Bon Natural Life Limited (Nasdaq: BON) ("BON" or the "Company"),

one of the leading bio-ingredient solutions providers in the

natural, health and personal care industries, today announced its

2022 annual financial results for the fiscal year ended September

30, 2022.

FY 2022

Financial Highlights

- Total net revenues

were US$29.9 million, representing a 17.3% increase from US$25.5

million for the same period in 2021.

- Gross profit

increased by 32.5% to US$9.4 million from US$7.1 million for the

same period in 2021.

- Gross margin was

31.5%, an increase by 3.6% from 27.9% for the same period in

2021.

- Revenues and gross profit of our

bioactive food ingredient products increased by 48.5% and 61.4%

compared to the same period of 2021.

- Net income

increased by 35.4% to US$6.2 million in FY2022 from US$4.6 million

for the same period in 2021.

- Diluted earnings per share

(“EPS”) was $0.74, compared to $0.68 for the same period

in 2021.

Management Commentary

“We are pleased to conclude fiscal 2022 with

solid growth in both top and bottom lines compared to fiscal year

2021 despite challenges caused by volatile global environment

including high inflation, supply chain disruption, and persistent

outbreak of COVID-19 pandemic in last year.” Commented Richard

(Yongwei) Hu, BON’s Chairman & CEO, “I would like to recognize

our team for their contribution in navigating through these

conditions by market strategy adjustment, disciplined cost

management as well as pricing efforts. Thanks to their relentless

effort and hard work, the gross profits of fragrance compound,

health supplemental powder drinks and bioactive food ingredients

increased by 27.3%, 10.4% and 61.4% from the prior year. Our net

income grew 35.4% to $6.2 million.”

“Looking ahead to 2023, we expect the

first-phase completion of our third production site - Yumen Plant

in May 2023. Once up and running, Yumen Plant will add 150% revenue

growth potential on an annualized basis. In addition, the

successful launch of our new vegetable based probiotic powder drink

for regulation and improvement of human's overall microbiome and

digestive health, as well as natural based personal care product

for female hygiene health will attract more natural

health-conscious consumers and further drive revenue growth for

BON. Last but not the least, the reopening of China will help boost

our profit by alleviate pressures from supply chain and logistics.

With our new Yumen plant, our new natural based products, along

with post-COVID reopening, we are confident to deliver the

sustainable growth and create lasting long-term value for our

shareholders.”

FY 2022

Product Categories Summary:

Growth vs. Prior Year

|

|

Revenues increase |

Gross Profits increase |

|

Fragrance Compounds |

7.6 |

% |

27.3 |

% |

|

Health Supplements (Powder Drinks) |

7.4 |

% |

10.4 |

% |

|

Bioactive Food Ingredients |

48.5 |

% |

61.4 |

% |

Fragrance Compounds

- Revenue from sales of fragrance

compound products increased by 7.6% to US$13.7 million from US$12.7

million for the same period in 2021. The increase was primarily

attributable to 9.1% and 27.5% increases in average purchase order

by customers and average selling price, partially offset by a

decrease of 15.1% in sales volume due to the shortage of material

supply.

- Gross profit from fragrance

compound increased by 27.3% from US$3.0 million to US$3.8 million

for the same period in 2021. The increase was primarily

attributable to the above referenced factors.

Health Supplements (Powder Drinks)

- Revenue from sales of health

supplement (powder drinks) products increased by 7.4% to US$7.1

million from US$6.7 million for the same period in 2021. The

increase was attributable to 7.0% and 1.0% increases in average

selling price and sales volume.

- Gross profit from health supplement

(powder drinks) increased by 10.4% from US$2.1 million to US$2.3

million for the same period in 2021. The increase was primarily due

to the above referenced factors.

Bioactive Food Ingredients

- Revenue from sales of bioactive

food ingredient products increased by 48.5% to US$9.1 million from

US$6.1 million for the same period in 2021. The increase was mainly

attributable to 27.3% increase in sales volume due to strong

customer demand and sales effort. The increase was also due to

17.4% increase in average selling price.

- Gross profit of our bioactive food

ingredient products increased by 61.4% to $3.4 million from $2.1

million for the same period in 2021. This increase was primarily

due to the above referenced reasons.

Selling

expenses increased by $80,292, or approximately

58.0%, from $138,530 to $218,822 in the same period of 2021, mainly

attributable to increase of advertising expense, salaries and

social benefits on attending more trade shows as well as recruiting

more sales staff.

Research and development

(“R&D”) expenses increased by

$175,508, or approximately 70.5%, from $249,050 in fiscal year 2021

to $424,558 in fiscal year 2022. The increase was mainly due to an

increase of $140,504 in outsourcing R&D activities to external

consulting firms.

Government subsidies received

in the form of a grant and recognized as other operating income

totaled $1,306,627 and $449,972 for the fiscal years ended

September 30, 2022 and 2021, respectively.

Net income

increased from $4.6 million in the fiscal year ended September 30,

2021 to $6.2 million in the same period of 2022.

Net cash used

in operating activities during the year

ended September 30, 2022 was $0.2 million compared to $4.1 million

net cash provided by operating activities in the same period of

2021. The decrease was mainly attribute to a decrease of $3,632,922

in taxes payable primarily due to income and VAT tax paid in fiscal

year 2022, an increase of $1,300,942 account receivable due to

increased sales in the year ended September 30, 2022, and decrease

in deferred revenue of $875,295 due to changes in customer payment

pattern related with COVID-19.

Basic earnings per

share (“EPS”) was $0.75, compared to $0.69 for the same

period in 2021.

Diluted earnings per share

(“EPS”) was $0.74, compared to $0.68 for the same period

in 2021.

Subsequent Events

- On September 30, 2022, the Company

announced there will be a delay to the completion of the

construction work for its third production site – Yumen Plant to

May 2023.

- On January 17, 2023, the Company

closed a private offering with gross proceeds of $2,200,000, mainly

to fund its new Yumen Plant and working capital for the new

production facility.

Investor Conference Call and

Webcast

A live webcast to discuss the Company’s FY 2022

financial results will be held on February 10, 2023, beginning at

9:00 a.m. EST. The webcast and accompanying slide presentation may

be accessed on the Company’s IR website at

https://www.bnlus.com/investorrelations-ep. The webcast also can be

accessed by using the direct link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=oKNXFTV5

. For those unable to listen to the live webcast, a recorded

version will be available on the Company’s website after the

event.

Pre-registration:

https://dpregister.com/sreg/10175699/f5ecaa11e8

Callers who pre-register will be given a

conference passcode and unique PIN to gain immediate access to the

call and bypass the operator. Participants may pre-register at any

time, up to and including after the time that the call has

started.

Those without internet access or unable to

pre-register may dial in by calling:U.S. Toll Free: 1-866-777-2509

| International Toll: 1-412-317-5413

About Bon Natural Life

Limited

The Company focuses on the manufacturing of

personal care ingredients, such as plant extracted fragrance

compounds for perfume and fragrance manufacturers, natural health

supplements such as powder drinks and bioactive food ingredient

products mostly used as food additives and nutritional supplements

by their customers. For additional information, please visit the

Company’s website at www.bnlus.com.

Safe Harbor Statement

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements that

are other than statements of historical facts. When the Company

uses words such as "may, "will, "intend," "should," "believe,"

"expect," "anticipate," "project," "estimate" or similar

expressions that do not relate solely to historical matters, it is

making forward-looking statements. Forward-looking statements are

not guarantees of future performance and involve risks and

uncertainties that may cause the actual results to differ

materially from the Company's expectations discussed in the

forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the

following: the Company's goals and strategies; the Company's future

business development; product and service demand and acceptance;

changes in technology; economic conditions; the growth of the

natural, health and personal care market in China and the

other international markets the Company plans to serve; reputation

and brand; the impact of competition and pricing; government

regulations; fluctuations in general economic and business

conditions in China and the international markets the

Company plans to serve and assumptions underlying or related to any

of the foregoing and other risks contained in reports filed by the

Company with the SEC. For these reasons, among others, investors

are cautioned not to place undue reliance upon any forward-looking

statements in this press release. Additional factors are discussed

in the Company's filings with the SEC, which are available for

review at www.sec.gov. The Company undertakes no obligation to

publicly revise these forward–looking statements to reflect events

or circumstances that arise after the date hereof.

| For more information, please

contact: |

| |

|

| In the United States: |

|

| Maggie Zhang | Impact IR |

Sophie Zhang | Impact IR |

| Phone: (646) 893-8916 |

Phone: (917) 830-5219 |

| Email: maggie.zhang@irimpact.com |

Email: sophie.zhang@irimpact.com |

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS

|

|

|

As of September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

840,861 |

|

|

$ |

1,903,867 |

|

|

Short-term investments |

|

|

- |

|

|

|

1,703,314 |

|

|

Accounts receivable, net |

|

|

6,784,307 |

|

|

|

6,152,807 |

|

|

Inventories, net |

|

|

1,722,120 |

|

|

|

1,596,492 |

|

|

Advance to suppliers, net |

|

|

4,091,990 |

|

|

|

4,094,312 |

|

|

Acquisition deposit |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

Prepaid expenses and other current assets |

|

|

277,509 |

|

|

|

98,960 |

|

|

TOTAL CURRENT ASSETS |

|

|

14,716,787 |

|

|

|

16,549,752 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

21,624,437 |

|

|

|

19,228,642 |

|

|

Intangible assets, net |

|

|

366,167 |

|

|

|

411,056 |

|

|

Right-of-use lease assets, net |

|

|

546,690 |

|

|

|

201,007 |

|

|

Deferred tax assets, net |

|

|

2,768 |

|

|

|

22,342 |

|

|

TOTAL ASSETS |

|

$ |

37,256,849 |

|

|

$ |

36,412,799 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Short-term loans |

|

$ |

2,424,587 |

|

|

$ |

41,381 |

|

|

Current portion of long-term loans |

|

|

2,135,979 |

|

|

|

448,005 |

|

|

Accounts payable |

|

|

214,585 |

|

|

|

380,385 |

|

|

Due to related parties |

|

|

72,836 |

|

|

|

245,104 |

|

|

Taxes payable |

|

|

1,239,708 |

|

|

|

5,052,018 |

|

|

Deferred revenue |

|

|

188,745 |

|

|

|

1,096,101 |

|

|

Accrued expenses and other current liabilities |

|

|

114,431 |

|

|

|

41,711 |

|

|

Finance lease liabilities, current |

|

|

26,285 |

|

|

|

161,286 |

|

|

Operating lease liability, current |

|

|

230,182 |

|

|

|

62,871 |

|

|

TOTAL CURRENT LIABILITIES |

|

$ |

6,647,338 |

|

|

$ |

7,528,862 |

|

|

Long-term loans |

|

|

189,813 |

|

|

|

2,173,532 |

|

| Finance lease liabilities,

noncurrent |

|

|

- |

|

|

|

28,953 |

|

|

Operating lease liability, noncurrent |

|

|

327,202 |

|

|

|

146,703 |

|

|

TOTAL LIABILITIES |

|

|

7,164,353 |

|

|

|

9,878,050 |

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.0001 par value, 500,000,000 shares authorized,

8,396,226 and 8,330,000 shares issued and outstanding as of

September 30, 2022 and 2021, respectively |

|

$ |

840 |

|

|

$ |

833 |

|

|

Additional paid in capital |

|

|

15,711,450 |

|

|

|

15,540,433 |

|

|

Statutory reserve |

|

|

1,804,116 |

|

|

|

1,050,721 |

|

|

Retained earnings |

|

|

14,676,769 |

|

|

|

9,192,676 |

|

|

Accumulated other comprehensive income |

|

|

(2,631,171 |

) |

|

|

222,221 |

|

|

TOTAL BON NATURAL LIFE LIMITED SHAREHOLDERS’

EQUITY |

|

|

29,562,004 |

|

|

|

26,006,884 |

|

|

Non-controlling interest |

|

|

530,492 |

|

|

|

527,865 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

|

30,092,496 |

|

|

|

26,534,749 |

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

37,256,849 |

|

|

$ |

36,412,799 |

|

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF INCOME AND

COMPREHENSIVE INCOME

| |

|

For the Years Ended September 30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| REVENUE |

|

$ |

29,908,561 |

|

|

$ |

25,494,564 |

|

|

$ |

18,219,959 |

|

| COST OF REVENUE |

|

|

(20,484,996 |

) |

|

|

(18,382,637 |

) |

|

|

(13,017,646 |

) |

| GROSS

PROFIT |

|

|

9,423,565 |

|

|

|

7,111,927 |

|

|

|

5,202,313 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

(218,822 |

) |

|

|

(138,530 |

) |

|

|

(161,719 |

) |

| General and administrative

expenses |

|

|

(2,239,967 |

) |

|

|

(1,323,726 |

) |

|

|

(1,367,070 |

) |

| Research and development

expenses |

|

|

(424,558 |

) |

|

|

(249,050 |

) |

|

|

(205,359 |

) |

| Total operating expenses |

|

|

(2,883,347 |

) |

|

|

(1,711,306 |

) |

|

|

(1,734,148 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

|

6,540,218 |

|

|

|

5,400,621 |

|

|

|

3,468,165 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

1,392 |

|

|

|

3,207 |

|

|

|

714 |

|

| Interest expense |

|

|

(446,884 |

) |

|

|

(417,266 |

) |

|

|

(329,102 |

) |

| Unrealized foreign transaction

exchange gain (loss) |

|

|

18,831 |

|

|

|

(45,124 |

) |

|

|

(248 |

) |

| Gain on disposal of fixed

assets |

|

|

- |

|

|

|

- |

|

|

|

20,150 |

|

| Government subsidies |

|

|

1,306,627 |

|

|

|

449,972 |

|

|

|

362,187 |

|

| Income from short-term

investments |

|

|

20,343 |

|

|

|

565 |

|

|

|

- |

|

| Other income |

|

|

68,922 |

|

|

|

38,409 |

|

|

|

132,713 |

|

| Total other income, net |

|

|

969,231 |

|

|

|

29,763 |

|

|

|

186,414 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAX PROVISION |

|

|

7,509,449 |

|

|

|

5,430,384 |

|

|

|

3,654,579 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX

PROVISION |

|

|

(1,267,025 |

) |

|

|

(820,931 |

) |

|

|

(556,262 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET

INCOME |

|

|

6,242,424 |

|

|

|

4,609,453 |

|

|

|

3,098,317 |

|

| Less: net income attributable

to non-controlling interest |

|

|

4,936 |

|

|

|

18,650 |

|

|

|

71,644 |

|

| NET INCOME

ATTRIBUTABLE TO BON NATURAL LIFE LIMITED |

|

$ |

6,237,488 |

|

|

$ |

4,590,803 |

|

|

$ |

3,026,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total foreign currency

translation adjustment |

|

|

(2,855,701 |

) |

|

|

612,806 |

|

|

|

450,234 |

|

| TOTAL COMPREHENSIVE

INCOME |

|

|

3,386,723 |

|

|

|

5,222,259 |

|

|

|

3,548,551 |

|

| Less: comprehensive income

attributable to non-controlling interest |

|

|

2,627 |

|

|

|

21,133 |

|

|

|

81,737 |

|

| COMPREHENSIVE INCOME

ATTRIBUTABLE TO BON NATURAL LIFE LIMITED |

|

$ |

3,384,096 |

|

|

$ |

5,201,126 |

|

|

$ |

3,466,814 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER

SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.75 |

|

|

$ |

0.69 |

|

|

$ |

0.58 |

|

|

Diluted |

|

$ |

0.74 |

|

|

$ |

0.68 |

|

|

$ |

0.58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE

NUMBER OF SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

8,360,774 |

|

|

|

6,615,833 |

|

|

|

5,210,649 |

|

|

Diluted |

|

|

8,396,064 |

|

|

|

6,706,235 |

|

|

|

5,210,649 |

|

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

|

For the Years Ended September 30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

6,242,424 |

|

|

$ |

4,609,453 |

|

|

$ |

3,098,317 |

|

|

Adjustments to reconcile net income to cash provided (used in) by

operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for doubtful accounts |

|

|

116 |

|

|

|

2,948 |

|

|

|

22,137 |

|

|

Depreciation and amortization |

|

|

218,526 |

|

|

|

228,547 |

|

|

|

230,597 |

|

|

Inventory reserve (recovery) reverse |

|

|

(138,354 |

) |

|

|

(312,532 |

) |

|

|

29,539 |

|

|

Deferred income tax |

|

|

19,012 |

|

|

|

29,109 |

|

|

|

(7,751 |

) |

|

Amortization of operating lease right-of-use assets |

|

|

150,978 |

|

|

|

58,147 |

|

|

|

- |

|

|

Amortization of stock-based compensation |

|

|

170,883 |

|

|

|

44,910 |

|

|

|

- |

|

|

Unrealized foreign currency exchange loss (gain) |

|

|

(18,831 |

) |

|

|

45,124 |

|

|

|

248 |

|

|

Gain on disposal of property and equipment |

|

|

(725 |

) |

|

|

- |

|

|

|

(20,150 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,300,942 |

) |

|

|

(89,543 |

) |

|

|

(284,546 |

) |

|

Inventories |

|

|

(157,709 |

) |

|

|

(209,011 |

) |

|

|

1,636,321 |

|

|

Advance to suppliers, net |

|

|

(407,022 |

) |

|

|

(399,262 |

) |

|

|

(3,021,739 |

) |

|

Prepaid expenses and other current assets |

|

|

(265,446 |

) |

|

|

2,642 |

|

|

|

72,116 |

|

|

Accounts payable |

|

|

(141,927 |

) |

|

|

(969,414 |

) |

|

|

(1,982,205 |

) |

|

Operating lease liabilities |

|

|

(147,812 |

) |

|

|

(49,648 |

) |

|

|

- |

|

|

Taxes payable |

|

|

(3,632,922 |

) |

|

|

410,716 |

|

|

|

2,662,542 |

|

|

Deferred revenue |

|

|

(875,295 |

) |

|

|

684,030 |

|

|

|

161,045 |

|

|

Accrued expenses and other current liabilities |

|

|

97,925 |

|

|

|

(33,092 |

) |

|

|

46,605 |

|

| Net cash (used in) provided by

operating activities |

|

|

(187,121 |

) |

|

|

4,053,124 |

|

|

|

2,643,076 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

|

(5,097,816 |

) |

|

|

(2,159,920 |

) |

|

|

- |

|

|

Proceeds upon redemption of short-term investments |

|

|

6,776,385 |

|

|

|

470,082 |

|

|

|

- |

|

|

Purchase of property and equipment |

|

|

(27,695 |

) |

|

|

(51,878 |

) |

|

|

(31,885 |

) |

|

Proceeds from sales of property and equipment |

|

|

1,613 |

|

|

|

- |

|

|

|

- |

|

|

Capital expenditures on construction-in-progress |

|

|

(4,708,138 |

) |

|

|

(4,432,941 |

) |

|

|

(4,301,103 |

) |

|

Purchase of intangible assets |

|

|

- |

|

|

|

(269,088 |

) |

|

|

- |

|

|

(Payment) refund of acquisition deposit |

|

|

- |

|

|

|

(1,000,000 |

) |

|

|

1,329,945 |

|

| Net cash used in investing

activities |

|

|

(3,055,651 |

) |

|

|

(7,443,745 |

) |

|

|

(3,003,043 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net proceeds from issuance of Ordinary Shares in initial public

offerings |

|

|

- |

|

|

|

11,271,480 |

|

|

|

- |

|

|

Proceeds from exercise of stock options |

|

|

140 |

|

|

|

|

|

|

|

|

|

|

Proceeds from short-term loans |

|

|

2,631,890 |

|

|

|

1,257,225 |

|

|

|

2,033,570 |

|

|

Proceeds from long-term loans |

|

|

578,343 |

|

|

|

1,245,871 |

|

|

|

319,342 |

|

|

Repayment of short-term loans |

|

|

(40,780 |

) |

|

|

(2,563,433 |

) |

|

|

(2,872,778 |

) |

|

Repayment of long-term loans |

|

|

(637,147 |

) |

|

|

(2,522,101 |

) |

|

|

- |

|

|

(Repayment of) proceeds from borrowings from related parties |

|

|

(96,969 |

) |

|

|

(2,262,378 |

) |

|

|

1,067,808 |

|

|

(Repayment of) proceeds from third party loans |

|

|

- |

|

|

|

(721,484 |

) |

|

|

238,133 |

|

|

(Repayment of) principal from finance lease |

|

|

(173,961 |

) |

|

|

169,153 |

|

|

|

(392,030 |

) |

|

Payment for deferred initial public offering costs |

|

|

- |

|

|

|

(521,651 |

) |

|

|

(281,553 |

) |

| Net cash provided by financing

activities |

|

|

2,261,516 |

|

|

|

5,352,682 |

|

|

|

112,492 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of changes of

foreign exchange rates on cash |

|

|

(81,750 |

) |

|

|

(111,300 |

) |

|

|

6,810 |

|

| Net (decrease)

increase in cash |

|

|

(1,063,006 |

) |

|

|

1,850,761 |

|

|

|

(240,665 |

) |

| Cash, beginning of

year |

|

|

1,903,867 |

|

|

|

53,106 |

|

|

|

293,771 |

|

| Cash, end of

year |

|

$ |

840,861 |

|

|

$ |

1,903,867 |

|

|

$ |

53,106 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest expense |

|

$ |

446,884 |

|

|

$ |

417,266 |

|

|

$ |

276,671 |

|

|

Cash paid for income tax |

|

$ |

2,290,393 |

|

|

$ |

2,411 |

|

|

$ |

- |

|

| Supplemental

disclosure of non-cash investing and financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of share-based compensation for initial public

offering services |

|

$ |

- |

|

|

$ |

422,221 |

|

|

$ |

211,112 |

|

|

Right-of-use assets obtained in exchange for operating lease

obligations |

|

$ |

546,323 |

|

|

$ |

257,564 |

|

|

$ |

- |

|

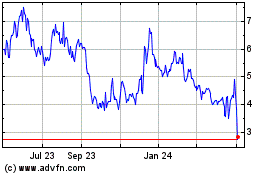

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Oct 2024 to Nov 2024

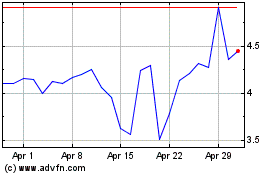

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Nov 2023 to Nov 2024