UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12a |

CEA

Industries Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| |

|

|

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

|

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

| |

|

|

CEA

Industries INC.

385

South Pierce Avenue, Suite C

Louisville,

Colorado 80027

(303)

993-5271

October

26, 2023

Dear

Stockholder:

You

are cordially invited to attend the 2023 Annual Meeting of Stockholders of CEA Industries Inc. (the “Annual Meeting”) to

be held on December 18, 2023 at 8:30 a.m., Mountain Time, at the company’s corporate headquarters located at 385 South Pierce Avenue,

Suite C, Louisville, Colorado 80027.

In

accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over

the Internet, we will be sending to stockholders as of the record date, which is the close of business on October 25, 2023, a Notice

of Internet Availability of Proxy Materials, or “Notice.” The Notice contains instructions on how to access our Proxy Statement

and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading

a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as

in the attached Proxy Statement.

Attached

to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the

meeting. We urge you to read this information carefully.

Your

vote is important to us. Whether or not you plan to attend the Annual Meeting, and regardless of the number of shares of the Company

that you own, it is important that your shares be represented and voted. Please vote electronically over the Internet, or if you receive

a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. We encourage you to vote by proxy

so that your shares will be represented and voted at the meeting, whether or not you can attend. If you decide to attend the meeting,

you will still be able to vote online during the meeting, even if you previously submitted your proxy.

On

behalf of the Board of Directors of the Company, we thank you for your participation.

| |

Sincerely

yours, |

| |

|

| |

/s/

Anthony K. McDonald |

| |

Anthony

K. McDonald |

| |

Chief

Executive Officer |

CEA

Industries INC.

385

South Pierce Avenue, Suite C

Louisville,

Colorado 80027

(303)

993-5271

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON DECEMBER 18, 2023

To

the Stockholders of CEA Industries Inc.:

The

2023 Annual Meeting of Stockholders of CEA Industries Inc. (the “Company”) will be held on December 18, 2023, at 8:30 a.m.,

Mountain Time, at the Company’s corporate headquarters located at 385 South Pierce Avenue, Suite C, Louisville, CO 80027.

The

2023 Annual Meeting of Stockholders (the “Annual Meeting”) is being held for the following purposes:

| 1. |

To

vote on the election of the five director nominees named in the attached Proxy Statement to serve on the Board of Directors for a

term of one year or until their respective successors are duly elected and qualified; |

| 2. |

To

ratify the selection of Sadler, Gibb & Associates, L.L.C. as the Company’s independent registered public accounting firm

for the fiscal year ending December 31, 2023; |

| 3. |

To

authorize the Board, at its discretion, at any time until June 30, 2024, (i) to effect a reverse stock split of the common stock

with a ratio not less than two-for-one but not greater than twenty -for-one; and |

| 4. |

To

approve any adjournment of the Annual Meeting, if necessary or appropriate, to permit solicitation of additional proxies to hold

the meeting and approve the foregoing proposals. |

The

accompanying Proxy Statement describes each of these items of business in detail. Only stockholders of record at the close of business

on October 25, 2023, the record date, are entitled to receive notice of, attend and vote at the Annual Meeting or any continuation, postponement

or adjournment thereof. Voting instructions are provided in the Notice and included in the accompanying Proxy Statement. Any stockholder

attending the Annual Meeting may vote at the meeting even if he or she previously submitted a proxy. If your shares of common stock are

held by a bank, broker or other agent, please follow the instructions from your bank, broker or other agent to have your shares voted.

Whether

or not you expect to be present in person at the meeting, we encourage you to read the Proxy Statement and vote on the Internet or submit

your proxy card, if you have requested one, as soon as possible.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Anthony K. McDonald |

| |

Chairman

of the Board |

This

Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about October

30, 2023.

Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting: This Proxy Statement and our Annual Report are available

free of charge at https://www.cstproxy.com/ceaindustries/2023.

CEA

Industries INC.

385

South Pierce Avenue, Suite C

Louisville,

Colorado 80027

(303)

993-5271

PROXY

STATEMENT

2023

Annual Meeting of Stockholders

This

Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (“Board”) of CEA Industries

Inc. (the “Company,” “CEA,” “we,” “us” or “our”) for use at the Company’s

2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on December 18, 2023, at 8:30 a.m., Mountain Time,

at the Company’s corporate headquarters located at 385 South Pierce Avenue, Suite C, Louisville, CO 80027, and at any postponements

or adjournments thereof.

The

Annual Report, Notice of Meeting, Proxy Statement and Proxy Card are available at https://www.cstproxy.com/ceaindustries/2023

and on our website at www.ceaindustries.com.

The

rules of the SEC permit us to furnish proxy materials, including this Proxy Statement and our Annual Report, to our stockholders by providing

access to such documents on the Internet instead of mailing printed copies. As a result, we are mailing most of our stockholders a paper

copy of a Notice of Internet Availability of Proxy Materials, or Notice, but not a paper copy of the proxy materials. This process allows

us to provide our proxy materials to our stockholders in a timelier and more readily accessible manner, while reducing the environmental

impact and lowering our printing and distribution costs. Stockholders will not receive paper copies of the proxy materials unless they

request them. Instead, the Notice provides instructions on how to access and review all of the proxy materials on the Internet. The Notice

also instructs you on how to vote your shares via the Internet. If you would like to receive a paper or email copy of our proxy materials,

you should follow the instructions for requesting such materials described in the Notice.

We

encourage you to vote your shares by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and

date the accompanying proxy card, or otherwise provide voting instructions, and the Company receives it in time for the Annual Meeting,

the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you give no

instructions on the proxy card, the shares covered by the proxy card will be voted “FOR” the election of the nominees

as directors listed on the enclosed proxy card and “FOR” the other matters listed in the accompanying Notice of Annual

Meeting of Stockholders.

To

vote your shares by telephone or internet, you may use the following: the web address for voting is https://www.cstproxy.com/ceaindustries/2023

and to vote by phone call at (866) 894-0536.

Purpose

of Meeting

At

the Annual Meeting, you will be asked to vote on the following proposals:

1.

To vote on the election of the five director nominees named in the attached Proxy Statement to serve on the Board of Directors for a

term of one year or until their respective successors are duly elected and qualified;

2.

To ratify the selection of Sadler, Gibb & Associates, L.L.C. as the Company’s independent registered public accounting firm

for the fiscal year ending December 31, 2023;

3.

To authorize the Board, at its discretion, at any time until June 30, 2024, (i) to effect a reverse stock split of the common stock with

a ratio not less than two-for-one but not greater than twenty-for-one; and

4.

To approve any adjournment of the Annual Meeting, if necessary or appropriate, to permit solicitation of additional proxies to hold the

meeting and approve the foregoing proposals.

Record

Date and Voting Securities

You

may vote your shares at the Annual Meeting only if you were a stockholder of record at the close of business on October 25, 2023 (the

“Record Date”). On the Record Date, there were 8,076,372 shares of the Company’s common stock outstanding. The holders

of common stock are entitled to one vote per share of common stock.

Quorum

Required

A

quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, by proxy or in person,

of the holders of a majority of the shares of common stock outstanding on the Record Date will constitute a quorum. Abstentions and broker

non-votes will be treated as shares present for quorum purposes. On the Record Date, together there were 8,076,372 shares of common stock

entitled to vote. Thus, 4,038,187 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Votes

cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election appointed for the Annual Meeting. The

inspector of election will determine whether or not a quorum is present at the Annual Meeting.

If

a quorum is not present at the Annual Meeting, the stockholders who are represented at the Annual Meeting, in person or by proxy, may

adjourn the Annual Meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless

marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Submitting

Voting Instructions for Shares Held Through a Broker or Other Nominee

If

you hold your shares through a broker or other nominee (i.e., in street name), you must follow the voting instructions you receive from

your broker or other nominee. If you hold shares through a broker or other nominee and you want to vote in person at the Annual Meeting,

you must obtain a legal proxy from the record holder of your shares and present it at the Annual Meeting.

A

proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted, which is referred to as a

stockholder withholding or abstaining with respect to a particular matter.

A

broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee

does not have discretionary voting power with respect to non-routine matters and has not received instructions from the beneficial owner.

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank, or other agent how to vote your

shares, your broker, bank, or other agent may still be able to vote your shares at its discretion. In this regard, under the rules of

the New York Stock Exchange, or NYSE, brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their

discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules,

but not with respect to “non-routine” matters. When a beneficial owner of shares held in “street name” does not

give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,”

the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

Whether

or not a broker or nominee votes, your proxy also will depend on the internal policies of the broker or nominee. In many cases brokers

and nominees do not vote on routine matters where they have not received any instructions. Therefore, it is important for you to instruct

your broker or nominee so that we achieve quorum and may conduct the business of the meeting.

We

believe that the election of directors (Proposal No. 1) will be considered a non-routine matter and broker non-votes, if any, will have

no effect on the result of their approval. We believe that the ratification of the appointment of Sadler, Gibb & Associates, L.L.C.

as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal No. 2) and

the grant to our Board of authority to adjourn the meeting if necessary (Proposal No. 4) also will be considered routine matters on which

a broker, bank or other agent will have discretionary authority to vote, and on this basis we do not expect any broker non-votes in connection

with those proposals. Therefore, shares represented by proxies that reflect a broker non-vote will be counted for purposes of determining

the presence of a quorum.

Voting

by Stockholders of Record

If

you are a stockholder of record, you may vote without attending the Annual Meeting by the following:

●

Via the Internet – You may vote by proxy via the Internet at https://www.cstproxy.com/ceaindustries/2023

by following the instructions provided in the Notice. Internet voting facilities for stockholders of record will be available 24 hours

a day and will close at 11:59 p.m., Eastern Time, on December 17, 2023.

●

By Mail – You may vote by proxy by filling out the proxy card you may have received or obtained by requesting one as provided in

the Notice and returning it in the envelope provided.

●

By Telephone – You may vote by telephoning the number provided in the Notice and following the prompts once you are connected.

Authorizing

a Proxy for Shares Held in Your Name

If

you are a record holder of shares of common stock, you may authorize a proxy to vote on your behalf. Authorizing your proxy will not

limit your right to vote in person at the Annual Meeting. A properly completed and submitted proxy will be voted in accordance with your

instructions unless you subsequently revoke your instructions. If you authorize a proxy without indicating your voting instructions,

the proxy holder will vote your shares according to the Board’s recommendations. The Notice will provide instructions on how to

vote by Internet, or by requesting and returning a paper proxy card or voting instruction card; the Notice is not a means by which you

may vote your shares. You may return a proxy card by mail, or you may vote your shares by calling toll free the telephone number indicated

on the Notice or electronically via the Internet by using the Internet address indicated on the Notice. If you vote by telephone or over

the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on the Notice. This code is designed

to confirm your identity, provide access into the voting sites, and confirm that your instructions are properly recorded.

Revoking

Your Proxy

Stockholders

of record who execute proxies may revoke them at any time before they are voted by filing with the Company a written notice of revocation,

by delivering a duly executed proxy bearing a later date, by voting your shares by telephone or electronically via the Internet, or by

attending the Annual Meeting and voting in person. Only the latest dated proxy you submit will be counted.

If

you hold shares of common stock through a broker or other nominee, you must follow the instructions you receive from your broker or other

nominee in order to revoke your voting instructions. Attending the Annual Meeting does not revoke your proxy unless you also vote in

person at the Annual Meeting.

Information

Regarding This Solicitation

The

Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing

this Proxy Statement, the accompanying Notice of Annual Meeting of Stockholders, the proxy card, and the Annual Report on Form 10-K for

the fiscal year ended December 31, 2022. We have requested that brokers and other nominees holding shares in their names, or in the name

of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners.

The

Company has retained as its proxy solicitor Advantage Proxy Services. The Company will pay the fees of this solicitation agent approximately

$6,500, plus reimbursement for its out-of-pocket expenses.

Officers,

directors, and employees of the Company also may actively solicit proxies personally on behalf of the Company. The Company will reimburse

brokers and other persons holding shares in their names, or in the names of nominees, for the expense of transmitting proxy materials.

The cost of soliciting proxies will be borne by the Company.

Preliminary

voting results will be announced at the Annual Meeting. Final voting results will be published in a current report on Form 8-K within

four business days from the date of the Annual Meeting.

Voting

The

holders of common stock are entitled to vote on all matters presented to the stockholders at the Annual Meeting. There are no other classes

of securities of the Company outstanding.

All

votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will tabulate affirmative and negative votes,

abstentions, and broker non-votes. Abstentions and shares that are voted by brokers as to any matter considered at the Annual Meeting

will be included in determining if a quorum is present or represented at the Annual Meeting. Any broker holding shares of record for

you only is entitled to vote on matters that are deemed to be routine; all other matters can only be voted upon by a broker only if the

broker receives voting instructions from you. Broker non-votes occur when shares are held by a broker who has not received instructions

from the beneficial owner of the shares on such non-routine matters, the broker does not have discretionary voting power with respect

to such non-routine matters and has so notified us on a proxy form in accordance with industry practice or has otherwise advised us that

the broker lacks voting authority with respect to such non-routine matters. The effects of broker non-votes and abstentions on the proposals

to be brought before the Annual Meeting are discussed below.

| Proposal |

|

Vote

Required |

|

Broker

Discretionary Voting Allowed? |

|

Effect

of Abstentions and Broker Non-Votes |

| Proposal

1 – Election of five directors of the Company nominated by the Board and named in this Proxy Statement who will each

serve until the 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified. |

|

Affirmative

vote of the holders of a plurality of all the votes cast at the Annual Meeting either in person or by proxy (i.e., the director nominees

receiving the greatest number of votes cast for each of the director positions being voted upon). |

|

No |

|

Because

the election of a directors requires a plurality of the votes cast, abstentions and broker non-votes will not be counted as votes

cast and will have no effect on the result of the vote. |

| Proposal

2 – Ratification of the appointment of Sadler, Gibb & Associates, L.L.C. as our independent registered public accounting

firm for the fiscal year ending December 31, 2022. |

|

Affirmative

vote of a majority of the votes cast at the Annual Meeting in person or by proxy. |

|

Yes |

|

Abstentions

will not be counted as votes cast and will have no effect on the result of the vote. |

| Proposal

3 – To authorize the Board, at its discretion, at any time until June 30, 2024, (i) to effect a reverse stock split

of the common stock with a ratio not less than two-for-one but not greater than twenty -for-one |

|

Affirmative

vote of a majority of issued and outstanding shares entitled to vote at the Annual Meeting. |

|

No |

|

Abstentions

and broker non-votes will have the effect of a vote against this proposal. |

| Proposal

4 – To approve any adjournment of the Annual Meeting, if necessary or appropriate, to permit solicitation of additional

proxies to hold the meeting and approve the foregoing proposals. |

|

Affirmative

vote of a majority of the votes cast in person or by proxy and present at the meeting at the time the adjournment vote is taken. |

|

Yes |

|

Abstentions

will not be counted as votes cast and will have no effect on the result of the vote. |

If

any other matter is presented, the shares represented by a proxy will be voted in accordance with the best judgment of the person or

persons exercising authority conferred by the proxy at the Annual Meeting.

Additional

Solicitation. If there are not enough votes to elect the director nominees or to ratify the appointment of Sadler, Gibb & Associates,

L.L.C., the stockholders who are represented at the Annual Meeting, in person or by proxy, may adjourn the Annual Meeting to permit the

further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted

against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Also,

a stockholder vote may be taken on the approval of a Proposal prior to any such adjournment if there are sufficient votes.

Stockholders

Sharing the Same Address – “Householding”

The

SEC has adopted rules that permit companies and intermediaries (such as banks and brokers) to satisfy the delivery requirements for proxy

statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement

addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience

for stockholders and cost savings for companies.

This

year, a number of banks and brokers with account holders who are our stockholders will be householding our proxy materials. A single

proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the

affected stockholders. Once you have received notice from your bank or broker that it will be householding communications to your address,

householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to

participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your bank or broker,

direct your written request to CEA Industries Inc., 385 South Pierce Avenue, Suite C, Louisville, Colorado 80027, Attention: Investor

Relations, or contact Investor Relations by email at info@ceaindustries.com; or find our materials posted online at www.ceaindustries.com.

Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of

their communications should contact their bank or broker.

Stockholder

List

A

complete list of registered stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder

for any purpose related to the Annual Meeting for the ten (10) days prior to the Annual Meeting during ordinary business hours at our

principal offices located at 385 South Pierce Avenue, Suite C, Louisville, CO 80027. We request that any person seeking to review the

shareholder list make an appointment during business hours for that purpose.

Forward-Looking

Statements

This

Proxy Statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995).

These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially

from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned

in the risk factors in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

PROPOSAL

1

ELECTION

OF DIRECTORS

Pursuant

to the Company’s Bylaws, as amended, the number of directors may be established, increased or decreased from time to time by the

Board, but will never be less than one, nor more than thirteen. The number of directors is currently set at five. The Company’s

Articles of Incorporation require that all directors stand for election annually at the Company’s Annual Meeting. Accordingly,

each of the Company’s directors holds office until the next annual meeting of stockholders and until his successor is duly elected

and qualified. Unless otherwise instructed, the proxyholders will vote the proxies received by them for the five (5) nominees named below.

If any of the nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for

any nominee designated by the present Board to fill the vacancy. It is not currently expected that any of the nominees named below will

be unable or will decline to serve as a director. If additional persons are nominated for election as directors, the proxyholders intend

to vote all proxies received by them in a manner to assure the election of as many of the nominees listed below as possible. In such

event, the specific nominees to be voted for will be determined by the proxyholders.

All

five of the Company’s current directors, Messrs. Anthony K. McDonald, James R. Shipley, Nicholas J. Etten, Marion Mariathasan,

and Troy L. Reisner have been nominated for election for a one-year term expiring in 2024. None of the nominees are being proposed for

election pursuant to any agreement or understanding between them and the Company requiring that they be nominated for election as a director.

Our

Board and the Nominating Committee believe the directors nominated collectively have the experience, qualifications, attributes and skills

to effectively oversee the management of the Company, including a high degree of personal and professional integrity, an ability to exercise

sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing

the Company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interests of the Company

and our stockholders and a dedication to enhancing stockholder value.

A

stockholder can vote for or withhold his vote from one or more of the director nominees. In the absence of instructions to the contrary,

it is the intention of the persons named as proxies to vote such proxy “FOR” the election of the director nominees

named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will vote for the election

of such person as is nominated by the Board as a replacement.

Information

about the Nominees

Certain

information, as of October 26, 2023, with respect to the nominees for election at the Annual Meeting, is set forth below, including

their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships

that each person holds, and the year in which each person became a director of the Company. The business address of each of the nominees

listed below is 385 South Pierce Avenue, Suite C Louisville, Colorado 80027.

| Name |

|

Age |

|

Positions

& Committees |

| Anthony

K. McDonald |

|

65 |

|

Chairman

of the Board; Chief Executive Officer and President |

| James

R. Shipley |

|

68 |

|

Director;

Compensation Committee Chair; Audit Committee Member |

| Nicholas

J. Etten |

|

56 |

|

Director;

Nominating Committee Chair; Audit Committee Member |

| Troy

L. Reisner |

|

56 |

|

Director;

Audit Committee Chair; Compensation Committee Member |

| Marion

Mariathasan |

|

48 |

|

Director;

Nominating Committee Member |

| Name

and Year First Elected Director |

|

Background

Information and Principal Occupation(s) During Past Five Years and Beyond |

| |

|

|

| Anthony

K. McDonald (2018) |

|

Mr.

McDonald was appointed a director on September 12, 2018. On November 28, 2018, Mr. McDonald was appointed our Chief Executive Officer

and President. On June 24, 2020, Mr. McDonald was appointed Chairman of the Board. Mr. McDonald has been involved in building businesses

in the cleantech, energy efficiency and heating, ventilation and air conditioning (“HVAC”) industries over the past 15

years. From 2008 to 2018, Mr. McDonald led sales and business development as Vice-President—Sales for Coolerado Corp., a manufacturer

and marketer of innovative, energy-efficient air conditioning systems for commercial, government, and military use. Along with Coolerado’s

CEO, Mr. McDonald was instrumental in growing the business to become an INC. 600 high-growth company award winner and assisted in

raising $15 million of private funding from a cleantech investment fund. In 2015, Coolerado was acquired by Seeley International,

Australia’s largest air conditioning manufacturer and an innovative global leader in the design and production of energy-efficient

cooling and heating products, where Mr. McDonald served as National Account Manager. He is the author of Cleantech Sell: The Essential

Guide to Selling Resource Efficient Products In The B2B Market. |

| |

|

Prior

to joining Coolerado, Mr. McDonald spent over ten years in the private equity industry where

he was involved in numerous transactions in the technology, manufacturing, and power development

industries. As a business development officer at several private equity acquisitions groups

Mr. McDonald identified, financed, or acquired numerous transactions with total enterprise

value in excess of $200 million.

Mr.

McDonald was also a consultant to international banks with KMPG from 1994 to 1997 and served as a director for Keating Capital, Inc.,

a publicly traded business development company that made investments in pre-IPO companies. He previously served as a mentor for companies

in the Clean Tech Open competition.

Mr.

McDonald is a U.S. Army veteran and a graduate of the U.S. Military Academy at West Point, N.Y. where he earned a B.S. degree in

Engineering and Economics. He also received an MBA degree from the Harvard Business School.

Among

the reasons for Mr. McDonald to be selected for service on the Board is his experience in sales, sales and operations management,

mergers and acquisitions, the HVAC industry, his in-depth knowledge of climate control systems and technologies. |

| |

|

|

| James

R. Shipley (2020) |

|

Mr.

Shipley was appointed a director on June 24, 2020. Mr. Shipley recently retired from AgTech

Holdings where he was the Chief Strategy Officer of GroAdvisor and the Vice-President of

Sales for VividGro since 2017. Since 2017, Mr. Shipley has assisted in design and build consulting

along with supply chain management for cultivation operations in 12 states, Puerto Rico,

and Canada, covering more than 500,000 square feet of warehouse indoor cultivation and continues

to consult independently with operators in North America. From 2014 to 2017 Mr. Shipley,

acting in several executive roles, helped build multiple business lines for MJIC Inc. (now

CNSX: MSVN); these roles included being a member of the board of directors, Chairman and

President. Mr. Shipley is currently president and a principal in RSX Enterprises Inc., a

sales agency and marketing firm that sells and markets equipment for use in controlled environment

agriculture on behalf of various manufacturers. Mr. Shipley has been active in the cannabis

business, where he has founded various summits such as the Marijuana Investor Summit and

been involved in many educational workshops and business expos. Previously, Mr. Shipley was

an officer and Chief Revenue Officer with Carrier Access Corporation (CACS), a public company

trading on Nasdaq. Prior to Carrier Access, Mr. Shipley worked at Williams Companies in their

telecommunications divisions.

Mr.

Shipley has been selected for service on the Board because of his experience in and commitment to the cannabis industry, his demonstrated

and consistent record of success as an executive and entrepreneur, and his extensive network of contacts in the cannabis industry. |

| |

|

|

| Nicholas

J. Etten (2020) |

|

Mr.

Etten was appointed a director on June 24, 2020. Mr. Etten is the Chief Executive Officer of Lone Star Bioscience, a Texas-based

medical cannabis company. From 2018 to 2022 he was the Senior Vice President of Government Affairs and a member of the senior management

team at Acreage Holdings, a vertically integrated, multi-state operator of cannabis licenses and assets in the U.S. In 2017 he founded

the Veterans Cannabis Project where he continues to serve as Chairman. Veterans Cannabis Project (VCP) is an organization dedicated

to advocating on behalf of cannabis access issues for U.S. military veterans. From 2015 to 2017, Mr. Etten set aside his career to

provide care for his seriously ill son. Mr. Etten’s career has been focused on the growth equity market, and prior to Acreage,

he held positions including Vice President of Global Business Development for FreightWatch International, and Director of Corporate

Development for Triple Canopy. Mr. Etten was an investment professional at Trident Capital, where he focused on the cyber-security

space, and an investment banker at Thomas Weisel Partners. Mr. Etten served on active duty as a U.S. Navy SEAL officer. He earned

an MBA from the J.L. Kellogg Graduate School of Management at Northwestern University, and a BS in political science from the United

States Naval Academy. |

| |

|

Mr.

Etten has been selected for service on the Board because of his experience in and commitment to the cannabis industry, his experience

with multi-site cannabis operators, his demonstrated and consistent record of success as an executive, and his extensive network

of contacts in the cannabis industry and investment banking world. |

| |

|

|

Marion

Mariathasan (2022)

|

|

Marion

Mariathasan was appointed as a director on January 17, 2022. Mr. Mariathasan is the Chief

Executive Officer and Co-Founder of Simplifya, the cannabis industry’s leading regulatory

and operational compliance software platform. The company’s suite of products takes

the guesswork out of confusing and continually changing state and local regulations. Featuring

SOPs, badge tracking, document storage, tailored reporting and employee accountability features,

the company’s Custom Audit software reduces the time clients spend on compliance by

up to 45 percent.

Mr.

Mariathasan is also a serial entrepreneur who has founded or advised numerous startups. He is currently an investor in 22 domestic

and international companies that range from cannabis companies to dating apps - four of which he serves as a board member.

Mr.

Mariathasan studied Architecture and Computer Science at the University of Kansas and Computer Information Systems with a minor in

Business Management from Emporia State University. Marion is a regular guest speaker at events such as Denver Start-Up Week, Colorado

University’s program on social entrepreneurship, various universities on the topic of entrepreneurship and the United Nations

Global Accelerator Initiative.

Mr.

Mariathasan was selected for service on the Board because of his experience in and commitment to the cannabis industry, his demonstrated

and consistent record of success as an executive and entrepreneur, and his extensive network of contacts in the cannabis industry. |

| |

|

|

Troy

L. Reisner (2022)

|

|

Troy

Reisner was appointed as a director on January 17, 2022. Mr. Reisner is currently the Chief Financial Officer at Phunware Inc., headquartered in Austin, Texas, where he leads

the finance and accounting function, including raising capital and corporate governance matters.

Prior to this role, Mr. Reisner was the Chief Financial Officer at Keystone Tower Systems,

Inc., where he led the finance and accounting functions, and served as an executive team

member. Before joining Keystone, Troy was a partner with the public accounting firm of Deloitte

& Touche LLP until his retirement. Troy brings significant cumulative knowledge and expertise

in accounting & auditing, including PCAOB auditing standards, M&A transactions, financial

due diligence, financial reporting, including expertise in SEC rules, regulations & reporting,

internal controls over financial reporting, and capital market and corporate governance experience

and expertise.

He

earned a B.S. degree in Accounting from Southern Illinois University at Edwardsville and practiced as a Certified Public Accountant

for over 30 years and is licensed (inactive) as a CPA in the State of Missouri.

Mr.

Reisner was selected for service on the Board because of his long experience in the accounting industry and his experience working

with public companies. |

Vote

Required and Board’s Recommendation

The

election of a director requires a plurality of all the votes cast either in person or by proxy present at the Annual Meeting (i.e., the

director nominees receiving the greatest number of votes cast for each of the director positions being voted upon). Each share of common

stock entitled to vote may be voted for as many persons as there are directors to be elected. However, stockholders may not cumulate

their votes. If you vote “Withhold Authority” with respect to a director nominee, your shares will not be voted with respect

to the person indicated. Because directors are elected by a plurality of all votes cast, abstentions and broker non-votes will have no

effect of the election of directors.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINEES NAMED IN THIS

PROXY STATEMENT.

PROPOSAL

2

RATIFICATION

OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon

the recommendation of the Board, Sadler, Gibb & Associates, L.L.C. has been selected to serve as our independent registered public

accounting firm for the fiscal year ending December 31, 2023, and the Board has further directed that the selection of our independent

registered public accounting firm be submitted for ratification by our stockholders at our Annual Meeting.

Representatives

of Sadler, Gibb & Associates, L.L.C. are expected to be present at the Annual Meeting, will have an opportunity to make a statement

if they so desire, and will be available to respond to appropriate questions.

Stockholder

ratification of the selection of Sadler, Gibb & Associates, L.L.C. as our independent registered public accounting firm is not required

by our Bylaws or otherwise. However, the Board is submitting the selection of Sadler, Gibb & Associates, L.L.C. to the stockholders

for ratification as a matter of good corporate practice. If the stockholders do not ratify the selection, the Board will reconsider whether

or not to retain Sadler, Gibb & Associates, L.L.C. Even if the selection is ratified, the Board may, in their discretion, direct

the appointment of a different independent registered public accounting firm at any time during the year if they determine that such

a change would be in our and our stockholders’ best interests.

Sadler,

Gibb & Associates, L.L.C. has advised us that neither the firm nor any present member or associate of it has any material financial

interest, direct or indirect, in the Company or its affiliates.

Aggregate

fees for professional services billed to the Company by Sadler, Gibb & Associates, L.L.C. and ACM LLP, respectively, for the years

ended December 31, 2022 and 2021, were as follows:

| | |

2022 | | |

2021 | |

| Audit

Fees | |

$ | 107,060 | | |

$ | 97,500 | |

| Audit-Related

Fees | |

| 90,000 | | |

| 32,800 | |

| Tax

Fees | |

| 12,574 | (1) | |

| 7,850 | (2) |

| Total | |

$ | 209,634 | | |

$ | 138,150 | |

| (1) |

Tax

fees in 2022 relate to tax returns for the 2021 year. |

| (2) |

Tax

fees in 2021 relate to tax returns for the 2020 year. |

Audit

Fees. Audit fees consist of fees billed by our independent registered public accounting firm for professional services rendered in

connection with the audit of our annual consolidated financial statements, and the review of our consolidated financial statements included

in our quarterly reports.

Audit-Related

Fees. Audit-related services consist of fees billed by our independent registered public accounting firm for assurance and related

services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not

reported under “Audit Fees.” These services include the review of our registration statements on Forms S-1 and S-8.

Tax

Fees. Tax fees consist of fees billed by our independent registered public accounting firm for professional services rendered for

tax compliance. These services include assistance regarding federal, state, and local tax compliance.

All

Other Fees. All other fees would include fees for products and services other than the services reported above.

Pre-Approval

Policy and Procedures

The

Audit Committee has responsibility for selecting, appointing, evaluating, compensating, retaining, and overseeing the work of the independent

registered public accounting firm. In recognition of this responsibility, the Audit Committee has established policies and procedures

in its charter regarding pre-approval of any audit and non-audit service provided to the Company by the independent registered public

accounting firm and the fees and terms thereof.

The

Audit Committee considers the compatibility of the provision of other services by its registered public accountant with the maintenance

of their independence.

Vote

Required and Board’s Recommendation

Approval

of this Proposal 2 requires the affirmative vote of a majority of the votes cast on this proposal at a meeting at which a quorum is present.

Abstentions will be counted as present for purposes of determining the presence of a quorum, but abstentions will have no effect on the

vote on this proposal. Broker non-votes are not expected to result from the vote on this proposal. The persons named in the enclosed

proxy will vote the proxies they receive FOR the ratification of the selection of Sadler, Gibb & Associates, L.L.C. as our independent

registered public accounting firm, unless a particular proxy card withholds authorization to do so or provides contrary instructions.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF SADLER, GIBB & ASSOCIATES,

L.L.C. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

PROPOSAL

3

TO

AUTHORIZE THE BOARD, AT ITS DISCRETION, AT ANY TIME UNTIL JUNE 30, 2024, TO EFFECT A REVERSE STOCK SPLIT OF THE COMMON STOCK WITH A RATIO

NOT LESS THAN TWO-FOR-ONE BUT NOT GREATER THAN TWENTY -FOR-ONE

The

Board believes it is in the best interest of the Company to authorize the Board to effect a reverse split of the common stock outstanding

and in conjunction with that reverse split to decrease the number of authorized shares of common and preferred stock. The text of the

proposed Articles of Amendment is attached hereto as Exhibit A.

Reason

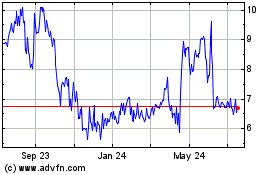

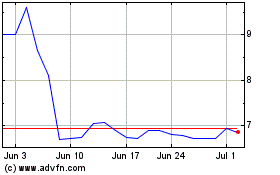

for the Proposal

The

Board is seeking approval, according to the Board’s discretion, of a reverse stock split of the Company’s common stock, at

a ratio of not less than 2:1 but not more than 20:1 (the “Reverse Stock Split”). The Company will round up for any fractional

shares as a result of the Reverse Split; the Company will not issue any fractional shares. If the Reverse Stock Split is fully implemented,

twenty (20) issued and outstanding shares of common stock before the Reverse Stock Split (the “Old Shares”) will become automatically

converted into one (1) share of common stock after the Reverse Stock Split (the “New Share”), with stockholders who would

receive a fractional share to receive such additional fractional share as will result in the holder having a whole number of shares.

The Board may authorize less than a twenty (20) for one (1) Reverse Stock Split, so long as it authorizes no less than a two (2) for

one (1) Reverse Stock Split, or no Reverse Stock Split at all.

The

Board believes that the increased market price of the common stock expected as a result of implementing a Reverse Stock Split will improve

the marketability and liquidity of the common stock for the stockholders and will encourage interest and trading in the common stock.

It will also allow the Company to meet the listing requirements of Nasdaq, for which it has received a potential listing notice due to

the fact that the per share of common stock trading price has been below $1.00. A reverse split will cause the per share trading price

to increase, although such an increase may not be maintained in the market. Therefore, the Board would select an rate that will increase

the stock price to such a level that the Company would not revert to a listing deficiency. Because of the trading volatility often associated

with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them

from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers.

Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to

brokers. Additionally, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price

than commissions on higher-priced stocks, the current average price per share of the common stock can result in individual stockholders

paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially

higher. It should be noted that the liquidity of the common stock may be adversely affected by the Reverse Stock Split given the reduced

number of shares that would be outstanding after the Reverse Stock Split. The Board anticipates, however, that the expected higher market

price will reduce, to some extent, the negative effects on the liquidity and marketability of the common stock inherent in some of the

policies and practices of institutional investors and brokerage houses described above.

There

can be no assurance that the Reverse Stock Split will increase the market price of the common stock or that any increase will be proportional

to the reverse-split ratio. Accordingly, the total market capitalization of the common stock immediately after the Reverse Stock Split

or at any time thereafter could be lower than the total market capitalization before the Reverse Stock Split.

The

Board confirms this transaction will not be the first step in a series of plans or proposals of a “going private transaction”

within the meaning of Rule 13e-3 of the Exchange Act.

Potential

Effects of the Reverse Stock Split

The

immediate effect of a Reverse Stock Split will be to reduce the number of shares of common stock outstanding, and to increase the trading

price of the common stock. However, the effect of the Reverse Stock Split upon the market price of the common stock cannot be predicted,

and the history of reverse stock splits for companies in similar circumstances to ours is varied. We cannot assure you that the trading

price of the common stock after the Reverse Stock Split will rise in exact proportion to the reduction in the number of shares of the

common stock outstanding as a result of the Reverse Stock Split. Also, as stated above, the Company cannot assure you that the Reverse

Stock Split will lead to a sustained increase in the trading price of the common stock. The trading price of the common stock may change

due to a variety of other factors, including the Company’s operating results, other factors related to the Company’s business,

and general market conditions.

Effect

on Ownership by Individual Stockholders

New

Shares issued pursuant to the Reverse Stock Split will be fully paid and non-assessable. All New Shares will have the same voting rights

and other rights as the Old Shares. The stockholders do not have preemptive rights to acquire additional shares of common stock. The

Reverse Stock Split will not alter any stockholder’s percentage interest in our equity, except to the extent that the Reverse Stock

Split results in any of our stockholders owning a fractional share, which will be rounded up to the next whole number of shares.

Effect

on Options, Warrants, and Other Securities

All

outstanding options, warrants, convertible notes, debentures, and other securities entitling their holders to purchase shares of common

stock will be adjusted as a result of the Reverse Stock Split, as required by the terms of these securities. In particular, the conversion

ratio for each instrument will be reduced, and the exercise price, if applicable, will be increased, in accordance with the terms of

each instrument and based on the ratio selected by the Board for the Reverse Stock Split.

Accounting

Consequences

The

per share par value of the common stock will remain unchanged at $0.00001 after the Reverse Stock Split. Also, the capital account of

the Company will remain unchanged, and the Company does not anticipate that any other accounting consequences will arise as a result

of the Reverse Stock Split.

Federal

Income Tax Consequences

The

discussion below is only a summary of certain U.S. federal income tax consequences of the Reverse Stock Split generally applicable to

beneficial holders of shares of our common stock and does not purport to be a complete discussion of all possible tax consequences. This

summary addresses only those stockholders who hold their old common stock shares as “capital assets” as defined in the Internal

Revenue Code of 1986, as amended (the “Code”), and will hold the new common stock shares as capital assets. This discussion

does not address all U.S. federal income tax considerations that may be relevant to particular stockholders in light of their individual

circumstances or to stockholders that are subject to special rules, such as financial institutions, tax-exempt organizations, insurance

companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Code, applicable

Treasury Regulations thereunder, judicial decisions, and current administrative rulings, as of the date hereof, all of which are subject

to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. EACH

STOCKHOLDER SHOULD CONSULT HIS, HER, OR ITS OWN TAX ADVISOR AS TO THE PARTICULAR FACTS AND CIRCUMSTANCES THAT MAY BE UNIQUE TO SUCH STOCKHOLDER

AND ALSO AS TO ANY ESTATE, GIFT, STATE, LOCAL, OR FOREIGN TAX CONSIDERATIONS ARISING OUT OF THE REVERSE STOCK SPLIT.

The

Reverse Stock Split will qualify as a recapitalization for U.S. federal income tax purposes. As a result:

●

Stockholders should not recognize any gain or loss as a result of the Reverse Stock Split.

●

The aggregate basis of a stockholder’s Old Shares will become the aggregate basis of the shares held by such stockholder immediately

after the Reverse Stock Split.

●

The holding period of the shares owned immediately after the Reverse Stock Split will include the stockholder’s holding period

before the Reverse Stock Split.

The

above discussion is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. Federal tax

penalties. It was written solely in connection with the proposed Reverse Stock Split of the common stock. Our opinion is not binding

upon the Internal Revenue Service or the courts, and there can be no assurance that the Internal Revenue Service or the courts will accept

the positions expressed above.

Vote

Required and Board Recommendation

Approval

of this Proposal 3 requires the affirmative vote of a majority of the issued and outstanding shares at a meeting at which a quorum is

present. Abstentions and broker non-votes will not be considered as votes cast under the Company’s bylaws, and accordingly will

have the effect of a vote against this Proposal 3.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 3.

PROPOSAL

4

APPROVAL

OF ANY ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY OR APPROPRIATE, TO PERMIT SOLICITATION OF ADDITIONAL PROXIES IN FAVOR OF THE PROPOSALS

PRESENTED HEREIN

The

Board seeks your approval to adjourn the Annual Meeting, if necessary or appropriate, to permit the solicitation of additional proxies

in favor of proposals presented herein. If it is necessary to adjourn the Annual Meeting, and the adjournment is for a period of less

than 60 days, no notice of the time or place of the reconvened meeting will be required to be given to our stockholders, other than an

announcement made at the Annual Meeting.

Vote

Required and Board Recommendation

Approval

of this Proposal 4 requires the affirmative vote of a majority of the votes cast on this proposal at a meeting at which a quorum is present.

Abstentions will not be considered as votes cast under the Company’s bylaws, and accordingly will have no effect on the outcome

of this Proposal 4.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 4.

CORPORATE

GOVERNANCE

Meetings

and Committees of the Board

Our

Board is responsible for overseeing the management of our business. We keep our directors informed of our business at meetings and through

reports and analyses presented to the Board and the committees of the Board, if any. Regular communications between our directors and

management also occur outside of formal meetings of the Board and committees of the Board.

Meeting

Attendance

Our

Board generally holds meetings on a quarterly basis but may hold additional meetings as required. In 2022, the Board held four meetings.

The Board took action by written consent once during 2022; each consent required that all the members of the Board consented to the action.

Most of our directors attended 100% of the Board meetings that were held during the periods when they were directors and 100% of the

meetings of each committee of the Board on which they served that were held during the periods that he served on such committee.

We do not have a policy requiring that directors attend our annual meetings of stockholders.

Director

Independence

Generally,

under the listing requirements and rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s

board of directors. Our Board has undertaken a review of its composition, the composition of its committees and the independence of each

director. Our Board has determined that no member of the Board has a relationship that would interfere with the exercise of independent

judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined under

the applicable rules and regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making these determinations,

our Board considered the current and prior relationships that each nonemployee director nominee has with our Company and all other facts

and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock

by each nonemployee director nominee. Accordingly, a majority of our directors are independent, as required under applicable Nasdaq Stock

Market rules, as of the date of this Proxy Statement.

Board

Leadership Structure

The

Board may, but is not required to, select a Chairman of the Board who presides over the meetings of the Board and meetings of the stockholders

and performs such other duties as may be assigned to him by the Board. The positions of Chairman of the Board and Chief Executive Officer

may be filled by one individual or two different individuals. Currently the positions of Chairman of the Board and Chief Executive Officer

are held by Mr. McDonald. The Board believes that Mr. McDonald’s work experience and his demonstrated leadership ability make him

the best choice currently to serve as our Chairman of the Board. The Board believes that the Company’s current model of the combined

Chairman/CEO role is the appropriate structure for CEA Industries at this time.

Diversity

of the Board

Diversity

and inclusion is important to the Board and the Company. The current and proposed Board complies with the Nasdaq’s Board Diversity

Rule effective as of this time. The following is the Board Diversity Matrix Disclosure:

| Total

Number of Directors |

5 |

| | |

Female | | |

Male | | |

Non-Binary | | |

Did Not Disclose Gender | |

| Part I: Gender Identity | |

| | | |

| | | |

| | | |

| | |

| Directors | |

| 0 | | |

| 5 | | |

| 0 | | |

| 0 | |

| | |

| | | |

| | | |

| | | |

| | |

| Part II: Demographic Background | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| African American or Black | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Alaskan Native or Native American | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Asian | |

| 0 | | |

| 1 | | |

| 0 | | |

| 0 | |

| Hispanic or Latinx | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Native Hawaiian or Pacific Islander | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| White | |

| 0 | | |

| 4 | | |

| 0 | | |

| 0 | |

| Two or More Races or Ethnicities | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| LGBTQ+ | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Did Not Disclose Demographic Background | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Board’s

Role in Risk Oversight

While

risk management is primarily the responsibility of the Company’s management team, the Board is responsible for the overall supervision

of the Company’s risk management activities. The Board as a whole has responsibility for risk oversight, and each Board committee

has responsibility for reviewing certain risk areas and reporting to the full Board. The oversight responsibility of the Board and its

committees is enabled by management reporting processes that are designed to provide visibility to the Board about the identification,

assessment, and management of critical risks and management’s risk mitigation strategies in certain focus areas. These areas of

focus include strategic, operational, financial and reporting, succession and compensation and other areas.

The

Board oversees risks associated with their respective areas of responsibility. The Board oversees: (i) risks and exposures associated

with our business strategy and other current matters that may present material risk to our financial performance, operations, prospects

or reputation, (ii) risks and exposures associated with management succession planning and executive compensation programs and arrangements,

including equity incentive plans, and (iii) risks and exposures associated with director succession planning, corporate governance, and

overall board effectiveness.

Management

provides regular updates to the Board regarding the management of the risks they oversee at each regular meeting of the Board. We believe

that the Board’s role in risk oversight must be evaluated on a case-by-case basis and that our existing Board’s role in risk

oversight is appropriate. However, we continually re-examine the ways in which the Board administers its oversight function on an ongoing

basis to ensure that they continue to meet the Company’s needs.

Audit

Committee Functions

Our

Board has established an Audit Committee, which consists of three independent directors, Mr. Reisner (Chairperson), Mr. Shipley, and

Mr. Etten. The Audit Committee held 4 meetings during 2022 and two meetings during 2023. The committee’s primary duties

are to:

| |

● |

review

and discuss with management and our independent auditor our annual and quarterly financial statements and related disclosures, including

disclosure under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the

results of the independent auditor’s audit or review, as the case may be; |

| |

● |

review

our financial reporting processes and internal control over financial reporting systems and the performance, generally, of our internal

audit function; |

| |

● |

oversee

the audit and other services of our independent registered public accounting firm and be directly responsible for the appointment,

independence, qualifications, compensation, and oversight of the independent registered public accounting firm, which reports directly

to the Audit Committee; |

| |

● |

provide

an open means of communication among our independent registered public accounting firm, management, our internal auditing function

and our Board; |

| |

● |

review

any disagreements between our management and the independent registered public accounting firm regarding our financial reporting; |

| |

● |

prepare

the Audit Committee report for inclusion in our proxy statement for our annual stockholder meetings; |

| |

● |

establish

procedures for complaints received regarding our accounting, internal accounting control and auditing matters; and |

| |

● |

approve

all audit and permissible non-audit services conducted by our independent registered public accounting firm. |

The

Board has determined that each of our Audit Committee members are independent of management and free of any relationships that, in the

opinion of the Board, would interfere with the exercise of independent judgment and are independent, as that term is defined under the

enhanced independence standards for audit committee members in the Exchange Act and the rules promulgated thereunder.

The

Board has further determined that Mr. Reisner is an “audit committee financial expert,” as that term is defined in the rules

promulgated by the Securities and Exchange Commission (the “SEC”) pursuant to the Sarbanes-Oxley Act of 2012. The Board has

further determined that each of the members of the Audit Committee shall be financially literate and that at least one member of the

committee has accounting or related financial management expertise, as such terms are interpreted by the Board in its business judgment.

Audit

Committee Report

The

Audit Committee’s purpose is to assist the Board in its oversight of (i) the integrity of our financial statements, (ii) our compliance

with legal and regulatory requirements, (iii) our independent auditors’ qualifications and independence, and (iv) the performance

of our internal audit function and independent auditors to decide whether to appoint, retain or terminate our independent auditors, and

to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors; and to prepare this Report.

Management

is responsible for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles

and the establishment and effectiveness of internal controls and procedures designed to assure compliance with accounting standards and

applicable laws and regulations. The independent auditors are responsible for performing an independent audit of the financial statements

in accordance with generally accepted auditing standards. The independent auditors have free access to the Audit Committee to discuss

any matters they deem appropriate.

The

Audit Committee reviewed our audited financial statements for the year ended December 31, 2022 and met with management to discuss such

audited financial statements. The Audit Committee has discussed with our independent accountants, Sadler, Gibb & Associates, L.L.C.,

the matters required to be discussed by the Statement on Auditing Standards No. 16, as adopted by the Public Company Accounting Oversight

Board. The Audit Committee has received the written disclosures and the letter from Sadler, Gibb & Associates, L.L.C. required by

the Independence Standards Board Standard No. 1, as may be modified or supplemented. The Audit Committee has discussed with Sadler, Gibb

& Associates, L.L.C. its independence from CEA Industries and its management. Sadler, Gibb & Associates, L.L.C. had full and

free access to the Audit Committee. Based on its review and discussions, the Audit Committee recommended to the Board that the audited

financial statements be included in the Annual Report.

Submitted

by the Audit Committee:

Troy

L. Reisner

James

R. Shipley

Nicholas

J. Etten

Nominations

Committee

Our

Board has also established a Nominations Committee, which consists of Mr. Etten (Chairperson) and Mr. Mariathasan. The Nominations Committee

has held one meeting in 2022 and one meeting during 2023. The committee’s primary duties are to:

| |

● |

recruit

new directors, consider director nominees recommended by stockholders and others and recommend nominees for election as directors; |

| |

● |

review

the size and composition of our Board and committees; |

| |

● |

oversee

the evaluation of the Board; |

| |

● |

recommend

actions to increase the Board’s effectiveness; and |

| |

● |

develop,

recommend, and oversee our corporate governance principles, including our Code of Business Conduct and Ethics and our Corporate Governance

Guidelines. |

There

are no stated minimum criteria for director nominees, although the Nominations Committee may consider such factors as it may deem are

in the best interests of the Company and its stockholders. The Nominations Committee also believes it is appropriate for certain key

members of our management to participate as members of the Board.

The

Nominations Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current

members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered

for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective.

If any member of the Board does not wish to continue in service, or if the Board decides not to re-nominate a member for re-election,

the Board identifies the desired skills and experience of a prospective director nominee in light of the criteria above, or determines

to reduce the size of the Board. Research may also be performed to identify qualified individuals. To date, we have not engaged third

parties to identify or evaluate or assist in identifying potential nominees, nor do we anticipate doing so in the future.

Compensation

Committee

Our

Board has established a Compensation Committee, which consists of two independent directors: Mr. Shipley (Chairperson) and Mr. Reisner.

The Compensation Committee held two meetings in 2022 and one meeting during 2023. The committee’s primary duties are to:

| |

● |

approve

corporate goals and objectives relevant to executive officer compensation and evaluate executive officer performance in light of

those goals and objectives; |

| |

● |

determine

and approve executive officer compensation, including base salary and incentive awards; |

| |

● |

make

recommendations to the Board regarding compensation plans; and |

| |

● |

administer

our stock plan. |

Our

Compensation Committee determines and approves all elements of executive officer compensation. It also provides recommendations to the

Board with respect to non-employee director compensation.

Communication

with the Board of Directors

Stockholders

may communicate with the Board by sending a letter to the Corporate Secretary, CEA Industries Inc., 385 South Pierce Avenue, Suite C,

Louisville, Colorado 80027. Each communication must set forth the name and address of the stockholder on whose behalf the communication

is sent and should indicate in the address whether the communication is intended for the entire Board, the non-employee directors as

a group or an individual director. Each communication will be screened by the Corporate Secretary or his designee to determine whether

it is appropriate for presentation to the Board or any specified director(s). Examples of inappropriate communications include junk mail,

spam, mass mailings, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening,

illegal, unsuitable, frivolous, patently offensive, or otherwise inappropriate material. Communications determined to be appropriate

for presentation to the Board, or the director(s) to whom they are specifically addressed, will be submitted to the Board or such director(s)

on a periodic basis. Any communications that concern accounting, internal control or auditing matters will be handled in accordance with

procedures adopted by the Board of Directors.

Code

of Conduct and Ethics

Our

Board has adopted a Code of Business Conduct and Ethics, which is available for review on our website at www.ceaindustries.com and is

also available in print, without charge, to any stockholder who requests a copy by writing to us at CEA Industries Inc., 385 South Pierce

Avenue, Suite C, Louisville, CO 80027, Attention: Corporate Secretary. Each of our directors, employees, and officers, including our

Chief Executive Officer, and all of our other principal executive officers, are required to comply with the Code of Business Conduct

and Ethics. There have not been any waivers of the Code of Business Conduct and Ethics relating to any of our executive officers or directors

in the past year.

Executive

and Director Compensation

Director

Compensation Program

On

August 20, 2021, the Board of Directors revised the previously adopted equity-based compensation plan and adopted a new compensation

plan for independent directors (the “Plan”). The Plan is effective retroactively for the current independent directors and