Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

October 01 2024 - 4:04PM

Edgar (US Regulatory)

Letter to Shareholders of Charles & Colvard, LTD from Riverstyx Capital Management, LLC

Urges Shareholders to Support Real Change on the Charles & Colvard Board of Directors

To Charles & Colvard, LTD Shareholders:

Riverstyx Capital Management, LLC (Riverstyx), the largest independent shareholder of Charles & Colvard, LTD (NASDAQ: CTHR)(the "Company"), has nominated three candidates for election to the Board of Directors. We urge shareholders to elect our three highly qualified nominees at the next annual shareholder meeting.

CHARLES & COLVARD'S BUSINESS HAS SIGNIFICANTLY DETERIORATED, ITS VALUE HAS COLLAPSED, AND RIVERSTYX IS CONCERNED ABOUT LIQUIDITY

- In Fiscal Year 2020, a difficult year for the company due to the pandemic, the company spent $9.4 million on Sales & Marketing. Yet, in the trailing 12 months ending 3/31/2024, those expenses increased by 45% to $13.7 million, as revenue for the trailing 12-month period declined 19% compared to the difficult COVID year of 2020.

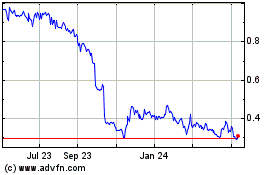

- This performance has led to a significant crash in the share price, down by 70% in the trailing one-year period ending 9/30/2024.

- In Riverstyx's view, the need to establish a credit line amid declining cash suggests that liquidity may become a problem. Additionally, Charles & Colvard's long-time supplier, Wolfspeed, Inc. ("Wolfspeed"), initiated confidential arbitration, alleging breach of contract and asserting Charles & Colvard intends to breach its remaining obligations. Wolfspeed alleges there are over $20 million in damages. While we are hopeful for a favorable outcome from a hearing yesterday, it is clear we need a team capable of avoiding such issues from the start.

CHANGE IS NEEDED NOW, AND RIVERSTYX HAS A PLAN. SHAREHOLDERS SHOULD CONTACT US RIGHT AWAY AT INFO@RIVERSTYXCAPITAL.COM TO LEARN MORE

The third quarter of 2024 saw an operating loss of $3.7 million, continuing a series of losing quarters. If something does not change soon, the remaining value will be completely eroded. Riverstyx has a credible turnaround plan and is prepared to execute swiftly. We encourage shareholders to contact us at info@riverstyxcapital.com.

RIVERSTYX'S GOOD FAITH EFFORTS AT ENCOURAGING CHANGE

We have engaged in discussions with Charles & Colvard leadership for many months, without any meaningful progress.

Note, shareholders can replace Board members only at an annual shareholder meeting. For the annual shareholder meeting in 2024, the company set a deadline to submit nominations by August 28, 2024. Despite multiple attempts to engage in good faith discussions about the company business and governance well before then, including an urgent meeting request on August 13, 2024, the Board denied Riverstyx any meaningful dialogue. While the company's Corporate Governance Standards policy states "it is the policy of our Company and the Board of Directors to encourage free and open communication between shareholders and the Board of Directors," we were told this is a quiet period, and an open discussion was not possible. Prior to informing the company we were proposing new Board members, there was no offer for us to go "over the wall" and have a confidential discussion. This lack of engagement hinders shareholders from having a candid dialogue at a critical time for the company.

Thus, on August 27th, 2024, consistent with the deadline to submit nominations, and in the absence of any discussions with the company, Riverstyx notified the company of the intent to nominate Ben Franklin, Michael Levin and Lloyd Sems to stand for election to the Board of Directors. Mr. Franklin is the portfolio manager of Riverstyx, and Mr. Levin and Mr. Sems are experienced independent directors.

CALL TO ACTION: SUPPORT POSITIVE CHANGE

We ask shareholders to support our effort to elect new, truly independent directors who will prioritize the best interests of all shareholders. Your vote for change is essential to ensure Charles & Colvard is governed with accountability and transparency.

RIVERSTYX ENCOURAGES ALL SHAREHOLDERS TO REACH OUT TO US DIRECTLY WITH QUESTIONS AND CONCERNS:

Ben Franklin

Portfolio Manager

Riverstyx Capital Management

904-294-5879

info@riverstyxcapital.com

The Participants (as defined below) intend to file a definitive proxy statement and accompanying form of proxy card with the SEC to be used in connection with the 2024 annual meeting of shareholder of Charles & Colvard, LTD (the "Company").

The "Participants" in this proxy solicitation are currently: (i) Riverstyx Fund, LP, (ii) Riverstyx Fund GP, LLC, (iii), Riverstyx Capital Management, LLC, and (iv) Ben Franklin.

As of the date hereof, the Participants beneficially own (within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended), in the aggregate, 307,615 shares of Common Stock of the Company. The Riverstyx Fund, LP may be deemed to beneficially own 307, 615 shares of Common Stock of the Company (including 100 shares of Common Stock held in record name by Riverstyx Fund, LP); Riverstyx Fund GP, LLC may be deemed to own 307,615 shares of Common Stock of the company; Riverstyx Capital Management, LLC may be deemed to beneficially 307,615 shares of Common Stock of the company; Ben Franklin may be deemed to beneficially own 307,615 shares of Common Stock of the company (including 100 shares of Common Stock held in record name by Ben Franklin).

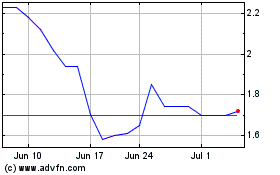

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Nov 2023 to Nov 2024