Filed pursuant to Rule 497(a)

Registration No. 333-256733

Rule 482ad

ARES CAPITAL CORPORATION PRICES PUBLIC OFFERING

OF

$600 MILLION 7.000% UNSECURED NOTES DUE 2027

New York, NY—July 27, 2023— Ares Capital

Corporation (Nasdaq: ARCC) announced that it has priced an underwritten public offering of $600 million in aggregate principal amount

of 7.000% notes due 2027. The notes will mature on January 15, 2027 and may be redeemed in whole or in part at Ares Capital’s option

at any time at par plus a “make-whole” premium.

BofA Securities, Inc., J.P. Morgan Securities LLC, SMBC Nikko Securities

America, Inc., Wells Fargo Securities, LLC, Mizuho Securities USA LLC, MUFG Securities Americas Inc., RBC Capital Markets, LLC, Santander

US Capital Markets LLC and Truist Securities, Inc. are acting as joint book-running managers for this offering. CIBC World Markets Corp.,

ICBC Standard Bank Plc, Morgan Stanley & Co. LLC, Barclays Capital Inc., BNP Paribas Securities Corp., BNY Mellon Capital Markets,

LLC, Capital One Securities, Inc., Goldman Sachs & Co. LLC, Natixis Securities Americas LLC, Regions Securities LLC, SG Americas Securities,

LLC and U.S. Bancorp Investments, Inc. are acting as joint lead managers for this offering. ING Financial Markets LLC, R. Seelaus &

Co., LLC, Academy Securities, Inc., Citigroup Global Markets Inc., Comerica Securities, Inc., Deutsche Bank Securities Inc., Keefe, Bruyette

& Woods, Inc., Loop Capital Markets LLC, Samuel A. Ramirez & Company, Inc. and Siebert Williams Shank & Co., LLC are acting

as co-managers for this offering. The offering is expected to close on August 3, 2023, subject to customary closing conditions.

Ares Capital expects to use the net proceeds of this offering to repay

certain outstanding indebtedness under its debt facilities. Ares Capital may reborrow under its debt facilities for general corporate

purposes, which include investing in portfolio companies in accordance with its investment objective.

Investors are advised to carefully consider

the investment objective, risks, charges and expenses of Ares Capital before investing. The pricing term sheet dated July 27, 2023, the

preliminary prospectus supplement dated July 27, 2023 and the accompanying prospectus dated June 3, 2021, each of which have been filed

with the Securities and Exchange Commission, contain this and other information about Ares Capital and should be read carefully before

investing.

The information in the pricing term sheet,

the preliminary prospectus supplement, the accompanying prospectus and this press release is not complete and may be changed. The

pricing term sheet, the preliminary prospectus supplement, the accompanying prospectus and this press release are not offers to sell any

securities of Ares Capital and are not soliciting an offer to buy such securities in any jurisdiction where such offer and sale is not

permitted.

The offering may be made only by means of a preliminary prospectus

supplement and an accompanying prospectus. Copies of the preliminary prospectus supplement (and accompanying prospectus) may be obtained

from BofA Securities, Inc., NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte NC 28255-0001, Attn: Prospectus Department,

or by calling 1-800-294-1322, or email dg.prospectus_requests@bofa.com; J.P. Morgan Securities LLC, 383 Madison Avenue, New York NY 10179,

Attn: Investment Grade Syndicate Desk, 1-212-834-4533; SMBC Nikko Securities America, Inc. at 277 Park Avenue, New York, New York

10172, Attn: Debt Capital Markets, 1-888-868-6856; or Wells Fargo Securities, LLC at 1-800-645-3751.

About

Ares Capital Corporation

Founded in 2004, Ares Capital is a

leading specialty finance company focused on providing direct loans and other investments in private middle market companies in the

United States. Ares Capital’s objective is to source and invest in high-quality borrowers that need capital to achieve their

business goals, which often leads to economic growth and employment. Ares Capital believes its loans and other investments in these

companies can generate attractive levels of current income and potential capital appreciation for investors. Ares Capital, through

its investment manager, utilizes its extensive, direct origination capabilities and incumbent borrower relationships to source and

underwrite predominantly senior secured loans but also subordinated debt and equity investments. Ares Capital has elected to be

regulated as a business development company (“BDC”) and was the largest publicly traded BDC by market capitalization as

of June 30, 2023. Ares Capital is externally managed by a subsidiary of Ares Management Corporation (NYSE: ARES), a publicly traded,

leading global alternative investment manager.

FORWARD-LOOKING STATEMENTS

Statements included herein may constitute “forward-looking statements,”

which relate to future events or Ares Capital’s future performance or financial condition. These statements are not guarantees of

future performance, condition or results and involve a number of risks and uncertainties. Actual results and conditions may differ materially

from those in the forward-looking statements as a result of a number of factors, including those described from time to time in Ares Capital’s

filings with the Securities and Exchange Commission. Ares Capital undertakes no duty to update any forward-looking statements made herein.

INVESTOR RELATIONS

Ares Capital Corporation

Carl G. Drake or John Stilmar

888-818-5298

irarcc@aresmgmt.com

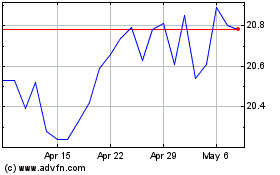

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Feb 2024 to Feb 2025