Strong Demand for Portable Audio Products

Drives Revenue Above Expectations

Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today posted on

its investor relations website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the fourth quarter and full fiscal year 2015, which

ended March 28, 2015, as well as the company’s current business

outlook.

“FY15 was a tremendous year for Cirrus Logic. We are extremely

pleased to have delivered strong revenue growth, achieved our

long-term non-GAAP operating profit target of 20 percent,

significantly expanded our product portfolio, and strengthened our

business through the acquisition of Wolfson Microelectronics,” said

Jason Rhode, president and chief executive officer. “As we move

into FY16, we expect revenue to grow year-over-year as shipments of

products designed for audio and voice applications in mobile

devices accelerate.”

Reported Financial Results – Fourth Quarter FY15

- Revenue of $255.2 million;

- GAAP and non-GAAP gross margin of 46.6

percent;

- GAAP operating expenses of $88.6

million and non-GAAP operating expenses of $73.7 million; and

- GAAP diluted earnings per share of

$0.32 and non-GAAP diluted earnings per share of $0.66.

Reported Financial Results – Full Year FY15

- Revenue of $916.6 million;

- GAAP gross margin of 46.5 percent and

non-GAAP gross margin of 47.4 percent;

- GAAP operating expenses of $317 million

and non-GAAP operating expenses of $253.2 million; and

- GAAP diluted earnings per share of

$0.85 and non-GAAP diluted earnings per share of $2.67.

A reconciliation of the non-GAAP charges is included in the

tables accompanying this press release.

Business Outlook – First Quarter FY16

- Revenue is expected to range between

$260 million and $280 million;

- GAAP gross margin is expected to be

between 45 percent and 47 percent; and

- Combined R&D and SG&A expenses

are expected to range between $93 million and $97 million, which

includes approximately $8 million in share-based compensation and

$7 million in amortization of acquired intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be

accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (404) 537-3406, or

toll-free at (855) 859-2056 (Access Code: 21372109).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal

integrated circuits for a broad range of innovative customers.

Building on its diverse analog and signal-processing patent

portfolio, Cirrus Logic delivers highly optimized products for a

variety of audio, industrial and energy-related applications. The

company operates from headquarters in Austin, Texas, with offices

in the United States, United Kingdom, Australia, Japan and Asia.

More information about Cirrus Logic is available at

www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including gross margins, operating expenses, net income, operating

profit and income, and diluted earnings per share. A reconciliation

of the adjustments to GAAP results is included in the tables below.

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. The non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including expectations for growth in fiscal year 2016 and our

estimates of first quarter fiscal year 2016 revenue, gross margin,

combined research and development and selling, general and

administrative expense levels, share-based compensation expense and

amortization of acquired intangibles. In some cases,

forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially. These risks and uncertainties

include, but are not limited to, the following: the level of orders

and shipments during the first quarter of fiscal year 2016, as well

as customer cancellations of orders, or the failure to place orders

consistent with forecasts; and the risk factors listed in our Form

10-K for the year ended March 29, 2014, and in our other filings

with the Securities and Exchange Commission, which are available at

www.sec.gov. The foregoing information concerning our business

outlook represents our outlook as of the date of this news release,

and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments

or otherwise.

Cirrus Logic, Cirrus and Wolfson are registered trademarks of

Cirrus Logic, Inc. or its subsidiaries. All other company or

product names noted herein may be trademarks of their respective

holders.

Summary financial data follows:

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED

STATEMENT OF OPERATIONS (unaudited) (in thousands,

except per share data)

Three Months Ended Twelve Months Ended

Mar. 28, Dec. 27, Mar. 29, Mar.

28, Mar. 29, 2015 2014 2014

2015 2014 Q4'15 Q3'15 Q4'14

Q4'15 Q4'14 Portable audio products $ 210,814 $

253,355 $ 113,413 $ 740,301 $ 562,718 Non-portable audio and other

products 44,369 45,251 36,246 176,267 151,620

Net sales

255,183 298,606 149,659 916,568

714,338 Cost of sales 136,208 167,775 76,291 490,820 358,175

Gross profit 118,975 130,831 73,368

425,748 356,163 Gross margin 46.6%

43.8% 49.0% 46.5% 49.9% Research

and development 58,070 55,474 35,511 197,878 126,189 Selling,

general and administrative 30,498 27,783 17,823 99,509 74,861

Acquisition related costs - 3,200 - 18,137 - Restructuring and

other - - (26) 1,455 (598) Patent infringement settlements, net - -

- - 695 Total operating expenses 88,568 86,457 53,308 316,979

201,147

Income from operations 30,407

44,374 20,060 108,769 155,016

Interest income (expense), net (869) (1,042) 267 (5,048) 848 Other

expense 392 (1,071) (27) (12,172) (127)

Income before income

taxes 29,930 42,261 20,300 91,549

155,737 Provision for income taxes 8,581 19,532 7,698 36,371

47,626

Net income $ 21,349 $ 22,729 $

12,602 $ 55,178 $ 108,111 Basic earnings

per share: $ 0.34 $ 0.36 $ 0.20 $ 0.88 $ 1.72 Diluted earnings per

share: $ 0.32 $ 0.35 $ 0.20 $ 0.85 $ 1.65 Weighted average

number of shares: Basic 62,852 62,885 62,215 62,503 62,926 Diluted

65,815 65,214 64,545 65,235 65,535 Prepared in accordance

with Generally Accepted Accounting Principles

CIRRUS

LOGIC, INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP

FINANCIAL INFORMATION (unaudited, in thousands, except per

share data) (not prepared in accordance with GAAP)

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Certain modifications to prior year non-GAAP presentation has been

made and had no material effect on the results of operations.

Three Months Ended

Twelve Months Ended Mar. 28, Dec. 27,

Mar. 29, Mar. 28, Mar. 29, 2015

2014 2014

2015 2014 Net Income

Reconciliation

Q4'15 Q3'15 Q4'14 Q4'15

Q4'14 GAAP Net Income $ 21,349 $

22,729 $ 12,602 $ 55,178

$ 108,111 Amortization of acquisition intangibles

7,141 5,151 217 15,062 492 Stock based compensation expense 7,735

7,815 5,545 27,668 23,074 Provision for litigation expenses and

settlements - - - - 695 Restructuring and other costs, net - - (26

) 1,455 (598 ) Wolfson acquisition items - 9,903 - 43,082 -

Provision (benefit) for income taxes 7,230

17,714 7,808 31,934

44,647

Non-GAAP Net Income $ 43,455

$ 63,312 $ 26,146

$ 174,379 $ 176,421

Earnings Per Share Reconciliation

GAAP Diluted earnings

per share $ 0.32 $ 0.35 $

0.20 $ 0.85 $ 1.65 Effect of

Amortization of acquisition intangibles 0.11 0.08 - 0.23 0.01

Effect of Stock based compensation expense 0.12 0.12 0.09 0.42 0.35

Effect of Provision for litigation expenses and settlements - - - -

0.01 Effect of Restructuring and other costs, net - - - 0.02 (0.01

) Effect of Wolfson acquisition items - 0.15 - 0.66 - Effect of

Provision (benefit) for income taxes 0.11 0.27 0.12 0.49 0.68

Non-GAAP Diluted earnings per

share $ 0.66 $ 0.97

$ 0.41 $ 2.67 $

2.69 Operating Income Reconciliation

GAAP

Operating Income $ 30,407 $ 44,374

$ 20,060 $ 108,769 $

155,016 GAAP Operating Profit 12 % 15 % 13 % 12 % 22 %

Amortization of acquisition intangibles 7,141 5,151 217 15,062 492

Stock compensation expense - COGS (10 ) 273 287 747 864 Stock

compensation expense - R&D 2,994 2,904 2,546 11,222 10,392

Stock compensation expense - SG&A 4,751 4,638 2,712 15,699

11,818 Provision for litigation expenses and settlements - - - -

695 Restructuring and other costs, net - - (26 ) 1,455 (598 )

Wolfson acquisition items - 9,903

- 28,642 -

Non-GAAP

Operating Income $ 45,283 $

67,243 $ 25,796 $

181,596 $ 178,679 Non-GAAP

Operating Profit 18 % 23 % 17 % 20 % 25 % Operating Expense

Reconciliation

GAAP Operating Expenses $

88,568 $ 86,457 $ 53,308

$ 316,979 $ 201,147 Amortization of

acquisition intangibles (7,141 ) (5,151 ) (217 ) (15,062 ) (492 )

Stock compensation expense - R&D (2,994 ) (2,904 ) (2,546 )

(11,222 ) (10,392 ) Stock compensation expense - SG&A (4,751 )

(4,638 ) (2,712 ) (15,699 ) (11,818 ) Provision for litigation

expenses and settlements - - - - (695 ) Restructuring and other

costs, net - - 26 (1,455 ) 598 Wolfson acquisition items -

(3,200 ) - (20,329 ) -

Non-GAAP Operating Expenses $ 73,682

$ 70,564 $ 47,859

$ 253,212 $ 178,348

Gross Margin/Profit Reconciliation

GAAP Gross Margin

$ 118,975 $ 130,831 $

73,368 $ 425,748 $ 356,163 GAAP

Gross Profit 46.6 % 43.8 % 49.0 % 46.5 % 49.9 % Wolfson acquisition

items - 6,703 - 8,313 - Stock compensation expense - COGS

(10 ) 273 287 747

864

Non-GAAP Gross Margin $ 118,965

$ 137,807 $ 73,655

$ 434,808 $ 357,027

Non-GAAP Gross Profit 46.6 % 46.2 % 49.2 % 47.4 % 50.0 %

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE

SHEET unaudited; in thousands Mar.

28, Dec. 27, Mar. 29,

2015 2014

2014 ASSETS Current assets Cash and

cash equivalents $ 76,401 $ 66,607 $ 31,850 Marketable securities

124,246 106,061 263,417 Accounts receivable, net 112,608 148,386

63,220 Inventories 84,196 73,896 69,743 Deferred tax asset 18,559

14,143 22,024 Other current assets 35,903

27,081 25,079 Total current Assets 451,913

436,174 475,333 Long-term marketable securities 60,072 3,404

89,243 Property and equipment, net 144,346 137,291 103,650

Intangibles, net 175,743 181,675 11,999 Goodwill 263,115 264,879

16,367 Deferred tax asset 25,593 24,991 25,065 Other assets

27,996 16,654 3,087 Total assets

$ 1,148,778 $ 1,065,068 $ 724,744

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts

payable $ 112,213 $ 77,195 $ 51,932 Accrued salaries and benefits

24,132 20,164 13,388 Deferred income 6,105 5,417 5,631 Other

accrued liabilities 34,128 27,402

11,572 Total current liabilities 176,578 130,178

82,523 Long-term debt 180,439 200,439 - Other long-term

liabilities 34,990 21,073 4,863 Stockholders' equity:

Capital stock 1,159,494 1,135,719 1,078,878 Accumulated deficit

(400,613 ) (421,514 ) (440,634 ) Accumulated other comprehensive

loss (2,110 ) (827 ) (886 ) Total

stockholders' equity 756,771 713,378

637,358 Total liabilities and stockholders' equity $

1,148,778 $ 1,065,068 $ 724,744

Prepared in accordance with Generally Accepted Accounting

Principles

Cirrus Logic, Inc.Thurman K. Case, 512-851-4125Chief Financial

OfficerInvestor.Relations@cirrus.com

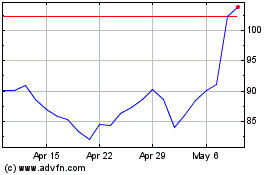

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Aug 2024 to Sep 2024

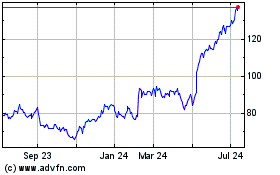

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Sep 2023 to Sep 2024