Current Report Filing (8-k)

June 05 2023 - 6:04AM

Edgar (US Regulatory)

0001447362FALSE00014473622023-06-052023-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2023

Castle Biosciences, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-38984 | | 77-0701774 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 505 S. Friendswood Drive, Suite 401 Friendswood, Texas | | 77546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (866) 788-9007

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | CSTL | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Castle Biosciences, Inc. (the “Company”) reaffirms its previously provided revenue guidance for the year ending December 31, 2023 of $170-$180 million. The Company also reaffirms its previously provided targets for the year ending December 31, 2025 relating to (i) total revenue of $255-$330 million and (ii) net operating cash flow positivity.

The information contained or incorporated in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which are subject to the “safe harbor” created by those sections. These forward-looking statements consist of statements regarding: (i) the Company’s expected total revenue for the year ending December 31, 2023 and (ii) the Company’s expectations for total revenue for the year ending December 31, 2025 and achieving net operating cash flow positivity by 2025. Actual future results may differ materially from those projected as a result of certain risks and uncertainties. These risks and uncertainties include, without limitation: the accuracy of the Company’s assumptions and expectations underlying its fiscal 2023 revenue and three-year revenue and net operating cash flow financial targets (including, without limitation, its assumptions or expectations regarding continued reimbursement for its products and subsequent coverage decisions for such products; the estimated total addressable markets for its products and pipeline products; the related expenses, capital requirements and potential needs for additional financing; the anticipated cost, timing and success of its product candidates; its plans to research, develop and commercialize new tests; and its ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions); adverse determinations by third party payors, including with respect to reimbursement coverage; the effects of macroeconomic events and conditions, including inflation, the COVID-19 pandemic and geopolitical events, among others, on its business and its efforts to address the impacts of such events; subsequent study or trial results and findings may contradict earlier study or trial results and findings; actual application of its tests may not provide the expected benefits to patients; and the risks set forth under “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 and in the Company’s other filings with the Securities and Exchange Commission. The forward-looking statements are applicable only as of the date on which they are made, and the Company does not assume any obligation to update any forward-looking statements, except as may be required by law.

| | |

| SIGNATURES |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | | |

| CASTLE BIOSCIENCES, INC. |

| | | |

| | | |

| By: | /s/ Frank Stokes | |

| | Frank Stokes | |

| | Chief Financial Officer | |

| Date: June 5, 2023 | | | |

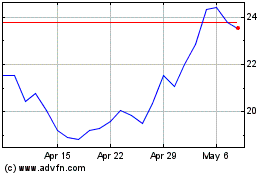

Castle Biosciences (NASDAQ:CSTL)

Historical Stock Chart

From Jun 2024 to Jul 2024

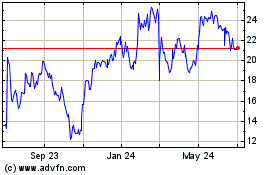

Castle Biosciences (NASDAQ:CSTL)

Historical Stock Chart

From Jul 2023 to Jul 2024