US Index Futures Slightly Rise; Bitcoin Reaches 2021 High

February 27 2024 - 6:16AM

IH Market News

On Tuesday, U.S. index futures showed a slight increase, in

anticipation of significant economic indicators expected later in

the week and statements from Federal Reserve officials, which may

reveal valuable clues about future interest rate directions.

At 5:35 AM, Dow Jones Industrial Average futures (DOWI:DJI) were

up 13 points, or 0.03%. S&P 500 futures rose 0.09%, and

Nasdaq-100 futures advanced 0.18%. The 10-year Treasury yield was

at 4.268%.

In the commodities market, West Texas Intermediate crude for

April fell 0.06% to $77.53 per barrel. Brent crude for April

dropped 0.10%, near $82.45 per barrel. Iron ore traded on the

Dalian exchange rose 1.24% to $124.68 per metric ton.

Bitcoin (COIN:BTCUSD) surpassed $57,000 on

Tuesday, before pulling back to $56,612, its first peak since 2021,

driven by ETFs and acquisitions by MicroStrategy

(NASDAQ:MSTR). With a 32% increase since the beginning of the year,

there’s growing enthusiasm for Ether (COIN:ETHUSD) and Dogecoin

(COIN:DOGEUSD) as well. Investments in Bitcoin ETFs in the U.S.

indicate growing interest, while MicroStrategy expanded its Bitcoin

portfolio, reinforcing confidence in the digital market.

Asian markets closed mixed, with Japan’s Nikkei slightly

positive, reaching a new record. Yields on Japanese government

bonds stood out, with the 2-year reaching a high since 2011 after

surprising inflation data, while in China, the anticipation of

government stimuli led to gains of 1.29%, contrasting with a drop

in South Korea’s Kospi, which fell -0.83%.

European markets traded higher, following a global downtrend the

previous day. Mining stocks led the gains in the region, while

media stocks fell 0.5%

On the U.S. economic agenda for Monday, at 08:30 AM, the

Commerce Department will release January’s durable goods orders.

Then, at 09:00 AM, attention turns to the December S&P

Case/Shiller index, which will provide insights into the

residential real estate market. Finally, at 10:00 AM, the February

consumer confidence index, published by the Conference Board, will

be closely observed. This week, the spotlight is on the Fed’s

preferred inflation index, expected on Thursday. In light of

surprisingly positive data on employment and inflation, markets

have adjusted their expectations, postponing the forecast of an

immediate easing of Fed policies to possibly June or July.

On Monday, the U.S. stock market closed lower, with major

indices losing ground amid investor caution ahead of important

economic data. The Dow Jones fell 0.16%, while the S&P 500 and

Nasdaq recorded declines of 0.38% and 0.13%, respectively.

Expectations around future economic reports, especially on

inflation and consumer spending, kept markets on alert, impacting

investment decisions.

In terms of quarterly earnings, companies scheduled to present

financial reports before the market opens include Norwegian

Cruise Line (NYSE:NCLH), Lowe’s

(NYSE:LOW), Macy’s (NYSE:M),

AutoZone (NYSE:AZO), American Electric

Power (NASDAQ:AEP), Lendingtree

(NASDAQ:TREE), Shift4 Payments (NYSE:FOUR),

Cracker Barrel (NASDAQ:CBRL), BMO

Financial Group (NYSE:BMO), Scotiabank

(NYSE:BNS), among others.

After the market closes, investors await results from

Devon Energy (NYSE:DVN), First

Solar (NASDAQ:FSLR), Cava (NYSE:CAVA),

Beyond Meat (NASDAQ:BYND),

Lemonade (NYSE:LMND), eBay

(NASDAQ:EBAY), Rocket Lab (NASDAQ:RKLB),

Array Technologies (NASDAQ:ARRY), Virgin

Galactic (NYSE:SPCE), Axon Enterprise

(NASDAQ:AXON), and more.

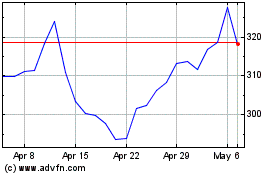

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Oct 2024 to Nov 2024

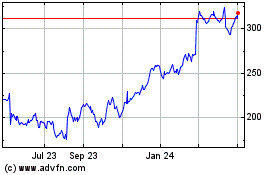

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Nov 2023 to Nov 2024