Statement of Beneficial Ownership (sc 13d)

June 25 2020 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. )*

Altimmune, Inc.

(Name of Issuer)

COMMON STOCK

(Title of Class of Securities)

02155H200

(CUSIP Number)

Attention: General Counsel

Venrock

3340 Hillview Avenue

Palo Alto, California 94304

Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

June 15, 2020

(Date of Event which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. x

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule.13d-7 for other parties to whom copies are to

be sent.

* The remainder of this cover page shall be filled out

for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

CUSIP No. 02155H200

|

Page 2 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

Venrock Healthcare Capital Partners II, L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

PN

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 3 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 4 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

VHCP Co-Investment Holdings II, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

OO

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 5 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698 shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29, 2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1, 2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 6 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

Venrock Healthcare Capital Partners III, L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

PN

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 7 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 8 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

VHCP Co-Investment Holdings III, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

OO

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 9 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 10 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

VHCP Management II, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

OO

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 11 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 12 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

VHCP Management III, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

OO

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 13 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 14 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

Shah, Nimish

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

United States

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 15 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698

shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29,

2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1,

2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market

offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 16 of 24

|

|

1

|

|

NAMES OF REPORTING PERSONS:

Koh, Bong

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) x1

(b) ¨

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e):

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

United States

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON WITH

|

7

|

|

SOLE VOTING POWER:

0

|

|

8

|

|

SHARED VOTING POWER:

4,500,0002

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

10

|

|

SHARED DISPOSITIVE POWER:

4,500,0002

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

4,500,0002

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.8%3

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN

|

|

|

|

|

|

|

|

|

CUSIP No. 02155H200

|

Page 17 of 24

|

|

1

|

Venrock Healthcare Capital Partners II, L.P., VHCP Co-Investment Holdings II, LLC, Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, VHCP Management II, LLC, VHCP Management III, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13D.

|

|

2

|

Consists of 1,189,350 shares owned by Venrock Healthcare Capital

Partners II, L.P., 481,949 shares owned by VHCP Co-Investment Holdings II, LLC, 2,571,752 shares owned by Venrock Healthcare Capital

Partners III, L.P. and 256,949 shares owned by VHCP Co-Investment Holdings III, LLC.

|

|

3

|

This percentage is calculated based on an estimated 21,611,698 shares of common stock outstanding as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29, 2020, as reported in the Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1, 2020, plus 1,500,000 shares of common stock purchased by the Reporting Persons directly from the Issuer pursuant to an at-the-market offering on June 15, 2020.

|

|

CUSIP No. 02155H200

|

Page 18 of 24

|

This Schedule 13D is being filed by the Venrock Entities (as

defined below) and the Venrock GPs (as defined below) to report the acquisition of Common Stock, as described in Item 3 below.

ITEM 1. SECURITY AND ISSUER

The class of equity securities to which

this statement relates is Common Stock, par value $0.0001 per share (the “Common Stock”), of Altimmune, Inc.,

a Delaware corporation (the “Issuer” or “Altimmune”). The principal executive offices of the Issuer are

located at 910 Clopper Road, Suite 201A, Gaithersburg, Maryland 20878.

ITEM 2. IDENTITY AND BACKGROUND

|

(a)

|

This Schedule 13D is filed by Venrock Healthcare Capital Partners II, L.P. (“VHCP II”), VHCP Co-Investment Holdings II, LLC (“VHCP-Co II”), Venrock Healthcare Capital Partners III, L.P. (“VHCP III”) and VHCP Co-Investment Holdings III, LLC (“VHCP-Co III” and together with VHCP II, VHCP-Co II and VHCP III, the “Venrock Entities”). VHCP Management II, LLC (“VHCPM II”) is the general partner of VHCP II and the manager of VHCP-Co II, and VHCP Management III, LLC (“VHCPM III” and together with VHCPM II, the “Venrock GPs”) is the general partner of VHCP III and the manager of VHCP-Co III. Nimish Shah (“Shah”) and Bong Koh (“Koh”) are the voting members of the Venrock GPs.

|

|

(b)

|

The address of the principal place of business of each of the Venrock Entities, Venrock GPs, Shah and Koh is 7 Bryant Park, 23rd Floor, New York, NY 10018.

|

|

(c)

|

The principal business of each of the Venrock Entities, Venrock GPs, Shah and Koh is a venture capital investment business.

|

|

(d)

|

During the last five years, none of the Venrock Entities, Venrock GPs, Shah or Koh has been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

(e)

|

During the last five years, none of the Venrock Entities, Venrock GPs, Shah or Koh has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction resulting in such Venrock Entity, Venrock GP, Shah or Koh being subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

(f)

|

Each of the Venrock Entities is a Delaware limited partnership and each of the Venrock GPs is a Delaware limited liability company. Shah and Koh are each United States citizens.

|

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR

OTHER CONSIDERATION

As of the date hereof, the Venrock Entities

may be deemed to beneficially own an aggregate of 4,500,000 shares of Common Stock, all of which were acquired between May 20,

2020 and June 15, 2020, as described in greater detail in Item 5. Of these shares, an aggregate of 3,000,000 shares were acquired

in open market transactions for an aggregate purchase price of $22.0 million and an aggregate of 1,500,000 shares were acquired

directly from the Issuer pursuant to an at the market (“ATM”) offering program for an aggregate purchase price of $11.3

million. The funds used by the Venrock Entities to acquire the securities described herein were obtained from capital contributions

from their respective partners.

|

CUSIP No. 02155H200

|

Page 19 of 24

|

ITEM 4. PURPOSE OF TRANSACTION

The Venrock Entities acquired the securities

for investment purposes with the aim of increasing the value of its investments and the Issuer.

Subject to applicable legal

requirements, one or more of the Reporting Persons may purchase or sell additional securities of the Issuer from time to time

in open market or private transactions, depending on their evaluation of the Issuer’s business, prospects and financial

condition, the market for the Issuer’s securities, other developments concerning the Issuer, the reaction of the Issuer

to the Reporting Persons’ ownership of the Issuer’s securities, other opportunities available to the Reporting

Persons, and general economic, money market and stock market conditions. In addition, depending upon the factors referred to

above, the Reporting Persons may dispose of all or a portion of their securities of the Issuer at any time. Each of the

Reporting Persons reserves the right to increase or decrease its holdings on such terms and at such times as each may

decide.

Other than as described above, as of the

date of this Schedule 13D, none of the Reporting Persons has any present plans which relate to or would result in:

|

|

(a)

|

the acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

|

|

|

(b)

|

an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

|

|

|

(c)

|

a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

|

|

|

(d)

|

any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board;

|

|

|

(e)

|

any material change in the present capitalization or dividend policy of the Issuer;

|

|

|

(f)

|

any other material change in the Issuer’s business or corporate structure including but not limited to, if the Issuer is a registered closed-end investment company, any plans or proposals to make any changes in its investment policy for which a vote is required by Section 13 of the Investment Company Act of 1940;

|

|

|

(g)

|

changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person;

|

|

|

(h)

|

causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

|

|

|

(i)

|

a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

|

|

|

(j)

|

any action similar to any of those enumerated above.

|

|

CUSIP No. 02155H200

|

Page 20 of 24

|

ITEM 5. INTEREST IN SECURITIES OF THE

ISSUER

The Reporting Persons are members of a

group for purposes of this Schedule 13D.

(a) As

of the date hereof, the Venrock Entities own the following shares:

|

Reporting

Persons

|

|

Shares

Held

Directly

|

|

|

Sole

Voting

Power

|

|

|

Shared

Voting

Power (1)

|

|

|

Sole

Dispositive

Power

|

|

|

Shared

Dispositive

Power (1)

|

|

|

Beneficial

Ownership

|

|

|

Percentage

of Class (2)

|

|

|

VHCP II

|

|

|

1,189,350

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

VHCP Co-II

|

|

|

481,949

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

VHCP III

|

|

|

2,571,752

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

VHCP Co-III

|

|

|

256,949

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

VHCPM II

|

|

|

—

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

VHCPM III

|

|

|

—

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

Shah

|

|

|

—

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

Koh

|

|

|

—

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

—

|

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

20.8

|

%

|

|

|

(1)

|

Shah and Koh are the voting members of VHCPM II (the general partner of VHCP II and manager of

VHCP-Co II) and VHCPM III (the general partner of VHCP III and manager of VHCP-Co III). The Venrock GPs, Shah and Koh own no securities

of the Issuer directly. Shah and Koh share voting and investment control over the securities owned by the Venrock Entities and

may be deemed to beneficially own the securities held by those entities. As general partners of the Venrock Entities, the Venrock

GPs may be deemed to beneficially own the securities held by those entities.

|

|

|

(2)

|

This percentage is calculated based on an estimated 21,611,698 shares of common stock outstanding

as of the date hereof, which consists of 20,111,698 shares of common stock outstanding on May 29, 2020, as reported in the

Issuer’s prospectus supplement filed with the Securities and Exchange Commission on June 1, 2020, plus 1,500,000 shares

of common stock purchased by the

Reporting Persons directly from the Issuer pursuant to an at-the-market offering on June 15, 2020.

|

|

|

(b)

|

Each of the Reporting Persons has sole power to vote or to direct the vote of no shares of Common

Stock, sole power to dispose or to direct the disposition of no shares of Common Stock, shared power to vote or to direct the vote

of 4,500,000 shares of Common Stock and shared power to dispose or to direct the disposition of 4,500,000 shares of Common Stock.

|

|

CUSIP No. 02155H200

|

Page 21 of 24

|

|

|

(c)

|

The shares of Common Stock beneficially owned by the Reporting Persons were acquired as follows:

|

VHCP II

|

Date of Transaction

|

|

|

Type of Purchase

|

|

Number of

Shares

Acquired

|

|

|

Weighted

Average Price

Per Share

|

|

|

Low Price

|

|

|

High Price

|

|

|

20-May-20

|

|

|

Open market

|

|

|

396,450

|

|

|

$

|

6.23

|

|

|

$

|

5.98

|

|

|

$

|

6.44

|

|

|

21-May-20

|

|

|

Open market

|

|

|

12,386

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

22-May-20

|

|

|

Open market

|

|

|

39,513

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

26-May-20

|

|

|

Open market

|

|

|

185,010

|

|

|

$

|

9.34

|

|

|

$

|

8.40

|

|

|

$

|

10.00

|

|

|

27-May-20

|

|

|

Open market

|

|

|

106,291

|

|

|

$

|

7.71

|

|

|

$

|

6.63

|

|

|

$

|

8.05

|

|

|

28-May-20

|

|

|

Open market

|

|

|

53,250

|

|

|

$

|

8.72

|

|

|

$

|

7.61

|

|

|

$

|

9.00

|

|

|

15-Jun-20

|

|

|

ATM

|

|

|

396,450

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

VHCP Co-II

|

Date of Transaction

|

|

|

Type of Purchase

|

|

Number of

Shares

Acquired

|

|

|

Weighted

Average Price

Per Share

|

|

|

Low Price

|

|

|

High Price

|

|

|

20-May-20

|

|

|

Open market

|

|

|

160,650

|

|

|

$

|

6.23

|

|

|

$

|

5.98

|

|

|

$

|

6.44

|

|

|

21-May-20

|

|

|

Open market

|

|

|

5,019

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

22-May-20

|

|

|

Open market

|

|

|

16,011

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

26-May-20

|

|

|

Open market

|

|

|

74,970

|

|

|

$

|

9.34

|

|

|

$

|

8.40

|

|

|

$

|

10.00

|

|

|

27-May-20

|

|

|

Open market

|

|

|

43,071

|

|

|

$

|

7.71

|

|

|

$

|

6.63

|

|

|

$

|

8.05

|

|

|

28-May-20

|

|

|

Open market

|

|

|

21,578

|

|

|

$

|

8.72

|

|

|

$

|

7.61

|

|

|

$

|

9.00

|

|

|

15-Jun-20

|

|

|

ATM

|

|

|

160,650

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

VHCP

III

|

Date

of Transaction

|

|

|

Type

of Purchase

|

|

Number

of

Shares

Acquired

|

|

|

Weighted

Average Price

Per Share

|

|

|

Low

Price

|

|

|

High

Price

|

|

|

20-May-20

|

|

|

Open

market

|

|

|

857,250

|

|

|

$

|

6.23

|

|

|

$

|

5.98

|

|

|

$

|

6.44

|

|

|

21-May-20

|

|

|

Open

market

|

|

|

26,783

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

22-May-20

|

|

|

Open

market

|

|

|

85,440

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

26-May-20

|

|

|

Open

market

|

|

|

400,050

|

|

|

$

|

9.34

|

|

|

$

|

8.40

|

|

|

$

|

10.00

|

|

|

27-May-20

|

|

|

Open

market

|

|

|

229,837

|

|

|

$

|

7.71

|

|

|

$

|

6.63

|

|

|

$

|

8.05

|

|

|

28-May-20

|

|

|

Open

market

|

|

|

115,142

|

|

|

$

|

8.72

|

|

|

$

|

7.61

|

|

|

$

|

9.00

|

|

|

15-Jun-20

|

|

|

ATM

|

|

|

857,250

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

|

CUSIP No. 02155H200

|

Page 22 of 24

|

VHCP

Co-III

|

Date of Transaction

|

|

Type of Purchase

|

|

Number of Shares

Acquired

|

|

|

Weighted Average

Price Per Share

|

|

|

Low Price

|

|

|

High Price

|

|

|

20-May-20

|

|

Open market

|

|

|

85,650

|

|

|

$

|

6.23

|

|

|

$

|

5.98

|

|

|

$

|

6.44

|

|

|

21-May-20

|

|

Open market

|

|

|

2,676

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

$

|

6.11

|

|

|

22-May-20

|

|

Open market

|

|

|

8,536

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

$

|

6.71

|

|

|

26-May-20

|

|

Open market

|

|

|

39,970

|

|

|

$

|

9.34

|

|

|

$

|

8.40

|

|

|

$

|

10.00

|

|

|

27-May-20

|

|

Open market

|

|

|

22,963

|

|

|

$

|

7.71

|

|

|

$

|

6.63

|

|

|

$

|

8.05

|

|

|

28-May-20

|

|

Open market

|

|

|

11,504

|

|

|

$

|

8.72

|

|

|

$

|

7.61

|

|

|

$

|

9.00

|

|

|

15-Jun-20

|

|

ATM

|

|

|

85,650

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

|

$

|

7.54

|

|

Except as reported herein, the

Reporting Persons have not engaged in any transactions involving the securities of the Issuer in the last 60 days.

|

|

(d)

|

No other person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends

from, or the proceeds from the sale of, Common Stock beneficially owned by the Reporting Persons.

|

ITEM 6. CONTRACTS, ARRANGEMENTS,

UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

To the best of the Reporting Persons’

knowledge, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in

Item 2 and between such persons and any person with respect to any securities of the Issuer.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

|

|

A.

|

Agreement regarding filing of joint Schedule 13D.

|

|

|

|

|

|

|

B.

|

Power of Attorney for Bong Koh (incorporated by reference to Exhibit B to Schedule 13D filed with the Securities and Exchange Commission on June 1, 2020).

|

|

|

|

|

|

|

C.

|

Power of Attorney for Nimish Shah (incorporated by reference to Exhibit C to Schedule 13D filed with the Securities and Exchange Commission on June 1, 2020).

|

|

CUSIP No. 02155H200

|

Page 23 of 24

|

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: June 25, 2020

|

Venrock Healthcare Capital Partners II, L.P.

|

|

Venrock Healthcare Capital Partners III, L.P.

|

|

|

|

|

|

|

|

By:

|

VHCP Management II, LLC

|

|

By:

|

VHCP Management III, LLC

|

|

Its:

|

General Partner

|

|

Its:

|

General Partner

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

VHCP Co-Investment Holdings II, LLC

|

|

VHCP Co-Investment Holdings III, LLC

|

|

|

|

|

|

|

|

By:

|

VHCP Management II, LLC

|

|

By:

|

VHCP Management III, LLC

|

|

Its:

|

Manager

|

|

Its:

|

Manager

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

VHCP Management II, LLC

|

|

VHCP Management III, LLC

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

Nimish Shah

|

|

Bong Koh

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

David L. Stepp, as attorney-in-fact

|

|

|

David L. Stepp, as attorney-in-fact

|

The original statement shall be signed by each person on whose

behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his authorized

representative (other than an executive officer or general partner of the filing person), evidence of the representative’s

authority to sign on behalf of such person shall be filed with the statement: provided, however, that a power of attorney for this

purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who

signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements

or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001)

|

CUSIP No. 02155H200

|

Page 24 of 24

|

EXHIBIT A

AGREEMENT

Pursuant to Rule 13d-1(k)(1) promulgated pursuant

to the Securities Exchange Act of 1934, as amended, the undersigned agree that the attached Schedule 13D is being filed on behalf

of each of the undersigned.

Dated: June 25, 2020

|

Venrock Healthcare Capital Partners II, L.P.

|

|

Venrock Healthcare Capital Partners III, L.P.

|

|

|

|

|

|

|

|

By:

|

VHCP Management II, LLC

|

|

By:

|

VHCP Management III, LLC

|

|

Its:

|

General Partner

|

|

Its:

|

General Partner

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

VHCP Co-Investment Holdings II, LLC

|

|

VHCP Co-Investment Holdings III, LLC

|

|

|

|

|

|

|

|

By:

|

VHCP Management II, LLC

|

|

By:

|

VHCP Management III, LLC

|

|

Its:

|

Manager

|

|

Its:

|

Manager

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

VHCP Management II, LLC

|

|

VHCP Management III, LLC

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Name:

|

David L. Stepp

|

|

|

Its:

|

Authorized Signatory

|

|

|

Its:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

Nimish Shah

|

|

Bong Koh

|

|

|

|

|

|

|

|

By:

|

/s/ David L. Stepp

|

|

By:

|

/s/ David L. Stepp

|

|

|

David L. Stepp, as attorney-in-fact

|

|

|

David L. Stepp, as attorney-in-fact

|

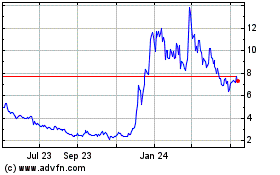

Altimmune (NASDAQ:ALT)

Historical Stock Chart

From Oct 2024 to Nov 2024

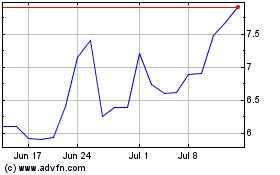

Altimmune (NASDAQ:ALT)

Historical Stock Chart

From Nov 2023 to Nov 2024