PROSPECTUS

SUPPLEMENT NO. 15

(to

prospectus dated May 14, 2021) |

|

Filed

pursuant to Rule 424(b)(3)

Registration No. 333-255842 |

AST

SPACEMOBILE, INC.

28,750,000

SHARES OF CLASS A COMMON STOCK

6,100,000

WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

17,600,000

SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus dated May 14, 2021 (the “Prospectus”),

related to (i) the offer and sale, from time to time, by the selling stockholders identified in the Prospectus, or their permitted transferees,

of (a) an aggregate of 28,750,000 shares of Class A common stock, par value $0.0001 per share (the “Class A Common Stock”),

of AST SpaceMobile, Inc., a Delaware corporation, and (b) 6,100,000 warrants to purchase Class A Common Stock at an exercise price of

$11.50 per share (the “private placement warrants”) and (ii) the issuance by us of up to 17,600,000 shares of Class A Common

Stock upon the exercise of outstanding public warrants (the “public warrants”) and private placement warrants (collectively,

the “warrants”), with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange

Commission (“SEC”) on May 16, 2022 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report

to this prospectus supplement.

This

prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered

or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should

be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

Our

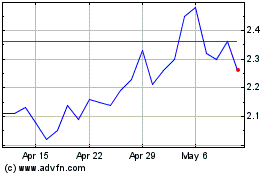

shares of Class A Common Stock are listed on The Nasdaq Capital Market LLC (“Nasdaq”) under the symbol “ASTS.”

On May 17, 2022, the closing sale price per share of our Class A Common Stock was $7.45. Our public warrants are listed on The Nasdaq

Capital Market under the symbol “ASTSW.” On May 17, 2022, the closing sale price per warrant of our public warrants was $2.48.

Investing

in shares of our Class A Common Stock or warrants involves risks that are described in the “Risk Factors” section beginning

on page 5 of the Prospectus.

Neither

the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined

if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is May 17, 2022.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended March 31, 2022

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

File No. 001-39040

| AST

SPACEMOBILE, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

84-2027232 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| Midland

Intl. Air & Space Port |

|

|

2901

Enterprise Lane

Midland,

Texas |

|

79706 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| (432)

276-3966 |

| (Registrant’s

telephone number, including area code) |

| |

| (Former

name, former address and former fiscal year, if changed since last report) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

ASTS |

|

The

Nasdaq Stock Market LLC |

| Warrants

exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

ASTSW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐

Large accelerated filer |

☐

Accelerated filer |

| ☒

Non-accelerated filer |

☒

Smaller reporting company |

| |

☒

Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As

of May 13, 2022 there were 51,862,973 shares of Class

A common stock, $0.0001 per value, 51,636,922 shares of Class B common stock, $0.0001 par value, and 78,163,078 shares of Class C common

stock, $0.0001 par value, issued and outstanding.

AST

SPACEMOBILE, INC.

FORM

10-Q FOR THE QUARTER ENDED MARCH 31, 2022

TABLE

OF CONTENTS

PART

I - FINANCIAL INFORMATION

Item

1. Interim Financial Statements.

AST

SPACEMOBILE, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(dollars

in thousands, except share data)

| | |

March

31, 2022 | | |

December

31, 2021 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current

assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 253,731 | | |

$ | 321,787 | |

| Restricted

cash | |

| 1,379 | | |

| 2,750 | |

| Accounts

receivable | |

| 2,593 | | |

| 2,173 | |

| Inventories | |

| 1,827 | | |

| 1,412 | |

| Prepaid

expenses | |

| 3,537 | | |

| 3,214 | |

| Other

current assets | |

| 9,862 | | |

| 4,467 | |

| Total

current assets | |

| 272,929 | | |

| 335,803 | |

| | |

| | | |

| | |

| Property

and equipment: | |

| | | |

| | |

| BlueWalker

3 satellite - construction in progress | |

| 82,693 | | |

| 67,615 | |

| Property

and equipment, net | |

| 32,157 | | |

| 28,327 | |

| Total

property and equipment, net | |

| 114,850 | | |

| 95,942 | |

| | |

| | | |

| | |

| Other

non-current assets: | |

| | | |

| | |

| Operating

lease right-of-use assets, net | |

| 7,990 | | |

| 7,991 | |

| Intangible

assets, net | |

| 205 | | |

| 242 | |

| Goodwill | |

| 3,546 | | |

| 3,641 | |

| Other

non-current assets | |

| 15,066 | | |

| 317 | |

| Total

other non-current assets | |

| 26,807 | | |

| 12,191 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 414,586 | | |

$ | 443,936 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current

liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 6,917 | | |

$ | 6,638 | |

| Accrued

expenses and other current liabilities | |

| 7,295 | | |

| 7,469 | |

| Deferred

revenue | |

| 7,800 | | |

| 6,636 | |

| Current

operating lease liabilities | |

| 900 | | |

| 634 | |

| Total

current liabilities | |

| 22,912 | | |

| 21,377 | |

| | |

| | | |

| | |

| Warrant

liabilities | |

| 63,544 | | |

| 58,062 | |

| Non-current

operating lease liabilities | |

| 7,312 | | |

| 7,525 | |

| Long-term

debt | |

| 4,940 | | |

| 5,000 | |

| Total

liabilities | |

| 98,708 | | |

| 91,964 | |

| | |

| | | |

| | |

| Commitments

and contingencies (Note 6) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’

Equity: | |

| | | |

| | |

| Class

A Common Stock, $.0001 par value; 800,000,000 shares authorized; 51,782,254 and 51,730,904 shares issued and outstanding as of March

31, 2022 and December 31, 2021, respectively. | |

| 5 | | |

| 5 | |

| Class

B Common Stock, $.0001 par value; 200,000,000 shares authorized; 51,636,922 shares issued and outstanding as of March 31, 2022 and

December 31, 2021, respectively. | |

| 5 | | |

| 5 | |

| Class

C Common Stock, $.0001 par value; 125,000,000 shares authorized; 78,163,078 shares issued and outstanding as of March 31, 2022 and

December 31, 2021, respectively. | |

| 8 | | |

| 8 | |

| Additional

paid-in capital | |

| 172,708 | | |

| 171,155 | |

| Accumulated

other comprehensive loss | |

| (505 | ) | |

| (433 | ) |

| Accumulated

deficit | |

| (81,182 | ) | |

| (70,461 | ) |

| Noncontrolling

interest | |

| 224,839 | | |

| 251,693 | |

| Total

stockholders’ equity | |

| 315,878 | | |

| 351,972 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 414,586 | | |

$ | 443,936 | |

See

accompanying notes to the condensed consolidated financial statements

AST

SPACEMOBILE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(dollars

in thousands, except share and per share data)

| | |

Three

Months Ended March 31, | |

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| Revenues | |

$ | 2,394 | | |

$ | 951 | |

| | |

| | | |

| | |

| Cost

of sales (exclusive of items shown separately below) | |

| 1,986 | | |

| 896 | |

| | |

| | | |

| | |

| Gross

profit | |

| 408 | | |

| 55 | |

| | |

| | | |

| | |

| Operating

expenses: | |

| | | |

| | |

| Engineering

services | |

| 11,740 | | |

| 5,659 | |

| General

and administrative costs | |

| 11,619 | | |

| 5,537 | |

| Research

and development costs | |

| 8,281 | | |

| 304 | |

| Depreciation

and amortization | |

| 1,100 | | |

| 614 | |

| Total

operating expenses | |

| 32,740 | | |

| 12,114 | |

| | |

| | | |

| | |

| Other

income (expense): | |

| | | |

| | |

| Loss

on remeasurement of warrant liabilities | |

| (5,482 | ) | |

| - | |

| Other

income (expense), net | |

| 15 | | |

| (28 | ) |

| Total

other expense, net | |

| (5,467 | ) | |

| (28 | ) |

| | |

| | | |

| | |

| Loss

before income tax expense | |

| (37,799 | ) | |

| (12,087 | ) |

| Income

tax expense | |

| 104 | | |

| 1 | |

| Net

loss before allocation to noncontrolling interest | |

| (37,903 | ) | |

| (12,088 | ) |

| | |

| | | |

| | |

| Net

loss attributable to noncontrolling interest | |

| (27,182 | ) | |

| (508 | ) |

| Net

loss attributable to common stockholders | |

$ | (10,721 | ) | |

$ | (11,580 | ) |

| Net

loss per share of common stock attributable to common stockholders (1) | |

| | | |

| | |

| Basic

and diluted | |

$ | (0.21 | ) | |

| N/A | |

| Weighted

average shares used in computing net loss per share of common stock (1) | |

| | | |

| | |

| Basic

and diluted | |

| 51,760,520 | | |

| N/A | |

(1)

Earnings per share information has not been presented for periods prior to the Business Combination, as it resulted in values that would

not be meaningful to the users of these condensed consolidated financial statements. Refer to Note 13 for further information.

See

accompanying notes to the condensed consolidated financial statements

AST

SPACEMOBILE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(dollars

in thousands)

| | |

Three

months ended March 31, | |

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| Net

loss before allocation to noncontrolling interest | |

$ | (37,903 | ) | |

$ | (12,088 | ) |

| Other

comprehensive loss | |

| | | |

| | |

| Foreign

currency translation adjustments | |

| (432 | ) | |

| (263 | ) |

| Total

other comprehensive loss | |

| (432 | ) | |

| (263 | ) |

| Total

comprehensive loss before allocation to noncontrolling interest | |

| (38,335 | ) | |

| (12,351 | ) |

| Comprehensive

loss attributable to noncontrolling interest | |

| (27,542 | ) | |

| (574 | ) |

| Comprehensive

loss attributable to common stockholders | |

$ | (10,793 | ) | |

$ | (11,777 | ) |

See

accompanying notes to the condensed consolidated financial statements

AST

SPACEMOBILE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (UNAUDITED)

(dollars

in thousands, except share data)

Three

Months Ended March 31, 2022

| | Three

Months Ended March 31, 2022 | |

| | |

Class

A

Common Stock | | |

Class

B

Common Stock | | |

Class

C

Common Stock | | |

Additional | | |

Accumulated

Other | | |

| | |

| | |

| |

| | |

Shares | | |

Values | | |

Shares | | |

Values | | |

Shares | | |

Values | | |

Paid-in

Capital | | |

Comprehensive

Loss | | |

Accumulated

Deficit | | |

Noncontrolling

Interest | | |

Total

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance,

December 31, 2021 | |

| 51,730,904 | | |

$ | 5 | | |

| 51,636,922 | | |

$ | 5 | | |

| 78,163,078 | | |

$ | 8 | | |

$ | 171,155 | | |

$ | (433 | ) | |

$ | (70,461 | ) | |

$ | 251,693 | | |

$ | 351,972 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,606 | | |

| - | | |

| - | | |

| 604 | | |

| 2,210 | |

| Issuance

of equity under employee stock plan | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (228 | ) | |

| - | | |

| - | | |

| 258 | | |

| 30 | |

| Vesting

of restricted stock units | |

| 51,250 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| - | | |

| (83 | ) | |

| - | |

| Warrant

exercise | |

| 100 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 92 | | |

| - | | |

| - | | |

| (91 | ) | |

| 1 | |

| Foreign

currency translation adjustments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (72 | ) | |

| - | | |

| (360 | ) | |

| (432 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (10,721 | ) | |

| (27,182 | ) | |

$ | (37,903 | ) |

| Balance,

March 31, 2022 | |

| 51,782,254 | | |

$ | 5 | | |

| 51,636,922 | | |

$ | 5 | | |

| 78,163,078 | | |

$ | 8 | | |

$ | 172,708 | | |

$ | (505 | ) | |

$ | (81,182 | ) | |

$ | 224,839 | | |

$ | 315,878 | |

| Three

Months Ended March 31, 2021 |

| | |

Class

A

Common Stock | | |

Class

B

Common Stock | | |

Class

C

Common Stock | | |

Additional

Paid-in | | |

Common

Equity

(Pre-Combination) | | |

Accumulated

Other

Comprehensive | | |

Accumulated | | |

Noncontrolling | | |

Total | |

| | |

Shares | | |

Values | | |

Shares | | |

Values | | |

Shares | | |

Values | | |

Capital | | |

Shares | | |

Values | | |

Loss | | |

Deficit | | |

Interest | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance,

December 31, 2020 (1) | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

$ | - | | |

| 129,800,000 | | |

$ | 117,573 | | |

$ | (168 | ) | |

$ | (39,908 | ) | |

$ | 2,490 | | |

$ | 79,987 | |

| Stock-based

compensation pre Business Combination | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 370 | | |

| - | | |

| - | | |

| - | | |

| 370 | |

| Foreign

currency translation adjustments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (197 | ) | |

| - | | |

| (66 | ) | |

| (263 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (11,580 | ) | |

| (508 | ) | |

| (12,088 | ) |

| Balance,

March 31, 2021 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

$ | - | | |

| 129,800,000 | | |

$ | 117,943 | | |

$ | (365 | ) | |

$ | (51,488 | ) | |

$ | 1,916 | | |

$ | 68,006 | |

(1)

Previously reported amounts have been adjusted for the retroactive application of the recapitalization related to the Business Combination.

Refer to Note 3 for further information.

See

accompanying notes to the condensed consolidated financial statements

AST

SPACEMOBILE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(dollars

in thousands)

| | |

Three

months ended March 31, | |

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

loss before allocation to noncontrolling interest | |

$ | (37,903 | ) | |

$ | (12,088 | ) |

Adjustments

to reconcile net loss before noncontrolling interest to cash

used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 1,046 | | |

| 557 | |

| Amortization

of intangible assets | |

| 54 | | |

| 57 | |

| Loss

on remeasurement of warrant liabilities | |

| 5,482 | | |

| - | |

| Non-cash

lease expense | |

| 170 | | |

| 100 | |

| Stock-based

compensation | |

| 2,254 | | |

| 356 | |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Accounts

receivable | |

| (470 | ) | |

| 942 | |

| Prepaid

expenses and other current assets | |

| (6,838 | ) | |

| 100 | |

| Inventory | |

| (457 | ) | |

| (443 | ) |

| Accounts

payable and accrued expenses | |

| 2,684 | | |

| 1,273 | |

| Operating

lease liabilities | |

| (112 | ) | |

| (94 | ) |

| Deferred

revenue | |

| 1,333 | | |

| 725 | |

| Other

assets and liabilities | |

| (14,751 | ) | |

| (12 | ) |

| Net

cash used in operating activities | |

| (47,508 | ) | |

| (8,527 | ) |

| | |

| | | |

| | |

| Cash

flows from investing activities: | |

| | | |

| | |

| Purchase

of property and equipment | |

| (4,660 | ) | |

| (2,728 | ) |

| BlueWalker

3 satellite - construction in process | |

| (16,907 | ) | |

| (8,695 | ) |

| Net

cash used in investing activities | |

| (21,567 | ) | |

| (11,423 | ) |

| | |

| | | |

| | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Direct

costs incurred for the Business Combination | |

| - | | |

| (595 | ) |

| Proceeds

from warrant exercises | |

| 33 | | |

| - | |

| Proceeds

from debt | |

| 97 | | |

| - | |

| Net

cash provided by (used in) financing activities | |

| 130 | | |

| (595 | ) |

| | |

| | | |

| | |

| Effect

of exchange rate changes on cash, cash equivalents and restricted cash | |

| (482 | ) | |

| (19 | ) |

| | |

| | | |

| | |

| Net

decrease in cash, cash equivalents and restricted cash | |

| (69,427 | ) | |

| (20,564 | ) |

| Cash,

cash equivalents and restricted cash, beginning of period | |

| 324,537 | | |

| 42,777 | |

| Cash,

cash equivalents and restricted cash, end of period | |

$ | 255,110 | | |

$ | 22,213 | |

| | |

| | | |

| | |

| Supplemental

disclosure of cash flow information: | |

| | | |

| | |

| Non-cash

transactions: | |

| | | |

| | |

| Purchases

of construction in process in accounts payable | |

$ | 1,483 | | |

$ | 3,263 | |

| Purchases

of property and equipment in accounts payable | |

| 1,661 | | |

| 362 | |

| Right-of-use

assets obtained in exchange for operating lease liabilities | |

| 191 | | |

| - | |

See

accompanying notes to the condensed consolidated financial statements

AST

SPACEMOBILE, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH

31, 2022

(Unaudited)

| 1. | Organization

and Nature of Operations |

AST

SpaceMobile, Inc., collectively with its subsidiaries (“SpaceMobile” or the “Company”), is an innovative satellite

designer and manufacturer. The Company is currently in the process of assembling, integrating, and testing its BlueWalker 3 (“BW3”)

test satellite. In addition, the Company is in the design, development, and procurement process for the constellation of BlueBird (“BB”)

satellites in advance of manufacturing and launching the first space based global cellular broadband network distributed through a constellation

of Low Earth Orbit satellites. Once deployed and operational, the BB satellites are designed to provide connectivity directly to standard/unmodified

cellular phones or any 2G/3G/4G LTE and 5G enabled device (the “SpaceMobile Service”). At that point, the Company intends

to offer the SpaceMobile Service to cellular subscribers and others through wholesale commercial roaming agreements with cellular service

providers on a global basis. The Company operates from six locations that include its corporate headquarters and 185,000 square foot

satellite assembly, integrating and testing facilities in Midland, Texas, and engineering and development centers in Maryland, Spain,

the United Kingdom, and Israel. In addition, its 51% owned and controlled subsidiary, NanoAvionika UAB (“Nano”), is located

in Lithuania.

On

April 6, 2021 (the “Closing Date”), the Company completed a business combination (the “Business Combination”)

pursuant to that certain equity purchase agreement, dated as of December 15, 2020 (the “Equity Purchase Agreement”), by and

among AST & Science, LLC (“AST LLC”), New Providence Acquisition Corp. (“NPA”), the existing equity holders

of AST LLC (“Existing Equityholders”), New Providence Acquisition Management LLC (“Sponsor”), and Mr. Abel Avellan,

as representative of the Existing Equityholders. Immediately, upon the completion of the Business Combination, NPA was renamed AST SpaceMobile,

Inc. and AST LLC became a subsidiary of the Company. The Business Combination is documented in greater detail in Note 3.

Following

the consummation of the Business Combination (the “Closing”), the combined company is organized in an “Up-C”

structure in which the business of AST LLC and its subsidiaries is held by SpaceMobile and continues to operate through the subsidiaries

of AST LLC, and in which SpaceMobile’s only direct assets consist of equity interests in AST LLC. The Company’s common stock

and warrants are listed on the Nasdaq Capital Market under the symbols “ASTS” and “ASTSW”, respectively. As the

managing member of AST LLC, SpaceMobile has full, exclusive and complete discretion to manage and control the business of AST LLC and

to take all action it deems necessary, appropriate, advisable, incidental, or convenient to accomplish the purposes of AST LLC and, accordingly,

the financial statements are being prepared on a consolidated basis with SpaceMobile.

The

Company is an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities

Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and the Company may take advantage

of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth

companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the

Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in the Company’s periodic reports and proxy

statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval

of any golden parachute payments not previously approved.

| 2. | Summary

of Significant Accounting Policies |

Basis

of Presentation and Principles of Consolidation

The

accompanying unaudited condensed consolidated financial statements and related notes have been prepared by the Company in accordance

with accounting principles generally accepted in the United States (“U.S. GAAP”) and the requirements of the Securities and

Exchange Commission (“SEC”). The unaudited condensed consolidated financial statements include the accounts of the Company

and its subsidiaries. Intercompany transactions and balances have been eliminated upon consolidation. Certain comparative amounts have

been reclassified to conform to the current period presentation. These reclassifications had no effect on the reported results of operations.

The March 31, 2021 balances reported herein are derived from the unaudited condensed consolidated financial statements of AST LLC. In

the opinion of management, these unaudited condensed consolidated financial statements contain all adjustments (consisting only of normal

and recurring adjustments) necessary to fairly state the unaudited condensed consolidated financial statements.

Pursuant

to the Business Combination, the transaction between the Company and AST LLC was accounted for as a reverse recapitalization in accordance

with U.S. GAAP. Under this method of accounting, NPA was treated as the “acquired” company for financial reporting purposes.

Accordingly, for accounting purposes, the Business Combination was treated as the equivalent of AST LLC issuing stock for the net assets

of the Company, accompanied by a recapitalization. The net assets of AST LLC are stated at historical cost and net assets of NPA are

stated at fair value, with no goodwill or other intangible assets recorded. The consolidated assets, liabilities and results of operations

prior to the Business Combination are those of AST LLC. The shares and corresponding capital amounts prior to the Business Combination

have been retroactively restated as shares reflecting the exchange ratio established in the Equity Purchase Agreement.

The

accompanying unaudited condensed consolidated financial statements and related notes should be read in conjunction with the Company’s

audited consolidated financial statements and notes thereto as of and for the year ended December 31, 2021, included in its Annual Report

on Form 10-K filed with the “SEC” on March 31, 2022 (the “2021 Annual Report on Form 10-K”). The results of operations

for the periods presented are not indicative of the results to be expected for the year ending December 31, 2022 or for any other interim

period or other future year.

Use

of Estimates

The

preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the

amounts reported in the unaudited condensed consolidated financial statements and accompanying notes. The Company bases its estimates

and assumptions on historical experience when available and on other market-specific or other relevant assumptions that it believes to

be reasonable under the circumstances. Significant estimates and assumptions reflected in these financial statements include, but are

not limited to, useful lives assigned to property and equipment, the fair values of warrant liabilities, valuation and potential impairment

of goodwill and long-lived assets, and equity-based compensation expense. The Company assesses estimates on an ongoing basis; however,

actual results could materially differ from those estimates due to risks and uncertainties, including the continued uncertainty surrounding

rapidly changing market and economic conditions due to the COVID-19 pandemic.

Foreign

Currency Translation and Transaction Gains

The

financial statements of the Company’s foreign subsidiaries are translated from local currency into reporting currency, which is

U.S. dollars, using the current exchange rate at the balance sheet date for assets and liabilities, and the weighted average exchange

rate prevailing during the period for revenues and expenses. The functional currency of the Company’s foreign subsidiaries is the

local currency for each entity and, accordingly, translation adjustments for these subsidiaries are included in accumulated other comprehensive

loss within stockholders’ equity. Realized and unrealized gains and losses resulting from foreign currency transactions denominated

in currencies other than the functional currency are reflected as other income (expense), net in the unaudited condensed consolidated

statements of operations.

BlueWalker3

Capitalization

The

Company accounts for research and development costs related to the BlueWalker3 test satellite based on guidance in ASC 730 - Research

and Development (“ASC 730”). The Company determined there is an alternative future use for BW3 as defined in this guidance.

As such, certain costs related to the construction of the BW3 test satellite are capitalized and reported as construction-in-progress

(“CIP”) on the unaudited condensed consolidated balance sheets. The Company capitalizes only those expenditures and ancillary

costs that are directly attributable to the construction phase and necessarily incurred to place BW3 into its intended location and use.

To date, capitalized expenditures include the costs for satellite parts, paid launch cost, and other non-recurring costs directly associated

with BW3 developments. The other non-recurring costs primarily include third-party engineers who are hired solely for the design, assembly,

and testing of BW3 and are responsible for the value and progression of the project. The costs for internal, recurrent engineers and

consultants are expensed as engineering services and not capitalized to the CIP account on the unaudited condensed consolidated balance

sheets, as these employees are not directly associated with the development of BW3.

Property

and Equipment

The

Company records property and equipment at cost. Cost includes expenditures that are directly attributable to the acquisition of the asset.

The cost of self-constructed assets includes the cost of materials and direct labor, and any other costs directly attributable to bringing

the asset to a working condition for the intended use. During their construction, items of property, plant, and equipment are classified

as construction in progress. When the asset is available for use, it is transferred from construction in progress to the appropriate

category of property, plant, and equipment and depreciation on the item commences. Repairs and maintenance costs that do not extend the

useful life or enhance the productive capacity of an asset are expensed as incurred and recorded as part of general and administrative

operating expenses in the accompanying unaudited condensed consolidated statements of operations. Upon retirement or disposal of property

and equipment, the Company derecognizes the cost and accumulated depreciation balance associated with the asset, with a resulting gain

or loss from disposal included in the determination of net income or loss. Depreciation expense is computed using the straight-line method

over the estimated useful lives which the Company has assigned to its underlying asset classes, which are as follows:

| | |

Estimated

Useful Life |

| Computers,

software, and equipment | |

2

to 5 years |

| Leasehold

improvements | |

Shorter

of estimated useful life or lease term |

| Satellite

antenna | |

5

years |

| Lab,

assembly, and integration equipment | |

5

years |

| Others

(1) | |

5

to 7 years |

(1)

Includes vehicles, furniture and fixtures, and a phased array test facility.

Warrant

Liabilities

The

Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s

specific terms and applicable authoritative guidance in ASC 480 - Distinguishing Liabilities from Equity (“ASC 480”)

and ASC 815 - Derivatives and Hedging (“ASC 815”). Management’s assessment considers whether the warrants are

freestanding financial instruments pursuant to ASC 480, whether they meet the definition of a liability pursuant to ASC 480, and whether

the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the

Company’s own common stock and whether the warrant holders could potentially require “net cash settlement” in a circumstance

outside of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of

professional judgment, is conducted at the time of warrant issuance and as of each subsequent quarterly period-end date while the warrants

are outstanding.

For

issued or modified warrants that meet all of the criteria for equity classification, they are recorded as a component of additional paid-in

capital at the time of issuance. For issued or modified warrants that do not meet all the criteria for equity classification, they are

recorded at their initial fair value on the date of issuance and subject to remeasurement each balance sheet date with changes in the

estimated fair value of the warrants to be recognized as an unrealized gain or loss in the unaudited condensed consolidated statements

of operations.

Recently

Adopted Accounting Pronouncements

In

May 2021, the FASB issued ASU 2021-04, Earnings Per Share (Topic 260), Debt-Modifications and Extinguishments (Subtopic 470-50), Compensation-Stock

Compensation (Topic 718), and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40): Issuer’s Accounting

for Certain Modifications or Exchanges of Freestanding Equity-Classified Written Call Options (a consensus of the FASB Emerging Issues

Task Force). The guidance clarifies certain aspects of the current guidance to promote consistency among reporting of an issuer’s

accounting for modifications or exchanges of freestanding equity-classified written call options (for example, warrants) that remain

equity classified after modification or exchange. The amendments in this update are effective for all entities for fiscal years beginning

after December 15, 2021, including interim periods within those fiscal years. Early adoption is permitted for all entities, including

adoption in an interim period. The Company adopted ASU 2021-04 on January 1, 2022. The adoption did not have a material impact on its

unaudited condensed consolidated financial statements.

In

November 2021, the FASB issued ASU 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance,

to increase the transparency of government assistance including the disclosure of the types of assistance an entity receives, an entity’s

method of accounting for government assistance, and the effect of the assistance on an entity’s financial statements. The guidance

in this update is effective for all entities for annual periods beginning after December 15, 2021. Early adoption is permitted for all

entities. The amendments are to be applied prospectively to all transactions within the scope of the amendments that are reflected in

financial statements at the date of initial application and new transactions that are entered into after the date of initial application

or, retrospectively to those transactions. The Company adopted ASU 2021-10 on January 1, 2022. The adoption did not have a material impact

on its disclosures.

All

other new accounting pronouncements issued, but not yet effective or adopted, have been deemed to be not relevant to the Company and,

accordingly, are not expected to have a material impact once adopted.

On

April 6, 2021, the Company completed the Business Combination with AST LLC pursuant to the Equity Purchase Agreement. Pursuant to ASC

805 – Business Combinations (“ASC 805”), for financial accounting and reporting purposes, AST LLC was deemed

the accounting acquirer and the Company was treated as the accounting acquiree, and the Business Combination was accounted for as a reverse

recapitalization. Accordingly, the Business Combination was treated as the equivalent of AST LLC issuing stock (“AST LLC Common

Units”) for the net assets of NPA, accompanied by a recapitalization. Under this method of accounting, the pre-Business Combination

consolidated financial statements of the Company are the historical financial statements of AST LLC. The net assets of NPA were stated

at fair value, with no goodwill or other intangible assets recorded in accordance with U.S. GAAP and are consolidated with AST LLC’s

financial statements on the Closing Date. As a result of the Business Combination with the Company, the AST LLC Series A and Series B

convertible preferred stock were converted to AST LLC Common Units. The shares and net income (loss) available to holders of the Company’s

common stock, prior to the Business Combination, have been retroactively restated as shares reflecting the exchange ratio established

in the Equity Purchase Agreement.

In

connection with the Business Combination, the Company entered into subscription agreements with certain investors (the Private Investment

in Public Entity Investors, or “PIPE Investors”), whereby it issued 23,000,000 Class A shares of common stock at $10.00 per

share (the “Private Placement Shares”) for an aggregate purchase price of $230.0 million (the “Private Placement”),

which closed simultaneously with the consummation of the Business Combination.

On

the Closing Date of the Business Combination, the Company completed the acquisition of AST LLC and in return AST LLC and the Existing

Equityholders received (i) $416.9 million in cash, net of transaction expenses, (ii) 51.6 million shares of Class B common stock, and

(iii) 78.2 million shares of Class C common stock. In connection with the Business Combination, the Company incurred direct and incremental

costs of approximately $45.7 million related to the equity issuance, consisting primarily of investment banking, legal, accounting and

other professional fees, which were recorded as a reduction of additional paid-in capital in the accompanying unaudited condensed consolidated

balance sheets.

The

shares of non-economic Class B and Class C common stock of the Company entitle each share to one vote and ten votes per share, respectively.

The non-economic Class B and Class C shares were issued to the Existing Equityholders to maintain the established voting percentage of

SpaceMobile, as determined in the Equity Purchase Agreement.

As

a result of the Business Combination, the Company, organized as a C corporation, owns an equity interest in AST LLC in what is commonly

referred to as an “Up-C” structure. AST LLC is treated as a partnership for U.S. federal and state income tax purposes. Also,

the Company has a controlling ownership interest in a Lithuanian subsidiary that is subject to foreign income taxes and is also treated

as a partnership for U.S. federal and state and local taxes. Accordingly, for U.S. federal and state income tax purposes, all income,

losses, and other tax attributes pass through to the members’ income tax returns, and no U.S. federal and state and local provision

for income taxes has been recorded for these entities in the unaudited condensed consolidated financial statements. Certain foreign wholly-owned

entities are taxed as corporations in the jurisdictions in which they operate, and accruals for such taxes are included in the unaudited

condensed consolidated financial statements.

As

a result of the Up-C structure, the noncontrolling interest is held by the Existing Equityholders who retained approximately 71.5% of

the economic ownership percentage of AST LLC. The noncontrolling interest is classified as permanent equity within the unaudited condensed

consolidated balance sheet as the Company, acting through the redemption election committee of the Company’s Board of Directors

(the “Redemption Election Committee”), may only elect to settle a redemption request in cash if the cash delivered in the

exchange is limited to the cash proceeds to be received from a new permanent equity offering through issuance of Class A common stock.

In

conjunction with the Business Combination, the Company also entered into the Tax Receivable Agreement (“TRA”) with AST LLC.

Pursuant to the TRA, the Company is required to pay the Existing Equityholders (i) 85% of the amount of savings, if any, in U.S. federal,

state, local and foreign income tax that the Company actually realizes as a result of (A) existing tax basis of certain assets of AST

LLC and its subsidiaries attributable to the AST LLC Common Units, (B) tax basis adjustments resulting from taxable exchanges of AST

LLC Common Units acquired by the Company, (C) tax deductions in respect of portions of certain payments made under the TRA, and (D) certain

tax attributes that are acquired directly or indirectly by the Company pursuant to a reorganization transaction. All such payments to

the Existing Equityholders of AST LLC are the obligations of the Company, and not that of AST LLC. As of March 31, 2022, there have been

no exchanges of AST LLC units for Class A common stock of the Company and, accordingly, no TRA liabilities have been recognized.

The

Company recorded a net deferred tax asset for the difference between the book value and tax basis of the Company’s investment in

AST LLC at the time of the Business Combination. The Company has assessed the realizability of their deferred tax assets and in that

analysis has considered the relevant positive and negative evidence available to determine whether it is more likely than not that some

portion or all of the deferred tax assets will be realized. As a result, the Company has recorded a full valuation allowance against

its deferred tax asset resulting from the Business Combination.

The

Company follows the guidance in ASC 820 - Fair Value Measurement (“ASC 820”), for its financial assets and liabilities

that are re-measured and reported at fair value at each reporting period, and non-financial assets and liabilities that are re-measured

and reported at fair value at least annually.

The

fair value of the Company’s financial assets and liabilities reflects management’s estimate of amounts that the Company would

have received in connection with the sale of the assets or paid in connection with the transfer of the liabilities in an orderly transaction

between market participants at the measurement date. In connection with measuring the fair value of its assets and liabilities, the Company

seeks to maximize the use of observable inputs (market data obtained from independent sources) and to minimize the use of unobservable

inputs (internal assumptions about how market participants would price assets and liabilities). The following fair value hierarchy is

used to classify assets and liabilities based on the observable inputs and unobservable inputs used in order to value the assets and

liabilities:

| ● | Level

1: Quoted prices in active markets for identical assets or liabilities. An active market

for an asset or liability is a market in which transactions for the asset or liability occur

with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| | | |

| ● | Level

2: Observable inputs other than Level 1 inputs. Examples of Level 2 inputs include quoted

prices in active markets for similar assets or liabilities and quoted prices for identical

assets or liabilities in markets that are not active. |

| | | |

| ● | Level

3: Unobservable inputs based on our assessment of the assumptions that market participants

would use in pricing the asset or liability. |

The

Company’s financial assets and liabilities at fair value on a recurring basis as of March 31, 2022 and December 31, 2021 were as

follows (in thousands):

| | |

March

31, 2022 | |

| | |

Level

1 | | |

Level

2 | | |

Level

3 | |

| Assets: | |

| | |

| | |

| |

| Cash

equivalents | |

$ | 247,038 | | |

$ | - | | |

$ | - | |

| Total

assets measured at fair value | |

$ | 247,038 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| Public

warrant liability | |

$ | 38,291 | | |

$ | - | | |

$ | - | |

| Private

placement warrant liability | |

| - | | |

| 25,253 | | |

| - | |

| Total

liabilities measured at fair value | |

$ | 38,291 | | |

$ | 25,253 | | |

$ | - | |

| | |

December

31, 2021 | |

| | |

Level

1 | | |

Level

2 | | |

Level

3 | |

| Assets: | |

| | |

| | |

| |

| Cash

equivalents | |

$ | 314,747 | | |

$ | - | | |

$ | - | |

| Total

assets measured at fair value | |

$ | 314,747 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| Public

warrant liability | |

$ | 34,151 | | |

$ | - | | |

$ | - | |

| Private

placement warrant liability | |

| - | | |

| 23,911 | | |

| - | |

| Total

liabilities measured at fair value | |

$ | 34,151 | | |

$ | 23,911 | | |

$ | - | |

As

of March 31, 2022 and December 31, 2021, the Company had $253.7 million and $321.8 million

of cash and cash equivalents, respectively, of which $247.0 million and $314.7 million,

respectively, is classified as cash equivalents, which consists principally of short-term money market funds with original maturities

of 90 days or less. For certain instruments, including cash, accounts receivable, accounts payable, and accrued expenses, it was estimated

that the carrying amount approximated fair value because of the short maturities of these instruments.

Warrant

liabilities are comprised of both publicly issued warrants (“Public Warrants”) and private placement warrants (“Private

Placement Warrants”), exercisable for shares of Class A common stock of the Company. Warrant liabilities are documented in greater

detail at Note 11. As of March 31, 2022 and December 31, 2021, the Public Warrants are classified as Level 1 due to the use of an observable

market quote in an active market under the ticker “ASTSW”.

The

Private Warrants are valued using a Black-Scholes-Merton Model. As of March 31, 2022 and December 31, 2021, the Private Warrants are

classified as Level 2 as the transfer of Private Warrants to anyone outside of a small group of individuals who are permitted transferees

would result in the Private Placement Warrants having substantially the same terms as the Public Warrants. For this reason, the Company

determined that the volatility of each Private Warrant is equivalent to that of each Public Warrant.

The

Company’s Black-Scholes-Merton model to value Private Warrants required the use of the following subjective assumption inputs:

| ● | The

risk-free interest rate assumption was based on a weighted average of the three and five-year

U.S. Treasury rate, which was commensurate with the contractual term of the Warrants, which

expire on the earlier of (i) five years after the completion of the initial Business Combination

and (ii) upon redemption or liquidation. An increase in the risk-free interest rate, in isolation,

would result in an increase in the fair value measurement of the warrant liabilities and

vice versa. |

| | | |

| ● | The

expected volatility assumption was based on the implied volatility of the Company’s

publicly-traded warrants, which as of March 31, 2022 and December 31, 2021 was 56.3% and

75.6%, respectively. |

Property

and equipment, net consisted of the following at March 31, 2022 and December 31, 2021 (in thousands):

| | |

March

31, 2022 | | |

December

31, 2021 | |

| Land | |

$ | 1,350 | | |

$ | 1,350 | |

| Computers,

software, and equipment | |

| 3,295 | | |

| 2,810 | |

| Leasehold

improvements | |

| 7,026 | | |

| 6,416 | |

| Satellite

antenna | |

| 3,402 | | |

| 2,996 | |

| Lab,

assembly, and integration equipment | |

| 11,080 | | |

| 10,301 | |

| Others

(1) | |

| 1,414 | | |

| 1,345 | |

| Property

and equipment | |

| 27,567 | | |

| 25,218 | |

| Accumulated

depreciation | |

| (4,605 | ) | |

| (3,592 | ) |

| Other

construction in progress | |

| 9,195 | | |

| 6,701 | |

| Property

and equipment, net | |

| 32,157 | | |

| 28,327 | |

| | |

| | | |

| | |

| BlueWalker

3 satellite - construction in progress | |

| 82,693 | | |

| 67,615 | |

| Total

property and equipment, net | |

$ | 114,850 | | |

$ | 95,942 | |

(1)

Includes vehicles, furniture and fixtures, and a phased array test facility.

Depreciation

expense for the three months ended March 31, 2022 and 2021 was approximately $1.0 million

and $0.6 million, respectively.

Texas

Purchase

On

December 8, 2021, the Company’s subsidiary, AST & Science Texas, LLC, executed an agreement to purchase real property, including

offices, industrial warehouse buildings and equipment for a total purchase price of $8.0 million. In connection with the purchase, the

Company issued a term promissory note (the “Term Loan”) for $5.0 million secured by the property; refer to Note 8 for additional

information. Under the terms of the Term Loan, the Company deposited $2.8 million to use exclusively for capital improvements at the

property. As of March 31, 2022, the remaining deposit balance of $1.4 million is presented as restricted cash in the unaudited condensed

consolidated balance sheets.

SpaceX

Multi-Launch Agreement

On

March 3, 2022, AST LLC entered into an agreement (the “Multi-Launch Agreement”) with Space Exploration Technologies Corp.

(“SpaceX”). The Multi-Launch Agreement provides a framework for future launches of the Company’s satellites through

December 31, 2024, including the launches of the BW3 test satellite and the first BB satellite. Pursuant to the Multi-Launch Agreement,

the Company and SpaceX also entered into a Launch Services Agreement (the “BB LSA”) covering the launch of the first BB satellite,

and in accordance with the BB LSA, the Company paid an initial payment for the SpaceX launch services. As part of the Multi-Launch Agreement,

the Company and SpaceX agreed on a framework for additional launch service agreements relating to the launch of future BB satellites.

The Company paid an initial reservation fee to secure a SpaceX launch vehicle for a future BB satellite launch. With respect to the Company’s

BW3 launch scheduled for Summer 2022, the Company and SpaceX agreed to changes to certain technical launch parameters, and the Company

paid an additional fee to SpaceX to adjust these parameters. In connection with entry into the

Multi-Launch Agreement, the Company paid an aggregate amount of $22.8 million, of which $8.0 million related to BW3 was capitalized to

BlueWalker 3 satellite - construction in progress in the unaudited condensed consolidated balance sheet, and $14.8 million of deposits

related to the first BB initial payment and launch reservation fee for a future BB launch was recorded to Other non-current assets in

the unaudited condensed consolidated balance sheet. The exact timing of the satellite launches is contingent on a number of factors,

including satisfactory and timely completion of construction and testing. The Multi-Launch Agreement

permits the Company to delay launches of its satellites upon payment of certain rebooking fees.

| 6. | Commitments

and Contingencies |

Legal

Proceedings

The

Company is not a party to any material litigation and does not have contingency reserves established for any litigation liabilities as

of March 31, 2022 and December 31, 2021.

The

change in the carrying amount of goodwill for the three months ended March 31, 2022 is summarized as follows (in thousands):

| | |

Goodwill | |

| Balance

as of December 31, 2021 | |

$ | 3,641 | |

| Translation

adjustments | |

| (95 | ) |

| Balance

as of March 31, 2022 | |

$ | 3,546 | |

Nano

Business Credit Agreement

On

December 8, 2021, the Company’s subsidiary, Nano, entered into an agreement with AB SEB Bank (the “Lender”) pursuant

to which the Lender agreed to provide up to $0.4 million (the “Business Credit”) to fund certain capital expenditures. Nano

may use this facility to fund up to 70% of certain capital expenditures on an as-invoiced basis through March 2022, at which time outstanding

principal and interest were due and payable in monthly installments commencing on March 31, 2022 and continuing until December 6, 2025.

Borrowings under the agreement bear interest at a rate per annum equal to the EURIBOR plus 3.00%. As of March 31, 2022, the outstanding

balance was approximately $0.1 million which is classified within accrued expenses and other current liabilities on the unaudited condensed

consolidated balance sheets.

Long-term

debt

Long-term

debt consists of the following, (in thousands):

| | |

March

31, 2022 | | |

December

31, 2021 | |

| Term

Loan | |

$ | 5,000 | | |

$ | 5,000 | |

| Less:

current portion | |

| (60 | ) | |

| - | |

| Total

long-term debt | |

$ | 4,940 | | |

$ | 5,000 | |

On

December 8, 2021, in connection with the Texas Purchase (refer to Note 5), the Company’s subsidiary, AST & Science Texas, LLC

entered into an agreement with Lone Star State Bank of West Texas (the “Credit Agreement”) to issue a Term Loan for $5.0

million with a maturity date of December 8, 2028 that is secured by the property. AST & Science Texas, LLC granted to the lenders

a security interest in the assets acquired under the Texas Purchase described in Note 5.

Borrowings

under the Term Loan bear interest at a fixed rate equal to 4.20% per annum until December 2026, and from December 2026 until December

2028 at a fixed rate per annum equal to 4.20% subject to adjustment if the index rate as defined in the Credit Agreement is greater than

4.20%. Interest is payable monthly in arrears commencing in January 2022. Thereafter, outstanding principal and accrued interest will

be due and payable in monthly installments of $40,000, commencing in January 2023 and continuing until November 2028, with the final

remaining balance of unpaid principal and interest due and payable in December 2028. As of March 31, 2022, and December 31, 2021, there

was no accrued interest payable in connection with this Term Loan.

Disaggregation

of Revenue

The

Company’s subsidiary, Nano, recognizes revenue related to sales of manufactured small satellites and their components, as well

as launch related services. Currently, this is the Company’s only source of revenue. Revenue recognized over time versus revenue

recognized upon transfer during the three months ended March 31, 2022 and 2021 was as follows (in thousands):

| | |

Three

months ended March 31, | |

| | |

2022 | | |

2021 | |

| Revenue

from performance obligations recognized over time | |

$ | 2,083 | | |

$ | 550 | |

| Revenue

from performance obligations recognized at point-in-time transfer | |

| 311 | | |

| 401 | |

| Total | |

$ | 2,394 | | |

$ | 951 | |

Contract

Balances

Contract

assets relate to the Company’s unconditional right to consideration for its completed performance under the contract. As of March

31, 2022 and December 31, 2021, the Company had no material contract assets. Contract liabilities relate to payments received in advance

of performance under the contract. Contract liabilities (i.e., deferred revenue) are recognized as revenue as (or when) the Company performs

under the contract. The following table reflects the change in contract liabilities for the period indicated (in thousands):

| | |

Three

months ended March 31, 2022 | |

| Beginning

balance | |

$ | 6,636 | |

| Revenue

recognized that was included in the contract liability at the beginning of the year | |

| (544 | ) |

| Increase,

excluding amounts recognized as revenue during the period | |

| 1,708 | |

| Ending

balance | |

$ | 7,800 | |

As

of March 31, 2022, the Company had deferred revenue of $7.8 million classified in current liabilities related to performance obligations

that have not yet been satisfied. The Company expects to recognize the revenue associated with satisfying these performance obligations

within the next 12 months.

The

unaudited condensed consolidated statements of stockholders’ equity reflect the Business

Combination as described in Note 3. Prior to the Business Combination, NPA was a Special Purpose Acquisition Company or a “blank

check company”, defined as a development stage company formed for the sole purpose of effecting a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Class

A Common Stock

At

March 31, 2022, there were 51,782,254 million shares of Class A common stock issued and

outstanding. Holders of Class A common stock are entitled to one vote for each share. The Company is authorized to issue 800,000,000

shares of Class A common stock with a par value of $0.0001 per share.

Class

B Common Stock

At

March 31, 2022, there were 51,636,922 shares of Class B Common Stock issued and outstanding. Shares of Class B Common Stock were issued

to the Existing Equityholders of AST LLC (other than Mr. Avellan) in connection with the Business Combination and are noneconomic, but

entitle the holder to one vote per share. The Company is authorized to issue 200,000,000 shares of Class B Common Stock with a par value

of $0.0001 per share.

The

Existing Equityholders (other than Mr. Avellan) own economic interests in AST LLC which are redeemable into either shares of Class A

Common Stock on a one-for-one basis or cash at the option of the Redemption Election Committee. Upon redemption of the AST LLC Common

Units by the Existing Equityholders (other than Mr. Avellan), a corresponding number of shares of Class B Common Stock held by such Existing

Equityholders will be cancelled. The Class B Common Stock is subject to a lock-up, during which the shares cannot be transferred until

April 6, 2022, the first anniversary of the closing of the Business Combination.

Class

C Common Stock

At

March 31, 2022, there were 78,163,078 million shares of Class C common stock issued and

outstanding. Shares of Class C common stock were issued to Mr. Avellan in connection with the Business Combination and are non-economic,

but entitle the holder to ten votes per share (the “Super-Voting Rights”). The Company is authorized to issue 125,000,000

shares of Class C common stock with a par value of $0.0001 per share.

Mr.

Avellan owns economic interests in AST LLC which are redeemable into either shares of Class A common stock on a one-for-one basis or

cash at the option of the Redemption Election Committee. Upon redemption of the AST LLC Common Units by Mr. Avellan, a corresponding

number of shares of Class C common stock held by Mr. Avellan will be cancelled. Correspondingly, the Super-Voting Rights associated with

the Class C common stock will be terminated. The Class C common stock is subject to a one-year lock-up, during which the shares cannot

be transferred until April 6, 2022, the first anniversary of the closing of the Business Combination.

Noncontrolling

Interest

Nano

Lithuania and Nano US

AST

LLC owns 51.0% of and controls Nano Lithuania and Nano US. As a result, the Company consolidates the financial results of Nano Lithuania

and Nano US and reports noncontrolling interests representing the equity interests held by equity-holders other than the Company in the

unaudited condensed consolidated balance sheets. As of March 31, 2022 and December 31, 2021, the noncontrolling interest percentage in

Nano Lithuania and Nano US was approximately 49.0%. There were no changes to the noncontrolling interest percentage in Nano Lithuania

or Nano US during the three months ended March 31, 2022 and 2021.

AST

LLC

On

April 6, 2021, upon the close of the Business Combination, the Company held a 28.5% ownership interest in AST LLC and became the sole

managing member of AST LLC, allowing it to control the operating decisions of AST LLC. As a result of this control, the Company has consolidated

the financial position and results of operations of AST LLC. The Company reports noncontrolling interests representing the equity interest

in AST LLC held by members other than the Company in the accompanying unaudited condensed consolidated balance sheets. On the date of

the Business Combination, the noncontrolling interest percentage in AST LLC was approximately 71.5%. During the three months ended March

31, 2022 there was an immaterial change in the noncontrolling interest percentage as a result of the exercise of warrants and the issuance

of incentive units at AST LLC. As of March 31, 2022, the noncontrolling interest percentage in AST LLC was approximately 71.6%.

Changes

in the Company’s ownership interest in AST LLC while retaining control of AST LLC are accounted for as equity transactions. Each

issuance of the Company’s Class A Common Stock is accompanied by a corresponding issuance of AST LLC Common Units to the Company,

which results in a change in ownership and reduces the amount recorded as noncontrolling interest and increases additional paid-in capital.

At March 31, 2022, there were 11,498,700 Public Warrants and 6,100,000 Private Placement Warrants outstanding (see Note 11 for further

details), each of which entitles the holder to purchase one whole share of Class A Common Stock at a price of $11.50 per share. Each

warrant exercise is accompanied by a corresponding issuance of AST LLC Common Units to the Company, which results in a change in ownership

and reduces the amount recorded as noncontrolling interest and increases additional paid in capital.

In

addition, the AST LLC Agreement permits the noncontrolling interest holders of AST LLC Common Units to exchange AST LLC Common Units,

together with related shares of the Company’s Class B or Class C Common Stock, for shares of the Company’s Class A Common

Stock on a one-for-one basis or, at the election of the Company, for cash (a “Cash Exchange.”) A Cash Exchange is limited

to the amount of net proceeds from the issuance of Class A Common Stock. Future redemptions or direct exchanges of AST LLC Common Units

by the noncontrolling interest holders will result in a change in ownership and reduce the amount recorded as noncontrolling interest

and increase additional paid-in capital. Certain members of AST LLC also hold incentive stock options that are subject to service or

performance conditions (see Note 12 for further details), that are exercisable for AST LLC

Common Units. The exercise of the options results in a change in ownership and increases the amount recorded as noncontrolling interest

and decreases additional paid-in capital.

Warrant

liabilities are comprised of both Public Warrants and Private Placement Warrants. Each whole Public Warrant entitles the registered holder

to purchase one whole share of Class A Common Stock at a price of $11.50 per share. Pursuant to the warrant agreement, a holder of Public

Warrants may exercise its warrants only for a whole number of shares of Class A Common Stock.

This

means that only a whole warrant may be exercised at any given time by a warrant holder. The Public Warrants expire on April 6, 2026,

five years after the Business Combination, at 5:00 p.m., New York City time, or earlier upon redemption or liquidation. The Company may

redeem the Public Warrants under the following conditions:

| ● | In

whole and not in part; |

| | | |

| ● | At

a price of $0.01 per warrant; |

| | | |

| ● | Upon

not less than 30 days’ prior written notice of redemption (the “30-day redemption

period”) to each warrant holder; and |

| | | |

| ● | If,

and only if, the reported last sale price of the Class A Common Stock equals or exceeds $18.00

per share for any 20 trading days within a 30-trading day period ending three business days

before the Company sends the notice of redemption to the warrant holders. |

The

redemption criteria discussed above prevent a redemption call unless there is at the time of the call a significant premium to the warrant

exercise price. If the foregoing conditions are satisfied and the Company issues a notice of redemption of the warrants, each warrant

holder will be entitled to exercise its warrant prior to the scheduled redemption date. However, the price of the Class A Common Stock

may fall below the $18.00 redemption trigger price (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations

and the like) as well as the $11.50 warrant exercise price after the redemption notice is issued.

The

Private Placement Warrants are identical to the Public Warrants, except that the Private Placement Warrants are exercisable on a cashless

basis and are non-redeemable so long as they are held by the initial purchasers or their permitted transferees. If the Private Placement

Warrants are held by someone other than the initial purchasers or their permitted transferees, the Private Placement Warrants will be

redeemable by the Company and exercisable by such holders on the same basis as the Public Warrants.

During

the three months ended March 31, 2022, 100 Public Warrants were exercised at a price of $11.50 per share, resulting in cash proceeds

of approximately $1,150 and the issuance of 100 shares of Class A Common Stock. At March 31, 2022 there were 11,498,700 Public Warrants

and 6,100,000 Private Placement Warrants outstanding. At December 31, 2021, there were 11,498,800 Public Warrants and 6,100,000 Private

Placement Warrants outstanding.

As

of March 31, 2022 and December 31, 2021, the Company recorded warrant liabilities of $63.5 million and $58.1 million in the unaudited

condensed consolidated balance sheets, respectively. For the three months ended March 31, 2022, the Company recognized a gain of $5.5

million on the change in the fair value of the warrant liabilities in the unaudited condensed consolidated statements of operations.

| 12. | Stock-Based

Compensation |

Stock-Based

Compensation Expense

Stock-based

compensation, measured at the grant date based on the fair value of the award, is typically recognized ratably over the requisite services

period, using the straight-line method of expense attribution. The Company recorded stock-based compensation expense in the following

categories of its unaudited condensed consolidated statements of operations and balance sheets (in thousands):

| | |

Three

Months Ended March 31, | |

| | |

2022 | | |

2021 | |

| Engineering

services | |

$ | 1,279 | | |

$ | 324 | |

| General

and administrative costs | |

| 975 | | |

| 32 | |

| BlueWalker

3 Satellite - construction in progress (1) | |

| (44 | ) | |

| 14 | |

| Total | |

$ | 2,210 | | |

$ | 370 | |

| (1) | For

the three months ended March 31, 2022 stock-based compensation was reversed as a result of

forfeiture of options previously provided to a supplier. |

The

Company estimates the fair value of the stock option awards to employees, non-employees and non-employee members of the Board of Directors

using the Black-Scholes option pricing model, which requires the input of subjective assumptions, including (i) the expected volatility

of our stock, (ii) the expected term of the award, (iii) the risk-free interest rate, and (iv) any expected dividends. Due to the lack

of company-specific historical and implied volatility data, the Company based the estimate of expected volatility on the estimated and

expected volatilities of a representative group of publicly traded companies. For these analyses, the Company selects companies with

comparable characteristics including enterprise value, risk profiles, position within the industry, and with historical share price information

sufficient to meet the expected life of the stock-based awards. The Company computes the historical volatility data using the daily closing

prices for the selected companies’ shares during the equivalent period of the calculated expected term of the stock-based awards.

The Company will continue to apply this process until a sufficient amount of historical information regarding the volatility of the Company’s

stock price becomes available. For awards that qualify as “plain-vanilla” options, the Company estimates the expected life

of the employee stock options using the “simplified” method, whereby, the expected life equals the average of the vesting

term and the original contractual term of the option. The expected term of stock options granted to non-employees is equal to the contractual

term of the option award. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve in effect at the time

of grant of the award for time periods approximately equal to the expected term of the award. Expected dividend yield is based on the

fact that the Company has never paid cash dividends and does not expect to pay any cash dividends in the foreseeable future. The Company

elects to account for forfeitures as they occur rather than apply an estimated forfeiture rate to stock-based payment expense.

The

fair value of restricted stock units granted to employees, non-employees, and non-employee members of the Board of Directors is based

on the fair value of the Company’s stock on the grant date. The Company elects to account for forfeitures as they occur rather

than apply an estimated forfeiture rate to stock-based payment expense.

AST

LLC 2019 Equity Incentive Plan

Prior

to the Business Combination, under the 2019 Equity Incentive Plan (“AST LLC Incentive Plan”), AST LLC was authorized to issue

ordinary shares, as well as options exercisable for ordinary shares, as incentives to its employees, non-employees, and non-employee

members of its Board of Directors. The issuance of share options and ordinary shares is administered by the Board of Directors using

standardized share option and share subscription agreements. Following the Business Combination, no further grants will be made under

the AST LLC Incentive Plan. However, the AST LLC Incentive Plan will continue to govern the terms and conditions of the outstanding awards

granted under it.

There