0001117171

false

0001117171

2023-09-27

2023-09-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

September 27, 2023

| CBAK ENERGY TECHNOLOGY, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-32898 |

|

86-0442833 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

BAK Industrial Park, Meigui Street

Huayuankou Economic Zone

Dalian, China, 116450

(Address, including zip code, of principal executive

offices)

(86)(411)-3918-5985

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.001 par value |

|

CBAT |

|

Nasdaq Capital Market |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

Equity Transfer Agreement

On September 27, 2023, Nanjing CBAK New Energy Technology Co., Ltd.

(“Nanjing CBAK”), a wholly-owned subsidiary of CBAK Energy Technology, Inc. (the “Company”) in China, entered

into an Equity Transfer Agreement (the “Equity Transfer Agreement”) with Shenzhen BAK Battery Co., Ltd. (“BAK Battery”),

under which BAK Battery shall sell a five percent (5%) equity interest in Shenzhen BAK Power Battery Co., Ltd. (“BAK Power”)

to Nanjing CBAK for a purchase price of RMB260 million (approximately $35.57 million) (the “Target Equity”). Pursuant to the

terms of the Equity Transfer Agreement, Nanjing CBAK will pay the Target Equity in three (3) installments as follows: (i) RMB40 million

due prior to December 31, 2023; (ii) RMB90 million due prior to September 30, 2024, and (iii) the remaining Target Equity balance of RMB130

million due following BAK Battery’s successful transfer to Nanjing CBAK of the five percent (5%) equity interest in BAK Power. Upon

Nanjing CBAK having paid RMB130 million of the Target Equity, the parties shall work together to complete the registration of equity change

with the local governmental authorities. Neither BAK Battery, nor BAK Power, is related to the Company.

The Equity Transfer Agreement contains customary representations,

warranties and covenants, conditions precedent, confidentiality, indemnification and termination provisions.

The Company expects to strengthen its competitiveness in the cylindrical

battery market through this acquisition.

The foregoing description of the Equity Transfer Agreement does not

purport to be complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached hereto

as Exhibit 10.1 and is incorporated herein by reference.

Equity Transfer Contract

On September 27, 2023, Zhejiang Hitrans Lithium Technology Co., Ltd.

(“Hitrans”), a majority-owned subsidiary of the Company in China, entered into an Equity Transfer Contract (the “Equity

Transfer Contract”) with Shengyang Xu, pursuant to which Hitrans will initially acquire a 26% equity interest in Zhejiang Shengyang

Renewable Resources Technology Co., Ltd. (“Zhejiang Shengyang”) from Shengyang Xu, an individual who currently holds 97% of

Zhejiang Shengyang, for a price of RMB28.6 million (approximately $3.9 million) (the “Initial Acquisition”). Hitrans shall

pay the Initial Acquisition price in two (2) installments as follows: (i) 50% of the price due within five (5) business days following

the execution of the Equity Transfer Contract and satisfaction of other conditions precedent set forth in the same; and (ii) the remaining

50% of the price due within five (5) business days following Shengyang Xu’s successful transfer to Hitrans of the 26% equity interest

in Zhejiang Shengyang. Within fifteen (15) business days after Hitrans has paid 50% of the price, or RMB14.3 million, the parties shall

complete the registration of equity change with the local governmental authorities.

Within three (3) months following the Initial Acquisition, Shengyang

Xu shall transfer an additional 44% equity interest in Zhejiang Shengyang to Hitrans at the same price per share as that of the Initial

Acquisition (the “Follow-on Acquisition”). The parties shall enter into another agreement to detail the terms of the Follow-on

Acquisition. Neither Shengyang Xu, nor Zhejiang Shengyang, is related to the Company.

The Equity Transfer Contract contains customary representations,

warranties and covenants, conditions precedent, non-competition, indemnification and termination provisions.

The Company expects this investment to help stabilize aspects of its

supply chain while enabling the Company to enter the battery recycling industry.

The foregoing description of the Equity Transfer Contract does not

purport to be complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached hereto

as Exhibit 10.2 and is incorporated herein by reference.

ITEM 3.01. NOTICE OF DELISTING OR FAILURE

TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING

Nasdaq Bid Price Deficiency Notice

On September 27, 2023, the Company received a letter (the “Bid Price

Deficiency Notice”) from the listing qualifications department staff of The Nasdaq Stock Market (“Nasdaq”) indicating

that the Company is not in compliance with the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued

listing on The Nasdaq Capital Market (the “Bid Price Requirement”).

The Bid Price Deficiency Notice has no immediate effect on

the listing of the Company’s common stock, and the Company’s common stock continues to trade on the Nasdaq Capital Market

under the symbol “CBAT.”

In accordance with Nasdaq listing rule 5810(c)(3)(A), the Company has

180 calendar days from the date of the Bid Price Deficiency Notice, or until March 25, 2024, to regain compliance with respect

to the Bid Price Requirement. The Bid Price Deficiency Notice states that to regain compliance with the Bid Price Requirement,

the closing bid price of the Company’s common stock must meet or exceed $1.00 per share for a minimum of ten consecutive business

days during the compliance period ending March 25, 2024.

If the Company fails to regain compliance with the Bid Price Requirement

by March 25, 2024, the Company may be eligible for an additional 180-day compliance period to demonstrate compliance with the Bid Price

Requirement. To qualify, the Company will be required to meet the continued listing requirement for market value of publicly held shares

and all other initial listing standards for The Nasdaq Capital Market, with the exception of the Bid Price Requirement, and will need

to provide written notice to Nasdaq of its intention to cure the deficiency during the second compliance period by effecting a reverse

stock split, if necessary. If the Company does not qualify for the second compliance period or fails to regain compliance with the Bid

Price Requirement during the second 180-day period, Nasdaq will notify the Company of its determination to delist the common stock, at

which point the Company would have an opportunity to appeal the delisting determination to a Hearings Panel.

The Company intends to actively monitor the closing bid price of the

Company’s common stock between now and March 25, 2024 and may, if appropriate, evaluate available options to resolve the deficiency

and regain compliance with the Bid Price Requirement. While the Company is exercising diligent efforts to maintain the listing of its

common stock on Nasdaq, there can be no assurance that the Company will be able to regain or maintain compliance with Nasdaq listing standards.

ITEM 8.01. OTHER EVENTS

On September 28, 2023, the Company issued a press release announcing

the entry into the aforementioned Equity Transfer Agreement relating to BAK Power, a copy of which is attached hereto as Exhibit 99.1.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

***

Forward-Looking Statements

Certain statements in this Current

Report on Form 8-K are “forward-looking statements” as the term is defined under applicable securities laws. These

statements include, without limitation, the anticipated timing of the completion of the BAK Power and Zhejiang Shengyang acquisitions

and the respective benefits thereof. These and other forward-looking statements are subject to risks, uncertainties and other factors

that could cause actual results to differ materially from those statements. Such risks and uncertainties are, in many instances, beyond

the Company’s control. Forward-looking statements, which are presented as of the date of this filing, will not be updated to reflect

events or circumstances after the date of this report except as required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CBAK ENERGY TECHNOLOGY, INC. |

| |

|

|

| Date: October 3, 2023 |

By: |

/s/ Jiewei Li |

| |

|

Jiewei Li |

| |

|

Chief Financial Officer |

4

Exhibit 10.1

深圳比克电池有限公司

与

南京中比新能源科技有限公司

关于

深圳市比克动力电池有限公司

之

《股权转让协议》

Equity Transfer Agreement

Regarding

Shenzhen BAK Power Battery Co., Ltd.

between

Shenzhen BAK Battery Co., Ltd.

and

Nanjing CBAK New Energy Technology Co., Ltd.

2023年9月

September 2023

股权转让协议

Equity Transfer Agreement

本协议由以下各方于2023年9月27日在深圳市大鹏新区签署:

This agreement is executed by

and between the parties below in Dapeng New District, Shenzhen City on September 27, 2023:

甲方(转让方):深圳市比克电池有限公司

Party A (Transferor): Shenzhen

BAK Battery Co., Ltd.

乙方(受让方):

南京中比新能源科技有限公司

Party B (Transferee): Nanjing

CBAK New Energy Technology Co., Ltd.

丙方(标的公司):深圳市比克动力电池有限公司

Party C (Target Company):

Shenzhen BAK Power Battery Co., Ltd.

鉴于:

Whereas:

1、甲方持有深圳市比克动力电池有限公司(以下简称“标的公司或比克动力”)股权,系比克动力的股东;

1. Party A holds the equity

of Shenzhen BAK Power Battery Co., Ltd. (hereinafter referred to as the “Target Company” or “BAK Power”) and is

a shareholder of BAK Power;

2、乙方系主要生产磷酸铁锂圆柱产品电池的电池制造企业,与国内、国际知名厂商建立长期稳定的战略合作关系。乙方在产品制造、市场拓展上,与甲方、丙方具有高度的互补性与协同性;

2. Party B is a battery manufacturing

enterprise that mainly produces cylindrical lithium iron phosphate batteries, and has established long-term and stable strategic cooperative

relationships with well-known domestic and international manufacturers. Party B is highly complementary and synergistic with Party A and

Party C in product manufacturing and market expansion.

3、丙方系专业生产三元系列、磷酸铁锂系列等圆柱产品与方型电池产品的专业化公司,具有完整的研发、产品开发、产品制造等产业化实施能力。

3. Party C is a company specialized

in the production of ternary series, lithium iron phosphate series and other cylindrical and prismatic battery products, and has capabilities

to implement completed R&D, product development, product manufacturing and other related industrialization processes.

鉴于三方在未来产品开发及市场拓展上实现互利共赢、战略协同的共同需求,乙方拟按照标的公司估值52亿元,受让甲方所持有丙方5%的股权,经三方友好协商,达成如下协议:

In view of the common needs

of the parties hereto to achieve mutual benefit and strategic synergy in future product development and market expansion, Party B intends

to accept the transfer of 5% of Party C’s equity held by Party A based on the Target Company’s valuation of CNY 5.2 billion. Through

friendly negotiation between the parties hereto, the following agreement has been reached:

第一条

股权转让

Article I Equity Transfer

1、经三方协商,标的公司按52亿元人民币的整体估值,甲方将所持丙方5%股权转让给乙方。

1. Through

negotiation between the parties hereto, Party A shall transfer 5% of Party C’s equity held by Party A to Party B based on the Target

Company’s overall valuation of CNY 5.2 billion.

2、三方同意,本协议项下乙方应付甲方股权转让款2.6亿元人民币,乙方可以采用分期支付股权受让款的方式予以支付。

2. The

parties hereto agree that Party B shall pay CNY 260 million to Party A for equity transfer hereunder, and Party B may make such payment

in installments.

2、标的股权转让完成后,乙方持有标的公司5%的股权。

2 . After the transfer

of the Target Equity, Party B shall hold 5% of the Target Company’s equity.

第二条 付款安排

Article II Payment Schedule

1、第一笔付款安排:2023年12月31日前付款4000万元;

1. First installment: CNY 40

million shall be paid before December 31, 2023;

2、第二笔付款安排:2024年9月30日前再支付9000万元;

2. Second installment: Another

CNY 90 million shall be paid before September 30, 2024;

3、第三笔付款安排:标的公司5%在市场监督管理局办理完毕过户登记后支付剩余股权款项。

3. Third installment: The rest

thereof shall be paid after the transfer registration procedure for such 5% of the Target Company’s equity is completed with the

State Administration for Market Regulation.

第三条

交割

Article III Delivery

双方同意,甲方、标的公司应在股权转让款支付完成1.3亿元后协商具体时间,向工商管理部门申请办理本次股权转让的工商变更登记和备案手续。

The Parties hereto agree that

Party A and the Target Company shall determine a specific time after the payment of CNY 130 million for equity transfer through negotiation

and apply to the administration for industry and commerce for the change registration and filing regarding the equity transfer.

第四条

过渡期义务

Article IV Obligations

during the Transition Period

1、自本协议签署之日起至本协议履行完毕之日(以下简称“完成日”)的连续期间(简称“过渡期”)内,甲方应确保标的公司按照与以往惯例一致的方式从事日常经营活动,并确保本协议的陈述和保证于过渡期间仍然是真实、完整、准确且无误导,如同该陈述和保证是与过渡期前所作出的保持一致。

1. During

the continuous period (hereinafter referred to as the “Transition Period”) from the date of signing to the date of completion

of performing this Agreement (hereinafter referred to as the “Date of Completion”), Party A shall ensure that the Target Company

conducts its daily business activities as usual. The representations and warranties of this Agreement are still true, complete, accurate,

and not misleading during the Transition Period, just as they were made before the Transition Period.

2、甲方应确保标的公司在过渡期内采取一切合理的措施保存和保护其资产,尽最大努力使其正常经营、营业。

2. Party

A shall ensure that the Target Company takes all reasonable measures to preserve and protect its assets during the Transition Period and

try its best to guarantee its normal operation.

第五条

风险承担及补偿约定

Article V Agreement

on Risks and Compensation

1、甲方向乙方特别承诺:任何在完成日之前发生的,与标的公司的业务、活动相关的,所有未向乙方明确揭示的负债,或欠缴税款的潜在税务责任风险(包括但不限于自身纳税、缴费、代扣扣缴任何税费等)或用工及社会保险和住房公积金债务风险,或业务经营资质及合规责任风险,及其他可能存在的任何不合法合规行为的民事、行政、刑事责任、处罚风险,均由甲方按照本协议签署前的持股比例承担。

1. Party

A hereby makes a special commitment to Party B that: Party A shall be responsible for any liabilities that have not been clearly disclosed

to Party B, occurred before the Date of Completion, and are related to the business and activities of the Target Company, the potential

liability risks of unpaid taxes (including but not limited to the payment of taxes, fees, withholding of any taxes, etc.), the debt risks

of employment, social insurance and housing provident fund, the risks of business qualification and compliance, and any other possible

civil, administrative, criminal liabilities and punishment risks due to illegal compliance, in proportion to Party A’s shareholding of

the Target Company before it signs this Agreement.

2、若标的公司因完成日之前的上述事由而遭受处罚或第三方索赔损失,从而导致乙方作为股东遭受损失,或者导致乙方因此而遭受直接处罚或被第三方索赔损失,甲方应补偿乙方因此直接及/或间接遭受及承担的所有损失、责任、成本、费用和支出。各方同意:在此情况下,乙方有权选择的赔偿方式可包括但不限于:用甲方在标的公司所享有的出资额或分红弥补乙方损失,或者由甲方向乙方支付现金补偿等。

2. If

the Target Company is punished or a Third Party is claiming for losses due to the reasons mentioned above before the Date of Completion,

thus causing Party B to suffer losses as a shareholder, or Party B to suffer direct punishment or be claimed for losses by such Third

Party, Party A shall compensate Party B for all direct and/or indirect losses, liabilities, costs, fees and expenses incurred therefrom.

Both Parties hereby agree that in such case, the compensation methods that Party B is entitled to choose may include, but are not limited

to, making up for Party B’s losses with the contribution or dividends enjoyed by Party A in the Target Company, making compensation in

cash, etc.

第六条

陈述和保证

Article VI Representation

and Warranty

1、甲方的陈述与保证

1. Party

A’s Representation and Warranty

(1)

甲方具有完全的民事权利能力和行为能力,有足够的能力履行本协议。

(1) Party

A has full capacity for civil rights and conduct, and can perform this Agreement.

(2)

甲方或甲方指定的第三方合法拥有标的公司股权。

(2) Party

A or the Third Party designated by Party A legally owns the equity of the Target Company.

(3) 甲方签署、履行本协议、完成本协议所述之交易,不会违反任何法律、行政法规、部门规章和行业准则,亦不会违反乙方作为协议缔约方或受其约束的任何合同、安排或谅解的约定。

(3) Party

A will not violate any laws, administrative regulations, departmental rules and industrial standards when signing and performing this

Agreement and completing the transactions mentioned herein, nor will it violate any contracts, arrangements or understanding to which

Party B is a party or bound.

(4)

按本协议约定协助标的公司办理股权转让的审批和工商登记手续。

(4) Party

A will assist the Target Company in obtaining any approval for the equity transfer and industrial and commercial registration according

to this Agreement.

2、乙方的承诺与保证

2. Party

B’s Representation and Warranty

(1)

乙方具有完全的民事权利能力和行为能力,有足够的能力履行本协议。

(1) Party

B has full capacity for civil rights and conduct and can perform this Agreement.

(2) 签署、履行本协议、完成本协议所述之交易,不会违反任何法律、行政法规、部门规章和行业准则,不会违反乙方的公司章程,亦不会违反乙方作为协议缔约方或受其约束的任何合同、安排或谅解的约定。

(2) Party

B will not violate any laws, administrative regulations, departmental rules and industrial standards when signing and performing this

Agreement and completing the transactions mentioned herein, nor will it violate its articles of association, any contracts, arrangements

or understanding to which itself is a party or bound.

(3) 因订立、履行本协议而提供予甲方和标的公司的相关文件及陈述的相关事项均真实、准确、完整,不存在虚假、误导性陈述和重大遗漏。

(3) The

relevant documents and representation provided for Party A and the Target Company due to the conclusion and performance of this Agreement

are true, accurate and complete, without any false or misleading statements and major omissions.

第七条

协议的生效、变更及解除

Article VII Effectiveness,

Change and Termination of this Agreement

1、本协议自各方的委派代表签字并加盖各方公章之日起成立并生效。

1. This

Agreement shall come into effect upon being signed and sealed by the representatives of both Parties.

2、经各方协商一致,各方可以书面形式对本协议进行变更、修改或者终止本协议。

2. Both

Parties may change, modify or terminate this Agreement in writing after negotiation.

3、发生法律、法规和规范性文件规定的导致本协议终止的事项,本协议经各方协商可以通过书面方式终止。

3. This

Agreement may be terminated in writing through negotiation by all Parties in case of any event that may cause the termination of this

Agreement as stipulated by laws, regulations and normative documents.

4、本协议的终止不妨碍或影响任何一方就其他方于本协议生效后终止前发生的违约行为进行追究的权利。

4. The

termination of this Agreement shall not hinder or affect either Party’s rights to investigate the other Party’s breach of contract after

the effective date of this Agreement and before its termination.

第八条

违约责任及争议解决

Article VIII Liability

for Breach of Contract and Resolution of Disputes

1、本协议签署后,除发生法律明文规定的不可抗力情况外,任何一方不能按本协议的规定履行其义务或做出虚假的陈述与保证,则被视为违约。违约方应赔偿因其违约而给守约方造成的损失。

1. After

signing this Agreement, unless any force majeure specified in laws and regulations occurred, if either Party fails to perform its obligations

according to the provisions hereof or makes false representation and warranty, such act will be regarded as a breach of contract. The

breaching party shall indemnify the non-breaching party for the losses caused by its breach of contract.

2、本协议受中华人民共和国法律管辖,并按中华人民共和国法律解释。本协议履行过程中如有争议或违约情形,各方协商解决;协商不成时,则任何一方均有权将争议交由华南国际经济贸易仲裁委员会(深圳仲裁委员会)予以仲裁解决。

2. This

Agreement shall be subject to and interpreted according to the laws of the People’s Republic of China. In case of any dispute or breach

of contract during the performance hereof, the Parties hereto shall negotiate for settlement; if the negotiation fails, either party hereto

shall be entitled to submit such dispute to the Shenzhen Court of International Arbitration (SCIA) for arbitration.

第九条

其他

Article IX Miscellaneous

1、就进行本协议下的股权转让所产生的相关税负、费用,各方应依照法律规定分别承担和缴纳。

1. According

to laws and regulations, both Parties shall bear and pay the relevant taxes and expenses arising from the equity transfer hereunder.

2、各方对于本协议内容及对方所提供的未公开的资料承担严格的保密义务,除因法律规定或任何有管辖权的政府机关、监管机构等国家权力机构要求以外,均不得以任何方式向任何第三方披露。

2. Each

Party shall undertake confidentiality obligations for the contents of this Agreement and the undisclosed materials provided by the other

Party, and shall not disclose such contents and materials to any Third Party in any way except as required by law or by any state authorities

with jurisdiction, such as government agencies and regulatory agencies.

3、本协议一式叁份,双方各持一份,其余文本交相关审批部门备案或保存,所有协议具有同等法律效力。

3. This

Agreement is made in triplicate, with Party A and Party B holding one copy each, and the rest is submitted to the relevant approval authorities

for filing and reservation. All copies shall share the same legal effect.

以下无正文,为协议签署页

The following is intentionally

left blank, and the signature page is attached

(本页无正文,为深圳市比克电池有限公司与南京中比新能源科技有限公司关于深圳市比克动力电池有限公司《股权转让协议》之签字盖章页)

(This page is intentionally

left blank for the signature of the Equity Transfer Agreement of Shenzhen BAK Power Battery Co., Ltd. between Shenzhen BAK Battery Co.,

Ltd. and Nanjing CBAK New Energy Technology Co., Ltd.)

甲方(盖章):

Party A (seal): Shenzhen

BAK Battery Co., Ltd.

法定代表人或授权代表(签字):

Legal representative or authorized

representative (signature): /s/ Xiangqian Li

乙方(盖章):

Party B (seal): Nanjing

CBAK New Energy Technology Co., Ltd.

法定代表人或授权代表(签字):

Legal representative or authorized

representative (signature):

丙方(盖章):

Party C (seal): Shenzhen

BAK Power Battery Co., Ltd.

法定代表人或授权代表(签字):

Legal representative or authorized

representative (signature): /s/ Xiangqian Li

签约时间:

年 月 日

Signed

on: MM/DD/YYYY

11

Exhibit 10.2

股权转让合同

Equity Transfer Contract

徐升洋

与

(浙江海创锂电科技有限公司)

签订之

浙江升阳再生资源科技有限公司

股 权 转 让 合

同

Zhejiang Shengyang Renewable Resources Technology

Co., Ltd.

Equity Transfer Contract

between

Xu Shengyang

and

Zhejiang Hitrans Lithium Technology Co., Ltd.

2023年

9 月

September 2023

中国金华

Jinhua, China

| | | 股权转让合同 |

| | | Equity Transfer Contract |

目录

Table of Contents

| 第一条 |

目标股权的基本情况 |

3 |

| |

|

|

| Article 1 |

Basic Information of Target Equity |

3 |

| |

|

|

| 第二条 |

投资前提条件 |

3 |

| |

|

|

| Article 2 |

Prerequisites for the Investment |

3 |

| |

|

|

| 第三条 |

股权转让价款 |

5 |

| |

|

|

| Article 3 |

Equity Transfer Price |

5 |

| |

|

|

| 第四条 |

股权转让价款的支付 |

5 |

| |

|

|

| Article 4 |

Payment of the Equity Transfer Price |

5 |

| |

|

|

| 第五条 |

承诺及保证 |

6 |

| |

|

|

| Article 5 |

Commitments and Warranties |

6 |

| |

|

|

| 第六条 |

相关手续办理 |

9 |

| |

|

|

| Article 6 |

Handling of Relevant Formalities |

9 |

| |

|

|

| 第七条 |

合同的变更、解除 |

9 |

| |

|

|

| Article 7 |

Change and Termination of Contract |

9 |

| |

|

|

| 第八条 |

违约责任 |

11 |

| |

|

|

| Article 8 |

Liability for Breach of Contract |

11 |

| |

|

|

| 第九条 |

争议的解决 |

12 |

| |

|

|

| Article 9 |

Dispute Resolution |

12 |

| |

|

|

| 第十条 |

通知及送达 |

12 |

| |

|

|

| Article 10 |

Notice and Service |

12 |

| |

|

|

| 第十一条 |

合同的生效 |

13 |

| |

|

|

| Article 11 |

Effectiveness of the Contract |

13 |

| |

|

|

| 第十二条 |

其他 |

13 |

| |

|

|

| Article 12 |

Miscellaneous |

13 |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

股权转让合同

Equity Transfer Contract

受让方(甲方):

Transferee (Party A):

浙江海创锂电科技有限公司

Zhejiang Hitrans Lithium Technology Co., Ltd.

注册地址:浙江省绍兴市杭州湾上虞经济技术开发区纬七东路5号

Registered Address: No.5, Weiqi East Road, Shangyu

Economic and Technological Development Zone, Hangzhou Bay, Shaoxing City, Zhejiang Province

法定代表人:吴海军

Legal Representative: Wu Haijun

转让方:(乙方):徐升洋

Transferor (Party B): Xu Shengyang

身份证号:

***

ID card number: ***

目标公司(丙方):

Target Company (Party C):

浙江升阳再生资源科技有限公司

Zhejiang Shengyang Renewable Resources Technology

Co., Ltd.

注册地址: 浙江省金华市婺城区金西经济开发区

Registered address: Jinxi Economic Development

Zone, Wucheng District, Jinhua City, Zhejiang Province

法定代表人:

徐升洋

Legal representative: Xu Shengyang

| | | 股权转让合同 |

| | | Equity Transfer Contract |

鉴于:

Whereas

| 1. | 浙江升阳再生资源科技有限公司(以下简称“目标公司”或“公司”)系一家根据中国法律设立并存续的有限责任公司,注册资本为人民币【1000】万元;住所地【浙江金华】。 |

| 1. | Zhejiang Shengyang Renewable Resources Technology Co., Ltd. (hereinafter referred to as the “Target

Company” or the “Company”) is a limited liability company incorporated and operating under the laws of the People's

Republic of China, with a registered capital of [RMB 10,000,000]; domicile: [Jinhua City, Zhejiang Province]. |

| 2. | 截至本合同签署之日,目标公司股东具体持股情况为如下: |

| 2. | As of the signing date of this Contract, the specific holdings of the Shareholders of the Target Company

are as follows: |

股东名称

Shareholder Name | |

出资额(万元)

Capital Contribution

(RMB 10,000) | | |

持股比例(%)

Shareholding

Ratio (%) | |

徐升洋

Xu Shengyang | |

| 970 | | |

| 97.00 | |

蒋光勤

Jiang Guangqin | |

| 30 | | |

| 3.00 | |

合计

Total | |

| 1000 | | |

| 100.00 | |

| 3. | 乙方有意转让其持有目标公司部分股权,甲方同意按照本合同的约定受让乙方持有的目标公司部分股权; |

| 3. | Party B intends to transfer part of the equity of the Target Company held by Party B, and Party A shall

agree to accept such part of the equity of the Target Company held by Party B as agreed herein. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

为此,本合同各方达成一致协议如下:

Therefore, the Parties hereto

have reached an agreement as follows:

第一条

目标股权的基本情况

Article 1 Basic

Information of Target Equity

| 1.1 | 截至本合同签署之日,乙方出资人民币【970】万元(【玖佰柒拾】万元整),占目标公司注册资本总额的【97】%。乙方同意根据本合同的条件和条款将其所持有的目标公司【26】%的股权转让给甲方。 |

| 1.1 | As of the signing date hereof, Party B has contributed [RMB

9,700,000] ([Nine Million and Seven Hundred Thousand Yuan Only]) accounting for [97] % of the total registered capital of the Target

Company. Party B shall agree to transfer [26] % of the Target Company’s equity held by Party B to Party A in accordance with the

terms and conditions hereof. |

| 1.2 | 本协议项下股权交易完成过户后3个月内,乙方须将目标公司另44%股权转让至甲方名下,每股受让价格按照本次交易的价格执行。详细交易条款另行约定。 |

| 1.2 | Within 3 months after the completion of the equity transaction

hereunder, Party B shall transfer another 44% of the equity of the Target Company to Party A, and the transfer price per share shall

be based on the price of this transaction. Detailed terms of this transaction will be agreed separately. |

第二条 投资前提条件

Article 2 Prerequisites

for the Investment

| 2.1 | 各方确认,转让方在本合同项下的义务以下列条件为前提: |

| 2.1 | The Parties confirm that the obligations of the Transferor

hereunder are subject to the following conditions: |

| 2.1.1 | 转让方已书面通知目标公司其他股东,并已取得其他股东放弃优先受让本次所转让股权的相关书面文件。 |

| 2.1.1 | The Transferor has notified the other Shareholders of the

Target Company in writing and has obtained relevant written documents stating that the other Shareholders have waived their pre-emption

to acquire the equity transferred this time. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

| 2.1.2 | 转让方已向受让方充分、完整披露了公司的资产、负债、权益、对外担保以及与本合同有关的信息等;转让方承诺已向受让方提供的公司【2020】年至【2022】年的财务会计报表真实地完整地反映了公司在该期间的资产、负债和盈利状况。 |

| 2.1.2 | The Transferor has fully and completely disclosed the Company’s

assets, liabilities, rights and interests, external guarantees, and information related to this Contract to the Transferee; the Transferor

shall hereby state and ascertain that the financial and accounting statements of the Company for the years from [2020] to [2022] that

have been provided to the Transferee truthfully and completely reflect the Company’s assets, liabilities and profitability during

that period. |

| 2.1.3 | 转让方保证在过渡期内(指本合同签订之日至按本合同约定的期限完成投资至办理完工商变更登记之间的时间段),公司的经营或财务状况没有发生重大的不利变化,不存在未披露的正在进行的诉讼或仲裁事项;未经受让方同意,公司或其控股子公司不得与他人达成以公司或其控股子公司为当事人的合资、合伙合同或直接设立独资子公司;公司股东不得转让其所持公司股权亦不得进行增资、减资或其他任何有损甲方利益的行为,如确有必要需书面通知受让方并获得其同意。 |

| 2.1.3 | The Transferor warrants that during the transition period

(the period from the signing date of this Contract to the completion of the investment within the period agreed herein and the completion

of industrial and commercial change registration), there is no material adverse change in the operation or financial condition of the

Company and there are no undisclosed on-going litigations or arbitrations; neither the Company nor any of its controlling subsidiary

shall enter into a joint venture or a partnership contract with such other parties to which the Company or its controlling subsidiary

is a party or directly establish a wholly-owned subsidiary without the consent of the Transferee; no Shareholder of the Company shall

transfer the equity held by him/her, nor shall he/she increase or reduce the capital or undertake any other act detrimental to the interests

of Party A. If such an Equity Transfer or a capital increase or a reduction is necessary, the Shareholder shall notify the Transferee

in writing and obtain its consent. |

| 2.1.4 | 转让方在过渡期内不向公司股东以外的第三方转让其所持有的部分或全部公司股权,如确有必要需书面通知受让方并获得其同意; |

| 2.1.4 | During the transition period, the Transferor shall not transfer

its equity in the Company, be it in whole or in part, to any third party other than the Shareholders of the Company and shall notify

the Transferee in writing and obtain its consent if such an Equity Transfer is necessary; |

| 2.1.5 | 转让方保证在过渡期内:公司没有处置其主要资产或在其上设置担保,也没有发生或承担任何重大债务,除了通常业务经营中的处置或负债以外; |

| 2.1.5 | The Transferor shall warrant that during the transition period:

the Company has not disposed of its major assets or encumbered them with guarantees, nor incurred or assumed any material debt other

than disposals or liabilities in the ordinary course of business operations; |

| 2.1.6 | 乙方确认自2022年12月31日起至本协议签署之日未进行利润分配,且承诺自本协议签署之日起至股权转让完成之日不进行利润分配。 |

| 2.1.6 | Party B shall confirm that it has not made profit distribution

from December 31, 2022 to the date of signing this Agreement, and shall undertake not to make profit distribution from the date of signing

this Agreement to the date of completion of the Equity Transfer. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

第三条

股权转让价款

Article 3 Equity

Transfer Price

| 3.1 | 本合同各方就股权转让价已协商一致,按照协议价进行转让。协议价按照目标公司100%股权价值人民币11000万元(【壹亿壹仟】万元整)进行定价。 |

| 3.1 | The Parties hereto have reached an agreement about the Equity

Transfer Price and shall transfer the equity at the agreed price. The agreed price shall be determined based on 100% of the equity value

of the Target Company of RMB 110,000,000 ([One Hundred and Ten Million Yuan Only]). |

| 3.2 | 本合同各方同意,乙方向甲方转让其持有的目标公司【26】%股权的价款为人民币【2860】万元(【贰仟捌佰陆拾】万元整)。 |

| 3.2 | The Parties hereto shall agree that the transfer price of

the [26] % of the equity of the Target Company held by Party B to Party A shall be [RMB 28,600,000] ([Twenty-eight Million and Six Hundred

Thousand Yuan Only]). |

第四条 股权转让价款的支付

Article 4

Payment of the Equity Transfer Price

| 4.1 | 本合同各方同意按两笔予以支付。甲方于本合同生效且各方约定的前提条件得以满足后5个工作日内向乙方支付50%的股权转让价款;在甲方支付50%股权转让款后15个工作日内,目标公司将26%股权过户至甲方名下;在完成26%股权过户后5个工作日内,甲方将剩余50%股权转让款支付给乙方。乙方应在收款之同时,向甲方开具合规的收据。 |

| 4.1 | The Parties shall agree to make payment in two installments.

Party A shall pay 50% of the Equity Transfer Price to Party B within 5 working days after this Contract takes effect and the prerequisites

agreed upon by the Parties are met; within 15 working days after Party A pays 50% of the Equity Transfer Price, the Target Company shall

transfer 26% equity to Party A; within 5 working days after the completion of the transfer of the 26% equity, Party A shall pay the remaining

50% of Equity Transfer Price to Party B. Party B shall issue a compliant receipt to Party A upon receipt of the payment. |

| 4.2 | 受让方应根据本合同之约定将转让价款支付至转让方如下银行账户或转让方于签署日后另行书面通知的其他银行账户: |

| 4.2 | The Transferee shall pay the transfer price to the following

bank account of the Transferor or other bank account otherwise notified by the Transferor in writing after the signing of the Contract

and in accordance with the provisions of thereof: |

|

户名

Account Name

|

徐升洋

Xu Shengyang

|

|

开户行

Bank of Deposit

|

宁波银行金华分行

Bank of Ningbo, Jinghua Branch

|

|

账户

Account No. |

*** |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

| 4.3 | 各方同意,股权转让所涉及的税款由各方依法承担并缴纳。 |

| 4.3 | The Parties agree that the taxes involved in the Equity Transfer

shall be borne and paid by the Parties in accordance with the law. |

| 4.4 | 公司的未分配利润,以及本次股权转让完成之日前后公司产生的所有利润,由转让后的股东共同享有。 |

| 4.4 | The undistributed profits of the Company and all the profits

generated by the Company before and after the completion date of this Equity Transfer shall be shared by the Shareholders after the transfer. |

第五条

承诺及保证

Article 5 Commitments

and Warranties

| 5.1 | Party A shall warrant and undertake to Party B as follows: |

| 1、

| 甲方是依法注册成立并且合法存续的企业法人,具有依照《公司法》及其公司章程签署本合同的权利能力和行为能力,并有足够的能力全面履行本合同规定的义务。 |

| 1. | Party A is an enterprise legal person legally incorporated and operating in accordance with the applicable

laws, holding the right and capacity to execute this Contract in accordance with the Company Law and its Articles of Association, and

has sufficient ability to perform its obligations hereunder fully. |

| 2、

| 本合同的签署和履行不与甲方公司章程或有关法律、法规、条例等有约束力的规范性文件及签订的协议所承担的义务相冲突。 |

| 2. | The execution and performance of this Contract shall not conflict with the obligations under the Articles

of Association of Party A or the relevant laws, regulations, rules, and other binding normative documents and agreements. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

| 3、

| 提供给公司的所有资料是真实的、完整的、准确的、有效的,不包含任何虚假成分,没有为误导公司而故意省略部分关键事实。 |

| 3. | All information provided to the Company is true, complete, accurate and valid, without any falseness or

intentional omission of any key fact premeditated to mislead the Company. |

| 5.2 | Party B shall warrant to Party A and shall undertake the

following: |

| 1、

| 拥有签订并履行本合同义务的全部权利与授权,并依据中国法律具有签订本合同所有的资格条件和/或行为能力。 |

| 1. | Party B has all the rights and authorization to enter into the Contract and perform the obligations hereunder

and has all the qualifications and/or capacity to enter into this Contract in accordance with the Laws of the People’s Republic

of China. |

| 2、

| 本合同的签订或履行不违反以其为一方的任何重大合同或协议。 |

| 2. | The execution or performance of this Contract does not violate any material contract or agreement to which

it is a party. |

| 3、

| 已就与本次交易向受让方提供的一切文件资料均是真实、有效完整的。 |

| 3. | All documents and materials provided to the Transferee regarding this transaction are true, valid and

complete. |

| 4、

| 在公司股东会上同意选举甲方(受让方)推荐的1名董事候选人为董事。 |

| 4. | Party B shall agree to elect, at a Meeting of the Shareholders of the Company, one Director candidate

recommended by Party A (Transferee). |

| 5、

| 自股权转让完成之日起3年内,不以任何方式(包括设立新的企业)从事与公司业务相同或类似的业务,否则其所得的利润归公司所有。 |

| 5. | Within 3 years of the date of completion of the Equity Transfer, it shall not engage in the same or similar

business as the Company’s business in any way (including by establishing a new enterprise), otherwise any profits arising therefrom

shall be due and given to the Company. |

| 6、

| 甲方依据本协议或其他相关协议约定解除本协议而要求乙方退还受让款及其他款项的,乙方应在约定的期限内予以退还。 |

| 6. | Should Party A terminate this Agreement in accordance herewith or subject to any other relevant agreement,

and then require Party B to refund the transfer payment and other payments, Party B shall refund the payment as agreed. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

| 5.3 | The Target Company (Company) shall warrant and undertake

as follows: |

| 1、

| 公司是依法注册登记并且合法存续的企业法人,具有签署本合同的权利能力和行为能力,并有足够的能力全面履行本合同规定的义务,且本合同的签署和履行不会与公司章程或有关法律、法规、条例等有约束力的规范性文件或签订的协议等所承担的义务相冲突。 |

| 1. | The Company is an enterprise legal person legally incorporated and existing in accordance with the law,

and has sufficient capacity to fully perform the obligations stipulated in this Contract; the execution and performance of this Contract

shall not conflict with the obligations undertaken by the Company under its Articles of Association or relevant laws, regulations, rules

and other binding regulatory documents or agreements entered into. |

| 2. | The Company is responsible for handling the industrial and commercial registration procedures for Equity

Transfer. |

| 3、

| 同意甲方成为公司股东后,有权查阅、复制公司的会计报表、会计账簿和会计凭证或委托注册会计师或财务人员对公司的财务情况进行核查。 |

| 3. | Party A shall have the right to access and copy the Company’s financial statements, accounting books,

and accounting vouchers, or entrust registered accountant or financial personnel to verify the Company’s financial condition after

Party A becomes a Shareholder of the Company. |

| 4、

| 公司应与其主要管理人员及核心技术人员(具体名单详见《股权转让协议》附件一)签订相关竞业禁止的协议,约定其主要管理人员及核心技术人员在公司任职期间不得以任何方式从事与公司业务相竞争的业务经营活动(包括但不限于自己从事或帮助他人从事的方式);其主要管理人员及技术人员因任何原因离职的,如公司要求,自离职之日起两年内,不得在与公司有业务竞争关系的其他企业内任职或自营、帮助他人从事与公司业务相竞争的业务。 |

| 4. | The Company shall enter into a non-compete agreement with its major management personnel and core technical

personnel (see Annex I to the Equity Transfer Agreement for the detailed list), which stipulates that its major management personnel

and core technical personnel shall not engage in any business activities that compete with the Company’s business (including but

not limited to engaging themselves or helping others to engage in such activities) during the period of their employment in the Company;

if its major management personnel and technical personnel leave the Company for any reason, as required by the Company, they shall not,

within two years from the date of departure, take up positions in other enterprises that have business competition with the Company or

operate their own operations or help others to engage in businesses that compete with the Company’s business. |

| 5、

| 已就与本次交易向受让方提供的一切文件资料均是真实、有效完整的。 |

| 5. | All documents and materials provided to the Transferee regarding this transaction are true, valid, and

complete. |

| 6、

| 公司签署本协议完全符合《公司法》、《公司章程》的约定,签署本协议及作出相关承诺经股东会及董事会一致决议通过,不存在任何法律实质及程序的违法违规。 |

| 6. | The execution of this Agreement by the Company is in full compliance with the provisions of the Company

Law and the Articles of Association of the Company. The execution of this Agreement and the relevant commitments have been

unanimously approved by the Shareholders’ meeting and the Board of Directors without any substantial and procedural violation of

any law. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

第六条

相关手续办理

Article 6 Handling

of Relevant Formalities

| 6.1 | 各方同意,由乙方负责协助目标公司办理本合同项下股权转让的工商变更登记手续。 |

| 6.1 | The Parties agree that Party B shall be responsible for assisting

the Target Company to go through the registration formalities for industrial and commercial change related to the Equity Transfer hereunder. |

| 6.2 | 公司应当在取得本次股权转让后换发的营业执照后应在3个工作日内向甲方提供加盖公章的更新后的营业执照复印件以及股东《出资证明书》(附件二)。 |

| 6.2 | The Company shall, within 3 working days after obtaining

the business license renewed after the Equity Transfer, provide Party A with the renewed copy of the business license stamped with the

official seal and the Shareholders’ Capital Contribution Certificate (Annex II). |

| 6.3 | The cost of industrial and commercial change registration

shall be assumed by the Target Company. |

第七条

合同的变更、解除

Article 7 Change

and Termination of Contract

| 7.1 | 本合同的任何修改、变更应经合同各方另行协商,并就修改、变更事项签署书面合同后方可生效。本合同项下的股权转让后,公司章程就有关投资人权利事项的约定与本合同的有关条款不一致的,以本合同为准,除非本合同当事人另行签订补充合同。 |

| 7.1 | Any modification or alteration to this Contract shall not

take effect unless the Parties hereto have negotiated separately and signed a written contract on such modification or alteration. After

the Equity Transfer hereunder, if there is any discrepancy between the provisions of the Articles of Association on the rights of investors

and the relevant provisions of this Contract, this Contract shall prevail, unless the Parties hereto sign a supplementary contract. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

| 7.2 | This Contract shall be terminated under the following circumstances: |

| (1) | The Contract is terminated by mutual agreement of the Parties. |

| (2) | 任一方发生影响股权交易的根本违约行为并在30天内不予更正的,或发生累计两次或以上违约行为,守约方有权单方解除本合同。 |

| (2) | If either party commits a fundamental breach affecting the

equity transaction and fails to correct it within 30 days, or has two or more breaches in total, the non-defaulting party shall have

the right to unilaterally terminate this Contract. |

| (3) | This Contract cannot be performed due to force majeure. |

有权提出解除合同的一方应当以书面形式通知,通知在到达其他各方时生效。

The party entitled to terminate

the Contract shall give a written notice, which shall become effective upon receipt by the other party.

| 7.3 | 本合同解除后,如股权转让并未交割的,则各方无须进行交割;如受让方已支付股权受让款的,则转让方应于收到受让方发出解除通知书之日起15日内退还受让方支付的全部受让款,受让方收到转让方退还的全部受让款及赔偿款和违约金后,按转让方的要求配合办理股权变更登记。 |

| 7.3 | After the termination of this Contract, if the Equity Transfer

is not delivered, the Parties do not need to make delivery; if the Transferee has paid the Equity Transfer Price, the Transferor shall

refund the Equity Transfer payments in full paid by the Transferee within 15 days upon receipt of the notice of termination issued by

the Transferee. Upon receipt of all the Equity Transfer payments returned by the Transferor, as well as compensation and liquidated damages,

the Transferee shall cooperate in the registration of equity change as required by the Transferor. |

| 7.4 | 本合同被解除后,不影响一方当事人要求支付违约金和赔偿损失的权利。 |

| 7.4 | The termination of this Contract shall not affect the right

of a party to demand payment of liquidated damages and compensation for losses. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

第八条

违约责任

Article 8 Liability

for Breach of Contract

| 8.1 | 本合同生效后,各方应按照本合同的规定全面、适当、及时地履行其义务及约定,除不可抗力因素外若本合同的任何一方违反本合同的任何约定,则构成违约。 |

| 8.1 | After this Contract comes into force, each party shall perform

its obligations and provisions in a comprehensive, appropriate, and timely manner in accordance with the provisions of this Contract.

Except for force majeure, any breach of any provision hereof by either party shall constitute a breach of contract. |

| 8.2 | 除非另有约定,各方同意,本合同的违约金为本合同项下股权转让款的5%,但甲方无正当理由逾期支付股权转让款时应付的违约金为每延期一日应向乙方支付逾期付款金额的万分之五。 |

| 8.2 | Unless otherwise agreed, the Parties agree that the liquidated

damages hereof shall be 5% of the Equity Transfer Price hereunder, provided that if Party A delays in paying the Equity Transfer Price

without justifiable reasons, the liquidated damages payable shall be 0.05% of the overdue payment payable to Party B for each day of

delay. |

| 8.3 | 一旦发生违约行为,违约方应当向守约方支付违约金,并赔偿因其违约而给守约方造成的损失。 |

| 8.3 | In case of any breach, the defaulting party shall pay liquidated

damages to the non-defaulting party and compensate the non-defaulting party for the losses caused by its breach. |

| 8.4 | 支付违约金并不影响守约方要求违约方继续履行合同。 |

| 8.4 | The payment of liquidated damages shall not affect the request

of the non-defaulting party to the defaulting party to continue to perform the Contract. |

| | | 股权转让合同 |

| | | Equity Transfer Contract |

第九条

争议的解决

Article 9 Dispute

Resolution

| 9.1 | 本合同的效力、解释及履行均适用中华人民共和国法律。 |

| 9.1 | The validity, interpretation, and performance of this Contract

shall be governed by the laws of the People’s Republic of China. |

| 9.2 | 合同各方当事人因本合同发生的任何争议,均应首先通过友好协商解决,协商不成,任何一方可向丙方所在地的人民法院提起诉讼。 |

| 9.2 | Any dispute arising out of this Contract shall be settled

by the Parties through friendly negotiation. If negotiation fails, either party may file a lawsuit with the People’s Court at the

place where Party C is located. |

第十条

通知及送达

Article 10 Notice

and Service

| 10.1 | 在本合同有效期内,因法律、法规、政策的变化,或任一方丧失履行本合同的资格和/或能力,导致影响本合同的履行,该方应承担相应的在合理时间内通知的义务。 |

| 10.1 | During the term of this Contract, if the performance of this

Contract is affected by changes in laws, regulations, and policies, or if either party loses its qualification and/or capacity to perform

this Contract, such party shall be obliged to give corresponding notice within a reasonable time. |

| 10.2 | 合同各方同意,与本合同有关的任何通知,以书面送达方式方为有效。 |

| 10.2 | The Parties agree that any notice in connection with this

Contract shall be effective only if it is served in writing. |

| 10.3 | 通知送达下列地点或各方的实际经营地或住所地: |

| 10.3 | The notice shall be served to the following places or the

actual place of business or domicile of each party: |

甲方地址:

浙江省绍兴市杭州湾上虞经济技术开发区纬七东路5号

Address of Party A: No.5, Weiqi

East Road, Shangyu Economic and Technological Development Zone, Hangzhou Bay, Shaoxing City, Zhejiang Province

乙方地址:

浙江省金华市婺城区雅畈镇下店村37号

Address of Party B: No.37,

Xiadian Village, Yafan Town, Wucheng District, Jinhua City, Zhejiang Province

丙方地址:

浙江省金华市婺城区金西经济开发区丹霞路500号

Address of Party C: No.500,

Danxia Road, Jinxi Economic Development Zone, Wucheng District, Jinhua City, Zhejiang Province

| | | 股权转让合同 |

| | | Equity Transfer Contract |

第十一条

合同的生效

Article 11 Effectiveness

of the Contract

本合同由各方在本合同文首注明之日签署并于签署之日起生效。

This Contract shall be executed

by the Parties on the date indicated at the beginning of this Contract and shall come into force on the date of execution.

第十二条

其他

Article 12 Miscellaneous

| 12.1 | 本合同的任何条款无效,且其无效对本合同的履行不产生根本性影响时,该等条款的无效不影响本合同其它条款的效力。 |

| 12.1 | In the event that any provision of this Contract is invalid

and its invalidity does not fundamentally affect the performance of this Contract, the invalidity of such provision shall not affect

the validity of other provisions hereof. |

| 12.2 | 任何一方未能行使或迟延行使其在本合同项下之任何权利,并不构成对该等权利的放弃;任何一方未能追究或迟延追究其他方当事人在本合同项下的责任并不构成对该等责任的豁免。 |

| 12.2 | The failure or delay by either party to exercise any of its

rights hereunder shall not constitute a waiver of such right; the failure or delay by either party to hold the other party liable under

this Contract shall not constitute a waiver of such liability. |

| 12.3 | 本合同一式叁份,本合同各方各执一份,其余由目标公司持有以报有关登记机关办理变更登记之用。如果在工商登记备案中需要另行根据工商行政管理局或市场监督管理局要求签订股权转让协议等文书,各方可以另行签订,但协议内容与本协议发生冲突或不一致的,以本协议为准。 |

| 12.3 | This Contract is made in triplicate, with each party holding

one copy and the rest held by the Target Company for change registration with the relevant registration authority. If it is necessary

to enter into an Equity Transfer agreement or other instruments as required by the Administration for Industry and Commerce or the Administration

for Market Regulation for the industrial and commercial registration and filing, the Parties may enter into such instruments separately.

In the event of any conflict or inconsistency between the content of such agreement and this Agreement, this Agreement shall prevail. |

(以下无正文)

(THE REMAINDER OF

THIS PAGE IS INTENTIONALLY LEFT BLANK)

| | | 股权转让合同 |

| | | Equity Transfer Contract |

(本页为浙江升阳再生资源科技有限公司《股权转让合同》的签署页)

(Signature Page of Equity Transfer Contract

for Zhejiang Shengyang Renewable Resources Technology Co., Ltd.)

转让方(签名)

Transferor (signature) /s/ Xu Shengyang

受让方(公章)

Transferee (official seal): Zhejiang Hitrans

Lithium Technology Co., Ltd.

授权代表:

Authorized representative: /s/ Wu Haijun

目标公司(公章)

Target Company (official seal): Zhejiang

Shengyang Renewable Resources Technology Co., Ltd.

授权代表:

Authorized representative: /s/ Xu Shengyang

附件一

Annex I

浙江升阳再生资源科技有限公司主要管理人员和核心技术人员名单

List of Major Management Personnel

and Core Technical Personnel of Zhejiang Shengyang Renewable Resources Technology Co., Ltd.

|

序号

S/N

|

姓名

Name

|

职务

Title

|

| 1 |

徐升洋

Xu Shengyang

|

董事长

Chairman

|

| 2 |

陆文

Lu Wen

|

总经理

General Manager

|

| 3 |

徐奕臻

Xu Yizhen |

副总经理

Deputy General Manager |

附件二

Annex II

浙江【】有限公司

Zhejiang [ ] Co., Ltd.

出资持股证明书

Capital Contribution Certificate

致:【】

To: [ ]

贵公司对【】有限公司(本“公司”)已完成出资金额人民币【】元(其中人民币【】万元作为对公司注册资本的增资,人民币【】元作为公司的资本公积金)。

In witness whereof, your company

has completed a capital contribution of RMB [ ] (including RMB [ ] as an increase in the registered capital of the Company and RMB [ ]

as the Company’s capital reserve) to [ ] Co., Ltd. (the “Company”).

出资后,贵公司持有本公司【】万元注册资本,即持有公司约【】%的股份。

After the capital contribution,

your company holds a registered capital of RMB [ ], which is approximately [ ]% of the Company’s shares.

特此证明。

特此证明。

| |

【】有限公司(公章) |

| |

|

| |

[ ] Co., Ltd. (official seal) |

| |

|

| |

法定代表人签署: |

| |

|

| |

Legal representative (signature): |

| |

|

| |

日期:2023年 月 日 |

| |

|

| |

Date: , 2023 |

Exhibit 99.1

CBAK Energy Announces a Strategic Investment

in BAK Power

DALIAN, China, Sept. 28, 2023 /PRNewswire/ --

CBAK Energy Technology, Inc. (NASDAQ: CBAT) (“CBAK Energy,” or the “Company”), a leading lithium-ion battery manufacturer

and electric energy solution provider in China, today announced that its wholly-owned subsidiary, Nanjing CBAK New Energy Technology Co.,

Ltd (“Nanjing CBAK”), has reached an agreement with Shenzhen BAK Battery Co., Ltd. (“BAK Battery”) to acquire, from

BAK Battery, a 5% stake in Shenzhen BAK Power Battery Co., Ltd. (“BAK Power”), an unrelated, well-respected power battery R&D

and manufacturing company.

Under the terms of the agreement, Nanjing CBAK

will acquire a 5% stake in BAK Power for RMB260 million (or approximately $35.57 million), based on a mutually agreed-upon fair market

valuation of RMB5.2 billion (or approximately $710 million). As one of China’s leading companies in the development of model 46800 batteries,

BAK Power has agreed to supply its battery products to CBAK Energy, creating synergy with models 46115 and 46157 batteries developed by

CBAK Energy and reinforcing product supply while establishing non-compete agreements for certain key customers.

Founded in 2001, BAK Power, as one of the foremost

lithium battery manufacturers in China, is dedicated to developing a global new energy business. Leveraging its core technology of self-developed

lithium batteries, BAK Power focuses on promoting efficient power supply for electric vehicles and providing stable energy storage system

products. BAK Power is recognized for its research and development of power batteries and advancing cylindrical lithium battery technology.

BAK Power has consistently remained at the forefront of the industry due to its forward-looking approach and continuous innovation.

Existing main shareholders of BAK Power include

renowned Chinese financial institutions, including: China Cinda Asset Management Co., Ltd., one of China’s largest asset management companies;

Shenzhen Capital Group Co., Ltd., a top-tier Chinese private equity firm; and CMS Capital Co., Ltd., one of the largest broker-owned investment

firms in China.

Yunfei Li, Chairman and Chief Executive Officer

of CBAK Energy, stated, “We’re thrilled to be bringing CBAK Energy and BAK Power together. This strategic acquisition of a minority

interest in BAK Power will enable us to leverage our collective expertise and resources to drive innovation and deliver advanced products

to our customers, enhancing our leading position in the power battery industry and further strengthening our capability in cylindrical

lithium battery production and electric energy solutions.”

About CBAK Energy

CBAK Energy Technology, Inc. (NASDAQ: CBAT) is

a leading high-tech enterprise in China engaged in the development, manufacturing, and sales of new energy high power lithium

batteries and raw materials for use in manufacturing high power lithium batteries. The applications of the Company’s products and

solutions include electric vehicles, light electric vehicles, electric tools, energy storage, uninterruptible power supply (UPS), and

other high-power applications. In January 2006, CBAK Energy became the first lithium battery manufacturer in China listed

on the Nasdaq Stock Market. CBAK Energy has multiple operating subsidiaries in Dalian, Nanjing and Shaoxing, as well as

a large-scale R&D and production base in Dalian.

For more information, please visit ir.cbak.com.cn.

Safe Harbor Statement

This press release contains “forward-looking

statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained

in this press release, including statements regarding the Company’s future results of operations and financial position, strategy,

plans, and expectations for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. The Company has attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Actual

results of the Company may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking

statements.

The forward-looking statements included in this

press release are made as of the date of this press release and the Company undertakes no obligation to publicly update or revise any

forward-looking statements, other than as required by applicable law.

For further inquiries, please contact:

In China:

CBAK Energy Technology, Inc.

Investor Relations Department

Phone: 86-18675423231

Email: ir@cbak.com.cn

Piacente Financial Communications

Ms. Hui Fan

Tel: +86-10-6508-0677

Email: CBAK@thepiacentegroup.com

In the United States:

Piacente Financial Communications

Ms. Brandi Piacente

Tel: +1-212-481-2050

Email: CBAK@thepiacentegroup.com

v3.23.3

Cover

|

Sep. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 27, 2023

|

| Entity File Number |

001-32898

|

| Entity Registrant Name |

CBAK ENERGY TECHNOLOGY, INC.

|

| Entity Central Index Key |

0001117171

|

| Entity Tax Identification Number |

86-0442833

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

BAK Industrial Park

|

| Entity Address, Address Line Two |

Meigui Street

|

| Entity Address, Address Line Three |

Huayuankou Economic Zone

|

| Entity Address, City or Town |

Dalian

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

116450

|

| City Area Code |

86

|

| Local Phone Number |

3918-5985

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CBAT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

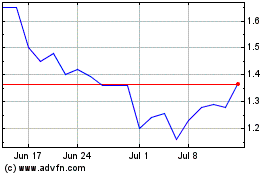

CBAK Energy Technology (NASDAQ:CBAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

CBAK Energy Technology (NASDAQ:CBAT)

Historical Stock Chart

From Jul 2023 to Jul 2024