Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 29 2023 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission

File Number: 001-38429

Bilibili Inc.

Building 3, Guozheng Center, No. 485 Zhengli Road

Yangpu District, Shanghai, 200433

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Exhibit Index

Exhibit 99.1 – Announcement with The Stock Exchange of Hong Kong Limited – Grant of Restricted Share Units

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| BILIBILI INC. |

|

|

| By : |

|

/s/ Xin Fan |

| Name : |

|

Xin Fan |

| Title : |

|

Chief Financial Officer |

Date: September 29, 2023

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no

representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Bilibili Inc.

(A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code: 9626)

GRANT OF RESTRICTED SHARE UNITS

On

September 29, 2023, the Company granted an aggregate of 1,201,636 RSUs pursuant to the 2018 Share Incentive Plan to 99 employees of the Company, representing the same number of Class Z Ordinary Shares and approximately 0.29% of the total

Shares of the Company (on a one share one vote basis) in issue as at the date of this announcement.

|

|

|

| Details of the Grants are as follows: |

|

|

| Date of grant: |

|

September 29, 2023 |

|

|

| Aggregate number of RSUs granted |

|

1,201,636 |

|

|

| Purchase price of the RSUs granted: |

|

Nil |

|

|

| Market price of the Class Z Ordinary Shares on the date of the Grants: |

|

HK$108.30 per Class Z Ordinary Share |

|

|

| Vesting period: |

|

The RSUs granted shall vest between September 29, 2025 and September 29, 2027. |

1

|

|

|

| Performance targets and clawback mechanism |

|

There are no additional performance targets attached to the Grants. The Grants are also not subject to any clawback mechanism for the

Company to recover the RSUs granted. The Compensation Committee is of the view that

it is not necessary to set any additional performance target and/or clawback mechanism for the Grants. Such arrangement is aligned with the purpose of the 2018 Share Incentive Plan as it increases the Grantees’ loyalty to the Company and

incentivizes the Grantees to work towards enhancing the value of the Company and its Shares. |

The Grants are subject to the terms and conditions of the 2018 Share Incentive Plan and the award agreements entered into

between the Company and each of the Grantees.

The RSUs will be satisfied through utilizing the Class Z Ordinary Shares issued and reserved for

future issuance upon the exercise or vesting of awards granted under the Company’s share incentive plans.

The Grants would not result in the options

and awards granted and to be granted to (i) each individual Grantee in the 12-month period up to and including the date of such Grant in aggregate to exceed 1% of the Shares in issue or (ii) each

related entity participant or service provider Grantee in the 12-month period up to and including the date of such Grant in aggregate to exceed 0.1% of the Shares in issue.

None of the Grants is subject to approval by the shareholders of the Company, and none of the Grantees is a Director, chief executive or substantial

shareholder (as defined in the Listing Rules) of the Company or an associate (as defined in the Listing Rules) or any of them.

Reasons for and

Benefits of the Grants

The purpose of the Grants is to (i) promote the success and enhance the value of the Company by linking the personal

interests of the Grantees to those of the Company’s shareholders and by providing such individuals with an incentive for outstanding performance to generate superior returns to the Company’s shareholders, and (ii) provide flexibility

to the Company in its ability to motivate, attract, and retain the services of the Grantees upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent.

Class Z Ordinary Shares available for grant under the 2018 Share Incentive Plan

The maximum aggregate number of Class Z Ordinary Shares which may be issued pursuant to all awards is 30,673,710, which is 10% of the total number of

issued Class Z Ordinary Shares as at October 3, 2022, the date on which the Company’s voluntary conversion of its secondary listing status in Hong Kong to primary listing on the Stock Exchange became effective (excluding Class Z

Ordinary Shares underlying awards which have terminated, expired, lapsed or have been forfeited in accordance with the rules of the 2018 Share Incentive Plan). Upon the making of the Grants, the Company may grant further awards representing a total

of 21,353,965 Class Z Ordinary Shares pursuant to the 2018 Share Incentive Plan.

2

The 2018 Share Incentive Plan was adopted before the effective date of the new Chapter 17 of the Listing

Rules. The Company has complied and will continue to comply with the new Chapter 17 to the extent required by the transitional arrangements for the existing share schemes.

DEFINITIONS

In this announcement, the following

expressions shall have the following meanings unless the context requires otherwise.

|

|

|

| “2018 Share Incentive Plan” |

|

the Company’s 2018 share incentive plan adopted in February 2018 as amended from time to time |

|

|

| “Board” |

|

the board of Directors |

|

|

| “Class Y Ordinary Shares” |

|

Class Y ordinary shares of the share capital of the Company with a par value of US$0.0001 each, giving a holder of a Class Y ordinary share 10 votes per share on any resolution tabled at the Company’s general

meeting, subject to Rule 8A.24 of the Listing Rules that requires the Reserved Matters to be voted on a one vote per share basis |

|

|

| “Class Z Ordinary Shares” |

|

Class Z ordinary shares of the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such that a holder of a Class Z ordinary share is entitled to one vote per

share on any resolution tabled at the Company’s general meeting |

|

|

| “Company” |

|

Bilibili Inc., a company incorporated in the Cayman Islands on December 23, 2013 as an exempted company and, where the context requires, its subsidiaries and consolidated affiliated entities from time to time |

|

|

| “Director(s)” |

|

the director(s) of the Company |

|

|

| “Grants” |

|

1,201,636 RSUs granted to the Grantees in accordance with the 2018 Share Incentive Plan |

|

|

| “Grantees” |

|

99 employees of the Company and its subsidiaries who were granted RSUs in accordance with the 2018 Share Incentive Plan |

|

|

| “Listing Rules” |

|

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended or supplemented from time to time |

3

|

|

|

|

|

| “Reserved Matters” |

|

those matters resolutions with respect to which each Share is entitled to one vote at general meetings of the Company pursuant to Listing Rule 8A.24, being: (i) any amendment to the Company’s memorandum of association

or Articles of Association, including the variation of the rights attached to any class of shares, (ii) the appointment, election or removal of any independent non-executive director, (iii) the

appointment or removal of the Company’s auditors, and (iv) the voluntary liquidation or winding-up of the Company |

|

|

| “RSUs” |

|

restricted share units |

|

|

| “Shares” |

|

the Class Y Ordinary Shares and Class Z Ordinary Shares in the share capital of the Company, as the context so requires |

|

|

| “Stock Exchange” |

|

The Stock Exchange of Hong Kong Limited |

|

|

|

|

|

By order of the Board |

|

|

Bilibili Inc. |

|

|

Rui Chen |

|

|

Chairman |

Hong Kong, September 29, 2023

As at the date of this announcement, the Board comprises Mr. Rui CHEN as the chairman, Ms. Ni LI and Mr. Yi XU as directors, Mr. JP

GAN, Mr. Eric HE, Mr. Feng LI and Mr. Guoqi DING as independent directors.

4

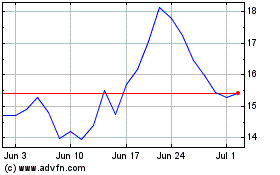

Bilibili (NASDAQ:BILI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bilibili (NASDAQ:BILI)

Historical Stock Chart

From Feb 2024 to Feb 2025