false

0001069530

0001069530

2024-10-08

2024-10-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 8, 2024

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41905

|

91-1911336

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

6801 N Capital of Texas Highway, Building 1; Suite 300

Austin, Texas 78731

(Address of principal executive offices, including zip code)

(512) 501-2444

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

|

SAVA

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

On October 8, 2024, Rick Barry, President and Chief Executive Officer of Cassava Sciences, Inc., issued An Open Letter to the Cassava Community. A copy of the letter is attached as Exhibit 99.1 hereto and incorporated into this Item 7.01 by reference.

The information furnished in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

9.01: Financial Statements and Exhibits

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CASSAVA SCIENCES, INC.

|

|

| |

a Delaware corporation

|

|

| |

|

|

|

|

Date: October 8, 2024

|

|

|

|

| |

By:

|

/s/ ERIC J. SCHOEN

|

|

| |

|

Eric J. Schoen

|

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

An Open Letter from President and CEO Rick Barry to the Cassava Community:

Patients and their Loved Ones, Caregivers, Principal Investigators, Shareholders and Employees

October 8, 2024

A lot has happened in the few months since I last wrote to you. It’s time that I update you on what has taken place here at Cassava and the substantial progress that we have made.

I am happy to inform you that our ReTHINK Phase 3 clinical trial recently completed its last patient, last visit. All patients have completed dosing, and all that remains is to collect and analyze the data. For a company our size, this is a remarkable achievement. This study enrolled 804 patients at 77 sites in the US, Puerto Rico, Canada, and Australia. Patients were randomized 1:1 between placebo and simufilam 100 mg, twice daily. Approximately 70% of the patients entered the study with mild Alzheimer’s disease, while 30% entered with moderate Alzheimer’s.

We expect to announce top-line results of the ReTHINK trial before year end. We submitted our proposed Statistical Analysis Plan to FDA in July and are now responding to comments that we have received from the agency. We expect to finalize the Statistical Analysis Plan in the near term.

This study has been rigorously designed and executed. The trial is managed by Premier Research International as our clinical research organization. After Premier has completed its final review procedures regarding the completeness and accuracy of the data, the database will be locked. No changes to the data will be made after database lock.

All statistical analyses will be performed by independent biostatisticians at Pentara Corporation. Importantly, the database will be sent directly from the clinical research organization to the biostatisticians at Pentara, as was the case with our open-label Phase 2 study data. Only then will the statisticians receive unblinding codes from Premier. Pentara will notify us when their top-line statistical analyses have been completed. Cassava will have no access to the unblinded data until after Pentara has performed its statistical analyses.

The primary co-endpoints for the ReTHINK trial, as defined by a Special Protocol Assessment with the FDA, are the ADAS-Cog12 and ADCS-ADL scales. A successful trial will demonstrate a statistically significant difference between drug and placebo in the change from baseline on these scales. The planned announcement of top-line data before year end 2024 will also include plasma biomarker data from approximately 100 patients. Plasma samples are being provided directly to an independent, accredited commercial laboratory, which will perform analyses of these samples under blinded conditions.

We plan to follow these data with top-line results from our second, larger Phase 3 trial, ReFOCUS, in mid-2025. That study enrolled 1,125 patients at 78 sites who were randomized 1:1:1 in three arms (50mg, 100mg, and placebo). Significantly, there is no overlap between the sites in ReTHINK and ReFOCUS, so the data they produce will be independent of one another in that respect. The enrollment criteria and the primary endpoints for the two trials are the same, though ReFOCUS contains some interesting additional sub-studies. In that trial, we will measure cerebrospinal fluid biomarkers in addition to plasma biomarkers, and we will also analyze MRI and PET images.

You may also have seen a couple of weeks ago that the Data and Safety Monitoring Board met, as scheduled, for the third time concerning our Phase 3 program. As before, the Board evaluated our interim patient safety database and recommended that we continue the Phase 3 program without modification.

I couldn’t be more proud of our clinical team and their execution of our Phase 3 program.

Shifting to a more displeasing topic, to appropriately focus on the critical task of simufilam’s development, we made the difficult, but appropriate, decision to enter a settlement with the Securities and Exchange Commission. In sum, we have been able to put the SEC’s three-year investigation of Cassava behind us by agreeing to settle a charge of negligently making inaccurate disclosures related to our 2020 Phase 2b clinical study and paying a $40 million monetary penalty. In addition, we do not anticipate that the Department of Justice will charge the company or seek a resolution from us.

Through our engagement with the SEC, a special committee of our Board of Directors was able to conduct their own investigation into the SEC’s allegations. The committee’s work was painstakingly thorough and enabled us to disclose supplemental information relating to the committee’s findings on July 1, 2024.

$40 million is a staggering sum of money, especially for a development-stage life sciences company. We are acutely aware that this precious capital could have been used for many other value-creating purposes. Nevertheless, we believe that it was a necessary step so that we could focus all our attention on the development of simufilam rather than being distracted by ongoing government investigations. Make no mistake, we recognize this as a very sad chapter in Cassava’s history.

Against this backdrop, we have taken a number of steps to enhance corporate governance, transparency, and accountability, including the separation of the CEO and Board Chair roles.

Corporate governance doesn’t need to be complicated. Shareholders own public companies. They elect directors, including independent directors, to manage companies in the shareholders’ best interests. Directors hire CEOs and provide input on the hiring of other key executives. Directors also provide oversight to ensure that management is executing a plan that they believe will create value for shareholders. This is how shareholder friendly companies operate. This is how we operate.

We have been asked a lot of questions about the SEC settlement and our Phase 2b study. The Phase 2b study was a 28-day trial with 64 patients across three arms that was not powered for statistical significance. Given the inherent limitations of such small sample sizes, often referred to as the tyranny of small numbers, the Company believes that it is more helpful to focus on examining the two-year Phase 2 safety study that concluded earlier this year.

The Phase 2 study enrolled 216 patients and consisted of a 12-month open-label treatment phase followed by a six-month “cognition maintenance study” at month 12 in which patients were randomized 1:1 between drug and placebo. For the last six months of the trial, all patients were again administered simufilam. Statistical analysis for the Phase 2 trial was performed by Pentara based on raw data collected at 16 clinical sites in the US.

Among the results of this Phase 2 study, 47 mild patients who took open-label simufilam continuously for 24 months experienced no mean decline in cognition as measured by ADAS-Cog11 as a group. Another 40 mild patients who took placebo for six of the 24 months declined by a mean of one point as a group. During the six-month randomization period, mild patients who were administered drug showed a trend of performing better as a group than those administered placebo, though this small, randomized portion of the study was not powered for, and did not reach, statistical significance. Patients in the study with moderate Alzheimer’s, including the 32 moderate patients who received simufilam treatment continuously for two years, declined in cognition much more than mild patients.

I recommend that you review the results for yourself. Our February 2024 press release (available here) describes top-line results from that 24-month Phase 2 study. A presentation from Suzanne Hendricks of Pentara to the 2023 CTAD conference (available here) describes the results of the placebo-controlled cognition maintenance study and compares the open-label data to historical placebo groups.

None of this is meant to imply that our Phase 3 trials will generate results similar to the open-label Phase 2 study. We won’t know the outcome until later this year when we release top-line results of the first of our large, randomized, well-controlled studies.

An effective, twice-daily oral medication with a compelling safety profile would be a valuable benefit to patients, their loved ones, and physicians. Our goal is to deliver such a medication to those who suffer from this cruel disease. Our first Phase 3 clinical trial, ReTHINK, has completed dosing, and ReFOCUS is only months away from completion. In the meantime, nearly 90% of all Phase 3 patients (currently, more than 1,000 individuals) have elected to participate in an extension trial where they receive open-label simufilam. With results imminent, we are disheartened that some detractors would openly root for the failure of a promising potential Alzheimer’s treatment.

We recognize the serious questions raised about some of the work performed at City University of New York, but those accusations do not negate the entire scientific body of evidence for our drug. We have previously highlighted independent research that supports the biological activity of simufilam, such as that conducted by researchers at the Cochin Institute in Paris and at Yale University. We are evaluating ways to make this information more readily accessible for journalists, investors, or anyone curious about our drug. We believe that some of our critics have mischaracterized the scientific and clinical basis supporting simufilam, while cherry-picking and taking out of context statements that we have made. We encourage interested parties to make their own determination in light of the information that we have provided.

When I was named Executive Chair in July, I did not expect to become Chief Executive Officer of Cassava. My goal was to provide stability and leadership while recruiting a seasoned CEO who could help the company succeed. As a Director, I was not directly exposed to the entire Cassava organization, and I didn’t fully appreciate the company culture. As I spent an increasing amount of time in Austin, I came to understand what these professionals were all about. They, like I, are singularly focused on making a difference in the lives of Alzheimer’s patients.

Thanks to the genuine passion of my fellow employees, I welcome the opportunity as CEO to potentially help bring a badly needed therapy to Alzheimer’s patients. Each of us could do a lot of things with our lives, but nothing is more important than our mission. If our Phase 3 program produces success, we will have made a significant contribution to the millions of patients and their families who live with the reality of this disease. If we fail, no one will be more crestfallen than we will be, but we also will know that we have done our best. Our patients deserve no less.

Rick Barry

Cautionary Note Regarding Forward-Looking Statements:

This letter contains forward-looking statements within the meaning of U.S. federal securities laws that may include but are not limited to statements regarding: the impact on Cassava Sciences of its settlement with the SEC; the status of, and developments related to, DOJ inquiries and investigations; the implementation of remedial measures and actions to enhance governance, transparency and accountability; the advancement and outcome of our ongoing Phase 3 clinical trials of simufilam in patients with Alzheimer's disease; the safety or efficacy of simufilam in people with Alzheimer’s disease; and the potential benefits, if any, of our product candidates. These statements may be identified by words such as “anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,” “may,” “opportunities,” “plan,” “possible,” “potential,” “will,” and other words and terms of similar meaning. Such statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, those described in the section entitled “Risk Factors” in Cassava Sciences’ Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the period ended June 30, 2024, and subsequent reports filed with the SEC. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this letter are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, Cassava Sciences disclaims any intention or responsibility for updating or revising any forward-looking statements.

v3.24.3

Document And Entity Information

|

Oct. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Cassava Sciences, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41905

|

| Entity, Tax Identification Number |

91-1911336

|

| Entity, Address, Address Line One |

6801 N Capital of Texas Highway

|

| Entity, Address, Address Line Two |

Building 1; Suite 300

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78731

|

| City Area Code |

512

|

| Local Phone Number |

501-2444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SAVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001069530

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

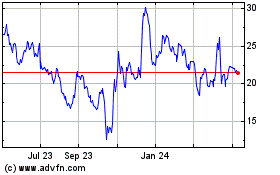

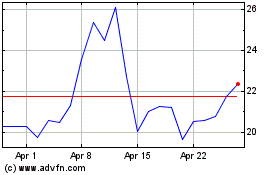

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Nov 2023 to Nov 2024