Aspen Technology, Inc. (“AspenTech” or the “Company”) (NASDAQ:

AZPN), a global leader in industrial software, held its 2024

Investor Day today, during which management provided updates on the

Company’s strategic priorities, business growth drivers, product

innovation, and financial outlook.

“AspenTech has worked hard to become the trusted partner we are

today, helping customers transform their operations to adapt to and

capitalize on the opportunities resulting from the global

transition to a new energy system while also achieving their

sustainability goals,” said Antonio Pietri, President and CEO of

AspenTech. “As a market leader with a deeply talented team and more

than 40 years of experience delivering leading-edge technology, we

are focused on driving continuous innovation, including in

Industrial AI, and increased product usage and adoption to support

our long-term growth and financial objectives.”

Pietri continued, “Over the past few years, our partnership with

Emerson has provided us with access to new cross-sell

opportunities, increased industry diversification, and the ability

to pursue value-creating M&A. Together, we have formed a

powerful new R&D vision for the future that we expect will only

strengthen going forward as a complementary offering across the

industrial technology stack.”

Multi-year Financial Outlook

AspenTech reaffirmed its outlook for the full year of fiscal

2025, as stated on August 6, 2024, and provided the following

multi-year financial outlook as part of its 2024 Investor Day.

- High-single-digits to double-digits Annual Contract Value1

(“ACV”) growth

- ACV margin2 of 45-47%

- Mid-teens free cash flow3 growth

David Baker, Chief Financial Officer of AspenTech, commented “We

start fiscal 2025 with a solid foundation, positioning us well in a

large industrial software market with durable tailwinds. Looking

ahead, we are confident in our ability to achieve strong ACV growth

while driving steady margin expansion to deliver mid-teens free

cash flow growth. We will continue to execute a disciplined capital

allocation approach focused on investing in key strategic areas of

the business, executing value-creating M&A, and returning

capital to shareholders via share buybacks.”

Attractive Shareholder Value Creation

AspenTech’s multi-year financial framework is supported by the

following value creation framework.

Driving ACV Growth

- Uniquely positioned to capitalize on ~$15 - $16 billion

addressable market in current suites or near-adjacent opportunities

in alignment with long-term macro trends.

- Building on a history of industry-leading innovation to deliver

transformational capabilities that better enable customers’

performance, resiliency investments and sustainability efforts

across the full asset lifecycle.

- Driving product usage and adoption by leveraging the Company’s

term and token model and closely collaborating with customers to

meet their needs and co-innovate.

Expanding Margins

- Increasing mix of software relative to services further in

alignment with pure play industrial software strategy.

- Advancing a scalable commercial model to grow ACV at minimal

cost while accelerating access to innovation and enhancing customer

value proposition.

- Driving productivity and efficiency improvements while

capitalizing on significant leverage in cost structure.

Executing Disciplined Capital Allocation

- Reinforcing track record of innovation through strategic

organic investment to expand customer relationships and drive

growth.

- Executing a proven, value-creating M&A playbook focused on

tuck-ins and strategic anchor targets to augment core suites,

extend solutions across the value chain, or access new

markets.

- Building on track record of returning capital to shareholders,

as represented by more than $2 billion of share repurchases over

past decade.

Event Recording and Presentation Materials

A replay of the event webcast and presentation materials are

available for a limited time on the Webcasts and Events section of

AspenTech’s IR website at

https://ir.aspentech.com/events-presentations/webcasts-and-events.

Footnotes

- AspenTech defines ACV as the estimate of the annual value of

portfolio of term license and software maintenance and support

("SMS") contracts, the annual value of SMS agreements purchased

with perpetual licenses and the annual value of standalone SMS

agreements purchased with certain legacy term license agreements,

which have become an immaterial part of the Company's

business.

- ACV margin is calculated as the sum of current ACV less

trailing twelve month total non-GAAP expenses, divided by current

ACV.

- Free cash flow is a non-GAAP metric that is calculated as net

cash provided by operating activities adjusted for the net impact

of purchases of property, equipment and leasehold improvements and

payments for capitalized computer software development costs. The

most directly comparable GAAP financial measure to Free Cash Flow

is Operating Cash Flow. Effective January 1, 2023, AspenTech no

longer excludes acquisition and integration planning related

payments from its computation of free cash flow.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software

leader helping industries at the forefront of the world’s dual

challenge meet the increasing demand for resources from a rapidly

growing population in a profitable and sustainable manner.

AspenTech solutions address complex environments where it is

critical to optimize the asset design, operation and maintenance

lifecycle. Through our unique combination of deep domain expertise

and innovation, customers in asset-intensive industries can run

their assets safer, greener, longer and faster to improve their

operational excellence.

Forward Looking Statements

Statements in this press release and our commentary and

responses to questions that are not strictly historical may be

“forward-looking” statements for purposes of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

which involve risks and uncertainties, and AspenTech undertakes no

obligation to update any such statements to reflect later

developments. These forward-looking statements include, but are not

limited to, our guidance for fiscal 2025, our target operating

model and annual contract value growth targets. In some cases, you

can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “strategy,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” "target,"

“opportunity” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain

these words. These risks and uncertainties include, without

limitation: the failure to realize the anticipated benefits of our

transaction with Emerson Electric Co.; risks resulting from our

status as a controlled company; risks arising from our suspension

of commercial activities in Russia and the scope, duration and

ultimate impact of the Israeli-Hamas conflict; as well as economic

and currency conditions, market demand (including adverse changes

in the process or other capital-intensive industries such as

materially reduced spending budgets due to oil and gas price

declines and volatility), pricing, protection of intellectual

property, cybersecurity, natural disasters, tariffs, sanctions,

competitive and technological factors, and inflation; and others,

as set forth in AspenTech’s most recent Annual Report on Form 10-K

and subsequent reports filed with the Securities and Exchange

Commission (the "SEC"). Except as otherwise required by law,

AspenTech disclaims any intention or obligation to update or revise

any forward-looking statements, which speak only as of the date

they were made, whether as a result of new information, future

events, or circumstances or otherwise. The outlook contained herein

represents AspenTech’s expectation for its consolidated results,

other than as noted herein.

© 2024 Aspen Technology, Inc. AspenTech and the Aspen leaf logo

are trademarks of Aspen Technology, Inc. All rights reserved. All

other trademarks not owned by AspenTech are property of their

respective owners.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under

the rules of the SEC. Non-GAAP financial measures are not based on

a comprehensive set of accounting rules or principles. This

non-GAAP information supplements, and is not intended to represent

a measure of performance in accordance with, disclosures required

by generally accepted accounting principles, or GAAP. Non-GAAP

financial measures should be considered in addition to, not as a

substitute for or superior to, financial measures determined in

accordance with GAAP.

Management considers both GAAP and non-GAAP financial results in

managing AspenTech’s business. As the result of adoption of new

licensing models, management believes that a number of AspenTech’s

performance indicators based on GAAP, including revenue, gross

profit, operating income and net income, should be viewed in

conjunction with certain non-GAAP and other business measures in

assessing AspenTech’s performance, growth and financial condition.

Accordingly, management utilizes a number of non-GAAP and other

business metrics, including the non-GAAP metrics set forth in this

press release, to track AspenTech’s business performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917065735/en/

Media Contact Len Dieterle Aspen Technology +1

781-221-4291 len.dieterle@aspentech.com

Investor Contact William Dyke Aspen Technology +1

781-221-5571 ir@aspentech.com

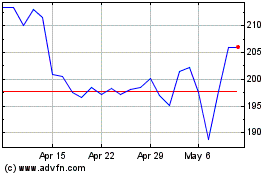

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

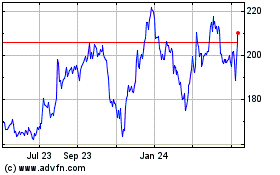

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Nov 2023 to Nov 2024