0001704287

false

0001704287

2023-08-16

2023-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

August 16, 2023

Bluejay Diagnostics, Inc.

(Exact Name of Registrant as Specified in its Charter)

| delaware |

|

001-41031 |

|

47-3552922 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

360 Massachusetts Avenue, Suite 203

Acton, MA 01720

(Address of principal executive offices and zip

code)

(844) 327-7078

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed from

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)). |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol (s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

BJDX |

|

The NASDAQ Stock Market LLC |

Item 2.02 Results of Operations and Financial Condition.

On

August 16, 2023, Bluejay Diagnostics, Inc. (the “Company”) issued a press release announcing its financial results for the

six months ended June 30, 2023 and a corporate update. A copy of the press release is attached to this report as Exhibit 99.1 and

is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Bluejay Diagnostics Inc. |

| |

|

| |

By: |

/s/ Kenneth Fisher |

| |

|

Kenneth Fisher |

| |

|

Chief Financial Officer |

Dated: August 16, 2023

2

Exhibit 99.1

Bluejay

Diagnostics Announces Clinical Update and

Reports

Second Quarter 2023 Financial Results

ACTON, Mass., August

16, 2023 – Bluejay Diagnostics, Inc. (NASDAQ: BJDX) (“Bluejay” or the “Company”), a medical technology company

developing rapid diagnostics on its Symphony platform to improve patient outcomes in critical care settings, announced financial results

for the six months ended June 30, 2023.

“We continued to

limit our cash burn during the quarter while executing our clinical strategy for the Symphony IL-6 test and are confident that our planned

clinical and analytical studies may support a 510(k) FDA regulatory submission with an initial indication for risk stratification of hospitalized

sepsis patients,” said Neil Dey, CEO of Bluejay Diagnostics. “We are excited to now have a clear pathway to obtain regulatory

clearance of our Symphony IL-6 test, which will serve to demonstrate the vast capabilities of our rapid, near-patient Symphony technology

platform.”

Symphony IL-6 has the

potential to be an influential tool for the prediction of clinical deterioration in sepsis patients. Symphony IL-6 testing, in conjunction

with clinical and other diagnostic findings, may enable healthcare providers to better prioritize appropriate care for those at high risk

to help prevent adverse outcomes, and potentially avoid unnecessary investigations and treatments in those at low risk. IL-6 appears as

a ‘first responder’ biomarker in the blood during early stages of inflammations and/or infection. A current unmet challenge

for healthcare professionals to overcome is the amount of time it takes to identify sepsis in patients and determine disease severity.

Existing technologies typically take several hours to deliver IL-6 results, which can delay critical treatment decisions that could improve

patient outcomes.

The Company submitted a pre-submission application

to the FDA presenting the new study design in May 2023 and participated in a pre-submission meeting on August 11, 2023. At the meeting,

the FDA provided feedback on the new study design, determined that the submission of a 510(k) is the appropriate premarket submission

pathway, and requested that certain data be provided in the 510(k). Based on this feedback, the Company intends to proceed as planned

while taking into account the FDA’s feedback. The Company has targeted large, well-known medical and academic institutions for its

study, which the Company believes will help support initial commercialization and market penetration. The Company believes that it will

maintain the previously disclosed Symphony IL-6 regulatory submission timeline of the first half of 2024.

Financial Results for the Six Months Ended June 30, 2023:

Cash and cash equivalents. Cash and cash

equivalents on June 30, 2023 were $5.1 million, as compared to $10.1 million on December 31, 2022. The Company closely monitors the management

of its liquidity and expects to raise additional capital in the near-term to fund its planned operations.

Research and development expense. Research

and development expenses for the six months ended June 30, 2023 were $3.0 million, as compared $1.5 million, for the same period in 2022.

The increase in research and development expenses was primarily due to an increase in personnel costs and product development expenses.

We expect future research and development expenses to be focused on our clinical trial program and any necessary manufacturing improvements.

General and administrative expense. General

and administrative expenses for the six months ended June 30, 2023 were $2.3 million, as compared to $2.5 million for the comparable period

in 2022. The minor decrease in general and administrative expenses is due to continued efforts to preserve capital by limiting our investment

in infrastructure commensurate with our commercialization timeline.

Sales and marketing expense. Sales and

marketing expenses for the six months ended June 30, 2023 were $302,000, as compared to $135,000 for the comparable period in 2022. The

increase in sales and marketing expenses was primarily due to increased personnel costs.

Net loss/Net loss per share. The net loss

for the six months ended June 30, 2023 was $5.4 million, or $5.24 per share, compared to $4.0 million, or $2.00 per share for the comparable

period in 2022.

About the SymphonyTM System:

Bluejay’s Symphony System (the “Symphony

System”) is designed to address the need for simple, reliable, rapid, near-patient testing by providing quantitative measurements

of specific biomarkers to determine the need for additional patient care and monitoring. The user-friendly Symphony System will not require

any sample preparation or dedicated staff and was shown in published clinical studies to deliver results in approximately 20 minutes.

The Symphony IL-6 Test is a development stage

product candidate for investigational use only. It is limited by United States law to investigational use.

About Bluejay Diagnostics:

Bluejay Diagnostics, Inc. is a medical diagnostics

company focused on improving patient outcomes using its Symphony System, a cost-effective, rapid, near-patient testing system for triage

and monitoring of disease progression. Bluejay’s first product candidate, an IL-6 Test for sepsis triage, is designed to provide

accurate, reliable results in approximately 20 minutes from ‘sample-to-result’ to help medical professionals make earlier

and better triage/treatment decisions. More information is available at www.bluejaydx.com.

Forward-Looking Statements:

This press release contains statements that the

Company believes are “forward-looking statements” within the meaning of the Private Litigation Reform Act. Forward-looking

statements in this press release include, without limitation, the expected nature and timing of the Company’s planned FDA submission

and related plans for clinical study expansion, whether the Company’s cash position will be sufficient to fund operations needed

to achieve regulatory approval and initial commercialization of the Symphony IL-6 Test, and whether such regulatory approval will actually

occur. Forward-looking statements may be identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,”

“suggest”, “will,” and similar expressions. The Company has based these forward-looking statements on its current

expectations and projections about future events, nevertheless, actual results or events could differ materially from the plans, intentions

and expectations disclosed in, or implied by, the forward-looking statements the Company makes. These statements are only predictions

and involve known and unknown risks, uncertainties, and other factors, including those discussed under item 1A. “Risk Factors”

in our most recently filed Form 10-K filed with the Securities and Exchange Commission, as updated by the Company’s subsequent Quarterly

Reports on Form 10-Q. You should not place undue reliance on these forward-looking statements, as they are subject to risks and uncertainties,

and actual results and performance in future periods may not occur or may be materially different from any future results or performance

suggested by the forward-looking statements in this release. This press release speaks as of the date indicated above. The Company undertakes

no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise. The Company

expressly disclaims any obligation to update or revise any forward-looking statements found herein to reflect any future changes in the

Company’s expectations of results or any future change in events.

Investor Contact:

Alexandra Schuman

LifeSci Advisors

alex@lifesciadvisors.com

t: 646-876-3647

Bluejay Diagnostics, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 5,100,407 | | |

$ | 10,114,990 | |

| Prepaid expenses and other current assets | |

| 1,481,512 | | |

| 1,673,480 | |

| Total current assets | |

| 6,581,919 | | |

| 11,788,470 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,464,125 | | |

| 1,232,070 | |

| Operating lease right-of-use assets | |

| 400,609 | | |

| 465,514 | |

| Other non-current assets | |

| 31,675 | | |

| 35,211 | |

| Total assets | |

$ | 8,478,328 | | |

$ | 13,521,265 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 271,488 | | |

$ | 635,818 | |

| Operating lease liability, current | |

| 168,713 | | |

| 168,706 | |

| Accrued expenses and other current liabilities | |

| 1,392,378 | | |

| 835,730 | |

| Total current liabilities | |

| 1,832,579 | | |

| 1,640,254 | |

| | |

| | | |

| | |

| Operating lease liability, non-current | |

| 255,306 | | |

| 323,915 | |

| Other non-current liabilities | |

| 14,104 | | |

| 15,823 | |

| Total liabilities | |

| 2,101,989 | | |

| 1,979,992 | |

| | |

| | | |

| | |

| Commitments and Contingencies (See Note 13) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.0001 par value; 7,500,000 shares authorized; 1,023,345 and 1,010,764 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| 102 | | |

| 101 | |

| Additional paid-in capital | |

| 28,726,487 | | |

| 28,538,274 | |

| Accumulated deficit | |

| (22,350,250 | ) | |

| (16,997,102 | ) |

| Total stockholders’ equity | |

| 6,376,339 | | |

| 11,541,273 | |

| Total liabilities and stockholders’ equity | |

$ | 8,478,328 | | |

$ | 13,521,265 | |

See notes to unaudited condensed consolidated financial

statements.

Reflects a 1-for-20 reverse stock split effective

July 24, 2023.

Bluejay Diagnostics, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

$ | - | | |

$ | 249,040 | | |

$ | - | | |

$ | 249,040 | |

| Cost of sales | |

| - | | |

| 200,129 | | |

| - | | |

| 200,129 | |

| Gross profit | |

| - | | |

| 48,911 | | |

| - | | |

| 48,911 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,676,256 | | |

| 756,283 | | |

| 3,030,805 | | |

| 1,451,040 | |

| General and administrative | |

| 1,073,103 | | |

| 1,196,996 | | |

| 2,250,080 | | |

| 2,516,815 | |

| Sales and marketing | |

| 154,329 | | |

| 81,357 | | |

| 302,375 | | |

| 135,042 | |

| Total operating expenses | |

| 2,903,688 | | |

| 2,034,636 | | |

| 5,583,260 | | |

| 4,102,897 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (2,903,688 | ) | |

| (1,985,725 | ) | |

| (5,583,260 | ) | |

| (4,053,986 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income: | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 90,383 | | |

| 48,323 | | |

| 230,112 | | |

| 103,181 | |

| Total other income, net | |

| 90,383 | | |

| 48,323 | | |

| 230,112 | | |

| 103,181 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (2,813,305 | ) | |

$ | (1,937,402 | ) | |

$ | (5,353,148 | ) | |

$ | (3,950,805 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - Basic and diluted | |

$ | (2.75 | ) | |

$ | (2.00 | ) | |

$ | (5.24 | ) | |

$ | (2.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 1,023,052 | | |

| 1,007,115 | | |

| 1,020,865 | | |

| 1,007,115 | |

See notes to unaudited condensed consolidated financial

statements.

Reflects a 1-for-20 reverse stock split effective

July 24, 2023.

4

v3.23.2

Cover

|

Aug. 16, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 16, 2023

|

| Entity File Number |

001-41031

|

| Entity Registrant Name |

Bluejay Diagnostics, Inc.

|

| Entity Central Index Key |

0001704287

|

| Entity Tax Identification Number |

47-3552922

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

360 Massachusetts Avenue

|

| Entity Address, Address Line Two |

Suite 203

|

| Entity Address, City or Town |

Acton

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01720

|

| City Area Code |

844

|

| Local Phone Number |

327-7078

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

BJDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

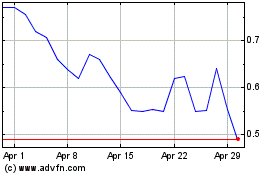

Bluejay Diagnostics (NASDAQ:BJDX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bluejay Diagnostics (NASDAQ:BJDX)

Historical Stock Chart

From Feb 2024 to Feb 2025