As filed with the Securities and Exchange

Commission on September 29, 2023.

Registration Statement No. 333-274562

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Avenue Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

2834 |

|

47-4113275 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

1111 Kane Concourse, Suite 301

Bay Harbor Islands, Florida 33154

(781) 652-4500

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Alexandra MacLean, M.D.

Chief Executive Officer

1111 Kane Concourse, Suite 301

Bay Harbor Islands, Florida 33154

(781) 652-4500

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Rakesh Gopalan

David S. Wolpa

McGuireWoods LLP

201 N. Tryon Street, Suite 3000

Charlotte, North Carolina 28202 |

Barry I. Grossman

Sarah Williams

Matthew Bernstein

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105 |

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not

complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

SEPTEMBER 29, 2023

Preliminary Prospectus

Up to 21,352,313 Units, Each Consisting

of One Share of Common Stock and One Warrant to Purchase One Share of Common Stock

or

Up to 21,352,313 Pre-Funded Units, Each

Consisting of One Pre-funded Warrant to Purchase One Share of Common Stock and One Warrant to Purchase One Share of Common Stock

Up to 21,352,313 Shares of Common Stock

Underlying the Warrants

Up to 21,352,313 Shares of Common Stock

Underlying the Pre-funded Warrants

We are offering on a best efforts basis up to 21,352,313 units,

each consisting of one share of our common stock, par value $0.0001 per share (“Common Stock”), and one warrant to purchase

one share of our Common Stock, at an assumed offering price of $0.562 per unit (which is the last reported sale price of our Common Stock

on The Nasdaq Capital Market on September 25, 2023). Each warrant will have an exercise price of $ (100% of the public offering

price per unit) per share of Common Stock, will be exercisable immediately, and will expire five years from the date of issuance.

We are also offering to those purchasers, if any, whose purchase of

units in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Common Stock immediately following the

consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded units in lieu of units that would

otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

shares of Common Stock. Each pre-funded unit consists of one pre-funded warrant to purchase one share of Common Stock and one warrant

to purchase one share of Common Stock. The purchase price of each pre-funded unit will be equal to the price per unit being sold to the

public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant included in the pre-funded units will be $0.0001

per share. The pre-funded warrants included in the pre-funded units will be immediately exercisable (subject to the beneficial ownership

cap) and may be exercised at any time until all of the pre-funded warrants are exercised in full. The warrant included in the pre-funded

unit is in the same form as the warrant included in the unit.

For each pre-funded unit we sell, the number of units including a share

of Common Stock we are offering will be decreased on a one-for-one basis. The units and the pre-funded units will not be issued or certificated.

The shares of Common Stock or pre-funded warrants and the accompanying warrants can only be purchased together in this offering, but the

securities contained in the units or pre-funded units will be immediately separable upon issuance and will be issued separately. The shares

of Common Stock issuable from time to time upon exercise of the warrants and the pre-funded warrants are also being offered by this prospectus.

The units will be offered at a fixed price and are expected to

be issued in a single closing. The offer will terminate on November 14, 2023, unless completed sooner or unless we decide to terminate

the offering (which we may do at any time in our discretion) prior to that date. We expect this offering to be completed not later

than two business days following the commencement of sales in this offering (after the effective date of the registration statement

of which this prospectus forms a part), and we will deliver all securities to be issued in connection with this offering delivery

versus payment/ receipt versus payment upon receipt by us of investor funds. Accordingly, neither we nor the placement agents (as

defined below) have made any arrangements to place investor funds in an escrow account or trust account since the placement agents

will not receive investor funds in connection with the sale of the securities offered hereunder.

We have engaged Maxim Group LLC and Lake Street Capital Markets,

LLC (the “placement agents”) to act as our placement agents in connection with this offering. The placement agents have agreed

to use their reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agents are not

purchasing or selling any of the securities we are offering, and the placement agents are not required to arrange the purchase or sale

of any specific number or dollar amount of securities. We have agreed to pay to the placement agents the placement agent fees set forth

in the table below, which assumes that we sell all of the securities offered by this prospectus. We will bear all costs associated with

the offering. See “Plan of Distribution” beginning on page 35 of this prospectus for more information regarding

these arrangements.

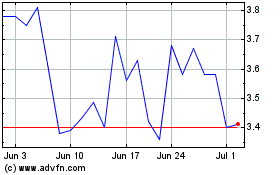

Our Common Stock is quoted for trading under the symbol “ATXI”

on The Nasdaq Capital Market. On September 25, 2023, the closing price of our Common Stock was $0.562 per share. The actual public offering

price per unit or pre-funded unit, as the case may be, in this offering will be determined between us, the placement agents and the investors

in this offering at the time of pricing, and may be at a discount to the current market price for our Common Stock. Therefore, the recent

market price used throughout this preliminary prospectus as an assumed per unit offering price may not be indicative of the final offering

price. There is no established public trading market for the warrants or the pre-funded warrants, and we do not expect such a market

to develop. In addition, we do not intend to apply for a listing of the warrants or the pre-funded warrants on any national securities

exchange or other nationally recognized trading system.

Investing in our securities involves risks. You should

review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this

prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus, as described

beginning on page 40 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

| | |

Per Unit | | |

Per Pre- Funded Unit | | |

Total | |

| Public Offering Price | |

$ | | | |

$ | | | |

$ | | |

| Placement agent fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us(2) | |

$ | | | |

$ | | | |

$ | | |

| (1) | See “Plan of Distribution” for additional disclosure regarding compensation payable to the placement agents. |

| (2) | Because there is no minimum number of securities or amount of proceeds required as a condition to closing of this offering, the actual

public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less

than the total maximum offering amounts set forth above. See “Plan of Distribution” for more information. |

We expect that delivery of the securities against payment therefor

will be made on or about , 2023.

Placement Agents

| Maxim

Group LLC |

Lake

Street |

The date of this

prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement that we filed

with the Securities and Exchange Commission, or the “SEC,” pursuant to which we may, from time to time, offer and sell or

otherwise dispose of the securities covered by this prospectus. As permitted by the rules and regulations of the SEC, the registration

statement filed by us includes additional information not contained in this prospectus.

This prospectus and the documents incorporated by reference into this

prospectus include important information about us, the securities being offered and other information you should know before investing

in our securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date

set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent

to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed

of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents

incorporated by reference therein, in making your investment decision. You should also read and consider the information in the documents

to which we have referred you under “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference” in this prospectus.

You should rely only on this prospectus and the information incorporated

or deemed to be incorporated by reference in this prospectus. We have not authorized anyone to give any information or to make any representation

to you other than those contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Unless otherwise indicated, information contained or incorporated by

reference in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information

from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted

by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions

based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s

future performance are necessarily uncertain due to a variety of factors, including those described in section of this prospectus titled

“Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions

and estimates.

We take no responsibility for, and can provide no assurance as to the

reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby

and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to

give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any free writing

prospectuses prepared by or on behalf of us or to which we have referred you or are incorporated by reference. This prospectus is not

an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted.

For investors outside the United States: we have not done anything

that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is

required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves

about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United

States.

This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed

or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain

copies of those documents as described in this prospectus under “Where You Can Find More Information.”

This prospectus contains references to trademarks, trade names and

service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus

may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor

will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use

or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship

of us by, any other entities.

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus

and does not contain all of the information that may be important to you in making an investment decision. This summary is qualified in

its entirety by the more detailed information included elsewhere in this prospectus and/or incorporated by reference herein. Before making

your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information in

our filings with the SEC incorporated by reference into this prospectus.

References in this prospectus to the “Company,” “we,”

“us,” “our” and similar words refer to Avenue Therapeutics, Inc.

Our Business

Overview and Product Candidate Development

We

are a specialty pharmaceutical company focused on the development and commercialization of therapies for the treatment of neurologic

diseases. Our product candidates include AJ201 for the treatment of spinal and bulbar muscular atrophy (“SBMA”), intravenous

tramadol (“IV tramadol”) for the treatment of post-operative acute pain, and BAER-101 for the treatment of epilepsy and

panic disorders.

In November 2022, we completed the transactions

contemplated under a Share Contribution Agreement, dated May 11, 2022 (“Contribution Agreement”), with Fortress Biotech, Inc.

(“Fortress”) to acquire shares in Baergic Bio, Inc. (“Baergic”), which is developing BAER-101, a novel α2/3–subtype-selective

gammaaminobutyric acid (“GABA”) A positive allosteric modulator (“PAM”). As a result, Baergic is a majority-controlled

and owned subsidiary company of the Company.

In February 2023, we entered into a license

agreement with AnnJi Pharmaceuticals Co. Ltd. (“AnnJi”) whereby the Company obtained an exclusive license from AnnJi to intellectual

property rights pertaining to the molecule known as JM17, which activates Nrf1 and Nrf2, enhances androgen receptor degradation and underlies

AJ201, a clinical product candidate currently in a Phase 1b/2a clinical trial in the United States (“U.S.”) for the treatment

of SBMA, also known as Kennedy’s Disease.

AJ201

In February 2023, the Company licensed intellectual

property rights pertaining to the molecule known as JM17, which actives Nrf1 and Nrf2, enhances androgen receptor degradation and underlies

AJ201 from AnnJi. AJ201 is currently in a Phase 1b/2a clinical trial in the U.S. for the treatment of SMBA. SBMA is a rare, inherited,

X-linked genetic neuromuscular disease primarily affecting men. The condition is caused by a polyglutamine expansion in the androgen receptor

(“AR”) which leads to production of an abnormal AR protein that forms aggregates responsible for muscle atrophy focused in

the spinal-bulbar region of the body. The weakening of the bulbar muscles affects chewing, speech and swallowing, with patients prone

to choking or inhaling foods or liquids, resulting in airway infection. SBMA also affects muscles in the limbs, leading to difficulty

walking and injury caused by falling. Currently, there is no effective treatment for SBMA.

AJ201 was designed to modify SBMA through multiple

mechanisms including degradation of the abnormal AR protein and by stimulating Nrf1 and Nrf2, which are involved in protecting cells from

oxidative stress which can lead to cell death. AJ201 completed a Phase 1 clinical trial in 2021, which demonstrated the safety of the

molecule. It is currently being studied in a Phase 1b/2a multicenter, randomized, double-blind clinical trial in six clinical sites across

the U.S., and screening of patients with SBMA has begun. This study aims to evaluate the safety and clinical response of AJ201 in patients

suffering from SBMA. AJ201 has been granted Orphan Drug Designation by the U.S. Food and Drug Administration (“FDA”) for the

indications of SBMA, Huntington’s Disease and Spinocerebellar Ataxia.

In July 2023, we announced the first patient

was dosed in the Phase 1b/2a trial of AJ201 for the treatment of SBMA. The 12-week, multicenter, randomized, double-blind trial is expected

to enroll approximately 24 patients, randomly assigned to AJ201 (600mg/day) or placebo. The primary endpoint of the study is to assess

safety and tolerability of AJ201 in subjects with clinically and genetically defined SBMA. Secondary endpoints include pharmacodynamic

data measuring change from baseline in mutant androgen receptor protein levels in skeletal muscle and changes in the fat and muscle composition

as seen on MRI scans. Further details on the study can be found using the ClinicalTrials.gov identifier NCT05517603. Information on clinicaltrials.gov

does not constitute part of this Form S-1.

IV tramadol

In February 2022, we had our Advisory Committee

meeting with the FDA regarding IV tramadol. In the final part of the public meeting, the Advisory Committee voted yes or no on the following

question: “Has the Applicant submitted adequate information to support the position that the benefits of their product outweigh

the risks for the management of acute pain severe enough to require an opioid analgesic in an inpatient setting?” The results were

8 yes votes and 14 no votes. In March 2022, we received an Appeal Denied Letter from the OND in response to the FDRR. In August 2022,

the Company participated in a Type A Meeting with the FDA Division of Anesthesia, Analgesia, and Addiction Products (“DAAAP”)

regarding a briefing document submitted that presented a study design the Company believed would have the potential to address the comments

and deficiencies noted in the Letter. The meeting on August 9, 2022 was a collaborative discussion on the study design and potential

path forward. We incorporated the FDA’s suggestions from the meeting minutes and submitted a detailed study protocol.

The Company participated in a Type C meeting with

the FDA in March 2023 to discuss a proposed study protocol to assess the risk of respiratory depression related to opioid stacking

on IV tramadol relative to an approved opioid analgesic. We announced in April 2023 that the Company has received official meeting

minutes from the Type C meeting with the FDA. The Type C meeting minutes indicate that the FDA and the Company are in agreement with a

majority of the proposed protocol items and are in active discussion about remaining open items. The minutes indicate that the FDA also

agrees that a successful study will support the submission of a complete response to the second Complete Response Letter for IV tramadol

pending final agreement on a statistical analysis plan and a full review of the submitted data in the complete response as well as concurrence

from the DAAAP.

In July 2023, the Company announced alignment

with the FDA on key elements of the Phase 3 safety study, including the primary endpoint and statistical analysis approach. The non-inferiority

study is designed to assess the theoretical risk of opioid-induced respiratory depression related to opioid stacking on IV tramadol compared

to IV morphine.

The study will randomize post bunionectomy

patients to IV tramadol or IV morphine for pain relief administered during a 48-hour post-operative period. Patients will have access

to IV hydromorphone, a Schedule II opioid, for rescue of breakthrough pain. The primary endpoint is a composite of elements indicative

of respiratory depression.

We submitted the revised protocol to the FDA

including the statistical plan, which reflects the study design previously discussed, for final review.

BAER-101 (novel α2/3–subtype-selective

GABA A PAM)

Baergic is a clinical-stage pharmaceutical company

founded in December 2019 that focuses on the development of pharmaceutical products for the treatment of neurologic disorders. Baergic

was acquired by the Company pursuant to the Contribution Agreement with Fortress, in order to strategically align with Avenue’s

goals of building a rare and neurologic pipeline. Baergic’s pipeline currently consists of a single compound, BAER-101, a novel

α2/3–subtype-selective GABA A positive allosteric modulator. BAER-101 (formally known as AZD7325) was originally developed

by AstraZeneca and has an established safety profile in early clinical trials including over 700 patients.

In August 2023, we reported preclinical data

for BAER-101 from an in vivo evaluation in SynapCell’s Genetic Absence Epilepsy Rate from Strasbourg (“GAERS”) model

of absence epilepsy. The GAERS model mimics behavioral, electrophysiological and pharmacological features of human absence seizures and

has shown to be an early informative indicator of efficacy in anti-seizure drug development. In the model, BAER-101 demonstrated full

suppression of seizure activity with a minimal effective dose of 0.3 mg/kg administered orally.

Relationship with Fortress

We were incorporated in Delaware on February 9,

2015, as a wholly owned subsidiary of Fortress, to develop and market pharmaceutical products for the acute care setting in the United

States. In 2017, we completed an initial public offering of shares of our Common Stock. Fortress continues to control a voting majority

of our capital stock pursuant to its ownership of a class of preferred stock. We anticipate remaining a majority controlled subsidiary

of Fortress after the completion of this offering.

Corporate Information

We are a majority-controlled subsidiary of Fortress.

Baergic is our sole subsidiary. Avenue Therapeutics, Inc. was incorporated in Delaware on February 9, 2015. Our executive offices

are located at 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154. Our telephone number is (781) 652-4500, and our

email address is info@avenuetx.com. Information on our website, or any other website, is not incorporated by reference in this prospectus.

We have included our website address in this prospectus solely as an inactive textual reference.

THE OFFERING

| Units Offered by Us |

Up

to 21,352,313 units on a “reasonable best efforts” basis, each unit consisting of one share of Common Stock and one warrant,

each warrant exercisable for one share of Common Stock. The shares of Common Stock and warrants that are part of the units are immediately

separable and will be issued separately in this offering. The warrants included within the units are exercisable immediately, have

an exercise price equal to $ (100%

of the public offering price per unit), and expire five years after the date of issuance. This prospectus also relates to

the offering of the shares of Common Stock issuable upon exercise of the warrants. For more information regarding the warrants, you

should carefully read the section titled “Description of Securities to be Registered” in this prospectus.

|

| Pre-Funded Units Offered by Us |

We are also offering to those purchasers, if any, whose purchase of

units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Common Stock immediately following the

consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded units (each pre-funded unit consisting

of one pre-funded warrant to purchase one share of Common Stock and one warrant to purchase one share of Common Stock), in lieu of units

that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding shares of Common Stock.

The purchase price of each pre-funded unit will be equal to the price

per unit being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant included in the pre-funded

units will be $0.0001 per share. The pre-funded warrants included in the pre-funded units will be immediately exercisable and may be exercised

at any time, and from time to time, until all of the pre-funded warrants are exercised in full.

For each pre-funded unit we sell, the number of units we are offering

will be decreased on a one-for-one basis. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise

of the pre-funded warrants. For more information regarding the pre-funded warrants, you should carefully read the section titled “Description

of Securities to be Registered” in this prospectus.

|

Reasonable Best Efforts Offering |

We have agreed to issue and sell the securities offered hereby

to the purchasers through the placement agents. The placement agents are not required to buy or sell any specific number or dollar

amount of the securities offered hereby, but will use their reasonable best efforts to solicit offers to purchase the securities

offered by this prospectus. See “Plan of Distribution” beginning on page 35 of this prospectus.

|

Shares of Common Stock Outstanding Prior to this Offering

|

8,964,222 shares of Common Stock |

Shares of Common Stock Outstanding Following this Offering(1)

|

30,316,535 shares of Common Stock (assuming all

of the units we are offering under this prospectus are sold, that we do not issue any pre-funded units in the offering and that none

of the holders of warrants issued in the offering exercise their warrants)

|

|

Nasdaq Capital Market Ticker Symbol of our Common Stock

|

ATXI |

| Use of Proceeds |

Assuming all of the units we are offering under

this prospectus are sold at an assumed public offering price of $0.562, we estimate that we will receive approximately $10.7 million

in net proceeds from this offering, after deducting the estimated placement agent fees and estimated offering expenses. However,

this is a reasonable best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing,

and we may not sell all or any of the securities offered pursuant to this prospectus; as a result, we may receive significantly less

in net proceeds.

The net proceeds from this offering will be used for general

corporate purposes and working capital requirements, which may include, among other things, the advancement of our product candidates

to obtain regulatory approval from the FDA. However, we will have broad discretion to allocate the net proceeds of this offering.

See “Use of Proceeds” for additional information.

|

| Lock-up |

We, all of our directors, officers and the holders of 10% or more of

our outstanding shares of Common Stock have agreed with the placement agents, subject to certain exceptions, not to sell, transfer or

dispose of, directly or indirectly, any of our Common Stock or securities convertible into or exercisable or exchangeable for our Common

Stock for a period of 180 days after the date of the final closing of this offering. See “Plan of Distribution” for

more information.

|

| Risk Factors |

Any investment in the Common Stock offered hereby is speculative

and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” in

this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. |

| (1) | The

number of shares of Common Stock to be outstanding after this offering is based on 8,964,222

shares of our Common Stock outstanding as of September 26, 2023, and excludes: |

| · | 6,078,132 shares of Common Stock issuable upon exercise of outstanding warrants having a weighted-average exercise price of $1.55

per share; |

| · | 85,000 shares of

Common Stock issuable upon the vesting and settlement of outstanding restricted stock award/units; |

| · | 3,352,489 shares of Common Stock reserved for issuance and available for future grant under our 2015 Incentive Plan; |

| · | 1,685,000 shares of Common Stock issuable upon the exercise of stock options with a weighted-average exercise price of $1.14 per share; |

| · | 16,666 shares of

Common Stock issuable upon conversion of the Class A Preferred Stock, at the holders’

election; |

| · | up to 21,352,313

shares of Common Stock issuable upon exercise of the warrants included in the units and the

pre-funded units; and |

| · | excludes 533,808

shares of Common Stock (assuming all of the units we are offering under this prospectus are

sold at the assumed offering price) issuable to Fortress, pursuant to the Amended and Restated

Founders Agreement between Fortress and the Company (the “Founders Agreement”),

following the closing of this offering. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains predictive or “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of

current or historical fact contained in this prospectus, including statements that express our intentions, plans, objectives, beliefs,

expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are

forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,”

“should,” “would” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

These statements are based on current expectations,

estimates and projections made by management about our business, our industry and other conditions affecting our financial condition,

results of operations or business prospects. These statements are not guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or

forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that could cause such outcomes

and results to differ include, but are not limited to, risks and uncertainties arising from:

| · | the fact that we currently have no drug products for sale and that our success is dependent on our product candidates receiving regulatory

approval and being successfully commercialized; |

| · | the possibility that serious adverse or unacceptable side effects are identified during the development of our current or future product

candidates, such that we would need to abandon or limit development of some of our product candidates; |

| · | our ability to successfully integrate Baergic Bio, Inc. or develop BAER-101 or AJ201; |

| · | the substantial doubt raised about our ability to continue as a going concern, which may hinder our ability to obtain future financing; |

| · | the significant losses we have incurred since inception and our expectation that we will continue to incur losses for the foreseeable

future; |

| · | our need for substantial additional funding, which may not be available to us on acceptable terms, or at all, which unavailability

could force us to delay, reduce or eliminate our product development programs or commercialization efforts; |

| · | our reliance on third parties for several aspects of our operations; |

| · | our reliance on clinical data and results obtained by third parties that could ultimately prove to be inaccurate or unreliable; |

| · | the possibility that we may not receive regulatory approval for any or all of our product candidates, or that such approval may be

significantly delayed due to scientific or regulatory reasons; |

| · | the fact that even if one or more of our product candidates receives regulatory approval, they will remain subject to substantial

regulatory scrutiny; |

| · | the effects of current and future laws and regulations relating to fraud and abuse, false claims, transparency, health information

privacy and security and other healthcare laws and regulations; |

| · | the effects of competition for our product candidates and the potential for new products to emerge that provide different or better

therapeutic alternatives for our targeted indications; |

| · | the possibility that the government or third-party payors fail to provide adequate coverage and payment rates for our product candidates

or any future products; |

| · | our ability to establish sales and marketing capabilities or to enter into agreements with third parties to market and sell our product

candidates; |

| · | our exposure to potential product liability claims; |

| · | our ability to secure adequate protection of our intellectual property and our potential inability to maintain sufficient patent protection

for our technology and products; |

| · | our ability to maintain compliance with the obligations under our intellectual property licenses and funding arrangements with third

parties, without which licenses and arrangements we could lose rights that are important to our business; |

| · | the fact that Fortress controls a voting majority of our Common Stock and has rights to receive significant share grants annually; |

| · | our ability to comply with the applicable listing standards and maintain our current listing for our Common Stock on The Nasdaq Capital

Market; and |

| · | those risks discussed or referred to in “Risk Factors” elsewhere in this prospectus, as well as those described

in any other filings which we make with the SEC. |

Any forward-looking statements speak only

as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect

events or circumstances that may arise after the date of this prospectus, except as required by applicable law. Investors should evaluate

any statements made by us in light of these important factors.

MARKET AND INDUSTRY DATA AND FORECASTS

We obtained the industry and market data used throughout this prospectus

and in the other documents incorporated by reference into this prospectus from our own internal estimates and research, as well as from

independent market research, industry and general publications and surveys, governmental agencies, publicly available information and

research, surveys and studies conducted by third parties. Internal estimates are derived from publicly available information released

by industry analysts and third-party sources, our internal research and our industry experience, and are based on assumptions made by

us based on such data and our knowledge of our industry and market, which we believe to be reasonable. In some cases, we do not expressly

refer to the sources from which this data is derived. In addition, while we believe the industry and market data included in this prospectus

is reliable and based on reasonable assumptions, such data involve material risks and other uncertainties and are subject to change based

on various factors, including those discussed in this prospectus in the section titled “Risk Factors,” as well as those

described in the documents incorporated by reference into this prospectus. These and other factors could cause results to differ materially

from those expressed in the estimates made by the independent parties or by us.

RISK FACTORS

Our business, results of operations and financial condition and

the industry in which we operate are subject to various risks. Accordingly, investing in our securities involves a high degree of risk.

This prospectus does not describe all of those risks. You should consider the risk factors described in this prospectus below, as well

as those described under the caption “Risk Factors” in the documents incorporated by reference herein, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, together with the other information contained or incorporated

by reference in this prospectus.

We have described below and in the documents incorporated by reference

herein the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. New

risks may emerge from time to time, and it is not possible for us to predict all potential risks or to assess the likely impact of all

risks. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate

by reference in this prospectus and any prospectus supplement. This prospectus also contains forward-looking statements that involve risks

and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of

a number of factors, including the risks described below. See the section titled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

This is a reasonable best efforts offering, with no minimum amount

of securities required to be sold, and we may sell fewer than all of the securities offered hereby.

The placement agents have agreed to use their reasonable best efforts

to solicit offers to purchase the securities in this offering. The placement agents have no obligation to buy any of the securities from

us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number

of securities that must be sold as a condition to completion of this offering, and there can be no assurance that the offering contemplated

hereby will ultimately be consummated. Even if we sell securities offered hereby, because there is no minimum offering amount required

as a condition to closing of this offering, the actual offering amount is not presently determinable and may be substantially less than

the maximum amount set forth on the cover page of this prospectus. We may sell fewer than all of the securities offered hereby, which

may significantly reduce the amount of proceeds received by us. Thus, we may not raise the amount of capital we believe is required for

our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable to

us.

If the price of our Common Stock fluctuates significantly, your

investment could lose value.

Although our Common Stock is listed on Nasdaq, we cannot assure you

that an active public market will continue for our Common Stock. If an active public market for our Common Stock does not continue, the

trading price and liquidity of our Common Stock will be materially and adversely affected. If there is a thin trading market or “float”

for our stock, the market price for our Common Stock may fluctuate significantly more than the stock market as a whole. Without a large

float, our Common Stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading prices

of our Common Stock may be more volatile. In addition, in the absence of an active public trading market, investors may be unable to liquidate

their investment in us. Furthermore, the stock market is subject to significant price and volume fluctuations, and the price of our Common

Stock could fluctuate widely in response to several factors, including:

| · | our quarterly or annual operating results; |

| · | changes in our earnings estimates; |

| · | investment recommendations by securities analysts following our business or our industry; |

| · | additions or departures of key personnel; |

| · | our failure to achieve operating results consistent with securities analysts’ projections; and |

| · | changes in industry, general market or economic conditions. |

The stock market has experienced extreme price and volume fluctuations

in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in our industry.

The changes often appear to occur without regard to specific operating performance. The price of our Common Stock could fluctuate based

upon factors that have little or nothing to do with our company and these fluctuations could materially reduce our stock price.

We will have broad discretion in the use of proceeds of this

offering designated for working capital and general corporate purposes.

Our management will have broad discretion over the use and investment

of the net proceeds of this offering. Accordingly, investors in this offering have only limited information concerning our management’s

specific intentions and will need to rely upon the judgment of our management with respect to the use of proceeds. The

failure by our management to apply these funds effectively could result in financial losses that could have a material adverse

effect on our business and cause the price of our securities to decline. Pending the application of these funds, we may invest the net

proceeds from this offering in a manner that does not produce income or that loses value.

We do not intend to pay dividends on our Common Stock, so any

returns will be limited to increases, if any, in our stock’s value. Your ability to achieve a return on your investment will depend

on appreciation, if any, in the price of our Common Stock.

We currently anticipate that we will retain future earnings for the

development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable

future. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on, among

other factors, our financial condition, operating results, capital requirements, general business conditions and other factors that our

board of directors may deem relevant. Any return to stockholders will therefore be limited to the appreciation in the value of their stock,

if any.

The warrants are speculative in nature.

The warrants included in the units and pre-funded units offered

hereby do not confer any rights of Common Stock ownership on their holders, such as voting rights or the right to receive dividends,

but rather merely represent the right to acquire shares of our Common Stock at a fixed price. Specifically, commencing on the date of

issuance, holders of the warrants may exercise their right to acquire the shares of our Common Stock and pay an exercise price of $

, equal to the public offering price per unit or pre-funded unit. Moreover, following this offering, the market value of the warrants

is uncertain and there can be no assurance that the market value of the warrants will equal or exceed their exercise price. Furthermore,

each warrant will expire five years from the original issuance date. In the event the price of our Common Stock does not exceed the exercise

price of the warrants during the period when the warrants are exercisable, the warrants may not have any value. There is no established

public trading market for warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend

to apply to list the warrants on any securities exchange or nationally recognized trading system, including Nasdaq. Without an active

market, the liquidity of the warrants will be limited.

Holders of the warrants or pre-funded warrants will have no rights

as a common stockholder until they acquire shares of our Common Stock.

Until you acquire shares of our Common Stock upon exercise of your

warrants or pre-funded warrants, you will have no rights with respect to shares of Common Stock issuable upon exercise of such warrants.

Upon exercise of your warrants or pre-funded warrants, you will be entitled to exercise the rights of a holder of our Common Stock as

to the security exercised only as to matters for which the record date occurs after the exercise.

Provisions of the warrants and pre-funded warrants offered by

this prospectus could discourage an acquisition of us by a third party.

In addition to the provisions of our amended and restated certificate

of incorporation and bylaws discussed elsewhere in this prospectus, certain provisions of the warrants and pre-funded warrants offered

by this prospectus could make it more difficult or expensive for a third party to acquire us. The warrants and pre-funded warrants prohibit

us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving

entity assumes our obligations under the warrants. These and other provisions of the warrants and pre-funded warrants offered by this

prospectus could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

If you purchase shares of our Common Stock included as part of

the units in this offering, you will incur immediate and substantial dilution in the book value of your shares.

Investors purchasing shares of our Common Stock included as

part of the units in this offering will pay a price per unit that substantially exceeds the pro forma as adjusted net tangible book

value per share. As a result, investors purchasing shares of our Common Stock included as part of the units in this offering will

incur immediate dilution of $0.40 per share, representing the difference between the public offering price of $0.562 per unit

and our pro forma as adjusted net tangible book value per share as of June 30, 2023. To the extent outstanding options or warrants

to purchase our Common Stock are exercised and to the extent that we issue to Fortress the shares of Common Stock issuable pursuant

to the Founders Agreement following the closing of this offering, new investors may incur further dilution. For more information on

the dilution you may experience as a result of investing in this offering, see the section of this prospectus entitled

“Dilution.”

If we sell Common Stock or preferred stock in future financings,

stockholders may experience immediate dilution and, as a result, our stock price may decline.

We may from time to time issue additional shares of Common Stock or

preferred stock at a discount from the current trading price of our Common Stock. As a result, our stockholders would experience immediate

dilution upon the purchase of any shares sold at such discount. In addition, as opportunities present themselves, we may enter into financing

or similar arrangements in the future, including the issuance of debt securities, Common Stock or preferred stock. If we issue Common

Stock or securities convertible into Common Stock, the holders of our Common Stock would experience additional dilution and, as a result,

our stock price may decline.

There is substantial doubt about our ability

to continue as a going concern, which may hinder our ability to obtain future financing.

We are not yet generating revenue, have incurred substantial

operating losses since our inception and expect to continue to incur significant operating losses for the foreseeable future as we

execute on our product development plan and may never become profitable. As of December 31, 2022, we had cash and cash

equivalents of $6.7 million and an accumulated deficit of $80.6 million, and, as of June 30, 2023, we had cash and cash

equivalents of $1.6 million and an accumulated deficit of $92.1 million. We do not believe that our cash is sufficient for the next

twelve months. As a result, there is substantial doubt about our ability to continue as a going concern. Our ability to continue as

a going concern will depend on our ability to obtain additional funding, as to which no assurances can be given. This offering is

being conducted on a best efforts basis and we may sell fewer than all of the securities offered hereby and may receive

significantly less in net proceeds from this offering than the maximum amount set forth on the cover page of this prospectus.

Furthermore, even if we sell all of the securities offered hereby and raise the maximum amount of proceeds, we may need to raise

additional capital to fund our operations and continue to support our planned development and commercialization activities. If we

are unable to obtain funds when needed or on acceptable terms, we may be required to curtail our current development programs, cut

operating costs, forgo future development and other opportunities or even terminate our operations.

If we fail to satisfy applicable listing standards of The Nasdaq

Capital Market, our Common Stock could be delisted from The Nasdaq Capital Market.

On May 19, 2023, we received a deficiency letter (the “Nasdaq

Stockholders’ Equity Letter”) from the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market

LLC, notifying us that we are not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires us to maintain a minimum of $2,500,000

in stockholders’ equity for continued listing on The Nasdaq Capital Market (the “Stockholders’ Equity Requirement”),

nor in compliance with either of the alternative listing standards, market value of listed securities of at least $35 million or net

income of $500,000 from continuing operations in the most recently completed fiscal year, or in two of the three most recently completed

fiscal years. Our failure to comply with the Stockholders’ Equity Requirement was based on the filing of our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2023, reporting the stockholders’ equity of negative $2,157,000. Pursuant to the Nasdaq

Stockholders’ Equity Letter, we had 45 calendar days from the date of the Nasdaq Stockholders’ Equity Letter to submit a

plan to regain compliance. On July 3, 2023, we submitted a compliance plan (the “Compliance Plan”). On

July 17, 2023, the Staff granted the Company’s request for an extension of the deadline to regain compliance with the

Rule to November 15, 2023.

Additionally, on September 27, 2023, we received a deficiency letter

(the “Nasdaq Minimum-Bid Price Letter”) from the Staff of the Nasdaq Capital Market LLC, stating that the bid price of our

Common Stock had closed below $1.00 per share for 30 consecutive business days and that, therefore, we are not in compliance with Nasdaq

Listing Rule 5550(a)(2) (the “Minimum-Bid Price Requirement”). We have a 180-calendar day grace period, through March 25,

2024, to regain compliance with the Minimum-Bid Price Requirement. Compliance can be achieved by evidencing a closing bid price of at

least $1.00 per share for a minimum of ten (10) consecutive business days, although the Staff may, in its discretion, require compliance

for a longer period of time (generally no more than 20 consecutive business days) during the 180-calendar day grace period. If we do

not regain compliance with the Minimum-Bid Price Requirement by March 25, 2024, we may be eligible for an additional 180-day compliance

period so long as we satisfy the criteria for initial listing

on The Nasdaq Stock Market, other than the market value of publicly held shares requirement, and the continued listing requirement for

market value of publicly held shares and we provide written notice of our intention to cure the deficiency during the second compliance

period by effecting a reverse stock split, if necessary. In the event we are not eligible for the second grace period, the Staff will

provide written notice that our Common Stock is subject to delisting; however, we may request a hearing before the Nasdaq Hearings Panel

(the “Panel”), which request, if timely made, would stay any further suspension or delisting action by the Staff pending

the conclusion of the hearing process and expiration of any extension that may be granted by the Panel. We intend to closely monitor

the closing bid price of the Common Stock and consider all available options to remedy the bid price deficiency, but no decision regarding

any action has yet been made.

We

intend to take all reasonable measures available to regain compliance under the Nasdaq Listing Rules and remain listed on The Nasdaq

Capital Market. However, there can be no assurance that The Nasdaq Stock Market LLC will approve the Compliance Plan or that we will ultimately

regain compliance with all applicable requirements for continued listing. If our Common Stock were delisted from The Nasdaq Stock Market,

it could severely limit the liquidity of our Common Stock and your ability to sell our securities on the secondary market. Delisting

from The Nasdaq Capital Market could adversely affect our ability to raise additional financing through the public or private sale of

equity securities, would significantly affect the ability of investors to trade our securities and would negatively affect the value and

liquidity of our Common Stock. Delisting could also have other negative results, including the potential loss of confidence by employees,

the loss of institutional investor interest and fewer business development opportunities. If our Common Stock is delisted from The Nasdaq

Capital Market, the price of our Common Stock may decline and our Common Stock may be eligible to trade on the OTC Bulletin Board, another

over-the-counter quotation system, or on the pink sheets where an investor may find it more difficult to dispose of their Common Stock

or obtain accurate quotations as to the market value of our Common Stock. Further, if we are delisted, we would incur additional costs

under requirements of state “blue sky” laws in connection with any sales of our securities. These requirements could severely

limit the market liquidity of our Common Stock and the ability of our stockholders to sell our Common Stock in the secondary market.

Purchasers who purchase our securities in

this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit

of a securities purchase agreement.

In addition to rights and remedies available to

all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement

will also be able to bring claims for breach of contract against us. The ability to pursue a claim for breach of contract provides those

investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including timely

delivery of shares and indemnification for breach of contract.

CAPITALIZATION

The following table sets forth our cash and capitalization as of June 30,

2023, as follows:

| · | on an as adjusted

basis to reflect the issuance and sale by us of 21,352,313 units in this offering at

an assumed public offering price of $0.562 per unit (which is the last reported sale price

of our Common Stock on The Nasdaq Capital Market on September 25, 2023), after deducting

the estimated offering expenses payable by us and assuming no sale of any pre-funded units

in the offering, but before applying any of the net proceeds as described below under

“Use of Proceeds,” including any amounts payable to InvaGen Pharmaceuticals Inc. (“InvaGen”). |

The as adjusted information below is illustrative only, and our capitalization

following the completion of this offering will be adjusted based on the actual public offering price and other terms of this offering

determined at pricing. You should read this information in conjunction with our financial statements and the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” section in our Quarterly Report on Form 10-Q for the period ended June 30, 2023, which is incorporated by reference in this prospectus.

| |

|

June 30, 2023 |

|

| |

|

(unaudited) |

|

| ($

in thousands) |

|

Actual |

|

|

As Adjusted |

|

| Cash and cash equivalents |

|

$ |

1,571 |

|

|

$ |

12,301 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

| Preferred Stock ($0.0001 par

value), 2,000,000 shares authorized |

|

|

|

|

|

|

|

|

| Class A Preferred

Stock – 250,000 shares issued and outstanding |

|

|

— |

|

|

|

— |

|

| Common Stock ($0.0001 par value), 75,000,000 shares

authorized |

|

|

|

|

|

|

|

|

| Common stock –

7,920,485 issued and outstanding |

|

|

1 |

|

|

|

3 |

|

| Additional paid-in

capital |

|

|

86,757 |

|

|

|

97,485 |

|

| Accumulated deficit |

|

|

(92,094 |

) |

|

|

(92,094 |

) |

| Total stockholders’

equity (deficit) attributed to the Company |

|

|

(5,336 |

) |

|

|

5,394 |

|

| Non-controlling

interests |

|

|

(810 |

) |

|

|

(810 |

) |

| Total Capitalization |

|

$ |

(6,146 |

) |

|

$ |

4,584 |

|

Each $0.10 increase or decrease in the assumed public offering

price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market on September 25, 2023)

would increase or decrease each of cash and cash equivalents, total stockholders’ equity and total capitalization on an as adjusted

basis by approximately $2.0 million, assuming the maximum number of units offered, as set forth on the cover page of this prospectus,

remains the same, and after deducting the estimated placement agent fees and estimated offering expenses payable by us and assuming no

sale of any pre-funded units in the offering.

Each 1,000,000 unit increase or decrease in the number of units

offered by us in this offering would increase or decrease each of cash and cash equivalents, total stockholders’ equity and total

capitalization on an as adjusted basis by approximately $0.5 million, assuming that the price per unit for the offering remains

at $0.562 (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market on September 25, 2023), and after

deducting the estimated placement agent fees and estimated offering expenses payable by us.

The

number of shares of Common Stock to be outstanding after this offering is based on 7,920,485 shares of our Common Stock outstanding

as of June 30, 2023, and:

| · | excludes 767,085 shares of Common Stock issued and sold on September 8, 2023 in a private placement transaction; |

| | · | excludes 276,652 shares of Common Stock issued to AnnJi

on September 26, 2023, pursuant to the Company’s license agreement with AnnJi, upon

the enrollment of the eighth (8th) participant in the first Phase 1b/2a Clinical Trial in

the United States; |

| | | |

| · | excludes 6,078,132 shares of Common Stock issuable upon exercise of outstanding warrants having a weighted-average exercise price

of $1.55 per share; |

| · | excludes 85,000

shares of Common Stock issuable upon the vesting and settlement of outstanding restricted

stock award/units; |

| · | excludes 3,352,489 shares of Common Stock reserved for issuance and available for future grant under our 2015 Incentive Plan; |

| · | excludes 1,685,000 shares of Common Stock issuable upon the exercise of stock options with a weighted-average exercise price of $1.14

per share; |

| · | excludes 16,666

shares of Common Stock issuable upon conversion of the Class A Preferred Stock, at the

holders’ election; |

| · | excludes up to

21,352,313 shares

of Common Stock issuable upon exercise of the warrants included in the units; and |

| · | excludes 533,808

shares of Common Stock (assuming all of the units we are offering under this prospectus are

sold at the assumed offering price) issuable to Fortress, pursuant to the Founders Agreement,

following the closing of this offering. |

USE OF PROCEEDS

We estimate that we will receive net proceeds from this offering

of approximately $10.7 million (assuming the sale of the maximum number of units offered hereby), based upon an assumed public offering

price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market on September 25, 2023),

after deducting the estimated placement agent fees and estimated offering expenses payable by us and assuming no exercise of the warrants

included in the units or pre-funded units. We will only receive additional proceeds from the exercise of the warrants included in the

units and pre-funded units we are selling in this offering if the warrants are exercised for cash. However, because this is a reasonable

best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, the actual offering amount,

placement agent fees, and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set

forth on the cover page of this prospectus, and we may not sell all or any of the securities we are offering. As a result, we may receive

significantly less in net proceeds. Based on the assumed offering price set forth above, we estimate that our net proceeds from the sale

of 75%, 50%, and 25% of the units offered in this offering would be approximately $8.0 million, $5.2 million, and $2.45 million, respectively,

after deducting the estimated placement agent fees and estimated offering expenses payable by us, and assuming no exercise of the warrants

included in the units or pre-funded units.

Each $0.10 increase (decrease) in the assumed public offering price

of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market on September 25, 2023)

would increase (decrease) the net proceeds to us from this offering by approximately $2.0 million, assuming the number of units

offered, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated offering expenses payable

by us and assuming no exercise of the warrants included in the units and no sale of any pre-funded units in the offering. Each 1,000,000

share increase (decrease) in the number of units offered by us in this offering would increase (decrease) the net proceeds to us from

this offering by approximately $0.5 million, assuming that the price per unit for the offering remains at $0.562 (which is the last

reported sale price of our Common Stock on The Nasdaq Capital Market on September 25, 2023), and after deducting the estimated offering

expenses payable by us and assuming no exercise of the warrants included in the units and no sale of any pre-funded units in the offering.

The net proceeds from this offering will be used for general

corporate purposes and working capital requirements, which may include, among other things, the advancement of our product

candidates to obtain regulatory approval from the FDA. Additionally, under the agreement with InvaGen under which we repurchased all

of InvaGen’s shares in the Company, until we have paid an aggregate of $4 million to InvaGen, we are contractually bound to

pay 7.5% of the net proceeds, before expenses, of any public or private financing to InvaGen. Accordingly, assuming the sale of the

maximum number of units offered hereby, we estimate we will pay InvaGen approximately $803,000 of the net proceeds. We have not

determined the amounts we plan to spend on the areas listed above or the timing of these expenditures, and we have no current plans

with respect to acquisitions as of the date of this prospectus. The timing and amounts of our actual expenditures will depend on

several factors. As a result, our management will have broad discretion to allocate the net proceeds of this offering. Pending their

ultimate use, we intend to invest the net proceeds in a variety of securities, including commercial paper, government and

non-government debt securities and/or money market funds that invest in such securities.

DILUTION

Purchasers

of the securities offered by this prospectus will suffer immediate and substantial dilution in the net tangible book value per share of

the Common Stock included in the units they purchase. Net tangible book value per share represents the amount of total tangible assets

less total liabilities, divided by the number of shares of our Common Stock outstanding as of June 30, 2023. Our net tangible book

value as of June 30, 2023 was approximately $(6.1) million, or $(0.78)

per share of our Common Stock.

Dilution in net tangible book value per share represents the

difference between the amount per share paid by purchasers in this offering and the net tangible book value per share of our Common

Stock immediately after this offering. After giving effect to the sale of the maximum number of units offered hereby at an assumed

public offering price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market on

September 25, 2023), and after deducting the estimated placement agent fees and the estimated expenses payable by us and assuming no

sale of any pre-funded units in this offering and excluding the issuance of shares of common Stock issuable

to Fortress, pursuant to the Founders Agreement, following the closing of this offering, our net tangible book value as of June 30, 2023 would have been approximately

$4.6 million, or $0.16 per share of Common Stock. This represents an immediate increase in net book value of $0.94 per

share to our existing stockholders and an immediate dilution in net tangible book value of $0.40 per share to new investors

participating in this offering.

The following table illustrates this calculation on a per share basis:

| Offering price per share | |

| | | |

$ | 0.562 | |

| | |

| | | |

| | |

| Net tangible book value per share as of June 30, 2023 | |

$ | (0.78 | ) | |

| | |

| Increase per share attributable to the offering | |

$ | 0.94 | | |

| | |

| As-adjusted net tangible book value per share after giving

effect to the offering | |

| | | |

$ | 0.16 | |

| Dilution in net tangible book value per share to new investors | |

| | | |

$ | 0.40 | |

If we sell only 75% of the units offered in this offering, at an

assumed public offering price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market

on September 25, 2023), and after deducting the estimated placement agent fees and the estimated expenses payable by us and assuming

no sale of any pre-funded units in this offering, our net tangible book value as of June 30, 2023 would have been approximately $1.8 million,

or $0.08 per share of Common Stock. This represents an immediate increase in net book value of $0.86 per share to our existing stockholders

and an immediate dilution in net tangible book value of $0.48 per share to new investors participating in this offering.

If we sell only 50% of the units offered in this offering, at an

assumed public offering price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market

on September 25, 2023), and after deducting the estimated placement agent fees and the estimated expenses payable by us and assuming

no sale of any pre-funded units in this offering, our net tangible book value as of June 30, 2023 would have been approximately $(0.9) million,

or $(0.05) per share of Common Stock. This represents an immediate increase in net book value of $0.73 per share to our existing stockholders

and an immediate dilution in net tangible book value of $0.61 per share to new investors participating in this offering.

If we sell only 25% of the units offered in this offering, at an

assumed public offering price of $0.562 per unit (which is the last reported sale price of our Common Stock on The Nasdaq Capital Market

on September 25, 2023), and after deducting the estimated placement agent fees and the estimated expenses payable by us and assuming

no sale of any pre-funded units in this offering, our net tangible book value as of June 30, 2023 would have been approximately $(3.7)

million, or $(0.28) per share of Common Stock. This represents an immediate increase in net book value of $0.50 per share to our

existing stockholders and an immediate dilution in net tangible book value of $0.84 per share to new investors participating in

this offering.

The

number of shares of Common Stock to be outstanding after this offering is based on 7,920,485 shares of our Common Stock outstanding

as of June 30, 2023, and:

| · | excludes 767,085 shares of Common Stock issued and sold on September 8, 2023 in a private placement transaction; |

| | · | excludes 276,652 shares of Common Stock issued to AnnJi

on September 26, 2023, pursuant to the Company’s license agreement with AnnJi, upon

the enrollment of the eighth (8th) participant in the first Phase 1b/2a Clinical Trial in

the United States; |

| | | |

| · | excludes 6,078,132 shares of Common Stock issuable upon exercise of outstanding warrants having a weighted-average exercise price

of $1.55 per share; |

| · | excludes 85,000

shares of Common Stock issuable upon the vesting and settlement of outstanding restricted

stock award/units; |

| · | excludes 3,352,489 shares of Common Stock reserved for issuance and available for future grant under our 2015 Incentive Plan; |

| · | excludes 1,685,000 shares of Common Stock issuable upon the exercise of stock options with a weighted-average exercise price of $1.14

per share; |

| · | excludes 16,666

shares of Common Stock issuable upon conversion of the Class A Preferred Stock, at the

holders’ election; |

| · | excludes up to

21,352,313 shares of Common Stock issuable upon exercise of the warrants included in

the units; and |

| · | excludes 533,808

shares of Common Stock (assuming all of the units we are offering under this prospectus are

sold at the assumed offering price) issuable to Fortress, pursuant to the Founders Agreement,

following the closing of this offering. |

DIVIDEND POLICY

We currently intend to retain all available funds and any future earnings

to fund the growth and development of our business. We have never declared or paid any cash dividends on our capital stock. We do not