false

0001860657

0001860657

2024-05-17

2024-05-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 17, 2024

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

24

School Street, 2nd

Floor,

Boston,

MA |

|

02108 |

| (Address of principal executive offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported in

our Current Report on Form 8-K filed with the Securities and Exchange Commission on March 20, 2024, on March 19, 2024, Allarity Therapeutics,

Inc. (the “Company”), entered into an At-The-Market Issuance Sales Agreement (the “Agreement”) with Ascendiant

Capital Markets, LLC (the “Agent”), pursuant to which the Company may offer and sell, from time to time, through the Agent,

shares (the “Placement Shares”) of the Company’s common stock.

On May 17, 2024, the parties

to the Agreement entered into a First Comprehensive Amendment to the Agreement (the “Amendment”). The amount of the Placement

Shares that may be sold under and pursuant to the terms of the Amendment was increased to $30 million.

The foregoing descriptions

of the Amendment are qualified in their entirety by reference to the full text of such Amendment, a copy of which is attached hereto as

Exhibits 10.1, and is incorporated herein in its entirety by reference.

Item 7.01 Regulation FD Disclosure.

On

May 20, 2024, the Company, issued a press release announcing that it had received formal written notice from The Nasdaq Stock Market,

LLC, confirming that the Company has regained compliance with the minimum stockholders’ equity requirement as set forth in Listing

Rule 5550(b)(1).

A

copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ Thomas H. Jensen |

| |

|

Thomas H. Jensen |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: May 21, 2024 |

|

|

2

Exhibit 10.1

First Comprehensive Amendment

to

At-The-Market Issuance Sales Agreement

This First Comprehensive Amendment

to At-The-Market Issuance Sales Agreement (this “Amendment”) is entered into on May 17, 2024 (the “Effective

Date”) by and between Ascendiant Capital Markets, LLC (the “Agent”), and Allarity Therapeutics, Inc., a Delaware

corporation (the “Company”). Defined terms used herein have the definitions assigned to them in the At-The-Market Issuance

Sales Agreement between the parties dated March 19, 2024 (the “Sales Agreement”). Unless specifically amended or modified

herein, the other terms of the Sales Agreement remain in full force and effect, not amended or modified, as of the date hereof.

1. The

parties have entered into several verbal amendments to the Sales Agreement, each resulting in increases in the amount of Placement Shares

that may be sold thereunder. The parties desire to comprehensively document the amendments as set forth herein.

2. The

amount of Placement Shares that may be sold under and pursuant to the terms of the Sales Agreement is increased to $30,000,000.

3. Other

than as set forth herein, the terms and conditions of the Sales Agreement shall remain in full force and effect.

If the foregoing correctly

sets forth the understanding between the Company and the Agent, please so indicate in the space provided below for that purpose, whereupon

this letter will constitute a binding agreement between the Company and the Agent.

| |

Very truly yours, |

| |

|

| |

ALLARITY THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/ Thomas H. Jensen |

| |

Name: |

Thomas H. Jensen |

| |

Title: |

Chief Executive Officer |

ACCEPTED as of the date first-above written:

| |

ASCENDIANT CAPITAL MARKETS, LLC |

| |

|

| |

By: |

/s/ Bradley J. Wilhite |

| |

Name: |

Bradley J. Wilhite |

| |

Title: |

Managing Partner |

Exhibit 99.1

Allarity Therapeutics Regains Compliance with

Nasdaq’s Minimum Stockholders’ Equity Requirement

Boston (May 20, 2024)—Allarity Therapeutics, Inc. (“Allarity”

or the “Company”) (NASDAQ: ALLR), a Phase 2 clinical-stage pharmaceutical company dedicated to developing personalized cancer

treatments, today announced that it has received formal written notice from The Nasdaq Stock Market, LLC’s Office of General Counsel

(“Nasdaq”) that the Company has regained compliance with the minimum stockholders’ equity requirement as set forth in Nasdaq

Listing Rule 5550(b)(1) (the “Equity Rule”).

This confirmation follows the Company’s successful efforts to

cut operation costs and improve its balance sheet, including raising new equity and reducing outstanding liabilities. As a result, Allarity

Therapeutics now meets the stockholders’ equity requirement of at least $2.5 million.

Thomas Jensen, CEO of Allarity Therapeutics, stated, “We are

very pleased to announce that Allarity has regained compliance with Nasdaq’s equity requirement. During our panel hearing with Nasdaq

in February this year, we presented a strategic plan to achieve this goal, and I am satisfied to note that we have successfully delivered

on our commitments and received formal confirmation from Nasdaq. This allows us to continue focusing on our mission to advance our lead

asset, stenoparib, toward regulatory approval with the aim of bringing this promising therapy to patients in need of new treatment options

for advanced ovarian cancer.”

As part of the compliance confirmation, Allarity Therapeutics will

be subject to a mandatory panel monitor for one year.

As announced in an earlier press release, the Company intends to provide

a more comprehensive clinical update in the near future to share more details on the progress made following the early conclusion of its

Company’s Drug Response Predictor (DRP®) guided Phase 2 trial of stenoparib in advanced, recurrent ovarian cancer.

About the Drug Response Predictor – DRP® Companion

Diagnostic

Allarity uses its drug-specific DRP® to select those

patients who, by the gene expression signature of their cancer, are found to have a high likelihood of benefiting from a specific drug.

By screening patients before treatment, and only treating those patients with a sufficiently high, drug-specific DRP score, the therapeutic

benefit rate may be significantly increased. The DRP method builds on the comparison of sensitive vs. resistant human cancer cell lines,

including transcriptomic information from cell lines combined with clinical tumor biology filters and prior clinical trial outcomes. DRP

is based on messenger RNA expression profiles from patient biopsies. The DRP® platform has proven its ability to provide

a statistically significant prediction of the clinical outcome from drug treatment in cancer patients dozens of clinical studies (both

retrospective and prospective). The DRP platform, which can be used in all cancer types and is patented for more than 70 anti-cancer drugs,

has been extensively published in the peer-reviewed literature.

Allarity Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

Page 1 of 2

About Allarity Therapeutics

Allarity Therapeutics, Inc. (NASDAQ: ALLR) is a clinical-stage biopharmaceutical

company dedicated to developing personalized cancer treatments. The Company is focused on development of stenoparib, a novel PARP/Tankyrase

inhibitor for advanced ovarian cancer patients, using its DRP® companion diagnostic for patient selection in the ongoing

phase 2 clinical trial, NCT03878849. Allarity is headquartered in the U.S., with a research facility in Denmark, and is committed to addressing

significant unmet medical needs in cancer treatment. For more information, visit www.allarity.com.

Follow Allarity on Social Media

LinkedIn: https://www.linkedin.com/company/allaritytx/

X: https://twitter.com/allaritytx

Forward-Looking Statements

This press release contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide the Company’s current

expectations or forecasts of future events. The words “anticipates,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,”

“potential,” “predicts,” “project,” “should,” “would” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking

statements include, but are not limited to, the impact of recent financial and operational achievements on future quarterly performance,

potential future financings, and the anticipated regulatory progress of stenoparib following the early conclusion of our Phase 2 clinical

trial. Any forward-looking statements in this press release are based on management’s current expectations of future events and

are subject to multiple risks and uncertainties that could cause actual results to differ materially and adversely from those set forth

in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to the risks associated with

maintaining compliance with Nasdaq’s continued listing requirements, obtaining regulatory approval for stenoparib, and potential market

fluctuations that could impact our financial stability and the drug’s market entry. For a discussion of other risks and uncertainties,

and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements,

see the section entitled “Risk Factors” in our Form S-1 registration statement filed on April 17, 2024, and our Form 10-K

annual report on file with the Securities and Exchange Commission (the “SEC”), available at the SEC’s website at www.sec.gov,

and as well as discussions of potential risks, uncertainties and other important factors in the Company’s subsequent filings with

the SEC. All information in this press release is as of the date of the release, and the Company undertakes no duty to update this information

unless required by law.

###

Company Contact:

investorrelations@allarity.com

Media Contact:

Thomas Pedersen

Carrotize PR & Communications

+45 6062 9390

tsp@carrotize.com

Allarity Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

Page

2 of 2

v3.24.1.1.u2

Cover

|

May 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 17, 2024

|

| Entity File Number |

001-41160

|

| Entity Registrant Name |

ALLARITY THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001860657

|

| Entity Tax Identification Number |

87-2147982

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

24

School Street

|

| Entity Address, Address Line Two |

2nd

Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02108

|

| City Area Code |

401

|

| Local Phone Number |

426-4664

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

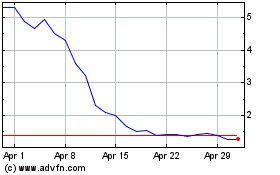

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From May 2024 to Jun 2024

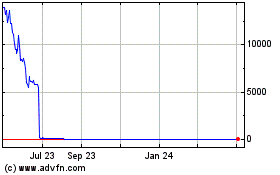

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Jun 2023 to Jun 2024