| PROSPECTUS |

Filed pursuant to Rule 424(b)(4) |

| |

Registration No. 333-265520

|

CEA

INDUSTRIES INC.

532,688

Warrants, 170,382 Pre-Funded Warrants, together

to

Purchase 703,070 Shares of Common Stock

and

710,890

Shares of Common Stock

The

selling securityholder named in this prospectus (the “Selling Securityholder”) may offer and sell from time to time up to

532,688 warrants (“Public Warrants”) and up to 170,382 pre-funded warrants (“Pre-Funded Warrants,” and together

with the Public Warrants and the Pre-Funded Warrants are referred to collectively as the “Warrants”), together to purchase

up to 703,070 shares of our common stock, par value $0.00001 per share (“Common Stock”). The Public Warrants are exercisable

to purchase an aggregate of 532,688 shares of Common Stock at an exercise price of $5.00 per share of Common Stock, and the Pre-Funded

Warrants are exercisable to purchase an aggregate of 170,382 shares of Common Stock at an exercise price of $0.01 per share of Common

Stock.

In

addition, this prospectus relates to the issuance by us of up to 710,890 shares of our Common Stock, which includes the common

stock that the Selling Security holder currently holds and the 703,070 shares of common stock that may be issued upon the exercise of

Public Warrants and Pre-Funded Warrants, which the Selling Securityholder may offer and sell from time to time.

We

are not selling any Warrants or Common Stock in this offering and will not receive any proceeds from the sale of Warrants or Common Stock

by the Selling Securityholder pursuant to this prospectus, but will receive $5.00 per warrant upon the exercise of any Public Warrant

and $0.01 per warrant upon exercise of any Pre-Funded Warrant. We will pay the expenses, other than any underwriting discounts and commissions,

associated with the sale of the Warrants and Common Stock pursuant to this prospectus.

Our

registration of the securities covered by this prospectus does not mean that the Selling Securityholder will offer or sell any of the

securities offered hereby. The Selling Securityholder may sell the securities covered by this prospectus in a number of different ways

and at varying prices. We provide more information about how the Selling Securityholder may sell the securities in the section entitled

“Plan of Distribution.”

Our

Common Stock is traded on NASDAQ under the symbol “CEAD.” On June 24, 2022, the last reported sales price of the Common

Stock was $1.22 per share. The Public Warrants trade on the Nasdaq Capital Market (“NASDAQ”) under the symbol “CEADW.”

On June 24, 2022, the last reported sales price of the Public Warrants was $0.19 per share. The Pre-Funded Warrants are

not publicly traded, and there is no established public or private market price for the Pre-Funded Warrants

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus and the risk

factors in the documents incorporated by reference in this prospectus to read about factors you should consider before deciding to invest

in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is June 24, 2022

TABLE

OF CONTENTS

You

should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus

and any applicable prospectus supplement. Neither we nor the Selling Securityholder have not authorized anyone to provide you with different

information. No offer or sale of these securities is being made in any jurisdiction where the offer or sale is not permitted. You should

not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is

accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents

incorporated by reference into this prospectus, the Company’s business, financial condition, results of operations and prospects

may have changed.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere or incorporated by reference in this prospectus. This summary does not contain

all of the information that you should consider before investing in the Warrants or Common Stock of the Company. For a more complete

understanding of us and this offering, you should read and carefully consider the entire prospectus and the documents incorporated by

reference herein, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” and our audited consolidated financial statements and the related

notes included in our 2021 Form 10-K and our 2022 Form 10-Q for the quarter ended March 31, 2022, which are incorporated by reference

herein. Unless otherwise indicated in this prospectus, the “Company”, “we”, “us” or “our”

refer to CEA Industries Inc. (formerly known as Surna Inc.) and, where appropriate, its wholly-owned subsidiary.

Overview

The

Company is an industry leader in CEA (Controlled Environment Agriculture) facility design, technologies, and services. The CEA industry

is one of the fastest-growing sectors of the United States’ economy and is defined by type of facility. The CEA industry is composed

of any horticultural facility that is fully self-contained and has a controlled environment. Three facility types meet these criteria:

●

Indoor facilities – environmentally sealed facilities for growing crops and that require artificial lighting.

●

Vertical farms –cultivation facilities oriented vertically to minimize ground square footage.

●

Greenhouses – facilities that are made of translucent materials to use natural sunlight on the crops.

Crops

grown in CEA facilities include: leafy greens (kale, Swiss chard, mustard, cress), microgreens (leafy greens harvested at the first true

leaf stage), ethnic vegetables, ornamentals and small fruits (such as strawberries, blackberries and raspberries), bell peppers, cucumbers,

tomatoes, cannabis and hemp. Historically, we have primarily served customers growing cannabis in indoor facilities and we are currently

pursuing our strategy to broaden our reach to serve other indoor farming facilities, including vertical farms.

We

provide full-service licensed architectural and mechanical, electrical, and plumbing (MEP) engineering services, carefully curated heating,

ventilation and air conditioning (“HVACD”) equipment, proprietary controls systems, air sanitation, lighting, and benching

and racking products. Our team (including both internal employees and outside partnerships) of project managers, licensed professional

architects and engineers, technology and horticulture specialists and systems integrations experts help our customers by precisely designing

for their unique applications. Through our partnership with a certified service contractor network, we provide maintenance services to

assist in a smooth build-out and ensure optimal facility performance.

We

leverage our industry-leading experience to bring value-added solutions to our customers that help improve their overall crop quality

and yield, optimize energy and water efficiency, and satisfy evolving state and local construction code, permitting and regulatory requirements.

Our revenue stream derives primarily from supplying our products, services and technologies to commercial indoor facilities ranging from

several thousand to more than 100,000 square feet.

CEA

facility operators face multiple headwinds from high energy costs, water usage and waste materials, and, in the case of cannabis growing,

increasingly rigorous quality standards and declining cannabis prices. To be competitive, among other things, our customers must develop

innovative ways to meet the demands of their business and reduce energy costs, 90% of which are typically related to their HVACD (50%)

and lighting systems (40%). HVACD systems have historically been and continue to be our primary area of expertise and energy efficiency

is high on our list of considerations when engineering environmental control systems.

We

often have the advantage of early engagement with our customers at the pre-build and construction phases and the corresponding opportunity

to build longer-term relationships with our existing customers. During 2021, we added architectural services to our offerings in an attempt

to engage with the customer at an even earlier stage. Going forward, we plan to leverage our existing customer relationships by introducing

them to our expanded design services along with our expanded product offerings. We believe these efforts will generate incremental revenue

and make us “stickier” to our customers.

We

have three core assets that we believe are important to our going-forward business strategy and that will contribute to our future growth.

First, we have a well-known brand name in the industry along with multi-year relationships with customers and others developed over our

fifteen years of service to the industry. This length of service and broad network of industry contacts will benefit not only our organic

growth initiatives, but also provide us with unique insight into other industry providers who may be appropriate for acquisition or joint

efforts. Second, we have specialized engineering know-how and experience gathered from designing environmental control systems for over

200 commercial CEA cultivation facilities. Third, we have an expanding line of proprietary and curated environmental control systems

and other core technology components needed to build a CEA facility.

Impact

of the COVID-19 Pandemic on Our Business

The

COVID-19 pandemic has prompted national, regional, and local governments, including those in the markets that the Company operates in,

to implement preventative or protective measures to control its spread. As a result, there have been disruptions in business operations

around the world, with an impact on our business.

In

response to the COVID-19 pandemic and the associated government and business response, the Company took and continues to take measures

to adjust its operations as necessary. In early 2020 the Company responded to reduced orders by reducing expenses in an effort to preserve

cash. As 2020 progressed and our sales rebounded, and we were able to obtain additional funds through a forgivable bank loan, we restored

our workforce and increased our operations. Many of these expense reductions were reversed by the end of 2021 when orders picked up and

the overall business climate improved. Because the pandemic continues in different parts of the world and in different ways in the United

States, the Company continues to actively monitor its operations.

We

are experiencing unexpected and uncontrollable delays with our international supply of products and shipments from vendors due to a significant

increase in shipments to U.S. ports, compounded by a reduction in cargo being shipped by air, a general shortage of containers, and a

shortage of domestic truck driver availability. While these delays have moderately improved in recent months, we, along with many other

importers of goods across all industries, continue to experience severe congestion and extensive wait times for carriers at ports across

the United States. In addition, restrictions imposed by local, state and federal agencies due to the COVID-19 pandemic have led to reduced

personnel of importers, government staff and others in our supply chain. We have been working diligently with our network of freight

partners and suppliers to expedite delivery dates and provide solutions to reduce further impact and delays. However, we are unable to

determine the full impact of these delays and how long they will continue as they are out of our control.

While

the Company is continuing to navigate the financial, operational, and personnel challenges presented by the COVID-19 pandemic, the full

extent of the impact of COVID-19 on our operational and financial performance will depend on future developments, including the duration

and spread of the pandemic, the potential uncertainty related to (and proliferation of) new strains, and related actions taken by federal,

state, local and international government officials, to prevent and manage the spread of COVID-19. All of these efforts are uncertain,

out of our control, and cannot be predicted at this time.

Impact

of Ukrainian Conflict

Currently,

we believe that the conflict between Ukraine and Russia does not have any direct impact on our operations, financial condition or financial

reporting. We believe the conflict will have only a general impact on our operations in the same manner as it is having a general impact

on all businesses that have their operations limited to North America resulting from international sanction and embargo regulations,

possible shortages of goods and goods incorporating parts that may be supplied from the Ukraine or Russia, supply chain challenges, and

the international and US domestic inflationary results of the conflict and government spending for and funding of our country’s

response. As our operations are related only to the North American controlled agricultural industry, largely within the cannabis space,

we do not believe we will be targeted for cyber-attacks. We have no operations in the countries directly involved in the conflict or

are specifically impacted by any of the sanctions and embargoes, as we principally operate in the United States and Canada. We do not

believe that the conflict will have any impact on our internal control over financial reporting. Other than general securities market

trends, we do not have reason to believe that investors will evaluate the company as having special risks or exposures related to the

Ukrainian conflict.

Recent

Developments

On

February 10, 2022, the Company completed a firm commitment underwriting for the public offering of shares of common stock and warrants,

which closed on February 15, 2022. The Company received net proceeds of approximately $21,711,000 for the sale of 5,811,138 shares of

common stock and 6,572,808 warrants, each warrant to purchase one share of common stock for five years, exercisable immediately, at an

exercise price of $5.00. The Company also issued to the representative of the underwriters 290,557 warrants, each warrant to purchase

one share of common stock at an exercise price of $5.16, during the period commencing August 9, 2022, and expiring on February 10, 2027.

The

net proceeds from the offering will be used to advance the Company’s organic growth and new product initiatives, to pursue select

acquisitions, and for general corporate and working capital purposes. In connection with this offering, we received approval to list

our common stock on the Nasdaq Capital Market under the symbol “CEAD” and our warrants under the symbol “CEADW”.

As a result, effective February 10, 2022, trading of both shares of the Company’s common stock and certain of the Company’s

warrants commenced on the Nasdaq.

On

February 16, 2022, the Company redeemed 1,650 shares of its Series B Preferred Stock for payment of $2.016 million in cash, which included

both principal and accrued dividends. At the same time, the remaining 1,650 shares of the Company’s Series B Preferred Stock were

converted into 362,306 shares of common stock and 703,070 warrants; 170,382 of the warrants, referred to as the Pre-Funded Warrants,

vested immediately, have an indefinite term and an exercise price of $0.01, and the balance of 532,688 warrants, referred to as the Public

Warrants, also vested immediately, have a term of 5 years and have an exercise price of $5.00.

Corporate

Information

Our

executive offices are located at 385 South Pierce Avenue, Suite C, Louisville, Colorado 80027. Our telephone number is (303) 993-5271.

Our website address is www. ceaindustrie.com. The information on our website is deemed not to be incorporated in this prospectus or to

be part of this prospectus.

THE

OFFERING

| Public

Warrants to purchase Common Stock: |

|

532,688

warrants to purchase Common Stock. |

| |

|

|

| Pre-Funded

Warrants to purchase Common Stock |

|

170,382

warrants to purchase Common Stock. |

| |

|

|

| Shares

of Common Stock, held by the Selling Securityholder and shares of Common Stock issuable upon exercise of Public Warrants and Pre-Funded

Warrants: |

|

710,890

shares of Common Stock. |

| |

|

|

| Shares

of Common Stock outstanding prior to any resale or exercise of the Public Warrants: |

|

7,784,444

shares of Common Stock. |

| |

|

|

| Use

of proceeds: |

|

We

are not selling any of the shares of Common Stock or Warrants in this offering and will not receive any of the proceeds from these

sales, but we will receive $5.00 per share upon the exercise of the Public Warrants and $0.01 per share upon the exercise of the

Pre-Funded Warrants. We will bear all of the offering expenses other than the underwriting discounts and commissions. |

| |

|

|

| Market

for our Warrants: |

|

Our

Public Warrants are currently listed on the NASDAQ Capital Market under the symbol “CEADW”.

The

Pre-Funded Warrants are not publicly listed on any exchange or trading medium. |

| |

|

|

| Market

for our Common Stock: |

|

Our

shares of Common Stock are currently listed on the NASDAQ Capital Market under the symbol “CEAD”. |

| |

|

|

| Risk

factors: |

|

Any

investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the

information set forth under “Risk Factors” on page 7 of this prospectus. |

Our

shares of common stock outstanding after this offering is based on 7,784,444 shares currently outstanding.

Unless

we indicate otherwise or the context otherwise requires, all information in this prospectus:

●

excludes 254,922 shares of common stock issuable upon the exercise of outstanding exercisable options at a weighted exercise price of

$9.06 per share;

●

excludes 3,367 shares of common stock issuable upon vesting of Restricted Stock Units;

●

excludes 7,794,154 shares of common stock issuable upon the exercise of outstanding warrants at a weighted exercise price of $5.03 per

share;

●

excludes 170,382 shares of common stock issuable upon the exercise of outstanding warrants at an exercise price of $0.01 per share and

●

excludes 567,849 shares of common stock reserved for future issuance pursuant to our 2017 Equity Incentive Plan and 2021 Equity Incentive

Plan.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding

future events or future results and therefore are, or may be deemed to be, “forward-looking statements.” All statements other

than statements of historical facts contained in this prospectus may be forward-looking statements. These forward-looking statements

can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,”

“continues,” “anticipates,” “expects,” “seeks,” “projects,” “intends,”

“plans,” “may,” “will,” “would” or “should” or, in each case, their negative

or other variations or comparable terminology. They appear in a number of places throughout this prospectus, and include statements regarding

our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity,

prospects, growth, strategies, future acquisitions and the industry in which we operate.

These

forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our

actual results of operations, financial condition, liquidity, performance, prospects, opportunities, achievements or industry results,

as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or suggested by, these forward-looking

statements. These forward-looking statements are based on assumptions regarding our present and future business strategies and the environment

in which we operate. Important factors that could cause those differences include, but are not limited to:

| |

● |

our business prospects and the prospects of our existing and

prospective customers; |

| |

|

|

| |

● |

the impact on our business and that of our customers of the

current and future response by the government and business to the COVID-19 pandemic, including what is necessary to protect our staff

and the staff of our customers in the conduct of our business; |

| |

|

|

| |

● |

the overall impact of the COVID-19 pandemic on the business

climate in our industry and the willingness of our customers to undertake projects in light of economic uncertainties; |

| |

|

|

| |

● |

our overall financial condition, including our reduced revenue

and business disruption, due to the COVID-19 pandemic business and economic response and its consequences; |

| |

|

|

| |

● |

the inherent uncertainty of product development; |

| |

|

|

| |

● |

regulatory, legislative and judicial developments, especially

those related to changes in, and the enforcement of, cannabis laws; |

| |

|

|

| |

● |

increasing competitive pressures in the CEA (Controlled Environment

Agriculture) industry; |

| |

|

|

| |

● |

the ability to effectively operate our business, including

servicing our existing customers and obtaining new business; |

| |

|

|

| |

● |

our relationships with our customers and suppliers; |

| |

|

|

| |

● |

the continuation of normal payment terms and conditions with

our customers and suppliers, including our ability to obtain advance payments from our customers; |

| |

|

|

| |

● |

general economic conditions, our customers’ operations

and access to capital, and market and business disruptions including severe weather conditions, natural disasters, health hazards, terrorist

activities, financial crises, political crises or other major events, or the prospect of these events, adversely affecting demand for

the products and services offered by us in the markets in which we operate; |

| |

|

|

| |

● |

the continuation of normal supply of products from our suppliers; |

| |

|

|

| |

● |

changes in our business strategy or development plans, including

our expected level of capital expenses and working capital; |

| |

|

|

| |

● |

our ability to attract and retain qualified personnel; |

| |

|

|

| |

● |

our ability to raise equity and debt capital to fund our operations

and growth strategy, including possible acquisitions; |

| |

● |

our ability to identify, complete and integrate potential strategic

acquisitions; |

| |

|

|

| |

● |

future revenue being lower than expected; |

| |

|

|

| |

● |

our ability to convert our backlog into revenue in a timely

manner, or at all; and |

| |

|

|

| |

● |

our intention not to pay dividends. |

These

factors should not be construed as exhaustive and should be read with the other cautionary statements in this prospectus.

Although

we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking

statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and

industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this

prospectus. The matters summarized under “Prospectus Summary,” “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this prospectus could cause

our actual results to differ significantly from those contained in our forward-looking statements. In addition, even if our results of

operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained

in this prospectus, those results or developments may not be indicative of results or developments in subsequent periods.

In

light of these risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements. Any forward-looking

statement that we make in this prospectus speaks only as of the date of such statement, and we undertake no obligation to update any

forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or

developments, except as required by applicable law. Comparisons of results for current and any prior periods are not intended to express

any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical

data.

RISK

FACTORS

You

should carefully consider the risks described below, as well as the risks and uncertainties set forth under the heading “Risk Factors”

in our 2021 Form 10-K, which is incorporated by reference in this prospectus, together with the financial and other information contained

in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occur, or if any

additional risks not presently known to us or that we have currently deemed immaterial occur, our business, financial condition, results

of operations, cash flows and prospects could be materially and adversely affected. In such an event, the trading price of our common

stock could decline and you could lose all or part of your investment in our common stock.

Risks

Related to Our Common Stock

Our

common stock price may be volatile and may decrease substantially.

The

trading price of our common stock has fluctuated substantially, and we expect that it will continue to do so. The price of our common

stock in the market on any particular day depends on many factors including, but not limited to, the following:

| |

● |

price

and volume fluctuations in the overall stock market from time to time; |

| |

|

|

| |

● |

investor

demand for our shares and warrants; |

| |

|

|

| |

● |

significant

volatility in the market price and trading volume of companies in the cannabis industry; |

| |

|

|

| |

● |

variations

in our operating results and market conditions specific to our business; |

| |

|

|

| |

● |

the

emergence of new competitors or new technologies; |

| |

|

|

| |

● |

operating

and market price performance of other companies that investors deem comparable; |

| |

|

|

| |

● |

changes

in our Board of Directors or management; |

| |

|

|

| |

● |

sales

or purchases of our common stock by insiders, including sales of our common stock issued to employees, directors and consultants

under our equity incentive plan which were registered under the Securities Act of 1933, as amended (the “Securities Act”)

under our S-8 registration statement; |

| |

|

|

| |

● |

commencement

of, or involvement in, litigation; |

| |

|

|

| |

● |

changes

in governmental regulations, in particular with respect to the cannabis industry; |

| |

|

|

| |

● |

actual

or anticipated changes in our earnings, and fluctuations in our quarterly operating results; |

| |

|

|

| |

● |

market

sentiments about the cannabis industry; |

| |

|

|

| |

● |

general

economic conditions and trends; and |

| |

|

|

| |

● |

departures

of any of our key employees. |

In

the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has

often been brought against that company. Due to the potential volatility of our stock price, we may therefore be the target of securities

litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources

from our business.

In

addition, if the market for stocks in our industry, or the stock market in general, experiences a loss of investor confidence, the market

price of our common stock could decline for reasons unrelated to our business, financial condition, or results of operations. If any

of the foregoing occurs, it could cause the price of our common stock to fall and may expose us to lawsuits that, even if unsuccessful,

could be costly to defend and a distraction to our Board of Directors and management.

Our

Board of Directors is authorized to reclassify any unissued shares of our preferred stock into one or more classes, which could convey

special rights and privileges to its owners.

Our

articles of incorporation permit our Board of Directors to reclassify any authorized but unissued shares of preferred stock into one

or more classes. Our Board of Directors will generally have broad discretion over the size and timing of any such classification, subject

to a finding that the classification and issuance of preferred stock is in our best interests. In the event our Board of Directors opts

to classify a portion of our unissued shares of preferred stock into a class of preferred stock, those preferred shares would have a

preference over our common stock with respect to dividends and liquidation. The cost of any classification would be borne by our existing

common stockholders. The class voting rights of any preferred shares we may issue could make it more difficult for us to take some actions

that may, in the future, be proposed by the Board of Directors and/or the holders of our common stock, such as a merger, exchange of

securities, liquidation, or alteration of the rights of a class of our securities, if these actions were perceived by the holders of

preferred shares as not in their best interests. These effects, among others, could have an adverse effect on your investment in our

common stock.

Registration

rights Rule 144 contains risks for certain shareholders.

From

time to time, we issue shares on an unregistered basis, which may be eligible for resale under SEC Rule 144 promulgated under the Securities

Act or may require us to register with the SEC the securities for resale. In the event there are securities outstanding that can be sold

under Rule 144 or under a registration statement for resale, there may be market pressure on our stock to absorb the securities in respect

of the then market value of the Company.

We

have a substantial number of options and warrants outstanding, which if exercised for shares of common stock, may put pressure on the

market price of a share.

We

have sold to public and private investors a substantial number of warrants to purchase common stock from time to time over the next several

years. In addition, we have a substantial number of options and warrants outstanding held by investment bankers who provided us with

underwriting and placement services that were issued warrants and employees that were issued options. To the extent that these are exercised

for shares, there may be pressure on our stock price while the market absorbs them. The potential of exercise may also have the same

effect. Investors should expect that the options and warrants will be exercised when the stock price is substantially above the exercise

price.

We

do not anticipating paying any cash dividends on our common stock in the foreseeable future.

We

currently intend to retain our future earnings, if any, for the foreseeable future, to repay indebtedness and to fund the development

and growth of our business. We do not intend to pay any dividends to holders of our common stock in the foreseeable future. Any decision

to declare and pay dividends in the future will be made at the discretion of our Board taking into account various factors, including

our business, operating results and financial condition, current and anticipated cash needs, plans for expansion, any legal or contractual

limitations on our ability to pay dividends under our loan agreements or otherwise. As a result, if our Board does not declare and pay

dividends, the capital appreciation in the price of our common stock, if any, will be your only source of gain on an investment in our

common stock, and you may have to sell some or all of your common stock to generate cash flow from your investment.

The

market price of our shares of common stock may be adversely affected by the sale of shares by our management or large stockholders.

Sales

of our shares of common stock by our officers or senior managers through 10b5-1 plans or otherwise or by large stockholders could adversely

and unpredictably affect the price of our common stock. Additionally, the price of our shares of common stock could be affected even

by the potential for sales by these persons. We cannot predict the effect that any future sales of our common stock, or the potential

for those sales, will have on our share price. Furthermore, due to relatively low trading volume of our stock, should one or more large

stockholders seek to sell a significant portion of their stock in a short period of time, the price of our stock may decline.

An

active, liquid trading market for our common stock and warrants may not develop or be sustained, and as a result, investors may not be

able to sell their common stock at or above their acquisition price, or at all.

Prior

to February 10, 2022, our common stock was quoted on the OTC Markets Group, Inc., OTCQB. Trading on the OTCQB marketplace was infrequent

and in limited volume. Although our common stock is now listed on Nasdaq, along with our public warrants, an active trading market for

these securities may never develop or be sustained. If an active trading market does not develop, investors will have difficulty selling

their shares of common stock and warrants at an attractive price, or at all. An inactive market may also impair our ability to raise

capital and may impair our ability to expand our business by using our common stock and common stock related securities as consideration

in an acquisition.

You

may be diluted by future issuances of preferred stock or additional common stock in connection with our incentive plans, acquisitions

or otherwise; future sales of such shares in the public market, or the expectations that such sales may occur, could lower our stock

price.

Our

articles of incorporation authorizes us to issue shares of our common stock and options, rights, warrants and appreciation rights relating

to our common stock for the consideration and on the terms and conditions established by our Board in its sole discretion. We could issue

a significant number of shares of common stock in the future in connection with investments or acquisitions. Any of these issuances could

dilute our existing stockholders, and such dilution could be significant. Moreover, such dilution could have a material adverse effect

on the market price for the shares of our common stock.

The

future issuance of shares of preferred stock with voting rights may adversely affect the voting power of the holders of shares of our

common stock, either by diluting the voting power of our common stock if the preferred stock votes together with the common stock as

a single class, or by giving the holders of any such preferred stock the right or ability to block an action on which they have a separate

class vote, even if the action were approved by the holders of our shares of our common stock.

The

future issuance of shares of preferred stock with dividend or conversion rights, liquidation preferences or other economic terms favorable

to the holders of preferred stock, when compared to the rights of the common stockholders, could adversely affect the market price for

our common stock by making an investment in the common stock less attractive. For example, investors in the common stock may not wish

to purchase common stock at a price above the conversion price of a series of convertible preferred stock because the holders of the

preferred stock would effectively be entitled to purchase common stock at the lower conversion price, causing economic dilution to the

holders of common stock.

Risks

Related to Our Warrants

There

has not been an active, long term or sustained trading market for the warrants, which could harm the market price of the warrants, and

you may not be able to resell the warrants at or above the price paid for the warrants or the exercise price of the warrants.

There

is a risk that an active trading market for the warrants may not develop or be sustained. The Exercise price of the warrants, and the

value of our company, were determined by negotiations among the underwriters and us in connection with the February 2022 public offering.

The warrants may not trade at prices that equal or are greater than the initial offering price of the warrants, the price paid for the

warrants or the exercise price of the warrants. of securities sold hereby. In the absence of an active trading market for the warrants,

investors may not be able to sell their warrants or sell them at a price that will generate a profit.

The

market price of the warrants may be volatile and you could lose all or part of your investment.

The

price of the securities of publicly traded companies, such as the Company, has been highly volatile and is likely to remain highly volatile

in the future. As a result of this volatility, you may not be able to sell your warrants. The market price of the warrants may fluctuate

significantly due to a variety of factors, including market factors, our financial results, the prospects for our business, and changes

in government regulation relating to the cannabis industry. General industry factors may cause the market price and demand for our securities

to fluctuate substantially

The

Warrants are speculative in nature.

The

warrants represent the right to acquire our common stock at a fixed cash price, for a limited period of time. While the Company maintains

an effective registration statement a warrant only may be exercised for cash, and if we do not do so, then the warrants may be exercised

on a cashless basis. If the warrants are not exercised before they expire, the warrants may not provide any value to the holder thereof.

It is usual that the price of a warrant in the public market is more volatile than that of the corresponding common stock for which it

is exercisable. Therefore, investors should expect the price of a warrant to fluctuate to a greater degree than our common stock, and

correspondingly be more speculative.

Holders

of the warrants do not have any rights of the holders of common stock until the warrants are exercised.

The

warrants being offered do not confer any of the rights afforded to the holders of our common stock, such as voting rights, the right

to receive dividends or liquidation rights, but rather merely represent the right to acquire shares of common stock at a fixed price.

There

is no assurance that any of the warrants will be exercised and provide additional working capital to the Company.

It

is not expected that the warrants will be exercised unless the price of a share of common stock in the market is substantially above

the then exercise price. There can be no assurance that our common stock price will be sufficiently high on a sustained basis to encourage

warrant holders to exercise their warrants. The warrants also have a net exercise right if we do not maintain a registration statement

to permit the warrants to be exercised for registered common stock, in which exercise instanced, the Company will not receive any cash

proceeds. There can be no assurance that we will receive cash proceeds from the exercise of the warrants.

USE

OF PROCEEDS

All

of the Warrants and Common Stock offered by the Selling Securityholder pursuant to this prospectus will be sold by the Selling Securityholder

for its account. We will not receive any of the proceeds from these sales. However, we will receive up to an aggregate of approximately

$2,665,140 from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. There is no assurance that

any of the Warrants will be exercised. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes.

The

Selling Securityholder will pay any underwriting discounts and commissions and expenses incurred by the Selling Securityholder for brokerage,

accounting, tax or legal services or any other expenses incurred by the Selling Securityholder in disposing of the Warrants and Common

Stock offered under this prospectus. We will bear all other costs, fees and expenses incurred in effecting the registration of the Warrants

and Common Stock covered by this prospectus, including, without limitation, all registration and filing fees, any NASDAQ listing fees,

and fees and expenses of our counsel and our independent registered public accountants.

DIVIDEND

POLICY

Since

our inception, we have not paid any dividends on our common stock, and we currently expect that, for the foreseeable future, all earnings,

if any, will be retained for use in the development and operation of our business. In the future, our Board may decide, at its discretion,

whether dividends may be declared and paid to holders of our common stock.

SELLING

SECURITYHOLDER

This

prospectus relates to the possible sale by the Selling Securityholder of up to 532,688 Public Warrants, up to 170,382 Pre-Funded Warrants

and up to 710,890 shares of Common Stock, which number of shares of Common Stock includes the Common Stock that may be issued

on exercise of the Warrants. Evergreen Capital Management LLC acquired its shares of Common Stock, and its Public Warrants and Pre-Funded

Warrants in connection with the redemption of 1,650 shares of our Series B Preferred Stock. The Selling Securityholder may from time

to time offer and sell any or all of the Public Warrants, Pre-Funded Warrants and Common Stock, offered by this prospectus, as set forth

below. When we refer to the “Selling Securityholder” in this prospectus, we mean the person listed in the table below, and

the pledgees, donees, transferees, assignees, successors, distributees and others who later come to hold any of the Selling Securityholder’s

interest in the Public Warrants, Pre-Funded Warrants and Common Stock, other than through a public sale.

The

following table sets forth, as of the date of this prospectus, (i) the Selling Securityholder, (ii) the number of Warrants and number

of shares of Common Stock that the Selling Securityholder beneficially owned as of May 31, 2022, (iii) the number of Warrants and shares

of Common Stock proposed to be sold in this offering by the Selling Securityholder, and (iv) the number of Warrants and shares of Common

Stock that will be beneficially owned by the Selling Securityholder following this offering.

Beneficial

ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if

he, she, or it possesses sole or shared voting or investment power of that security, including securities underlying warrants and options

that are currently exercisable or exercisable within 60 days of May 31, 2022. Under these rules, more than one person may be deemed a

beneficial owner of the same securities and a person may be deemed a beneficial owner of securities as to which he or she has no economic

interest.

Our

calculation of the percentage of beneficial ownership is based on 6,863,365 Public Warrants and Pre-Funded Warrants and on 7,784,444

shares of Common Stock outstanding as of May 31, 2022.

| Selling Securityholder | |

Number of Shares and Warrants Beneficially Owned Before the Offering | |

Number of Shares and Warrants to be Sold in the Offering | | |

Number of Shares and Warrants Beneficially Owned After the Offering | |

| Evergreen Capital Management LLC(1) | |

532,668 Public Warrants | |

| 532,668 | | |

| -0- | |

| | |

| |

| | | |

| | |

| | |

170,382 Pre-Funded Warrants | |

| 170,382 | | |

| -0- | |

| | |

| |

| | | |

| | |

| | |

192,982 September Warrants | |

| -0- | | |

| 192,982 | |

| | |

| |

| | | |

| | |

| | |

7,820 shares of Common Stock | |

| 7,820 | | |

| -0- | |

| |

(1)

|

After

this offering, the Selling Security holder will hold a beneficial interest of 2.4% of the shares of Common Stock of the Company,

and no interest in either the Public Warrants or the Pre-Funded Warrants and their underlying shares of Common Stock. The

business address of Evergreen Capital Management LLC (“Evergreen”) is 156 W. Saddle River Road, Saddle River, NJ 07458.

Jeffrey Pazdro is the Manager of Evergreen and, accordingly, he may be deemed to have beneficial ownership of the Warrants and Common

Stock owned by Evergreen. Mr. Pazdro disclaims beneficial ownership of these securities except to the extent of any pecuniary interest

therein. |

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

On

January 7, 2021, the Company entered into a consulting agreement with RSX Enterprises, Inc. (RSX), a company controlled by Mr. James

R. Shipley, a director of the Company. RSX provided consulting services to the Company focused on product offerings, engineering requirements,

key customer marketing outreach, and related matters, as mutually determined by the Company and RSX. The Company paid a monthly consulting

fee of $6,500 for up to 50 hours per month for the various consulting activities undertaken and provided for reimbursement of expenses.

The total amount paid on this agreement was $19,500. The term of the agreement was set for three months. Any intellectual property developed

by RSX will belong to the Company, and the contract provides for typical indemnification obligations and confidentiality provisions.

The

Company entered into a manufacturer representative agreement with RSX Enterprises in March 2021 to become a non-exclusive representative

for the Company to assist in marketing and soliciting orders. James R. Shipley, a current director of the Company, has a significant

ownership interest in RSX.

Under

the manufacturer representative agreement, RSX will act as a non-exclusive representative for the Company within the United States, Canada

and Mexico and may receive a commission for qualified customer leads. The agreement has an initial term through December 31, 2021, with

automatic one-year renewal terms unless prior notice is given 90 days prior to each annual expiration. During the year ended December

31, 2021, the Company paid $42,639 in commissions under this agreement.

During

2021, except as discussed above, there have been no transactions in which the Company was or is a participant, and there are no currently

proposed transactions in which the Company is to be a participant, in which the amount involved exceeds the lesser of $120,000 or 1%

of the Company’s average assets at year-end for the last two completed fiscal years, and in which any director, executive officer

or beneficial holder of more than 5% of any class of our voting securities or member of such person’s immediate family had or will

have a direct or indirect material interest.

DESCRIPTION

OF CAPITAL STOCK

General

For

a description of our capital stock and the material terms of our Articles of Incorporation, as amended, and Bylaws, as amended, see our

2021 Form 10-K filed with the SEC and incorporated by reference in this prospectus. For instructions on how to find copies of the filings

incorporated by reference in this prospectus, see “Where You Can Find More Information.”

Selling Securityholder

Securities

The

Selling Securityholder is offering up to 532,688 Public Warrants to purchase 532,688 shares of our Common Stock, up to 170,382 Pre-Funded

Warrants to purchase 170,382 shares of Common Stock, and up to 710,890 shares of Common Stock, including the shares of Common

Stock that may be issued upon exercise of the Warrants. As of May 31, 2022, we had 7,784,444 shares of common stock outstanding, and

no shares of preferred stock outstanding. Further, as of May 31, 2022, 254,922 shares of common stock were issuable upon the exercise

of outstanding stock options, 3,367 shares of common stock were issuable upon vesting of outstanding restricted stock units and 7,794,154

shares of common stock were issuable upon the exercise of outstanding warrants.

SHARES

ELIGIBLE FOR FUTURE SALE

Shares

of our common stock are traded on the Nasdaq Capital Market under the symbol “CEAD.” Future sales of substantial amounts

of our common stock in the public market, or the perception that such sales may occur, could adversely affect market prices prevailing

from time to time.

As

of May 31, 2022, we had 7,784,444 shares of common stock outstanding. Of these shares, 7,718,354 shares of our common stock are freely

transferable without restriction or further registration under the Securities Act. Of the remaining shares of outstanding common stock,

66,090 shares are “restricted shares” as defined in Rule 144. Restricted shares may be sold in the public market only if

registered under the Securities Act or if they qualify for an exemption from registration under Rule 144. As a result of the lock-up

period described below, the shares subject to lock-up arrangements will be available for sale in the public market only after August

9, 2022 (generally subject to resale limitations).

Rule

144

In

general, a person who has beneficially owned restricted shares of our common stock for at least six months would be entitled to sell

such securities, provided that (i) such person is not deemed to have been one of our affiliates at the time of, or at any time during

the 90 days preceding, the sale and (ii) we are subject to the Exchange Act periodic reporting requirements for at least 90 days before

the sale. Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates

at the time of, or any time during the 90 days preceding, the sale, would be subject to additional restrictions, by which such person

would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of the following:

| |

● |

1%

of the number of shares of our common stock then outstanding; or |

| |

|

|

| |

● |

the

average weekly trading volume of our common stock on the Nasdaq Capital Market during the four calendar weeks preceding the filing

of a notice on Form 144 with respect to the sale; |

provided,

in each case, that we are subject to the Exchange Act periodic reporting requirements for at least 90 days before the sale. Such sales

both by affiliates and by non-affiliates must also comply with the manner of sale and notice provisions of Rule 144 to the extent applicable.

Lock-up

Agreements

In

connection with our recently completed underwritten public offering of 5,811,138 shares of common stock and warrants to purchase up to

5,811,138 shares of common stock, we, each of our directors and executive officers, and our 5% and greater stockholders, have agreed

not to or are otherwise restricted in their ability to, subject to certain limited exceptions, offer, pledge, sell, contract to sell,

grant any option to purchase, or otherwise dispose of our common stock or any securities convertible into or exchangeable or exercisable

for common stock, or to enter into any hedge or other arrangement or any transaction that transfers, directly or indirectly, the economic

consequence of ownership of the shares of our common stock, in the case of the Company for a period of 90 days after February 10, 2022

(the date of the prospectus with respect to the offering), and in the case of our directors and executive officers and our 5% and greater

stockholders, for a period of 180 days after February 10, 2022, without the prior written consent of ThinkEquity, a division of Fordham

Financial Management, Inc., as representative of the underwriters. The underwriters do not have any present intention or arrangement

to release any shares of our common stock subject to lock-up arrangements prior to the expiration of the 90- or 180-day lock-up period.

PLAN

OF DISTRIBUTION

We

are registering 532,688 Public Warrants, 170,382 Pre-Funded Warrants, and 710,890 shares of Common Stock, including the shares

of Common Stock that may be issued upon exercise of the Warrants if the Warrants are exercised for possible sale by the Selling Securityholder.

The

securities beneficially owned by the Selling Securityholder covered by this prospectus may be offered and sold from time to time by the

Selling Securityholder. The term “Selling Securityholder” includes donees, pledgees, transferees or other successors in interest

selling the Public Warrants, Pre-Funded Warrants or Common Stock received after the date of this prospectus from the Selling Securityholder

as a gift, pledge, partnership distribution or other non-sale related transfer. The Selling Securityholder will act independently of

us in making decisions with respect to the timing, manner and size of each sale. The sales may be made on one or more exchanges or in

the over-the-counter market or otherwise, at prices and under terms then prevailing, at fixed prices, at prices related to the then current

market price, prices determined at the time of sale or in negotiated transactions. The Selling Securityholder may offer and sell their

securities by one or more of, or a combination of, the following methods:

| |

● |

purchases by a broker-dealer as principal and resale by such

broker-dealer for its own account pursuant to this prospectus; |

| |

|

|

| |

● |

ordinary brokerage transactions and transactions in which the

broker solicits purchasers; |

| |

|

|

| |

● |

block trades in which the

broker-dealer so engaged will attempt to sell the warrants as agent but may position and resell a portion of the block as principal

to facilitate the transaction; |

| |

|

|

| |

● |

an over-the-counter distribution in accordance with the rules

of the Nasdaq Capital Market; |

| |

|

|

| |

● |

through trading plans entered into by the Selling Securityholder

pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of an offering pursuant to this prospectus and any applicable

prospectus supplement hereto that provide for periodic sales of its securities on the basis of parameters described in such trading plans; |

| |

|

|

| |

● |

short sales; |

| |

|

|

| |

● |

in a rights offering; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the

applicable exchange; |

| |

|

|

| |

● |

distribution to employees,

members, limited partners or stockholders of the Selling Securityholder; |

| |

|

|

| |

● |

through the writing or

settlement of options or other hedging transaction, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

by pledge to secured debts and other obligations; |

| |

|

|

| |

● |

delayed delivery arrangements; |

| |

● |

to or through underwriters or agents; |

| |

|

|

| |

● |

in “at the market” offerings, as defined in Rule

415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing

market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an

exchange or other similar offerings through sales agents; |

| |

|

|

| |

● |

in privately negotiated transactions; |

| |

|

|

| |

● |

in options transactions; and |

| |

|

|

| |

● |

through a combination of any of the above methods of sale,

as described below or any other method permitted pursuant to applicable law. |

In

addition, any securities that qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

To

the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In

connection with distributions of the Public Warrants or otherwise, the Selling Securityholder may enter into hedging transactions with

broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions

may engage in short sales of the Public Warrants in the course of hedging the positions they assume with the Selling Securityholder.

The Selling Securityholder may also sell the securities short and redeliver the securities to close out such short positions. The Selling

Securityholder may also enter into option or other transactions with broker-dealers or other financial institutions which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling

Securityholder may also pledge securities to a broker-dealer or other financial institution, and, upon a default, such broker-dealer

or other financial institution, may effect sales of the pledged securities pursuant to this prospectus (as supplemented or amended to

reflect such transaction).

The

Selling Securityholder may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to

third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives,

the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions.

If so, the third party may use securities pledged by the Selling Securityholder or borrowed from the Selling Securityholder or others

to settle those sales or to close out any related open borrowings of warrants or stock, and may use securities received from the Selling

Securityholder in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions

will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, the

Selling Securityholder may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell

the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position

to investors in our securities or in connection with a concurrent offering of other securities.

The

Selling Securityholder may, from time to time, pledge or grant a security interest in some or all of the securities it owns that are

covered by this prospectus, and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer

and sell those securities, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or

other applicable provision of the Securities Act amending the list of Selling Securityholder to include the pledgee, transferee or other

successors in interest as Selling Securityholders under this prospectus. The Selling Securityholder may also transfer or distribute the

securities covered by this prospectus in other circumstances, including to its members, in which case the transferees, pledgees or other

successors in interest will be the selling beneficial owners for purposes of this prospectus.

The

Selling Securityholder may sell the securities covered by this prospectus directly. In this case, no underwriters or agents would be

involved.

The

Selling Securityholder may sell the securities covered by this prospectus to institutional investors or others who may be deemed to be

underwriters within the meaning of the Securities Act with respect to any sale of such Public Warrants. The terms of any sales of the

securities will be described in the applicable prospectus supplement.

The

securities covered by this prospectus may also be offered and sold, if so indicated in the applicable prospectus supplement, in connection

with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or

more marketing firms, acting as principals for their own accounts or as agents for the Selling Securityholder. Any remarketing firm will

be identified and the terms of its agreement, if any, with the Selling Securityholder and its compensation will be described in the applicable

prospectus supplement.

If

indicated in the prospectus supplement, the Selling Securityholder may authorize agents, underwriters or dealers to solicit offers from

certain types of institutions to purchase the securities covered by this prospectus at the public offering price under delayed delivery

contracts. These contracts would provide for payment and delivery on a specified date in the future. The contracts would be subject only

to those conditions described in the applicable prospectus supplement. The applicable prospectus supplement will describe the commission

payable for solicitation of those contracts.

In

effecting sales, broker-dealers or agents engaged by the Selling Securityholder may arrange for other broker-dealers to participate.

Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Securityholder in amounts to be negotiated

immediately prior to the sale.

In

offering the securities covered by this prospectus, the Selling Securityholder and any broker-dealers who execute sales for the Selling

Securityholder may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales.

Any profits realized by the Selling Securityholder and the compensation of any broker-dealer may be deemed to be underwriting discounts

and commissions.

In

order to comply with the securities laws of certain states, if applicable, the Public Warrants, Pre-Funded Warrants and shares of Common

Stock must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the securities

may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration

or qualification requirement is available and is complied with.

We

have advised the Selling Securityholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of

securities covered by this prospectus in the public market and to the activities of the Selling Securityholder and its affiliates. In

addition, we will make copies of this prospectus available to the Selling Securityholder for the purpose of satisfying the prospectus

delivery requirements of the Securities Act. The Selling Securityholder may indemnify any broker-dealer that participates in transactions

involving the sale of the securities covered by this prospectus against certain liabilities, including liabilities arising under the

Securities Act.

At

the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the kind

and number of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase

price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession

allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

Exercise

of Warrants

The

Public Warrants may be exercised upon the surrender of the certificate evidencing such warrant on or before the expiration date at the

offices of the warrant agent, Continental Stock Transfer & Trust Company, in the Borough of Manhattan, City and State of New York,

with the subscription form, as set forth in the Public Warrant, duly executed, accompanied by full payment of the exercise price, by

certified or official bank check payable to us, for the number of Public Warrants being exercised. No fractional shares or scrip representing

fractional shares shall be issued upon the exercise of the Public Warrant. As to any fraction of a share which the holder would otherwise

be entitled to purchase upon such exercise, the Company shall, at its election, either pay a cash adjustment in respect of such final

fraction in an amount equal to such fraction multiplied by the exercise price or round up to the next whole share.

The

Pre-Funded Warrants may be exercised upon the surrender of the certificate evidencing such warrant on or before the expiration date at

the offices of the Company, in Louisville, Colorado, with the subscription form, as set forth in the Pre-Funded Warrant, duly executed,

accompanied by full payment of the exercise price, by certified or official bank check payable to us, for the number of Pre-Funded Warrants

being exercised. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of the Pre-Funded Warrant.

As to any fraction of a share which the holder would otherwise be entitled to purchase upon such exercise, the Company shall, at its

election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise

price or round up to the next whole share.

The

prices at which the shares of Common Stock underlying the Warrants covered by this prospectus may actually be disposed of may be at fixed

prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined

at the time of sale or at negotiated prices.

LEGAL

MATTERS

The

validity of the securities offered hereby has been passed upon for us by Golenbock Eiseman Assor Bell & Peskoe LLP, New York, New

York.

EXPERTS

The

consolidated financial statements of CEA Industries appearing in the Company’s Annual Report (Form 10-K) for the fiscal year ended

December 31, 2021, have been audited by Sadler, Gibb & Associates, LLC, an independent registered public accounting firm, as set

forth in their report thereon, included therein and incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INCORPORATION

BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus

is a part of the information or documents listed below that we have filed with the SEC (File No. 001-54286):

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 29, 2022; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022, filed with the SEC on May 12, 2022; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 20, 2022, February 1, 2022, February 2, 2022, February 25, 2022, March

15, 2022, March 29, 2022 and May 12, 2022; and |

| |

|

|

| |

● |

the

description of our common stock set forth in our registration statement on Form 8-A, filed with the SEC on February 4, 2022, including

any amendments thereto or reports filed for the purposes of updating this description. |

Notwithstanding

the statements in the preceding paragraphs, no document, report or exhibit (or portion of any of the foregoing) or any other information

that we have “furnished” to the SEC pursuant to the Exchange Act shall be incorporated by reference into this prospectus.

We

will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this

prospectus, including exhibits to these documents. You should direct any requests for documents to CEA Industries Inc., 385 South Pierce

Avenue, Suite C, Louisville, CO 80027, Attention: Secretary.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus modifies, supersedes

or replaces such statement.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-1 under the Securities Act to register our securities being offered in this

prospectus. This prospectus, which forms part of the registration statement, does not contain all of the information included in the

registration statement and the attached exhibits. You will find additional information about us and our securities in the registration

statement. References in this prospectus to any of our contracts, agreements, or other documents are not necessarily complete, and you

should refer to the exhibits attached to the registration statement for copies of the actual contracts, agreements or documents.

The

SEC maintains an Internet website that contains reports and other information about issuers, like us, that file electronically with the

SEC. The address of that website is www.sec.gov. This reference to the SEC’s website is an inactive textual reference only and

is not a hyperlink.

We

are subject to the reporting, proxy and information requirements of the Exchange Act, and are required to file periodic reports, proxy

statements and other information with the SEC. These periodic reports, proxy statements and other information are available on the website

of the SEC referred to above, as well as on our website, www.ceaindustries.com. This reference to our website is an inactive textual

reference only and is not a hyperlink. The contents of, or other information accessible through, our website are not part of this prospectus.

We furnish our stockholders with annual reports containing audited financial statements and quarterly reports containing unaudited interim

financial statements for each of the first three quarters of each year. Information contained in, or accessible through, our website

is not a part of this prospectus.

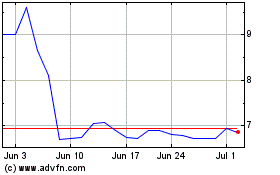

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

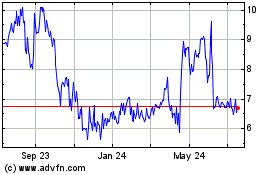

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Nov 2023 to Nov 2024