false

0000925741

0000925741

2023-08-09

2023-08-09

0000925741

bcda:CommonStockParValue0001CustomMember

2023-08-09

2023-08-09

0000925741

bcda:WarrantToPurchaseCommonStockCustomMember

2023-08-09

2023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2023

|

BIOCARDIA, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

0-21419

|

|

23-2753988

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

320 Soquel Way

Sunnyvale, California 94085

|

|

|

(Address of principal executive offices and zip code)

|

|

Registrant’s telephone number, including area code: (650) 226-0120

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

BCDA

|

The Nasdaq Capital Market

|

|

Warrant to Purchase Common Stock

|

BCDAW

|

The Nasdaq Capital Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter) ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2023, BioCardia, Inc. issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

BIOCARDIA, INC.

|

|

| |

|

|

/s/ Peter Altman, Ph.D.

|

|

|

Peter Altman, Ph.D.

|

|

|

President and Chief Executive Officer

|

|

| |

|

|

Date: August 9, 2023

|

|

Exhibit 99.1

BIOCARDIA REPORTS SECOND QUARTER 2023 BUSINESS HIGHLIGHTS AND FINANCIAL RESULTS

Sunnyvale, Calif. – August 9, 2023 - BioCardia, Inc. [Nasdaq: BCDA], a developer of cellular and cell-derived therapeutics for the treatment of cardiovascular and pulmonary diseases, today reports financial results for the second quarter of 2023 and filed its quarterly report on Form 10-Q for the three and six months ended June 30, 2023 with the Securities and Exchange Commission. The Company will also hold a conference call at 4:30 PM ET today in which it will discuss business highlights. Following management’s formal remarks, there will be a question-and-answer session.

“We have followed the recent recommendation from our Data Safety Monitoring Board (DSMB) to pause enrollment of new patients in our autologous cell therapy trial for ischemic heart failure or BCDA-01, even as there were no treatment emergent safety issues reported, patients in aggregate appear to be showing clinical improvements, and enrollment had accelerated in recent months. We continue to randomize and monitor patients enrolled in this clinical study. Unblinded statistics and clinical consultants are reviewing the primary endpoint analysis and secondary outcome measures. Potential next steps in Q3 include discussions between the DSMB and the consultancies before BioCardia unblinds itself to the interim data,” said Peter Altman PhD. “As we work through this process for BCDA-01, we expect important milestones for our other clinical programs. We look forward to completion of enrollment for the roll-in cohort of the Phase III trial of our autologous cell therapy for patients with chronic myocardial ischemia or BCDA-02, as well as treatment of the first patients in the Phase I/II clinical trial of our allogeneic mesenchymal stem cell therapy for ischemic heart failure or BCDA-03. Business development is active around our Helix biotherapeutic delivery platform and in other areas, and we are working to close two meaningful deals by the end of the year.”

RECENT BUSINESS HIGHLIGHTS:

CardiAMP® Autologous Cell Therapy for Patients with Ischemic Heart Failure (BCDA-01)

The CardiAMP Cell Therapy Trial for Heart Failure is a Phase III, multi-center, randomized, double-blinded, sham-controlled study intended to include up to 260 patients. The Phase III pivotal trial, which was granted Breakthrough designation by the U.S. Food and Drug Administration (FDA), is designed to provide the primary support for the safety and efficacy of the CardiAMP Cell Therapy System for the treatment of heart failure with reduced ejection fraction (HFrEF).

On July 12, 2023, the planned Data Safety Monitoring Board (DSMB) meeting was held utilizing the adaptive statistical analysis plan reviewed by FDA in the second quarter. On July 24, 2023, the Company announced that the DSMB had completed its review and recommended that the Company pause the trial pending the one-year follow-up outcomes analysis for patients that have been treated and those that have been enrolled but not yet treated.

The DSMB reviewed an initial analysis of the unblinded data and concluded that the trial was unlikely to meet its primary FS composite endpoint, even though the prespecified criteria for termination of the trial had not been met. This initial analysis excluded patients who had not yet made it to 12-month follow-up. The DSMB also cited the slow rate of enrollment in the trial. Additional data was subsequently provided to the DSMB, which the Company understands included: (1) statistical analysis prepared strictly in accordance with the prespecified data review plan, which had not initially been provided to the DSMB, (2) analysis of health outcomes as measured by endpoints other than the six-minute walk, and (3) information on the increased enrollment rates across many clinical centers. After consideration of the additional data, the DSMB recommended that the Company pause enrollment of new patients pending the 12-month outcomes analysis for all patients, and that the Company continue to treat patients already enrolled in the trial. The DSMB also recommended that the data blind be preserved so that the trial may be continued following analysis of the 12-month follow-up data for all enrolled patients.

The blinded aggregate data for the 96 randomized patients with 12-month outcome measures available for the most recent DSMB review showed better-than-expected patient survival, improvement in mean six-minute walk distance, improvement in NYHA class, improvement in quality of life and improvement in left ventricular ejection fraction. The DSMB reported that there were no treatment emergent safety concerns in the study. An estimated additional 25 randomized patients will be included in final trial results should the trial not be restarted. This estimate includes 10 patients in the queue expected to be randomization in the trial in the next six weeks, nine randomized patients who have not yet reached the 12-month follow-up visit, and six patients who were unable to walk at 12 months due to other non-cardiac issues. Results will not be available until the last patient reaches their 12-month follow-up visit.

An external statistics consultancy has completed a quality review on the primary endpoint interim data analysis provided to the DSMB to confirm they had accurate information. The company is working to enable this replicate analysis and the closed session DSMB information to be reviewed by a clinical consultant to make recommendations on next steps. If there are reasons to engage the DSMB, discussions between the DSMB and the unblinded consultants may take place. Once this quality review is completed by this external unblinded group, expected in the third quarter 2023, it is anticipated that a segregated BioCardia team will be unblinded to the data in order to provide strategic guidance for this program ahead. If the Company obtains material new information from this review, it will be shared publicly as appropriate.

In June 2023, the Company completed its submission of the CardiAMP Cell Therapy System to Japan’s Pharmaceutical and Medical Device Agency (PMDA) for a first formal consultation towards approval for the indication of ischemic heart failure with reduced ejection fraction (HFrEF) based on existing safety and efficacy data. In July, the formal consultation was reviewed and accepted by the PMDA for the consultation with some clarifying questions, which have been addressed. The PMDA consultation could take up to four months to schedule per their normal review process, although dates in September have been requested. Subsequent interactions with PMDA are expected. If approved, the CardiAMP Cell Therapy System has potential to be the first minimally invasive catheter-based cell therapy available in Japan.

CardiAMP® Autologous Cell Therapy for Patients with Chronic Myocardial Ischemia (BCDA-02)

The CardiAMP Cell Therapy Trial for Chronic Myocardial Ischemia is a Phase III, multi-center, randomized, double-blinded, controlled study intended to include up to 343 patients at up to 40 clinical sites. The Company expects to complete enrollment in the roll-in cohort of five patients in the fourth quarter of 2023 and begin the randomized phase of the trial. Planning for the randomization phase is already underway based on promising experience in the patients treated to date. Strategies of using the cell population analysis as a means to set patient dosing as opposed to excluding patients, and means to include more patients based on modifying baseline exclusion criteria, are under consideration to enable more rapid enrollment. Six additional centers are actively being onboarded.

CardiALLO™ Allogeneic Cell Therapy for Ischemic HFrEF (BCDA-03)

In December 2022, the FDA approved the Company’s Investigational New Drug (IND) application to initiate a first-in-human Phase I/II clinical trial encompassing 69 patients with HFrEF treated with the Company’s allogeneic cells. Clinical grade cells have been manufactured at BioCardia and are ready for use with the Company’s proprietary delivery system, also manufactured at BioCardia. The first clinical center has finalized its clinical study agreement and received conditional IRB approval. Cellular preparation test runs at the clinical site and site activation visit is scheduled for this month. Patient enrollment is expected to begin in the third quarter.

This study builds on three previous trials of mesenchymal stem cells (MSC) in ischemic heart failure using the Company’s proprietary Helix™ delivery system encompassing 93 patients treated with culture expanded MSCs with no treatment emergent serious adverse events. Previous trial results showed compelling early signals for benefit that this trial is expected to build upon.

Allogeneic Cell Therapy for Acute Respiratory Distress Syndrome (BCDA-04)

The Company’s Allogeneic Cell Therapy Trial for Acute Respiratory Distress Syndrome (ARDS) has been deprioritized to focus current financial resources on other programs. This decision was based on the greatly reduced population of patients with acute respiratory distress secondary to COVID. When resources permit, BioCardia intends to expand the current indication to a broader ARDS population beyond COVID and to other pulmonary indications.

HelixTM Biotherapeutic Delivery System

BioCardia’s Helix Biotherapeutic Delivery System (Helix) delivers therapeutics into the heart muscle with a penetrating helical needle from within the heart. It enables local delivery of cell and gene-based therapies, including BioCardia’s own cell therapies. It remains the safest, easiest to use, and most efficient means for the delivery of cells, genes, and proteins to the heart muscle. The delivery platform includes proprietary approved steerable guide systems, approved delivery catheters, and investigational imaging navigation.

The Company’s Helix team has active discussions with current and prospective partners regarding programs utilizing the Helix platform. These relationships are intended to share the costs of ongoing maintenance of and advances in the valuable enabling platform, and for BioCardia shareholders to benefit from the future success of these partnered programs.

Intellectual Property

In June, the Company announced that the Japan Patent Office granted Patent No: JP7282649B2 titled “Radial and Transendocardial Delivery Catheter” with a patent term that will expire on September 30, 2034. The patent describes interventional biotherapeutic delivery catheters to deliver biologics to specific target sites from within the heart chamber. The allowed claims cover BioCardia’s helical needle tipped catheter technology platform in existing products and in future products in active development with enhanced features.

Also in June, the European Patent Office issued an Intention to Grant a patent titled: “Site Selection, Entry, And Update with Automatic Remote Inage Annotation.” The patent application describes techniques to bring previously obtained high-resolution three dimensional images of a patient's heart, such as from an MRI into the cardiac catheterization procedure suite, and to merge this image with the X-ray images that the physician uses to navigate during the procedure. This approach has been compelling in preclinical studies and is expected to further enhance targeting, ease of procedure, and data collection compared to our current procedures.

Second Quarter 2023 Financial Results:

| |

>

|

Revenues were approximately $43,000 for the three months ended June 2023, compared to approximately $974,000 in the three months ended June 2022, due primarily to the timing of collaboration agreement revenues. |

| |

>

|

Research and development expenses were approximately $2.3 million for the three months ended June 2023 and for the three months ended June 2022.

|

| |

>

|

Selling, general and administrative expenses were approximately $1.2 million for the three months ended June 2023 and for the three months ended June 2022.

|

| |

>

|

Our net loss was approximately $3.4 million for the three months ended June 2023, compared to approximately $2.5 million for the three months ended June 2022, due primarily to the timing of collaboration agreement revenues.

|

| |

>

|

Net cash used in operations for the three months ended June 2023 was approximately $3.2 million, as compared to approximately $2.6 million for the three months ended June 2022.

|

ANTICIPATED UPCOMING MILESTONES AND EVENTS:

| |

>

|

BCDA-01: CardiAMP Cell Therapy for Heart Failure Phase III Trial

|

| |

-

|

Q3 2023: Finalize External Review of Interim Data and DSMB Recommendation

|

| |

-

|

Q4 2023: Japan PMDA Formal Consultation

|

| |

>

|

BCDA-02: CardiAMP Cell Therapy for Chronic Myocardial Ischemia Phase III Trial

|

| |

-

|

Q4 2023: Completion of Roll-in Cohort and Transition to Randomized Pivotal Trial

|

| |

>

|

BCDA-03: NK1R+ MSC Allogeneic Cell Therapy in ischemic HFrEF Phase I/II Trial

|

| |

-

|

Q3 2023: First Patient Enrolled

|

| |

>

|

Helix Biotherapeutic Delivery System

|

| |

-

|

Q4 2023 Completion of Enrollment in Partner CellProthera’s EXCELLENT Trial

|

| |

-

|

Q4 2023: Update on Licensing / Partnerships

|

About BioCardia®

BioCardia, Inc., headquartered in Sunnyvale, California, is a developer of two biotherapeutic platforms – the CardiAMP autologous bone marrow derived mononuclear cell therapy for cardiovascular indications, and the NK1R+ allogeneic bone marrow derived mesenchymal stem cell therapy for cardiovascular and pulmonary diseases. These platforms underly four product candidates, each with the potential to meaningfully benefit millions of patients. Three of BioCardia’s investigational therapies are enabled by the Company’s proprietary biotherapeutic delivery platform, which the Company also selectively licenses to other biotherapeutic development firms. The CardiAMP Cell Therapy Trial for Heart Failure has been supported financially by the Maryland Stem Cell Research Fund and the Center for Medicare and Medicaid Services. For more information visit: www.BioCardia.com.

Conference call access:

Participants can register for the conference by navigating to https://dpregister.com/sreg/10181574/fa1ff8fef0. Please note that registered participants will receive their dial-in number upon registration. For those who have not registered, to listen to the call by phone, interested parties within the U.S. should call 1-833-316-0559 and international callers should call 1-412-317-5730. All callers should dial in approximately 10 minutes prior to the scheduled start time and ask to be joined into the BioCardia call. The conference call will also be available through a live webcast, which can be accessed through the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=IBDjLUv7.

A webcast replay of the call will be available approximately one hour after the end of the call through November 9, 2023, at the above links. A telephonic replay of the call will be available through August 23, 2023 and may be accessed by calling 1-877-344-7529 (domestic), 1-412-317-0088 (international) or 855-669-9658 (Canada) by using access code 7514640 or by the link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=IBDjLUv7.

Forward Looking Statements

This press release contains forward-looking statements that are subject to many risks and uncertainties. Forward-looking statements include, among other things, references to the enrollment in our clinical trials, the availability of data from our clinical trials, filings and communications with the FDA and Japan’s Pharmaceutical and Medical Device Agency, FDA and Japanese product clearances, the efficacy and safety of our products and therapies, preliminary conclusions about new data, the achievement of any of the anticipated upcoming milestones, our positioning for growth or the market for our products and therapies, the expected benefits of our intellectual property, the future prospects for BCDA-01 and the regulatory timeline and process associated with such trial, and other statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations. Such risks and uncertainties include, among others, the inherent uncertainties associated with developing new products or technologies, regulatory approvals, unexpected expenditures, the ability to raise the additional funding needed to continue to pursue BioCardia’s business and product development plans, the ability to enter into licensing and partnering arrangements and overall market conditions. We may find it difficult to enroll patients in our clinical trials due to many factors, some of which are outside of our control. Slower than targeted enrollment could delay completion of our clinical trials and delay or prevent development of our therapeutic candidates. These forward-looking statements are made as of the date of this press release, and BioCardia assumes no obligation to update the forward-looking statements.

We may use terms such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or other words that convey the uncertainty of future events or outcomes to identify these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained herein, we caution you that forward-looking statements are not guarantees of future performance and that our actual results may differ materially from the forward-looking statements contained in this press release. As a result of these factors, we cannot assure you that the forward-looking statements in this press release will prove to be accurate. Additional factors that could materially affect actual results can be found in BioCardia’s Form 10-K filed with the Securities and Exchange Commission on March 29, 2023, under the caption titled “Risk Factors,” and in our subsequently filed Quarterly Reports on Form 10-Q. BioCardia expressly disclaims any intent or obligation to update these forward-looking statements, except as required by law.

###

Media Contact:

Miranda Peto, Marketing / Investor Relations

Email: mpeto@BioCardia.com

Phone: 650-226-0120

Investor Contact:

David McClung, Chief Financial Officer

Email: investors@BioCardia.com

Phone: 650-226-0120

BioCardia, Inc.

Condensed Consolidated Statements of Operations

(Unaudited in thousands, except share and per share amounts)

| |

|

Three Months ended

June 30,

|

|

|

Six Months ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net product revenue

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1 |

|

|

Collaboration agreement revenue

|

|

|

43 |

|

|

|

974 |

|

|

|

107 |

|

|

|

1,033 |

|

|

Total revenue

|

|

|

43 |

|

|

|

974 |

|

|

|

107 |

|

|

|

1,034 |

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

2,314 |

|

|

|

2,304 |

|

|

|

4,698 |

|

|

|

4,490 |

|

|

Selling, general and administrative

|

|

|

1,181 |

|

|

|

1,166 |

|

|

|

2,371 |

|

|

|

2,367 |

|

|

Total costs and expenses

|

|

|

3,495 |

|

|

|

3,470 |

|

|

|

7,069 |

|

|

|

6,857 |

|

|

Operating loss

|

|

|

(3,452 |

) |

|

|

(2,496 |

) |

|

|

(6,962 |

) |

|

|

(5,823 |

) |

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense), net

|

|

|

28 |

|

|

|

(1 |

) |

|

|

37 |

|

|

|

1 |

|

|

Net loss

|

|

$ |

(3,424 |

) |

|

$ |

(2,497 |

) |

|

$ |

(6,925 |

) |

|

$ |

(5,822 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted

|

|

$ |

(0.17 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.34 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic and diluted

|

|

|

20,384,522 |

|

|

|

17,651,892 |

|

|

|

20,281,417 |

|

|

|

17,360,598 |

|

|

BioCardia, Inc.

|

|

Selected Balance Sheet Data

|

|

(amounts in thousands)

|

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023(1)

|

|

|

2022(1)

|

|

| |

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,305 |

|

|

$ |

7,363 |

|

|

Other current assets

|

|

|

345 |

|

|

|

501 |

|

|

Property, equipment and other noncurrent assets

|

|

|

1,739 |

|

|

|

1,929 |

|

|

Total assets

|

|

$ |

6,389 |

|

|

$ |

9,793 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

$ |

3,616 |

|

|

$ |

3,585 |

|

|

Operating lease liability - noncurrent

|

|

|

1,138 |

|

|

|

1,316 |

|

|

Total stockholders’ equity

|

|

|

1,635 |

|

|

|

4,892 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

6,389 |

|

|

$ |

9,793 |

|

|

(1) June 30, 2023 amounts are unaudited. December 31, 2022 amounts were derived from the audited Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission on March 29, 2023.

|

v3.23.2

Document And Entity Information

|

Aug. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BIOCARDIA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 09, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-21419

|

| Entity, Tax Identification Number |

23-2753988

|

| Entity, Address, Address Line One |

320 Soquel Way

|

| Entity, Address, City or Town |

Sunnyvale

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94085

|

| City Area Code |

650

|

| Local Phone Number |

226-0120

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000925741

|

| CommonStockParValue0001 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

BCDA

|

| Security Exchange Name |

NASDAQ

|

| WarrantToPurchaseCommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrant to Purchase Common Stock

|

| Trading Symbol |

BCDAW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bcda_CommonStockParValue0001CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bcda_WarrantToPurchaseCommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

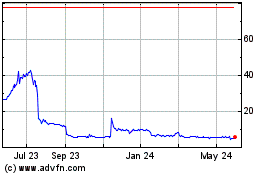

BioCardia (NASDAQ:BCDA)

Historical Stock Chart

From Oct 2024 to Nov 2024

BioCardia (NASDAQ:BCDA)

Historical Stock Chart

From Nov 2023 to Nov 2024