false

0001488039

0001488039

2023-08-14

2023-08-14

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 14, 2023

Atossa Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

| |

|

|

|

|

|

Delaware

|

|

001-35610

|

|

26-4753208

|

| |

|

|

|

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

| |

|

|

|

107 Spring Street

Seattle, Washington

|

|

98104

|

| |

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (206) 588-0256

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuance to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.18 par value

|

ATOS

|

The Nasdaq Capital Market

|

Item 2.02. Results of Operations and Financial Condition.

On August 14, 2023, Atossa Therapeutics, Inc. (the “Company”) issued a press release announcing the quarter ended June 30, 2023 financial results and a Company update. A copy of the press release is attached as Exhibit 99.1 to this current report and is incorporated herein by reference.

The information in Items 2.02, and 9.01 of this report, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

| |

|

|

|

104

|

|

Cover page Interactive Data File (embedded within the Inline XBRL document)

|

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

Date: August 14, 2023

|

Atossa Therapeutics, Inc.

|

|

| |

By:

|

/s/ Greg Weaver

|

|

| |

|

Greg Weaver |

|

| |

|

Executive VP, Chief Financial Officer and Secretary

|

|

EXHIBIT 99.1

Atossa Therapeutics Announces Second Quarter 2023 Financial Results and Provides Corporate Update

| |

●

|

Achieved significant enrollment milestones in three ongoing Phase 2 clinical trials

|

| |

●

|

Broadened patent protection for proprietary (Z)-endoxifen

|

| |

●

|

Strengthened management team with appointment of Greg Weaver as Chief Financial Officer

|

| |

●

|

Ended second quarter 2023 with $99.4 million of cash and cash equivalents

|

SEATTLE, August 14, 2023 (GLOBE NEWSWIRE) — Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical stage biopharmaceutical company developing innovative proprietary medicines to address significant unmet needs in oncology with a focus on breast cancer, today announces financial results for the quarter ended June 30, 2023, and provides an update on recent company developments.

Key developments from Q2 2023 and year to date include:

Clinical Highlights

| |

●

|

Full Enrollment and Completion of 40 mg/day Pharmacokinetic Run-In Cohort in Phase 2 EVANGELINE Clinical Trial – the PK run-in cohort is designed to identify the appropriate dose of (Z)-endoxifen to deliver the steady state plasma concentrations required to effectively target PKC beta 1 inhibition and further enhance (Z)-endoxifen’s antitumor mechanism of action.

|

| |

●

|

70% Enrollment in Ongoing Phase 2 Karisma-Endoxifen Clinical Trial – the study is investigating (Z)-endoxifen in premenopausal women with measurable breast density. Participants receive daily doses of (Z)-endoxifen for six months, over the course of which mammograms are conducted to measure reduction in breast density. Full enrollment is expected by year-end 2023 with data expected in 2024.

|

| |

●

|

30% Enrollment in Phase 2 I-SPY 2 Clinical Trial – (Z)-endoxifen is being evaluated as a neoadjuvant treatment in a study arm of the ongoing I-SPY 2 clinical trial. The study arm targets patients with newly diagnosed estrogen receptor-positive invasive breast cancer whose tumors are predicted to be sensitive to endocrine therapy but for whom chemotherapy is expected to provide little or no benefit. Approximately 20 patients will be treated with (Z)-endoxifen for up to 24 weeks prior to surgery.

|

| |

●

|

Approval from Health Canada to Conduct Phase 2 EVANGELINE Clinical Trial in Canada – Atossa was authorized to open sites and enroll patients in the Phase 2 EVANGELINE study throughout Canada.

|

Corporate Highlights

| |

●

|

Appointment of Greg Weaver as Chief Financial Officer – Mr. Weaver has over 30 years of life sciences, financial and operations executive experience, with deep expertise in corporate strategy, financing, and business development, having served as CFO and a board director for multiple Nasdaq listed biotech companies over his career.

|

| |

●

|

Additional Intellectual Property Protection for (Z)-endoxifen – the US Patent and Trademark Office granted a new patent (No. 11,680,036) directed to enterically encapsulated endoxifen compositions formulated as a suspension. These include all liquid suspension formulations suitable for oral administration and dispersible tablets, powders, granules, pellets, or sprinkles for reconstitution, which are commonly used for pediatric administration.

|

| |

●

|

Research Agreement with Weill Cornell Medicine – partnership to study the potential of inducing estrogen receptor (ER) expression in triple-negative breast cancer (TNBC). The goal of this research is to determine if treating TNBC with extracellular vesicles carrying the ER will convert the tumor to ER+ and render it sensitive to treatment with Selective Estrogen Receptor Modulators (SERM), including Atossa’s proprietary (Z)-endoxifen.

|

“Positive momentum established last quarter has accelerated into the second quarter of 2023,” said Dr. Steven Quay, Atossa’s President and Chief Executive Officer. “We reached important enrollment milestones in each of our three ongoing Phase 2 trials, we strengthened our executive team with the addition of our board director Greg Weaver as our new CFO, and we further broadened intellectual property protection for our proprietary (Z)-endoxifen. Our balance sheet remains strong, and our focus remains squarely on completing our ongoing Phase 2 trials, designing Phase 3 protocols in coordination with the FDA and identifying the right partners to support pivotal trials and potential commercialization activities."

Comparison of the Three Months Ended June 30, 2023 and 2022

(Dollar amounts in thousands unless otherwise noted)

Total cash as of June 30, 2023 was $99,390 compared to $110,890 as of December 31, 2022.

Total operating expenses were $7,793 for the three months ended June 30, 2023, which was an increase of $1,198, or 18%, from the three months ended June 30, 2022. Operating expenses for the three months ended June 30, 2023, consisted of R&D expenses of $3,705 and G&A expenses of $4,088.

Operating expenses for the three months ended June 30, 2022, consisted of R&D expenses of $3,433 and G&A expenses of $3,162. Factors contributing to the increased operating expenses for the three months ended June 30, 2023, are explained below.

R&D expenses for the three months ended June 30, 2023, were $3,705 compared to $3,433 for same quarter prior year. an increase of $272, due to:

| |

●

|

Increased spending on clinical and non-clinical trials of $717 compared to the prior year period due to (Z)-endoxifen trial costs and increased spending on drug product formulation and development.

|

| |

●

|

Decreased R&D compensation expense attributable to the decrease in non-cash stock-based compensation expense of $184.

|

| |

●

|

In the second quarter of 2022, the Company paid $300 for the one-time exclusive right to negotiate for the acquisition of Dynamic Cell Therapeutics (DCT).

|

G&A expenses for the three months ended June 30, 2023, were $4,088 compared to $3,162 for same quarter prior year, an increase of $926, due to:

| |

●

|

G&A compensation expense increased in part attributable to salary and bonus severance costs for our former CFO of $554 and an increase of $138 in overall compensation.

|

| |

●

|

Legal and professional fees increased by $288 due primarily to higher patent activity for (Z)-endoxifen and our immunotherapy research, higher costs for investor relations and higher auditor fees.

|

Interest income was $983 for the three months ended June 30, 2023, an increase of $972 compared to same quarter prior year. The increase was due to the higher average balance of invested cash in a money market account and higher average interest rates.

An impairment charge on Investment in Equity Securities was recorded for the three months ended June 30, 2023, on our investment in DCT by $2,990.

Net loss for the second quarter of 2023 was $9,830 compared to a net loss $6,672 for the second quarter of 2022.

Comparison of the Six Months Ended June 30, 2023, and 2022

(Dollar amounts in thousands unless otherwise noted)

Total operating expenses were $14,891 for the six months ended June 30, 2023, which was an increase of $3,543, or 31%, from the six months ended June 30, 2022. Operating expenses for the six months ended June 30, 2023, consisted of R&D expenses of $7,213 and G&A expenses of $7,678.

Operating expenses for the six months ended June 30, 2022, consisted of R&D expenses of $4,937 and G&A expenses of $6,411. Factors contributing to the increased operating expenses for the six months ended June 30, 2023, are explained below.

R&D expenses for the six months ended June 30, 2023, were $7,213 compared to $4,937 same quarter prior year, an increase of $2,276, due to:

| |

●

|

Increased spending on clinical and non-clinical trials of $1,765 compared to the prior year period due to (Z)-endoxifen trial costs and increased spending on active pharmaceutical ingredients (API) and drug product formulation and development.

|

| |

●

|

Decreased R&D compensation expense attributable to a decrease in non-cash stock-based compensation of $289.

|

| |

●

|

The decrease in exclusivity agreement expense was due to a refund in the prior year of $1,000 from the research institution with which the Company had an exclusive right to negotiate for the acquisition of worldwide rights of two oncology programs, offset by $300 paid for the exclusive right to negotiate a DCT acquisition.

|

G&A expenses for the six months ended June 30, 2023, were $7,678, an increase of $1,267 from total G&A expenses for quarter ended June 30, 2022, of $6,411. Key changes were as follows:

| |

●

|

G&A compensation expense increased for the six months ended June 30, 2023, in part attributable to an increase in overall compensation expense of $900, offset by a decrease in non-cash stock-based compensation of $112. The increase in compensation expense was driven primarily by salary and bonus severance costs for our former CFO of $554 and an increase of $346 due to growth in overall compensation. Non-cash stock-based compensation decreased by $112 due to a decrease of $411 driven by option values, offset in part by the acceleration of expense recognized for options granted to our former CFO of $320.

|

| |

●

|

Legal and professional fees increased by $545 due primarily to higher patent activity and an increase in accounting fees.

|

Interest income was $1,833 for the six months ended June 30, 2023, an increase of $1,820 from interest income of $13 for the six months ended June 30, 2022. The increase was due to the higher average balance of invested cash in a money market account and higher average interest rates for the six months ended June 30, 2023, compared to the prior year period.

An impairment charge on Investment in Equity Securities was recorded for the six months ended June 30, 2023, as we wrote down our investment in DCT by $2,990.

Net loss for the six months ended June 30, 2023 was $16,111 compared to a net loss $11,457 for the same period in 2022.

Conference Call Information

Members of Atossa’s management team will host a live conference call today, Monday, August 14, at 9:00 AM ET to review the Company's financial results and provide a general business update. Interested parties can access the conference call here: https://edge.media-server.com/mmc/p/2qtrmqz3

Following the call, a recording will be made available on the investor relations page of Atossa’s website: https://investors.atossatherapeutics.com.

About (Z)-Endoxifen

(Z)-endoxifen is the most active metabolite of the FDA approved Selective Estrogen Receptor Modulator (SERM), tamoxifen. Studies by others have demonstrated that the therapeutic effects of tamoxifen are driven in a concentration-dependent manner by (Z)-endoxifen. In addition to its potent anti-estrogen effects, (Z)-endoxifen at higher concentrations has been shown to target PKCβ1, a known oncogenic protein.

Atossa is developing a proprietary oral formulation of (Z)-endoxifen that does not require liver metabolism to achieve therapeutic concentrations and is encapsulated to bypass the stomach as acidic conditions in the stomach convert a greater proportion of (Z)-endoxifen to the inactive (E)-endoxifen. Atossa’s (Z)-endoxifen has been shown to be well tolerated in Phase 1 studies and in a small Phase 2 study of women with breast cancer. The Company is currently studying (Z)-endoxifen in three Phase 2 studies: one in healthy women with measurable breast density and two other studies including the EVANGELINE study in women with ER+/HER2- breast cancer. Atossa’s (Z)-endoxifen is protected by three issued U.S. patents and numerous pending patent applications.

About Atossa Therapeutics

Atossa Therapeutics, Inc. is a clinical-stage biopharmaceutical company developing innovative medicines in areas of significant unmet medical need in oncology with a focus on breast cancer. For more information, please visit www.atossatherapeutics.com

Contact:

Eric Van Zanten

VP, Investor and Public Relations

610-529-6219

eric.vanzanten@atossainc.com

FORWARD LOOKING STATEMENTS

This press release contains certain information that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We may identify these forward-looking statements by the use of words such as “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “future,” or other comparable words. Forward-looking statements in this press release are subject to risks and uncertainties that may cause actual results, outcomes, or the timing of actual results or outcomes, to differ materially from those projected or anticipated, including risks and uncertainties associated with: macroeconomic conditions and increasing geopolitical instability; the expected timing of releasing data; any variation between interim and final clinical results; actions and inactions by the FDA and foreign regulatory bodies; the outcome or timing of regulatory approvals needed by Atossa, including those needed to continue our planned (Z)-endoxifen trials; our ability to satisfy regulatory requirements; our ability to successfully develop and commercialize new therapeutics; the success, costs and timing of our development activities, including our ability to successfully initiate or complete our clinical trials, including our (Z)-endoxifen trials; our anticipated rate of patient enrollment; our ability to contract with third-parties and their ability to perform adequately; our estimates on the size and characteristics of our potential markets; our ability to successfully defend litigation and other similar complaints and to establish and maintain intellectual property rights covering our products; whether we can successfully complete our clinical trial of oral (Z)-endoxifen in women with mammographic breast density and our trials of (Z)-endoxifen in women with breast cancer, and whether the studies will meet their objectives; our expectations as to future financial performance, expense levels and capital sources, including our ability to raise capital; our ability to attract and retain key personnel; our anticipated working capital needs and expectations around the sufficiency of our cash reserves; and other risks and uncertainties detailed from time to time in Atossa’s filings with the Securities and Exchange Commission, including without limitation its Annual Reports on Form 10-K and Quarterly Reports on 10-Q. Forward-looking statements are presented as of the date of this press release. Except as required by law, we do not intend to update any forward-looking statements, whether as a result of new information, future events or circumstances or otherwise.

ATOSSA THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except for par value)

(Unaudited)

| |

|

|

|

|

|

|

|

|

| |

|

As of June 30,

|

|

|

As of December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

99,390

|

|

|

$

|

110,890

|

|

|

Restricted cash

|

|

|

110

|

|

|

|

110

|

|

|

Prepaid expenses

|

|

|

5,759

|

|

|

|

4,031

|

|

|

Research and development rebate receivable

|

|

|

737

|

|

|

|

743

|

|

|

Other current assets

|

|

|

7

|

|

|

|

2,423

|

|

|

Total current assets

|

|

|

106,003

|

|

|

|

118,197

|

|

| |

|

|

|

|

|

|

|

|

|

Investment in equity securities

|

|

|

1,710

|

|

|

|

4,700

|

|

|

Other assets

|

|

|

642

|

|

|

|

635

|

|

|

Total Assets

|

|

$

|

108,355

|

|

|

$

|

123,532

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

1,174

|

|

|

$

|

2,965

|

|

|

Accrued expenses

|

|

|

803

|

|

|

|

1,059

|

|

|

Payroll liabilities

|

|

|

1,455

|

|

|

|

1,525

|

|

|

Other current liabilities

|

|

|

46

|

|

|

|

19

|

|

|

Total current liabilities

|

|

|

3,478

|

|

|

|

5,568

|

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

3,478

|

|

|

|

5,568

|

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

|

|

|

|

|

|

|

Series B convertible preferred stock - $0.001 par value; 10,000 shares authorized; 1 share issued and outstanding as of June 30, 2023 and December 31, 2022

|

|

|

-

|

|

|

|

-

|

|

|

Additional paid-in capital - Series B convertible preferred stock

|

|

|

582

|

|

|

|

582

|

|

|

Common stock - $0.18 par value; 175,000 shares authorized; 126,505 and 126,624 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively

|

|

|

22,792

|

|

|

|

22,792

|

|

|

Additional paid-in capital - common stock

|

|

|

253,960

|

|

|

|

250,784

|

|

|

Treasury stock, at cost; 119 and 0 shares of common stock at June 30, 2023 and December 31, 2022, respectively

|

|

|

(152

|

)

|

|

|

-

|

|

|

Accumulated deficit

|

|

|

(172,305

|

)

|

|

|

(156,194

|

)

|

| |

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity

|

|

|

104,877

|

|

|

|

117,964

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$

|

108,355

|

|

|

$

|

123,532

|

|

ATOSSA THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(amounts in thousands, except for per share amounts)

(Unaudited)

| |

|

For the Three Months Ended June 30,

|

|

|

For the Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$

|

3,705

|

|

|

$

|

3,433

|

|

|

$

|

7,213

|

|

|

$

|

4,937

|

|

|

General and administrative

|

|

|

4,088

|

|

|

|

3,162

|

|

|

|

7,678

|

|

|

|

6,411

|

|

|

Total operating expenses

|

|

|

7,793

|

|

|

|

6,595

|

|

|

|

14,891

|

|

|

|

11,348

|

|

|

Operating loss

|

|

|

(7,793

|

)

|

|

|

(6,595

|

)

|

|

|

(14,891

|

)

|

|

|

(11,348

|

)

|

|

Impairment charge on investment in equity securities

|

|

|

(2,990

|

)

|

|

|

-

|

|

|

|

(2,990

|

)

|

|

|

-

|

|

|

Interest income

|

|

|

983

|

|

|

|

11

|

|

|

|

1,833

|

|

|

|

13

|

|

|

Other expense, net

|

|

|

(30

|

)

|

|

|

(88

|

)

|

|

|

(63

|

)

|

|

|

(122

|

)

|

|

Loss before income taxes

|

|

|

(9,830

|

)

|

|

|

(6,672

|

)

|

|

|

(16,111

|

)

|

|

|

(11,457

|

)

|

|

Income taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net loss

|

|

|

(9,830

|

)

|

|

|

(6,672

|

)

|

|

|

(16,111

|

)

|

|

|

(11,457

|

)

|

|

Loss per share of common stock - basic and diluted

|

|

$

|

(0.08

|

)

|

|

$

|

(0.05

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

(0.09

|

)

|

|

Weighted average shares outstanding - basic and diluted

|

|

|

126,623

|

|

|

|

126,624

|

|

|

|

126,623

|

|

|

|

126,624

|

|

v3.23.2

Document And Entity Information

|

Aug. 14, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Atossa Therapeutics, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 14, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35610

|

| Entity, Tax Identification Number |

26-4753208

|

| Entity, Address, Address Line One |

107 Spring Street

|

| Entity, Address, City or Town |

Seattle

|

| Entity, Address, State or Province |

WA

|

| Entity, Address, Postal Zip Code |

98104

|

| City Area Code |

206

|

| Local Phone Number |

588-0256

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ATOS

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001488039

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

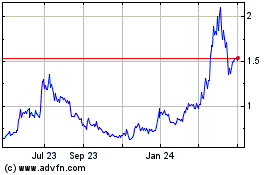

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Nov 2023 to Nov 2024