0001666134 False 0001666134 2025-01-09 2025-01-09 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2025

_______________________________

BLACKLINE, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-37924 | 46-3354276 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

21300 Victory Boulevard, 12th Floor

Woodland Hills, California 91367

(Address of Principal Executive Offices) (Zip Code)

(818) 223-9008

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | BL | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 13, 2025, BlackLine, Inc. (the “Company”) announced preliminary financial results for the fourth quarter ending December 31, 2024.

The information furnished pursuant to Item 2.02 on this Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 13, 2025, the Company announced that Mark Woodhams, Chief Revenue Officer of the Company, will retire from the Company, effective June 2, 2025. The Company also announced that Stuart Van Houten will join the Company as Chief Commercial Officer, effective February 17, 2025, leading the Company’s global sales organization and revenue operations. At that time, he will assume Mr. Woodhams’ role as head of the global sales team.

Under the circumstances of his retirement and departure of the Company, Mr. Woodhams is entitled to severance benefits under the Company’s Change in Control and Severance Policy (the “Severance Policy”) upon his departure. In addition to the benefits under the Severance Policy, Mr. Woodhams will receive additional cash compensation of $80,000 in relocation benefits, with all such payments and benefits subject to execution of a release of claims in favor of the Company and other released parties, and complying with various post-employment obligations. The terms and conditions of the severance otherwise are consistent with the Severance Policy. Mr. Woodhams’ current compensation arrangements will continue until his retirement date.

A copy of the related press release announcing the appointment of Mr. Van Houten and Mr. Woodhams’ retirement is attached hereto as Exhibit 99.1

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | BLACKLINE, INC. |

| | | |

| | | |

| Date: January 13, 2025 | By: | /s/ Karole Morgan-Prager |

| | | Karole Morgan-Prager |

| | | Chief Legal and Administrative Officer |

| | | |

EXHIBIT 99.1

BlackLine Appoints Stuart Van Houten as Chief Commercial Officer

Stuart Van Houten, Will Join BlackLine Effective February 17, 2025, and Succeed Mark Woodhams as Head of Global Sales Team

BlackLine Expects Fourth Quarter and Full Year 2024 Revenue to Meet or Slightly Exceed High End of Guidance Range; Reaffirms Non-GAAP Operating Margin Guidance

LOS ANGELES, Jan. 13, 2025 (GLOBE NEWSWIRE) -- BlackLine, Inc. (Nasdaq: BL) (“BlackLine” or the “Company”), the future-ready platform for the Office of the CFO, today announced that Stuart Van Houten, a seasoned technology and enterprise SaaS veteran, will assume the newly created role of Chief Commercial Officer on February 17, 2025. Mr. Van Houten will be responsible for leading the Company’s global sales organization and revenue operations. He will succeed BlackLine’s current Chief Revenue Officer, Mark Woodhams, as head of the global sales team. Mr. Woodhams will retire effective June 2nd.

Mr. Van Houten brings over 20 years of sales leadership and strategic expertise to BlackLine, with nearly a decade spent in roles of increasing responsibility at SAP. Most recently, he has served as the Chief Revenue Officer for SAP’s North American Intelligent Spend Management division, where he successfully doubled the division’s revenue during his tenure. At SAP, he has led a high-performing team of hundreds of professionals across sales, customer success, solution and value advisory, in delivering innovation and fostering strong client relationships. Mr. Van Houten has also held transformative leadership roles at Orchestro, Clarabridge, and GridPoint, where he scaled revenues, built global teams, and spearheaded successful transitions to SaaS models.

"We are incredibly excited to welcome Stuart to BlackLine. His experience accelerating growth and leading large sales teams make him a perfect fit for BlackLine and where we are in our transformation. We also want to recognize Mark and, on behalf of our Board of Directors and executive leadership team, thank him for his valuable contributions to BlackLine for almost seven years. We wish him all the best and thank him for helping to ensure a smooth transition,” said Therese Tucker, Co-CEO and Founder of BlackLine.

“At our November Investor Day, we presented our refined strategy centered on accelerating platform innovation, while expanding our market reach, with particular focus on strategic partnerships, including SAP," said Owen Ryan, Co-CEO and Chairman of BlackLine. “Stuart's appointment is expected to accelerate this momentum, bringing his deep expertise in enterprise technology partnerships and industry-specific solutions to drive immediate impact."

“I’ve seen firsthand how compelling the BlackLine offering is, and it is exciting to join this team at this pivotal moment,” said Mr. Van Houten. “I think Owen and Therese have re-energized BlackLine and strengthened its position in the market. The Office of the CFO is at the center of technology transformation, where flawless execution is the goal, and return on investment must be demonstrated. I’m confident the BlackLine offering and this team have substantial runway for growth and are poised for incredible success.”

BlackLine also announced that it expects fourth quarter and full year 2024 revenue to meet or slightly exceed the high end of its previously disclosed guidance range. The Company also expects non-GAAP operating margin to be within the guidance range for the fourth quarter and the full year 2024. The previously disclosed ranges are below:

Previously Disclosed Fourth Quarter 2024 Guidance

- Total GAAP revenue is expected to be in the range of $167 million to $169 million.

- Non-GAAP operating margin is expected to be in the range of 18.0% to 19.0%.

Previously Disclosed Full Year 2024 Guidance

- Total GAAP revenue is expected to be in the range of $651.0 million to $653.0 million.

- Non-GAAP operating margin is expected to be in the range of 19.4% to 19.6%.

The preliminary estimated financial results for the fourth quarter ended December 31, 2024 are preliminary, unaudited and subject to completion, and may change as a result of management's continued review. Such preliminary results are subject to the finalization of quarter and year-end financial and accounting procedures.

About BlackLine

BlackLine (Nasdaq: BL), the future-ready platform for the Office of the CFO, drives digital finance transformation by empowering organizations with accurate, efficient, and intelligent financial operations. BlackLine’s comprehensive platform addresses mission-critical processes, including record-to-report and invoice-to-cash, enabling unified and accurate data, streamlined and optimized processes, and real-time insight through visibility, automation, and AI. BlackLine’s proven, collaborative approach ensures continuous transformation, delivering immediate impact and sustained value. With a proven track record of innovation, industry-leading R&D investment, and world-class security practices, more than 4,400 customers across multiple industries partner with BlackLine to lead their organizations into the future.

For more information, please visit blackline.com.

Forward-looking Statements

This release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “would,” “continue,” “ongoing” or the negative of these terms or other comparable terminology. Forward-looking statements in this release include statements regarding our growth plans, strategies and opportunities, our expected financial results for the fourth quarter and full year ended December 31, 2024 and trends in our business.

Any forward-looking statements contained in this press release are based upon BlackLine’s current plans, estimates and expectations, and are not a representation that such plans, estimates, or expectations will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events and are subject to risks and uncertainties. If any of these risks or uncertainties materialize or if any assumptions prove incorrect, actual performance or results may differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to the Company’s ability to execute on its strategies, attract new customers, enter new geographies and develop, release and sell new features and solutions; and other risks and uncertainties described in the other filings we make with the Securities and Exchange Commission from time to time, including the risks described under the heading “Risk Factors” in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q.

Forward-looking statements should not be read as a guarantee of future performance or results, and you should not place undue reliance on such statements. Except as required by law, we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Media Contact:

Samantha Darilek

samantha.darilek@blackline.com

Investor Relations Contact:

Matt Humphries, CFA

matt.humphries@blackline.com

v3.24.4

Cover

|

Jan. 09, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 09, 2025

|

| Entity File Number |

001-37924

|

| Entity Registrant Name |

BLACKLINE, INC.

|

| Entity Central Index Key |

0001666134

|

| Entity Tax Identification Number |

46-3354276

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

21300 Victory Boulevard, 12th Floor

|

| Entity Address, City or Town |

Woodland Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91367

|

| City Area Code |

818

|

| Local Phone Number |

223-9008

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

BL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

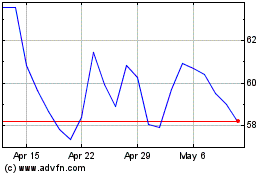

BlackLine (NASDAQ:BL)

Historical Stock Chart

From Dec 2024 to Jan 2025

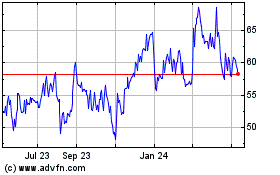

BlackLine (NASDAQ:BL)

Historical Stock Chart

From Jan 2024 to Jan 2025