Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-261155

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated November 26, 2021)

3,871,000

Shares

Common

Stock

We

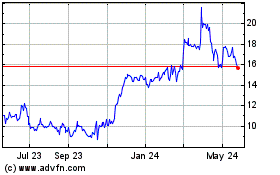

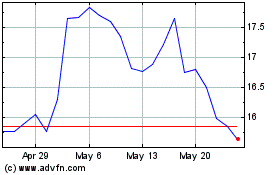

are offering 3,871,000 shares of our common stock. Our common stock is listed on The Nasdaq Stock Market LLC under the symbol “CELC.”

On May 29, 2024, the last reported sale price of our common stock on The Nasdaq Stock Market LLC was $14.84 per share.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement,

page 14 of the accompanying prospectus and under similar headings in the documents incorporated by reference into this prospectus supplement

and the accompanying prospectus.

We

are a “smaller reporting company” under applicable Securities and Exchange Commission rules and are subject to reduced public

company reporting requirements. See “Prospectus Supplement Summary - Implications of Being a Smaller Reporting Company.”

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 15.50 | | |

$ | 60,000,500 | |

| Underwriting discount and commissions(1) | |

$ | 0.93 | | |

$ | 3,600,030 | |

| Proceeds to us (before expenses) | |

$ | 14.57 | | |

$ | 56,400,470 | |

| |

(1) |

See

“Underwriting” on page S-16 of this prospectus supplement for additional information regarding underwriter compensation. |

Delivery

of the shares of common stock is expected to be made on or about May 31, 2024.

Joint

Bookrunning Managers

| Leerink

Partners |

TD

Cowen |

Stifel |

Prospectus

Supplement dated May 30, 2024.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus relate to the sale of shares of our common stock registered for sale under our

Registration Statement on Form S-3 (File No. 333-261155) (the “Registration Statement”), which the Securities and Exchange

Commission (the “Commission” or the “SEC”) declared effective on November 26, 2021. This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this common stock offering and also adds to and updates

information contained in the accompanying prospectus and the documents incorporated by reference herein and therein. The second part,

the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both

parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and

the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of

this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of

these documents is inconsistent with a statement in another document having a later date – for example, a document incorporated

by reference in the accompanying prospectus – the statement in the document having the later date modifies or supersedes the earlier

statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Neither

we nor the underwriters have authorized anyone to provide information different from that contained in this prospectus supplement and

the accompanying prospectus, including any free writing prospectus that we have authorized for use in this offering. When you make a

decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus

supplement or the accompanying prospectus, including any free writing prospectus that we have authorized for use in this offering. You

should assume that the information contained in this prospectus supplement is accurate only as of its date and that any information we

have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery

of this prospectus supplement for any sale of securities. Neither the delivery of this prospectus supplement or the accompanying prospectus,

including any free writing prospectus that we have authorized for use in this offering, nor the sale of our common stock means that information

contained in this prospectus supplement and the accompanying prospectus, including any free writing prospectus that we have authorized

for use in this offering, is correct after their respective dates. It is important for you to read and consider all information contained

in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference into this prospectus

supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering

in making your investment decision. You should also read and consider the information in the documents to which we have referred you

in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference”

in this prospectus supplement.

We

are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

The

distribution of this prospectus supplement and the accompanying prospectus and the offering of the common stock in certain jurisdictions

may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying

prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution

of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying

prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities

offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such

person to make such an offer or solicitation.

In

this prospectus, “Celcuity,” “we,” “our,” “ours,” and “us” refer to Celcuity

Inc., except where the context otherwise requires or as otherwise indicated.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

Because it is a summary, it does not contain all the information you should consider before investing in our common stock. You should

carefully read this entire prospectus supplement and the accompanying prospectus, including the “Risk Factors” section beginning

on page S-6 of this prospectus supplement and page 14 of the accompanying prospectus and under similar headings in the other documents

that are incorporated by reference into this prospectus supplement and the accompanying prospectus, along with our consolidated financial

statements and notes to those consolidated financial statements and the other information incorporated by reference into this prospectus

supplement and the accompanying prospectus, before making an investment decision.

Business Overview

We

are a clinical-stage biotechnology company focused on the development of targeted therapies for the treatment of multiple solid tumor

indications. Our lead therapeutic candidate is gedatolisib, a potent, well-tolerated, small molecule reversible inhibitor, administered

intravenously, that selectively targets all Class I isoforms of phosphatidylinositol-3-kinase (PI3K) and the two mechanistic target of

rapamycin (mTOR) sub-complexes, mTORC1 and mTORC2. Gedatolisib’s mechanism of action and pharmacokinetic properties are highly

differentiated from other currently approved and investigational therapies that target PI3K or mTOR alone or together. We believe there

is significant potential for gedatolisib to address breast and prostate cancer tumors, and it has the potential to be used in other tumor

types where the PAM pathway is either: i) driving tumorigenesis directly; ii) cooperating with other dysregulated signaling pathways;

or iii) a mechanism of resistance to other drug therapies.

Recent

Developments

Amended

Loan Agreement

On

May 30, 2024, we entered into an amended and restated loan and security agreement (the “Loan Agreement”) with Innovatus Life

Sciences Lending Fund I, LP, a Delaware limited partnership (“Innovatus”), as collateral agent and the Lenders listed on

Schedule 1.1 thereto, including Innovatus in its capacity as a Lender and Oxford Finance LLC (“Oxford”), pursuant to which

Innovatus and Oxford, as Lenders, have agreed to make certain term loans to the Company in the aggregate principal amount of up to $180.0

million (the “Term Loans”). The Loan Agreement amends and restates, in its entirety, our Loan and Security Agreement dated

April 8, 2021, as amended, with Innovatus, as Collateral Agent and the Lenders named in that agreement (the “Original Agreement”).

Funding of the first $100.0 million occurred on May 30, 2024, including $38.3 million reflecting repayment of the principal amount of

loans under the Original Agreement plus accrued payment-in-kind interest on those loans (“Term A Loan” of $16.8 million and

“Term B Loan” of $21.5 million) and $61.7 million of new borrowings (“Term C Loan”). The Company will be eligible

to draw on a fourth tranche of $30.0 million (“Term D Loan”) and a fifth tranche of $50 million (“Term E Loan”),

in each case upon the achievement of certain clinical trial milestones and satisfaction of certain financial covenants determined on

a pro forma as-funded basis. The Lenders may, in their sole discretion upon our request, agree to make additional term loans to us of

$45 million (“Term F Loan”). Funding of these additional tranches is also subject to other customary conditions and limits

on when the Company can request funding for such tranches.

The

Company is entitled to make interest-only payments for thirty-six months, or up to forty-eight months if certain conditions are met.

The Term Loans will mature on May 1, 2029 and will bear interest at a rate equal to sum of (a) the greater of (i) the Prime Rate (as

defined in the Loan Agreement) or (ii) 7.75%, plus (b) 2.85%, provided that 1.0% of such interest will be payable in-kind by adding an

amount equal to such 1.0% of the outstanding principal amount to the then outstanding principal balance on a monthly basis through May

31, 2027. The Loan Agreement is secured by all assets of the Company. Proceeds will be used for working capital purposes and to fund

the Company’s general business requirements. The Loan Agreement contains customary representations and warranties and covenants,

subject to customary carve outs, and includes financial covenants related to liquidity and trailing twelve months’ revenue.

Innovatus

has the right, at its election, until August 9, 2025, to convert up to 20% of the outstanding principal amount of the Term A Loan into

shares of the Company’s common stock at a price per share of $10.00. Innovatus will continue to have the right to exercise a warrant

granted to it under the Original Agreement to purchase 26,042 shares of our common stock at a per share price of $14.40 through April

8, 2031. In connection with each funding of the Term C Loan, Term D Loan, Term E Loan and Term F Loan, the Company is required to issue

to Innovatus and Oxford warrants (the “Warrants”) to purchase a number of shares of the Company’s common stock equal

to 2.5% of the principal amount of the relevant Term Loan funded divided by the exercise price, which will, with respect to the Term

C Loan, be based on the lower of (i) the volume weighted average closing price of the Company’s stock for the 5-trading day period

ending on the last trading day immediately preceding the execution of the Loan Agreement or (ii) the closing price on the last trading

day immediately preceding the execution of the Loan Agreement. For the additional Term Loans, the exercise price will be based on the

lower of (i) the exercise price for the first tranche or (ii) the volume weighted average closing price of the Company’s stock

for the 5-trading day period ending on the last trading day immediately preceding the relevant Term Loan funding. The Warrants may be

exercised on a cashless basis and are exercisable through the 10th anniversary of the applicable funding date. The number of shares of

common stock for which each Warrant is exercisable and the associated exercise price are subject to certain proportional adjustments

as set forth in such Warrant.

Based

on our current business plan including the planned first-line trial described below, we believe that the proceeds from this offering,

together with our current cash, cash equivalents and short-term investments, and available borrowings under the Loan Agreement described

above, will provide sufficient cash to finance our operations and pay our obligations when due through at least the second half of 2026.

Phase

3 Clinical Trial Evaluating First-Line Treatment for Patients with HR+/HER2- ABC (VIKTORIA-2)

Inhibitors

of CDK4/6 in combination with either letrozole or fulvestrant have emerged as the standard of care for the treatment of patients with

HR+/HER2- advanced breast cancer (“ABC”) who are treatment-naïve. For adults with endocrine sensitive HR+/HER2- ABC,

whose disease recurred more than 12 months after receiving adjuvant or neoadjuvant endocrine treatment, three CDK4/6 inhibitors (palbociclib,

ribociclib, and abemaciclib) are approved in combination with letrozole as first-line treatment. The median PFS reported for these three

regimens was similar, ranging from approximately 25 to 28 months.

For

patients with HR+/HER2- ABC, whose disease recurs while receiving or within 12 months of completing adjuvant endocrine treatment, standard-of-care

first-line treatment includes any one of the three approved CDK4/6 inhibitors combined with fulvestrant. This group of patients is considered

endocrine treatment resistant (ETR) and known to have significantly less favorable clinical outcomes than patients whose disease is considered

endocrine sensitive. Approximately 15,000 patients with HR+/HER2- ABC that is endocrine treatment resistant are diagnosed annually.

A

recently completed Phase 3 clinical trial evaluated palbociclib plus fulvestrant in patients with HR+/HER2-/PIK3CA mutant ABC who were

endocrine treatment resistant. The median progression-free survival (PFS) for these patients was 7.3 months. For the subgroup of subjects

who had relapsed while on the first two years of adjuvant endocrine therapy, the median PFS was only 3.7 months. These results highlight

the significant need to develop more effective therapies for patients with ETR ABC.

Our

Phase 1b study enrolled subjects with treatment-naïve HR+/HER2- ABC and evaluated gedatolisib in combination with standard doses

of palbociclib plus letrozole. This combination induced an objective response rate of 85.2% and a median PFS of 48.4 months. These results

compare favorably to results published for palbociclib plus letrozole and provide a strong scientific rationale to conduct a Phase 3

clinical trial evaluating gedatolisib in combination with a CDK inhibitor and fulvestrant as first-line treatment for patients with HR+/HER2-

ABC that is endocrine treatment resistant.

We

intend to commence a Phase 3, global, open-label, randomized study to evaluate the efficacy and safety of gedatolisib combined

with fulvestrant plus a CDK4/6 inhibitor in comparison to fulvestrant plus a CDK4/6 inhibitor as first-line treatment for patients with

HR+/HER2- ABC who are endocrine therapy resistant. For the CDK4/6 inhibitor, investigators may choose either ribociclib or palbociclib.

The safety profile of gedatolisib combined with fulvestrant and palbociclib is well described, but the investigational combination of

gedatolisib with ribociclib has not yet been clinically tested. Therefore, a safety run-in of approximately 12-36 subjects will evaluate

the safety profile of gedatolisib combined with ribociclib and fulvestrant. The safety run-in will be completed, and the dose regimen

(RP3D) confirmed before expanding Phase 3 study to full enrollment.

During

the Phase 3 portion of the study, approximately 638 subjects who meet the eligibility criteria will be assigned to a cohort based on

their PIK3CA mutation status (Cohort 1: Wild-type, or WT, or Cohort 2: Mutated, or MT). After the investigator selects the CDK4/6 inhibitor

for a subject (either ribociclib or palbociclib), the subject will then be randomly assigned on a 1:1 basis to either Arm A (gedatolisib,

fulvestrant, and Investigator’s choice of ribociclib or palbociclib) or Arm B (fulvestrant and Investigator’s choice of ribociclib

or palbociclib). Investigators must select the CDK4/6 inhibitor (either palbociclib or ribociclib) for each subject and determine their

PIK3CA status prior to randomization into a study arm.

The

clinical trial primary endpoints are progression free survival (PFS), per RECIST 1.1 criteria, as assessed by blinded independent central

review. Cohort 1 (PIK3CA WT) and Cohort 2 (PIK3CA MT) each have independent primary endpoints that will be evaluated. All subjects will

receive treatment according to the assigned study arm until objective progressive disease, unacceptable toxicity, death, or withdrawal

of consent, whichever occurs first. Subjects will be followed for adverse events, safety laboratory testing, tumour assessment by RECIST

1.1, quality of life, and overall survival.

The

study’s design was reviewed and discussed with the U.S. Food and Drug Administration (FDA) during a Type C Meeting.

This

global trial is expected to enroll subjects at up to 200 clinical sites across North America, Europe, Latin America, and Asia. We expect

to enroll the first patient in the second quarter of 2025.

Additional

Information

Our

principal executive office is located at 16305 36th Avenue North, Suite 100, Minneapolis, Minnesota. Our telephone number is (763) 392-0767,

and our website is www.celcuity.com. The information contained on or accessible through our website is not incorporated by reference

into, and should not be considered part of, this prospectus supplement, the accompanying prospectus or the information incorporated herein

by reference.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Rule 12b-2 promulgated under the Securities Exchange Act. We may remain a

smaller reporting company if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual

revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates

is less than $700 million. As a smaller reporting company, we may rely on exemptions from certain disclosure requirements that are available

to smaller reporting companies. Specifically, as a smaller reporting company, we may choose to present only the two most recent years

of audited financial statements in our Annual Report on Form 10-K and smaller reporting companies have reduced disclosure obligations

regarding executive compensation.

We

have taken advantage of these reduced reporting requirements in this prospectus supplement, the accompanying prospectus and the information

incorporated herein by reference. Accordingly, the information contained herein may be different from the information you receive from

other public companies that are not smaller reporting companies.

THE

OFFERING

| Common

stock offered by us |

|

3,871,000

shares. |

| |

|

|

| Common

stock to be outstanding after this offering |

|

35,101,335

shares. |

| |

|

|

| Use

of Proceeds |

|

We

intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures,

research and development expenditures, clinical trial expenditures, expansion of business development activities and other general

corporate purposes. See “Use of Proceeds” on page S-11 of this prospectus supplement. |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves a high degree of risk. You should carefully consider the information set forth in the section of this

prospectus supplement entitled “Risk Factors” beginning on page S-6 as well as other information included in this prospectus

supplement, the accompanying prospectus and the documents incorporated herein or therein by reference, including our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”), filed with the SEC on March 27, 2024

and our subsequent Quarterly Reports on Form 10-Q, which are incorporated by reference

into this prospectus supplement, before deciding to invest in our common stock. |

| |

|

|

| Nasdaq

symbol |

|

“CELC” |

The

number of shares of common stock to be outstanding after this offering as set forth in the table above is based on 30,773,895 shares

outstanding as of March 31, 2024, plus 456,440 shares (including 435,414 shares sold pursuant to an Open Market Sale AgreementSM with Jefferies LLC and 21,026

issued through purchases under our 2017 Employee Stock Purchase Plan and the exercise of employee stock options) issued subsequent

to March 31, 2024 and prior to the date hereof, and the shares offered by us in this offering. The number of shares outstanding as of

March 31, 2024 does not include:

| |

● |

3,049,387

shares of our common stock issuable upon exercise of outstanding options at a weighted average price of $8.65 per share; |

| |

|

|

| |

● |

5,052,770

shares of our common stock issuable upon conversion of 505,277 shares of outstanding Series A Convertible Preferred Stock (“Series

A Preferred Stock”); |

| |

|

|

| |

● |

5,517,725

shares of our common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price of $8.14 per share; |

| |

|

|

| |

● |

5,747,787

shares of our common stock issuable upon exercise of outstanding pre-funded warrants with an exercise price of $0.001 per share;

and |

| |

|

|

| |

● |

1,397,579

shares of our common stock reserved for issuance under our Amended and Restated 2017 Stock Incentive Plan and our 2017 Employee Stock

Purchase Plan. |

Shares

available for future issuance under our Amended and Restated 2017 Stock Incentive Plan do not include shares that may become available

for issuance pursuant to provisions in this plan that provide for the re-issuance of shares that are cancelled or forfeited in accordance

with such plan.

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of outstanding options or warrants after March

31, 2024.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Before you decide to invest in our common stock, you should carefully consider the

risks described below, along with the other information in this prospectus supplement and the accompanying prospectus and the risks described

in the section entitled “Risk Factors” of our 2023 Form 10-K, Quarterly Reports on Form 10-Q, as well as the other information

incorporated herein or therein by reference. If any of these risks occur, our business could be materially harmed, and our financial

condition and results of operations could be materially and adversely affected. As a result, the price of our common stock could decline,

and you could lose all or part of your investment.

Risks

Relating to This Offering

We

have broad discretion in the use of the proceeds of this offering and may apply the proceeds in ways with which you do not agree.

Our

net proceeds from this offering will be used primarily for working capital and general corporate purposes, which may include capital

expenditures, research and development expenditures, clinical trial expenditures, expansion of business development activities, and other

general corporate purposes. We may also use a portion of the proceeds for the potential acquisition of businesses, technologies, and

products, although we have no current binding understandings, commitments or agreements to do so. Our management will have broad discretion

over the use and investment of these net proceeds, and, accordingly, you will have to rely upon the judgment of our management with respect

to our use of these net proceeds, with only limited information concerning management’s specific intentions. You will not have

the opportunity, as part of your investment decision, to assess whether we used the net proceeds from this offering appropriately. We

may place the net proceeds in investments that do not produce income or that lose value, which may cause our stock price to decline.

You

will experience immediate and substantial dilution.

The

public offering price per share in this offering exceeds the net tangible book value per share of our common stock outstanding prior

to this offering. Based on the public offering price, you will experience immediate dilution of $10.80 per share, representing the difference

between our as adjusted net tangible book value per share as of March 31, 2024 after giving effect to this offering and the public offering

price. The exercise of outstanding stock options and warrants, as well as the conversion of shares of Series A Preferred Stock, may result

in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the

dilution you would incur if you participate in this offering.

The

price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our

common stock or could subject us to securities litigation.

Our

stock price may be extremely volatile. The stock market in general and the market for smaller medical technology companies in particular

have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of

this volatility, investors may not be able to sell our common stock at or above the price they paid for such stock. The market price

for our common stock may be influenced by many factors, including:

| |

● |

the

success of competitive products or technologies; |

| |

● |

results

of existing or future clinical trials; |

| |

● |

regulatory

or legal developments in the United States and other countries; |

| |

● |

developments

or disputes concerning patent applications, issued patents or other proprietary rights; |

| |

● |

the

recruitment or departure of key personnel; |

| |

● |

the

level of expenses related to any of our products or clinical development programs; |

| |

● |

actual

or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| |

● |

operating

results that fail to meet expectations of securities analysts that cover our company; |

| |

● |

variations

in our financial results or those of companies that are perceived to be similar to us; |

| |

● |

changes

in the structure of healthcare payment systems; |

| |

● |

market

conditions in the pharmaceutical, biotechnology and medical technology sectors; |

| |

● |

sales

of our stock by us, our insiders and our other stockholders; and |

| |

● |

general

economic and market conditions. |

Additionally,

companies that have experienced volatility in the market price of their stock have been subject to an increased incidence of securities

class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result

in substantial costs and divert our management’s attention from other business concerns, which could seriously harm our business.

Future

sales of shares of our common stock, including by us and significant stockholders, could negatively affect our stock price.

Sales

of a substantial number of shares of our common stock in the public market could occur at any time. Since December 2022, we have issued

9,371,006 shares of common stock pursuant to equity financing arrangements, including pursuant to our Open Market Sale AgreementSM

with Jefferies LLC, as agent, pursuant to which we may offer and sell, from time to time, through Jefferies, shares of our common

stock having an aggregate offering price of up to $50,000,000. As of the date of this prospectus supplement, $22.2 million of common

stock remains available for sale under the Jefferies agreement. We may enter into additional equity financing arrangements in the future.

The shares of common stock that we have issued pursuant to equity financings, or may issue in the future, may be resold at any time in

the discretion of the investors.

In

addition, as of the date of this prospectus supplement, an aggregate of 11,265,512 shares of common stock are issuable upon conversion

or exercise of currently outstanding preferred stock and financing warrants, subject to certain beneficial ownership limitations, which

the investors may subsequently resell into the market, and 3,161,887 shares of common stock are issuable upon exercise of awards granted

under our 2017 Stock Incentive Plan and 2012 Equity Incentive Plan. Under our amended and restated loan and security agreement with Innovatus

Life Sciences Lending Fund I, LP (“Innovatus”), Innovatus also has the right, at its election, to convert up to $3.4 million

of outstanding principal of our Innovatus loans into 337,265 shares of common stock at a price of $10.00 per share.

Sales

of substantial amounts of shares of our common stock or other securities by these investors or our other stockholders or by us under

the Open Market Sale AgreementSM, or the perception in the market that the holders of a large number of shares of our common

stock intend to sell their shares, could reduce the trading price of our common stock, make it more difficult for you to sell your shares

at a price that you desire and impair our ability to raise capital through the sale of equity or equity-related securities.

Our

Series A Preferred Stock has rights, preferences, and privileges that are not held by, and are preferential to, the rights of holders

of our common stock.

We

issued 1,120,873 shares of Series A Preferred Stock in a financing transaction in December 2022, and 505,277 shares of Series A Preferred

Stock were outstanding as of March 31, 2024. The Certificate of Designations of Preferences, Rights and Limitations of Series A Convertible

Preferred Stock provides that, in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, or

in the event of a Deemed Liquidation Event (as defined in the Certificate of Designations of Preferences, Rights and Limitations of Series

A Convertible Preferred Stock), the holders of Series A Preferred Stock are entitled to be paid from assets of the Company available

for distribution to its stockholders, before any payment is made to the holders of common stock by reason of their ownership thereof,

an amount per share equal to the greater of (i) the original issue price ($5.75 on an as-converted-to-common stock basis), plus all accrued

and unpaid dividends and (ii) the amount that the holder would have been entitled to receive at such time if the Series A Preferred Stock

were converted into common stock. The Company may not, without the consent of holders of a majority of the outstanding shares of Series

A Preferred Stock, amend its charter in a manner that adversely affects the powers, preferences or rights of the Series A Preferred Stock

or issue or obligate itself to issue shares of any additional class or series of capital stock unless the same ranks junior to the Series

A Preferred Stock with respect to the distribution of assets on the liquidation, dissolution or winding up of the Company and the payment

of dividends.

We

may need additional capital and any additional capital we seek may not be available in the amount or at the time we need it.

We

believe that the proceeds from this offering, together with our current cash, cash equivalents and short-term investments, and available

borrowings under our amended and restated loan and security agreement with Innovatus, will provide sufficient cash to finance our operations

and pay our obligations when due through at least the second half of 2026. However, if we are not able to increase our revenues, generate

positive cash flow or operate in a profitable manner, we may need to raise funds in the future to execute our business plan.

We

may seek to raise additional capital to expand our business, pursue strategic investments, and take advantage of financing or other opportunities

that we believe to be in the best interests of the Company and our stockholders. Additional capital may be raised through the sale of

common or preferred equity or convertible debt securities, entry into debt facilities or other third-party funding arrangements. The

sale of equity and convertible debt securities may result in dilution to our stockholders and those securities may have rights senior

to those of our common shares. Agreements entered into in connection with such capital raising activities could contain covenants that

would restrict our operations or require us to relinquish certain rights. Additional capital may not be available on reasonable terms,

or at all. If we cannot timely raise any needed funds,

we may be forced to reduce our operating expenses, which could adversely affect our ability to implement our long-term strategic roadmap

and grow our business.

Our

expected financing needs are based upon management estimates as to future revenue and expense. Our business plan and financing needs

are subject to change based upon, among other factors, our ability to increase revenues, our ability to achieve cash flow, and our ability

to manage expenses. If our estimates of our financing needs change, we may need additional capital more quickly than we expect or we

may need a greater amount of capital.

We

do not expect to pay cash dividends for the foreseeable future, and accordingly, stockholders must rely on stock appreciation for any

return on their investment in the company.

We

have never declared or paid any cash dividends on our common stock and currently we anticipate that we will retain our earnings, if any,

for future growth and therefore do not anticipate that we will pay cash dividends for the foreseeable future. As a result, appreciation

of the price of our common stock is the only potential source of return to stockholders. Investors seeking cash dividends should not

invest in our common stock.

If

securities or industry analysts issue an adverse opinion regarding our stock, our stock price and trading volume could decline.

The

trading market for our common stock depends in part on the research and reports that securities or industry analysts publish about us

or our business. We do not have any control over these analysts. There can be no assurance that analysts will cover us or provide favorable

coverage. If one or more of the analysts who cover us downgrade our stock or change their opinion of our stock, our stock price would

likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose

visibility in the financial markets, which could cause our stock price or trading volume to decline.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference contain forward-looking statements

and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act”, and

Section 21E of the Exchange Act which are subject to the safe harbor created by those sections. These forward-looking statements and

information regarding us, our business prospects and our results of operations are subject to certain risks and uncertainties that could

cause our actual business, prospects, and results of operations to differ materially from those that may be anticipated by such forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to, those described under “Risk

Factors” herein, in our 2023 Form 10-K and in our other filings with the SEC. You should not place undue reliance on these forward-looking

statements. You should assume that the information contained in or incorporated by reference in this prospectus supplement, and the accompanying

prospectus, is accurate only as of the date on the front cover of this prospectus supplement, and the accompanying prospectus, or as

of the date of the documents incorporated by reference herein or therein, as applicable. We expressly disclaim any intent or obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are urged

to carefully review and consider the various disclosures made by us in this prospectus supplement, the accompanying prospectus and the

documents incorporated herein by reference and in our other reports filed with the SEC that advise interested parties of the risks and

uncertainties that may affect our business.

All

statements, other than statements of historical facts, contained in this prospectus supplement, the accompanying prospectus and the documents

incorporated herein by reference, including statements regarding our plans, objectives and expectations for our business, operations

and financial performance and condition, are forward-looking statements. In some cases, you can identify forward-looking statements by

the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “target,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would,”

or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause our results, performance, or achievements

to be materially different from the information expressed or implied by the forward-looking statements in this prospectus supplement,

the accompanying prospectus and the documents incorporated herein by reference. Additionally, our forward-looking statements do not reflect

the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments that we may make. Forward-looking

statements may include, among other things, statements relating to:

| |

● |

our

clinical trial plans and the estimated timelines and costs for such trials; |

| |

|

|

| |

● |

our

plans to develop and commercialize our products, and our expectations about the market opportunity for gedatolisib and our CELsignia

tests, and our ability to serve those markets; |

| |

|

|

| |

● |

our

expectations with respect to our competitive advantages, including the potential efficacy of gedatolisib in various patient types

alone or in combination with other treatments; |

| |

|

|

| |

● |

our

expectations regarding the timeline of patient enrollment and results from clinical trials, including our existing Phase 3 VIKTORIA-1

clinical trial and Phase 1b/2 study and clinical trial, as well as our planned Phase 3 VIKTORIA-2 clinical trial for gedatolisib; |

| |

|

|

| |

● |

our

expectations with respect to the development, validation, required approvals, costs and timelines of gedatolisib and our CELsignia

tests; |

| |

|

|

| |

● |

our

beliefs related to the potential benefits resulting from Breakthrough Therapy designation for gedatolisib; |

| |

|

|

| |

● |

our

beliefs about our ability to capitalize on the exclusive global development and commercialization rights obtained from our license

agreement with Pfizer with respect to gedatolisib; |

| |

|

|

| |

● |

our

plans with respect to research and development and related expenses for the foreseeable future; |

| |

● |

our

beliefs with respect to the potential rate and degree of market acceptance, both in the United States and internationally, and clinical

utility of our therapeutics, diagnostic platform and tests; |

| |

|

|

| |

● |

our

intended business development activities, including collaborations with pharmaceutical companies; |

| |

|

|

| |

● |

our

expectations as to the use of proceeds from this offering; |

| |

|

|

| |

● |

our

expectations with respect to accessing our current debt facility or any other debt facility or other capital sources in the future; |

| |

|

|

| |

● |

our

beliefs regarding the adequacy of our cash on hand to fund our research and development expenses, capital expenditures, working capital,

sales and marketing expenses, and other general corporate expenses, as well as the increased costs associated with being a public

company; and |

| |

|

|

| |

● |

our

expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates, including

our gedatolisib drug candidate and our CELsignia platform and tests. |

These

statements involve known and unknown risks, uncertainties and other factors that may cause our results or our industry’s actual

results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these

forward-looking statements. Certain risks, uncertainties and other factors include, but are not limited to, our limited operating history;

our potential inability to develop, validate and commercialize gedatolisib on a timely basis or at all; the uncertainties and costs associated

with clinical studies and with developing and commercializing biopharmaceuticals; the complexity and difficulty of demonstrating the

safety and sufficient magnitude of benefit to support regulatory approval of gedatolisib and other products we may develop; challenges

we may face in developing and maintaining relationships with pharmaceutical company partners; the complexity and timeline for development

of our CELsignia tests; the uncertainty regarding market acceptance of our products and services by physicians, patients, third-party

payors and others in the medical community, uncertainty with respect to the size of market opportunities available to us; uncertainty

regarding the pricing of drug products and molecular and other diagnostic products and services that compete or may compete with us;

uncertainty with insurance coverage and reimbursement for our products and services; the potential impact of public health matters on

our business and clinical study activities; difficulties we may face in managing growth, such as hiring and retaining key personnel;

changes in government regulations; costs to comply with evolving regulations; and obtaining and maintaining intellectual property protection

for our technology and time and expense associated with defending third-party claims of intellectual property infringement, investigations

or litigation threatened or initiated against us. See “Risk Factors” beginning on page S-6 of this prospectus supplement

for additional risks, uncertainties and other factors applicable to the Company.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date of this prospectus supplement, and while we believe such information

forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain

and investors are cautioned not to unduly rely upon these statements.

USE

OF PROCEEDS

We

estimate that the net proceeds to us from this offering will be approximately $56.2 million, after deducting the underwriting discount

and estimated offering expenses payable by us.

We

intend to use the net proceeds from this offering for working capital and general corporate purposes. General corporate purposes may

include capital expenditures, research and development expenditures, clinical trial expenditures, expansion of business development activities

and other general corporate purposes. We may also use a portion of the proceeds for the potential acquisition of businesses, technologies,

and products, although we have no current binding understandings, commitments, or agreements to do so.

Based

on our current plans, we believe our existing cash, cash equivalents and short-term investments and available borrowings under our amended

and restated loan and security agreement, together with the net proceeds from this offering, will be sufficient to fund our operating

expenses and capital expenditure requirements through at least the second half of 2026. We have based these estimates on assumptions

that may prove to be incorrect, and we could use our available capital resources sooner than we currently expect. In any event, we may

require additional funding to be able to continue to advance our research and development pipeline, support our commercialization activities,

or conduct additional business development activities. We may satisfy our future cash needs through the sale of equity securities, debt

financings, working capital lines of credit, corporate collaborations or license agreements, grant funding, interest income earned on

invested cash balances or a combination of one or more of these sources.

As

of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from

this offering. Accordingly, we will retain broad discretion over the use of these proceeds. Pending these uses, we intend to invest the

net proceeds in investment-grade, interest-bearing securities.

DILUTION

If

you purchase our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering

price per share and the net tangible book value per share of our common stock after this offering. We calculate net tangible book value

per share by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued

and outstanding as of March 31, 2024.

Our

net tangible book value at March 31, 2024 was approximately $133.7 million, or $3.66 per share. After giving effect to this

offering, and after deducting the underwriting discount and estimated offering expenses payable by us, our as adjusted net tangible

book value as of March 31, 2024, would have been approximately $189.9 million, or $4.70 per share of common stock. This represents an

immediate increase in the net tangible book value of $1.04 per share to our existing stockholders and an immediate dilution in net

tangible book value of $10.80 per share to new investors. The following table illustrates this per share dilution:

| Public offering price per share | |

| | | |

$ | 15.50 | |

| Net tangible book value per share as of March 31, 2024 | |

$ | 3.66 | | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

| 1.04 | | |

| | |

| As adjusted net tangible book value per share as of March 31, 2024, after giving effect to this offering | |

| | | |

| 4.70 | |

| Dilution per share to new investors purchasing shares in this offering | |

| | | |

$ | 10.80 | |

The

foregoing table and calculations are based on 30,773,895 shares of common stock outstanding as of March 31, 2024, plus 5,747,787 shares

of common stock issuable upon the exercise of outstanding pre-funded warrants for nominal consideration, and do not include, as of that

date:

| |

● |

3,049,387

shares of our common stock issuable upon exercise of outstanding options at a weighted average price of $8.65 per share; |

| |

|

|

| |

● |

5,052,770

shares of our common stock issuable upon conversion of 505,277 shares of outstanding Series A Convertible Preferred Stock (“Series

A Preferred Stock”); |

| |

|

|

| |

● |

5,517,725

shares of our common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price of $8.14 per share;

and |

| |

|

|

| |

● |

1,397,579

shares of our common stock reserved for issuance under our Amended and Restated 2017 Stock Incentive Plan and our 2017 Employee Stock

Purchase Plan. |

To

the extent that options or warrants as of March 31, 2024 have been or are exercised, or other shares are issued, investors purchasing

shares in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market conditions

or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that

additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result

in further dilution to our stockholders.

MATERIAL

U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR COMMON STOCK

The

following discussion is a summary of the material U.S. federal income tax consequences to non-U.S. holders (as defined below) of the

ownership and disposition of our common stock issued pursuant to this offering. This discussion is not a complete analysis of all

potential U.S. federal income tax consequences relating thereto, does not address the potential application of the special tax

accounting rules under Section 451(b) of the U.S. Internal Revenue Code of 1986, or the Code, the Medicare contribution tax on net

investment income or the alternative minimum tax, and does not address any estate or gift tax consequences or any tax consequences

arising under any state, local or foreign tax laws, or any other U.S. federal tax laws. This discussion is based on the Code, Treasury Regulations promulgated thereunder, judicial decisions and published rulings and

administrative pronouncements of the Internal Revenue Service, or the IRS, all as in effect as of the date of this prospectus. These

authorities are subject to differing interpretations and may change, possibly retroactively, resulting in U.S. federal income tax

consequences different from those discussed below. We have not requested a ruling from the IRS with respect to the statements made

and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will agree with such

statements and conclusions.

This

discussion is limited to non-U.S. holders who purchase our common stock pursuant to this offering and who hold our common stock as a

“capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion

does not address all of the U.S. federal income tax consequences that may be relevant to a particular holder in light of such holder’s

particular circumstances. This discussion also does not consider any specific facts or circumstances that may be relevant to holders

subject to special rules under U.S. federal income tax laws, including:

| |

● |

certain

former citizens or long-term residents of the United States; |

| |

● |

partnerships

or other pass-through entities (and investors therein); |

| |

● |

“controlled

foreign corporations”; |

| |

● |

“passive

foreign investment companies”; |

| |

● |

corporations

that accumulate earnings to avoid U.S. federal income tax; |

| |

● |

banks,

financial institutions, investment funds, insurance companies, or brokers, dealers or traders in securities or foreign currencies; |

| |

● |

tax-exempt

organizations and governmental organizations; |

| |

● |

tax-qualified

retirement plans; |

| |

● |

persons

who hold or receive our common stock pursuant to the exercise of any employee stock option or otherwise as compensation; |

| |

● |

“qualified

foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified

foreign pension funds; |

| |

● |

persons

that own, or have owned, actually or constructively, more than 5% of our common stock; |

| |

● |

persons

who have elected to mark securities to market; and |

| |

● |

persons

holding our common stock as part of a hedging or conversion transaction or straddle, a constructive sale, or other risk reduction

strategy or integrated investment. |

If

an entity or arrangement that is classified as a partnership for U.S. federal income tax purposes holds our common stock, the U.S. federal

income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership.

Partnerships holding our common stock and the partners in such partnerships are urged to consult their tax advisors about the particular

U.S. federal income tax consequences to them of holding and disposing of our common stock.

THIS

DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. PROSPECTIVE INVESTORS SHOULD CONSULT THEIR TAX ADVISORS REGARDING

THE PARTICULAR U.S. FEDERAL INCOME TAX CONSEQUENCES TO THEM OF ACQUIRING, OWNING AND DISPOSING OF OUR COMMON STOCK, AS WELL AS ANY TAX

CONSEQUENCES ARISING UNDER ANY STATE, LOCAL OR FOREIGN TAX LAWS AND ANY OTHER U.S. FEDERAL TAX LAWS.

Definition

of Non-U.S. Holder

For

purposes of this discussion, a “non-U.S. holder” is any beneficial owner of our common stock that is not a “U.S. person” or

a partnership (including any entity or arrangement treated as a partnership) for U.S. federal income tax purposes. A U.S. person is any

person that, for U.S. federal income tax purposes, is or is treated as any of the following:

| |

● |

an

individual who is a citizen or resident of the United States; |

| |

● |

a

corporation (or any entity treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of

the United States, any state thereof or the District of Columbia; |

| |

● |

an

estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| |

● |

a

trust (1) whose administration is subject to the primary supervision of a U.S. court and which has one or more U.S. persons who have

the authority to control all substantial decisions of the trust or (2) that has a valid election in effect under applicable Treasury

Regulations to be treated as a U.S. person. |

Distributions

on Our Common Stock

We

have not paid and do not anticipate paying any cash distributions in the foreseeable future. However, if we make cash or other

property distributions on our common stock (other than certain distributions of stock), such distributions will constitute dividends for U.S. federal income tax purposes to

the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles.

Amounts that exceed such current and accumulated earnings and profits and, therefore, are not treated as dividends for U.S. federal

income tax purposes will constitute a return of capital and will first be applied against and reduce a holder’s tax basis in

our common stock, but not below zero. Any excess amount distributed will be treated as gain realized on the sale or other

disposition of our common stock and will be treated as described under the section titled “—Gain On Disposition of Our

Common Stock” below.

Subject

to the discussions below regarding effectively connected income, backup withholding and FATCA (as defined below), dividends paid to a

non-U.S. holder of our common stock generally will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of

the dividends or such lower rate specified by an applicable income tax treaty. To receive the benefit of a reduced treaty rate, a non-U.S.

holder must furnish us or the applicable withholding agent a valid IRS Form W-8BEN or IRS Form W-8BEN-E (or applicable successor form)

certifying such holder’s qualification for the reduced rate. This certification must be provided to us or the withholding agent

before the payment of dividends and must be updated periodically. If the non-U.S. holder holds the stock through a financial institution

or other agent acting on the non-U.S. holder’s behalf, the non-U.S. holder will be required to provide appropriate documentation

to the agent, which then will be required to provide certification to us or the withholding agent, either directly or through other intermediaries.

If

a non-U.S. holder holds our common stock in connection with the conduct of a trade or business in the United States, and dividends paid

on our common stock are effectively connected with such holder’s U.S. trade or business (and are attributable to such holder’s

permanent establishment or fixed base in the United States if required by an applicable tax treaty), the non-U.S. holder will be exempt

from U.S. federal withholding tax. To claim the exemption, the non-U.S. holder must generally furnish a valid IRS Form W-8ECI (or applicable

successor form) to the applicable withholding agent.

However,

any such effectively connected dividends paid on our common stock generally will be subject to U.S. federal income tax on a net income

basis at the regular U.S. federal income tax rates in the same manner as if such holder were a resident of the United States. A non-U.S.

holder that is a foreign corporation also may be subject to an additional branch profits tax equal to 30% (or such lower rate specified

by an applicable income tax treaty) of its effectively connected earnings and profits for the taxable year, as adjusted for certain items.

Non-U.S.

holders that do not provide the required certification on a timely basis, but that qualify for a reduced treaty rate, may obtain a refund

of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Non-U.S.

holders should consult their tax advisors regarding any applicable income tax treaties that may provide for different rules.

Gain

on Disposition of Our Common Stock

Subject

to the discussions below regarding backup withholding and FATCA, a non-U.S. holder generally will not be subject to U.S. federal income

tax on any gain realized on the sale or other disposition of our common stock, unless:

| |

● |

the

gain is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States and, if required

by an applicable income tax treaty, is attributable to a permanent establishment or fixed base maintained by the non-U.S. holder

in the United States; |

| |

● |

the

non-U.S. holder is a nonresident alien individual present in the United States for 183 days or more during the taxable year of the

disposition and certain other requirements are met; or |

| |

● |

our

common stock constitutes a “United States real property interest” by reason of our status as a United States real property

holding corporation, or USRPHC, for U.S. federal income tax purposes at any time within the shorter of the five-year period preceding

the disposition or the non-U.S. holder’s holding period for our common stock, and our common stock is not regularly traded

on an established securities market (as defined in applicable Treasury Regulations). |

Determining

whether we are a USRPHC depends on the fair market value of our U.S. real property interests relative to the fair market value of our

worldwide real property interests and our other assets used or held for use in a trade or business. We believe that we are not currently

and do not anticipate becoming a USRPHC for U.S. federal income tax purposes, although there can be no assurance we will not in the future

become a USRPHC.

Gain

described in the first bullet point above generally will be subject to U.S. federal income tax on a net income basis at the regular U.S.

federal income tax rates in the same manner as if such holder were a resident of the United States. A non-U.S. holder that is a foreign

corporation also may be subject to an additional branch profits tax equal to 30% (or such lower rate specified by an applicable income

tax treaty) of its effectively connected earnings and profits for the taxable year, as adjusted for certain items. Gain described in

the second bullet point above will be subject to U.S. federal income tax at a flat 30% rate, but may be offset by certain U.S.-source

capital losses (even though the individual is not considered a resident of the United States), provided that the non-U.S. holder has

timely filed U.S. federal income tax returns with respect to such losses. Gain described in the third bullet point above will generally

be subject to U.S. federal income tax in the same manner as gain that is effectively connected with the conduct of a U.S. trade or business

(subject to any provisions under an applicable income tax treaty), except that the branch profits tax generally will not apply. Non-U.S.

holders should consult their tax advisors regarding any applicable income tax treaties that may provide for different rules.

Information

Reporting and Backup Withholding

Annual

reports are required to be filed with the IRS and provided to each non-U.S. holder indicating the amount of distributions on our common

stock paid to such holder and the amount of any tax withheld with respect to those distributions. These information reporting requirements

apply even if no withholding was required because the distributions were effectively connected with the holder’s conduct of a U.S.

trade or business, or withholding was reduced or eliminated by an applicable income tax treaty. This information also may be made available

under a specific treaty or agreement with the tax authorities in the country in which the non-U.S. holder resides or is established.

Backup withholding, currently at a 24% rate, generally will not apply to payments to a non-U.S. holder of dividends on or the gross proceeds

of a disposition of our common stock provided the non-U.S. holder furnishes the required certification for its non-U.S. status, such

as by providing a valid IRS Form W-8BEN, IRS Form W-8BEN-E or IRS Form W-8ECI (or applicable successor form), or certain other requirements

are met. Backup withholding may apply if the payor has actual knowledge, or reason to know, that the holder is a U.S. person who is not

an exempt recipient.

Backup

withholding is not an additional tax. If any amount is withheld under the backup withholding rules, the non-U.S. holder should consult

with a U.S. tax advisor regarding the possibility of and procedure for obtaining a refund or a credit against the non-U.S. holder’s

U.S. federal income tax liability, if any.

Withholding

on Foreign Entities

Sections

1471 through 1474 of the Code, commonly referred to as “FATCA”, impose a U.S. federal withholding tax of 30% on certain payments made to

a “foreign financial institution” (as specially defined under these rules) unless such institution enters into an agreement

with the U.S. government to withhold on certain payments and to collect and provide to the U.S. tax authorities substantial information

regarding certain U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well

as certain account holders that are foreign entities with U.S. owners) or an exemption applies. FATCA also generally will impose a U.S.

federal withholding tax of 30% on certain payments made to a non-financial foreign entity unless such entity either certifies that it

does not have any “substantial United States owners” as defined in the Code or provides the withholding agent a certification

identifying certain direct and indirect U.S. owners of the entity or an exemption applies. An intergovernmental agreement between the

United States and an applicable foreign country may modify these requirements. Under certain circumstances, a non-U.S. holder might be

eligible for refunds or credits of such taxes. FATCA currently applies to dividends paid on our common stock. FATCA would have applied

to payments of gross proceeds from the sale or other disposition of stock, but under proposed regulations (the preamble to which specifies

that taxpayers are permitted to rely on such proposed regulations pending finalization), no withholding would apply with respect to payments

of gross proceeds.

Prospective

investors are encouraged to consult with their own tax advisors regarding the possible implications of FATCA on their investment in our

common stock.

UNDERWRITING

Leerink

Partners LLC, TD Securities (USA) LLC and Stifel, Nicolaus & Company, Incorporated are acting as representatives of each of the underwriters

named below and as joint bookrunning managers for this offering. Subject to the terms and conditions set forth in the underwriting agreement

among us and the underwriters, we have agreed to sell to the underwriters, and each of the underwriters has agreed, severally and not

jointly, to purchase from us, the number of shares of common stock set forth opposite its name below.

| | |

Number of | |

| Underwriter | |

| Shares | |

| | |

| | |

| Leerink Partners LLC | |

| 1,548,400 | |

| TD Securities (USA) LLC | |

| 1,548,400 | |

| Stifel, Nicolaus & Company, Incorporated | |

| 774,200 | |

| Total | |

| 3,871,000 | |

Subject

to the terms and conditions set forth in the underwriting agreement, the underwriters have agreed, severally and not jointly, to purchase

all of the shares sold under the underwriting agreement if any of the shares are purchased. If an underwriter defaults, the underwriting

agreement provides that the purchase commitments of the non-defaulting underwriters may be increased or the underwriting agreement may

be terminated.

We

have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute

to payments the underwriters may be required to make in respect of those liabilities.

The

underwriters are offering the shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal

matters by their counsel, including the validity of the shares, and subject to other conditions contained in the underwriting agreement,

such as the receipt by the underwriters of officers’ certificates and legal opinions. The underwriters reserve the right to withdraw,

cancel or modify offers to the public and to reject orders in whole or in part.

Discounts

and Commissions

The

representatives have advised us that the underwriters propose initially to offer the shares to the public at the initial public offering

price set forth on the cover page of this prospectus supplement and to dealers at that price less a concession not in excess of $0.5580

per share. After the initial offering of the shares, the public offering price, concession or any other term of this offering may be

changed by the representatives.

The

following table shows the initial public offering price, underwriting discounts and commissions and proceeds, before expenses, to us.

| | |

Per Share | | |

Total | |

| Initial public offering price | |

$ | 15.50 | | |

$ | 60,000,500 | |

| Underwriting discounts and commissions | |

$ | 0.93 | | |

$ | 3,600,030 | |

| Proceeds, before expenses, to us | |

$ | 14.57 | | |

$ | 56,400,470 | |

We

estimate expenses payable by us in connection with this offering, other than the underwriting discounts and commissions referred to above,

will be approximately $250,000. We also have agreed to reimburse the underwriters for their FINRA counsel fee. In accordance with FINRA

Rule 5110, this reimbursed fee is deemed underwriting compensation for this offering.

No

Sales of Similar Securities

We,

our executive officers and directors and certain of our other existing security holders have agreed not to sell or transfer any common

stock or securities convertible into or exchangeable or exercisable for common stock, for 90 days after the date of this prospectus supplement

without first obtaining the written consent of Leerink Partners LLC and TD Securities (USA) LLC on behalf of the underwriters. Specifically,

we and these other persons have agreed, with certain limited exceptions, not to directly or indirectly:

| |

● |

sell

or offer to sell any shares of common stock or securities convertible into or exchangeable or exercisable for common stock currently

or hereafter owned either of record or beneficially (as defined in Rule 13d-3 under the Exchange Act) by the stockholder or a family

member; |

| |

|

|

| |

● |

enter

into any swap, hedge or similar arrangement or agreement; |

| |

|

|

| |

● |

make

any demand for, or exercise any right with respect to, the registration under the Securities Act of the offer and sale of any shares

of common stock or securities convertible into or exchangeable or exercisable for common stock, or cause to be filed a registration

statement, prospectus or prospectus supplement (or an amendment or supplement thereto) with respect to any such registration; or |

| |

|

|

| |

● |

publicly

announce any intention to do any of the foregoing. |

The

lock-up provisions apply to common stock and to securities convertible into or exchangeable or exercisable for common stock. They also

apply to common stock owned now or acquired later by the person executing the lock-up agreement or for which the person executing the

lock-up agreement later acquires the power of disposition.

Nasdaq

Capital Market Listing

Our

common stock is listed on the Nasdaq Capital Market under the symbol “CELC.”

Price

Stabilization, Short Positions and Penalty Bids

Until

the distribution of the shares is completed, SEC rules may limit underwriters and selling group members from bidding for and purchasing

our common stock. However, the representatives may engage in transactions that stabilize the price of the common stock, such as bids

or purchases to peg, fix or maintain that price.

In

connection with this offering, the underwriters may purchase and sell our common stock in the open market. These transactions may include

short sales, purchases on the open market to cover positions created by short sales and stabilizing transactions. Short sales involve

the sale by the underwriters of a greater number of shares than they are required to purchase in this offering. Because we have not granted

the underwriters an option to purchase additional shares, the underwriters must close out any short position by purchasing shares in

the open market. Stabilizing transactions consist of various bids for or purchases of shares of common stock made by the underwriters

in the open market prior to the closing of this offering.

The

underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting

discount received by it because the representatives have repurchased shares sold by or for the account of such underwriter in stabilizing

or short covering transactions.

Similar

to other purchase transactions, the underwriters’ purchases to cover the syndicate short sales may have the effect of raising or

maintaining the market price of our common stock or preventing or retarding a decline in the market price of our common stock. As a result,

the price of our common stock may be higher than the price that might otherwise exist in the open market. The underwriters may conduct

these transactions on the Nasdaq Capital Market, in the over-the-counter market or otherwise.

Neither

we nor any of the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions

described above may have on the price of our common stock. In addition, neither we nor any of the underwriters make any representation

that the representatives will engage in these transactions or that these transactions, once commenced, will not be discontinued without

notice.

Electronic

Distribution

In

connection with this offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means, such

as e-mail.

Other

Relationships

The

underwriters and certain of their affiliates are full service financial institutions engaged in various activities, which may include

securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment,