0001517175false00015171752023-02-152023-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

THE CHEFS’ WAREHOUSE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35249 | 20-3031526 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (I.R.S. Employer Identification No.) |

100 East Ridge Road

Ridgefield, Connecticut 06877

(Address of principal executive offices)

Registrant’s telephone number, including area code: (203) 894-1345

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | CHEF | The NASDAQ Stock Market LLC |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02.

Results of Operations and Financial Condition.

In a press release dated July 31, 2024 (the “Press Release”), The Chefs’ Warehouse, Inc. (the “Company”) announced financial results for the Company’s thirteen and twenty-six weeks ended June 28, 2024. The full text of the Press Release is furnished herewith as Exhibit 99.1 to this report.

The information contained in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release of The Chefs’ Warehouse, Inc. dated July 31, 2024. |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | THE CHEFS’ WAREHOUSE, INC. |

| | |

| | By: | /s/ James Leddy |

| | Name:

Title: | James Leddy

Chief Financial Officer |

Date: July 31, 2024

The Chefs’ Warehouse Reports Second Quarter 2024 Financial Results

Ridgefield, CT, July 31, 2024 - The Chefs’ Warehouse, Inc. (NASDAQ: CHEF) (the “Company” or “Chefs’”), a premier distributor of specialty food products in the United States, the Middle East, and Canada, today reported financial results for its second quarter ended June 28, 2024.

Financial highlights for the second quarter of 2024:

•Net sales increased 8.3% to $954.7 million for the second quarter of 2024 from $881.8 million for the second quarter of 2023.

•GAAP net income was $15.5 million, or $0.37 per diluted share, for the second quarter of 2024 compared to $9.9 million, or $0.25 per diluted share, in the second quarter of 2023.

•Adjusted net income per share1 was $0.40 for the second quarter of 2024 compared to $0.35 for the second quarter of 2023.

•Adjusted EBITDA1 was $56.2 million for the second quarter of 2024 compared to $51.1 million for the second quarter of 2023.

“Second quarter customer demand and pricing displayed typical seasonality as revenue and profitability continued to build as expected - moving from a solid first quarter into the seasonally stronger second quarter months. Our operating divisions across domestic and international markets delivered strong unique customer and item placement growth and managed pricing effectively while providing our customers with high-quality product and high-value service”, said Christopher Pappas, Chairman and Chief Executive of the Company. “We are extremely proud of all our teams, from sales, sourcing, pricing, operations and support functions, coming together to deliver value to our customers and leveraging our diverse and broad supply chain, value-add processing and culinary expertise to assist our customers with managing menu development as well as product and labor related costs.”

Second Quarter Fiscal 2024 Results

Net sales for the second quarter of 2024 increased 8.3% to $954.7 million from $881.8 million in the second quarter of 2023. The growth in net sales was the result of an increase in organic sales of approximately 7.2% as well as the contribution of sales from acquisitions, which added approximately 1.1% to sales growth for the quarter. Organic case count increased approximately 4.7% in the Company’s specialty category for the second quarter of 2024 with unique customers and placement increases at 8.2% and 11.3% respectively, compared to the second quarter of 2023. Organic pounds sold in the Company’s center-of-the-plate category increased approximately 2.9% for the second quarter of 2024 compared to the second quarter of 2023.

Gross profit increased 9.9% to $229.0 million for the second quarter of 2024 from $208.4 million for the second quarter of 2023. The increase in gross profit dollars was primarily as a result of increased sales and price inflation. Gross profit margins increased approximately 35 basis points to 24.0%.

Selling, general and administrative expenses increased by approximately 8.8% to $194.8 million for the second quarter of 2024 from $179.0 million for the second quarter of 2023. The increase was primarily due to higher depreciation and amortization driven by acquisitions and facility investments, and higher costs associated with compensation and benefits, facilities and distribution to support sales growth. As a percentage of net sales, selling, general and administrative expenses were 20.4% in the second quarter of 2024 compared to 20.3% in the second quarter of 2023.

Other operating expenses, net decreased by $3.8 million primarily due to an impairment charge on customer relationships intangible assets of $1.8 million recorded during the second quarter of 2023

1EBITDA, Adjusted EBITDA, adjusted net income and adjusted net income per share are non-GAAP measures. Please see the schedules accompanying this earnings release for a reconciliation of EBITDA, Adjusted EBITDA, adjusted net income and adjusted net income per share to these measures’ most directly comparable GAAP measure.

related to the loss of a significant Hardie’s Fresh Foods customer post-acquisition and lower third-party deal costs incurred in the second quarter of 2024 in connection with business acquisitions and financing arrangements.

Operating income for the second quarter of 2024 was $33.9 million compared to $25.3 million for the second quarter of 2023. The increase in operating income was driven primarily by higher gross profit, partially offset by higher selling, general and administrative expense, as discussed above. As a percentage of net sales, operating income was 3.6% in the second quarter of 2024 as compared to 2.8% in the second quarter of 2023.

Net income for the second quarter of 2024 was $15.5 million, or $0.37 per diluted share, compared to $9.9 million, or $0.25 per diluted share, for the second quarter of 2023.

Adjusted EBITDA1 was $56.2 million for the second quarter of 2024 compared to $51.1 million for the second quarter of 2023. For the second quarter of 2024, adjusted net income1 was $17.0 million, or $0.40 per diluted share compared to adjusted net income of $14.4 million, or $0.35 per diluted share for the second quarter of 2023.

2024 Guidance

We are providing fiscal 2024 full year financial guidance as follows:

•Net sales in the range of $3.665 billion to $3.785 billion,

•Gross profit to be between $874.0 million and $902.0 million and

•Adjusted EBITDA to be between $208.0 million and $219.0 million.

Second Quarter 2024 Earnings Conference Call

The Company will host a conference call to discuss second quarter 2024 financial results today at 8:30 a.m. EDT. Hosting the call will be Chris Pappas, chairman and chief executive officer, and Jim Leddy, chief financial officer. The conference call will be webcast live from the Company’s investor relations website at http://investors.chefswarehouse.com. An online archive of the webcast will be available on the Company’s investor relations website.

Forward-Looking Statements

Statements in this press release regarding the Company’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties and are based on current expectations and management estimates; actual results may differ materially. The risks and uncertainties which could impact these statements include, but are not limited to the following: our success depends to a significant extent upon general economic conditions, including disposable income levels and changes in consumer discretionary spending; the relatively low margins of our business, which are sensitive to inflationary and deflationary pressures and intense competition; the effects of rising costs for and/or decreases in supply of commodities, ingredients, packaging, other raw materials, distribution and labor; crude oil prices and their impact on distribution, packaging and energy costs; our continued ability to promote our brand successfully, to anticipate and respond to new customer demands, and to develop new products and markets to compete effectively; our ability and the ability of our supply chain partners to continue to operate distribution centers and other work locations without material disruption, and to procure ingredients, packaging and other raw materials when needed despite disruptions in the supply chain or labor shortages; risks associated with the expansion of our business; our possible inability to identify new acquisitions or to integrate recent or future acquisitions, or our failure to realize anticipated revenue enhancements, cost savings or other synergies from recent or future acquisitions; other factors that affect

1EBITDA, Adjusted EBITDA, adjusted net income and adjusted net income per share are non-GAAP measures. Please see the schedules accompanying this earnings release for a reconciliation of EBITDA, Adjusted EBITDA, adjusted net income and adjusted net income per share to these measures’ most directly comparable GAAP measure.

2

the food industry generally, including: recalls if products become adulterated or misbranded, liability if product consumption causes injury, ingredient disclosure and labeling laws and regulations and the possibility that customers could lose confidence in the safety and quality of certain food products; new information or attitudes regarding diet and health or adverse opinions about the health effects of the products we distribute; changes in disposable income levels and consumer purchasing habits; competitors’ pricing practices and promotional spending levels; fluctuations in the level of our customers’ inventories and credit and other related business risks; and the risks associated with third-party suppliers, including the risk that any failure by one or more of our third-party suppliers to comply with food safety or other laws and regulations may disrupt our supply of raw materials or certain products or injure our reputation; our ability to recruit and retain senior management and a highly skilled and diverse workforce; unanticipated expenses, including, without limitation, litigation or legal settlement expenses; the cost and adequacy of our insurance policies; the impact and effects of public health crises, pandemics and epidemics, such as the outbreak of COVID-19, and the adverse impact thereof on our business, financial condition, and results of operations; significant governmental regulation and any potential failure to comply with such regulations; federal, state, provincial and local tax rules in the United States and the foreign countries in which we operate, including tax reform and legislation; risks relating to our substantial indebtedness; our ability to raise additional capital and/or obtain debt or other financing, on commercially reasonable terms or at all; our ability to meet future cash requirements, including the ability to access financial markets effectively and maintain sufficient liquidity; the effects of currency movements in the jurisdictions in which we operate as compared to the U.S. dollar; changes in the method of determining Secured Overnight Financing Rate (“SOFR”), or the replacement of SOFR with an alternative rate; and the effects of international trade disputes, tariffs, quotas and other import or export restrictions on our international procurement, sales and operations. Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. A more detailed description of these and other risk factors is contained in the Company’s most recent annual report on Form 10-K filed with the SEC on February 27, 2024 and other reports filed by the Company with the SEC since that date. The Company is not undertaking to update any information until required by applicable laws. Any projections of future results of operations are based on a number of assumptions, many of which are outside the Company’s control and should not be construed in any manner as a guarantee that such results will in fact occur. These projections are subject to change and could differ materially from final reported results. The Company may from time to time update these publicly announced projections, but it is not obligated to do so.

About The Chefs’ Warehouse

The Chefs’ Warehouse, Inc. (http://www.chefswarehouse.com) is a premier distributor of specialty food products in the United States, the Middle East and Canada focused on serving the specific needs of chefs who own and/or operate some of the nation’s leading menu-driven independent restaurants, fine dining establishments, country clubs, hotels, caterers, culinary schools, bakeries, patisseries, chocolateries, cruise lines, casinos and specialty food stores. The Chefs’ Warehouse, Inc. carries and distributes more than 70,000 products to more than 44,000 customer locations throughout the United States, the Middle East and Canada.

Contact:

Investor Relations

Jim Leddy, CFO, (718) 684-8415

THE CHEFS’ WAREHOUSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited; in thousands except share amounts and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 | | June 28, 2024 | | June 30, 2023 |

| Net sales | $ | 954,704 | | | $ | 881,820 | | | $ | 1,829,192 | | | $ | 1,601,465 | |

| Cost of sales | 725,702 | | | 673,376 | | | 1,390,754 | | | 1,223,313 | |

| Gross profit | 229,002 | | | 208,444 | | | 438,438 | | | 378,152 | |

| | | | | | | |

| Selling, general and administrative expenses | 194,834 | | | 179,042 | | | 385,155 | | | 335,179 | |

| Other operating expenses, net | 301 | | | 4,062 | | | 3,413 | | | 5,734 | |

| Operating income | 33,867 | | | 25,340 | | | 49,870 | | | 37,239 | |

| | | | | | | |

| Interest expense | 11,690 | | | 12,006 | | | 24,934 | | | 22,012 | |

| | | | | | | |

| Income before income taxes | 22,177 | | | 13,334 | | | 24,936 | | | 15,227 | |

| | | | | | | |

| Provision for income tax expense | 6,653 | | | 3,467 | | | 7,481 | | | 3,959 | |

| | | | | | | |

| Net income | $ | 15,524 | | | $ | 9,867 | | | $ | 17,455 | | | $ | 11,268 | |

| | | | | | | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.41 | | | $ | 0.26 | | | $ | 0.46 | | | $ | 0.30 | |

| Diluted | $ | 0.37 | | | $ | 0.25 | | | $ | 0.44 | | | $ | 0.29 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 37,924,931 | | | 37,634,127 | | | 37,871,080 | | | 37,570,595 | |

| Diluted | 45,947,728 | | | 45,604,297 | | | 45,959,061 | | | 38,201,408 | |

THE CHEFS’ WAREHOUSE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 28, 2024 AND DECEMBER 29, 2023

(unaudited; in thousands)

| | | | | | | | | | | |

| | June 28, 2024 | | December 29, 2023 |

| Cash and cash equivalents | $ | 38,340 | | | $ | 49,878 | |

| Accounts receivable, net | 323,433 | | | 334,015 | |

| Inventories | 310,355 | | | 284,528 | |

| Prepaid expenses and other current assets | 68,421 | | | 62,522 | |

| Total current assets | 740,549 | | | 730,943 | |

| | | |

| Property and equipment, net | 259,585 | | | 234,793 | |

| Operating lease right-of-use assets | 179,813 | | | 192,307 | |

| Goodwill | 356,531 | | | 356,021 | |

| Intangible assets, net | 172,461 | | | 184,863 | |

| | | |

| | | |

| Other assets | 6,482 | | | 6,379 | |

| Total assets | $ | 1,715,421 | | | $ | 1,705,306 | |

| | | |

| | | |

| Accounts payable | $ | 220,391 | | | $ | 200,547 | |

| Accrued liabilities | 61,761 | | | 70,728 | |

| Short-term operating lease liabilities | 23,502 | | | 24,246 | |

| Accrued compensation | 37,254 | | | 37,071 | |

| Current portion of long-term debt | 56,626 | | | 53,185 | |

| Total current liabilities | 399,534 | | | 385,777 | |

| | | |

| Long-term debt, net of current portion | 660,759 | | | 664,802 | |

| Operating lease liabilities | 173,042 | | | 184,034 | |

| Deferred taxes, net | 17,413 | | | 14,418 | |

| Other liabilities | 2,794 | | | 1,603 | |

| Total liabilities | 1,253,542 | | | 1,250,634 | |

| | | |

| | | |

| Common stock | 398 | | | 396 | |

| Additional paid in capital | 356,363 | | | 356,157 | |

| Accumulated other comprehensive loss | (2,284) | | | (1,832) | |

| Retained earnings | 117,406 | | | 99,951 | |

| Treasury stock | (10,004) | | | — | |

| Stockholders’ equity | 461,879 | | | 454,672 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 1,715,421 | | | $ | 1,705,306 | |

THE CHEFS’ WAREHOUSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE TWENTY-SIX WEEKS ENDED JUNE 28, 2024 AND JUNE 30, 2023

(unaudited; in thousands)

| | | | | | | | | | | |

| Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 17,455 | | | $ | 11,268 | |

| | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 18,771 | | | 15,682 | |

| Amortization of intangible assets | 12,342 | | | 10,456 | |

| Provision for allowance for doubtful accounts | 6,097 | | | 3,311 | |

| | | |

| Deferred income tax provision | 3,003 | | | 990 | |

| | | |

| Loss on debt extinguishment | 366 | | | — | |

| Stock compensation | 8,754 | | | 10,581 | |

| Change in fair value of contingent earn-out liabilities | (615) | | | 1,092 | |

| Intangible asset impairment | — | | | 1,838 | |

| Non-cash interest and other operating activities | 2,747 | | | 3,647 | |

| Loss on asset disposal | | | |

| Changes in assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | 4,269 | | | (9,854) | |

| Inventories | (25,431) | | | (35,450) | |

| Prepaid expenses and other current assets | (3,368) | | | (2,435) | |

| Accounts payable, accrued liabilities and accrued compensation | 17,812 | | | 453 | |

| | | |

| Other assets and liabilities | (1,976) | | | (796) | |

| Net cash provided by operating activities | 60,226 | | | 10,783 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (33,123) | | | (23,155) | |

| Cash paid for acquisitions | (315) | | | (119,580) | |

| | | |

| Net cash used in investing activities | (33,438) | | | (142,735) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| Payment of debt and other financing obligations | (14,500) | | | (10,238) | |

| Payment of finance leases | (3,839) | | | (1,442) | |

| | | |

| Common stock repurchases | (10,004) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Surrender of shares to pay withholding taxes | (7,283) | | | (2,115) | |

| Cash paid for contingent earn-out liabilities | (3,550) | | | (3,210) | |

| Borrowings under asset based loan facility and revolving credit facilities | 813 | | | 50,000 | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (38,363) | | | 32,995 | |

| | | |

| Effect of foreign currency translation on cash and cash equivalents | 37 | | | (251) | |

| | | |

| Net change in cash and cash equivalents | (11,538) | | | (99,208) | |

| Cash and cash equivalents at beginning of period | 49,878 | | | 158,800 | |

| Cash and cash equivalents at end of period | $ | 38,340 | | | $ | 59,592 | |

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF GAAP NET INCOME PER SHARE

(unaudited; in thousands except share amounts and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 | | June 28, 2024 | | June 30, 2023 |

| Numerator: | | | | | | | |

| Net income | $ | 15,524 | | | $ | 9,867 | | | $ | 17,455 | | | $ | 11,268 | |

| Add effect of dilutive securities: | | | | | | | |

| Interest on convertible notes, net of tax | 1,322 | | | 1,397 | | | 2,628 | | | — | |

| Net income available to common shareholders | $ | 16,846 | | | $ | 11,264 | | | $ | 20,083 | | | $ | 11,268 | |

| Denominator: | | | | | | | |

| Weighted average basic common shares outstanding | 37,924,931 | | | 37,634,127 | | | 37,871,080 | | | 37,570,595 | |

| Dilutive effect of unvested common shares | 573,930 | | | 521,102 | | | 642,767 | | | 564,119 | |

| Dilutive effect of stock options and warrants | 56,050 | | | 56,251 | | | 52,397 | | | 66,694 | |

| Dilutive effect of convertible notes | 7,392,817 | | | 7,392,817 | | | 7,392,817 | | | — | |

| Weighted average diluted common shares outstanding | 45,947,728 | | | 45,604,297 | | | 45,959,061 | | | 38,201,408 | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.41 | | | $ | 0.26 | | | $ | 0.46 | | | $ | 0.30 | |

| Diluted | $ | 0.37 | | | $ | 0.25 | | | $ | 0.44 | | | $ | 0.29 | |

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(unaudited; in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 | | June 28, 2024 | | June 30, 2023 |

| Net income | $ | 15,524 | | | $ | 9,867 | | | $ | 17,455 | | | $ | 11,268 | |

| Interest expense | 11,690 | | | 12,006 | | | 24,934 | | | 22,012 | |

| Depreciation and amortization | 9,537 | | | 8,671 | | | 18,771 | | | 15,682 | |

| Amortization of intangible assets | 6,171 | | | 5,759 | | | 12,342 | | | 10,456 | |

| Provision for income tax expense | 6,653 | | | 3,467 | | | 7,481 | | | 3,959 | |

| EBITDA (1) | 49,575 | | | 39,770 | | | 80,983 | | | 63,377 | |

| | | | | | | |

| Adjustments: | | | | | | | |

| Stock compensation (2) | 4,555 | | | 5,247 | | | 8,754 | | | 10,581 | |

| Other operating expenses, net (3) | 301 | | | 4,063 | | | 3,413 | | | 5,735 | |

| Duplicate rent (4) | 1,082 | | | 1,851 | | | 2,444 | | | 4,060 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Moving expenses (5) | 667 | | | 186 | | | 746 | | | 186 | |

| | | | | | | |

| Adjusted EBITDA (1) | $ | 56,180 | | | $ | 51,117 | | | $ | 96,340 | | | $ | 83,939 | |

1.We are presenting EBITDA and Adjusted EBITDA, which are not measurements determined in accordance with the U.S. generally accepted accounting principles, or GAAP, because we believe these measures provide additional metrics to evaluate our operations and which we believe, when considered with both our GAAP results and the reconciliation to net income, provide a more complete understanding of our business than could be obtained absent this disclosure. We use EBITDA and Adjusted EBITDA, together with financial measures prepared in accordance with GAAP, such as revenue and cash flows from operations, to assess our historical and prospective operating performance and to enhance our understanding of our core operating performance. The use of EBITDA and Adjusted EBITDA as performance measures permits a comparative assessment of our operating performance relative to our performance based upon GAAP results while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

2.Represents non-cash stock compensation expense associated with awards of restricted shares of our common stock and stock options to our key employees and our independent directors.

3.Represents non-cash changes in the fair value of contingent earn-out liabilities related to our acquisitions, non-cash charges related to asset disposals, asset impairments, including intangible asset impairment charges, certain third-party deal costs incurred in connection with our acquisitions or financing arrangements and certain other costs.

4.Represents rent and occupancy costs expected to be incurred in connection with our facility consolidations while we are unable to use those facilities.

5.Represents moving expenses for the consolidation and expansion of several of our distribution facilities.

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME

(unaudited; in thousands except share amounts and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 | | June 28, 2024 | | June 30, 2023 |

| Net income | $ | 15,524 | | | $ | 9,867 | | | $ | 17,455 | | | $ | 11,268 | |

| Adjustments to reconcile net income to adjusted net income (1): | | | | | | | |

| Other operating expenses, net (2) | 301 | | | 4,063 | | | 3,413 | | | 5,735 | |

| Duplicate rent (3) | 1,082 | | | 1,851 | | | 2,444 | | | 4,060 | |

| | | | | | | |

| Moving expenses (4) | 667 | | | 186 | | | 746 | | | 186 | |

| | | | | | | |

| Debt modification and extinguishment expenses (5) | 77 | | | — | | | 1,141 | | | 376 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Tax effect of adjustments (6) | (638) | | | (1,586) | | | (2,323) | | | (2,693) | |

| | | | | | | |

| Total adjustments | 1,489 | | | 4,514 | | | 5,421 | | | 7,664 | |

| | | | | | | |

| Adjusted net income | $ | 17,013 | | | $ | 14,381 | | | $ | 22,876 | | | $ | 18,932 | |

| | | | | | | |

| Diluted adjusted net income per common share | $ | 0.40 | | | $ | 0.35 | | | $ | 0.55 | | | $ | 0.48 | |

| | | | | | | |

| Diluted shares outstanding - adjusted | 45,947,728 | | | 45,604,297 | | | 45,959,061 | | | 45,594,225 | |

1.We are presenting adjusted net income and adjusted net income per share, which are not measurements determined in accordance with U.S. generally accepted accounting principles, or GAAP, because we believe these measures provide additional metrics to evaluate our operations and which we believe, when considered with both our GAAP results and the reconciliations to net income and net income available to common stockholders, provide a more complete understanding of our business than could be obtained absent this disclosure. We use adjusted net income and adjusted net income per share, together with financial measures prepared in accordance with GAAP, such as revenue and cash flows from operations, to assess our historical and prospective operating performance and to enhance our understanding of our core operating performance. The use of adjusted net income and adjusted net income per share as performance measures permits a comparative assessment of our operating performance relative to our performance based upon our GAAP results while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

2.Represents non-cash changes in the fair value of contingent earn-out liabilities related to our acquisitions, non-cash charges related to asset disposals, asset impairments, including intangible asset impairment charges, certain third-party deal costs incurred in connection with our acquisitions or financing arrangements and certain other costs.

3.Represents rent and occupancy costs expected to be incurred in connection with our facility consolidations while we are unable to use those facilities.

4.Represents moving expenses for the consolidation and expansion of several of our distribution facilities.

5.Represents debt modification costs, extinguishment costs and interest expense related to the write-off of certain deferred financing fees related to our credit agreements.

6.Represents the adjustments to the tax provision values to a normalized annual effective tax rate on adjusted pretax earnings to 30.0% and 26.0% for the second quarters and year-to-date periods of 2024 and 2023, respectively.

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF ADJUSTED NET INCOME PER SHARE

(unaudited; in thousands except share amounts and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | June 28, 2024 | | June 30, 2023 | | June 28, 2024 | | June 30, 2023 |

| Numerator: | | | | | | | |

| Adjusted net income | $ | 17,013 | | | $ | 14,381 | | | $ | 22,876 | | | $ | 18,932 | |

| Add effect of dilutive securities: | | | | | | | |

| Interest on convertible notes, net of tax | 1,322 | | | 1,397 | | | 2,628 | | | 2,794 | |

| Adjusted net income available to common shareholders | $ | 18,335 | | | $ | 15,778 | | | $ | 25,504 | | | $ | 21,726 | |

| Denominator: | | | | | | | |

| Weighted average basic common shares outstanding | 37,924,931 | | | 37,634,127 | | | 37,871,080 | | | 37,570,595 | |

| Dilutive effect of unvested common shares | 573,930 | | | 521,102 | | | 642,767 | | | 564,119 | |

| Dilutive effect of stock options and warrants | 56,050 | | | 56,251 | | | 52,397 | | | 66,694 | |

| Dilutive effect of convertible notes | 7,392,817 | | | 7,392,817 | | | 7,392,817 | | | 7,392,817 | |

| Weighted average diluted common shares outstanding | 45,947,728 | | | 45,604,297 | | | 45,959,061 | | | 45,594,225 | |

| | | | | | | |

| Adjusted net income per share: | | | | | | | |

| Diluted | $ | 0.40 | | | $ | 0.35 | | | $ | 0.55 | | | $ | 0.48 | |

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF ADJUSTED EBITDA GUIDANCE FOR FISCAL 2024

(unaudited; in thousands)

| | | | | | | | | | | |

| | Low-End Guidance | | High-End Guidance |

| Net Income: | $ | 51,000 | | | $ | 53,000 | |

| Provision for income tax expense | 21,750 | | | 22,750 | |

| Depreciation & amortization | 62,000 | | | 65,000 | |

| Interest expense | 48,000 | | | 52,000 | |

| EBITDA (1) | 182,750 | | | 192,750 | |

| | | |

| Adjustments: | | | |

| Stock compensation (2) | 17,000 | | | 18,000 | |

| Duplicate rent (3) | 4,000 | | | 4,000 | |

| Other operating expenses (4) | 3,500 | | | 3,500 | |

| | | |

| | | |

| Moving expenses (5) | 750 | | | 750 | |

| | | |

| Adjusted EBITDA (1) | $ | 208,000 | | | $ | 219,000 | |

1.We are presenting estimated EBITDA and Adjusted EBITDA for fiscal 2024, which are not measurements determined in accordance with the U.S. generally accepted accounting principles, or GAAP, because we believe these measures provide additional metrics to evaluate our currently estimated results and which we believe, when considered with both our estimated GAAP results and the reconciliation to our estimated net income, provide a more complete understanding of our business than could be obtained absent this disclosure. We use EBITDA and Adjusted EBITDA, together with financial measures prepared in accordance with GAAP, such as revenue and cash flows from operations, to assess our historical and prospective operating performance and to enhance our understanding of our performance relative to our performance based upon GAAP results while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

2.Represents non-cash stock compensation expense associated with awards of restricted shares of our common stock and stock options to our key employees and our independent directors.

3.Represents rent and occupancy costs expected to be incurred in connection with our facility consolidations while we are unable to use those facilities.

4.Represents non-cash changes in the fair value of contingent earn-out liabilities related to our acquisitions, non-cash charges related to asset disposals, asset impairments, including intangible asset impairment charges, certain third-party deal costs incurred in connection with our acquisitions or financing arrangements and certain other costs.

5.Represents moving expenses for the consolidation and expansion of several of our distribution facilities.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

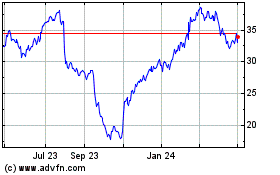

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Dec 2024 to Jan 2025

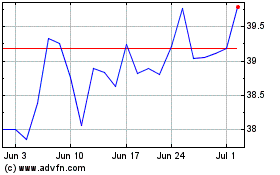

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Jan 2024 to Jan 2025