Net Sales of $333M, up 13% and GAAP Net

Income of $29M, up $19M

Record Quarterly Adj. EBITDA of $48M, up

$19M with 2,151 Buses Sold

FY2024 Adj. EBITDA Guidance Raised to $175M

or 13% of Revenue

Long-Term Adj. EBITDA Margin Outlook Raised

to 15%

Blue Bird Corporation (“Blue Bird”) (Nasdaq: BLBD), the leader

in electric and low-emission school buses, announced today its

fiscal 2024 third quarter results.

Highlights

(in millions except Unit Sales and EPS

data)

Three Months Ended

June 29, 2024

B/(W)

Prior Year

Nine Months Ended

June 29, 2024

B/(W)

Prior Year

Unit Sales

2,151

14

6,534

136

GAAP Measures:

Revenue

$

333.4

$

39.1

$

996.9

$

167.1

Net Income

$

28.7

$

19.4

$

80.9

$

75.7

Diluted EPS

$

0.85

$

0.56

$

2.43

$

2.27

Non-GAAP Measures1:

Adjusted EBITDA

$

48.2

$

18.6

$

141.6

$

94.4

Adjusted Net Income

$

30.5

$

16.1

$

89.5

$

76.4

Adjusted Diluted EPS

$

0.91

$

0.47

$

2.69

$

2.28

1

Reconciliation to relevant GAAP metrics

shown below

“I am incredibly proud of our team’s achievements in delivering

another outstanding result and record profit in the third quarter,”

said Phil Horlock, CEO of Blue Bird Corporation. “The Blue Bird

team continued to exceed expectations, improving operations,

driving new orders, and expanding our leadership in

alternative-powered buses. Market demand remains very strong with

over 5,200 units in our order backlog. Unit sales were up slightly

from last year, revenue grew by 13% to $333 million, and Adjusted

EBITDA hit a record $48 million with a 14.5% margin.

“In our push to expand our leadership in alternative-powered

school buses, we delivered over 200 electric-powered buses this

quarter, nearly 40% more than last year. We also saw strong growth

in EV orders from the EPA’s Clean School Bus Program, ending the

quarter with over 560 EV orders in our backlog. Following the

nearly $1 billion funding from Phase 1 of the $5 billion program,

we’re excited for new EV orders over the next year from Phases 2

and 3, which provide another $2 billion in funding. These buses

need to be delivered by the end of 2026, and we’re working

aggressively with our dealers and school districts, confident in

the continued, exciting growth ahead for Blue Bird.

“Based on our strong year-to-date performance, we’ve increased

our full-year financial guidance for Adjusted EBITDA to $175

million, with a 13% margin. This will be an all-time full-year

record for Blue Bird, and we look forward to sustained profitable

growth in the coming years, particularly as the global supply-chain

recovery progresses.”

FY2024 Guidance Increased and Long-Term

Outlook Raised

“We are very pleased with the third quarter results, with the

highest ever quarterly Adj. EBITDA,” said Razvan Radulescu, CFO of

Blue Bird Corporation. “Our business transformation continues to

yield great results, and ahead of the plan we have been messaging.

We are raising our full-year guidance for Net Revenue to $1.30-1.33

Billion, Adj. EBITDA to $170-180 million (13.1% - 13.5% margin) and

Adj. Free Cash Flow to $80-90 million. Additionally, we are raising

our long-term profit outlook towards an Adjusted EBITDA margin of

15% on ~$2 billion in revenues.”

Fiscal 2024 Third Quarter Results

Net Sales Net sales were $333.4 million for the third quarter of

fiscal 2024, an increase of $39.1 million, or 13.3%, from the third

quarter of last year. Bus sales increased $37.8 million, reflecting

a 13.2% increase in average sales price per unit, resulting from

pricing actions taken by management as well as product and customer

mix changes, as well as a 0.7% increase in units booked. In the

third quarter of fiscal 2024, 2,151 units were booked compared with

2,137 units booked for the same period in fiscal 2023. The small

increase in units sold was primarily due to customer and product

mix changes, although both quarters were negatively impacted by

supply chain constraints that limited the Company's ability to

produce and deliver buses due to shortages of critical components.

Additionally, Parts sales increased $1.3 million, or 5.5%, for the

third quarter of fiscal 2024 compared with the third quarter of

fiscal 2023. This increase is primarily attributed to price

increases, driven by ongoing inflationary pressures, as well as

higher fulfillment volumes and slight variations due to product and

channel mix.

Gross Profit Third quarter gross profit of $69.4 million

represented an increase of $23.6 million from the third quarter of

last year. The increase was primarily driven by the $39.1 million

increase in net sales, discussed above, and partially offset by an

increase of $15.5 million in cost of goods sold. The increase in

cost of goods sold was primarily driven by increased inventory

costs, as the average cost of goods sold per unit for the third

quarter of fiscal 2024 was 5.8% higher compared to the third

quarter of fiscal 2023, primarily due to increases in manufacturing

costs attributable to a) increased raw materials costs resulting

from ongoing inflationary pressures and b) ongoing supply chain

disruptions that resulted in higher purchase costs for

components.

Net Income Net income was $28.7 million for the third quarter of

fiscal 2024, which was a $19.4 million increase from the third

quarter of last year. The increase was primarily driven by the

$23.6 million increase in gross profit, discussed above. Partially

offsetting this was the corresponding $8.1 million increase in

income tax expense.

Adjusted Net Income Adjusted net income was $30.5 million,

representing an increase of $16.1 million compared with the same

period last year, primarily due to the $19.4 million increase in

net income, discussed above.

Adjusted EBITDA Adjusted EBITDA was $48.2 million, which was an

increase of $18.6 million compared with the third quarter last

year. This increase primarily results from the $19.4 million

increase in net income as a result of the factors discussed

above.

Fiscal 2024 Year-to-Date

Results

Net Sales Net sales were $996.9 million for the nine months

ended June 29, 2024, an increase of $167.1 million, or 20.1%,

compared with the same period in fiscal 2023. Bus sales increased

$162.4 million, or 21.5%, reflecting a 18.9% increase in average

sales price per unit, primarily driven by pricing actions taken by

management in response to increased inventory purchase costs, and a

2.1% increase in units booked. There were 6,534 units booked in the

nine months ended June 29, 2024 compared with 6,398 units booked

during the same period in fiscal 2023. The increase in units sold

was primarily due to slight improvements in supply chain

constraints impacting the Company's ability to produce and deliver

buses due to shortages of critical components during the first nine

months of fiscal 2024 relative to the same period in fiscal 2023.

Parts sales increased $4.7 million, or 6.4%, for the nine months

ended June 29, 2024 compared with the nine months ended July 1,

2023. This increase is primarily attributed to price increases,

driven by ongoing inflationary pressures, as well as higher

fulfillment volumes and slight variations due to product and

channel mix.

Gross Profit Gross profit for the nine months ended June 29,

2024 was $196.6 million, an increase of $107.7 million compared

with the same period in the prior year. The increase was primarily

driven by the $167.1 million increase in net sales, discussed

above. This was partially offset by an increase of $59.4 million in

cost of goods sold, primarily driven by the 2.1% increase in units

booked and increased inventory costs, as the average cost of goods

sold per unit for the nine months ended June 29, 2024 was 6.1%

higher compared to the nine months ended July 1, 2023, primarily

due to increases in manufacturing costs attributable to a)

increased raw materials costs resulting from ongoing inflationary

pressures and b) ongoing supply chain disruptions that resulted in

higher purchase costs for components.

Net Income Net income was $80.9 million for the nine months

ended June 29, 2024, which was a $75.7 million increase from the

same period in the prior year. The increase in net income was

primarily driven by the $107.7 million increase in gross profit,

discussed above. This was partially offset by a corresponding $26.4

million increase in income tax expense.

Adjusted Net Income Adjusted net income for the nine months

ended June 29, 2024 was $89.5 million, an increase of $76.4 million

compared with the same period last year, primarily due to the $75.7

million increase in net income, discussed above.

Adjusted EBITDA Adjusted EBITDA was $141.6 million for the nine

months ended June 29, 2024, an increase of $94.4 million compared

with the same period in the prior year. This is primarily due to

the $75.7 million increase in net income, discussed above, and the

corresponding $26.4 million increase in income tax expense.

Conference Call Details

Blue Bird will discuss its third quarter 2024 results in a

conference call at 4:30 PM ET today. Participants may listen to the

audio portion of the conference call either through a live audio

webcast on the Company's website or by telephone. The slide

presentation and webcast can be accessed via the Investor Relations

portion of Blue Bird's website at www.blue-bird.com.

- Webcast participants should log on and register at least 15

minutes prior to the start time on the Investor Relations homepage

of Blue Bird’s website at http://investors.blue-bird.com. Click the

link in the events box on the Investor Relations landing page.

- Participants desiring audio only should dial 404-975-4839 or

833-470-1428

A replay of the webcast will be available approximately two

hours after the call concludes via the same link on Blue Bird’s

website.

About Blue Bird

Corporation

Blue Bird (NASDAQ: BLBD) is recognized as a technology leader

and innovator of school buses since its founding in 1927. Our

dedicated team members design, engineer and manufacture school

buses with a singular focus on safety, reliability, and durability.

School buses carry the most precious cargo in the world – 25

million children twice a day – making them the most trusted mode of

student transportation. The company is the proven leader in low-

and zero-emission school buses with more than 20,000 propane,

natural gas, and electric powered buses in operation today. Blue

Bird is transforming the student transportation industry through

cleaner energy solutions. For more information on Blue Bird's

complete product and service portfolio, visit

www.blue-bird.com.

Key Non-GAAP Financial Measures We Use

to Evaluate Our Performance

This press release includes the following non-GAAP financial

measures “Adjusted EBITDA,” "Adjusted EBITDA Margin," "Adjusted Net

Income," "Adjusted Diluted Earnings per Share," “Free Cash Flow”

and “Adjusted Free Cash Flow”. Adjusted EBITDA and Free Cash Flow

are financial metrics that are utilized by management and the board

of directors, as and when applicable, to determine (a) the annual

cash bonus payouts, if any, to be made to certain employees based

upon the terms of the Company’s Management Incentive Plan, and (b)

whether the performance criteria have been met for the vesting of

certain equity awards granted annually to certain members of

management based upon the terms of the Company’s Omnibus Equity

Incentive Plan. Additionally, consolidated EBITDA, which is an

adjusted EBITDA metric defined by our Amended Credit Agreement that

could differ from Adjusted EBITDA discussed above as the

adjustments to the calculations are not uniform, is used to

determine the Company's ongoing compliance with several financial

covenant requirements, including being utilized in the denominator

of the calculation of the Total Net Leverage Ratio. Accordingly,

management views these non-GAAP financial metrics as key for the

above purposes and as a useful way to evaluate the performance of

our operations as discussed further below.

Adjusted EBITDA is defined as net income or loss prior to

interest income; interest expense including the component of

operating lease expense (which is presented as a single operating

expense in selling, general and administrative expenses in our U.S.

GAAP financial statements) that represents interest expense on

lease liabilities; income taxes; and depreciation and amortization

including the component of operating lease expense (which is

presented as a single operating expense in selling, general and

administrative expenses in our U.S. GAAP financial statements) that

represents amortization charges on right-of-use lease assets; as

adjusted for certain non-cash charges or credits that we may record

on a recurring basis such as share-based compensation expense and

unrealized gains or losses on certain derivative financial

instruments; net gains or losses on the disposal of assets as well

as certain charges such as (i) significant product design changes;

(ii) transaction related costs; or (iii) discrete expenses related

to major cost cutting and/or operational transformation

initiatives. While certain of the charges that are added back in

the Adjusted EBITDA calculation, such as transaction related costs

and operational transformation and major product redesign

initiatives, represent operating expenses that may be recorded in

more than one annual period, the significant project or transaction

giving rise to such expenses is not considered to be indicative of

the Company’s normal operations. Accordingly, we believe that

these, as well as the other credits and charges that comprise the

amounts utilized in the determination of Adjusted EBITDA described

above, should not be used in evaluating the Company’s ongoing

annual operating performance.

We define Adjusted EBITDA Margin as Adjusted EBITDA as a

percentage of net sales. Adjusted EBITDA and Adjusted EBITDA Margin

are not measures of performance defined in accordance with U.S.

GAAP. The measures are used as a supplement to U.S. GAAP results in

evaluating certain aspects of our business, as described below.

We believe that Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, and Adjusted Diluted Earnings per Share are

useful to investors in evaluating our performance because the

measures consider the performance of our ongoing operations,

excluding decisions made with respect to capital investment,

financing, and certain other significant initiatives or

transactions as outlined in the preceding paragraph. We believe the

non-GAAP measures offer additional financial metrics that, when

coupled with the GAAP results and the reconciliation to GAAP

results, provide a more complete understanding of our results of

operations and the factors and trends affecting our business.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income and

Adjusted Diluted Earnings per Share should not be considered as

alternatives to net income or GAAP earnings per share as an

indicator of our performance or as alternatives to any other

measure prescribed by GAAP as there are limitations to using such

non-GAAP measures. Although we believe the non-GAAP measures may

enhance an evaluation of our operating performance based on recent

revenue generation and product/overhead cost control because they

exclude the impact of prior decisions made about capital

investment, financing, and other expenses, (i) other companies in

Blue Bird’s industry may define Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net Income, and Adjusted Diluted Earnings per

Share differently than we do and, as a result, they may not be

comparable to similarly titled measures used by other companies in

Blue Bird’s industry, and (ii) Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net Income, and Adjusted Diluted Earnings per

Share exclude certain financial information that some may consider

important in evaluating our performance.

We compensate for these limitations by providing disclosure of

the differences between Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, and Adjusted Diluted Earnings per Share and

GAAP results, including providing a reconciliation to GAAP results,

to enable investors to perform their own analysis of our operating

results.

Our measures of “Free Cash Flow” and "Adjusted Free Cash Flow"

are used in addition to and in conjunction with results presented

in accordance with GAAP and free cash flow and adjusted free cash

flow should not be relied upon to the exclusion of GAAP financial

measures. Free cash flow and adjusted free cash flow reflect an

additional way of viewing our liquidity that, when viewed with our

GAAP results, provides a more complete understanding of factors and

trends affecting our cash flows. We strongly encourage investors to

review our financial statements and publicly-filed reports in their

entirety and not to rely on any single financial measure.

We define Free Cash Flow as total cash provided by/used in

operating activities as adjusted for net cash paid for the

acquisition of fixed assets and intangible assets. We use Free Cash

Flow, and ratios based on Free Cash Flow, to conduct and evaluate

our business because, although it is similar to cash flow from

operations, we believe it is a more conservative measure of cash

flow since purchases of fixed assets and intangible assets are a

necessary component of ongoing operations.

Forward Looking

Statements

This press release includes forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to expectations for future financial performance,

business strategies or expectations for our business. Specifically,

forward-looking statements include statements in this press release

regarding guidance, seasonality, product mix and gross profits and

may include statements relating to:

- Inherent limitations of internal controls impacting financial

statements

- Growth opportunities

- Future profitability

- Ability to expand market share

- Customer demand for certain products

- Economic conditions (including tariffs) that could affect fuel

costs, commodity costs, industry size and financial conditions of

our dealers and suppliers

- Labor or other constraints on the Company’s ability to maintain

a competitive cost structure

- Volatility in the tax base and other funding sources that

support the purchase of buses by our end customers

- Lower or higher than anticipated market acceptance for our

products

- Other statements preceded by, followed by or that include the

words “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “anticipate,” “believe,” “seek,” “target” or similar

expressions

These forward-looking statements are based on information

available as of the date of this press release, and current

expectations, forecasts and assumptions, and involve a number of

judgments, risks and uncertainties. Accordingly, forward-looking

statements should not be relied upon as representing our views as

of any subsequent date, and we do not undertake any obligation to

update forward-looking statements to reflect events or

circumstances after the date they were made, whether as a result of

new information, future events or otherwise, except as may be

required under applicable securities laws. The factors described

above, as well as risk factors described in reports filed with the

SEC by us (available at www.sec.gov), could cause our actual

results to differ materially from estimates or expectations

reflected in such forward-looking statements.

BLUE BIRD CORPORATION AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands of dollars, except for share

data)

June 29, 2024

September 30, 2023

Assets

Current assets

Cash and cash equivalents

$

88,416

$

78,988

Accounts receivable, net

34,006

12,574

Inventories

144,537

135,286

Other current assets

8,738

9,215

Total current assets

$

275,697

$

236,063

Property, plant and equipment, net

$

97,608

$

95,101

Goodwill

18,825

18,825

Intangible assets, net

44,022

45,424

Equity investment in affiliate

28,715

17,619

Deferred tax assets

—

2,182

Finance lease right-of-use assets

507

1,034

Other assets

2,696

1,518

Total assets

$

468,070

$

417,766

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable

$

128,144

$

137,140

Warranty

6,796

6,711

Accrued expenses

36,817

32,894

Deferred warranty income

9,075

8,101

Finance lease obligations

1,124

583

Other current liabilities

10,618

24,391

Current portion of long-term debt

5,000

19,800

Total current liabilities

$

197,574

$

229,620

Long-term liabilities

Revolving credit facility

$

—

$

—

Long-term debt

91,158

110,544

Warranty

8,700

8,723

Deferred warranty income

17,978

15,022

Deferred tax liabilities

4,620

2,513

Finance lease obligations

6

987

Other liabilities

8,757

7,955

Pension

1,994

2,404

Total long-term liabilities

$

133,213

$

148,148

Guarantees, commitments and

contingencies

Stockholders' equity

Preferred stock, $0.0001 par value,

10,000,000 shares authorized, 0 shares outstanding at June 29, 2024

and September 30, 2023

$

—

$

—

Common stock, $0.0001 par value,

100,000,000 shares authorized, 32,331,161 and 32,165,225 shares

outstanding at June 29, 2024 and September 30, 2023,

respectively

3

3

Additional paid-in capital

193,869

177,861

Retained earnings (accumulated

deficit)

25,184

(55,700

)

Accumulated other comprehensive loss

(31,491

)

(31,884

)

Treasury stock, at cost, 1,782,568 shares

at June 29, 2024 and September 30, 2023

(50,282

)

(50,282

)

Total stockholders' equity

$

137,283

$

39,998

Total liabilities and stockholders'

equity

$

468,070

$

417,766

BLUE BIRD CORPORATION AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

Nine Months Ended

(in thousands of dollars except for share

data)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net sales

$

333,367

$

294,284

$

996,942

$

829,830

Cost of goods sold

264,014

248,534

800,392

740,974

Gross profit

$

69,353

$

45,750

$

196,550

$

88,856

Operating expenses

Selling, general and administrative

expenses

29,625

26,328

82,798

66,365

Operating profit

$

39,728

$

19,422

$

113,752

$

22,491

Interest expense

(2,107

)

(4,507

)

(8,550

)

(13,895

)

Interest income

990

246

3,132

258

Other expense, net

(2,729

)

(6,421

)

(5,918

)

(6,999

)

Loss on debt refinancing or

modification

—

—

(1,558

)

(537

)

Income before income taxes

$

35,882

$

8,740

$

100,858

$

1,318

Income tax expense

(9,938

)

(1,884

)

(26,645

)

(292

)

Equity in net income of non-consolidated

affiliate

2,767

2,502

6,671

4,168

Net income

$

28,711

$

9,358

$

80,884

$

5,194

Earnings per share:

Basic weighted average shares

outstanding

32,305,396

32,073,497

32,238,805

32,044,581

Diluted weighted average shares

outstanding

33,653,447

32,598,938

33,222,354

32,335,381

Basic earnings per share

$

0.89

$

0.29

$

2.51

$

0.16

Diluted earnings per share

$

0.85

$

0.29

$

2.43

$

0.16

BLUE BIRD CORPORATION AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended

(in thousands of dollars)

June 29, 2024

July 1, 2023

Cash flows from operating

activities

Net income

$

80,884

$

5,194

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

10,913

12,077

Non-cash interest expense

305

1,124

Share-based compensation expense

7,017

2,229

Equity in net income of non-consolidated

affiliate

(6,671

)

(4,168

)

Dividend from equity investment in

affiliate

2,991

—

Loss on disposal of fixed assets

33

13

Deferred income tax expense

4,165

522

Amortization of deferred actuarial pension

losses

516

896

Loss on debt refinancing or

modification

1,558

537

Changes in assets and liabilities:

Accounts receivable

(21,432

)

1,105

Inventories

(9,251

)

13,808

Other assets

680

(228

)

Accounts payable

(9,961

)

27,953

Accrued expenses, pension and other

liabilities

(5,987

)

23,069

Total adjustments

$

(25,124

)

$

78,937

Total cash provided by operating

activities

$

55,760

$

84,131

Cash flows from investing

activities

Cash paid for fixed assets

$

(10,137

)

$

(6,390

)

Total cash used in investing

activities

$

(10,137

)

$

(6,390

)

Cash flows from financing

activities

Revolving credit facility borrowings

$

36,220

$

45,000

Revolving credit facility repayments

(36,220

)

(65,000

)

Term loan borrowings - new credit

agreement

100,000

—

Term loan repayments

(134,300

)

(14,850

)

Principal payments on finance leases

(440

)

(425

)

Cash paid for debt costs

(3,128

)

(3,272

)

Repurchase of common stock in connection

with stock award exercises

(301

)

(57

)

Cash received from stock option

exercises

1,974

1,119

Total cash used in financing

activities

$

(36,195

)

$

(37,485

)

Change in cash, cash equivalents, and

restricted cash

9,428

40,256

Cash, cash equivalents, and restricted

cash at beginning of period

78,988

10,479

Cash, cash equivalents, and restricted

cash at end of period

$

88,416

$

50,735

Supplemental disclosures of cash flow

information

Cash paid or received during the

period:

Interest paid, net of interest

received

$

4,725

$

12,202

Income tax paid (received), net of tax

refunds

18,856

(33

)

Non-cash investing and financing

activities:

Changes in accounts payable for capital

additions to property, plant and equipment

$

2,336

$

745

Right-of-use assets obtained in exchange

for operating lease obligations

1,682

199

Warrants issued for equity investment in

affiliate

7,416

—

Reconciliation of Net Income

to Adjusted EBITDA

Three Months Ended

Nine Months Ended

(in thousands of dollars)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income

$

28,711

$

9,358

$

80,884

$

5,194

Adjustments:

Interest expense, net (1)

1,214

4,353

5,729

13,923

Income tax expense

9,938

1,884

26,645

292

Depreciation, amortization, and disposals

(2)

4,055

5,481

12,253

13,477

Operational transformation initiatives

—

196

—

1,133

Share-based compensation expense

2,474

941

7,017

2,229

Stockholder transaction costs

—

5,509

3,154

6,252

Loss on debt refinancing or

modification

—

—

1,558

537

Other

2

293

(81

)

574

Subtotal (Adjusted EBITDA as previously

presented)

$

46,394

$

28,015

$

137,159

$

43,611

Micro Bird Holdings, Inc. total interest

expense, net; income tax expense or benefit; depreciation expense

and amortization expense

1,852

1,650

4,442

3,606

Adjusted EBITDA

$

48,246

$

29,665

$

141,601

$

47,217

Adjusted EBITDA margin (percentage of net

sales)

14.5

%

10.1

%

14.2

%

5.7

%

___________________

(1)

Includes $0.1 million for both the three

months ended June 29, 2024 and July 1, 2023, and $0.3 million for

both the nine months ended June 29, 2024 and July 1, 2023,

representing interest expense on operating lease liabilities, which

are a component of lease expense and presented as a single

operating expense in selling, general and administrative expenses

on our Condensed Consolidated Statements of Operations.

(2)

Includes $0.3 million and $0.5 million for

the three months ended June 29, 2024 and July 1, 2023,

respectively, and $1.3 million for both the nine months ended June

29, 2024 and July 1, 2023, representing amortization charges on

right-of-use lease assets, which are a component of lease expense

and presented as a single operating expense in selling, general and

administrative expenses on our Condensed Consolidated Statements of

Operations.

Reconciliation of Free Cash

Flow to Adjusted Free Cash Flow

Three Months Ended

Nine Months Ended

(in thousands of dollars)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net cash provided by operating

activities

$

989

$

39,415

$

55,760

$

84,131

Cash paid for fixed assets

(4,494

)

(2,650

)

(10,137

)

(6,390

)

Free cash flow

$

(3,505

)

$

36,765

$

45,623

$

77,741

Cash paid for operational transformation

initiatives

—

196

—

1,133

Cash paid for stockholder transaction

costs

—

5,509

3,154

6,252

Cash paid for other items

2

293

(81

)

574

Adjusted free cash flow

(3,503

)

42,763

48,696

85,700

Reconciliation of Net Income

to Adjusted Net Income

Three Months Ended

Nine Months Ended

(in thousands of dollars)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income

$

28,711

$

9,358

$

80,884

$

5,194

Adjustments, net of tax benefit or expense

(1)

Operational transformation initiatives

—

145

—

838

Share-based compensation expense

1,831

696

5,193

1,649

Stockholder transaction costs

—

4,077

2,334

4,626

Loss on debt modification

—

—

1,153

397

Other

1

217

(60

)

425

Adjusted net income, non-GAAP

$

30,543

$

14,493

89,504

13,129

___________________

(1)

Amounts are net of estimated tax rates of

26%.

Reconciliation of Diluted EPS

to Adjusted Diluted EPS

Three Months Ended

Nine Months Ended

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Diluted earnings per share

$

0.85

$

0.29

$

2.43

$

0.16

One-time charge adjustments, net of tax

benefit or expense

0.06

0.15

0.26

0.25

Adjusted diluted earnings per share,

non-GAAP

$

0.91

$

0.44

$

2.69

$

0.41

Adjusted weighted average dilutive shares

outstanding

33,653,447

32,598,938

33,222,354

32,335,381

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807911595/en/

Mark Benfield Investor Relations (478) 822-2315

Mark.Benfield@blue-bird.com

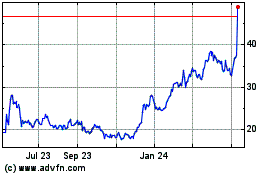

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

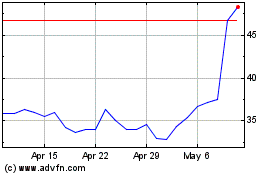

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Nov 2023 to Nov 2024