By Brent Kendall and Drew FitzGerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 7, 2020).

WASHINGTON -- AT&T Inc. is working with the Justice

Department as the government considers whether to bring an

antitrust case against Alphabet Inc.'s Google, two years after the

telecommunications giant was at loggerheads with the department

over its acquisition of Time Warner, according to people familiar

with the matter.

AT&T has conferred several times with Justice officials to

share its views that Google is stifling competition in the

advertising sector, where AT&T is seeking to make inroads with

its Xandr division, the people said.

Those discussions have included an audience with the top DOJ

officials overseeing the probe, they said, and the Dallas company

also is cooperating with a group of state attorneys general, led by

Texas, that are investigating Google's ad practices.

Google has said the ad marketplace remains competitive, with the

search giant competing against companies large and small to power

digital advertising across the web.

It isn't uncommon for rival companies and industry customers to

speak with the Justice Department during an antitrust review, and

the department has spoken with many companies during its Google

probe, including Wall Street Journal publisher News Corp, a

longtime Google critic, and others such as Yelp, DuckDuckGo and

Oracle Corp.

AT&T in recent years has said it wants to take on Google and

Facebook Inc. in the fight for advertising dollars. It has built

its Xandr advertising division to leverage its wireless subscriber

base, its pay-TV customers and the stable of entertainment content

it acquired when it bought Time Warner in 2018.

Two years ago, it was AT&T that was embroiled with the

Justice Department, which filed suit against the company over its

proposed acquisition of Time Warner, alleging the merger would harm

competition in pay-TV markets. AT&T won the case and the merger

went ahead.

"We talk to advertisers. You're hard-pressed to find an

advertiser who says, I would like to spend more with Facebook and

Google," AT&T Chief Executive Randall Stephenson testified

during the 2018 trial.

In court, he and other AT&T officials touted their plans to

take on the tech giants in advertising as a counterargument to

DOJ's claims that the Time Warner transaction would be

anticompetitive.

The telecom and media company is also a major advertiser in its

own right, spending large sums to market everything from cellphone

plans to Warner Bros. movies, further complicating its relationship

with Google, the world's biggest digital advertising company.

AT&T was deeply critical of the Justice Department's

decision to challenge the Time Warner deal, and its motivation in

doing so, but the company's recent dialogue with the department

underscores the reality that adversaries often cooperate when their

interests align.

Google's practices in the ad-tech business are a key focus of

the Justice Department's investigation. In recent months, the

department has been posing increasingly detailed questions -- to

Google's rivals and executives inside the company itself -- about

how Google's third-party advertising business interacts with

publishers and advertisers, The Wall Street Journal reported last

month.

AT&T became a player in the digital ad market through its

2018 purchase of AppNexus, a technology provider for buyers and

sellers of online ads -- and a vocal Google critic. A few months

after closing the Time Warner deal, it formally launched Xandr as

the company's new advertising company, encompassing AppNexus and

other AT&T advertising assets. It acquired video ad-targeting

service Clypd a year later, strengthening a division that benefits

from its parent's access to more than 170 million mobile, broadband

and satellite-TV customer connections.

Xandr is pitching itself as a potential counterweight in the ad

marketplace to Google and Facebook. Xandr's revenue has continued

to grow but still accounts for only about 1% of its parent's

revenue, which topped $181 billion in 2019 before interdivision

eliminations.

AT&T and Xandr officials have voiced concerns about an array

of Google tactics that discourage advertisers from doing business

with Google's competitors, including rules that required

advertisers to use Google's tools for purchasing video ads on

YouTube, according to some of the people familiar with the

matter.

A Xandr executive was among the participants last year in a

Justice Department workshop examining competition issues in

television and digital advertising.

AT&T for years has maintained an uneasy relationship with

Alphabet. The tech giant's Google Fiber division has competed with

AT&T in some home-broadband markets, while its YouTube TV

service grabbed a large share of U.S. households swapping

traditional pay-TV service for online channels, hurting results at

AT&T's DirecTV.

But the two companies have struck alliances in other areas.

AT&T agreed to integrate Android technology into its TV set-top

boxes, giving Google's preferred operating system a foothold in a

still massive pay-TV customer base. AT&T's newest TV service

uses hardware with Google Assistant built into its remote

control.

The setup gives AT&T exclusive control of information about

what its customers are watching while they use its TV service, a

valuable input for its advertising business. At the same time,

Alphabet will get insights into AT&T subscribers' use of other

apps downloaded from its Google Play store.

Keach Hagey and John D. McKinnon contributed to this

article.

Write to Brent Kendall at brent.kendall@wsj.com and Drew

FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

March 07, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

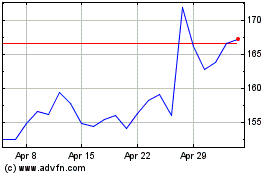

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Nov 2023 to Nov 2024