UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of April 2020

Commission

File Number: 333-231839

CHINA

SXT PHARMACEUTICALS, INC.

(Translation

of registrant’s name into English)

178

Taidong Rd North, Taizhou

Jiangsu,

China

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the

home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a

press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing

a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENT

This Current Report contains forward-looking

statements. All statements contained in this Current Report other than statements of historical fact are forward-looking statements.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “seek” and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about future events

and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term

business operations and objectives, and financial needs.

These forward-looking statements are subject

to a number of risks, uncertainties and assumptions, including, but not limited to, the following: the effects of the COVID-19

outbreak, including its impact on the demand for our products; the duration of the COVID-19 outbreak and severity of such

outbreak in regions where we operate; the pace of recovery following the COVID-19 outbreak; our ability to implement

cost containment and business recovery strategies; the adverse effects of the COVID-19 outbreak on our business or the market

price of our ordinary shares, the Company's goals and strategies; the Company's future business development; product and service

demand and acceptance; changes in technology; economic conditions; reputation and brand; the impact of competition and pricing;

government regulations; fluctuations in general economic and business conditions in China and assumptions underlying or related

to any of the foregoing and other risks contained in reports filed by the Company with the Securities and Exchange Commission.

In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Current Report may not occur

and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements

as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or

occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake no duty to

update any of these forward-looking statements after the date of this Current Report or to conform these statements to actual results

or revised expectations.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Operating

Metrics for the period from April 1, 2019 to September 30, 2019.

The

following table presents the selected condensed consolidated financial information of our company. The selected condensed consolidated

statements of operations data for the six months period ended September 30, 2019, 2018 and the selected condensed consolidated

balance sheets data as of September 30, 2019, and March 31, 2019 have been derived from our unaudited condensed consolidated interim financial

statements, which are included in this interim report. Our unaudited condensed consolidated interim financial statements are prepared

and presented in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Our historical results

do not necessarily indicate results expected for any future period.

|

|

●

|

Revenues

declined by $0.70 million, or 17.9%, for the six months ended September 30, 2019 to $3.22 million from $3.92 million for the

same period of the prior fiscal year. Revenues decline were attributable to Advanced TCMP product types demand adjustment

made by some customers but were partially offset by the engagement of new Fine TCMP customers and 4 solid beverage products

as part of the Company’s TCM Homologous Supplements (“TCMHS”) products that were developed and commercially

launched in April 2019. Decline in revenue was primarily due to procurement adjustment of existing customers such as hospitals.

|

|

|

●

|

GAAP

gross profit decreased by 31.3% to $1.84 million for the six months ended September 30, 2019 from $2.68 million for the same

period of the prior fiscal year. Gross margin declined by 11.2 percentage points to 57.2% for the six months ended September

30, 2019 from 68.4% for the same period of the prior fiscal year mainly due to packaging requirement changes that drove up

Regular TCMP cost of revenues. Gross profit decline was resulted from revenue decline, change of packaging requirements, and

product types combination, i.e. smaller or bigger packaging, that led to increase in production cost and cost of revenues.

|

|

|

●

|

GAAP

operating loss was $0.22 million for the six months ended September 30, 2019 compared to GAAP operating income of $1.33 million

for the same period of the prior fiscal year as a result of revenues decline and increased packaging cost.

|

|

|

●

|

Non-GAAP

operating loss was $0.09 million for the six months ended September 30 after adjusted for depreciation and amortization, 2019

compared to non-GAAP operating income of $1.43 million for the same period of the prior fiscal year.

|

|

|

●

|

GAAP

net loss was $2.35 million, or ($0.10) per share, for the six months ended September 30, 2019, compared to net income of $1.00

million, or $0.05 per share, for the same period of the prior fiscal year owing to $1.67million of Convertible Notes interest

and expenses, $0.22 million of Investor Relations and US legal fees that were not in the same period of prior fiscal year.

|

|

|

●

|

Non-GAAP

net loss was $0.67 million, or ($0.03) per share after adjusted for depreciation, intangibles amortization, accretion of convertible

notes finance cost and convertible notes interest for the six months ended September 30, 2019, compared to net income of $1.0

million, or $0.05 per share, for the same period of the prior fiscal year.

|

|

|

●

|

Adjusted

EBITDA loss was $1.66 million for the six months ended September 30, 2019, compared to adjusted EBITDA of $1.43 million for

the same period of the prior fiscal year.

|

Selected

Financial Data

The

following information is derived from our Unaudited Financial Results for the Six Months Ended September 30, 2019 and 2018,

attached hereto as Exhibit 99.1.

Results

of Operations for the Six Months Period Ended September 30, 2019 Compared to the Six Months Period Ended September 30, 2018

|

For the Six Months Ended September 30

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Amount

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

3,215,147

|

|

|

$

|

3,917,707

|

|

|

$

|

(702,560

|

)

|

|

|

(17.9

|

)

|

|

Cost of revenue

|

|

|

(1,375,762

|

)

|

|

|

(1,239,023

|

)

|

|

|

(136,739

|

)

|

|

|

11.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

|

1,839,385

|

|

|

|

2,678,684

|

|

|

|

(839,299

|

)

|

|

|

(31.3

|

)

|

|

|

|

|

57.2

|

%

|

|

|

68.4

|

%

|

|

|

|

|

|

|

(11.2

|

)

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

(774,253

|

)

|

|

|

(838,217

|

)

|

|

|

63,964

|

|

|

|

(7.6

|

)

|

|

General and administrative expenses

|

|

|

(1,285,885

|

)

|

|

|

(513,532

|

)

|

|

|

(772,353

|

)

|

|

|

150.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

(2,060,138

|

)

|

|

|

(1,351,749

|

)

|

|

|

(708,389

|

)

|

|

|

52.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Income from operations

|

|

|

(220,753

|

)

|

|

|

1,326,935

|

|

|

|

(1,547,688

|

)

|

|

|

(116.6

|

)

|

|

|

|

|

-6.9

|

%

|

|

|

33.9

|

%

|

|

|

|

|

|

|

(40.7

|

)

|

|

Other income, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(2,170,561

|

)

|

|

|

1,501

|

|

|

|

(2,172,062

|

)

|

|

|

(144,707.7

|

)

|

|

Other income, net

|

|

|

38,079

|

|

|

|

(984

|

)

|

|

|

39,063

|

|

|

|

(3,969.8

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other expenses, net

|

|

|

(2,132,482

|

)

|

|

|

517

|

|

|

|

(2,132,999

|

)

|

|

|

(412,572.3

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Income before income taxes

|

|

|

(2,353,235

|

)

|

|

|

1,327,452

|

|

|

|

(3,680,687

|

)

|

|

|

(277.3

|

)

|

|

Income tax expense

|

|

|

5,166

|

|

|

|

(332,406

|

)

|

|

|

337,572

|

|

|

|

(101.6

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) /Income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

$

|

(3,343,115

|

)

|

|

|

(336.0

|

)

|

We

generated revenues primarily from manufacture and sales of three types of traditional Chinese medicine pieces (the “TCMP”)

products: Advanced TCMP, Fine TCMP, Regular TCMP, and TCM Homologous Supplements (“TCMHS”)

products. TCMHS is a classification of health-supporting food used traditionally in China as TCM but which are also consumed as

food, which recently has been developed and commercialized.

The

following table sets forth the breakdown of revenues by revenue source for each period presented:

|

|

|

For the Six Months Ended September 30,

|

|

|

(In US$, except percentages)

|

|

2019

|

|

|

2018

|

|

|

|

|

% Change

|

|

|

Revenues

|

|

$

|

3,215,147

|

|

|

$

|

3,917,707

|

|

|

|

|

|

-17.9

|

%

|

|

- Advanced TCMP

|

|

$

|

1,100,405

|

|

|

$

|

2,124,588

|

|

|

|

|

|

-48.2

|

%

|

|

- Fine TCMP

|

|

$

|

656,397

|

|

|

$

|

175,146

|

|

|

|

|

|

274.8

|

%

|

|

- Regular TCMP

|

|

$

|

1,297,974

|

|

|

$

|

1,617,973

|

|

|

|

|

|

-19.8

|

%

|

|

- TCMHS Solid Beverages

|

|

$

|

160,371

|

|

|

$

|

-

|

|

|

|

|

|

100.0

|

%

|

|

Gross profit

|

|

$

|

1,839,385

|

|

|

$

|

2,678,684

|

|

|

|

|

|

-31.3

|

%

|

|

Gross margin

|

|

|

57.2

|

%

|

|

|

68.4

|

%

|

|

-11.2

|

|

|

percentage points

|

|

|

Operating (loss) / income

|

|

$

|

(220,753

|

)

|

|

$

|

1,326,935

|

|

|

|

|

|

-116.6

|

%

|

|

Operating margin

|

|

|

(6.9

|

)%

|

|

|

33.9

|

%

|

|

-40.7

|

|

|

percentage points

|

|

|

Net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

|

|

|

-336.0

|

%

|

|

Net margin

|

|

|

(73.0

|

)%

|

|

|

25.40

|

%

|

|

-98.4

|

|

|

percentage points

|

|

|

(Loss) / Earnings per share

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

|

|

|

-307.7

|

%

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET (LOSS) /

INCOME TO ADJUSTED EBITDA

(In US$, except percentages)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

133,540

|

|

|

|

99,413

|

|

|

Interest expense

|

|

|

604,476

|

|

|

|

(4,010

|

)

|

|

Interest (income) and other

|

|

|

(4,990

|

)

|

|

|

2,509

|

|

|

Other income / (expenses)

|

|

|

(38,079

|

)

|

|

|

984

|

|

|

Provision for income taxes

|

|

|

(5,166

|

)

|

|

|

332,406

|

|

|

Adjusted EBITDA

|

|

$

|

(1,658,288

|

)

|

|

$

|

1,426,348

|

|

|

Adjusted EBITDA as % of revenue

|

|

|

-51.6

|

%

|

|

|

36.4

|

%

|

RECONCILIATION OF GAAP OPERATING (LOSS)

/ INCOME TO NON-GAAP OPERATING (LOSS) / INCOME

(In US$)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP operating (loss) / income

|

|

$

|

(220,753

|

)

|

|

$

|

1,326,935

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

133,540

|

|

|

|

99,413

|

|

|

Non-GAAP operating (loss) / income

|

|

$

|

(87,213

|

)

|

|

$

|

1,426,348

|

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET (LOSS) / INCOME

TO NON-GAAP NET (LOSS) / INCOME

(In US$, except per share data)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangibles amortization

|

|

|

4,111

|

|

|

|

3,547

|

|

|

Amortization of convertible notes interest

|

|

|

1,672,708

|

|

|

|

—

|

|

|

Non-GAAP net (loss) / income

|

|

$

|

(671,250

|

)

|

|

$

|

998,593

|

|

|

GAAP net (loss) / income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

Diluted

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

Non-GAAP net (loss) / income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

Diluted

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

Shares used in computing GAAP net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Diluted

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Shares used in computing non-GAAP net income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Diluted

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

SUMMARY OF DEPRECIATION, INTANGIBLES

AMORTIZATION,

AMORTIZATION OF CONVERTIBLE NOTES INTEREST

AND ISSUANCE COST

(In US$)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

$

|

129,429

|

|

|

$

|

95,866

|

|

|

Intangibles amortization

|

|

|

4,111

|

|

|

|

3,547

|

|

|

Amortization of convertible notes interest

|

|

|

1,672,708

|

|

|

|

—

|

|

|

Total

|

|

$

|

1,806,248

|

|

|

$

|

99,413

|

|

Revenues

We

generated revenues primarily from manufacture and sales of three types of traditional Chinese medicine pieces (the “TCMP”)

products: Advanced TCMP, Fine TCMP and Regular TCMP. For the six months ended September 30, 2019, the total revenues decreased

by $0.7 million, or 17.9%, to $3.22 million from $3.92 million for the same period of the prior fiscal year. Decrease in total

revenues was primarily due to the decrease in sales of Advanced TCMP products and were partly offset by the increase in the sales

of Fine TCMP products and newly launched Homologous Supplements (“TCMHS”), a classification of health-supporting food

used traditionally in China as TCM but also consumed as food. As for the TCMHS, the company has developed and commercially launched

four solid beverage products in April 2019.

Regular

TCMP

We

currently manufacture 427 Regular TCMP products listed on China Pharmacopoeia (version 2015) Part I for hospitals and drug

stores in treatment of various diseases or serving as dietary supplements. Sales of Regular TCMP products decreased by $0.32 million,

or 19.8%, to $1.30 million for the six months ended September 30, 2019 from $1.62 million for the same period of the prior fiscal

year. Decrease in sales of Regular TCMP products is consistent with the company’s plan to shift from low margin Regular

TCMPs and to focus more on the business of high margin Fine and Advanced TCMPs.

Fine

TCMP

We

currently produce over 20 Fine TCMP products for drug stores and hospitals. Our Fine TCMP products are manufactured manually

only from the high-quality authentic ingredients derived from their regions of origin. Sales of Fine TCMP products increased by

$0.48 million, or 274.8%, to $0.66 million for the six months ended September 30, 2019 from $0.18 million for the same period

of the prior fiscal year. The exponential growth in sales was attributable to engagement of a new major customer.

Advanced

TCMP

Advanced

TCMP is comprised of 8 Directly Oral TCMP products (the “Directly-Oral-TCMP”) and 9 After-soaking-oral TCMP products

(the “After-Soaking-Oral-TCMP”). Both Directly Oral TCMP and After-soaking-oral TCMP are new types of Advanced TCMP.

Sales of Advanced TCMP products decreased by $1.02 million, or 48.2%, to $1.10 million for the six months ended September 30,

2019 from $2.12 million for the same period of the prior fiscal year. Decrease in sales of Advanced TCMP products of $1.02 million

was due to product types demand adjustment made by some customers and was partially offset by the increased sales of Fine TCMP

and newly launched 4 solid beverage products that contributed $0.16 million.

TCMHS

Solid Beverages

Four

solid beverage products as part of the Company’s TCMHS products were developed and commercially launched in April 2019 and

generated $0.16 million revenues in its nascent launch with encouraging growth.

Sales

of Advanced TCMP, Fine TCMP, Regular TCMP, and TCMHS products accounted for 34.2%, 20.4%, 40.4%, and 5% of total revenues, respectively,

for the six months ended September 30, 2019, compared to 54.2%, 4.5%, 41.3%, and 0% of total revenues, respectively, for the same

period of the prior fiscal year.

Gross

profit

Cost

of revenues primarily include cost of materials, direct labors, overhead, and other related incidental expenses that are directly

attributable to the Company’s principal operations. Total cost of goods sold increased by $0.14 million, or 11%, to $1.38

million for the six months ended September 30, 2019 from $1.24 million for the same period of the prior fiscal year. Increase

in cost of revenues was driven by change of packaging requirements and product types combination that led to increase in production

cost.

Gross

profit decreased by $0.84 million, or 31.3%, to $1.84 million for the six months ended September 30, 2019 from $2.68 million for

the same period of the prior fiscal year. Gross margin was 57.2% for the six months ended September 30, 2019, compared to 68.4%

for the same period of the prior fiscal year.

Operating

income

Selling

expenses primarily consisted of transportation, sales staff payroll, welfare expenses, travelling expenses, advertisement and

promotion expenses, and distribution expenses. For the six months ended September 30, 2019, selling expenses decreased by $0.06

million, or 7.6%, to $0.77 million from $0.84 million for the same period of the prior fiscal year. Decrease in selling expenses

was primarily due to the combined effect of a decrease in revenues of $0.70 million.

General

and administrative expenses primarily consisted of staff payroll and welfare expenses, research and development, entertainment

expenses, travelling expenses, depreciation and amortization expenses for administrative purposes, and office supply expenses.

For the six months ended September 30, 2019, general and administrative expenses increased by $0.77 million, or 150.4%, to $1.29

million from $0.51 million for the same period of the prior fiscal year. Increase in general and administrative expenses was related

to an increase of $0.09 million in research and development expense, an increase of $0.22 million in legal and investor relations

fees, $0.19 million repairs and maintenance expenses.

As

a result, total operating expenses increased by $0.71 million, or 52.4%, to $2.06 million for the six months ended September 30,

2019 from $1.35 million for the same period of the prior fiscal year.

Operating

income decreased by $1.55 million, or 116.6%, to $0.22 million operating loss for the six months ended September 30, 2019 from

$1.33 million operating income for the same period of the prior fiscal year. Operating margin was -6.9% for the six months ended

September 30, 2019, compared to 33.9% for the same period of the prior fiscal year. Decrease in operating margin was primarily

due to decrease in gross margin, increase in operating expenses after initial public offering, etc.

Finance

cost increased by $2.17 million, or 144,707.7%, to $2.17 million interest cost for the six months ended September 30, 2019 from

$1,501 interest income for the same period of the prior fiscal year attributable to $1.67 million and $0.47 million of Convertible

Notes accretion of finance cost and interest expense.

Income

before income taxes

Total

net other loss, which includes interest income and expenses, and other non-operating income, was $2.13 million, netting other

expenses for the six months ended September 30, 2019, compared to $517 net other income for the same period of the prior fiscal

year. This increase was primarily due to $1.67 million of Convertible Notes interest, issuance cost, debt discount, and transaction

cost amortization.

Income

before income taxes decreased by $3.68 million, or 277.3%, to $2.35 million loss before income taxes for the six months ended

September 30, 2019 from $1.33 million income before income taxes for the same period of the prior fiscal year. Decrease was primarily

due to decrease in gross profit, increase in legal and investor relations fees of $0.22 million after IPO, Convertible Notes accretion

of finance cost of $1.67 million and interest expense of $0.47 million.

Provision

for income taxes was $5,166 for the six months ended September 30, 2019, compared to $0.33 million for the same period of the

prior fiscal year.

Net

income and EPS

Net

income decreased by $3.34 million, or 336%, to $2.35 million net loss for the six months ended September 30, 2019 from $1 million

net income for the same period of the prior fiscal year.

Loss

per share was ($0.10) for the six months ended September 30, 2019, compared to earnings per share of $0.05 for the same period

of the prior fiscal year.

Liquidity

and Financial Resources

As

of September 30, 2019, the Company had cash and cash equivalents and restricted cash of $8.32 million, compared to $9.29 million

at March 31, 2019. Accounts receivable and inventories were $4.57 million and $0.85 million, respectively, as of September 30,

2019, compared to $4.26 million and $1.01 million, respectively, at March 31, 2019. Total current assets and current liabilities

were $17.54 million and $10.76 million, respectively, leading to a current ratio of 1.63 as of September 30, 2019. This compared

to total current assets and current liabilities of $15.59 million and $6.32 million, respectively, and current ratio of 2.47 at

March 31, 2019.

Net

cash used in operating activities was $2.02 million for the six months ended September 30, 2019, compared to $0.47 million for

the same period of the prior fiscal year. Increase in net cash used in operating activities was primarily due to increase in prepayments

and other receivables.

Increase

in net cash used in investing activities was attributable to long-term investment of $3.6 million and loan receivable of $1.5

million.

Increase

in net cash provided by financing activities was mainly driven by convertible notes placement.

Relevant

PRC statutory laws and regulations permit payments of dividends by the Company’s PRC subsidiary and VIE only from their

retained earnings, if any, determined in accordance with PRC GAAP. In addition, the Company’s subsidiary and VIE in China

are required to make annual appropriations of 10% of after-tax profit to a general reserve fund or statutory reserve fund until

such reserve has reached 50% of its registered capital based on the enterprise’s PRC statutory accounts. Paid in capital

of the PRC subsidiary and VIE included in the Company’s condensed consolidated net assets are also non-distributable for

dividend purposes. As a result of these PRC laws and regulations, the Company’s PRC subsidiary and VIE are restricted in

their abilities to transfer net assets to the Company in the form of dividends, loans or advances. The Company is expected to

focus the operation mainly in PRC and is not expected to have significant operations outside the PRC in the foreseeable future,

and is not expected to have significant transfer of cash to and/or from the PRC subsidiary and VIE.

According

to applicable PRC laws and regulations, a number of conditions must be met before any dividends of a wholly foreign owned enterprise,

such as our PRC subsidiary, may be distributed. In accordance with the Implementation Rules of Wholly Foreign-Owned Enterprise

Law of the PRC promulgated by the State Council, prior to the payment of any dividend, our PRC subsidiary is required to (i) reserve

funds from its profit of current accounting year to make up its losses for the previous accounting years, (ii) pay the income

taxes pursuant to applicable tax laws of the PRC and (iii) reserve accumulated funds to improve our PRC subsidiary’s ability

to withstand operation risks. Therefore, the PRC regulations could conceivably limit the amount of dividends that can be paid

by our PRC subsidiary although our PRC subsidiary has historically not paid any dividends. We believe that such limitation will

exist in the future.

Off-Balance

Sheet Arrangements

We

do not have any off-balance sheet arrangements.

Non-GAAP

Financial Measures

In

addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this

filing and the accompanying tables contain certain non-GAAP financial measures. We calculate adjusted EBITDA by adding back or

removing the following items to or from GAAP net income (loss): depreciation and amortization, interest expense, interest (income)

and other, and provision for income taxes. We calculate non-GAAP operating income as GAAP operating income excluding depreciation

and amortization. We calculate non-GAAP net income as GAAP net income (loss) excluding intangibles amortization, amortization

of debt discount and issuance costs, accretion of finance costs on convertible notes, and amortization of interest costs on convertible

notes. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly

titled measures presented by other companies. The company considers these non-GAAP financial measures to be important

because they provide useful measures of the operating performance of the company, exclusive of factors that do not directly affect

what we consider to be our core operating performance, as well as unusual events. The company’s management uses these measures

to illustrate underlying trends in the company’s business that could otherwise be masked by the effect of income or expenses

that are excluded from non-GAAP measures. In addition, investors often use similar measures to evaluate the operating performance

of a company. Non-GAAP financial measures are presented only as supplemental information for purposes of understanding the company’s

operating results. The non-GAAP financial measures should not be considered a substitute for financial information presented in

accordance with GAAP. Please see the reconciliation of non-GAAP financial measures set forth herein and attached to this release.

Recent

Development

PIPE

Transaction

On

April 16, 2019, the company entered into a Securities Purchase Agreement with certain unaffiliated institutional investors relating

to a private placement by the company of (1) Senior Convertible Notes (the “Convertible Notes”) in the aggregate principal

amount of $15 million, consisting of (i) a Series A Note in the principal amount of $ 10 million , and (ii) a Series B Note in

the principal amount of $ 5 million and (2) warrants (the “Warrants”) to purchase such amount of shares of the company’s

ordinary shares equal to 50% of the shares issuable upon conversion of the Notes, exercisable for a period of five years at an

initial exercise price of $8.38, for consideration consisting of (i) a cash payment of $10,000,000, and (ii) a secured promissory

note payable by the Investors to the Company in the principal amount of $5 million. All amounts outstanding under the Notes will

mature and will be due and payable on or before October 2, 2020.

Limited

Partnership Agreement

In

June 2019, Taizhou Suxuantang entered into a limited partnership agreement with Huangshan Panjie Investment Management Co., Ltd.

(the “GP”), one of the general partners of Huangshan Panjie Investment LLP Fund (“the Fund”), to join

the Fund as a limited partner. The GP will take 20% carried interest. Pursuant to the limited partnership agreement and its supplements,

the Taizhou Suxuantang is committed to contribute $7 million (RMB50 million) into the Fund in two installments, with one installment

of $3.5 million (RMB 25 million) made on June 14, 2019, and the second installment of $3.5 million (RMB 25 million) to be made

no later than October 31, 2019. As of the date of this interim report, the GP provided written assurance that second installment

of $3.5 million (RMB 25 million) will not be required and such obligation will be borne by the GP and Fund if the contribution

obligation is being called upon.

Receipt

of Event of Default Redemption Notices

On

July 23 and 29, 2019, the company received from the investors an Event of Default Redemption Notice claimed that the company failed

to timely make the instalment payment and elected to effect the redemption of $14,318,462.62 comprising in aggregate the entire

principal amount, accrued and unpaid Interest. In addition, demand for the company to purchase the Series A Warrant issued for

the Event of Default Black Scholes Value of not less than $1,208,384.07 was made.

Entry

into Forbearance Agreements, Lock-Up Agreements, Leak-Out Agreements, and the Mutual Releases

Upon

negotiation with the Investors, on December 13, 2019, the company entered into certain Forbearance and Amendment Agreements (the

“Forbearance Agreement”) with each Investor and agreed to redeem the Series A Notes for an aggregate redemption price

of $10,939,410.21 in installments as set forth in the Forbearance Agreement. Concurrently with the execution of the Forbearance

Agreements, the Investors and the Company have entered into the Lock-Up Agreements, Leak-Out Agreements and Mutual Releases.

Material

Terms of Forbearance Agreements

Upon

the execution of the Forbearance Agreements, the Investor shall Net (as defined in the Series B Note) all Restricted Principal

(as defined in the Series B Note) outstanding under the Series B Note against the amounts outstanding under the Investor Note

(as defined in the Series B Note), after which the Investor Note, the Series B Note and the Series B Warrant shall no longer remain

outstanding.

Pursuant

to the Forbearance Agreement, commencing on the Effective Date till the earlier of (1) 5:00PM, New York city time on October 15,

2020, (or, if earlier, such date when all the Forbearance Redemption Amounts (as defined therein) are fully paid) and (2) the

time of any breach by the Company of any term or provision of this Agreement or the occurrence of any Event of Default that is

not an “Existing Default” as set forth in the Schedule I of the Forbearance Agreements or an “Additional Forborne

Default” as set forth in the Schedule II of the Forbearance Agreement (such earlier date, the “Forbearance Expiration

Date”, such period from the Effective Date to the Forbearance Expiration Date, the “Forbearance Period”), the

Investors agreed, among other things, to the following:

(a)

to forbear from (i) taking any action to enforce their Redemption Notice with respect to certain existing defaults (the “Existing

Defaults”) including but not limited to such defaults as described in the Redemption Notices, and (ii) issuing any new demand

for redemption of the Series A Note on the basis of certain additional defaults (the “Additional Forborne Defaults”),

including but not limited to the occurrence of the event that the aggregate daily dollar trading volume of the Company’s

ordinary shares does not exceed $1,500,000, and that the volume weighted average price of the Company’s ordinary shares

on any two trading days during the thirty trading day period ending on the trading day immediately preceding such date of determination

fails to exceed $2.14.

(b)

not to effect any conversions of the Series A Note or Alternate Conversions except for conversions or Alternate Conversions of

the Series A Note and/or exercises of the Series A Warrant, in each case, on any Trading Day where the trading price of the Ordinary

Shares is at least $2.50 (as adjusted for share splits, share dividends, share combinations, recapitalizations and similar events

on or after the date hereof) (such price, a “Forbearance Conversion Floor” and each such conversion, a “Permitted

Transaction”); provided, that any Ordinary Shares issued in a Permitted Transaction (other than Applied Pre-Delivery Shares

or any Ordinary Shares issued upon conversion of any Forbearance Redemption Amount that the Company has failed to pay in cash

either prior to, or during, the applicable Payment Grace Period (as defined in Schedule II of the Forbearance Agreement) with

respect thereto)(collectively, the “Excluded Leak-Out Shares”)) shall be subject to the Leak-Out Agreement. If the

Company or its agents do not deliver conversion shares pursuant to such aforementioned conversion, the Investor may apply any

remaining Pre-Delivered Shares to satisfy such obligations (on a share-for-share basis, against the Ordinary Shares not timely

delivered in such aforementioned conversion);

(c)

not to effect any Installment Conversion, Installment Redemption, Disclosure Delay Payments or Event of Default Redemption (as

defined in the Notes, solely with respect to the Existing Defaults and Additional Forborne Defaults) prior to the Forbearance

Expiration Date other than as permitted under this Agreement

(d)

not to exercise the Series A Warrant during the Forbearance Period (other than exercises of the Series A Warrant in Permitted

Transactions);

(e)

to return the original share certificate representing the Pre-Delivered Shares (other than Applied Pre-Delivery Shares (as defined

below)) to the Company for cancellation upon the Company’s payment of the full Forbearance Redemption Amounts (as defined

below),

(f)

to execute and deliver to the Company certain lock-up agreements with respect to the Pre-Delivered Shares (each a “Lock-Up

Agreement”, collectively “Lock-Up Agreements”) , certain mutual release (each a “Mutual Release”,

collectively, the “Mutual Releases”) and to execute and deliver to the Company the Leak-Out Agreement (as defined

below)

In

consideration for the above, the Company agreed to the followings:

(a)

in lieu of the payment of the redemption price as stated in each Redemption Notices respectively, the Company shall (I) pay to

each Investor $500,000 (the “Initial Forbearance Fee”) on or prior to December 16, 2019, and (II) commencing on January

24th 2020, redeem the Series A Notes for an aggregate redemption price of $10,939,410.21 (the “Forbearance Redemption

Price”), in accordance with Section 8 of the Series A Note, but replacing the applicable Installment Dates and Installment

Amounts (including, Principal Amounts, Interest and Make-Whole Amounts with respect thereto) with the dates (each a “New

Installment Date”) and amounts (each, a “New Installment Amount”), respectively and (III) pay the aggregate

amount of any payment obligations of the Company arising after the date hereof pursuant to the Sections 3(c)(ii), 20 or 24(c)

of the Series A Note, 9(k) of the Securities Purchase Agreement, and/or Sections 2(e), 6 and 7 of the Registration Rights Agreement,

(each such amounts, an “Ancillary Redemption Amount”, and together with the New Installment Amounts, each an “Additional

Forbearance Redemption Amount”, and together with the Initial Forbearance Fee, each a “Forbearance Redemption Amount”);

(b)

If the Company fails to pay any New Installment Amount within 5 days of the applicable New Installment Date pursuant to the Installment

Notice (as defined in Section 8 of the Series A Note), the Investor may convert the applicable New Installment Amount in one or

multiple conversion notices as an Alternate Conversion pursuant to Section 3(e) of the Series A Note with the Forbearance Conversion

Floor and the Leak-Out Agreement being disregarded for such conversions and such conversions deemed a Permitted Transaction for

the purposes of this Agreement and any sales of such Ordinary Shares shall not be included in the applicable Daily Limit (as defined

in the Leak-Out Agreement) with respect thereto. In the event that the Company or its agents do not deliver applicable Conversion

Shares pursuant to any conversion in accordance with Section 3 of the Series A Note, the Investor may apply any remaining Pre-Delivered

Shares to satisfy such obligations (on a share-for-share basis, against the Ordinary Shares not timely delivered in such aforementioned

conversion) (each an “Applied Pre-Delivery Share”);

(c)

In accordance with Section 2(h) of the Series A Warrant, the Company agreed to adjust the exercise price of the Series A Warrant

from $8.38 to $2.50 (subject to further adjustment in accordance with the terms of the Series A Warrant); and

(d)

the Company shall cause all restrictive legends on the Pre-Delivered Shares to be removed and delivery of un-legended Pre-Delivery

Shares into the Investor’s custodian’s account pursuant to the DWAC instructions set forth therein.

Material

Terms of Lock-Up Agreements

Pursuant

to the Lock-Up Agreement, except that investors may pledge the Pre-Delivered Shares in connection with a bona fide margin account

or other loan or financing arrangement secured by the Pre-Delivered Shares, the Investors agreed not to make any hedge, swap or

other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the Pre-Delivered Shares

(excluding the Applied Pre-Delivery Shares, the “Locked Shares”). The investor also agreed to provide, up to

three (3) times during the forbearance period, evidence reasonably satisfactory to the Company within two (2) Business Days after

receipt of the Company’s written request, showing that the Locked Shares remain in the account of the Investor. In the event

that prior to the expiration of the Forbearance Period, the aggregate number of Ordinary Shares held in the brokerage account

of such Investor is less than the Locked Shares, the undersigned shall within one (1) Business Day of the Company’s written

request, return the Locked Shares to the Company for cancellation by directing the Investors’ broker to initiate a DWAC

withdrawal of the Pre-Delivered Shares and delivering duly executed cancellation instructions along with the original certificates

(if any) evidencing the Pre-Delivered Shares, original stock power with medallion guaranteed and corporate resolution approving

such cancellation to the Company’s transfer agent.

Material

terms of Leak-Out Agreements

Pursuant

to the Leak-Out Agreements, each Investor (together with certain of its affiliates) has agreed to not sell, dispose or otherwise

transfer, directly or indirectly (including, without limitation, any sales, short sales, swaps or any derivative transactions

that would be equivalent to any sales or short positions) any Ordinary Shares issued in any Permitted Transaction (collectively,

the “Restricted Securities”), on any Trading Day (as defined in Series A Notes) (each date of determination, each

a “Measuring Date”), if such sale, together with all prior sales of Restricted Securities by the Investor on such

Measuring Date, exceed 20% of the daily composite trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such

Measuring Date) (the “Daily Limit”); provided that any other sales of Restricted Shares on such Measuring Date (excluding

any sales of Restricted Securities) shall not be included in the Daily Limit calculation above.

Further,

this restriction will not apply to sales or transfers of any such shares of Restricted Shares in transactions with any Person

(an “Assignee”); provided, that as a condition to any such sale or transfer an authorized signatory of the Company

and such Assignee duly execute and deliver a leak-out agreement in the form of this Leak-Out Agreement with respect to such transferred

Restricted Securities (or such securities convertible or exercisable into Restricted Securities, as applicable) (an “Assignee

Agreement”) and sales of the Investor and all Assignees shall be aggregated for all purposes of this Leak-Out Agreement

and all Assignee Agreements.

Material

Terms of Mutual Release

In

accordance with the Mutual Release, both parties agree not to bring any and all charges, complaints, liabilities, claims and demands

of any nature whatsoever solely with respect to the Notes and the Warrants against each other effective upon the full payment

of the forbearance redemption amounts.

Entry

into Amended Leak-Out Agreements

Upon

the execution the Due to the Company’s failure to obtain timely approval from State Administration of Foreign Exchange in

People’s Republic of China to redeem Series A Notes in cash as previously contemplated, the Company separately amended and

restated the Leak-Out Agreements (each an “Amended Leak-Out Agreement”) with each Investor on March 3, 2020 (“Effective

Date”).

Material

Terms of the Amended Leak-Out Agreements

Pursuant

to the Amended Leak-Out Agreements, each Investor (together with certain of its affiliates) has agreed to not sell, dispose or

otherwise transfer, directly or indirectly (including, without limitation, any sales, short sales, swaps or any derivative transactions

that would be equivalent to any sales or short positions) any Series A Conversion Shares converted during the period commencing

on the Effective Date and ending on the later of (x) the date the Series A Note issued to the Investor no longer remains outstanding

and (y) such date as the Investor (and/or its Affiliates) shall have sold all Series A Conversion Shares, (collectively, the “Restricted

Securities”), on any Trading Day (as defined in Series A Notes) (each date of determination, each a “Measuring Date”),

if such sale, together with all prior sales of Restricted Securities by the Investor on such Measuring Date, exceed 20% of the

daily composite trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such Measuring Date) (the “Daily

Limit”); provided that the sales of any other shares of Ordinary Shares (excluding any sales of Restricted Securities) on

such applicable Measuring Date shall not be included in the Daily Limit calculation above.

In

addition, if the Investor on a given date desires to convert the Series A Note, in whole or in part, and the aggregate of the

Conversion Amount of all conversions from December 13, 2019 through, and including, such date of determination (including the

Conversion Amount of the proposed conversion) exceeds the sum of (x) the aggregate New Installment Amounts (as set forth in the

Forbearance Agreement) and (y) any other unpaid amounts under the Forbearance Agreement (including, without limitation, the Initial

Forbearance Fee), in the aggregate, that have become due and payable (or would have become due and payable, assuming the Forbearance

Agreement remained in full force and effect through, and including, such date of determination) in accordance with the Forbearance

Agreement on or prior to such date of determination, the Investor shall be prohibited from effecting such conversion (the “Conversion

Limit”).

Notwithstanding the foregoing Conversion Limit,

as of any time of determination, if both (x) the daily average composite trading volume of the Ordinary Share (as reported by Bloomberg,

LP for such Measuring Date) exceeds 1.5 million and (y) the trading price of the Ordinary Share as of such time of determination

exceeds the Closing Bid Price (as defined in the Series A Note) of the Ordinary Share as of the Trading Day immediately prior to

such Measuring Date, the Investor shall be permitted to convert, in one or more conversions on such Measuring Date, up to an additional

aggregate amount (which shall be excluded from the Conversion Limit) not to exceed the lesser of (i) 500,000 shares of Ordinary

Share and (ii) 20% of the daily average composite trading volume of the Ordinary Shares.

The Outbreak of COVID-19

In December 2019, a novel strain of coronavirus

was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world,

including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease

(COVID-19) a “Public Health Emergency of International Concern,” and on March 11, 2020, the World Health Organization

characterized the outbreak as a “pandemic.” Governments in affected countries are imposing travel bans, quarantines

and other emergency public health measures, which have caused material disruption to businesses globally resulting in an economic

slowdown. These measures, though temporary in nature, may continue and increase depending on developments in the COVID-19’s

outbreak.

Jiangsu Province, where we conduct a substantial

part of our business, was materially impacted by the COVID-19. We have been following the recommendations of local health authorities

to minimize exposure risk for our employees, including the temporary closures of our offices and production, and having employees

work remotely. Our on-site work was not resumed until mid-March, 2020 upon the approval from the local government. Due to the extended

lock-down and self-quarantine policies in China, we have experienced significant business disruption for the past two and a half

months. Some of our employees in other provinces are still subject to the lock-down policy implemented by the local governments

and could not return to work. Our production was resumed in mid-March, 2020, and was picking up slowly due to the material impacts

of COVID-19 on our logistics.

The extent to which the COVID-19 continues

to impact the Company’s business, sales, and results of operations will depend on future developments, which are highly uncertain

and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private

businesses to attempt to contain the coronavirus, but is likely to result in a material impact on our business operations at least

for the near term.

Statement

Regarding Unaudited Financial Information

The

unaudited financial information set forth above is subject to adjustments that may be identified when audit work is performed

on the Company’s year-end financial statements, which could result in significant differences from this unaudited financial

information.

Exhibit.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CHINA

SXT PHARMACEUTICAL, INC.

|

|

|

|

|

|

|

By:

|

/s/

Feng Zhou

|

|

|

|

Feng

Zhou

|

|

|

|

Chief

Executive Officer

|

Date:

April 22, 2020

13

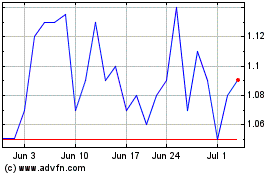

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Feb 2024 to Feb 2025