0001829576false00018295762024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20429

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

CARTER BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 001-39731 | 85-3365661 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (IRS Employer

Identification No.) |

1300 Kings Mountain Road, Martinsville, Virginia 24112

(Address of Principal Executive Offices) (Zip Code)

(276) 656-1776

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

| Common Stock, $1.00 par value | CARE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. OTHER EVENTS.

Carter Bankshares, Inc. Issues Statement Regarding Lawsuit Filed in Virginia by GLAS Trust Company LLC

In order to provide further clarity, Carter Bankshares, Inc. (the “Company”), the holding company for Carter Bank & Trust (“Carter Bank”), is providing additional information relating to the lawsuit filed in the United States District Court for the Western District of Virginia on February 12, 2024 (the “Lawsuit”) by GLAS Trust Company LLC (“GLAS”).

The claims in the Lawsuit relate to a series of financing transactions that occurred between five and six years ago in 2018 between Bluestone Resources, Inc. (“Bluestone Resources”), its subsidiary Bluestone Coal Sales Corporation (“Bluestone Sales”, and together with Bluestone Resources and their respective affiliates, the “Bluestone Entities”), and Greensill (UK) Limited, Ltd. (“Greensill”). The Bluestone Entities are owned and controlled by West Virginia Governor James C. Justice, II, his wife Cathy Justice, and his son James C. Justice, III. Greensill was a supply chain finance company based in the United Kingdom that filed for insolvency protection in 2021. GLAS alleges that it serves as trustee for investors that acquired notes via a series of securities transactions that repackaged the Bluestone Entities’ obligations to repay Greensill and sold them to those investors.

The Lawsuit is an attempt to recover from Carter Bank approximately $226 million that was paid to Carter Bank on account of loans owed by certain Bluestone Entities and other entities owned or controlled by West Virginia Governor James C. Justice, II, his wife Cathy Justice, and/or his son James C. Justice, III. Carter Bank received those funds as part of routine refinance and payment transactions in good faith and in the ordinary course, as repayment of amounts owed to Carter Bank. Neither the Company nor Carter Bank was a party to any financing arrangement between Greensill and the Bluestone Entities.

The Company and Carter Bank strongly believe that the factual allegations in the Lawsuit regarding transactions involving Carter Bank are false and misleading, and the Company and Carter Bank vehemently object to GLAS’s attempt in the Lawsuit to question these repayments. The Company and Carter Bank deny the allegations contained in the Lawsuit and intend to defend vigorously all claims asserted in the Lawsuit. Based on information presently available to the Company and Carter Bank, the Company believes that Carter Bank has meritorious defenses to all allegations contained in the Lawsuit; however, because the Lawsuit is in its early stages, no prediction can be made as to the ultimate outcome thereof.

During the course of Carter Bank’s lending transactions with West Virginia Governor James C. Justice, II, his wife, Cathy L. Justice, his son, James C. Justice, III, and various Justice Entities, each of James C. Justice, II, his wife, Cathy L. Justice, his son, James C. Justice, III, and each Justice Entity, agreed (the “Justice Indemnity Agreement”) to indemnify, defend and hold harmless Carter Bank from damages, claims, liabilities, losses, and expenses incurred in connection with certain claims that may be asserted against Carter Bank, including the claims that are asserted in the Lawsuit. These indemnity obligations are supported by substantial pledged collateral. The Company and Carter Bank intend to pursue vigorously all remedies afforded to Carter Bank under the Justice Indemnity Agreement. Included among the Justice Entities that are parties to the Justice Indemnity Agreement are Greenbrier Hotel Corporation, Greenbrier Medical Institute, LLC, Greenbrier Golf & Tennis Club Corporation, The Greenbrier Sporting Club, Inc., The Greenbrier Sporting Club Development Company, Inc., and Oakhurst Club, LLC.

Important Note Regarding Forward-Looking Statements

Certain matters discussed in this Current Report on Form 8-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to the Company’s financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting the Company and its future business and operations, and specifically including information and expectations related to the Lawsuit and related matters and transactions, Carter Bank’s loans to the Justice Entities, the Justice Indemnity Agreement, and related legal and collection proceedings. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although the Company believes the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements. For a discussion of factors that could affect our business and financial results, see the “Risk Factors” outlined in our periodic and current report filings with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. The Company cautions you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and the Company undertakes no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CARTER BANKSHARES, INC. |

| | (Registrant) |

| | | | | | | | |

| Date: February 15, 2024 | By: | /s/ Litz H. Van Dyke |

| Name: | Litz H. Van Dyke |

| Title: | Chief Executive Officer |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

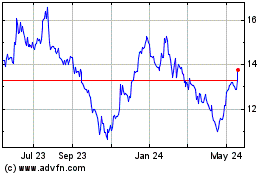

Carter Bankshares (NASDAQ:CARE)

Historical Stock Chart

From Nov 2024 to Dec 2024

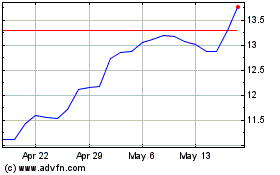

Carter Bankshares (NASDAQ:CARE)

Historical Stock Chart

From Dec 2023 to Dec 2024