Strong underlying growth supports FY 2024

guidance upgrade, with both Total Revenue and Core EPS now expected

to increase by a mid teens percentage at CER1

AstraZeneca:

Revenue and EPS summary

H1 2024

% Change

Q2 2024

% Change

$m

Actual

CER

$m

Actual

CER

- Product Sales

24,629

15

18

12,452

14

18

- Alliance Revenue

939

50

50

482

42

42

- Collaboration Revenue

49

(78)

(78)

4

(98)

(98)

Total Revenue

25,617

15

18

12,938

13

17

Reported EPS

$2.65

13

23

$1.24

6

15

Core2 EPS

$4.03

(1)

5

$1.98

(8)

(3)

Financial performance for H1 2024 (Growth numbers at constant

exchange rates)

- Total Revenue up 18% to $25,617m, driven by an 18% increase in

Product Sales and continued growth in Alliance Revenue from

partnered medicines

- Total Revenue growth from Oncology was 22%, CVRM 22%, R&I

22%, and Rare Disease 15%

- Core Product Sales Gross Margin3 of 82%

- Core Operating Margin of 33%

- Core Tax Rate of 20%

- Core EPS increased 5% to $4.03. The increase in Core EPS was

lower than Total Revenue growth principally due to gains recognised

in the prior year, specifically a $241m gain on the disposal of

Pulmicort Flexhaler US rights (Q1 2023), and a $712m gain relating

to updates to contractual arrangements for Beyfortus (Q2 2023)

- Interim dividend increased 7c to $1.00 (77.6 pence, 10.79 SEK)

has been declared

- Guidance for FY 2024 increased, with Total Revenue and Core EPS

anticipated to grow by a mid teens percentage at CER (previously a

low double-digit to low teens percentage). An increase in

Collaboration Revenue is not assumed in the upgraded guidance

Pascal Soriot, Chief Executive Officer, AstraZeneca,

said:

“Building on our strong growth in the first half of the year and

continued underlying demand for our medicines we are upgrading our

FY 2024 guidance for both Total Revenue and Core EPS.

At our Investor Day in May we set out a new revenue ambition to

deliver $80 billion of Total Revenue by 2030. This is a clear

reflection of the substantial growth potential we see from both our

approved medicines and those in our late-stage pipeline. Already

this year we have announced five positive, potentially

practice-changing Phase III studies that are anticipated to

meaningfully contribute to our growth.

In the year to date we have continued to make encouraging

progress with several disruptive technologies, including antibody

drug conjugates, bispecifics, cell and gene therapies,

radioconjugates, and weight management medicines, all of which have

the potential to drive our growth beyond 2030.”

Key milestones achieved since the prior results

announcement

- Positive read-outs for Imfinzi in combination with chemotherapy

in muscle-invasive bladder cancer (NIAGARA), Calquence in untreated

mantle cell lymphoma (ECHO), Enhertu in HR-positive, HER2-low

metastatic breast cancer (DESTINY-Breast06)

- US approvals for Imfinzi in combination with chemotherapy

followed by Imfinzi monotherapy for primary advanced or recurrent

endometrial cancer that is mismatch repair deficient (DUO-E). EU

approvals for Truqap in combination with Faslodex for

biomarker-positive estrogen receptor-positive, HER2‑negative

advanced breast cancer (CAPItello-291), Tagrisso with the addition

of chemotherapy for 1st‑line EGFRm NSCLC (FLAURA2). Japan and China

approvals for Tagrisso with the addition of chemotherapy for the

1st‑line EGFRm NSCLC (FLAURA2)

Guidance

Due to strong underlying growth in Product Sales and Alliance

Revenue, the Company raises its Total Revenue and Core EPS guidance

for FY 2024 at CER, based on the average foreign exchange rates

through 2023.

Total Revenue is expected to

increase by a mid teens percentage (previously a low double-digit

to low teens percentage)

Core EPS is expected to increase

by a mid teens percentage (previously a low double-digit to low

teens percentage)

- An increase in Collaboration Revenue is not assumed in the

upgraded guidance (previously assumed a substantial increase)

- Other operating income is expected to decrease substantially

(FY 2023 included a $241m gain on the disposal of Pulmicort

Flexhaler US rights, and a $712m one-time gain relating to updates

to contractual arrangements for Beyfortus)

- The Core Tax rate is expected to be between 18-22%

The Company is unable to provide guidance on a Reported basis

because it cannot reliably forecast material elements of the

Reported results, including any fair value adjustments arising on

acquisition-related liabilities, intangible asset impairment

charges and legal settlement provisions. Please refer to the

cautionary statements section regarding forward-looking statements

at the end of this announcement.

Currency impact

If foreign exchange rates for July 2024 to December 2024 were to

remain at the average rates seen in June 2024, it is anticipated

that FY 2024 Total Revenue would incur a low single-digit

percentage adverse impact compared to the performance at CER, and

Core EPS would incur a mid single-digit percentage adverse impact.

The Company’s foreign exchange rate sensitivity analysis is

provided in Table 17.

Table 1: Key elements of Total Revenue performance in Q2

2024

% Change

Revenue type

$m

Actual %

CER %

Product Sales

12,452

14

18

Alliance Revenue

482

42

42

• $344m Enhertu (Q2 2023: $255m)

• $104m Tezspire (Q2 2023: $62m)

Collaboration Revenue

4

(98)

(98)

• Q2 2023 included $180m for COVID-19

mAbs

Total Revenue

12,938

13

17

Therapy areas

$m

Actual %

CER %

Oncology

5,331

15

19

• Tagrisso up 8% (12% at CER) due to

strong global demand, Calquence up 21% (22% at CER) with sustained

leadership in 1L CLL. Enhertu Total Revenue up 46% (49% at CER)

CVRM

3,160

18

22

• Farxiga up 29% (32% at CER), Lokelma up

36% (41% at CER)

R&I

1,905

23

26

• Breztri up 44% (47% at CER). Saphnelo up

65%, Tezspire up 97% (>2x at CER), Symbicort up 20% (25%

CER)

V&I

119

(57)

(53)

• The drop in V&I revenue was

primarily driven by lower Collaboration Revenue from COVID-19 mAbs

• Beyfortus revenue was $35m (Q2 2023: $2m), which more than offset

a $6m decline in Synagis

Rare Disease

2,147

10

14

• Ultomiris up 33% (36% at CER), partially

offset by decline in Soliris of 14% (8% at CER) • Strensiq up 13%

(14% at CER) and Koselugo up 43% (45% at CER)

Other Medicines

276

(11)

(5)

Total Revenue

12,938

13

17

Regions

$m

Actual %

CER %

US

5,571

17

17

Emerging Markets

3,386

9

18

- China

1,630

13

18

- Ex-China Emerging Markets

1,756

5

18

Europe

2,732

24

24

Established RoW

1,249

(5)

6

Total Revenue

12,938

13

17

Key partnered medicines

- Combined sales of Enhertu, recorded by Daiichi Sankyo Company

Limited (Daiichi Sankyo) and AstraZeneca, amounted $1,772m in H1

2024 (H1 2023: $1,169m).

- Combined sales of Tezspire, recorded by Amgen and AstraZeneca,

amounted to $507m in H1 2024 (H1 2023: $257m).

Table 2: Key elements of financial performance in Q2

2024

Metric

Reported

Reported change

Core

Core change

Comments4

Total Revenue

$12,938m

13% Actual 17% CER

$12,938m

13% Actual 17% CER

• See Table 1 and the Total Revenue

section of this document for further details

Product Sales Gross Margin

82%

Stable Actual Stable CER

83%

Stable Actual Stable CER

• Variations in Product Sales Gross Margin

can be expected between periods due to product seasonality (e.g.

FluMist and Beyfortus in H2), foreign exchange fluctuations and

other effects

R&D

expense

$3,008m

13% Actual 13% CER

$2,872m

12% Actual 13% CER

+ Increased investment in the pipeline •

Core R&D-to-Total Revenue ratio of 22% (Q2 2023: 22%)

SG&A expense

$4,929m

-1% Actual 1% CER

$3,735m

13% Actual 16% CER

+ Market development for recent launches

and pre-launch activities • Core SG&A-to-Total Revenue ratio of

29% (Q2 2023: 29%)

Other operating income and expense5

$60m

-92% Actual -92% CER

$60m

-92% Actual -92% CER

‒The prior year quarter included a $712m

gain relating to updates to contractual arrangements for

Beyfortus

Operating Margin

21%

Stable Actual +1pp CER

32%

-6pp Actual -5pp CER

• See commentary above on Gross Margin,

R&D, SG&A and Other operating income and expense

Net finance expense

$343m

-7% Actual -7% CER

$285m

10% Actual 10% CER

+ Higher level of Net debt

Tax rate

20%

+7pp Actual +7pp CER

19%

+2pp Actual +2pp CER

• Variations in the tax rate can be

expected between periods

EPS

$1.24

6% Actual 15% CER

$1.98

-8% Actual -3% CER

• Further details of differences between

Reported and Core are shown in Table 12

Table 3: Pipeline highlights since prior results

announcement

Event

Medicine

Indication / Trial

Event

Regulatory approvals and other regulatory

actions

Imfinzi

Primary advanced or recurrent endometrial

cancer with mismatch repair deficiency (DUO-E)

Regulatory approval (US), CHMP positive

opinion (EU)

Imfinzi + Lynparza

Primary advanced or recurrent endometrial

cancer with mismatch repair proficiency (DUO-E)

CHMP positive opinion (EU)

Tagrisso

EGFRm NSCLC (1st-line)

(FLAURA2)

Regulatory approval (EU, JP, CN)

Truqap

Biomarker-positive ER-positive

HER2-negative locally advanced or metastatic breast cancer

(CAPItello-291)

Regulatory approval (EU)

Regulatory submissions or acceptances*

Tagrisso

EGFRm NSCLC (Stage III unresectable)

(LAURA)

sNDA acceptance and Priority Review

(US)

Dato-DXd

Non-squamous NSCLC (2nd- and 3rd-line)

(TROPION-Lung01)

Regulatory submission (EU)

sipavibart

Prevention of COVID-19

(SUPERNOVA)

Regulatory submission (EU)

Major Phase III data readouts and other

developments

Calquence

Mantle cell lymphoma (1st‑line) (ECHO)

Primary endpoint met

Dato-DXd

Locally advanced or metastatic NSCLC

(TROPION-Lung01)

Dual primary endpoint OS not met in the

intention to treat population

Enhertu

HER2-low breast cancer (2nd-line)

(DESTINY-Breast-06)

Primary endpoint met

Imfinzi

Muscle-invasive bladder cancer

(NIAGARA)

Primary endpoint met

Imfinzi

Adjuvant use in early-stage PD-L1 ≥25%

NSCLC (Adjuvant BR.31)

Primary endpoint not met

Truqap

Locally advanced or metastatic TNBC

(CAPItello-290)

Primary endpoint not met

sipavibart

Prevention of COVID-19

(SUPERNOVA)

Primary endpoint met

*US, EU and China regulatory submission

denotes filing acceptance

Upcoming pipeline catalysts

For recent trial starts and anticipated timings of key trial

readouts, please refer to the Clinical Trials Appendix, available

on www.astrazeneca.com/investor-relations.html.

Corporate and business development

In May 2024, AstraZeneca announced its intention to build a $1.5

billion manufacturing facility in Singapore for antibody drug

conjugates (ADCs), enhancing global supply of its ADC portfolio.

ADCs are next-generation treatments that deliver highly potent

cancer-killing agents directly to cancer cells through a targeted

antibody. The planned greenfield facility, supported by the

Singapore Economic Development Board, will be AstraZeneca’s first

end-to-end ADC production site, fully incorporating all steps of

the manufacturing process at a commercial scale. Manufacturing of

ADCs is a multi-step process that comprises antibody production,

synthesis of chemotherapy drug and linker, conjugation of

drug-linker to the antibody, and filling of the completed ADC

substance.

In May 2024, AstraZeneca completed an additional $140m equity

investment in Cellectis, a clinical-stage biotechnology company.

The equity investment and a research collaboration agreement,

announced in November 2023, will leverage the Cellectis proprietary

gene editing technologies and manufacturing capabilities, to design

up to 10 novel cell and gene therapy products for areas of high

unmet need, including oncology, immunology and rare diseases. In Q4

2023, Cellectis received an initial payment of $105m from

AstraZeneca, which comprised a $25m upfront cash payment under the

terms of a research collaboration agreement and an $80m equity

investment. Now that the additional $140m equity investment has

closed, AstraZeneca holds a total equity stake of c.44% in

Cellectis and AstraZeneca continues to treat its investment in

Cellectis as an associate.

In June 2024, AstraZeneca completed the acquisition of Fusion

Pharmaceuticals Inc., a clinical-stage biopharmaceutical company

developing next-generation radioconjugates. The acquisition marks a

major step forward in AstraZeneca delivering on its ambition to

transform cancer treatment and outcomes for patients by replacing

traditional regimens like chemotherapy and radiotherapy with more

targeted treatments. The acquisition complements AstraZeneca’s

leading oncology portfolio with the addition of the Fusion pipeline

of radioconjugates, including FPI-2265, a potential new treatment

for patients with mCRPC, and brings new expertise and pioneering

R&D, manufacturing and supply chain capabilities in

actinium-based radioconjugates to AstraZeneca. See Note 5 for

further information.

In July 2024, AstraZeneca completed the acquisition of Amolyt

Pharma, a clinical-stage biotechnology company focused on

developing novel treatments for rare endocrine diseases. The

acquisition bolsters the Alexion, AstraZeneca Rare Disease

late-stage pipeline and expands on its bone metabolism franchise

with the notable addition of eneboparatide (AZP-3601), a Phase III

investigational therapeutic peptide with a novel mechanism of

action designed to meet key therapeutic goals for

hypoparathyroidism. In patients with hypoparathyroidism, a

deficiency in parathyroid hormone production results in significant

dysregulation of calcium and phosphate, which can lead to

life-altering symptoms and complications, including chronic kidney

disease. See Note 7 for further information.

Sustainability highlights

At the 77th World Health Assembly in Geneva, Switzerland in May,

AstraZeneca convened Ministers of Health, industry, civil society

and patient groups. Areas of focus for engagement, led by Ruud

Dobber, EVP BioPharmaceuticals, included the need to increase early

action to prevent, diagnose and treat disease and to accelerate

collaboration to build resilient, equitable and net zero health

systems.

Conference call

A conference call and webcast for investors and analysts will

begin today, 25 July 2024, at 11:45 UK time. Details can be

accessed via astrazeneca.com.

Reporting calendar

The Company intends to publish its 9M and Q3 2024 results on 12

November 2024.

To read AstraZeneca's H1 and Q2 2024 Financial Results press

release in full including the glossary, please click here.

1

Constant exchange rates. The differences between Actual Change and

CER Change are due to foreign exchange movements between periods in

2024 vs. 2023. CER financial measures are not accounted for

according to generally accepted accounting principles (GAAP)

because they remove the effects of currency movements from Reported

results.

2

Core financial measures are adjusted to exclude certain items. The

differences between Reported and Core measures are primarily due to

costs relating to the amortisation of intangibles, impairments,

legal settlements and restructuring charges. A full reconciliation

between Reported EPS and Core EPS is provided in Table 11 and Table

12 in the Financial performance section of this document.

3

The calculations for Reported and Core Product Sales Gross Margin

exclude the impact of Alliance Revenue and Collaboration Revenue.

4

In Table 2, the plus and minus symbols denote the directional

impact of the item being discussed, e.g. a ‘+’ symbol next to a

comment related to the R&D expense indicates that the item

resulted in an increase in the R&D spend relative to the prior

year.

5

Income from disposals of assets and businesses, where the Group

does not retain a significant ongoing economic interest, continue

to be recorded in Other operating income and expense in the

Company’s financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724980001/en/

Global Media Relations team global-mediateam@astrazeneca.com +44

(0)1223 344 800

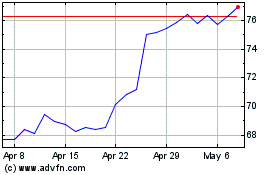

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Oct 2024 to Nov 2024

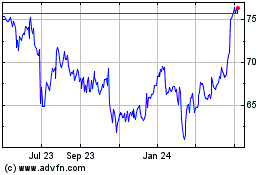

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Nov 2023 to Nov 2024