false

0000887596

0000887596

2024-10-23

2024-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 23, 2024

THE CHEESECAKE

FACTORY INCORPORATED

(Exact name of registrant as specified in its

charter)

| Delaware |

|

0-20574 |

|

51-0340466 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

26901

Malibu Hills Road

Calabasas Hills,

California |

|

91301 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code (818) 871-3000

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered: |

| Common

Stock, par value $.01 per share |

|

CAKE |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

The following information under Item 2.02

of Form 8-K, “Results of Operations and Financial Condition” and Item 7.01 “Regulation FD Disclosure” is

intended to be furnished. This information shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, whether made before or after the date of this report, regardless of any general incorporation

language in the filing.

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

In a press release dated October 29, 2024, a copy

of which is furnished as Exhibit 99.1 to this report, The Cheesecake Factory Incorporated (the “Company”) reported

third quarter fiscal 2024 financial results.

| ITEM 5.02 |

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN

OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

(b) On October 24, 2024, Laurence B. Mindel, a member of the Board of Directors of the Company

(the “Board”), notified the Board of his intention to retire from the Board, effective immediately. The Board expressed its

deep appreciation and sincere thanks for Mr. Mindel’s service on the Board and for his invaluable contributions to the Company.

| ITEM 7.01 | REGULATION FD DISCLOSURE |

On October 29, 2024, the Company posted an updated Investor Presentation

on the Company’s Investor Relations website at investors.thecheesecakefactory.com. A copy of the presentation is furnished as Exhibit

99.2 hereto and is incorporated by reference herein.

On October 23, 2024, the Board declared a quarterly cash dividend of

$0.27 per share which will be paid on November 26, 2024 to the stockholders of record of each share of the Company’s common stock

at the close of business on November 13, 2024. Future decisions to pay or to increase or decrease dividends are at the discretion of the

Board and will depend upon operating performance and other factors.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 29,

2024 |

THE CHEESECAKE FACTORY INCORPORATED |

| |

|

| |

By: |

/s/ Matthew E. Clark |

| |

|

Matthew E. Clark |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

PRESS

RELEASE

| FOR IMMEDIATE

RELEASE |

Contact: Etienne

Marcus |

| |

(818) 871-3000 |

| |

investorrelations@thecheesecakefactory.com |

THE CHEESECAKE

FACTORY REPORTS RESULTS FOR

THIRD QUARTER

OF FISCAL 2024

CALABASAS

HILLS, Calif. – October 29, 2024 – The Cheesecake Factory Incorporated (NASDAQ: CAKE) today reported financial

results for the third quarter of fiscal 2024, which ended on October 1, 2024.

Total revenues

were $865.5 million in the third quarter of fiscal 2024 compared to $830.2 million in the third quarter of fiscal 2023. Net income

and diluted net income per share were $30.0 million and $0.61, respectively, in the third quarter of fiscal 2024.

The Company recorded

pre-tax net income of $2.5 million related to impairment of assets and lease termination income and Fox Restaurant Concepts (“FRC”)

acquisition-related expenses. Excluding the after-tax impact of these items, adjusted net income and adjusted net income per share for

the third quarter of fiscal 2024 were $28.2 million and $0.58, respectively. Please see the Company’s reconciliation of non-GAAP

financial measures at the end of this press release.

Comparable restaurant

sales at The Cheesecake Factory restaurants increased 1.6% year-over-year in the third quarter of fiscal 2024.

“The third

quarter was our fourth consecutive quarter of year-over-year top- and bottom-line growth, reflecting our strong operational execution,

the benefits of our scale, and the delicious, memorable experiences we offer across our restaurant concepts,” said David Overton,

Chairman and Chief Executive Officer. “We are capturing market share as evidenced by the continued strong outperformance in comparable

sales and traffic at The Cheesecake Factory restaurants versus the broader casual dining industry. Execution within our restaurants was

exceptional with our operators delivering significant improvements in labor productivity, hourly staff and manager retention, and guest

satisfaction scores.”

“We opened

four new restaurants during the third quarter and, subsequent to quarter-end, opened three additional restaurants across various concepts

for a total of 17 new openings year-to-date. Our ability to execute against our pipeline and successfully expand our restaurant footprint

reinforces our confidence in our ability to achieve our near-term and longer-term development objectives. Looking ahead we remain focused

on operational excellence, growing profitably and creating long-term, sustainable value into 2025 and beyond.”

26901

Malibu Hills Road, Calabasas Hills, CA 91301 • Telephone (818) 871-3000

Development

During the third

quarter of fiscal 2024, the Company opened four new restaurants, including one Flower Child location and three FRC restaurants. Subsequent

to quarter-end, the Company opened three new restaurants, including one North Italia, one Flower Child and one Blanco location.

The Company continues

to expect to open as many as 22 new restaurants in fiscal 2024, including as many as three The Cheesecake Factory restaurants, six North

Italia restaurants, six to seven Flower Child locations, and eight FRC restaurants.

Liquidity and

Capital Allocation

As of October 1,

2024, the Company had total available liquidity of $288.7 million, including a cash balance of $52.2 million and availability on its

revolving credit facility of $236.5 million. Total principal amount of debt outstanding was $475 million, including $345 million in principal

amount of 0.375% convertible senior notes due 2026 and $130 million in principal amount drawn on the Company’s revolving credit

facility.

The Company repurchased

approximately 29,450 shares of its stock at a cost of $1.1 million in the third quarter of fiscal 2024. In addition, the Company’s

Board of Directors has declared a quarterly dividend of $0.27 per share to be paid on November 26, 2024, to shareholders of record

at the close of business on November 13, 2024.

Conference Call

and Webcast

The Company will

hold a conference call to review its results for the third quarter of fiscal 2024 today at 2:00 p.m. Pacific Time. The conference

call will be webcast live on the Company’s website at investors.thecheesecakefactory.com and a replay of the webcast will be available

through November 28, 2024.

About The Cheesecake Factory Incorporated

The Cheesecake

Factory Incorporated is a leader in experiential dining. We are culinary forward and relentlessly focused on hospitality. Delicious,

memorable experiences created by passionate people – this defines who we are and where we are going. We currently own and operate

344 restaurants throughout the United States and Canada under brands including The Cheesecake Factory®, North Italia®,

Flower Child® and a collection of other FRC brands. Internationally, 34 The Cheesecake Factory® restaurants

operate under licensing agreements. Our bakery division operates two facilities that produce quality cheesecakes and other baked products

for our restaurants, international licensees and third-party bakery customers. In 2024, we were named to the FORTUNE Magazine “100

Best Companies to Work For®” list for the eleventh consecutive year. To learn more, visit www.thecheesecakefactory.com,

www.northitalia.com, www.iamaflowerchild.com and www.foxrc.com.

From Fortune. ©2024 Fortune Media

IP Limited. All rights reserved. Used under license. Fortune® and Fortune 100 Best Companies to Work For® are registered trademarks

of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse

products or services of, The Cheesecake Factory Incorporated.

26901

Malibu Hills Road, Calabasas Hills, CA 91301 • Telephone (818) 871-3000

Safe Harbor Statement

This press release

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as codified in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements

include, without limitation, statements regarding the Company’s operations, growth, digital strategies and other objectives. Such

forward-looking statements include all other statements that are not historical facts, as well as statements that are preceded by, followed

by or that include words or phrases such as “believe,” “plan,” “will likely result,” “expect,”

“intend,” “will continue,” “is anticipated,” “estimate,” “project,” “may,”

“could,” “would,” “should” and similar expressions. These statements are based on current expectations

and involve risks and uncertainties which may cause results to differ materially from those set forth in such statements. Investors are

cautioned that forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such

statements. These forward-looking statements may be affected by various factors including: economic, public health and political conditions

that impact consumer confidence and spending, including interest rate fluctuations, periods of heightened inflation and market instability,

and armed conflicts; supply chain disruptions; demonstrations, political unrest, potential damage to or closure of the Company’s

restaurants and potential reputational damage to the Company or any of its brands; pandemics and related containment measures, including

the potential for quarantines or restriction on in-person dining; acceptance and success of The Cheesecake Factory in international markets;

acceptance and success of North Italia, Flower Child and Other Fox Restaurant Concepts restaurants; the risks of doing business abroad

through Company-owned restaurants and/or licensees; foreign exchange rates, tariffs and cross border taxation; changes in unemployment

rates; increases in minimum wages and benefit costs; the economic health of the Company’s landlords and other tenants in retail

centers in which its restaurants are located, and the Company’s ability to successfully manage its lease arrangements with landlords;

the economic health of suppliers, licensees, vendors and other third parties providing goods or services to the Company; the timing of

new unit development and related permitting; compliance with debt covenants; strategic capital allocation decisions including with respect

to share repurchases or dividends; the ability to achieve projected financial results; the resolution of uncertain tax positions with

the Internal Revenue Service and the impact of tax reform legislation; changes in laws impacting the Company’s business; adverse

weather conditions in regions in which the Company’s restaurants are located; factors that are under the control of government

agencies, landlords and other third parties; the risks, costs and uncertainties associated with opening new restaurants; and other risks

and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Forward-looking statements speak only as of the dates on which they are made, and the Company undertakes no obligation to publicly update

or revise any forward-looking statements or to make any other forward-looking statements, whether as a result of new information, future

events or otherwise, unless required to do so by law. Investors are referred to the full discussion of risks and uncertainties associated

with forward-looking statements and the discussion of risk factors contained in the Company’s latest Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the SEC, which are available at www.sec.gov.

26901

Malibu Hills Road, Calabasas Hills, CA 91301 • Telephone (818) 871-3000

| The

Cheesecake Factory Incorporated |

| Condensed

Consolidated Financial Statements |

| (unaudited;

in thousands, except per share and statistical data) |

| | |

13 Weeks Ended | | |

13 Weeks Ended | | |

39 Weeks Ended | | |

39 Weeks Ended | |

| Consolidated Statements of Income | |

October 1, 2024 | | |

October 3, 2023 | | |

October 1, 2024 | | |

October 3, 2023 | |

| | |

Amount | | |

Percent of

Revenues | | |

Amount | | |

Percent of

Revenues | | |

Amount | | |

Percent of

Revenues | | |

Amount | | |

Percent of

Revenues | |

| Revenues | |

$ | 865,471 | | |

| 100.0 | % | |

$ | 830,210 | | |

| 100.0 | % | |

$ | 2,660,736 | | |

| 100.0 | % | |

$ | 2,562,494 | | |

| 100.0 | % |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Food and beverage costs | |

| 195,306 | | |

| 22.6 | % | |

| 194,733 | | |

| 23.5 | % | |

| 600,253 | | |

| 22.6 | % | |

| 602,051 | | |

| 23.5 | % |

| Labor expenses | |

| 310,939 | | |

| 35.9 | % | |

| 301,663 | | |

| 36.3 | % | |

| 949,151 | | |

| 35.7 | % | |

| 919,340 | | |

| 35.9 | % |

| Other operating costs and expenses | |

| 239,470 | | |

| 27.7 | % | |

| 229,534 | | |

| 27.6 | % | |

| 712,108 | | |

| 26.9 | % | |

| 687,459 | | |

| 26.7 | % |

| General and administrative expenses | |

| 56,204 | | |

| 6.5 | % | |

| 54,209 | | |

| 6.5 | % | |

| 170,954 | | |

| 6.4 | % | |

| 162,766 | | |

| 6.4 | % |

| Depreciation and amortization expenses | |

| 25,299 | | |

| 2.9 | % | |

| 22,837 | | |

| 2.8 | % | |

| 75,015 | | |

| 2.8 | % | |

| 69,124 | | |

| 2.7 | % |

| Impairment of assets and lease terminations (income)/expense | |

| (3,472 | ) | |

| (0.4 | )% | |

| 48 | | |

| 0.0 | % | |

| (1,577 | ) | |

| (0.1 | )% | |

| 1,637 | | |

| 0.1 | % |

| Acquisition-related contingent consideration, compensation and amortization expenses | |

| 1,020 | | |

| 0.1 | % | |

| 1,414 | | |

| 0.2 | % | |

| 3,287 | | |

| 0.1 | % | |

| 3,890 | | |

| 0.2 | % |

| Preopening costs | |

| 7,005 | | |

| 0.8 | % | |

| 6,742 | | |

| 0.8 | % | |

| 19,860 | | |

| 0.7 | % | |

| 15,800 | | |

| 0.6 | % |

| Total costs and expenses | |

| 831,771 | | |

| 96.1 | % | |

| 811,180 | | |

| 97.7 | % | |

| 2,529,051 | | |

| 95.1 | % | |

| 2,462,067 | | |

| 96.1 | % |

| Income from operations | |

| 33,700 | | |

| 3.9 | % | |

| 19,030 | | |

| 2.3 | % | |

| 131,685 | | |

| 4.9 | % | |

| 100,427 | | |

| 3.9 | % |

| Interest and other (expense)/income, net | |

| (1,865 | ) | |

| (0.2 | )% | |

| (2,027 | ) | |

| (0.3 | )% | |

| (5,974 | ) | |

| (0.2 | )% | |

| (6,069 | ) | |

| (0.2 | )% |

| Income before income taxes | |

| 31,835 | | |

| 3.7 | % | |

| 17,003 | | |

| 2.0 | % | |

| 125,711 | | |

| 4.7 | % | |

| 94,358 | | |

| 3.7 | % |

| Income tax provision/(benefit) | |

| 1,841 | | |

| 0.2 | % | |

| (942 | ) | |

| (0.2 | )% | |

| 10,082 | | |

| 0.4 | % | |

| 5,688 | | |

| 0.2 | % |

| Net income | |

$ | 29,994 | | |

| 3.5 | % | |

$ | 17,945 | | |

| 2.2 | % | |

$ | 115,629 | | |

| 4.3 | % | |

$ | 88,670 | | |

| 3.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 0.63 | | |

| | | |

$ | 0.37 | | |

| | | |

$ | 2.42 | | |

| | | |

$ | 1.83 | | |

| | |

| Basic weighted average shares outstanding | |

| 47,750 | | |

| | | |

| 48,281 | | |

| | | |

| 47,734 | | |

| | | |

| 48,489 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per share | |

$ | 0.61 | | |

| | | |

$ | 0.37 | | |

| | | |

$ | 2.37 | | |

| | | |

$ | 1.80 | | |

| | |

| Diluted weighted average shares outstanding | |

| 48,946 | | |

| | | |

| 48,985 | | |

| | | |

| 48,751 | | |

| | | |

| 49,197 | | |

| | |

26901

Malibu Hills Road, Calabasas Hills, CA 91301 • Telephone (818) 871-3000

| | |

13 Weeks Ended | | |

13 Weeks Ended | | |

39 Weeks Ended | | |

39 Weeks Ended | |

| Selected Segment Information | |

October 1, 2024 | | |

October 3, 2023 | | |

October 1, 2024 | | |

October 3, 2023 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory restaurants | |

$ | 647,754 | | |

$ | 628,140 | | |

$ | 1,992,245 | | |

$ | 1,936,621 | |

| North Italia | |

| 71,878 | | |

| 62,417 | | |

| 218,266 | | |

| 191,654 | |

| Other FRC | |

| 66,984 | | |

| 58,642 | | |

| 214,850 | | |

| 193,010 | |

| Other | |

| 78,855 | | |

| 81,011 | | |

| 235,375 | | |

| 241,209 | |

| Total | |

$ | 865,471 | | |

$ | 830,210 | | |

$ | 2,660,736 | | |

$ | 2,562,494 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income/(loss) from operations: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory restaurants | |

$ | 87,822 | | |

$ | 67,637 | | |

$ | 274,928 | | |

$ | 231,700 | |

| North Italia | |

| 4,408 | | |

| 4,081 | | |

| 13,085 | | |

| 15,314 | |

| Other FRC | |

| (1,372 | ) | |

| 1,036 | | |

| 8,510 | | |

| 15,826 | |

| Other | |

| (57,158 | ) | |

| (53,724 | ) | |

| (164,838 | ) | |

| (162,413 | ) |

| Total | |

$ | 33,700 | | |

$ | 19,030 | | |

$ | 131,685 | | |

$ | 100,427 | |

| | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization expenses: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory restaurants | |

$ | 16,142 | | |

$ | 15,702 | | |

$ | 49,242 | | |

$ | 47,955 | |

| North Italia | |

| 2,360 | | |

| 1,578 | | |

| 6,653 | | |

| 4,713 | |

| Other FRC | |

| 3,031 | | |

| 1,891 | | |

| 8,246 | | |

| 5,627 | |

| Other | |

| 3,766 | | |

| 3,666 | | |

| 10,874 | | |

| 10,829 | |

| Total | |

$ | 25,299 | | |

$ | 22,837 | | |

$ | 75,015 | | |

$ | 69,124 | |

| | |

| | | |

| | | |

| | | |

| | |

| Impairment of assets and lease termination (income)/expenses: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory restaurants | |

$ | (3,858 | ) | |

$ | 29 | | |

$ | (1,732 | ) | |

| 160 | |

| North Italia | |

| - | | |

| - | | |

| - | | |

| - | |

| Other FRC | |

| - | | |

| - | | |

| - | | |

| 55 | |

| Other | |

| 386 | | |

| 19 | | |

| 155 | | |

| 1,422 | |

| Total | |

$ | (3,472 | ) | |

$ | 48 | | |

$ | (1,577 | ) | |

$ | 1,637 | |

| | |

| | | |

| | | |

| | | |

| | |

| Preopening costs: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory restaurants | |

$ | 1,483 | | |

$ | 3,861 | | |

$ | 5,615 | | |

$ | 8,401 | |

| North Italia | |

| 1,765 | | |

| 1,068 | | |

| 5,179 | | |

| 2,132 | |

| Other FRC | |

| 2,900 | | |

| 1,764 | | |

| 6,810 | | |

| 4,483 | |

| Other | |

| 857 | | |

| 49 | | |

| 2,256 | | |

| 784 | |

| Total | |

$ | 7,005 | | |

$ | 6,742 | | |

$ | 19,860 | | |

$ | 15,800 | |

| | |

13 Weeks Ended | | |

13 Weeks Ended | | |

39 Weeks Ended | | |

39 Weeks Ended | |

| The Cheesecake Factory restaurants operating information: | |

October 1, 2024 | | |

October 3, 2023 | | |

October 1, 2024 | | |

October 3, 2023 | |

| Comparable restaurant sales vs. prior year | |

| 1.6 | % | |

| 2.4 | % | |

| 0.8 | % | |

| 3.2 | % |

| Restaurants opened during period | |

| - | | |

| 2 | | |

| 1 | | |

| 3 | |

| Restaurants open at period-end | |

| 215 | | |

| 213 | | |

| 215 | | |

| 213 | |

| Restaurant operating weeks | |

| 2,804 | | |

| 2,756 | | |

| 8,419 | | |

| 8,227 | |

| | |

| | | |

| | | |

| | | |

| | |

| North Italia operating information: | |

| | | |

| | | |

| | | |

| | |

| Comparable restaurant sales vs. prior year | |

| 2 | % | |

| 8 | % | |

| 2 | % | |

| 8 | % |

| Restaurants opened during period | |

| - | | |

| - | | |

| 3 | | |

| - | |

| Restaurants open at period-end | |

| 39 | | |

| 33 | | |

| 39 | | |

| 33 | |

| Restaurant operating weeks | |

| 507 | | |

| 429 | | |

| 1,486 | | |

| 1,287 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Fox Restaurant Concepts (FRC) operating information:(1) | |

| | | |

| | | |

| | | |

| | |

| Restaurants opened during period | |

| 3 | | |

| - | | |

| 6 | | |

| 3 | |

| Restaurants open at period-end | |

| 46 | | |

| 37 | | |

| 46 | | |

| 37 | |

| Restaurant operating weeks | |

| 575 | | |

| 481 | | |

| 1,654 | | |

| 1,394 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other operating information:(2) | |

| | | |

| | | |

| | | |

| | |

| Restaurants opened during period | |

| 1 | | |

| - | | |

| 4 | | |

| 1 | |

| Restaurants open at period-end | |

| 41 | | |

| 40 | | |

| 41 | | |

| 40 | |

| Restaurant operating weeks | |

| 526 | | |

| 520 | | |

| 1,475 | | |

| 1,555 | |

| | |

| | | |

| | | |

| | | |

| | |

| Number of company-owned restaurants: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory | |

| 215 | | |

| | | |

| | | |

| | |

| North Italia | |

| 39 | | |

| | | |

| | | |

| | |

| Other FRC | |

| 46 | | |

| | | |

| | | |

| | |

| Other | |

| 41 | | |

| | | |

| | | |

| | |

| Total | |

| 341 | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Number of international-licensed restaurants: | |

| | | |

| | | |

| | | |

| | |

| The Cheesecake Factory | |

| 34 | | |

| | | |

| | | |

| | |

(1) The

Other FRC segment includes all FRC brands except Flower Child.

(2) The

Other segment includes the Flower Child, Grand Lux Cafe and Social Monk Asian Kitchen concepts, as well as the Company's third-party

bakery, international and consumer packaged goods businesses, unallocated corporate expenses and gift card costs.

| Selected Consolidated Balance Sheet Information | |

October 1, 2024 | | |

January 2, 2024 | |

| Cash and cash equivalents | |

$ | 52,215 | | |

$ | 56,290 | |

| Long-term debt, net of issuance costs (1) | |

| 471,558 | | |

| 470,047 | |

(1) Includes $341.6 million net balance of 0.375% convertible senior notes due 2026 (principal amount of $345 million less $3.4 million in unamortized issuance costs) and $130 million drawn on the Company's revolving credit facility. The unamortized issuance costs were recorded as a contra-liability and netted with long-term debt on the Condensed Consolidated Balance Sheet and are being amortized as interest expense.

26901

Malibu Hills Road, Calabasas Hills, CA 91301 • Telephone (818) 871-3000

Reconciliation of Non-GAAP Results

to GAAP Results

In addition to

the results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

in this press release, the Company is providing non-GAAP measurements which present net income and net income per share excluding the

impact of certain items. The non-GAAP measurements are intended to supplement the presentation of the Company’s financial results

in accordance with GAAP. These non-GAAP measures are calculated by eliminating from net income and diluted net income per share the impact

of items the Company does not consider indicative of its ongoing operations. The Company uses these non-GAAP financial measures for financial

and operational decision-making and as a means to evaluate period-to-period comparisons.

| The

Cheesecake Factory Incorporated |

| Reconciliation

of Non-GAAP Financial Measures |

| (unaudited;

in thousands, except per share data) |

| | |

13 Weeks Ended | | |

13 Weeks Ended | | |

39 Weeks Ended | | |

39 Weeks Ended | |

| | |

October 1, 2024 | | |

October 3, 2023 | | |

October 1, 2024 | | |

October 3, 2023 | |

| Net income (GAAP) | |

$ | 29,994 | | |

$ | 17,945 | | |

$ | 115,629 | | |

$ | 88,670 | |

| Impairment

of assets and lease termination (income)/expenses(1) | |

| (3,472 | ) | |

| 48 | | |

| (1,577 | ) | |

| 1,637 | |

Acquisition-related

contingent consideration,

compensation and amortization expenses(2) | |

| 1,020 | | |

| 1,414 | | |

| 3,287 | | |

| 3,890 | |

| Tax

effect of adjustments(3) | |

| 638 | | |

| (380 | ) | |

| (445 | ) | |

| (1,437 | ) |

| Adjusted net income (non-GAAP) | |

$ | 28,180 | | |

$ | 19,027 | | |

$ | 116,894 | | |

$ | 92,760 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per share (GAAP) | |

$ | 0.61 | | |

$ | 0.37 | | |

$ | 2.37 | | |

$ | 1.80 | |

| Impairment of assets and lease termination (income)/expenses | |

| (0.07 | ) | |

| 0.00 | | |

| (0.03 | ) | |

| 0.03 | |

Acquisition-related contingent consideration,

compensation and amortization expenses | |

| 0.02 | | |

| 0.03 | | |

| 0.07 | | |

| 0.08 | |

| Tax effect of adjustments | |

| 0.01 | | |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.03 | ) |

| Adjusted net income per share (non-GAAP)(4) | |

$ | 0.58 | | |

$ | 0.39 | | |

$ | 2.40 | | |

$ | 1.89 | |

(1) A detailed breakdown of impairment of assets and lease termination (income)/expenses recorded in the thirteen and thirty-nine weeks ended October 1, 2024 and October 3, 2023 can be found in the Selected Segment Information table.

(2) Represents changes in the fair value of the deferred consideration and contingent consideration and compensation liabilities related to the North Italia and FRC acquisition, as well as amortization of acquired definite-lived licensing agreements.

(3) Based on the federal statutory rate and an estimated blended state tax rate, the tax effect on all adjustments assumes a 26% tax rate for the fiscal 2024 and 2023 periods.

(4) Adjusted net income per share may not add due to rounding.

Exhibit 99.2

| INVESTOR

PRESENTATION

October 29, 2024 |

| SAFE HARBOR STATEMENT

2

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. This includes, without limitation, financial guidance and projections, including underlying assumptions, and statements with respect to expectations of the

Company’s future financial condition, results of operations, cash flows, potential price increases, plans, targets, goals, objectives, performance, growth potential, engines and

opportunities and expected growth rates and targets; long-term outlook; industry-leading comparable sales growth, retention and competitive position; quality control and supply

chain efficiencies; operational execution and retention; annualized average unit volume; the Company’s differentiation and strong foothold in the off-premise channel; the opportunity

for additional domestic and foreign locations and licensees and territories; target returns for new restaurant openings; international expansion; North Italia and Fox Restaurant

Concepts (“FRC”) as growth drivers and FRC as an incubation engine; new restaurant targeted ranges and unit growth rates.

Such forward-looking statements include all other statements that are not historical facts, as well as statements that are preceded by, followed by or that include words or phrases such

as “believe,” “plan,” “will likely result,” “expect,” “intend,” “will continue,” “is anticipated,” “estimate,” “project,” “may,” “could,” “would,” “should” and similar expressions. These

statements are based on current expectations and involve risks and uncertainties which may cause results to differ materially from those set forth in such statements. Investors are

cautioned that forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such statements. These forward-looking

statements may be affected by various factors including: economic, public health and political conditions that impact consumer confidence and spending, including changes in interest

rates, periods of heightened inflation and market instability, and armed conflicts; supply chain disruptions; demonstrations, political unrest, potential damage to or closure of our

restaurants and potential reputational damage to us or any of our brands; pandemics and related containment measures, including the potential for quarantines or restriction on in-person dining; acceptance and success of The Cheesecake Factory in international markets; acceptance and success of North Italia and the FRC concepts; the risks of doing business

abroad through Company-owned restaurants and/or licensees; foreign exchange rates, tariffs and cross border taxation; changes in unemployment rates; increases in minimum wages

and benefit costs; the economic health of our landlords and other tenants in retail centers in which our restaurants are located, and our ability to successfully manage our lease

arrangements with landlords; the economic health of suppliers, licensees, vendors and other third parties providing goods or services to us; the timing of our new unit development

and related permitting; compliance with debt covenants; strategic capital allocation decisions including with respect to share repurchases or dividends; the ability to achieve projected

financial results; the resolution of uncertain tax positions with the Internal Revenue Service and the impact of tax reform legislation; changes in laws impacting our business; adverse

weather conditions in regions in which our restaurants are located; factors that are under the control of government agencies, landlords and other third parties; the risks, costs and

uncertainties associated with opening new restaurants; and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange

Commission (“SEC”). Forward-looking statements speak only as of the dates on which they are made and the Company undertakes no obligation to publicly update or revise any

forward-looking statements or to make any other forward-looking statements, whether as a result of new information, future events or otherwise, unless required to do so by law.

Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s latest

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the SEC, which are available at www.sec.gov. |

| COMPANY

OVERVIEW |

| INVESTMENT HIGHLIGHTS

4

• Experiential dining category leader with diversified growth engines

• Best-in-class operational execution and industry-leading retention

• Significant growth opportunities driving one of the highest expected growth rates

in the casual dining industry

• Differentiation and strong foothold in the off-premise channel |

| CAKE AT A GLANCE

5

(1) Market data as of October 1, 2024.

(2) Represents fiscal year 2023 revenue for the twelve months ended January 2, 2024.

We own and operate 344 restaurants across the

US and Canada including:

• 215 The Cheesecake Factory locations

• 40 North Italia locations

• 35 Flower Child locations

• 47 Fox Restaurant Concepts locations

Our nearly 48,000 staff members

recently helped us become one of the

Fortune “100 Best Companies to Work

For®” for the 11th consecutive year

34

International

CCF Locations

China

Thailand

Mexico

Bahrain

Kuwait

Saudi Arabia

Qatar | UAE

FOUNDED

1972

IPO

1992

TICKER

CAKE

REVENUE(2)

$3.4B

HEADQUARTERS

CALABASAS HILLS, CA

MARKET CAP(1)

$2.1B

PORTFOLIO OF EXPERIENTIAL DINING CONCEPTS |

| 6 |

| GLOBAL FOOTPRINT

7

Company-Owned: 215

(Including Toronto, Canada)

Latin America

Mexico City (5)

Monterrey (1)

Guadalajara (1)

Querétaro (1)

Asia

Shanghai (3)

Beijing (1)

Chengdu (1)

Hangzhou (1)

Hong Kong (1)

Macau (1)

Thailand (1)

Middle East

UAE (6)

Saudi Arabia (4)

Kuwait (3)

Qatar (3)

Bahrain (1)

International – Licensed: 34

Opportunity for 300

Domestic Locations

Long runway for growth as

we continue to open in new

and existing markets

Continued International

Expansion

In existing and new markets with

current licensees and evaluating

new markets

High-quality, High-profile

Locations Worldwide

Strong presence in premier

markets with attractive consumer

demographics |

| 8

High-Energy Atmosphere

Contemporary Décor

Distinct, High-Quality

Cheesecakes and Desserts

Best-in-Class Execution

Exceptional Service

Menu Breadth and Innovation

Made Fresh From Scratch

MENU OPERATIONS AMBIANCE BAKERY

A HIGHLY DIFFERENTIATED CONCEPT |

| 9

INTEGRATED BAKERY – THE “CHEESECAKE” MAGIC

Enables creativity, quality control and

supply chain efficiencies

60 Varieties of

cheesecakes & 2 desserts

Bakery

production

facilities

17%

FY 2023(1)

1

FY 2019

6%

(1)

(1) Percent of total sales.

Impressive Level of Dessert Sales |

| BEST-IN-CLASS STAFFING AND OPERATIONS

10

Well-positioned to attract and retain high-quality, experienced

staff as an employer of choice

• Top-tier recruiting and training programs

• Fortune’s ‘100 Best Companies to Work For’ List for 11 consecutive years

• Competitive compensation, benefits and healthcare options

• High sales volume restaurants provide predictability and stability for staff

Average Tenure by Position

34 years

25 years

20 years

19 years

12 years

11 years

Executive VP of Operations

Regional Vice Presidents

Area Directors of Operations

Area Kitchen Operations Managers

General Managers

Executive Kitchen Managers

EXCEPTIONAL SERVICE AND OPERATIONAL EXECUTION SUPPORTED BY INDUSTRY-LEADING RETENTION

2023 PEOPLE Companies that Care logo © 2023 TI Gotham, Inc., a Dotdash Meredith company. Used under license.

From Fortune. ©2023, ©2024 Fortune Media IP Limited. All rights reserved. Used under license. Fortune® and Fortune 100 Best Companies to Work For® are registered trademarks of Fortune

Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse products or services of, The Cheesecake Factory Incorporated. |

| DIFFERENTIATION IN OFF-PREMISE

11

• Extensive menu with over 225 items made from scratch daily

• Large portions designed for sharing

• Lower incremental delivery pricing versus peers

• Fully integrated systems for better execution

• Separate bakery counter and register for pick-up of orders

Exceptional Value

Operational Execution

• Omni channel ordering – Online | Delivery | Phone | In-person

• Curbside delivery, geo-location and real-time tracking

• Redesigned to-go packaging to improve food quality

Guest Experience and Convenience

9% 11% 16%

43% 32% 25% 22% 22% 21% 21%

OFF-PREMISE SALES % OF TOTAL REVENUE

OFF-PREMISE AWS FOR FY 2023(2)

$51.9

$25.2

$22.6

$20.5

$18.1

$17.7

$15.2

$15.2

$14.7

$12.6

Olive Garden

Carrabba's

BJ's

Texas Roadhouse

Chili's

Outback

Cracker Barrel

Red Robin

LongHorn

(1) $2.5 million in off-premise sales per restaurant is annualized based on 3Q24.

(2) Company reports and Gordon Haskett Research Advisors.

($ in thousands)

$2.5 million per restaurant (1)

LEVERAGING OUR DIFFERENTIATED POSITIONING TO

DRIVE THE HIGHEST OFF-PREMISE AVERAGE WEEKLY SALES |

| 12

ICONIC

BRAND

AND

CULT

STATUS |

| Followers(1) (in thousands)

Followers / $M Sales(2)

Followers / $M Sales Instagram Followers

0 200 400 600 800 1,000 1,200

CAKE

Maggiano's

Outback

Bonefish

Olive Garden

YardHouse

Chili's

Cracker Barrel

BJ's Restaurants

LongHorn

Carrabba's

Texas Roadhouse

- 75 150 225 300 375 450

CAKE

Maggiano's

Outback

Bonefish

Olive Garden

YardHouse

Chili's

Cracker Barrel

BJ's Restaurants

LongHorn

Carrabba's

Texas Roadhouse

13

STRONG

CONSUMER

ENGAGEMENT

CAKE has more Instagram followers

and significantly outpaces peers in

followers relative to sales

Leveraging the STRENGTH OF

OUR BRAND across social media

channels to ENGAGE WITH OUR

CONSUMERS and further

ENHANCE BRAND AWARENESS

MILLIONS OF FOLLOWERS

(1) Instagram Follower count as of May 3, 2024.

(2) Sales represent fiscal year 2023 revenue based on latest SEC 10-K filings and company presentations. |

| BROAD APPEAL AND BRAND AFFINITY

14

Diverse

Appeal

Across a broad

demographic range

Extensive

Menu

Something for every taste,

every price point

Special

Occasions

Seen as a destination for

experiential dining

Signature

Desserts

High-quality cheesecakes

and desserts

Consumers (millennials in particular)

regularly rank the Cheesecake Factory

as one of the best chain restaurants,

as well as having the best

ambiance and the best quality food.

A chain restaurant triple threat if there

was ever one.

-Vox, December 24, 2022

Sources:

(1) The Cheesecake Factory Ranks No. 1 in Casual Dining Online Reputation Study, SOCi Marketing Study, FSR Magazine, December 12, 2023.

(2) Most-Beloved Restaurant Brands in America – Savanta’s Marketing Intelligence Platform BrandVue Eating Out, FSR Magazine, October 11, 2023. |

| CHEESECAKE REWARDS®

15

PROGRAM

OBJECTIVE

A SURPRISE and DELIGHT program

To leverage data analytics to engage more effectively with

our guests and drive incremental sales while maintaining

our restaurant level margins

Published

Offers

To support

member

acquisition and

on-going

engagement

Offered to all

rewards members

Unpublished

Offers

To surprise and

delight our guests

and drive

incremental

member visits

Tailored rewards

offered to all members

Marketable

Offers

To leverage key

marketable

moments to drive

increased

engagement

Offered to all

rewards members

Opportunity to drive incremental traffic

® |

| $12.2 $9.8 $9.7

$7.6 $6.1 $5.6 $4.9 $4.1 $3.6 $3.6 $3.3

Maggiano's Yard

House

Texas

Roadhouse

BJ's Olive

Garden

LongHorn Outback Carrabba's Chili's Bonefish

With a Moderate Average Check (1)

Driving the Highest Unit Volumes in the Industry(1)

($ in millions)

$36 $35 $34 $31 $28 $28 $25 $23 $22 $21 $20

Maggiano's Yard

House

Bonefish Outback LongHorn Carraba's Olive

Garden

Texas

Roadhouse

BJ's Chili's

16 (1) Latest SEC 10-K filings and company presentations.

(2) Average check for The Cheesecake Factory defined as on-premise average check for FY 2023.

(2) |

| 17 |

| 18

• Filling White Space for an On-Trend, Contemporary Italian Offering

• Menu features classic Italian favorites with a fresh twist from hand-tossed pizzas and

homemade pastas to crave-worthy appetizers, salads and seasonal entrees

• Unique menu items tailored to local markets

• All dishes handmade from scratch daily

• Serving lunch, dinner, weekend brunch & weekday happy hour

• Robust selection of wine, beer and craft cocktails driving ~25% alcohol mix

• Average check of low to mid $30s for lunch and low to mid $40s for dinner |

| 19

• Potential for 200 domestic locations over time

• Currently have 40 locations in 13 states &

Washington D.C.

• Italian is one of the most popular ethnic cuisines

in the United States

• Targeting ~20% average annual unit growth

• Attractive return profile and sales growth

Comp Sales

3Q24 (vs. 3Q23): 2%

FY ‘23 (vs. FY ‘22): 8% |

| 20 |

| • A differentiated concept in the growing fast casual dining segment

• 35 locations in 12 states

• Targeting ~15% - 20% average annual unit growth

• A healthy, balanced dining experience with organic, gluten-free and vegan dishes

• All dishes handmade from scratch daily

• Menu features customizable bowls, wraps, salads, veggies and healthy proteins

• Attractive consumer demographic

• Significant off-premise volumes - trending over 50% of sales(1)

• Separate take-out area for third-party delivery and take-out business

On a simple, soul-satisfying mission to spread positively delicious vibes and healthy food.

21 (1) As of Q3 2024 ending October 1, 2024. |

| 22 |

| FOX RESTAURANT CONCEPTS (FRC)

23

FRC HIGHLIGHTS

• Locations: 47

• Geographies 10 states

• FY 2023 Revenue(1) $264M

(1) Fiscal year 2023 revenue represents revenue for the twelve months ended January 2, 2024 and excludes revenue for Flower Child.

FRC serves as an incubation engine, innovating new food, dining and hospitality

experiences to create fresh, exciting concepts for the future

FRC’s experiential concepts are designed to deliver unique guest experiences across different

industry segments, occasions, square footage and geographies

Provides Diversification | Accretive Unit Growth Potential | Value Creation Opportunities

“Great hospitality, every time.”

- Sam Fox |

| Culinary forward. First class hospitality. Concepts like no other.

DIVERSIFYING OUR PORTFOLIO ACROSS

EXPERIENTIAL FOR GROWTH

24

National

Expansion

Boutique

Brands

Incubation

Stage

Testing

Growth

Global

Footprint |

| Accelerating Unit Growth

AS MANY AS 22 NEW UNITS IN 2024 17 NROs YTD

ACCELERATING UNIT GROWTH

As of October 29, 2024

13 New Restaurants Opened in 2022 16 New Restaurants Opened in 2023

The Cheesecake Factory | Orem, UT Doughbird | Dallas, TX The Henry | Nashville, TN

Culinary

Dropout

Atlanta, GA

Birmingham, AL

Dallas, TX

Flower

Child

North

Italia

Houston, TX

Dallas, TX

Charlotte, NC

Peoria, AZ

Salt Lake City, UT

Charlotte, NC

Frontenac, MO

Plano, TX

Phoenix, AZ

Coronado, CA

Peoria, AZ Blanco | |

| FINANCIAL

PERFORMANCE |

| 27

DRIVING STRONG SALES GROWTH

FY 2023

COMP SALES

AVERAGE WEEKLY SALES (2)

FY 2023

AVERAGE WEEKLY SALES

Q3 2024

COMP SALES

AVERAGE WEEKLY SALES (2)

Q3 2024

vs 2022

3.0%

8%

vs 2022

3%

vs 3Q23

1.6%

2%

vs 3Q23

(4)%

~$231,000

Equates to $12.0M

Annualized AUV(1)

~$141,800

Equates to $7.4M

Annualized AUV(1)

~$116,500

Equates to $6.1M

Annualized AUV(1)

(1) 3Q24 Average Unit Volumes (AUV) annualized based on average weekly sales.

(2) FRC excludes Flower Child. |

| Q3 2024 HIGHLIGHTS(1)

28

Total Revenue

$865M

Up 4% from PY

Adj. Net Inc. Margin

3.3%

Up 100 bps from PY

Capital Allocation

(1) A reconciliation of Non-GAAP measures can be found in the appendix.

(2) The Cheesecake Factory comparable sales outperformed the casual dining industry by 310 bps as measured by the Black Box casual dining index.

(3) Represents total company owned and operated restaurants across the US and Canada.

Adjusted EPS

$0.58

Up 49% from PY

The Cheesecake Factory

Comp Sales

1.6%

310 bps above

Industry

(2)

$54M

CapEx

$1M

Repurchases

$13M

Dividends

Unit Growth

4 NROs

Restaurant Count(3)

341

Up 6% from 323

in PY |

| 2024 UNDERLYING KEY ASSUMPTIONS(1)

29

(1) Assumes no material operating or consumer disruptions as well as assumptions with respect to future decisions, which are subject to change. Actual results will vary and those

variations may be material.

(2) Future decisions to pay or to increase or decrease dividends or to repurchase shares are at the discretion of the Board and will be dependent on several factors.

Consolidated Sales Approximately $3.57 Billion

CCF AUVs Approximately $12.4 Million

Net Income Margin Targeting approximately 4.5% at the stated sales level

New Unit Growth

As many as 22 New Restaurant Openings

• 3 The Cheesecake Factory locations

• 6 North Italia locations

• 6-7 Flower Child locations

• 8 FRC restaurants

Capital Expenditure Approximately $180 Million - $200 Million

Dividend Program Q4 2024 dividend of $0.27 per share(2)

Share Repurchase Program Offset dilution from employee stock-based compensation

and support EPS(2) |

| QUALITY GROWTH OPPORTUNITY

30

New Unit Growth Targets(1)(2)

Size(3) Sales per Sq Ft(3) Annual Unit Growth

7,000 -10,000 ~$1,100 - $1,200 ~2% -3%

6,000 -7,000 ~$1,200 - $1,300 ~20%

3,000 -4,000 ~$1,100 - $1,200 ~15% -20%

3,500 -15,000 ~$1,100 ~10% -15%

Diversified Portfolio

Differentiated experiential concepts

diversified across industry segment, price

point, cuisine, occasion and real estate

Value Creation Opportunities

Leveraging brand power, operational

excellence, scale, supply chain and real

estate development expertise

1% - 2%

Comparable Sales Growth

LONG-TERM OUTLOOK(2)

AVERAGE ANNUAL GROWTH TARGETS

7% - 8%

Top-line Revenue Growth

Attractive Growth Potential

Significant runway for future development

across portfolio of concepts to drive

accretive growth over time

(1) Illustrative example of new restaurant openings targeted size, sales per square foot and annual unit growth; Targets represent steady-state and typically are reached after 3 years of operations.

(2) Targets are forward-looking and are based upon assumptions that there are no material operating or consumer disruptions as well as assumptions with respect to future decisions, which are subject to change. Actual results

will vary and those variations may be material.

(3) Target size and sales per square foot are an average based on productive square feet defined as all interior square footage plus seasonally adjusted exterior patio square footage. |

| HISTORY OF OUTPERFORMING THE INDUSTRY

(4.2)%

(6.8)%

(0.3)%

4.0% 4.2% 3.3% 2.6%

4.1% 3.8%

0.4% 0.9%

2.5%

(27.4)%

3.3%

10.5%

13.9%

(4.3)%

(8.7)%

(6.1)%

1.0% 2.0%

(0.9)% (1.6)%

0.8%

(0.4)%

(2.2)%

0.5% 1.4%

(24.0)%

(0.9)%

6.5%

10.3%

2008

Knapp-Track Index

Comparable Sales - Historical 2-year Stack(1),(2)

Industry Outperformance

During Economic

Downturn

Geographical

discrepancies

in dining

restrictions &

reopening

timelines

31

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020(1) 2021(2) 2022(2) 2023(2)

Comparison to pre-pandemic sales (2019)

(1) 2020 results reflect the impact of the COVID-19 pandemic.

(2) Due to impact of COVID-19 pandemic on results 2021, 2022 and 2023 compare against 2019. |

| DURABLE BUSINESS OVER TIME(1)

32

$0.84 $1.07 $1.42 $1.64 $1.88 $2.10 $1.97 $2.37

$2.83 $2.60 $2.51 $2.61

$(1.49)

$2.13

$1.51

$2.69

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Capital Allocation Detail

$85

$163

$128 $120 $112 $107

$135

$94

$158

$100

$163

$120

$(47)

$146

$50 $67

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

$85 $37 $42 $77 $86 $106 $114 $154 $158 $139 $128 $99 $50 $67 $112 $152

$173

$52

$172 $101

$184 $141 $109 $146 $123 $109

$51

$4

$6 $63 $46

$13

$27 $30 $36

$42

$50 $56

$61

$16

$42 $53

64,009

44,545 49,050

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Capex / Investment Share Repurchases Common Stock Dividend Weighted Average Shares Outstanding

Adjusted Earnings/(Loss) Per Common Share Free Cash Flow

'20 '20

(1) A reconciliation of Non-GAAP measures can be found in the appendix. 2020 results reflect the impact of the pandemic and the issuance of 200,000 shares of Series A Convertible Preferred

Stock. An explanation regarding accounting reclassifications for prior years can be found in the 10-K and 10-Q.

(2) 2019 Capex / Investment does not include the acquisition of North Italia and Fox Restaurant Concepts.

(2)

(2) |

| APPENDIX |

| NON-GAAP RECONCILIATIONS

34

In addition to the results provided in accordance with the Generally Accepted Accounting Principles (“GAAP”)

in this presentation, the Company is providing non-GAAP measurements which present adjusted diluted net

income/(loss) per common share excluding the impact of certain items, adjusted net income margin and free

cash flow.

The non-GAAP measurements are intended to supplement the presentation of the Company’s financial results

in accordance with GAAP. The Company believes that the presentation of these items provides additional

information to facilitate the comparison of past and present financial results.

($ in millions) Fiscal Year

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Cash flow from operations (1) $ 170 $ 200 $ 170 $ 197 $ 198 $ 213 $ 249 $ 248 $ 316 $ 239 $ 291 $ 219 $ 3 $ 213 $ 162 $ 218

Capital expenditures / investments 85 37 42 77 86 106 114 154 158 139 128 99 50 67 112 152

Free cash flow(2) $ 85 $ 163 $ 128 $ 120 $ 112 $ 107 $ 135 $ 94 $ 158 $ 100 $ 163 $ 120 $ (47) $ 146 $ 50 $ 67

(1) The excess tax benefit related to stock options exercised is no longer reclassified from cash flows from operating activities to cash flows from financing activities in the consolidated statements of

cash flows. The consolidated statements of cash flows for fiscal 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008 have been adjusted to conform to the subsequent years presentation.

(2) Free cash flow may not add due to rounding. |

| NON-GAAP RECONCILIATIONS

35

($ in thousands, except per share data) Fiscal Year

Fiscal

Quarter

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 3Q23 3Q24

Net income/(loss) $ 52,293 $ 42,833 $ 81,713 $ 95,720 $ 98,423 $114,356 $101,276 $116,523 $139,494 $157,392 $ 99,035 $127,293 $(277,107) $ 49,131 $ 43,123 $ 101,351 $ 17,945 $ 29,994

Impairment of assets and lease termination expenses/(income)(1) 2,952 26,541 - 1,547 9,536 (561) 696 6,011 114 10,343 17,861 18,247 219,333 18,139 31,387 29,464 48 (3,472)

Partial IRS settlement - - - (1,794) - - - - - - - - - - - - - -

Termination of Interest rate swap - 7,421 7,376 - - - - - - - - - - 2,354 - - - -

Chairman and CEO employment agreement - 2,550 - - - - - - - - - - - - - - -

Proceeds from variable life insurance contract - (668) - - (419) - - - - - - - - - - - - -

Loss on investment in unconsolidated affiliates - - - - - - - - - 479 4,754 13,439 - - - - - -

Gain on investment in unconsolidated affiliates - - - - - - - - - - - (52,672) - - - - - -

Acquisition-related costs - - - - - - - - - - - 5,270 2,699 - - - - -

Acquisition-related contingent consideration, compensation and

amortization expenses/(benefit) (2) - - - - - - - - - - - 1,033 (3,872) 19,510 13,368 11,686 1,414 1,020

Dividends on Series A preferred stock - - - - - - - - - - - - 13,485 18,661 - - - -

Net income attributable to Series A preferred stock to apply if-converted method - - - - - - - - - - - - - 4,581 - - - -

Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 10,257 - - - - -

Assumed impact of potential conversion of Series A preferred

stock into common stock - - - - - - - - - - - - - - - - - -

COVID-19 related costs (3) - - - - - - - - - - - - 22,963 4,917 - - - -

Uncertain tax positions - - - - - - - - - - - - - 7,139 - - - -

Tax effect of adjustments (4) (1,181) (14,605) (2,951) (331) (3,814) 224 (278) (2,404) (46) (4,329) (5,880) 3,818 (62,692) (11,679) (11,637) (10,699) (380) 638

One-time tax items (5) - - - - - - - - - (38,525) - - - - - - - -

Adjusted net income/(loss) $ 54,064 $ 64,072 $ 86,138 $ 95,142 $103,726 $114,019 $101,694 $120,130 $139,562 $125,360 $115,770 $116,428 $ (74,934) $112,753 $ 76,241 $ 131,802 $ 19,027 $ 28,180

Revenues $2,482,692 $830,210 $865,471

Adjusted net income margin 4.7% 2.3% 3.3%

Diluted net income/(loss) per share $ 0.82 $ 0.71 $ 1.35 $ 1.64 $ 1.78 $ 2.10 $ 1.96 $ 2.30 $ 2.83 $ 3.27 $ 2.14 $ 2.86 $ (6.32) $ 1.01 $ 0.86 $ 2.07 $ 0.37 $ 0.61

Impairment of assets and lease termination expenses/(income)(1) 0.05 0.44 - 0.03 0.17 (0.01) 0.01 0.12 0.00 0.21 0.39 0.41 4.36 0.34 0.62 0.61 - (0.07)

Partial IRS settlement - - - (0.03) - - - - - - - - - - - - - -

Termination of Interest rate swap - 0.12 0.12 - - - - - - - - - - 0.04 - - - -

Chairman and CEO employment agreement - 0.04 - - - - - - - - - - - - - - - -

Proceeds from variable life insurance contract - (0.01) - - (0.01) - - - - - - - - - - - - -

Loss on investment in unconsolidated affiliates - - - - - - - - - 0.01 0.10 0.30 - - - - - -

Gain on investment in unconsolidated affiliates - - - - - - - - - - - (1.18) - - - - - -

Acquisition-related costs - - - - - - - - - - - 0.12 0.05 - - - - -

Acquisition-related contingent consideration, compensation and

amortization expenses/(benefit) (2) -

- - - - - - - - - - 0.02 (0.08) 0.37 0.27 0.24 0.03 0.02

Dividends on Series A preferred stock - - - - - - - - - - - - 0.27 0.35 - - - -

Net income attributable to Series A preferred stock to apply if-converted method -

- - - - - - - - - - - - 0.09 - - - -

Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 0.20 - - - - -

Assumed impact of potential conversion of Series A preferred

stock into common stock -

- - - - - - - - - - - 0.80 (0.08) - - - -

COVID-19 related costs (3) - - - - - - - - - - - - 0.46 0.09 - - - -

Uncertain tax positions - - - - - - - - - - - - - 0.13 - - - -

Tax effect of adjustments (4) (0.03) (0.23) (0.05) - (0.06) 0.01 - (0.05) 0.00 (0.09) (0.12) 0.09 (1.25) (0.22) (0.23) (0.22) (0.01) 0.01

One-time tax items (5) - - - - - - - - - (0.80) - - - - - - - -

Adjusted diluted net income/(loss) per share(6) $ 0.84 $ 1.07 $ 1.42 $ 1.64 $ 1.88 $ 2.10 $ 1.97 $ 2.37 $ 2.83 $ 2.60 $ 2.51 $ 2.61 $ (1.49) $ 2.13 $ 1.51 $ 2.69 $ 0.39 $ 0.58

(1) A detailed breakdown of impairment of assets and lease termination expenses recorded can be found in the Selected Segment Information table in the 10-K and 10-Q.

(2) Represents changes in the fair value of the deferred consideration and contingent consideration and compensation liabilities related to the North Italia and FRC acquisition, as well as amortization of acquired definite-lived licensing agreements.

(3) Represents incremental costs associated with COVID-19 such as sick and vaccination pay, healthcare and meal benefits for furloughed staff members, additional sanitation and personal protective equipment.

(4) The tax effect assumes a tax rate based on the federal statutory rate and an estimated blended state tax rate.

(5) Fiscal 2017 includes a $38.5 million benefit to the income tax provision related to tax reform enacted in December 2017.

(6) Adjusted diluted net income/(loss) per share may not add due to rounding. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

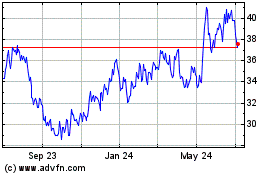

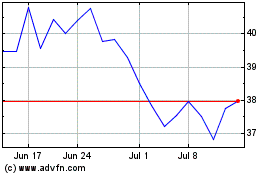

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Dec 2023 to Dec 2024