Record Revenue Driven by High-Performance

Mixed-Signal Content Gains in Smartphones

Cirrus Logic, Inc. (Nasdaq: CRUS) today posted on its website at

http://investor.cirrus.com the quarterly Shareholder Letter that

contains the complete financial results for the third quarter

fiscal year 2022, which ended Dec. 25, 2021, as well as the

company’s current business outlook.

“Cirrus Logic reported record revenue in the December quarter,

above the top end of our guidance, driven by significant

contributions from the expanded high-performance mixed-signal

content shipping into smartphones and strong overall demand for our

products,” said John Forsyth, Cirrus Logic president and chief

executive officer. “These results reflect our continued momentum in

FY22 and mark another milestone in the execution of our strategy to

diversify our product and technology portfolio. Building on our

success over the past few years, we are investing in additional

technologies targeting new opportunities for incremental content,

including the areas of sensing, power, and battery systems. Moving

forward, we believe we are well-positioned to increase the

diversity of our business and drive long-term revenue growth.”

Reported Financial Results – Third Quarter FY22

- Revenue of $548.3 million;

- GAAP gross margin of 52.8 percent and non-GAAP gross margin of

52.8 percent;

- GAAP operating expenses of $145.3 million and non-GAAP

operating expenses of $115.5 million; and

- GAAP earnings per share of $2.16 and non-GAAP earnings per

share of $2.54.

A reconciliation of GAAP to non-GAAP financial information is

included in the tables accompanying this press release.

Business Outlook – Fourth Quarter FY22

- Revenue is expected to range between $400 million and $440

million;

- GAAP gross margin is forecasted to be between 51 percent and 53

percent; and

- Combined GAAP R&D and SG&A expenses are anticipated to

range between $150 million and $156 million, including

approximately $19 million in stock-based compensation expense, $8

million in amortization of acquired intangibles and $3 million in

acquisition-related costs.

Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor@cirrus.com. A replay of the webcast can be accessed on the

Cirrus Logic website approximately two hours following its

completion, or by calling (416) 621-4642, or toll-free at (800)

585-8367 (Access Code: 3871289).

Cirrus Logic, Inc.

Cirrus Logic is a leader in low-power, high-precision

mixed-signal processing solutions that create innovative user

experiences for the world’s top mobile and consumer applications.

With headquarters in Austin, Texas, Cirrus Logic is recognized

globally for its award-winning corporate culture. Check us out at

www.cirrus.com.

Cirrus Logic, Cirrus and the Cirrus Logic logo are registered

trademarks of Cirrus Logic, Inc. All other company or product names

noted herein may be trademarks of their respective holders.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, the company has provided non-GAAP financial

information, including non-GAAP net income, diluted earnings per

share, operating income and profit, operating expenses, gross

margin and profit, tax expense, tax expense impact on earnings per

share, and effective tax rate. A reconciliation of the adjustments

to GAAP results is included in the tables below. Non-GAAP financial

information is not meant as a substitute for GAAP results but is

included because management believes such information is useful to

our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally

by management to evaluate and manage the company. The non-GAAP

financial information used by Cirrus Logic may differ from that

used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements

including our statements about our ability to diversify our product

and technology portfolios and drive long-term revenue growth, , and

our estimates for the fourth quarter fiscal year 2022 revenue,

gross margin, combined research and development and selling,

general and administrative expense levels, stock compensation

expense, amortization of acquired intangibles and

acquisition-related costs. In some cases, forward-looking

statements are identified by words such as “expect,” “anticipate,”

“target,” “project,” “believe,” “goals,” “opportunity,”

“estimates,” “intend,” and variations of these types of words and

similar expressions. In addition, any statements that refer to our

plans, expectations, strategies or other characterizations of

future events or circumstances are forward-looking statements.

These forward-looking statements are based on our current

expectations, estimates, and assumptions and are subject to certain

risks and uncertainties that could cause actual results to differ

materially and readers should not place undue reliance on such

statements. These risks and uncertainties include, but are not

limited to, the following: the effects of the global COVID-19

outbreak and the measures taken to limit the spread of COVID-19,

including any disruptions to our business that could result from

measures to contain the outbreak that may be taken by governmental

authorities in the jurisdictions in which we and our supply chain

operate; the susceptibility of the markets we address to economic

downturns, including as a result of the COVID-19 outbreak and the

actions taken to mitigate the spread of COVID-19; the risks of

doing business internationally, including increased import/export

restrictions and controls (e.g., the effect of the U.S. Bureau of

Industry and Security of the U.S. Department of Commerce placing

Huawei Technologies Co., Ltd. and certain of its affiliates on the

Bureau’s Entity List), imposition of trade protection measures

(e.g., tariffs or taxes), security and health risks, possible

disruptions in transportation networks, and other economic, social,

military and geo-political conditions in the countries in which we,

our customers or our suppliers operate; recent increased

industry-wide capacity constraints that may impact our ability to

meet current customer demand, which could cause an unanticipated

decline in our sales and damage our existing customer relationships

and our ability to establish new customer relationships; the

potential for increased prices due to capacity constraints in our

supply chain, which, if we are unable to increase our selling price

to our customers, could result in lower revenues and margins that

could adversely affect our financial results; our ability to

attract, hire, and retain qualified personnel to support the

development, marketing, and sales of our products; the level of

orders and shipments during the fourth quarter of fiscal year 2022,

customer cancellations of orders, or the failure to place orders

consistent with forecasts, along with the risk factors listed in

our Form 10-K for the year ended March 28, 2021 and in our other

filings with the Securities and Exchange Commission, which are

available at www.sec.gov. The foregoing information concerning our

business outlook represents our outlook as of the date of this news

release, and we expressly disclaim any obligation to update or

revise any forward-looking statements, whether as a result of new

developments or otherwise.

Summary financial data follows:

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended

Nine Months Ended

Dec. 25,

Sep. 25,

Dec. 26,

Dec. 25,

Dec. 26,

2021

2021

2020

2021

2020

Q3'22

Q2'22

Q3'21

Q3'22

Q3'21

Audio

$

341,897

$

300,775

$

381,885

$

860,027

$

868,239

High-Performance Mixed-Signal

206,452

165,111

103,910

431,461

207,454

Net sales

548,349

465,886

485,795

1,291,488

1,075,693

Cost of sales

258,827

230,442

234,295

626,576

516,511

Gross profit

289,522

235,444

251,500

664,912

559,182

Gross margin

52.8

%

50.5

%

51.8

%

51.5

%

52.0

%

Research and development

107,101

102,116

89,435

294,913

252,986

Selling, general and administrative

38,247

38,132

32,415

111,526

93,366

Restructuring costs

-

-

-

-

352

Total operating expenses

145,348

140,248

121,850

406,439

346,704

Income from operations

144,174

95,196

129,650

258,473

212,478

Interest income (expense)

(78

)

35

1,206

718

4,160

Other income (expense)

(87

)

1,859

(207

)

1,530

688

Income before income taxes

144,009

97,090

130,649

260,721

217,326

Provision for income taxes

16,373

11,994

16,281

30,780

25,263

Net income

$

127,636

$

85,096

$

114,368

$

229,941

$

192,063

Basic earnings per share:

$

2.23

$

1.48

$

1.97

$

4.01

$

3.30

Diluted earnings per share:

$

2.16

$

1.43

$

1.91

$

3.88

$

3.20

Weighted average number of shares: Basic

57,178

57,364

58,024

57,374

58,176

Diluted

59,031

59,451

59,963

59,317

60,101

Prepared in accordance with Generally Accepted Accounting

Principles

RECONCILIATION BETWEEN GAAP

AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands,

except per share data)

(not prepared in accordance

with GAAP)

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Three Months Ended Nine Months

Ended

Dec. 25,

Sep. 25,

Dec. 26,

Dec. 25,

Dec. 26,

2021

2021

2020

2021

2020

Net Income Reconciliation

Q3'22

Q2'22

Q3'21

Q3'22

Q3'21

GAAP Net Income

$

127,636

$

85,096

$

114,368

$

229,941

$

192,063

Amortization of acquisition intangibles

9,083

7,054

2,998

19,135

8,994

Stock-based compensation expense

17,833

16,551

13,287

49,368

42,069

Restructuring costs

-

-

-

-

352

Acquisition-related costs

3,155

5,834

-

8,989

-

Adjustment to income taxes

(7,903

)

(6,045

)

(2,897

)

(16,897

)

(8,172

)

Non-GAAP Net Income

$

149,804

$

108,490

$

127,756

$

290,536

$

235,306

Earnings Per Share Reconciliation

GAAP

Diluted earnings per share

$

2.16

$

1.43

$

1.91

$

3.88

$

3.20

Effect of Amortization of acquisition intangibles

0.16

0.12

0.05

0.32

0.15

Effect of Stock-based compensation expense

0.30

0.28

0.22

0.83

0.70

Effect of Restructuring costs

-

-

-

-

0.01

Effect of Acquisition-related costs

0.05

0.09

-

0.15

-

Effect of Adjustment to income taxes

(0.13

)

(0.10

)

(0.05

)

(0.28

)

(0.14

)

Non-GAAP Diluted earnings per share

$

2.54

$

1.82

$

2.13

$

4.90

$

3.92

Operating Income Reconciliation

GAAP

Operating Income

$

144,174

$

95,196

$

129,650

$

258,473

$

212,478

GAAP Operating Profit

26.3

%

20.4

%

26.7

%

20.0

%

19.8

%

Amortization of acquisition intangibles

9,083

7,054

2,998

19,135

8,994

Stock-based compensation expense - COGS

245

272

236

763

640

Stock-based compensation expense - R&D

12,260

10,496

9,526

32,368

27,414

Stock-based compensation expense - SG&A

5,328

5,783

3,525

16,237

14,015

Restructuring costs

-

-

-

-

352

Acquisition-related costs

3,155

5,834

-

8,989

-

Non-GAAP Operating Income

$

174,245

$

124,635

$

145,935

$

335,965

$

263,893

Non-GAAP Operating Profit

31.8

%

26.8

%

30.0

%

26.0

%

24.5

%

Operating Expense Reconciliation

GAAP

Operating Expenses

$

145,348

$

140,248

$

121,850

$

406,439

$

346,704

Amortization of acquisition intangibles

(9,083

)

(7,054

)

(2,998

)

(19,135

)

(8,994

)

Stock-based compensation expense - R&D

(12,260

)

(10,496

)

(9,526

)

(32,368

)

(27,414

)

Stock-based compensation expense - SG&A

(5,328

)

(5,783

)

(3,525

)

(16,237

)

(14,015

)

Restructuring costs

-

-

-

-

(352

)

Acquisition-related costs

(3,155

)

(2,373

)

-

(5,528

)

-

Non-GAAP Operating Expenses

$

115,522

$

114,542

$

105,801

$

333,171

$

295,929

Gross Margin/Profit Reconciliation

GAAP

Gross Profit

$

289,522

$

235,444

$

251,500

$

664,912

$

559,182

GAAP Gross Margin

52.8

%

50.5

%

51.8

%

51.5

%

52.0

%

Acquisition-related costs

-

3,461

-

3,461

-

Stock-based compensation expense - COGS

245

272

236

763

640

Non-GAAP Gross Profit

$

289,767

$

239,177

$

251,736

$

669,136

$

559,822

Non-GAAP Gross Margin

52.8

%

51.3

%

51.8

%

51.8

%

52.0

%

Effective Tax Rate Reconciliation

GAAP Tax

Expense

$

16,373

$

11,994

$

16,281

$

30,780

$

25,263

GAAP Effective Tax Rate

11.4

%

12.4

%

12.5

%

11.8

%

11.6

%

Adjustments to income taxes

7,903

6,045

2,897

16,897

8,172

Non-GAAP Tax Expense

$

24,276

$

18,039

$

19,178

$

47,677

$

33,435

Non-GAAP Effective Tax Rate

13.9

%

14.3

%

13.1

%

14.1

%

12.4

%

Tax Impact to EPS Reconciliation

GAAP Tax

Expense

$

0.28

$

0.20

$

0.27

$

0.52

$

0.42

Adjustments to income taxes

0.13

0.10

0.05

0.28

0.14

Non-GAAP Tax Expense

$

0.41

$

0.30

$

0.32

$

0.80

$

0.56

CONSOLIDATED CONDENSED BALANCE SHEET unaudited; in

thousands

Dec. 25,

Mar. 27,

Dec. 26,

2021

2021

2020

ASSETS Current assets

Cash and cash equivalents

$

195,121

$

442,164

$

327,294

Marketable securities

3,719

55,697

43,289

Accounts receivable, net

326,131

108,712

244,803

Inventories

148,525

173,263

142,689

Other current assets

90,025

62,683

45,469

Total current Assets

763,521

842,519

803,544

Long-term marketable securities

72,118

312,759

326,491

Right-of-use lease assets

173,054

133,548

135,719

Property and equipment, net

157,186

154,942

154,312

Intangibles, net

165,581

22,031

24,322

Goodwill

437,783

287,518

287,518

Deferred tax asset

7,203

9,977

7,277

Long-term prepaid wafers

195,000

-

-

Other assets

96,671

67,320

86,446

Total assets

$

2,068,117

$

1,830,614

$

1,825,629

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities Accounts

payable

$

110,250

$

102,744

$

90,814

Accrued salaries and benefits

43,044

54,849

39,367

Lease liability

14,653

14,573

14,539

Acquisition-related liabilities

30,964

-

-

Other accrued liabilities

40,603

41,444

40,135

Total current liabilities

239,514

213,610

184,855

Non-current lease liability

164,896

127,883

129,583

Non-current income taxes

77,683

64,020

70,866

Long-term acquisition-related liabilities

5,528

-

-

Other long-term liabilities

17,749

36,096

39,968

Stockholders' equity:

Capital stock

1,556,746

1,498,819

1,483,567

Accumulated earnings (deficit)

6,416

(112,689

)

(88,238

)

Accumulated other comprehensive income (loss)

(415

)

2,875

5,028

Total stockholders' equity

1,562,747

1,389,005

1,400,357

Total liabilities and stockholders' equity

$

2,068,117

$

1,830,614

$

1,825,629

Prepared in accordance with Generally Accepted

Accounting Principles

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220131005288/en/

Investor Contact: Thurman K. Case Chief Financial Officer

Cirrus Logic, Inc. (512) 851-4125 Investor@cirrus.com

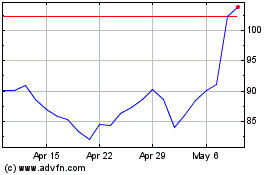

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Oct 2024 to Nov 2024

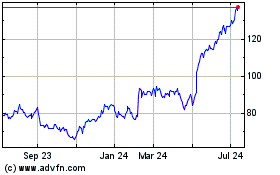

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Nov 2023 to Nov 2024