Current Report Filing (8-k)

July 13 2021 - 4:16PM

Edgar (US Regulatory)

false 0000723612 0000723612 2021-07-09 2021-07-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 9, 2021

Avis Budget Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-10308

|

|

06-0918165

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

6 Sylvan Way

Parsippany, NJ

|

|

07054

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(973) 496-4700

Registrant’s telephone number, including area code

N/A

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title Of Each Class

|

|

Trading

Symbol(s)

|

|

Name Of Each Exchange

On Which Registered

|

|

Common Stock, par value $0.01

|

|

CAR

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On July 9, 2021, Avis Budget Group, Inc. and its subsidiaries, Avis Budget Holdings, LLC and Avis Budget Car Rental, LLC, as the Borrower, entered into a Sixth Amended and Restated Credit Agreement with JPMorgan Chase Bank, N.A., as Administrative Agent and the other lenders party thereto. Pursuant to this amendment and restatement, the amount available under the Company’s revolving credit facility was increased from $1.8 billion to $1.95 billion, and the maturity of the facility was extended until 2026. In addition, certain restrictions put in place in connection with the amendment to the Fifth Amended and Restated Credit Agreement, dated as of April 27, 2020, were removed, including, among others, a liquidity covenant. Going forward, the consolidated first lien leverage ratio may not exceed 3:1. In addition, the amendment and restatement contains certain other revised terms.

The foregoing summary is qualified by reference to the terms of the Sixth Amended and Restated Credit Agreement, which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Certain of the lenders party to the credit agreement, and their respective affiliates, have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for Avis Budget Group, Inc., Avis Budget Car Rental, LLC and their subsidiaries for which they have received, and will receive, customary fees and expenses.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information described above under Item 1.01 of this report is incorporated into this Item 2.03 by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

The following exhibits are filed as part of this report:

|

|

|

|

|

Exhibit

No.

|

|

Description of Exhibit

|

|

|

|

|

10.1

|

|

Sixth Amended and Restated Credit Agreement, dated as of July 9, 2021, among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, Avis Budget Group, Inc., the subsidiary borrowers from time to time party thereto, the financial institutions from time to time party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent.

|

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

|

|

AVIS BUDGET GROUP, INC.

|

|

|

|

|

By:

|

|

/s/ Jean Sera

|

|

|

|

Jean Sera

|

|

|

|

Senior Vice President, General Counsel, Chief

Compliance Officer and Corporate Secretary

|

Date: July 13, 2021

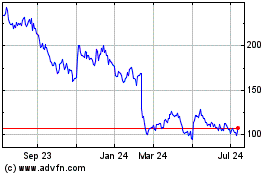

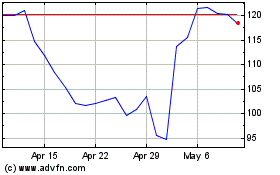

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Sep 2024 to Oct 2024

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Oct 2023 to Oct 2024