Celcuity Inc. (Nasdaq: CELC), a clinical-stage biotechnology

company pursuing development of targeted therapies for oncology,

today announced financial results for the first quarter ended March

31, 2024 and other recent business developments.

“We continued to execute well this quarter. Our VIKTORIA-1 study

remains on-track, and we dosed the first patient in our Phase 1b/2

trial in metastatic castration resistant prostate cancer,” said

Brian Sullivan, Celcuity’s Chief Executive Officer and co-founder.

“With the addition of a Chief Commercial Officer to our executive

team, we began the foundational work needed to prepare for the

potential commercial launch of gedatolisib. We look forward to

presenting topline data from the PIK3CA wild type patient sub-group

later this year.”

First Quarter 2024 Business Highlights and Other Recent

Developments

- The VIKTORIA-1 Phase 3 trial remains on track to provide

topline data for the PIK3CA wild type patient sub-group in the

second half of 2024 and for the PIK3CA mutant patient sub-group in

the first half of 2025.

- VIKTORIA-1 is evaluating gedatolisib in combination with

fulvestrant with and without palbociclib in adults with HR+, HER2-

advanced breast cancer who have received prior treatment with a

CDK4/6 inhibitor.

- The Phase 3 VIKTORIA-1 clinical trial is enrolling patients at

approximately 220 sites in 23 countries in North and South America,

Europe, and Asia.

- The Phase 1b/2 clinical trial evaluating gedatolisib in

combination with darolutamide for the treatment of metastatic

castration resistant prostate cancer (mCRPC) was initiated in the

fourth quarter of 2023. In February 2024, the first patient was

dosed.

- Enrollment is ongoing and the trial is expected to enroll up to

54 patients with mCRPC whose disease progressed after treatment

with an androgen receptor signaling inhibitor.

- The Phase 1b/2 trial is on track to provide initial preliminary

data in the first half of 2025.

- In February 2024, the Company

appointed Eldon Mayer as Chief Commercial Officer to enable

Celcuity to begin laying the groundwork for the potential

commercial launch of gedatolisib.

First Quarter 2024 Financial Results

Unless otherwise stated, all comparisons are for the first

quarter ended March 31, 2024, compared to the first quarter ended

March 31, 2023.

Total operating expenses were $22.5 million for the first

quarter of 2024, compared to $12.6 million for the first quarter of

2023.

Research and development (R&D) expenses were $20.7 million

for the first quarter of 2024, compared to $11.3 million for the

prior-year period. Of the approximately $9.4 million increase in

R&D expenses, $7.9 million primarily related to activities

supporting the VIKTORIA-1 Phase 3 trial and the initiation of the

CELC-G-201 Phase 1b/2 clinical trial, and $1.5 million was related

to increased employee and consulting expenses.

General and administrative (G&A) expenses were $1.8 million

for the first quarter of 2024, compared to $1.3 million for the

prior-year period. Employee-related expenses accounted for $0.3

million of the increase. Professional fees and other administrative

expenses accounted for the remaining increase of approximately $0.2

million.

Net loss for the first quarter of 2024 was $21.6 million, or

$0.64 loss per share, compared to a net loss of $11.9 million, or

$0.55 loss per share, for the first quarter of 2023. Non-GAAP

adjusted net loss for the first quarter of 2024 was $19.9 million,

or $0.59 loss per share, compared to non-GAAP adjusted net loss of

$11.9 million, or $0.55 loss per share, for the first quarter of

2023. Non-GAAP adjusted net loss excludes stock-based compensation

expense, non-cash interest expense, and non-cash interest income.

Because these items have no impact on Celcuity’s cash position,

management believes non-GAAP adjusted net loss better enables

Celcuity to focus on cash used in operations. For a reconciliation

of financial measures calculated in accordance with generally

accepted accounting principles in the United States (GAAP) to

non-GAAP financial measures, please see the financial tables at the

end of this press release.

Net cash used in operating activities for the first quarter of

2024 was $17.1 million, compared to $12.9 million for the first

quarter of 2023.

At March 31, 2024, Celcuity reported cash, cash equivalents and

short-term investments of $177.7 million. We expect cash, cash

equivalents, investments and drawdown on our debt facility to fund

current operational activities into the first half of 2026.

Webcast and Conference Call Information

The Celcuity management team will host a webcast/conference call

at 4:30 p.m. ET today to discuss the first quarter 2024 financial

results and provide a corporate update. To participate in the

teleconference, domestic callers should dial 1-888-886-7786 or

1-416-764-8658. A live webcast presentation can also be accessed

using this weblink:

https://viavid.webcasts.com/starthere.jsp?ei=1664947&tp_key=8c4820dec8.

A replay of the webcast will be available on the Celcuity website

following the live event.

About Celcuity

Celcuity is a clinical-stage biotechnology company focused on

development of targeted therapies for treatment of multiple solid

tumor indications. The company's lead therapeutic candidate is

gedatolisib, a potent, pan-PI3K and mTOR inhibitor. Its mechanism

of action and pharmacokinetic properties are highly differentiated

from other currently approved and investigational therapies that

target PI3K or mTOR alone or together. A Phase 3 clinical trial,

VIKTORIA-1, evaluating gedatolisib in combination with fulvestrant

with or without palbociclib in patients with HR+/HER2- advanced

breast cancer is currently enrolling patients. More detailed

information about the VIKTORIA-1 study can be found at

ClinicalTrials.gov. A Phase 1b/2 clinical trial, CELC-G-201,

evaluating gedatolisib in combination with darolutamide in patients

with metastatic castration resistant prostate cancer, is enrolling

patients. The company's CELsignia companion diagnostic platform is

uniquely able to analyze live patient tumor cells to identify new

groups of cancer patients likely to benefit from already approved

targeted therapies. Further information about Celcuity can be

found at www.celcuity.com. Follow us

on LinkedIn and Twitter.

Forward-Looking Statements

This press release contains statements that constitute

"forward-looking statements" including, but not limited to, the

design of our clinical trials; the timing of initiating and

enrolling patients in, and receiving results and data from, our

clinical trials; the costs and expected results from any ongoing or

planned clinical trials; the market opportunity for gedatolisib;

our strategy, marketing and commercialization plans; other

expectations with respect to Celcuity's lead product candidate,

gedatolisib, and its CELsignia platform; our anticipated use of

cash; and the strength of our balance sheet. In some cases, you can

identify forward-looking statements by terminology such as "may,"

"should," "expects," "plans," "anticipates," "believes,"

"estimates," "predicts," "potential," "intends" or "continue," and

other similar expressions that are predictions of or indicate

future events and future trends, or the negative of these terms or

other comparable terminology. Forward-looking statements are

subject to numerous risks, uncertainties, and conditions, many of

which are beyond the control of Celcuity. These include, but are

not limited to, unforeseen delays in our clinical trials, our

ability to obtain and maintain regulatory approvals to

commercialize our products, and the market acceptance of such

products, the development of therapies and tools competitive with

our products, and those risks set forth in the Risk Factors section

in Celcuity's Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission

on March 27, 2024. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. Celcuity undertakes no obligation to update

these statements for revisions or changes after the date of this

press release, except as required by law.

View source version of release on GlobeNewswire.com

Contacts:

Celcuity Inc. Brian Sullivan,

bsullivan@celcuity.com Vicky Hahne,

vhahne@celcuity.com (763) 392-0123

ICR Westwicke Maria Yonkoski,

maria.yonkoski@westwicke.com (203) 682-7167

|

Celcuity Inc. |

|

Condensed Balance Sheets |

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

(unaudited) |

|

|

| Assets |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

31,214,741 |

|

|

$ |

30,662,774 |

|

|

Investments |

|

146,447,843 |

|

|

|

149,919,974 |

|

|

Other current assets |

|

9,860,535 |

|

|

|

10,007,849 |

|

| Total current

assets |

|

187,523,119 |

|

|

|

190,590,597 |

|

| |

|

|

|

| Property and equipment,

net |

|

306,024 |

|

|

|

228,782 |

|

| Operating lease right-of-use

assets |

|

351,911 |

|

|

|

400,019 |

|

| Total

Assets |

$ |

188,181,054 |

|

|

$ |

191,219,398 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

| Current

Liabilities: |

|

|

|

|

Accounts payable |

$ |

5,276,690 |

|

|

$ |

5,076,699 |

|

|

Operating lease liabilities |

|

181,882 |

|

|

|

184,950 |

|

|

Accrued expenses |

|

11,237,509 |

|

|

|

8,927,094 |

|

| Total current

liabilities |

|

16,696,081 |

|

|

|

14,188,743 |

|

| Operating lease

liabilities |

|

182,079 |

|

|

|

225,922 |

|

| Note payable, non-current |

|

37,566,230 |

|

|

|

37,035,411 |

|

| Total

Liabilities |

|

54,444,390 |

|

|

|

51,450,076 |

|

| |

|

|

|

| Stockholders'

Equity: |

|

|

|

| Preferred stock |

|

505 |

|

|

|

854 |

|

| Common stock |

|

30,774 |

|

|

|

25,506 |

|

| Additional paid-in

capital |

|

315,393,843 |

|

|

|

299,818,965 |

|

| Accumulated deficit |

|

(181,688,458 |

) |

|

|

(160,076,003 |

) |

|

Total Stockholders' Equity |

|

133,736,664 |

|

|

|

139,769,322 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

188,181,054 |

|

|

$ |

191,219,398 |

|

|

Celcuity Inc. |

|

Condensed Statements of Operations |

|

(unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

Research and development |

$ |

20,647,559 |

|

|

$ |

11,278,493 |

|

|

General and administrative |

|

1,846,276 |

|

|

|

1,269,044 |

|

| Total operating expenses |

|

22,493,835 |

|

|

|

12,547,537 |

|

| Loss from operations |

|

(22,493,835 |

) |

|

|

(12,547,537 |

) |

| |

|

|

|

| Other income (expense) |

|

|

|

|

Interest expense |

|

(1,400,712 |

) |

|

|

(1,242,012 |

) |

|

Interest income |

|

2,282,092 |

|

|

|

1,851,132 |

|

| Other income (expense),

net |

|

881,380 |

|

|

|

609,120 |

|

| Net loss before income

taxes |

|

(21,612,455 |

) |

|

|

(11,938,417 |

) |

| Income tax benefits |

|

- |

|

|

|

- |

|

| Net loss |

$ |

(21,612,455 |

) |

|

$ |

(11,938,417 |

) |

| |

|

|

|

| Net loss per share, basic and

diluted |

$ |

(0.64 |

) |

|

$ |

(0.55 |

) |

| |

|

|

|

| Weighted average common shares

outstanding, basic and diluted |

|

33,612,054 |

|

|

|

21,680,877 |

|

Cautionary Statement Regarding Non-GAAP

Financial Measures

This press release contains references to non-GAAP adjusted net

loss and non-GAAP adjusted net loss per share. Management believes

these non-GAAP financial measures are useful supplemental measures

for planning, monitoring, and evaluating operational performance as

they exclude stock-based compensation expense, non-cash interest

expense, and non-cash interest income from net loss and net loss

per share. Management excludes these items because they do not

impact Celcuity’s cash position, which management believes better

enables Celcuity to focus on cash used in operations. However,

non-GAAP adjusted net loss and non-GAAP adjusted net loss per share

are not recognized measures under GAAP and do not have a

standardized meaning prescribed by GAAP. As a result, management’s

method of calculating non-GAAP adjusted net loss and non-GAAP

adjusted net loss per share may differ materially from the method

used by other companies. Therefore, non-GAAP adjusted net loss and

non-GAAP adjusted net loss per share may not be comparable to

similarly titled measures presented by other companies. Investors

are cautioned that non-GAAP adjusted net loss and non-GAAP adjusted

net loss per share should not be construed as alternatives to net

loss, net loss per share or other statements of operations data

(which are determined in accordance with GAAP) as an indicator of

Celcuity’s performance or as a measure of liquidity and cash

flows.

|

Celcuity Inc. |

|

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net

Loss and |

|

GAAP Net Loss Per Share to Non-GAAP Adjusted Net Loss Per

Share |

|

|

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| GAAP net loss |

$ |

(21,612,455 |

) |

|

$ |

(11,938,417 |

) |

|

Adjustments: |

|

|

|

| Stock-based compensation |

|

|

|

|

Research and development(1) |

|

832,180 |

|

|

|

654,471 |

|

|

General and administrative(2) |

|

499,166 |

|

|

|

618,811 |

|

| Non-cash interest

expense(3) |

|

530,819 |

|

|

|

495,188 |

|

| Non-cash interest

income(4) |

|

(153,845 |

) |

|

|

(1,697,811 |

) |

| Non-GAAP adjusted net

loss |

$ |

(19,904,135 |

) |

|

$ |

(11,867,758 |

) |

| |

|

|

|

| GAAP net loss per share -

basic and diluted |

$ |

(0.64 |

) |

|

$ |

(0.55 |

) |

| Adjustment to net loss (as

detailed above) |

|

0.05 |

|

|

|

0.00 |

|

| Non-GAAP adjusted net

loss per share |

$ |

(0.59 |

) |

|

$ |

(0.55 |

) |

| |

|

|

|

| Weighted average common shares

outstanding, basic and diluted |

|

33,612,054 |

|

|

|

21,680,877 |

|

| (1) To reflect a non-cash

charge to operating expense for Research and Development

stock-based compensation. |

| (2) To reflect a non-cash

charge to operating expense for General and Administrative

stock-based compensation. |

| (3) To reflect a non-cash

charge to other expense for amortization of debt issuance and

discount costs |

| and PIK interest related to

the issuance of a note payable. |

| (4) To reflect a non-cash

adjustment to other income for accretion on investments. |

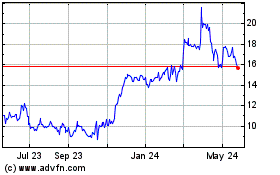

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Dec 2024 to Jan 2025

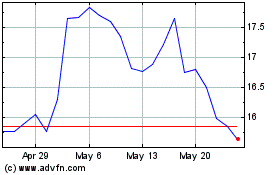

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Jan 2024 to Jan 2025