstanding at June 30, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value; 90,000,000 shares authorized at

June 30, 2024 and December 31, 2023; 27,588,812 shares

issued and outstanding at June 30, 2024; and 24,652,729 issued

and outstanding at December 31, 2023 |

|

276 |

|

|

|

247 |

|

|

Additional paid-in capital |

|

212,866 |

|

|

|

193,382 |

|

|

Accumulated deficit |

|

(181,010 |

) |

|

|

(172,456 |

) |

|

Total stockholders’ equity |

|

32,132 |

|

|

|

21,173 |

|

|

Total liabilities and stockholders’ equity |

$ |

52,574 |

|

|

$ |

42,661 |

|

|

|

|

|

|

|

|

|

|

|

CLEARPOINT NEURO, INC. |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

|

(in thousands) |

| |

| |

For The Six Months

EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

Net loss |

$ |

(8,554 |

) |

|

$ |

(12,661 |

) |

|

Adjustments to reconcile net loss to net cash flows from operating

activities: |

|

|

|

|

Allowance for credit losses (recoveries) |

|

(507 |

) |

|

|

454 |

|

|

Depreciation and amortization |

|

476 |

|

|

|

285 |

|

|

Share-based compensation |

|

3,300 |

|

|

|

2,952 |

|

|

Amortization of debt issuance costs and original issue

discounts |

|

29 |

|

|

|

28 |

|

|

Amortization of lease right-of-use, net of accretion in lease

liabilities |

|

461 |

|

|

|

325 |

|

|

Accretion of discounts on short-term investments |

|

— |

|

|

|

(126 |

) |

|

Increase (decrease) in cash resulting from changes in: |

|

|

|

|

Accounts receivable |

|

244 |

|

|

|

(588 |

) |

|

Inventory, net |

|

(320 |

) |

|

|

94 |

|

|

Prepaid expenses and other current assets |

|

(294 |

) |

|

|

(438 |

) |

|

Other assets |

|

(39 |

) |

|

|

(25 |

) |

|

Accounts payable and accrued expenses |

|

726 |

|

|

|

(282 |

) |

|

Lease liabilities |

|

(401 |

) |

|

|

(293 |

) |

|

Deferred revenue |

|

(1,629 |

) |

|

|

(480 |

) |

| Net cash flows from operating

activities |

|

(6,508 |

) |

|

|

(10,755 |

) |

| Cash flows from investing

activities: |

|

|

|

|

Purchases of property and equipment |

|

— |

|

|

|

(461 |

) |

|

Acquisition of licensing rights |

|

— |

|

|

|

(167 |

) |

|

Proceeds from maturities of short-term investments |

|

— |

|

|

|

10,000 |

|

|

Net cash flows from investing activities |

|

— |

|

|

|

9,372 |

|

|

Cash flows from financing activities: |

|

|

|

|

Proceeds from public offering of common stock, net of offering

costs |

|

16,183 |

|

|

|

— |

|

|

Proceeds from stock option exercises |

|

21 |

|

|

|

— |

|

|

Payments for taxes related to net share settlement of equity

awards |

|

(279 |

) |

|

|

(82 |

) |

|

Proceeds from issuance of common stock under employee stock

purchase plan |

|

288 |

|

|

|

314 |

|

| Net cash flows from financing

activities |

|

16,213 |

|

|

|

232 |

|

| Net change in cash and cash

equivalents |

|

9,705 |

|

|

|

(1,151 |

) |

| Cash and cash equivalents,

beginning of period |

|

23,140 |

|

|

|

27,615 |

|

| Cash and cash equivalents, end

of period |

$ |

32,845 |

|

|

$ |

26,464 |

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION |

|

|

|

| Cash paid for: |

|

|

|

|

Income taxes |

$ |

— |

|

|

$ |

— |

|

|

Interest |

$ |

370 |

|

|

$ |

369 |

|

Contact:

Media Contact:

Jacqueline Keller, Vice President of Marketing

(888) 287-9109 ext. 4

info@clearpointneuro.com

Investor Relations:

Danilo D’Alessandro, Chief Financial Officer

(888) 287-9109 ext. 3

ir@clearpointneuro.com

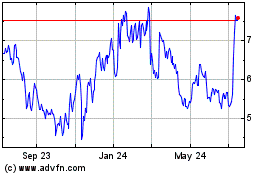

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From Nov 2023 to Nov 2024