0001213037FALSE00012130372024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

Cardiff Oncology, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35558 | 27-2004382 |

| (State or other jurisdiction | (Commission File Number) | IRS Employer |

| of incorporation or organization) | | Identification No.) |

11055 Flintkote Avenue

San Diego, CA 92121

(Address of principal executive offices)

Registrant’s telephone number, including area code: (858) 952-7570

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

Common Stock | | CRDF | | Nasdaq Capital Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Conditions.

On August 8, 2024, Cardiff Oncology, Inc. issued a press release announcing company highlights and financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 8, 2024

| | | | | | | | |

| CARDIFF ONCOLOGY, INC. |

| |

| |

| By: | /s/ Mark Erlander |

| | Mark Erlander |

| | Chief Executive Officer |

Cardiff Oncology Reports Second Quarter 2024 Results and Provides Business Update

- Initial readout from first-line RAS-mut. mCRC randomized CRDF-004 trial expected in 2H 2024 -

- Published preclinical data underscores the ability of onvansertib to overcome resistance to PARP inhibitors in high-grade serous ovarian carcinomas -

- Five abstracts presented at AACR provide strong scientific rationale for the clinical development of onvansertib across multiple tumor types and various combinations -

- Cash and equivalents of $60 million as of June 30, 2024, projected runway through the end of Q3 2025 -

- Company will hold a conference call today at 4:30 p.m. ET/1:30 p.m. PT -

SAN DIEGO, August 8, 2024 -- Cardiff Oncology, Inc. (Nasdaq: CRDF), a clinical-stage biotechnology company leveraging PLK1 inhibition to develop novel therapies across a range of cancers, today announced financial results for the second quarter ended June 30, 2024, and provided a business update.

“The first half of 2024 has been productive for Cardiff Oncology as we have been focused on the enrollment of our CRDF-004 trial for first-line treatment of RAS-mutated mCRC evaluating onvansertib + chemo/bev,” said Mark Erlander, Ph.D., Chief Executive Officer of Cardiff Oncology. “We are working closely with our clinical operations partner, Pfizer Ignite, and are encouraged by ongoing enrollment trends at the 33 sites currently open to enrollment. We believe the robust body of evidence generated to date from our Phase 1b/2 and ONSEMBLE trials lays a strong foundation for our upcoming data readout for CRDF-004 later this year. Furthermore, we are optimistic about the potential of onvansertib to change the treatment paradigm for the entire first-line RAS-mutated mCRC patient population who has not had access to any new therapies in over 20 years.”

Upcoming expected milestones

•First-line RAS-mutated mCRC randomized data readout expected in 2H 2024

Company highlights for the quarter ended June 30, 2024 and subsequent weeks include:

•Updated clinical development plan for metastatic pancreatic ductal adenocarcinoma (mPDAC) with a planned new investigator-initiated trial

◦The new mPDAC trial will evaluate onvansertib in combination with the recently approved first-line standard of care, NALIRIFOX, details of which we will announce when available. The trial replaces a previously planned Phase 2 trial of onvansertib in combination with first-line standard of care, Gemzar® and Abraxane®.

•Published preclinical data of the combination of onvansertib and olaparib in olaparib-resistant ovarian cancer models in a peer-reviewed journal

◦The combination of onvansertib and olaparib, a PARP inhibitor approved in ovarian cancer, demonstrated inhibition of tumor growth and prolonged survival in olaparib-resistant high-grade serous ovarian carcinomas. The combination was well tolerated in vivo, and these findings underscore onvansertib's ability to slow the progressions of ovarian carcinomas. Resistance to olaparib has been shown in clinical settings and these data support the ability of onvansertib to resensitize ovarian cancers to PARP inhibitors.

•Presented five abstracts at AACR providing a strong scientific rationale for the clinical development of onvansertib across multiple tumor types and various combinations

◦The posters are located in the “Scientific Presentations” section of the Cardiff Oncology website and a press release summarizing the data can be found here.

Second Quarter 2024 Financial Results

Liquidity, cash burn, and cash runway

As of June 30, 2024, Cardiff Oncology had approximately $60.3 million in cash, cash equivalents, and short-term investments.

Net cash used in operating activities for the second quarter of 2024 was approximately $9.2 million, an increase of approximately $2.1 million from $7.1 million for the same period in 2023.

Based on its current expectations and projections, the Company believes its current cash resources are sufficient to fund its operations through the end of Q3 2025.

Operating results

Total operating expenses were approximately $12.7 million for the three months ended June 30, 2024, an increase of $0.4 million from $12.3 million for the same period in 2023. The increase in operating expenses was primarily due to clinical programs and outside service costs related to the development of our lead drug candidate, onvansertib, offset by an employee severance agreement which occurred during the previous period.

Conference Call and Webcast

Cardiff Oncology will host a corresponding conference call and live webcast at 4:30 p.m. ET/1:30 p.m. PT on August 8, 2024. Individuals interested in listening to the live conference call may do so by using the webcast link in the "Investors" section of the company's website at www.cardiffoncology.com. A webcast replay will be available in the investor relations section on the company's website following the completion of the call.

About Cardiff Oncology, Inc.

Cardiff Oncology is a clinical-stage biotechnology company leveraging PLK1 inhibition, a well-validated oncology drug target, to develop novel therapies across a range of cancers. The Company's lead asset is onvansertib, a PLK1 inhibitor being evaluated in combination with standard of care (SoC) therapeutics in clinical programs targeting indications such as RAS-mutated metastatic colorectal cancer (mCRC), as well as in ongoing and planned investigator-initiated trials in metastatic pancreatic ductal adenocarcinoma (mPDAC), small cell lung cancer (SCLC) and triple negative breast cancer (TNBC). These programs and the Company's broader development strategy are designed to target tumor vulnerabilities in order to overcome treatment resistance and deliver superior clinical benefit compared to the SoC alone. For more information, please visit https://www.cardiffoncology.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified using words such as "anticipate," "believe," "forecast," "estimated" and "intend" or other similar terms or expressions that concern Cardiff Oncology's expectations, strategy, plans or intentions. These forward-looking statements are based on Cardiff Oncology's current expectations and actual results could differ materially. There are several factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results; our clinical trials may be suspended or discontinued due to unexpected side effects or other safety risks that could preclude approval of our product candidate; results of preclinical studies or clinical trials for our product candidate could be unfavorable or delayed; our need for

additional financing; risks related to business interruptions, including the outbreak of an epidemic or pandemic such as the COVID-19 coronavirus and cyber-attacks on our information technology infrastructure, which could seriously harm our financial condition and increase our costs and expenses; uncertainties of government or third party payer reimbursement; dependence on key personnel; limited experience in marketing and sales; substantial competition; uncertainties of patent protection and litigation; dependence upon third parties; and risks related to failure to obtain FDA clearances or approvals and noncompliance with FDA regulations. There are no guarantees that our product candidate will be utilized or prove to be commercially successful. Additionally, there are no guarantees that future clinical trials will be completed or successful or that our product candidate will receive regulatory approval for any indication or prove to be commercially successful. Investors should read the risk factors set forth in Cardiff Oncology's Form 10-K for the year ended December 31, 2023, and other periodic reports filed with the Securities and Exchange Commission. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and Cardiff Oncology does not undertake any obligation to update publicly such statements to reflect subsequent events or circumstances.

Cardiff Oncology Contact:

James Levine

Chief Financial Officer

858-952-7670

jlevine@cardiffoncology.com

Investor Contact:

Kiki Patel, PharmD

Gilmartin Group

332-895-3225

Kiki@gilmartinir.com

Media Contact:

Grace Spencer

Taft Communications

609-583-1151

grace@taftcommunications.com

Cardiff Oncology, Inc.

Condensed Statements of Operations

(in thousands, except for per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Royalty revenues | $ | 163 | | | $ | 108 | | | $ | 368 | | | $ | 191 | |

| Costs and expenses: | | | | | | | |

| | | | | | | |

| Research and development | 9,493 | | | 8,020 | | | 17,501 | | | 17,072 | |

| Selling, general and administrative | 3,215 | | | 4,296 | | | 6,345 | | | 7,379 | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | 12,708 | | | 12,316 | | | 23,846 | | | 24,451 | |

| | | | | | | |

| Loss from operations | (12,545) | | | (12,208) | | | (23,478) | | | (24,260) | |

| | | | | | | |

| Interest income, net | 805 | | | 1,053 | | | 1,731 | | | 1,993 | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | (38) | | | 5 | | | (42) | | | (106) | |

| Net loss | (11,778) | | | (11,150) | | | (21,789) | | | (22,373) | |

| Preferred stock dividend | (6) | | | (6) | | | (12) | | | (12) | |

| | | | | | | |

| Net loss attributable to common stockholders | $ | (11,784) | | | $ | (11,156) | | | $ | (21,801) | | | $ | (22,385) | |

| | | | | | | |

| Net loss per common share — basic and diluted | $ | (0.26) | | | $ | (0.25) | | | $ | (0.49) | | | $ | (0.50) | |

| | | | | | | |

| | | | | | | |

| Weighted-average shares outstanding — basic and diluted | 44,825 | | | 44,677 | | | 44,752 | | | 44,677 | |

| | | | | | | |

Cardiff Oncology, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 25,501 | | | $ | 21,655 | |

| Short-term investments | 34,818 | | | 53,168 | |

| Accounts receivable and unbilled receivable | 451 | | | 288 | |

| Prepaid expenses and other current assets | 1,476 | | | 2,301 | |

| Total current assets | 62,246 | | | 77,412 | |

| Property and equipment, net | 1,095 | | | 1,238 | |

| Operating lease right-of-use assets | 1,439 | | | 1,708 | |

| Other assets | 1,271 | | | 1,279 | |

| Total Assets | $ | 66,051 | | | $ | 81,637 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 5,108 | | | $ | 1,966 | |

| Accrued liabilities | 6,712 | | | 7,783 | |

| | | |

| Operating lease liabilities | 702 | | | 691 | |

| | | |

| Total current liabilities | 12,522 | | | 10,440 | |

| | | |

| | | |

| Operating lease liabilities, net of current portion | 1,141 | | | 1,458 | |

| | | |

| | | |

| Total Liabilities | 13,663 | | | 11,898 | |

| | | |

| Stockholders’ equity | 52,388 | | | 69,739 | |

| Total liabilities and stockholders’ equity | $ | 66,051 | | | $ | 81,637 | |

Cardiff Oncology, Inc.

Condensed Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Operating activities | | | |

| Net loss | $ | (21,789) | | | $ | (22,373) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| | | |

| | | |

| Depreciation | 207 | | | 188 | |

| Stock-based compensation expense | 2,303 | | | 2,645 | |

| Accretion of discounts on short-term investments, net | (283) | | | (405) | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities | 2,592 | | | 4,154 | |

| Net cash used in operating activities | (16,970) | | | (15,791) | |

| | | |

| Investing activities: | | | |

| Capital expenditures | (80) | | | (259) | |

| Net purchases, maturities and sales of short-term investments | 18,731 | | | 19,072 | |

| Net cash provided by investing activities | 18,651 | | | 18,813 | |

| | | |

| Financing activities: | | | |

| Proceeds from sales of common stock, net of expenses | 1,805 | | | — | |

| | | |

| | | |

| Proceeds from exercise of options | 360 | | | — | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | 2,165 | | | — | |

| Net change in cash and cash equivalents | 3,846 | | | 3,022 | |

| Cash and cash equivalents—Beginning of period | 21,655 | | | 16,347 | |

| Cash and cash equivalents—End of period | $ | 25,501 | | | $ | 19,369 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

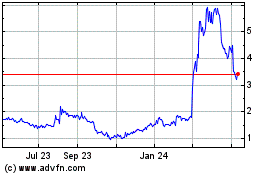

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

From Dec 2024 to Jan 2025

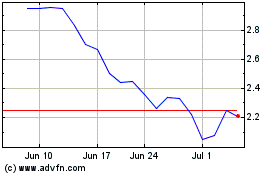

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

From Jan 2024 to Jan 2025