2023 Fourth Quarter Results Earnings Release Presentation 2024 Janney CEO Forum for Exhibit 99.1

Cautionary Notes and Additional Disclosures 2 DATES AND PERIODS PRESENTED Unless otherwise noted, “20YY” refers to either the corresponding fiscal year-end date or the corresponding 12-months (i.e., fiscal year) then ended. “MMM-YY” refers to either the corresponding quarter-end date, or the corresponding three-month period then ended. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”) . The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward- looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “on pace,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; adverse impacts to the Company or CCFBank arising from the COVID-19 pandemic; acts of terrorism and political or military actions by the United States or other governments; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; higher lending risks associated with our commercial and agricultural banking activities; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; disintermediation risk; our ability to maintain our reputation; our ability to maintain or increase our market share; our ability to realize the benefits of net deferred tax assets; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; our ability to attract and retain key personnel; our ability to keep pace with technological change; prevalence of fraud and other financial crimes; cybersecurity risks; the possibility that our internal controls and procedures could fail or be circumvented; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; restrictions on our ability to pay dividends; the potential volatility of our stock price; accounting standards for loan losses; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or CCFBank; public company reporting obligations; changes in federal or state tax laws; and changes in accounting principles, policies or guidelines and their impact on financial performance. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, "Risk Factors," in the Company's Form 10-K, for the year ended December 31, 2022, filed with the Securities and Exchange Commission ("SEC") on March 7, 2023, the Company’s Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, filed with the SEC on May 4, 2023, August 3, 2023 and November 3, 2023, respectively, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. NON-GAAP FINANCIAL MEASURES These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non·GAAP financial measures referred to herein include net income as adjusted, EPS as adjusted, ROAA as adjusted, return on average tangible common equity (ROATCE), ROATCE as adjusted, tangible book value, tangible book value per share, efficiency ratio as adjusted and tangible common equity / tangible assets. Reconciliations of all Non·GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. SOURCE Unless otherwise noted, internal Company documents

Investment Summary Markets Strong earnings and ROATCE profile with capacity and infrastructure to grow organically 3 Returns Asset Quality Growing markets with diverse industries and unemployment rates lower than national averages mitigate volatility and support steady growth Sound underwriting practices and portfolio administration have produced strong credit performance Capital Ratios Solid bank capital ratios and improving holding company regulatory capital ratios Shareholder Friendly Board and Executive Management commitment to the company’s stock through individual share repurchases and open authorization to reduce share count

Performance Objectives Increase Tangible Book and Shareholder Value Maintain Strong Asset Quality Metrics Increase Operating Leverage Sustainable Business Practices Maximize earnings in a lower NIM environment to offset AOCI impact on Tangible Book Value and Tangible Common Equity Monitor credit portfolio and maintain NPAs, classifieds and NCOs at or better than peer group median Maintain efficiency ratio in mid 60% range by controlling expenses while NIM pressure persists Implement business priorities that enhance customer, colleague, and community engagement to generate results that increase franchise value 4 Diversified Portfolios Maintain diversified loan and deposit portfolios by geography, industry, loan type and size, and customer relationship, predominantly in Northwest Wisconsin and Southern Minnesota

Operating Market Overview CZWI Operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Source: S&P Global Market Intelligence 0 0 0 0 0 5

$574 $733 $759 $1,177 $1,238 $1,311 $1,412 $1,421 $1,425 $1,448 $1,460 $558 $743 $747 $1,196 $1,295 $1,388 $1,425 $1,437 $1,465 $1,473 $1,519 $696 $941 $975 $1,531 $1,649 $1,740 $1,816 $1,861 $1,830 $1,831 $1,851 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY Mar-23 Jun-23 Sep-23 23-Dec Franchise Expansion CZWI has transformed the Company from a consumer bank to a commercial bank to strengthen the earnings profile and franchise. Total Assets Loans Receivable Total Deposits Source: S&P Global Market Intelligence, company filings 6 July 2019 Assets: $192mm Tomah, WI May 2016 Assets: $154mm Rice Lake, WI 2 Central Bank branches February 2016 Deposits: $27mm Northwestern WI August 2017 Assets: $269mm Wells, MN October 2018 Assets: $269mm Osseo, WI

89.2% 82.3% 76.1% 87.1% 73.7% 86.5% 87.1% 84.0% 80.8% 89.6% 74.1% 87.4% 87.4% 84.2% 76.8% 84.9% 70.2% 90.9% 0.0% 25.0% 50.0% 75.0% 100.0% Overall Role Team Supervisor Compensation Organization Colleague Engagement 2021 Favorable 2022 Favorable 2023 Favorable Excellent Target Values Our six main values are: integrity, commitment, innovation, collaboration, focus, and sustainability. Vision Make more possible for our customers, colleagues, communities, and shareholders! Mission Provide the best products, service, and ideas to our customers every interaction every day. Culture & Engagement 7 75% Participation Rate 2021 2022 2023 71.8% 91.4% 84.8%

Net Income and Diluted EPS Source: S&P Global Market Intelligence, company filings Net Income as Adjusted and Diluted EPS Income as Adjusted are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Net Income and Diluted EPS Income as Adjusted to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. 8 $2,499 $4,283 $9,463 $12,725 $21,266 $17,761 $3,662 $3,206 $2,498 $3,693 $4,221 $4,962 $10,675 $12,425 $21,339 $18,500 $3,662 $3,206 $2,498 $3,993 $0 $5,000 $10,000 $15,000 $20,000 $25,000 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Net Income Net Income Net Income as Adjusted $0.46 $0.58 $0.85 $1.14 $1.98 $1.69 $0.35 $0.31 $0.24 $0.35 $0.78 $0.68 $0.96 $1.11 $1.99 $1.76 $0.35 $0.31 $0.24 $0.38 $0.00 $0.50 $1.00 $1.50 $2.00 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Diluted EPS Diluted EPS Diluted EPS Income as Adjusted

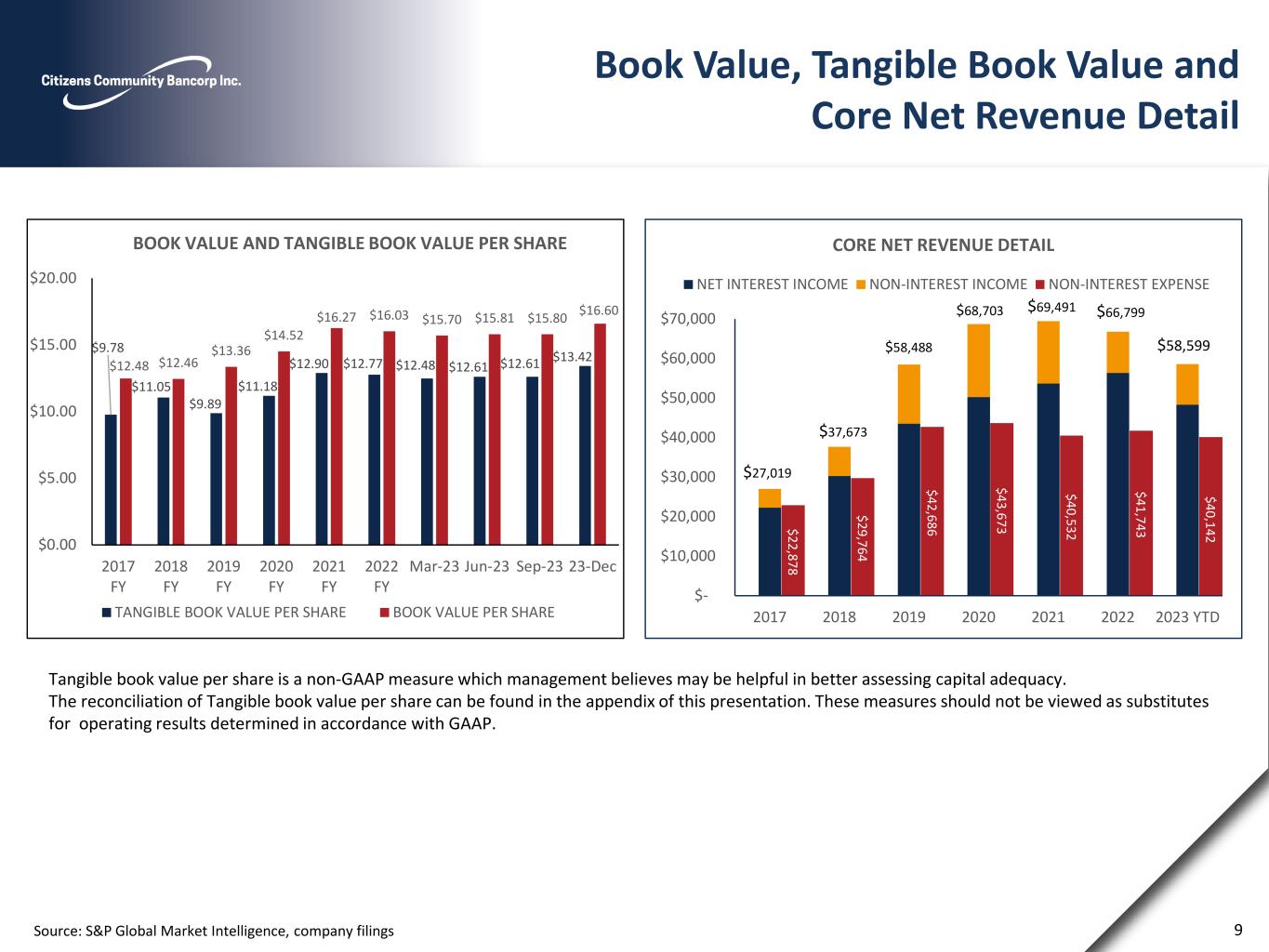

Book Value, Tangible Book Value and Core Net Revenue Detail Source: S&P Global Market Intelligence, company filings Tangible book value per share is a non-GAAP measure which management believes may be helpful in better assessing capital adequacy. The reconciliation of Tangible book value per share can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. 9 $9.78 $11.05 $9.89 $11.18 $12.90 $12.77 $12.48 $12.61 $12.61 $13.42 $12.48 $12.46 $13.36 $14.52 $16.27 $16.03 $15.70 $15.81 $15.80 $16.60 $0.00 $5.00 $10.00 $15.00 $20.00 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY Mar-23 Jun-23 Sep-23 23-Dec BOOK VALUE AND TANGIBLE BOOK VALUE PER SHARE TANGIBLE BOOK VALUE PER SHARE BOOK VALUE PER SHARE $22,878 $29,764 $42,686 $43,673 $40,532 $41,743 $40,142 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2017 2018 2019 2020 2021 2022 2023 YTD CORE NET REVENUE DETAIL NET INTEREST INCOME NON-INTEREST INCOME NON-INTEREST EXPENSE $58,488 $68,703 $69,491 $27,019 $37,673 $66,799 $58,599

Return on average assets as adjusted, return on average tangible common equity (ROATCE) and ROATCE as adjusted are non-GAAP measures, which management believes may be helpful in better understanding the underlying business performance trends related to average assets and average tangible equity. Reconciliations of ROAA as adjusted, ROTCE, and ROTCE as adjusted can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Return on Average Assets and Return on Average Tangible Common Equity Source: SEC filings and Company documents 10 0.34% 0.45% 0.68% 0.80% 1.23% 1.00% 0.81% 0.70% 0.54% 0.79% 0.58% 0.52% 0.76% 0.78% 1.24% 1.04% 0.81% 0.70% 0.54% 0.86% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 23-Dec ROAA ROAA ROAA INCOME AS ADJUSTED 4.5% 5.3% 10.1% 12.1% 17.6% 14.4% 11.9% 10.3% 7.7% 11.3% 7.5% 6.0% 11.2% 11.8% 17.6% 14.9% 11.9% 10.3% 7.7% 12.2% 0.0% 5.0% 10.0% 15.0% 20.0% 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 ROATCE ROATCE ROATCE INCOME AS ADJUSTED

Efficiency Ratio, Net Interest Income (NII) and Net Interest Margin (NIM) The efficiency ratio as adjusted is a non-GAAP measure, which management believes may be helpful in better understanding the underlying business performance trends related to non-interest expense. A reconciliation of the efficiency ratio as adjusted to its comparable GAAP financial measure can be found in the appendix of this presentation. This measure should not be viewed as a substitute for operating results determined in accordance with GAAP. 11 84% 77% 71% 61% 57% 61% 66% 66% 67% 72% 74% 76% 66% 62% 57% 59% 66% 66% 67% 69% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 EFFICIENCY RATIO EFFICIENCY RATIO EFFICIENCY RATIO AS ADJUSTED $20,077 $22,268 $30,303 $43,513 $50,255 $53,667 $56,369 $48,349 3.27% 3.31% 3.42% 3.37% 3.40% 3.34% 3.39% 2.81% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 YTD NII AND NIM NET INTEREST INCOME NET INTEREST MARGIN

Citizens Community Bancorp, Inc. Capital Ratios 12 6.6% 8.3% 7.7% 7.7% 7.9% 8.5% 8.5% 8.6% 8.7% 8.9% 0.0% 4.0% 8.0% 12.0% LEVERAGE RATIO 8.9% 10.2% 9.1% 10.5% 9.7% 9.7% 9.7% 9.9% 10.0% 10.3% 0.0% 5.0% 10.0% 15.0% COMMON EQUITY TIER 1 RATIO 12.0% 12.4% 11.2% 14.3% 13.1% 14.0% 14.1% 14.3% 14.4% 14.7% 0.0% 5.0% 10.0% 15.0% TOTAL CAPITAL RATIO Tangible common equity/tangible assets is a non-GAAP measure, which management believes may be helpful in better understanding the underlying business performance trends related to tangible assets and tangible common equity. A reconciliation of tangible common equity and tangible assets to its comparable financial measure can be found in the appendix of the presentation. This measure should not be viewed as a substitute for operating results determined in accordance with GAAP. 6.3% 10.7% 9.9% 7.7% 7.9% 7.5% 7.2% 7.3% 7.3% 7.7% 0.0% 4.0% 8.0% 12.0% TANGIBLE COMMON EQUITY / TANGIBLE ASSETS

Asset Quality 0.82% 0.89% 0.88% 1.38% 1.29% 1.27% 1.60% 1.63% 1.59% 1.57% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% ALLOWANCE FOR CREDIT LOSSES (ACL) - LOANS 1.49% 1.14% 1.41% 0.70% 0.76% 0.70% 0.63% 0.95% 0.85% 0.83% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% NON-PERFORMING ASSETS (NPA) / ASSETS 13 73.90% 81.04% 51.19% 150.38% 143.03% 156.67% 217.86% 143.39% 159.24% 168.78% 0.00% 50.00% 100.00% 150.00% 200.00% 250.00% ACL-LOANS / NON-PERFORMING LOANS (NPL) 0.07% 0.07% 0.08% 0.08% 0.01% 0.03% 0.01% -0.01% -0.04% -0.07% -0.20% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% NET CHARGE OFFS (NCOS)/ AVERAGE LOANS

CRE, C&I, Ag. Related, C&D 90% Residential & HELOC 9% Consumer 1% Loan Portfolio 09/30/2016 12/31/23 CRE, C&I, Ag. Related, C&D 34% Residential & HELOC 33% Consumer 33% 14 (1) Yield excludes SBA PPP accretion, PCI loan accretion, loan purchase accretion, and interest income recognized on nonaccrual loan payoffs ($000s) Sep-16 Sep-17 Sep-18 Dec-19 Dec-20 Dec-21 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Commercial Real Estate $54,600 $109,024 $156,735 $420,383 $425,283 $610,214 $630,857 $633,618 $638,558 $657,735 $653,437 Housing related CRE $53,475 $77,166 $108,029 $181,084 $204,544 $266,600 $304,022 $300,916 $302,089 $311,740 $325,189 Commercial & Industrial $31,001 $55,251 $76,254 $133,734 $116,553 $122,167 $136,013 $130,943 $133,763 $121,033 $121,666 Ag. Real Estate / Ag. Operating $42,845 $91,875 $97,066 $123,143 $101,580 $110,083 $116,714 $115,104 $111,556 $109,110 $109,041 Q4 2023 Construction & Development $16,580 $19,708 $17,739 $86,410 $98,517 $79,520 $102,492 $114,951 $105,624 $109,799 $110,941 5.26% Residential mortgage and Purchased HELOC loans $187,738 $247,634 $209,781 $184,739 $137,646 $94,861 $108,651 $113,585 $122,940 $128,820 $131,901 Yield (1) Indirect Consumer Installment $168,294 $115,287 $78,245 $39,585 $25,851 $15,971 $10,236 $9,314 $8,189 $7,175 $6,535 Consumer Installment $19,715 $20,668 $18,844 $18,186 $13,213 $8,874 $7,150 $6,728 $6,487 $6,440 $6,187 Gross Loans Ex SBA PPP Loans $574,248 $736,613 $762,693 $1,187,264 $1,123,187 $1,308,290 $1,416,135 $1,425,159 $1,429,206 $1,451,852 $1,464,897 SBA PPP Loans $0 $0 $0 $0 $123,702 $8,755 $0 $0 $0 $0 $0 Total Gross Loans $574,248 $736,613 $762,693 $1,187,264 $1,246,889 $1,317,045 $1,416,135 $1,425,159 $1,429,206 $1,451,852 $1,464,897

Commercial & Ag Loan Portfolio CZWI has transformed its loan portfolio through organic growth and acquisitions Change has occurred from a primarily consumer focused portfolio to a diversified mix consisting of commercial real estate, agricultural and commercial business loans Credit quality remains a focus in conjunction with loan growth 15 ($000s) Sep-16 Sep-17 Sep-18 Dec-19 Dec-20 Dec-21 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Gross Commercial & Ag Loans: Commercial real estate $88,940 $159,962 $216,703 $514,459 $507,675 $698,465 $725,971 $726,748 $732,435 $750,282 $750,531 Agricultural real estate $28,198 $68,002 $70,517 $85,363 $68,795 $78,495 $87,908 $90,958 $87,198 $84,558 $83,350 Multi-family real estate $19,135 $26,228 $48,061 $87,008 $122,152 $178,349 $208,908 $207,786 $208,211 $219,193 $228,095 Construction and development $16,580 $19,708 $17,739 $86,410 $98,517 $79,520 $102,492 $114,951 $105,625 $109,799 $110,941 Commercial and industrial $31,001 $55,251 $76,254 $133,734 $116,553 $122,167 $136,013 $130,943 $133,763 $121,033 $121,666 Agricultural operating $14,647 $23,873 $26,549 $37,780 $32,785 $31,588 $28,806 $24,146 $24,358 $24,552 $25,691 Total Gross Commercial & Ag Loans $198,501 $353,024 $455,823 $944,754 $946,477 $1,188,584 $1,290,098 $1,295,532 $1,291,590 $1,309,417 $1,320,274

Deposit Composition Focus has been on transforming the deposit composition to core deposits Deposit transformation and growth has been achieved through both acquisitions and organic initiatives 9/30/2016 12/31/2023 Source: S&P Global Market Intelligence, company filings Non Interest Bearing Demand 8% Interest Bearing Demand 9% MMDA & Savings 34% CDs 49% 16 Non Interest Bearing Demand 19% Interest Bearing Demand 23% MMDA & Savings 33% CDs 25% ($000) Sep-16 Sep-17 Sep-18 Dec-19 Dec-20 Dec-21 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Non-interest-bearing demand deposits $45,408 $75,318 $87,495 $168,157 $238,348 $276,631 $284,726 $247,735 $261,876 $275,790 $265,704 Interest bearing demand deposits $48,934 $147,912 $139,276 $223,102 $301,764 $396,231 $371,210 $390,730 $358,226 $336,962 $343,276 Q4 2023 Savings accounts $52,153 $102,756 $97,329 $156,599 $196,348 $222,674 $220,019 $214,537 $206,380 $183,702 $176,548 Cost of Deposits Money market accounts $137,234 $125,749 $109,314 $246,430 $245,549 $288,985 $323,435 $309,005 $288,934 $312,689 $374,055 2.12% Certificate accounts $273,948 $290,769 $313,115 $401,414 $313,247 $203,014 $225,334 $274,786 $349,266 $364,092 $359,509 Total Deposits $557,677 $742,504 $746,529 $1,195,702 $1,295,256 $1,387,535 $1,424,724 $1,436,793 $1,464,682 $1,473,235 $1,519,092 Deposit Composition - Quarter Lookback

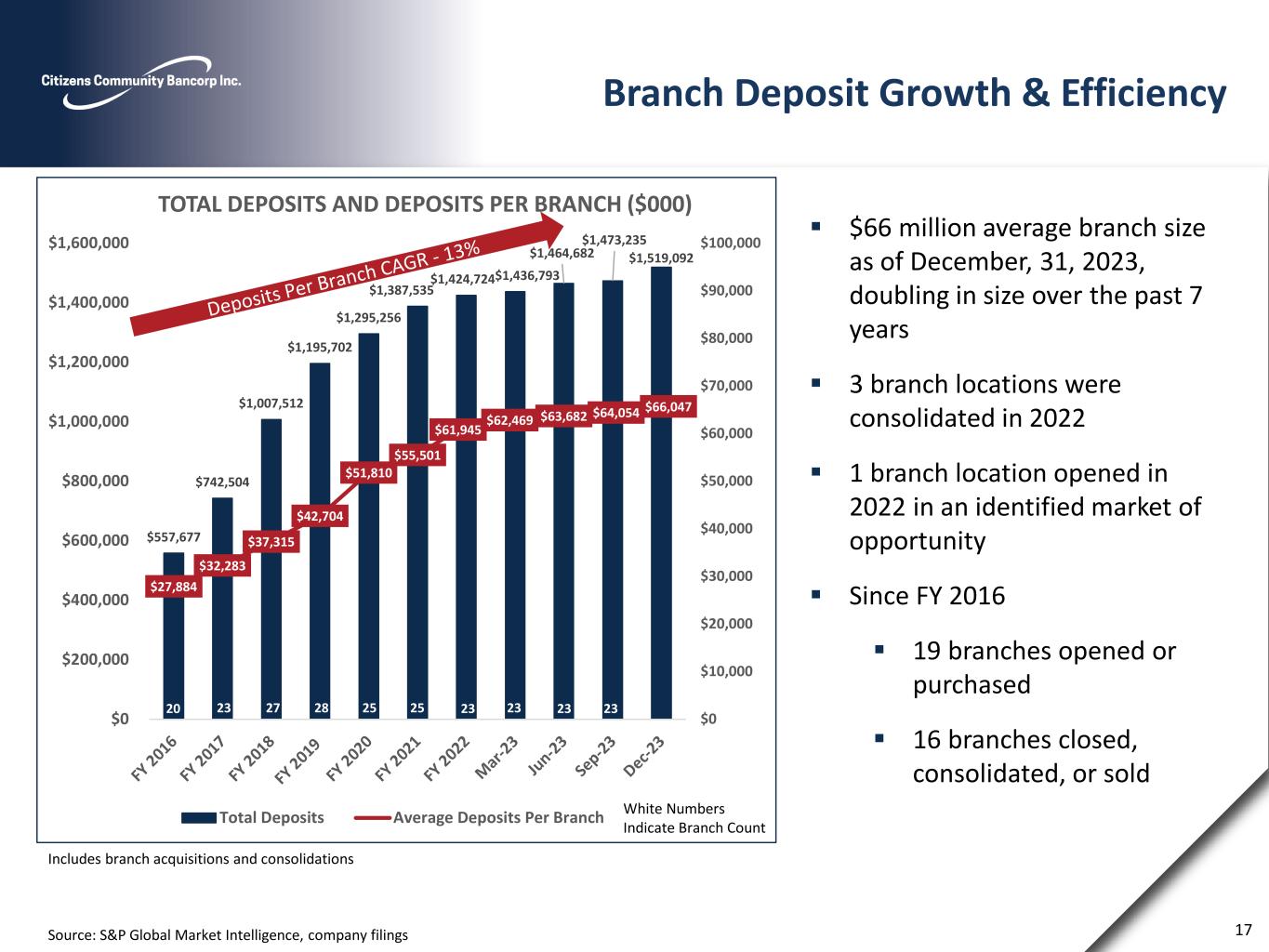

$557,677 $742,504 $1,007,512 $1,195,702 $1,295,256 $1,387,535 $1,424,724 $1,436,793 $1,464,682 $1,473,235 $1,519,092 $27,884 $32,283 $37,315 $42,704 $51,810 $55,501 $61,945 $62,469 $63,682 $64,054 $66,047 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 TOTAL DEPOSITS AND DEPOSITS PER BRANCH ($000) Total Deposits Average Deposits Per Branch 23 27 28 25 25 2323 23 Branch Deposit Growth & Efficiency $66 million average branch size as of December, 31, 2023, doubling in size over the past 7 years 3 branch locations were consolidated in 2022 1 branch location opened in 2022 in an identified market of opportunity Since FY 2016 19 branches opened or purchased 16 branches closed, consolidated, or sold Includes branch acquisitions and consolidations Source: S&P Global Market Intelligence, company filings 17 20 White Numbers Indicate Branch Count 23

Appendix 18

Net Interest Margin Analysis Source: S&P Global Market Intelligence, company filings 19 (1) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 21% for the quarters ended December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023. Quarter ended December 31, 2023 Quarter ended September 30, 2023 Quarter ended June 30, 2023 Quarter ended March 31, 2023 Interest Average Interest Average Interest Average Interest Average Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ ($ Dollars in Thousands) Balance Expense Rate Balance Expense Rate Balance Expense Rate Balance Expense Rate Average interest earning assets: Cash and cash equivalents 16,699$ 241$ 5.75% 21,298$ 302$ 5.63% 24,779$ 327$ 5.29% 18,270$ 140$ 3.11% Loans receivable 1,458,558 19,408 5.28% 1,435,284 19,083 5.27% 1,414,925 17,960 5.09% 1,412,409 17,126 4.92% Interest-bearing deposits - - 0.00% - - 0.00% 5 - 0.00% 249 1 1.63% Investment securities (1) 243,705 2,102 3.42% 252,226 2,119 3.33% 264,579 2,210 3.34% 270,174 2,175 3.22% Non-marketable equity securities, at cost 15,760 275 6.92% 15,511 268 6.85% 17,491 280 6.42% 16,663 231 5.62% Total interest earning assets 1,734,722$ 22,026$ 5.04% 1,724,319$ 21,772$ 5.01% 1,721,779$ 20,777$ 4.84% 1,717,765$ 19,673$ 4.64% Average interest-bearing liabilities: Total deposits 1,199,468$ 7,851$ 2.60% 1,209,688$ 7,388$ 2.42% 1,167,777$ 6,162$ 2.12% 1,165,081$ 4,348$ 1.51% FHLB Advances & Other Borrowings 191,575 2,428 5.03% 182,967 2,263 4.91% 238,776 2,929 4.92% 232,166 2,530 4.42% Total interest bearing liabilities 1,391,043$ 10,279$ 2.93% 1,392,655$ 9,651$ 2.75% 1,406,553$ 9,091$ 2.59% 1,397,247$ 6,878$ 2.00% Net interest income 11,747$ 12,121$ 11,686$ 12,795$ Interest Rate Spread 2.11% 2.26% 2.25% 2.64% Net interest margin 2.69% 2.79% 2.72% 3.02%

Interest Rate Risk 20 (1) Assumes an immediate and parallel shift in the yield curve at all maturities. Note: The tables above may not be indicative of future results. Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Percent Change Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Percent Change +300 bp 0% +300 bp 0% +200 bp 0% +200 bp 0% +100 bp 0% +100 bp 0% -100 bp 0% -100 bp -1% -200 bp -2% -200 bp -4% Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Percent Change Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Percent Change +300 bp -13% +300 bp -3% +200 bp -8% +200 bp -2% +100 bp -4% +100 bp -1% -100 bp 4% -100 bp 1% -200 bp 7% -200 bp 2% December 31, 2022December 31, 2023 December 31, 2022December 31, 2023 Economic Value of Equity (EVE) Net Interest Income Over One Year Horizon

21 Reconciliation of Non-GAAP Financial Measures Reconciliation of GAAP Earnings and Core Earnings (non-GAAP): GAAP pre-tax earnings 3,822$ 6,609$ 12,277$ 17,280$ 28,959$ 23,581$ 4,916$ 4,303$ 5,042$ 4,671$ Merger related costs (1) 1,860$ 463$ 3,880$ -$ -$ -$ -$ -$ -$ -$ Branch closure costs (2) 951$ 26$ 15$ 165$ -$ 981$ -$ -$ -$ 380$ Settlement proceeds (3) (283)$ -$ -$ (131)$ -$ -$ -$ -$ -$ -$ FHLB borrowings prepayment fee (4) 104$ -$ -$ -$ 102$ -$ -$ -$ -$ -$ Audit and Financial Reporting (5) -$ -$ 358$ -$ -$ -$ -$ -$ -$ -$ Net gain on sale of branch -$ -$ (2,295)$ -$ -$ -$ -$ -$ -$ -$ Net gain on sale of acquired business lines (6) -$ -$ -$ (432)$ -$ -$ -$ -$ -$ -$ Income before provision for income taxes as adjusted (7) 6,454$ 7,098$ 14,235$ 16,882$ 29,061$ 24,562$ 4,916$ 4,303$ 5,042$ 5,051$ Provision for income tax on pre-tax earnings as adjusted (8) 2,233$ 1,798$ 3,260$ 4,457$ 7,722$ 6,062$ 1,254$ 1,097$ 2,544$ 1,058$ Tax impact of certain acquired BOLI policies (9) -$ -$ 300$ -$ -$ -$ -$ -$ -$ Tax cuts and Jobs Act of 2017 (10) -$ 338$ -$ -$ -$ -$ -$ -$ -$ -$ Total provision for income tax as adjusted 2,233$ 2,136$ 3,560$ 4,457$ 7,722$ 6,062$ 1,254$ 1,097$ 2,544$ 1,058$ Net income as adjusted (non-GAAP) (7) 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 18,500$ 3,662$ 3,206$ 2,498$ 3,993$ GAAP diluted earnings per share, net of tax 0.46$ 0.58$ 0.85$ 1.14$ 1.98$ 1.69$ 0.35$ 0.31$ 0.24$ 0.35$ Merger related costs, net of tax 0.22$ 0.06$ 0.27$ -$ -$ -$ -$ -$ -$ -$ Branch related costs, net of tax 0.12$ -$ -$ 0.01$ -$ 0.07$ -$ -$ -$ 0.03$ Settlement proceeds (0.03)$ -$ -$ (0.01)$ -$ -$ -$ -$ -$ -$ FHLB borrowings prepayment fee 0.01$ -$ -$ -$ 0.01$ -$ -$ -$ -$ -$ Tax impact of certain acquired BOLI policies (9) -$ -$ (0.03)$ -$ -$ -$ -$ -$ -$ -$ Tax Cuts and Jobs Act of 2017 tax provision (10) -$ 0.04$ -$ -$ -$ -$ -$ -$ -$ -$ Audit and Financial Reporting, net of tax -$ -$ 0.02$ -$ -$ -$ -$ -$ -$ -$ Net gain on sale of branch -$ -$ (0.15)$ -$ -$ -$ -$ -$ -$ -$ Net gain on sale of acquired business lines -$ -$ -$ (0.03)$ -$ -$ -$ -$ -$ -$ Diluted earnings per share, as adjusted, net of tax (non-GAAP) 0.78$ 0.68$ 0.96$ 1.11$ 1.99$ 1.76$ 0.35$ 0.31$ 0.24$ 0.38$ Average diluted shares outstanding 5,378,548 7,335,247 11,121,435 11,161,811 10,726,539 10,513,773 10,477,610 10,478,206 10,470,098 10,457,184 FY 2022 Jun-23Mar-23FY 2020 FY 2021 Sep-23 Dec-23FY 2017 FY 2018 FY 2019

(1) All costs incurred are presented as professional fees and other non-interest expense in the consolidated statement of operations and include costs $0, $0, $0, $0, $0, $0, $0, $341,000, $350,000, and $565,000 for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, and March 31, 2023 and years ended December 31, 2022, December 31, 2021, December 31, 2020, December 31, 2019, September 30, 2018, and September 30, 2017, respectively, which are nondeductible expenses for federal income tax purposes. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of a closed branch office in the fourth quarter of fiscal 2017 and costs associated with three branch closures during the quarter ended December 31, 2020, one branch closure in the quarter ended September 30, 2022, two branch closures in the quarter ended December 31, 2022, and one branch office closure in the quarter ended December 31, 2023. Professional services includes legal costs related to the sale of the Michigan branch included in these Branch closure costs during the quarter ended March 31, 2019. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage-Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Audit and financial reporting costs include additional audit and professional fees related to the change in our year end from September 30 to December 31, effective December 31, 2018. (6) Net gain on sale of acquired business lines resulted from (1) the sale of Wells Insurance Agency and (2) the termination and sale of the wealth management business line sales contract acquired in a former acquisition. (7) Pretax net income as adjusted and net income as adjusted are non-GAAP measures that management believes enhances the market’s ability to assess the underlying business performance and trends related to core business activities. (8) Provision for income tax on pre-tax income as adjusted is calculated at our effective tax rate for each respective period presented. (9) Tax impact of certain acquired BOLI policies from United Bank. (10) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $338,000 in 2018, which is included in provision for income taxes expense in the consolidated statement of operations. 22 Reconciliation of Non-GAAP Financial Measures

Note: All quarterly periods are annualized for net income / net income as adjusted. 23 Reconciliation of Non-GAAP Financial Measures 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Net Income 2,499$ 4,283$ 9,463$ 12,725$ 21,266$ 17,761$ 3,662$ 3,206$ 2,498$ 3,693$ Net Income as adjusted 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 18,500$ 3,662$ 3,206$ 2,498$ 3,993$ Average assets 731,407$ 954,912$ 1,398,482$ 1,594,053$ 1,722,483$ 1,775,049$ 1,823,748$ 1,844,196$ 1,836,775$ 1,843,789$ Return on average assets 0.34% 0.45% 0.68% 0.80% 1.23% 1.00% 0.81% 0.70% 0.54% 0.79% Return on average assets as adjusted 0.58% 0.52% 0.76% 0.78% 1.24% 1.04% 0.81% 0.70% 0.54% 0.86% 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Common Equity 73,483$ 135,847$ 150,553$ 160,564$ 170,866$ 167,088$ 164,561$ 165,558$ 165,402$ 173,334$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) Less: Core Deposit and other intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (2,449) (2,245) (2,052) (1,873) (1,694) Tangible Common Equity (TCE) 57,590$ 120,598$ 111,468$ 123,572$ 135,470$ 133,141$ 130,818$ 132,008$ (132,031)$ 140,142$ Average Tangible Common Equity 58,300$ 89,094$ 105,340$ 115,313$ 127,793$ 131,305$ 130,582$ 131,016$ 132,671$ 134,776$ Net Income 2,499$ 4,283$ 9,463$ 12,725$ 21,266$ 17,761$ 3,662$ 3,206$ 2,498$ 3,693$ Intangible amortization, net of tax 143 417 1,153 1,194 1,171 1,095 152 144 89 142 Tangible Net Income 2,642$ 4,700$ 10,616$ 13,919$ 22,437$ 18,856$ 3,814$ 3,350$ 2,587$ 3,835$ Net Income as adjusted 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 18,500$ 3,662$ 3,206$ 2,498$ 3,993$ Intangible amortization, net of tax 143 417 1,153 1,194 1,171 1,095 152 144 89 142 Tangible Net Income as adjusted 4,364$ 5,379$ 11,828$ 13,619$ 22,510$ 19,595$ 3,814$ 3,350$ 2,587$ 4,135$ ROATCE 4.5% 5.3% 10.1% 12.1% 17.6% 14.4% 11.8% 10.3% 7.7% 11.3% ROATCE as adjusted 7.5% 6.0% 11.2% 11.8% 17.6% 14.9% 11.8% 10.3% 7.7% 12.2% Return on Average Assets (ROAA) as Adjusted Return on Average Tangible Common Equity (ROATCE) as Adjusted (In thousands except ROATCE and ROATCE as adjusted) (In thousands except ROAA and ROAA as adjusted)

Reconciliation of Non-GAAP Financial Measures Note: All quarterly periods are annualized for net income / net income as adjusted 24 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Non-interest Expense (GAAP) 22,878$ 29,764$ 42,686$ 43,673$ 40,532$ 41,743$ 10,121$ 9,846$ 9,969$ 10,206$ Less amortization of intangibles (219) (644) (1,496) (1,622) (1,596) (1,449) (204) (193) (179) (179) Efficiency ratio numerator 22,659 29,120 41,190 42,051 38,936 40,294 9,917 9,653 9,790 10,027 Merger related costs (1,860) (463) (3,880) - - - - - - - Branch Closure costs (951) (26) (15) (165) - (981) - - - (380) Audit and financial reporting - - (358) - - - - - - - Prepayment fee (104) - - - (102) - - - - - Efficiency ratio numerator as adjusted 19,744$ 28,631$ 36,937$ 41,886$ 38,834$ 39,313$ 9,917$ 9,653$ 9,790$ 9,647$ Non-interest income 4,751$ 7,370$ 14,975$ 18,448$ 15,824$ 10,430$ 2,292$ 2,913$ 2,565$ 2,480$ Net interest margin 22,268 30,303 43,513 50,255 53,667 56,369 12,795 11,686 12,121 11,747 Loss (Gain) on investment securities (111) 17 (271) (110) (1,224) (541) (56) (10) (116) (277) Efficiency ratio denominator (GAAP) 26,908 37,690 58,217 68,593 68,267 66,258 15,031 14,589 14,570 13,950 Net gain on sale of branch - - (2,295) - - - - - - - Net gain on sale of acquired business l ines - - - (432) - - - - - - Settlement proceeds (283) - - (131) - - - - - - Efficiency ratio denominator as adjusted 26,625$ 37,690$ 55,922$ 68,030$ 68,267$ 66,258$ 15,031$ 14,589$ 14,570$ 13,950$ Efficiency ratio 84% 77% 71% 61% 57% 61% 66% 66% 67% 72% Efficiency ratio as adjusted 74% 76% 66% 62% 57% 59% 66% 66% 67% 69% 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Total Stockholders' equity 73,483$ 135,847$ 150,553$ 160,564$ 170,866$ 167,088$ 164,561$ 165,558$ 165,402$ 173,334$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (2,449) (2,245) (2,052) (1,873) (1,694) Tangible book value (non-GAAP) 57,590$ 120,598$ 111,468$ 123,572$ 135,470$ 133,141$ 130,818$ 132,008$ 132,031$ 140,142$ Shares outstanding 5,888,816 10,913,853 11,266,954 11,056,349 10,502,442 10,425,119 10,482,821 10,470,175 10,468,091 10,440,591 Book Value 12.48$ 12.45$ 13.36$ 14.52$ 16.27$ 16.03$ 15.70$ 15.81$ 15.80$ 16.60$ TBVPS 9.78$ 11.05$ 9.89$ 11.18$ 12.90$ 12.77$ 12.48$ 12.61$ 12.61$ 13.42$ 2017 2018 2019 2020 2021 2022 Mar-23 Jun-23 Sep-23 Dec-23 Total Assets 940,664$ 975,409$ 1,167,060$ 1,649,095$ 1,739,628$ 1,816,367$ 1,860,720$ 1,829,837$ 1,831,087$ 1,851,391$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (2,449) (2,245) (2,052) (1,873) (1,694) Tangible Assets (non-GAAP) 924,771$ 960,160$ 1,127,975$ 1,612,103$ 1,704,232$ 1,782,420$ 1,826,977$ 1,796,287$ 1,797,716$ 1,818,199$ Tangible Common Equity / Tangible Assets 6.2% 12.6% 9.9% 7.7% 7.9% 7.5% 7.2% 7.3% 7.3% 7.7% Efficiency Ratio as Adjusted Tangible Book Value Per Share (TBVPS) as Adjusted Tangible Common Equity / Tangible Assets (In thousands except Tangible Common Equity / Tangible Asets) (In thousands except Shares Outstanding, Book Value and TBVPS) (In thousands except Efficiency Ratio and Efficiency Ratio as adjusted)

Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images, US Bureau of Labor Statistics Eau Claire MSA: Features a broad-based, diverse economy, which is driven by commercial, housing, retail and medical industries. Mankato MSA: The Mankato market also possesses a broad-based, diverse economy, which is driven by manufacturing, agribusiness, health care and education. Mankato Area EmployersEau Claire Area Employers Market Demographics 25 2.3% 2.5% 4.0% 2.2% 2.3% 2.5% 1.9% 2.0% 3.4% 2.0% 1.9% 1.4% 0.0% 2.5% 5.0% Nov-18 Nov-19 Nov-20 Nov-21 Nov-22 Nov-23 MSA Unemployment Rates Eau Claire MSA Mankato MSA

Leadership Team Stephen M. Bianchi Chairman of the Board President & CEO Mr. Stephen M. Bianchi, also known as Steve, has been the Chief Executive Officer and President of Citizens Community Bancorp, Inc. and Citizens Community Federal since June 24, 2016. He has been Chairman of Citizens Community Bancorp, Inc. since October 2018 and Citizens Community Federal National Association. As a banking veteran with 38 years of experience, Mr. Bianchi served in several senior management positions at Wells Fargo Bank and with Associated Bank. He served as the Chief Executive Officer at HF Financial Corp. from October 2011 and its President from April 2010 to May 2015. Mr. Bianchi served as the Chief Executive Officer and President of Home Federal Bank, a subsidiary of HF Financial Corp. from August 2012 to May 2015. He served as the Interim Chief Executive Officer and Interim President of HF Financial Corp. from October 2011 until July 2012. Mr. Bianchi served as Senior Vice President at Associated Bank, where he served as Minnesota Regional President and Minnesota Regional Commercial Banking Manager from July 2006 to April 2010. Before that, he served as Twin Cities Business Banking Manager for Wells Fargo Bank, where he held several other management positions over 14 years. He has been a Director of Citizens Community Bancorp, Inc. since May 25, 2017. He has been a Director of Citizens Community Federal since June 24, 2016. Mr. Bianchi received his B.S. degree in Finance and M.B.A. from Providence College. James S. Broucek Executive VP, CFO Principal Accounting Officer, Treasurer & Secretary Mr. James S. Broucek, also known as Jim, has been Chief Financial Officer and Principal Accounting Officer at Citizens Community Bancorp, Inc and Citizens Community Federal since October 31, 2017. He serves as Executive Vice President, CFO, Treasurer, and Secretary of Citizens Community Bancorp, Inc. and of Citizens Community Federal National Association. He served as a Senior Manager of Wipfli LLP (“Wipfli”) from December 2013 to October 2017. Before joining Wipfli, Mr. Broucek held several positions with TCF Financial Corporation (“TCF Financial”) and its subsidiaries from 1995 to 2013, with his last position being Treasurer of TCF Financial. Prior to joining TCF Financial, Mr. Broucek served as the Controller of Great Lakes Bancorp. Mr. Broucek is a banking veteran with 38 years of experience. Mr. Broucek holds a B.A. in mathematics and business administration with a concentration in accounting from Hope College. 26