Blackbaud, Inc. (the "Company") (NASDAQ:BLKB), the leading provider

of software and services for the global philanthropic

community, today announced financial results for its fourth quarter

and full year ended December 31, 2015.

Fourth Quarter 2015 versus Fourth

Quarter 2014 Highlights

- Total revenue growth of 15.1% to $175.9 million

- Non-GAAP organic revenue growth of 7.0%; 8.5% in constant

currency

- Recurring revenue represented 77.6% of total revenue

- Income from operations increased 35.3% to $10.3 million

- Non-GAAP income from operations increased 16.7% to $32.2

million

- Cash flow from operations growth of 73.1%, to $29.0

million

Full Year 2015 versus Full Year 2014

Highlights

- Total revenue growth of 13.0% to $637.9 million

- Non-GAAP organic revenue growth of 6.1%; 7.7% in constant

currency

- Recurring revenue represented 76.1% of total revenue

- Income from operations increased 0.8% to $46.7 million

- Non-GAAP income from operations increased 19.9% to $122.0

million

- Cash flow from operations growth of 11.8% to $114.3

million

An explanation of all non-GAAP financial

measures referenced in this press release is included below under

the heading "Non-GAAP Financial Measures." A reconciliation of the

Company's non-GAAP financial measures to their most directly

comparable GAAP measures has been provided in the financial

statement tables included below in this press release.

2016 Full Year Financial

Guidance

- Non-GAAP revenue of $725.0 million to $740.0 million

- Non-GAAP income from operations of $141.0 million to $147.0

million

- Non-GAAP operating margin of 19.4% to 19.9%

- Non-GAAP diluted earnings per share of $1.90 to $1.98

- Cash flow from operations of $145.0 million to $155.0

million

President and CEO, Mike Gianoni, commented, "We

had a strong finish to the year and are very pleased with our 2015

financial results, especially when considering this year marked the

beginning of our cloud-transition for mid-market solutions like

Raiser’s Edge NXT and Financial Edge NXT. Non-GAAP recurring

revenue reached a record 78% of total revenue in the fourth quarter

and fueled the 8.5% non-GAAP organic revenue growth after adjusting

for constant currency. The Company maintained its focus on

efficiency and profitability resulting in strong margin expansion

for the quarter and the full year. We’ve done an excellent job

positioning ourselves to accelerate our revenue growth and improve

our operating leverage in 2016, which is clearly shown by our

financial guidance.”

Fourth Quarter 2015 GAAP and Non-GAAP

Financial Results

Blackbaud generated total revenue of $175.9

million in the fourth quarter of 2015, an increase of 15.1%

compared to $152.8 million in the fourth quarter of 2014. Income

from operations and net income were $10.3 million and $6.4 million,

respectively, up from $7.6 million and $4.8 million, respectively,

in the fourth quarter of 2014. Diluted earnings per share was $0.14

in the fourth quarter of 2015, up from $0.10 during the same period

in 2014.

Total revenue, income from operations and net

income were positively impacted in the fourth quarter from growth

in subscriptions revenue and contributions from Blackbaud's

acquisition of Smart Tuition in October 2015.

Blackbaud achieved non-GAAP revenue of $178.1

million and non-GAAP organic revenue growth of 7.0% in the fourth

quarter of 2015. On a constant currency basis, non-GAAP organic

revenue growth was 8.5% in the fourth quarter of 2015.

Non-GAAP income from operations, which excludes

certain effects of acquisition-related accounting, as well as

certain non-cash and other extraordinary items, increased 16.7% to

$32.2 million in the fourth quarter of 2015, compared to $27.6

million in the same period in 2014. Non-GAAP net income increased

14.6% to $17.8 million in the fourth quarter of 2015 compared to

$15.5 million in the same period in 2014. Non-GAAP diluted earnings

per share was $0.38 in the fourth quarter of 2015, up from $0.34

per diluted share in the same period last year. Non-GAAP diluted

earnings per share would have been $0.39 if it had not been for

revaluation of foreign currency negatively impacting other expense

by approximately $0.5 million.

Non-GAAP income from operations and non-GAAP net

income were positively impacted in the fourth quarter by growth in

subscriptions revenue and contributions from Blackbaud's

acquisition of Smart Tuition in October 2015.

Balance Sheet and Cash Flow

The Company ended the fourth quarter with $15.4

million of cash and cash equivalents, compared to $17.6 million on

September 30, 2015. The Company generated $29.0 million in cash

flow from operations during the fourth quarter, returned $5.6

million to stockholders by way of dividend and had cash outlays of

$8.7 million for capital expenditures and capitalized software. The

Company increased net debt by $169.1 million during the fourth

quarter, primarily due to the acquisition of Smart Tuition in

October 2015. Following the acquisition, the total amount

outstanding on the letters of credit, revolving credit loans and

term loan was $429.0 million.

Full Year 2015 GAAP and Non-GAAP Financial

Results

Blackbaud reported total revenue of $637.9

million for the full year 2015, an increase of 13.0% compared to

$564.4 million for 2014. Income from operations and net income were

$46.7 million and $25.6 million, respectively, for the full year

2015 compared to $46.4 million and $28.3 million, respectively, for

2014. Diluted earnings per share was $0.55 for the full year 2015,

compared to $0.62 for 2014.

Total revenue and income from operations were

positively impacted in 2015 from growth in subscriptions revenue

and contributions from Blackbaud's acquisitions of WhippleHill in

June 2014 and MicroEdge in October 2014, each of which contributed

a full year of revenue in 2015, compared partial period

contributions in the prior year. Total revenue and income from

operations were also positively impacted by incremental revenue

from Blackbaud's acquisition of Smart Tuition in October 2015. Net

income was negatively impacted in 2015 by increased amortization of

finite-lived intangible assets arising from acquisitions, as well

as increased stock-based compensation.

Blackbaud achieved non-GAAP revenue of $647.3

million and non-GAAP organic revenue growth of 6.1% for the full

year 2015. On a constant currency basis, non-GAAP organic revenue

growth was 7.7% for the full year 2015.

Non-GAAP income from operations, which excludes

certain effects of acquisition-related accounting, as well as

certain non-cash and other extraordinary items, increased 19.9% to

$122.0 million for the full year 2015, compared to $101.7 million

in 2014. Non-GAAP net income increased 19.5% to $69.6 million for

the full year 2015 compared to $58.3 million in 2014. Non-GAAP

diluted earnings per share was $1.50 for the full year 2015, up

from $1.27 per diluted share in 2014.

Blackbaud generated $114.3 million in cash flow

from operations for the full year 2015, an 11.8% increase over the

$102.3 million generated for the full year 2014.

Executive Vice President and CFO, Tony Boor,

commented, "While many technology companies lack revenue and margin

growth during a cloud-transition period, Blackbaud posted solid

results on both fronts in 2015. Non-GAAP organic revenue growth

improved 60 basis points to 7.7% on a constant currency basis as a

result of investments we’ve made into sales, customer success and

solution portfolio innovation. We maintained focus on our strategic

initiative to expand margins during the year, and increased

non-GAAP operating margin 130 basis points to 19.1% on a constant

currency basis. I’m very pleased to report that we expect to

improve upon these results in 2016. At the mid-point of our

financial guidance, non-GAAP organic revenue growth exceeds 9% on a

constant currency basis, and non-GAAP operating margin is

approximately 20% on a constant currency basis. We will continue to

effectively manage our balance sheet in 2016, allowing us to seize

compelling opportunities that are accretive to our financial

performance and expand our addressable market."

Long-Term Financial Goal

Update

Blackbaud today announced that it is updating

its long-term aspirational goal for aggregate operating cash flow

over the four year period from 2014 to 2017 from its initial

estimated range of $400 million to $450 million to an updated

estimated range of $500 million to $550 million.

Dividend

Blackbaud announced today that its Board of

Directors has declared a first quarter 2016 dividend of $0.12 per

share payable on March 15, 2016 to stockholders of record on

February 26, 2016.

Conference Call Details

Blackbaud will host a conference call on

February 10, 2016, at 8:00 a.m. (Eastern Time) to discuss the

Company's financial results, operations and related matters. A live

webcast will be available and archived at

www.blackbaud.com/investorrelations, or access this call by dialing

1-888-461-2030 (domestic) or 1-719-457-2712 (international) and

entering passcode 507993.

Investors and others should note that Blackbaud

announces material financial information including SEC filings,

press releases, public conference calls and webcasts, on its

website. Blackbaud also uses this channel, as well as social media

channels, to communicate information about the Company, its

services and other issues with its customers and the public. It is

possible that information shared through social media channels

could be deemed material information. Therefore, investors, the

media, and others interested in the Company, are encouraged to

visit Blackbaud's press room, at www.blackbaud.com/press-room, to

further review any information shared through social media.

About Blackbaud

Serving the worldwide philanthropic community

for more than 30 years, Blackbaud (NASDAQ:BLKB) combines innovative

software and services, and expertise to help organizations

achieve their missions. Blackbaud works in over 60 countries

to power the passions of approximately 35,000 customers, including

nonprofits, K-12 private and higher education institutions,

healthcare organizations, foundations and other charitable

giving entities, and corporations. The Company offers a

full spectrum of cloud and on-premise solutions, as well as a

resource network that empowers and connects organizations of all

sizes. Blackbaud's portfolio of software and services

support nonprofit fundraising and relationship management,

digital marketing, advocacy, accounting, payments and analytics, as

well as grant management, corporate social responsibility, and

education. Using Blackbaud technology, these organizations raise,

invest, manage and award more than $100 billion each year.

Recognized as a top company, Blackbaud is headquartered in

Charleston, South Carolina and has operations in the United States,

Australia, Canada, Ireland and the United Kingdom. For more

information, visit www.blackbaud.com.

Forward-looking Statements

Except for historical information, all of the

statements, expectations, and assumptions contained in this news

release are forward-looking statements which are subject to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995, including, but not limited to, statements regarding:

expectations that we will accelerate our revenue growth and that

our operating margins will continue to improve, expectations that

we will achieve our projected 2016 full year financial guidance and

expectations that effectively managing our capital structure will

allow us to seize compelling opportunities that accelerate our

shift to the cloud and are accretive to our financial performance.

These statements involve a number of risks and uncertainties.

Although Blackbaud attempts to be accurate in making these

forward-looking statements, it is possible that future

circumstances might differ from the assumptions on which such

statements are based. In addition, other important factors that

could cause results to differ materially include the following:

management of integration of acquired companies; uncertainty

regarding increased business and renewals from existing customers;

a shifting revenue mix that may impact gross margin; continued

success in sales growth; risks related to our dividend policy and

stock repurchase program, including the possibility that we might

discontinue payment of dividends; and the other risk factors set

forth from time to time in the SEC filings for Blackbaud, copies of

which are available free of charge at the SEC’s website at

www.sec.gov or upon request from Blackbaud's investor relations

department. Blackbaud assumes no obligation and does not intend to

update these forward-looking statements, except as required by law.

All Blackbaud product names appearing herein are trademarks or

registered trademarks of Blackbaud, Inc.

Non-GAAP Financial Measures

Blackbaud has provided in this release financial

information that has not been prepared in accordance with GAAP.

This information includes non-GAAP revenue, non-GAAP gross profit,

non-GAAP gross margin, non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income and non-GAAP diluted earnings

per share. The Company has acquired businesses whose net tangible

assets include deferred revenue. In accordance with GAAP reporting

requirements, the Company recorded write-downs of deferred revenue

to fair value, which resulted in lower recognized revenue. Both on

a quarterly and year-to-date basis, the revenue for the acquired

businesses is deferred and typically recognized over a one-year

period, so Blackbaud's GAAP revenues for the one-year period after

the acquisitions will not reflect the full amount of revenues that

would have been reported if the acquired deferred revenue was not

written down to fair value. The non-GAAP measures described above

reverse the acquisition-related deferred revenue write-downs so

that the full amount of revenue booked by the acquired companies is

included, which the Company believes provides a more accurate

representation of a revenue run-rate in a given period. In addition

to reversing write-downs of acquisition-related deferred revenue,

non-GAAP financial measures discussed above exclude the impact of

certain items that Blackbaud believes are not directly related to

its performance in any particular period, but are for its long-term

benefit over multiple periods.

In addition, Blackbaud discusses non-GAAP

organic revenue growth and non-GAAP organic revenue growth on a

constant currency basis, which it believes provides useful

information for evaluating the periodic growth of its business on a

consistent basis. Non-GAAP organic revenue growth excludes

incremental acquisition-related revenue attributable to companies

acquired in the current fiscal year. For companies acquired in the

immediately preceding fiscal year, non-GAAP organic revenue growth

reflects presentation of full year incremental non-GAAP revenue

derived from such companies as if they were combined throughout the

prior period, and it includes the current period non-GAAP revenue

attributable to those companies, as if there were no

acquisition-related write-downs of acquired deferred revenue to

fair value as required by GAAP. In addition, non-GAAP organic

revenue growth excludes prior period revenue associated with

divested businesses in the current fiscal year. The exclusion of

the prior period revenue is to present the results of the divested

businesses within the results of the combined company for the same

period of time in both the prior and current periods. Blackbaud

believes this presentation provides a more comparable

representation of its current business’ organic revenue growth and

revenue run-rate.

Unaudited calculations of non-GAAP organic

revenue growth and non-GAAP organic revenue growth on a constant

currency basis for the fourth quarter and full year of 2015, as

well as unaudited reconciliations of those non-GAAP measures to

their most directly comparable GAAP measures, are as follows:

| |

|

|

|

| (in thousands, except

percentages) |

Three months ended December

31, |

|

Years ended December 31, |

| 2015 |

2014 |

|

2015 |

2014 |

| GAAP revenue |

$ |

175,877 |

|

$ |

152,813 |

|

|

$ |

637,940 |

|

$ |

564,421 |

|

| GAAP revenue

growth |

15.1 |

% |

|

|

13.0 |

% |

|

| (Less)

Add: Non-GAAP acquisition-related revenue (1) |

(7,990 |

) |

4,642 |

|

|

(858 |

) |

37,429 |

|

| Less:

Revenue from divested businesses (2) |

— |

|

(520 |

) |

|

— |

|

(1,279 |

) |

| Total Non-GAAP

adjustments |

(7,990 |

) |

4,122 |

|

|

(858 |

) |

36,150 |

|

| Non-GAAP revenue

(3) |

$ |

167,887 |

|

$ |

156,935 |

|

|

$ |

637,082 |

|

$ |

600,571 |

|

| Non-GAAP

organic revenue growth |

7.0 |

% |

|

|

6.1 |

% |

|

| |

|

|

|

|

|

| Non-GAAP revenue

(3) |

$ |

167,887 |

|

$ |

156,935 |

|

|

$ |

637,082 |

|

$ |

600,571 |

|

| Foreign currency impact

on Non-GAAP revenue (4) |

2,412 |

|

— |

|

|

9,623 |

|

— |

|

| Non-GAAP revenue on

constant currency basis (4) |

$ |

170,299 |

|

$ |

156,935 |

|

|

$ |

646,705 |

|

$ |

600,571 |

|

| Non-GAAP

organic revenue growth on constant currency basis

|

8.5 |

% |

|

|

7.7 |

% |

|

| |

|

|

|

|

|

|

|

(1) Non-GAAP acquisition-related revenue excludes incremental

acquisition-related revenue calculated in accordance with GAAP that

is attributable to companies acquired in the current fiscal year.

For companies acquired in the immediately preceding fiscal year,

non-GAAP acquisition-related revenue reflects presentation of

full-year incremental non-GAAP revenue derived from such companies,

as if they were combined throughout the prior period, and it

includes the current period non-GAAP revenue from the

acquisition-related deferred revenue write-down attributable to

those companies.

(2) For businesses divested in the current fiscal year, non-GAAP

organic revenue growth excludes a portion of the prior year period

revenue associated with businesses divested of in the current

fiscal year. The exclusion of the prior period revenue is to

present the results of the divested business with the results of

the combined company for the same period of time in both the prior

and current periods.

(3) Non-GAAP revenue for the prior year periods presented herein

will not agree to non-GAAP revenue presented in the respective

prior period quarterly financial information solely due to the

manner in which non-GAAP organic revenue growth is calculated.

(4) To determine non-GAAP organic revenue growth on a constant

currency basis, revenues from entities reporting in foreign

currencies were translated to U.S. Dollars using the comparable

prior period's quarterly weighted average foreign currency exchange

rates. The primary foreign currencies creating the impact are the

Canadian Dollar, EURO, British Pound and Australian Dollar.

Additional details of Blackbaud's methodology

for calculating non-GAAP organic revenue growth and non-GAAP

organic revenue growth on a constant currency basis can be found on

the "Investor Relations" page of the Company's website at

www.blackbaud.com/investorrelations.

As announced at its 2015 Investor Day, beginning

in 2016, Blackbaud intends to update the non-GAAP tax rate it

applies to the aggregate of the non-GAAP adjustments discussed

above, which will impact the tax impact related to non-GAAP

adjustments, non-GAAP net income and non-GAAP diluted earnings per

share measures in future periods. Historically, for the purposes of

determining non-GAAP net income, Blackbaud has utilized a non-GAAP

tax rate of 39.0% in its calculation of the tax impact related to

non-GAAP adjustments. At Investor Day, Blackbaud communicated that

it would be adjusting this rate to 36.0% to better reflect its

periodic effective tax rate calculated in accordance with GAAP and

its then current expectations related to tax rate impacting

legislation such as the domestic production activities deduction

and certain credits which are recurring in nature. Subsequent to

that Investor Day communication, the business research and

development tax credit was permanently extended. As a result, for

the purposes of determining non-GAAP net income in 2016, Blackbaud

now intends to utilize a 32.0% non-GAAP tax rate in its calculation

of the tax impact related to non-GAAP adjustments. The non-GAAP tax

rate utilized in future periods will be reviewed annually to

determine whether it remains appropriate in consideration of

Blackbaud's financial results including its periodic effective tax

rate calculated in accordance with GAAP, its operating environment

and related tax legislation in effect and other factors deemed

necessary. All fourth quarter and full year 2015 measures of the

tax impact related to non-GAAP adjustments, non-GAAP net income and

non-GAAP diluted earnings per share included in this news release

are calculated under Blackbaud's historical methodology.

Blackbaud uses these non-GAAP financial measures

internally in analyzing its financial results and believes they are

useful to investors, as a supplement to GAAP measures, in

evaluating Blackbaud's ongoing operational performance. Blackbaud

believes that these non-GAAP financial measures reflect the

Blackbaud's ongoing business in a manner that allows for meaningful

period-to-period comparison and analysis of trends in its business.

In addition, Blackbaud believes that the use of these non-GAAP

financial measures provides additional information for investors to

use in evaluating ongoing operating results and trends and in

comparing its financial results from period to period with other

companies in Blackbaud's industry, many of which present similar

non-GAAP financial measures to investors. However, these non-GAAP

financial measures may not be completely comparable to similarly

titled measures of other companies due to differences in the exact

method of calculation between companies. Non-GAAP financial

measures should not be considered in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures.

Reclassifications

In order to provide comparability between

periods presented, "donor restricted cash" and "donations payable"

have been renamed as "restricted cash due to customers" and "due to

customers", respectively, in the previously reported consolidated

balance sheet to conform to presentation of the current period. In

addition, capitalized software development costs have been

presented separately as "software development costs, net", in the

previously reported consolidated balance sheet to conform to

presentation of the current period.

| |

|

|

| Blackbaud, Inc. |

| Consolidated balance sheets |

| (Unaudited) |

| |

|

|

|

(in thousands, except share amounts) |

December 31, 2015 |

December 31, 2014 |

|

Assets |

|

|

| Current

assets: |

|

|

| Cash and

cash equivalents |

$ |

15,362 |

|

$ |

14,735 |

|

| Restricted

cash due to customers |

255,038 |

|

140,709 |

|

| Accounts

receivable, net of allowance of $4,943 and $4,539 at December 31,

2015 and December 31, 2014, respectively |

80,046 |

|

77,523 |

|

| Prepaid

expenses and other current assets |

48,666 |

|

40,392 |

|

| Deferred tax

asset, current portion |

— |

|

14,423 |

|

|

Total current assets |

399,112 |

|

287,782 |

|

| Property

and equipment, net |

52,651 |

|

49,896 |

|

| Software

development costs, net |

19,551 |

|

9,420 |

|

|

Goodwill |

436,449 |

|

349,008 |

|

|

Intangible assets, net |

294,672 |

|

229,307 |

|

| Other

assets |

21,418 |

|

17,770 |

|

|

Total assets |

$ |

1,223,853 |

|

$ |

943,183 |

|

| Liabilities and

stockholders’ equity |

|

|

| Current

liabilities: |

|

|

| Trade

accounts payable |

$ |

19,208 |

|

$ |

11,436 |

|

| Accrued

expenses and other current liabilities |

57,461 |

|

52,201 |

|

| Due to

customers |

255,038 |

|

140,709 |

|

| Debt,

current portion |

4,375 |

|

4,375 |

|

| Deferred

revenue, current portion |

230,216 |

|

212,283 |

|

|

Total current liabilities |

566,298 |

|

421,004 |

|

| Debt, net

of current portion |

404,229 |

|

276,196 |

|

| Deferred

tax liability |

27,996 |

|

43,639 |

|

| Deferred

revenue, net of current portion |

7,119 |

|

8,991 |

|

| Other

liabilities |

7,623 |

|

7,437 |

|

|

Total liabilities |

1,013,265 |

|

757,267 |

|

|

Commitments and contingencies |

|

|

|

Stockholders’ equity: |

|

|

| Preferred

stock; 20,000,000 shares authorized, none outstanding |

— |

|

— |

|

| Common

stock, $0.001 par value; 180,000,000 shares authorized, 56,873,817

and 56,048,135 shares issued at December 31, 2015 and December 31,

2014, respectively |

57 |

|

56 |

|

| Additional

paid-in capital |

276,340 |

|

245,674 |

|

| Treasury

stock, at cost; 9,903,071 and 9,740,054 shares at December 31, 2015

and December 31, 2014, respectively |

(199,861 |

) |

(190,440 |

) |

| Accumulated

other comprehensive loss |

(825 |

) |

(1,032 |

) |

| Retained

earnings |

134,877 |

|

131,658 |

|

|

Total stockholders’ equity |

210,588 |

|

185,916 |

|

|

Total liabilities and stockholders’

equity |

$ |

1,223,853 |

|

$ |

943,183 |

|

| |

|

|

|

|

|

|

| |

|

|

|

| Blackbaud, Inc. |

| Consolidated statements of comprehensive

income |

| (Unaudited) |

| |

|

|

|

| (in thousands, except share and per share

amounts) |

Three months ended December

31, |

|

Years ended December 31, |

| 2015 |

2014 |

|

2015 |

2014 |

|

Revenue |

|

|

|

|

|

|

Subscriptions |

$ |

98,336 |

|

$ |

73,139 |

|

|

$ |

331,759 |

|

$ |

263,435 |

|

|

Maintenance |

38,069 |

|

38,418 |

|

|

153,801 |

|

147,418 |

|

|

Services |

32,100 |

|

32,603 |

|

|

132,978 |

|

128,371 |

|

| License

fees and other |

7,372 |

|

8,653 |

|

|

19,402 |

|

25,197 |

|

|

Total revenue |

175,877 |

|

152,813 |

|

|

637,940 |

|

564,421 |

|

| Cost of

revenue |

|

|

|

|

|

| Cost of

subscriptions |

52,278 |

|

38,091 |

|

|

167,341 |

|

133,221 |

|

| Cost of

maintenance |

5,887 |

|

7,904 |

|

|

27,066 |

|

25,448 |

|

| Cost of

services |

23,694 |

|

27,592 |

|

|

102,815 |

|

106,506 |

|

| Cost of

license fees and other |

3,357 |

|

3,677 |

|

|

7,409 |

|

8,263 |

|

|

Total cost of revenue |

85,216 |

|

77,264 |

|

|

304,631 |

|

273,438 |

|

| Gross

profit |

90,661 |

|

75,549 |

|

|

333,309 |

|

290,983 |

|

| Operating

expenses |

|

|

|

|

|

| Sales and

marketing |

34,222 |

|

28,713 |

|

|

123,646 |

|

107,360 |

|

| Research

and development |

22,633 |

|

22,914 |

|

|

84,636 |

|

77,179 |

|

| General

and administrative |

22,840 |

|

16,159 |

|

|

76,084 |

|

58,277 |

|

|

Amortization |

695 |

|

174 |

|

|

2,231 |

|

1,803 |

|

|

Total operating expenses |

80,390 |

|

67,960 |

|

|

286,597 |

|

244,619 |

|

| Income from

operations |

10,271 |

|

7,589 |

|

|

46,712 |

|

46,364 |

|

| Interest

expense |

(2,698 |

) |

(1,952 |

) |

|

(8,073 |

) |

(6,011 |

) |

| Other

expense, net |

(318 |

) |

(187 |

) |

|

(1,687 |

) |

(1,119 |

) |

| Income before

provision for income taxes |

7,255 |

|

5,450 |

|

|

36,952 |

|

39,234 |

|

| Income

tax provision |

844 |

|

634 |

|

|

11,303 |

|

10,944 |

|

| Net

income |

$ |

6,411 |

|

$ |

4,816 |

|

|

$ |

25,649 |

|

$ |

28,290 |

|

| Earnings per

share |

|

|

|

|

|

|

Basic |

$ |

0.14 |

|

$ |

0.11 |

|

|

$ |

0.56 |

|

$ |

0.63 |

|

|

Diluted |

$ |

0.14 |

|

$ |

0.10 |

|

|

$ |

0.55 |

|

$ |

0.62 |

|

| Common shares and

equivalents outstanding |

|

|

|

|

|

| Basic

weighted average shares |

45,766,891 |

|

45,377,465 |

|

|

45,623,854 |

|

45,215,138 |

|

| Diluted

weighted average shares |

46,714,204 |

|

46,055,420 |

|

|

46,498,704 |

|

45,799,874 |

|

| Dividends per

share |

$ |

0.12 |

|

$ |

0.12 |

|

|

$ |

0.48 |

|

$ |

0.48 |

|

| Other

comprehensive income |

|

|

|

|

|

| Foreign

currency translation adjustment |

416 |

|

323 |

|

|

62 |

|

261 |

|

|

Unrealized gain (loss) on derivative instruments, net of tax

|

779 |

|

(295 |

) |

|

145 |

|

92 |

|

|

Total other comprehensive income |

1,195 |

|

28 |

|

|

207 |

|

353 |

|

|

Comprehensive income |

$ |

7,606 |

|

$ |

4,844 |

|

|

$ |

25,856 |

|

$ |

28,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Blackbaud, Inc. |

| Consolidated statements of cash

flows |

| (Unaudited) |

| |

|

| |

Years ended December 31, |

|

(in thousands) |

2015 |

2014 |

| Cash flows from

operating activities |

|

|

| Net

income |

$ |

25,649 |

|

$ |

28,290 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

| Depreciation

and amortization |

55,997 |

|

45,417 |

|

| Provision

for doubtful accounts and sales returns |

6,825 |

|

5,248 |

|

| Stock-based

compensation expense |

25,246 |

|

17,345 |

|

| Excess tax

benefits from exercise and vesting of stock-based compensation |

(5,466 |

) |

(7,455 |

) |

| Deferred

taxes |

3,165 |

|

3,050 |

|

| Loss on sale

of business |

1,976 |

|

— |

|

| Impairment

of capitalized software development costs |

239 |

|

1,626 |

|

| Loss on debt

extinguishment and termination of derivative instruments |

— |

|

996 |

|

| Amortization

of deferred financing costs and discount |

899 |

|

734 |

|

| Other

non-cash adjustments |

(197 |

) |

1,163 |

|

| Changes in

operating assets and liabilities, net of acquisition of

businesses: |

|

|

|

Accounts receivable |

(7,593 |

) |

(5,750 |

) |

|

Prepaid expenses and other assets |

(10,979 |

) |

(8,464 |

) |

| Trade

accounts payable |

6,133 |

|

(948 |

) |

|

Accrued expenses and other liabilities |

(166 |

) |

4,014 |

|

|

Restricted cash due to customers |

(34,279 |

) |

(33,510 |

) |

| Due

to customers |

34,279 |

|

33,510 |

|

|

Deferred revenue |

12,612 |

|

17,011 |

|

|

Net cash provided by operating

activities |

114,340 |

|

102,277 |

|

| Cash flows from

investing activities |

|

|

| Purchase

of property and equipment |

(18,633 |

) |

(13,911 |

) |

|

Capitalized software development costs |

(15,481 |

) |

(8,535 |

) |

| Purchase

of net assets of acquired companies, net of cash acquired |

(188,072 |

) |

(188,918 |

) |

| Net cash

used in sale of business |

(521 |

) |

— |

|

|

Net cash used in investing

activities |

(222,707 |

) |

(211,364 |

) |

| Cash flows from

financing activities |

|

|

| Proceeds

from issuance of debt |

312,300 |

|

365,100 |

|

| Payments

on debt |

(184,475 |

) |

(235,589 |

) |

| Debt

issuance costs |

(429 |

) |

(3,003 |

) |

| Proceeds

from exercise of stock options |

32 |

|

188 |

|

| Excess

tax benefits from exercise and vesting of stock-based

compensation |

5,466 |

|

7,455 |

|

| Dividend

payments to stockholders |

(22,508 |

) |

(22,107 |

) |

|

Net cash provided by financing

activities |

110,386 |

|

112,044 |

|

| Effect of exchange rate on

cash and cash equivalents |

(1,392 |

) |

(111 |

) |

| Net increase in

cash and cash equivalents |

627 |

|

2,846 |

|

| Cash and cash

equivalents, beginning of year |

14,735 |

|

11,889 |

|

|

Cash and cash equivalents, end of year |

$ |

15,362 |

|

$ |

14,735 |

|

| |

|

|

|

|

|

|

| |

|

|

|

| Blackbaud, Inc. |

| Reconciliation of GAAP to non-GAAP financial

measures |

| (Unaudited) |

| |

|

|

|

| (in thousands, except per share amounts and

percentages) |

Three months ended December

31, |

|

Years ended December 31, |

| 2015 |

2014 |

|

2015 |

2014 |

| GAAP

Revenue |

$ |

175,877 |

|

$ |

152,813 |

|

|

$ |

637,940 |

|

$ |

564,421 |

|

| Non-GAAP

adjustments: |

|

|

|

|

|

| Add:

Acquisition-related deferred revenue write-down |

2,239 |

|

4,642 |

|

|

9,371 |

|

6,242 |

|

| Non-GAAP

revenue |

$ |

178,116 |

|

$ |

157,455 |

|

|

$ |

647,311 |

|

$ |

570,663 |

|

| |

|

|

|

|

|

| GAAP gross

profit |

$ |

90,661 |

|

$ |

75,549 |

|

|

$ |

333,309 |

|

$ |

290,983 |

|

|

GAAP gross margin |

51.5 |

% |

49.4 |

% |

|

52.2 |

% |

51.6 |

% |

| Non-GAAP

adjustments: |

|

|

|

|

|

| Add:

Acquisition-related deferred revenue write-down |

2,239 |

|

4,642 |

|

|

9,371 |

|

6,242 |

|

| Add:

Stock-based compensation expense |

775 |

|

894 |

|

|

3,494 |

|

3,605 |

|

| Add:

Amortization of intangibles from business combinations |

7,236 |

|

7,868 |

|

|

29,987 |

|

24,345 |

|

| Add:

Employee severance |

26 |

|

— |

|

|

1,492 |

|

— |

|

|

Subtotal |

10,276 |

|

13,404 |

|

|

44,344 |

|

34,192 |

|

| Non-GAAP gross

profit |

$ |

100,937 |

|

$ |

88,953 |

|

|

$ |

377,653 |

|

$ |

325,175 |

|

|

Non-GAAP gross margin |

56.7 |

% |

56.5 |

% |

|

58.3 |

% |

57.0 |

% |

| |

|

|

|

|

|

| GAAP income

from operations |

$ |

10,271 |

|

$ |

7,589 |

|

|

$ |

46,712 |

|

$ |

46,364 |

|

|

GAAP operating margin |

5.8 |

% |

5.0 |

% |

|

7.3 |

% |

8.2 |

% |

| Non-GAAP

adjustments: |

|

|

|

|

|

| Add:

Acquisition-related deferred revenue write-down |

2,239 |

|

4,642 |

|

|

9,371 |

|

6,242 |

|

| Add:

Stock-based compensation expense |

7,347 |

|

4,853 |

|

|

25,246 |

|

17,345 |

|

| Add:

Amortization of intangibles from business combinations |

7,931 |

|

8,042 |

|

|

32,218 |

|

26,148 |

|

| Add:

Employee severance |

961 |

|

— |

|

|

3,174 |

|

— |

|

| Add:

Impairment of capitalized software development costs |

239 |

|

856 |

|

|

239 |

|

1,626 |

|

| Add:

Acquisition-related integration costs |

367 |

|

461 |

|

|

1,091 |

|

796 |

|

| Add:

Acquisition-related expenses |

2,859 |

|

1,170 |

|

|

3,904 |

|

2,315 |

|

| Add: CEO

transition costs |

— |

|

— |

|

|

— |

|

870 |

|

|

Subtotal |

21,943 |

|

20,024 |

|

|

75,243 |

|

55,342 |

|

| Non-GAAP income

from operations |

$ |

32,214 |

|

$ |

27,613 |

|

|

$ |

121,955 |

|

$ |

101,706 |

|

|

Non-GAAP operating margin |

18.1 |

% |

17.5 |

% |

|

18.8 |

% |

17.8 |

% |

| |

|

|

|

|

|

| GAAP net

income |

$ |

6,411 |

|

$ |

4,816 |

|

|

$ |

25,649 |

|

$ |

28,290 |

|

| |

|

|

|

|

|

| Shares used in

computing GAAP diluted earnings per share |

46,714 |

|

46,055 |

|

|

46,499 |

|

45,800 |

|

|

GAAP diluted earnings per share |

$ |

0.14 |

|

$ |

0.10 |

|

|

$ |

0.55 |

|

$ |

0.62 |

|

| |

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

| Add:

Total Non-GAAP adjustments affecting loss from operations |

21,943 |

|

20,024 |

|

|

75,243 |

|

55,342 |

|

| Add: Loss

on sale of business |

— |

|

— |

|

|

1,976 |

|

— |

|

| Add: Loss

on debt extinguishment and termination of derivative instruments

|

— |

|

— |

|

|

— |

|

996 |

|

| Less: Tax

impact related to Non-GAAP adjustments |

(10,544 |

) |

(9,299 |

) |

|

(33,223 |

) |

(26,328 |

) |

| Non-GAAP net

income |

$ |

17,810 |

|

$ |

15,541 |

|

|

$ |

69,645 |

|

$ |

58,300 |

|

| |

|

|

|

|

|

| Shares used in

computing Non-GAAP diluted earnings per share |

46,714 |

|

46,055 |

|

|

46,499 |

|

45,800 |

|

|

Non-GAAP diluted earnings per share |

$ |

0.38 |

|

$ |

0.34 |

|

|

$ |

1.50 |

|

$ |

1.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Blackbaud, Inc. |

| Reconciliation of GAAP to Non-GAAP financial

measures (continued) |

| (Unaudited) |

| |

|

|

|

| (in thousands, except

percentages) |

Three months ended December

31, |

|

Years ended December 31, |

| 2015 |

2014 |

|

2015 |

2014 |

| Detail of

certain Non-GAAP adjustments: |

|

|

|

|

|

|

Stock-based compensation expense: |

|

|

|

|

|

| Included

in cost of revenue: |

|

|

|

|

|

| Cost of

subscriptions |

$ |

449 |

|

$ |

131 |

|

|

$ |

1,130 |

|

$ |

687 |

|

| Cost of

maintenance |

67 |

|

187 |

|

|

420 |

|

689 |

|

| Cost of

services |

259 |

|

576 |

|

|

1,944 |

|

2,229 |

|

|

Total included in cost of revenue |

775 |

|

894 |

|

|

3,494 |

|

3,605 |

|

| Included

in operating expenses: |

|

|

|

|

|

| Sales and

marketing |

706 |

|

526 |

|

|

2,979 |

|

2,147 |

|

| Research

and development |

1,556 |

|

1,078 |

|

|

4,865 |

|

3,264 |

|

| General

and administrative |

4,310 |

|

2,355 |

|

|

13,908 |

|

8,329 |

|

|

Total included in operating expenses |

6,572 |

|

3,959 |

|

|

21,752 |

|

13,740 |

|

|

Total stock-based compensation

expense |

$ |

7,347 |

|

$ |

4,853 |

|

|

$ |

25,246 |

|

$ |

17,345 |

|

| |

|

|

|

|

|

|

Amortization of intangibles from business combinations: |

|

|

|

|

|

| Included

in cost of revenue: |

|

|

|

|

|

| Cost of

subscriptions |

$ |

5,775 |

|

$ |

6,524 |

|

|

$ |

23,075 |

|

$ |

20,239 |

|

| Cost of

maintenance |

1,003 |

|

428 |

|

|

4,162 |

|

772 |

|

| Cost of

services |

375 |

|

810 |

|

|

2,382 |

|

2,910 |

|

| Cost of

license fees and other |

83 |

|

106 |

|

|

368 |

|

424 |

|

|

Total included in cost of revenue |

7,236 |

|

7,868 |

|

|

29,987 |

|

24,345 |

|

| Included

in operating expenses |

695 |

|

174 |

|

|

2,231 |

|

1,803 |

|

|

Total amortization of intangibles from

business combinations |

$ |

7,931 |

|

$ |

8,042 |

|

|

$ |

32,218 |

|

$ |

26,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Contact:

Mark Furlong

Blackbaud, Inc.

843-654-2097

mark.furlong@blackbaud.com

Media Contact:

Nicole McGougan

Blackbaud, Inc.

843-654-3307

nicole.mcgougan@blackbaud.com

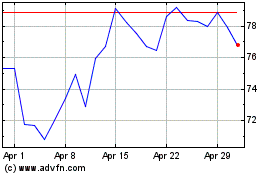

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Jan 2024 to Jan 2025