Bitfarms Ltd. (Nasdaq/TSX: BITF) (“Bitfarms” or the “Company”), a

global vertically integrated Bitcoin data center company, today

announced that, in connection with the Securities and Exchange

Commission’s (“SEC”) review of its annual report for the fiscal

year ended December 31, 2023 (the “SEC Review”), and in

consultation with its Audit Committee of the Board of Directors and

management, the Company has determined that its previously issued

consolidated financial statements for the fiscal years ended

December 31, 2023 and 2022 and the related management’s discussion

and analysis for the year ended December 31, 2023, as well as the

unaudited interim condensed consolidated financial statements for

the three and nine months ended September 30, 2024 and 2023 (such

interim periods together with the fiscal years ended December 31,

2023 and 2022, the “Restatement Periods”) and the related

management’s discussion and analysis for the three and nine months

ended September 30, 2024, should be restated to correct a material

error in the classification of proceeds derived from the sale of

digital assets.

Shareholders and users of Bitfarms’ financial

statements should note that the restatements are not a result of

any change to its operations, business or financial operating

performance for the periods being restated. For any and all of the

Restatement Periods, there is no impact on the Company’s overall

cash position or net cash flows.

Bitfarms previously categorized proceeds derived

from the sale of digital assets as a cash flow from operating

activities. In conjunction with the SEC review, it was determined

that proceeds from the sale of digital assets should be classified

as cash flow from investing activities. Due to the materiality of

the error in classification, the Company is restating the financial

statements for the Restatement Periods. In addition to the

correction to the consolidated statements of cash flows, the

Company is also restating its financials to adjust for an error in

the accounting for the redemption of warrants in 2023.

A summary of the restatements is described in

further detail in the tables set forth below (expressed in

thousands of U.S. dollars). More details may be found in the

revised financial statements and related revised management’s

discussion and analyses, which are available on the Company’s

profile on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov/edgar.

Adjustments to consolidated statements of cash flows for

the year ended December 31, 2022* - Restatement

|

|

Year ended December 31, |

|

|

2022 (as reported) |

|

Cash flowreclassification |

|

2022 (as restated) |

|

|

|

|

|

|

| Cash flows from (used

in) operating activities |

|

|

|

| Net loss |

(175,644 |

) |

— |

|

(175,644 |

) |

| Adjustments for: |

|

|

— |

|

|

Proceeds from sale of digital assets earned |

158,674 |

|

(158,674 |

) |

— |

|

|

Net change in cash related to operating

activities |

36,250 |

|

(158,674 |

) |

(122,424 |

) |

|

|

|

|

|

| Cash flows from (used

in) investing activities |

|

|

|

| Proceeds from sale of digital

assets earned |

— |

|

158,674 |

|

158,674 |

|

|

Net change in cash related to investing

activities |

(155,011 |

) |

158,674 |

|

3,663 |

|

Adjustments to consolidated statements of cash flows for

the year ended December 31, 2023* - Restatement

|

|

Year ended December 31, |

|

|

2023 (as reported) |

|

Cash flowreclassification |

|

2023 warrantsadjustment |

|

2023 (as restated) |

|

|

|

|

|

|

|

| Cash flows from (used

in) operating activities |

|

|

|

|

| Net loss |

(104,036 |

) |

— |

|

(4,886 |

) |

(108,922 |

) |

| Adjustments for: |

|

|

|

|

|

Net financial expenses |

32,308 |

|

— |

|

4,886 |

|

37,194 |

|

|

Proceeds from sale of digital assets earned |

129,309 |

|

(129,309 |

) |

— |

|

— |

|

|

Net change in cash related to operating

activities |

23,598 |

|

(129,309 |

) |

— |

|

(105,711 |

) |

|

|

|

|

|

|

| Cash flows from (used

in) investing activities |

|

|

|

|

| Proceeds from sale of digital

assets earned |

— |

|

129,309 |

|

— |

|

129,309 |

|

|

Net change in cash related to investing

activities |

(58,343 |

) |

129,309 |

|

— |

|

70,966 |

|

Adjustments to consolidated statements of financial

position as of December 31, 2023* - Restatement

|

|

As of December 31, |

|

Adjustment |

|

As of December 31, |

|

|

|

2023 (as reported) |

|

2023 warrantsadjustment |

|

2023 (as restated) |

|

|

Shareholders’ equity |

|

|

|

| Share capital |

530,123 |

|

4,886 |

|

535,009 |

|

| Contributed surplus |

56,622 |

|

— |

|

56,622 |

|

| Revaluation surplus |

2,941 |

|

— |

|

2,941 |

|

|

Accumulated deficit |

(294,924 |

) |

(4,886 |

) |

(299,810 |

) |

|

Total equity |

294,762 |

|

— |

|

294,762 |

|

Adjustments to consolidated statements

of profit or loss and comprehensive profit or loss for the year

ended December 31, 2023* - Restatement

|

|

Year ended December 31, |

|

|

2023 (as reported) |

|

2023 warrantsadjustment |

|

2023 (as restated) |

|

|

|

|

|

|

|

Operating loss |

(72,129 |

) |

— |

|

(72,129 |

) |

|

|

|

|

|

| Net

financial expenses |

(32,308 |

) |

(4,886 |

) |

(37,194 |

) |

|

Net loss before income taxes |

(104,437 |

) |

(4,886 |

) |

(109,323 |

) |

|

|

|

|

|

| Income

tax recovery |

401 |

|

— |

|

401 |

|

|

Net loss and total comprehensive loss |

(104,036 |

) |

(4,886 |

) |

(108,922 |

) |

|

|

|

|

|

| Other comprehensive

income (loss) |

|

|

|

| Item that will not be

reclassified to profit or loss: |

|

|

|

|

Change in revaluation surplus - digital assets, net of tax |

9,242 |

|

— |

|

9,242 |

|

|

Total comprehensive loss, net of tax |

(94,794 |

) |

(4,886 |

) |

(99,680 |

) |

|

Loss per share |

|

|

|

| Basic

and diluted |

(0.40 |

) |

(0.02 |

) |

(0.42 |

) |

|

Weighted average number of common shares

outstanding |

|

|

|

| Basic

and diluted |

262,237,117 |

|

— |

|

262,237,117 |

|

Adjustments to interim consolidated

statements of cash flows for the nine months ended

September 30, 2023 and 2024* - Restatement

|

|

Nine months ended September 30, |

Nine months ended September 30, |

|

|

2024(as reported) |

|

Cash flowreclassification |

|

2024(as restated) |

|

2023(as reported) |

|

Cash flowreclassification |

|

2023(as restated) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Cash flows from (used

in) operating activities |

|

|

|

|

|

|

| Net loss |

(69,228 |

) |

— |

|

(69,228 |

) |

(46,877 |

) |

— |

|

(46,877 |

) |

| Adjustments for: |

|

|

|

|

|

|

| Proceeds from sale of digital

assets |

111,264 |

|

(111,264 |

) |

— |

|

87,724 |

|

(87,724 |

) |

— |

|

|

Net change in cash related to operating

activities |

14,104 |

|

(111,264 |

) |

(97,160 |

) |

10,028 |

|

(87,724 |

) |

(77,696 |

) |

|

|

|

|

|

|

|

|

| Cash flows from (used

in) investing activities |

|

|

|

|

|

|

| Proceeds from sale of digital

assets |

— |

|

111,264 |

|

111,264 |

|

— |

|

87,724 |

|

87,724 |

|

|

Net change in cash related to investing

activities |

(268,862 |

) |

111,264 |

|

(157,598 |

) |

(35,373 |

) |

87,724 |

|

52,351 |

|

Adjustments to consolidated statements of financial

position as of September 30, 2024* - Restatement

|

|

As of September 30, |

|

Adjustment |

|

As of September 30, |

|

|

|

2024 (as reported) |

|

2023 warrantsadjustment |

|

2024 (as restated) |

|

|

Shareholders’ equity |

|

|

|

| Share capital |

796,751 |

|

4,886 |

|

801,637 |

|

| Contributed surplus |

63,785 |

|

— |

|

63,785 |

|

| Accumulated deficit |

(351,823 |

) |

(4,886 |

) |

(356,709 |

) |

|

Revaluation surplus |

3,311 |

|

— |

|

3,311 |

|

|

Total equity |

512,024 |

|

— |

|

512,024 |

|

*U.S. $ in thousands

The Company’s management has previously

concluded that the Company had a material weakness in its internal

control over financial reporting during the Restatement Periods.

Management is in the process of implementing remediation measures

to address the material weakness in respect of the errors described

above.

About Bitfarms Ltd.Founded in

2017, Bitfarms is a global Bitcoin data center company that

contributes its computational power to one or more mining pools

from which it receives payment in Bitcoin. Bitfarms develops, owns,

and operates vertically integrated mining farms with in-house

management and company-owned electrical engineering, installation

service, and multiple onsite technical repair centers. The

Company’s proprietary data analytics system delivers best-in-class

operational performance and uptime.

Bitfarms currently has 12 operating Bitcoin data

centers and two under development, and two under Hosting

agreements, situated in four countries: Canada, the United States,

Paraguay, and Argentina. Powered predominantly by environmentally

friendly hydro-electric and long-term power contracts, Bitfarms is

committed to using sustainable and often underutilized energy

infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

www.bitfarms.comhttps://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding the impact of the Restatement, the filing of the

Restated Financials and Restated MD&A, the Company’s plans to

remediate the material weakness in its internal control over

financial reporting and other statements regarding future growth,

plans and objectives of the Company are forward-looking

information.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “prospects”,

“believes” or “intends” or variations of such words and phrases or

stating that certain actions, events or results “may” or “could”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of Bitfarms at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of Bitfarms to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors, risks and

uncertainties include, among others: the pending SEC Review; the

potential that additional restatements of the financial statements

will be required; the potential that the Company identifies

additional material weaknesses in its control over financial

reporting; the ability of the Company to remediate known material

weaknesses; the acquisition, construction and operation of new

facilities may not occur as currently planned, or at all; expansion

of existing facilities may not materialize as currently

anticipated, or at all; new miners may not perform up to

expectations; revenue may not increase as currently anticipated, or

at all; the ongoing ability to successfully mine Bitcoin is not

assured; failure of the equipment upgrades to be installed and

operated as planned; the availability of additional power may not

occur as currently planned, or at all; expansion may not

materialize as currently anticipated, or at all; the power purchase

agreements and economics thereof may not be as advantageous as

expected; For further information concerning these and other risks

and uncertainties, refer to Bitfarms’ filings on www.sedarplus.ca

(which are also available on the website of the U.S. Securities and

Exchange Commission (the “SEC") at www.sec.gov), including the

restated MD&A for the year-ended December 31, 2023, filed on

December 9, 2024 and the restated MD&A for the three and nine

months ended September 30, 2024 filed on December 9, 2024. Although

Bitfarms has attempted to identify important factors that could

cause actual results to differ materially from those expressed in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended, including

factors that are currently unknown to or deemed immaterial by

Bitfarms. There can be no assurance that such statements will prove

to be accurate as actual results, and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on any forward-looking

information. Bitfarms undertakes no obligation to revise or update

any forward-looking information other than as required by law.

Trading in the securities of the Company should be considered

highly speculative. No stock exchange, securities commission or

other regulatory authority has approved or disapproved the

information contained herein. Neither the Toronto Stock Exchange,

Nasdaq, nor any other securities exchange or regulatory authority

accepts responsibility for the adequacy or accuracy of this

release.

Investor Relations

Contacts:

BitfarmsTracy KrummeSVP, Head of IR & Corp. Comms.+1

786-671-5638tkrumme@bitfarms.com

Media Contacts:

Québec: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

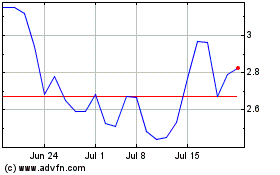

Bitfarms (NASDAQ:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bitfarms (NASDAQ:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025