false000145920000014592002024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

ALARM.COM HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37461 | | 26-4247032 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 8281 Greensboro Drive | Suite 100 | Tysons | Virginia | | 22102 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (877) 389-4033

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | ALRM | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Alarm.com Holdings, Inc. (the "Company") issued a press release (the "Press Release") announcing its financial results for the quarter ended June 30, 2024. A copy of the Press Release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including the Press Release attached as Exhibit 99.1 hereto, is furnished under Item 2.02 and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company's filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Alarm.com Holdings, Inc. |

| | |

| Date: | August 8, 2024 | |

| | By: | /s/ Steve Valenzuela |

| | | Steve Valenzuela |

| | | Chief Financial Officer |

Alarm.com Reports Second Quarter 2024 Results

-- Second quarter SaaS and license revenue increased 11.0% to $155.9 million, compared to $140.4 million for the second quarter of 2023 --

-- Second quarter GAAP net income attributable to common stockholders increased 112.1% to $33.5 million, compared to $15.8 million for the second quarter of 2023 --

-- Second quarter non-GAAP adjusted EBITDA increased 17.8% to $42.8 million, compared to $36.4 million for the second quarter of 2023 --

TYSONS, VA., August 8, 2024 -- Alarm.com Holdings, Inc. (Nasdaq: ALRM), the leading platform for the intelligently connected property, today reported financial results for its second quarter ended June 30, 2024. Alarm.com also provided its financial outlook for SaaS and license revenue for the third quarter of 2024 and increased its guidance for revenue, non-GAAP adjusted EBITDA and non-GAAP adjusted net income attributable to common stockholders for the full year of 2024.

“We’re pleased to report solid results for the second quarter,” said Steve Trundle, CEO of Alarm.com. “We continued to drive growth in diverse areas of the business and to support our service provider partners with an expanding range of innovative solutions for both the residential and commercial markets.”

Second Quarter 2024 Financial Results as Compared to Second Quarter 2023

•SaaS and license revenue increased 11.0% to $155.9 million, compared to $140.4 million.

•Total revenue increased 4.4% to $233.8 million, compared to $223.9 million.

•GAAP net income attributable to common stockholders increased 112.1% to $33.5 million, or $0.62 per diluted share, compared to $15.8 million, or $0.30 per diluted share.

•Non-GAAP adjusted EBITDA(*) increased 17.8% to $42.8 million, compared to $36.4 million.

•Non-GAAP adjusted net income attributable to common stockholders(*) increased 20.2% to $32.0 million, or $0.58 per diluted share, compared to $26.6 million, or $0.49 per diluted share.

Balance Sheet and Cash Flow

•Total cash and cash equivalents increased to $1.1 billion as of June 30, 2024, compared to $697.0 million as of December 31, 2023. The increase in cash and cash equivalents was primarily due to the issuance of $500.0 million aggregate principal amount of 2.25% convertible senior notes due June 1, 2029 in a private placement to qualified institutional buyers, or the 2029 Notes, resulting in proceeds of $485.2 million, net of $14.8 million of transaction fees and other debt issuance costs.

◦Alarm.com used $63.1 million of the net proceeds from the 2029 Notes to pay the cost of privately negotiated capped call transactions to cover the number of shares of Alarm.com's common stock initially underlying the 2029 Notes. Alarm.com also used $75.0 million to repurchase 1,117,068 shares of its common stock at a per share price of $67.14 concurrently with the pricing of the 2029 Notes.

•For the six months ended June 30, 2024, cash flows from operations was $72.8 million, compared to $33.3 million for the six months ended June 30, 2023. For the six months ended June 30, 2024, non-GAAP free cash flow(*) was $67.8 million, compared to $29.9 million for the six months ended June 30, 2023.

(*) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

Recent Business Highlights

•EnergyHub Wins Grid Innovators Award: Grid Forward, an industry association, recognized EnergyHub’s significant contributions to accelerating grid innovation and modernization with a Grid Innovators Award. The selection panel highlighted EnergyHub for proving that flexible resources can operate at scale and for its deep integrations with various types of grid edge energy resources.

•Hosted First Regional Partner Event in Latin America: Alarm.com hosted service provider partners from across Latin America at its newly opened regional headquarters in Bogota, Colombia. Attendees learned about Alarm.com’s latest innovations from Dan Kerzner, Alarm.com’s President of Platforms Business, and about product offerings from Alarm.com subsidiaries OpenEye and EBS. The service providers in attendance represented over 15 markets across Latin America and the Caribbean.

•Shooter Detection Systems Earns Industry Recognition: Shooter Detection Systems’ Indoor Gunshot Detection System won a Secure Campus Award from the industry publication Campus Security Today. The solution was recognized for providing fast, accurate and cost-effective gunshot detection and real-time data sharing with emergency response services.

Financial Outlook

Alarm.com is providing its outlook for SaaS and license revenue for the third quarter of 2024 and increasing its guidance for revenue, non-GAAP adjusted EBITDA and non-GAAP adjusted net income attributable to common stockholders for the full year of 2024 based upon current management expectations.

For the third quarter of 2024:

•SaaS and license revenue is expected to be in the range of $157.3 million to $157.5 million.

For the full year 2024:

•SaaS and license revenue is expected to be in the range of $626.8 million to $627.2 million.

•Total revenue is expected to be in the range of $920.8 million to $931.2 million, which includes anticipated hardware and other revenue in the range of $294.0 million to $304.0 million.

•Non-GAAP adjusted EBITDA is expected to be in the range of $165.0 million to $167.0 million.

•Non-GAAP adjusted net income attributable to common stockholders is expected to be in the range of $119.5 million to $120.5 million, based on an estimated tax rate of 21.0%.

•Based on an expected 58.1 million weighted average diluted shares outstanding, non-GAAP adjusted net income attributable to common stockholders is expected to be $2.06 to $2.07 per diluted share.

The 2024 guidance provided above is forward-looking in nature. Actual results may differ materially. See the cautionary note regarding “Forward-Looking Statements” below. The guidance provided above is based on expectations as of the date of this press release and Alarm.com undertakes no obligation to update guidance after such date.

Conference Call and Webcast Information

Alarm.com will host a conference call to discuss its second quarter 2024 financial results and its outlook for the third quarter and full year 2024. A live audio webcast is scheduled to begin at 4:30 p.m. ET on August 8, 2024. To participate on the live call, analysts and investors should pre-register to obtain a dial-in number and individual passcode by visiting: https://register.vevent.com/register/BI293560b655e649819868f1050580376a. Alarm.com will also offer a live and archived webcast of the conference call accessible on Alarm.com’s Investor Relations website at http://investors.alarm.com. The information contained on any referenced website is not incorporated herein.

About Alarm.com Holdings, Inc.

Alarm.com is the leading platform for the intelligently connected property. Millions of consumers and businesses depend on Alarm.com's technology to manage and control their property from anywhere. Our platform integrates with a growing variety of Internet of Things devices through our apps and interfaces. Our security, video, access control, intelligent automation, energy management, and wellness solutions are available through our network of thousands of professional service providers in North America and around the globe. Alarm.com's common stock is traded on Nasdaq under the ticker symbol ALRM. For more information, please visit www.alarm.com.

Non-GAAP Financial Measures

To supplement our consolidated selected financial data presented on a basis consistent with GAAP, this press release contains certain non-GAAP financial measures, including non-GAAP adjusted EBITDA, non-GAAP adjusted income before income taxes, non-GAAP adjusted net income, non-GAAP adjusted income attributable to common stockholders before income taxes, non-GAAP adjusted net income attributable to common stockholders, non-GAAP adjusted net income attributable to common stockholders per share and non-GAAP free cash flow. We have included non-GAAP measures in this press release because they are financial, operating or liquidity measures used by our management to (i) understand and evaluate our core operating performance and trends and generate future operating plans, (ii) make strategic decisions regarding the allocation of capital and investments in initiatives that are focused on cultivating new markets for our solutions and (iii) provide useful information to management about the amount of cash generated by the business after necessary capital expenditures. We also use non-GAAP adjusted EBITDA as a performance measure under our executive bonus plan. Further, we believe that these non-GAAP measures of our financial results provide useful information to investors and others in understanding and evaluating our results of operations, business trends and financial condition. While we believe the use of these non-GAAP measures provides useful information to investors and management in analyzing our financial performance, non-GAAP measures have inherent limitations in that they do not reflect all of the amounts and transactions that are included in our financial statements prepared in accordance with GAAP. Non-GAAP measures do not serve as an alternative to GAAP nor do we consider our non-GAAP measures in isolation. Accordingly, we present non-GAAP financial measures only in connection with GAAP results. We urge investors to consider non-GAAP measures only in conjunction with our GAAP financials and to review the reconciliation of our non-GAAP financial measures to the most directly comparable GAAP financial measures, which are included in this press release.

We consider non-GAAP free cash flow to be a liquidity measure, which we define as cash flows from operating activities less purchases of property and equipment.

With respect to our expectations under “Financial Outlook” above, reconciliation of non-GAAP adjusted EBITDA and non-GAAP adjusted net income attributable to common stockholders guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures. In particular, non-ordinary course litigation expense, acquisition-related expense and tax windfall adjustments can have unpredictable fluctuations based on unforeseen activity that is out of our control and/or cannot reasonably be predicted. We expect the above charges to have a significant and potentially highly variable impact on our future GAAP financial results.

We exclude one or more of the following items from non-GAAP financial and operating measures:

Interest expense: We record interest expense primarily related to the January 2021 issuance of $500.0 million aggregate principal amount of 0% convertible senior notes due January 15, 2026, or the 2026 Notes, and the 2029 Notes. We exclude interest expense in calculating our non-GAAP adjusted EBITDA. For non-GAAP adjusted net income, non-GAAP adjusted net income attributable to common stockholders and non-GAAP adjusted net income attributable to common stockholders per share, basic and diluted, we do not exclude interest expense other than the interest expense related to the amortization of debt issuance costs related to the 2026 Notes and 2029 Notes as discussed below.

Interest income and certain activity within other expense, net: We exclude interest income as well as certain activity within other expense, net including gains, losses or impairments on investments without readily determinable fair values and other assets, gains on settlement fees as well as losses on the early extinguishment of the debt, when applicable, from our non-GAAP financial measures because we do not consider it part of our ongoing results of operations.

Provision for income taxes: We exclude the impact related to our provision for income taxes from our non-GAAP adjusted EBITDA calculation. We do not consider this tax adjustment to be part of our ongoing results of operations.

Amortization expense: GAAP requires that operating expenses include the amortization of acquired intangible assets, which principally include acquired customer relationships, developed technology and trade names. We exclude amortization of intangibles from our non-GAAP financial measures because we do not consider amortization expense when we evaluate our ongoing business operations, nor do we factor amortization expense into our evaluation of potential acquisitions, or our measurement of the performance of those acquisitions. We believe that the exclusion of amortization expense enables the comparison of our performance to other companies in our industry as other companies may be more or less acquisitive than we are and therefore, amortization expense may vary significantly by company based on their acquisition history. Although we exclude amortization of acquired intangible assets from our non-GAAP financial measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation.

Depreciation expense: We record depreciation primarily for investments in property and equipment. We exclude depreciation in calculating non-GAAP adjusted EBITDA because we do not consider depreciation when we evaluate our ongoing business operations. For non-GAAP adjusted net income, non-GAAP adjusted net income attributable to common stockholders and non-GAAP adjusted net income attributable to common stockholders per share, basic and diluted, we do not exclude depreciation.

Amortization of debt issuance costs: We record amortization of debt issuance costs related to the 2026 Notes and 2029 Notes as interest expense. We exclude amortization of debt issuance costs from our non-GAAP adjusted net income, non-GAAP adjusted net income attributable to common stockholders and non-GAAP adjusted net income attributable to common stockholders per share, basic and diluted, because we believe that the exclusion of this non-cash interest expense will provide for more meaningful information about our financial performance.

Stock-based compensation expense: We exclude stock-based compensation expense, which relates to restricted stock units and other forms of equity incentives primarily awarded to employees of Alarm.com, because they are non-cash charges that we do not consider when assessing the operating performance of our business. Additionally, the determination of stock-based compensation expense can be calculated using various methodologies and is dependent upon subjective assumptions and other factors that vary on a company-by-company basis. Therefore, we believe that excluding stock-based compensation expense from our non-GAAP financial measures improves the comparability of our results to the results of other companies in our industry.

Acquisition-related expense: Included in operating expenses are incremental costs directly related to business and asset acquisitions as well as changes in the fair value of contingent consideration liabilities, when applicable. We exclude acquisition-related expense from our non-GAAP financial measures because we believe that the exclusion of this expense allows us to better provide meaningful information about our operating performance, facilitates comparisons to our historical operating results, improves the comparability of our results to the results of other companies in our industry, and ultimately, we believe helps investors better understand the acquisition-related expense and the effects of the transaction on our results of operations.

Litigation expense: We exclude non-ordinary course litigation expense because we do not consider legal costs and settlement fees incurred and received in litigation and litigation-related matters of non-ordinary course lawsuits and other disputes, particularly costs incurred in ongoing intellectual property litigation, to be indicative of our core operating performance. We do not adjust for ordinary course legal expenses, including those expenses resulting from maintaining and enforcing our intellectual property portfolio and license agreements.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “designed,” “enable,” “ensure,” “expect,” “intend,” “will,” and other similar terms and phrases, and such forward-looking statements include, but are not limited to, the statements regarding the Company’s opportunities, positioning, the benefits of recently launched offerings, acquisitions and investments, and the Company’s guidance for the third quarter and full year 2024 described under “Financial Outlook” above and key assumptions related thereto. The events described in these forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements, including, but not limited to: impact of the global economic uncertainty and financial market conditions caused by significant worldwide events, including public health crises, geopolitical upheaval, such as Russia’s incursion into Ukraine and the conflict between Israel and regional adversaries, supply chain disruptions, interest rates and inflation (collectively, Macroeconomic Conditions); impact of Macroeconomic Conditions and their economic effects on demand for the Company's products; the reliability of the Company’s network operations centers; the Company’s ability to retain service provider partners and residential and commercial subscribers and sustain its growth rate; the Company’s ability to manage growth and execute on its business strategies; the effects of increased competition and evolving technologies; the Company’s ability to integrate acquired assets and businesses and to manage service provider partners, customers and employees; consumer demand for interactive security, video monitoring, intelligent automation, energy management and wellness solutions; the Company’s reliance on its service provider network to attract new customers and retain existing customers; the Company's dependence on its suppliers; the potential loss of any key supplier or the inability of a key supplier to deliver their products to us on time or at the contracted price; the reliability of the Company’s hardware and wireless network suppliers and enhanced United States tax, tariff, import/export restrictions, or other trade barriers, particularly tariffs from China; and other risks and uncertainties discussed in the “Risk Factors” section of the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 10, 2024 and other subsequent filings the Company makes with the Securities and Exchange Commission from time to time, including its Form 10-Q for the quarter ended June 30, 2024. In addition, the forward-looking statements included in this press release represent the Company’s views and expectations as of the date hereof and are based on information currently available to the Company. The Company anticipates that subsequent events and developments may cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Investor & Media Relations:

Matthew Zartman

Alarm.com

ir@alarm.com

ALARM.COM HOLDINGS, INC.

Consolidated Statements of Operations

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| SaaS and license revenue | $ | 155,927 | | | $ | 140,432 | | | $ | 306,271 | | | $ | 275,826 | |

| Hardware and other revenue | 77,880 | | | 83,443 | | | 150,819 | | | 157,765 | |

| Total revenue | 233,807 | | | 223,875 | | | 457,090 | | | 433,591 | |

Cost of revenue(1): | | | | | | | |

| Cost of SaaS and license revenue | 22,094 | | | 21,576 | | | 42,522 | | | 41,159 | |

| Cost of hardware and other revenue | 59,188 | | | 64,791 | | | 115,275 | | | 121,380 | |

| Total cost of revenue | 81,282 | | | 86,367 | | | 157,797 | | | 162,539 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 27,837 | | | 23,772 | | | 53,291 | | | 50,417 | |

| General and administrative | 26,104 | | | 28,799 | | | 55,400 | | | 57,298 | |

| Research and development | 65,730 | | | 60,918 | | | 131,686 | | | 122,826 | |

| Amortization and depreciation | 7,080 | | | 7,860 | | | 14,417 | | | 15,533 | |

| Total operating expenses | 126,751 | | | 121,349 | | | 254,794 | | | 246,074 | |

| Operating income | 25,774 | | | 16,159 | | | 44,499 | | | 24,978 | |

| Interest expense | (1,968) | | | (827) | | | (2,764) | | | (1,695) | |

| Interest income | 10,856 | | | 7,417 | | | 19,396 | | | 12,599 | |

| Other expense, net | (1,258) | | | (631) | | | (1,576) | | | (779) | |

| Income before income taxes | 33,404 | | | 22,118 | | | 59,555 | | | 35,103 | |

| Provision for income taxes | 884 | | | 6,507 | | | 3,631 | | | 5,285 | |

| Net income | 32,520 | | | 15,611 | | | 55,924 | | | 29,818 | |

| | | | | | | |

| Net loss attributable to redeemable noncontrolling interests | 991 | | | 188 | | | 1,182 | | | 397 | |

| | | | | | | |

| Net income attributable to common stockholders | $ | 33,511 | | | $ | 15,799 | | | $ | 57,106 | | | $ | 30,215 | |

| | | | | | | |

| Per share information attributable to common stockholders: | | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.67 | | | $ | 0.32 | | | $ | 1.14 | | | $ | 0.61 | |

| Diluted | $ | 0.62 | | | $ | 0.30 | | | $ | 1.06 | | | $ | 0.58 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 49,832,503 | | | 49,859,615 | | | 49,897,884 | | | 49,723,012 | |

| Diluted | 56,680,355 | | | 54,446,275 | | | 55,868,047 | | | 54,423,047 | |

| | | | | | | |

| ______________________________ | | | | |

(1) Exclusive of amortization and depreciation shown in operating expenses below. | | | | |

| | | | | | | |

| Stock-based compensation expense data: | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Cost of hardware and other revenue | $ | 1 | | | $ | — | | | $ | 2 | | | $ | — | |

| Sales and marketing | 724 | | | 892 | | | 1,479 | | | 1,924 | |

| General and administrative | 3,303 | | | 3,468 | | | 6,484 | | | 6,613 | |

| Research and development | 7,185 | | | 7,571 | | | 14,516 | | | 16,080 | |

| Total stock-based compensation expense | $ | 11,213 | | | $ | 11,931 | | | $ | 22,481 | | | $ | 24,617 | |

ALARM.COM HOLDINGS, INC.

Consolidated Balance Sheets

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,104,539 | | | $ | 696,983 | |

| | | |

Accounts receivable, net of allowance for credit losses of $3,766 and $3,864, and net of allowance for product returns of $2,608 and $2,279 as of June 30, 2024 and December 31, 2023, respectively | 123,551 | | | 130,626 | |

| Inventory | 79,582 | | | 96,140 | |

Other current assets, net | 35,074 | | | 33,031 | |

| Total current assets | 1,342,746 | | | 956,780 | |

| Property and equipment, net | 54,784 | | | 54,164 | |

| Intangible assets, net | 69,928 | | | 78,564 | |

| Goodwill | 154,356 | | | 154,498 | |

| Deferred tax assets | 172,421 | | | 131,815 | |

| Operating lease right-of-use assets | 22,025 | | | 24,242 | |

Other assets, net of allowance for credit losses of $1 and $5 as of June 30, 2024 and December 31, 2023, respectively | 38,987 | | | 39,500 | |

| Total assets | $ | 1,855,247 | | | $ | 1,439,563 | |

| Liabilities, redeemable noncontrolling interests and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable, accrued expenses and other current liabilities | $ | 96,075 | | | $ | 124,475 | |

| Accrued compensation | 24,920 | | | 28,626 | |

| Deferred revenue | 12,181 | | | 10,193 | |

| Operating lease liabilities | 12,039 | | | 12,043 | |

| Total current liabilities | 145,215 | | | 175,337 | |

| Deferred revenue | 13,726 | | | 12,692 | |

| Convertible senior notes, net | 980,492 | | | 493,515 | |

| | | |

| Operating lease liabilities | 18,098 | | | 20,468 | |

| Other liabilities | 14,314 | | | 12,697 | |

| Total liabilities | 1,171,845 | | | 714,709 | |

| | | |

| Redeemable noncontrolling interests | 37,933 | | | 36,308 | |

| Stockholders’ equity | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized; no shares issued and outstanding as of June 30, 2024 and December 31, 2023 | — | | | — | |

| Common stock, $0.01 par value, 300,000,000 shares authorized; 52,321,569 and 51,888,838 shares issued; and 49,183,838 and 49,868,175 shares outstanding as of June 30, 2024 and December 31, 2023, respectively | 523 | | | 519 | |

| Additional paid-in capital | 506,850 | | | 531,734 | |

| Treasury stock, at cost; 3,137,731 and 2,020,663 shares as of June 30, 2024 and December 31, 2023, respectively | (186,291) | | | (111,291) | |

| Accumulated other comprehensive income | 1,095 | | | 1,398 | |

| Retained earnings | 323,292 | | | 266,186 | |

| Total stockholders’ equity | 645,469 | | | 688,546 | |

| Total liabilities, redeemable noncontrolling interests and stockholders’ equity | $ | 1,855,247 | | | $ | 1,439,563 | |

ALARM.COM HOLDINGS, INC.

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| Cash flows from operating activities: | 2024 | | 2023 |

| Net income | $ | 55,924 | | | $ | 29,818 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| | | |

| Provision for credit losses on accounts receivable | 357 | | | 616 | |

| Reserve for product returns | 2,022 | | | 2,498 | |

| Provision for credit losses on notes receivable | 3,996 | | | — | |

| Inventory write-down | — | | | 1,181 | |

| Amortization on patents and tooling | 417 | | | 637 | |

| Amortization and depreciation | 14,417 | | | 15,533 | |

| Amortization of debt issuance costs | 1,811 | | | 1,570 | |

| Amortization of operating leases | 5,953 | | | 5,621 | |

| Deferred income taxes | (24,992) | | | (36,870) | |

| Change in fair value of contingent liability | 44 | | | 27 | |

| Stock-based compensation | 22,481 | | | 24,617 | |

| | | |

| | | |

| Loss from investment in unconsolidated entity | 23 | | | — | |

| | | |

| | | |

| Changes in operating assets and liabilities (net of business acquisitions): | | | |

| Accounts receivable | 4,668 | | | (583) | |

| Inventory | 16,484 | | | (523) | |

| Other current and non-current assets | 601 | | | 432 | |

| Accounts payable, accrued expenses and other current liabilities | (30,437) | | | (4,696) | |

| Deferred revenue | 3,022 | | | 3,105 | |

| Operating lease liabilities | (6,751) | | | (6,796) | |

| Other liabilities | 2,776 | | | (2,920) | |

| Cash flows from operating activities | 72,816 | | | 33,267 | |

| Cash flows used in investing activities: | | | |

| Business acquisition, net of cash acquired | — | | | (9,696) | |

| | | |

| | | |

| Additions to property and equipment | (5,058) | | | (3,393) | |

| | | |

| Issuances of notes receivable | (500) | | | (300) | |

| Receipt of payments on notes receivable | 26 | | | 28 | |

| Capitalized software development costs | (632) | | | (115) | |

| Purchase of investment in unconsolidated entities | (2,950) | | | (200) | |

| | | |

| Purchases of other intangible assets | (45) | | | (5,915) | |

| Cash flows used in investing activities | (9,159) | | | (19,591) | |

| Cash flows from / (used in) financing activities: | | | |

| | | |

| | | |

| Proceeds from issuance of convertible senior notes | 500,000 | | | — | |

| Payments of debt issuance costs | (13,946) | | | — | |

| Purchases of capped calls related to convertible senior notes | (63,050) | | | — | |

| Payments of deferred consideration for acquisitions | (4,569) | | | (1,655) | |

| Purchases of treasury stock, including transaction costs | (75,000) | | | (6,726) | |

| Payments of tax withholdings related to vesting of restricted stock units | (3,401) | | | — | |

| Purchases of redeemable noncontrolling interest | — | | | (832) | |

| Payments of acquired debt | — | | | (389) | |

| Issuances of common stock from equity-based plans | 6,734 | | | 1,513 | |

| Cash flows from / (used in) financing activities | 346,768 | | | (8,089) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (133) | | | (124) | |

| Net increase in cash, cash equivalents and restricted cash | 410,292 | | | 5,463 | |

| Cash, cash equivalents and restricted cash at beginning of the period | 701,079 | | | 622,879 | |

| Cash, cash equivalents and restricted cash at end of the period | $ | 1,111,371 | | | $ | 628,342 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | |

| Cash and cash equivalents | $ | 1,104,539 | | | $ | 627,041 | |

| | | |

| Restricted cash included in other current assets and other assets | 6,832 | | | 1,301 | |

| Total cash, cash equivalents and restricted cash | $ | 1,111,371 | | | $ | 628,342 | |

ALARM.COM HOLDINGS, INC.

Reconciliation of Non-GAAP Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP adjusted EBITDA: | | | | | | | |

| Net income | $ | 32,520 | | | $ | 15,611 | | | $ | 55,924 | | | $ | 29,818 | |

| Adjustments: | | | | | | | |

| Interest expense, interest income and certain activity within other expense, net | (8,888) | | | (6,590) | | | (16,632) | | | (10,904) | |

| Provision for income taxes | 884 | | | 6,507 | | | 3,631 | | | 5,285 | |

| Amortization and depreciation expense | 7,080 | | | 7,860 | | | 14,417 | | | 15,533 | |

| Stock-based compensation expense | 11,213 | | | 11,931 | | | 22,481 | | | 24,617 | |

| | | | | | | |

| Acquisition-related expense | 13 | | | (199) | | | 44 | | | 580 | |

| Litigation expense | 9 | | | 1,253 | | | 12 | | | 2,019 | |

| Total adjustments | 10,311 | | | 20,762 | | | 23,953 | | | 37,130 | |

| Non-GAAP adjusted EBITDA | $ | 42,831 | | | $ | 36,373 | | | $ | 79,877 | | | $ | 66,948 | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP adjusted net income: | | | | | | | |

| Net income, as reported | $ | 32,520 | | | $ | 15,611 | | | $ | 55,924 | | | $ | 29,818 | |

| Provision for income taxes | 884 | | | 6,507 | | | 3,631 | | | 5,285 | |

| Income before income taxes | 33,404 | | | 22,118 | | | 59,555 | | | 35,103 | |

| Adjustments: | | | | | | | |

| Less: interest income and certain activity within other expense, net | (10,856) | | | (7,417) | | | (19,396) | | | (12,599) | |

| Amortization expense | 4,718 | | | 5,048 | | | 9,401 | | | 9,886 | |

| Amortization of debt issuance costs | 1,021 | | | 786 | | | 1,811 | | | 1,570 | |

| Stock-based compensation expense | 11,213 | | | 11,931 | | | 22,481 | | | 24,617 | |

| | | | | | | |

| Acquisition-related expense | 13 | | | (199) | | | 44 | | | 580 | |

| Litigation expense | 9 | | | 1,253 | | | 12 | | | 2,019 | |

| Non-GAAP adjusted income before income taxes | 39,522 | | | 33,520 | | | 73,908 | | | 61,176 | |

Income taxes 1 | (8,300) | | | (7,039) | | | (15,521) | | | (12,847) | |

| Non-GAAP adjusted net income | $ | 31,222 | | | $ | 26,481 | | | $ | 58,387 | | | $ | 48,329 | |

1 Income taxes are calculated using a rate of 21.0% for each of the three and six months ended June 30, 2024 and 2023. The 21.0% effective tax rate for each of the three and six months ended June 30, 2024 and 2023 excludes the income tax effect on the non-GAAP adjustments and reflects the estimated long-term corporate tax rate.

ALARM.COM HOLDINGS, INC.

Reconciliation of Non-GAAP Measures - continued

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP adjusted net income attributable to common stockholders: | | | | | | | |

| Net income attributable to common stockholders, as reported | $ | 33,511 | | | $ | 15,799 | | | $ | 57,106 | | | $ | 30,215 | |

| Provision for income taxes | 884 | | | 6,507 | | | 3,631 | | | 5,285 | |

| Income attributable to common stockholders before income taxes | 34,395 | | | 22,306 | | | 60,737 | | | 35,500 | |

| Adjustments: | | | | | | | |

| Less: interest income and certain activity within other expense, net | (10,856) | | | (7,417) | | | (19,396) | | | (12,599) | |

| Amortization expense | 4,718 | | | 5,048 | | | 9,401 | | | 9,886 | |

| Amortization of debt issuance costs | 1,021 | | | 786 | | | 1,811 | | | 1,570 | |

| Stock-based compensation expense | 11,213 | | | 11,931 | | | 22,481 | | | 24,617 | |

| | | | | | | |

| Acquisition-related expense | 13 | | | (199) | | | 44 | | | 580 | |

| Litigation expense | 9 | | | 1,253 | | | 12 | | | 2,019 | |

| Non-GAAP adjusted income attributable to common stockholders before income taxes | 40,513 | | | 33,708 | | | 75,090 | | | 61,573 | |

Income taxes 1 | (8,508) | | | (7,078) | | | (15,769) | | | (12,930) | |

| Non-GAAP adjusted net income attributable to common stockholders | $ | 32,005 | | | $ | 26,630 | | | $ | 59,321 | | | $ | 48,643 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP adjusted net income attributable to common stockholders per share: | | | | | | | |

| Net income attributable to common stockholders per share - basic, as reported | $ | 0.67 | | | $ | 0.32 | | | $ | 1.14 | | | $ | 0.61 | |

| Provision for income taxes | 0.02 | | | 0.13 | | | 0.07 | | | 0.11 | |

| Income attributable to common stockholders before income taxes | 0.69 | | | 0.45 | | | 1.21 | | | 0.72 | |

| Adjustments: | | | | | | | |

| Less: interest income and certain activity within other expense, net | (0.22) | | | (0.15) | | | (0.39) | | | (0.25) | |

| Amortization expense | 0.09 | | | 0.10 | | | 0.19 | | | 0.20 | |

| Amortization of debt issuance costs | 0.02 | | | 0.02 | | | 0.04 | | | 0.03 | |

| Stock-based compensation expense | 0.23 | | | 0.24 | | | 0.46 | | | 0.50 | |

| | | | | | | |

| Acquisition-related expense | — | | | — | | | — | | | 0.01 | |

| Litigation expense | — | | | 0.03 | | | — | | | 0.04 | |

| Non-GAAP adjusted income attributable to common stockholders before income taxes | 0.81 | | | 0.69 | | | 1.51 | | | 1.25 | |

Income taxes 1 | (0.17) | | | (0.15) | | | (0.32) | | | (0.27) | |

| Non-GAAP adjusted net income attributable to common stockholders per share - basic | $ | 0.64 | | | $ | 0.54 | | | $ | 1.19 | | | $ | 0.98 | |

| Non-GAAP adjusted net income attributable to common stockholders per share - diluted | $ | 0.58 | | | $ | 0.49 | | | $ | 1.07 | | | $ | 0.89 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic, as reported | 49,832,503 | | | 49,859,615 | | | 49,897,884 | | | 49,723,012 | |

| Diluted, as reported | 56,680,355 | | | 54,446,275 | | | 55,868,047 | | | 54,423,047 | |

1 Income taxes are calculated using a rate of 21.0% for each of the three and six months ended June 30, 2024 and 2023. The 21.0% effective tax rate for each of the three and six months ended June 30, 2024 and 2023 excludes the income tax effect on the non-GAAP adjustments and reflects the estimated long-term corporate tax rate.

ALARM.COM HOLDINGS, INC.

Reconciliation of Non-GAAP Measures - continued

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP free cash flow: | | | | | | | |

| Cash flows from operating activities | $ | 22,963 | | | $ | 36,788 | | | $ | 72,816 | | | $ | 33,267 | |

| Additions to property and equipment | (1,992) | | | (995) | | | (5,058) | | | (3,393) | |

| Non-GAAP free cash flow | $ | 20,971 | | | $ | 35,793 | | | $ | 67,758 | | | $ | 29,874 | |

| | | | | | | |

Cover Page

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

ALARM.COM HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37461

|

| Entity Tax Identification Number |

26-4247032

|

| Entity Address, Address Line One |

8281 Greensboro Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Tysons

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22102

|

| City Area Code |

877

|

| Local Phone Number |

389-4033

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

ALRM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001459200

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

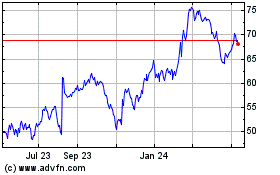

Alarm com (NASDAQ:ALRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

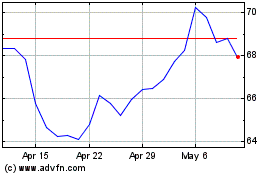

Alarm com (NASDAQ:ALRM)

Historical Stock Chart

From Nov 2023 to Nov 2024