Agenus Provides Corporate Update and Second Quarter 2022 Financial Report

August 09 2022 - 8:00AM

Agenus Inc. (NASDAQ: AGEN), an immuno-oncology company with an

extensive pipeline of therapeutics designed to activate the immune

response to cancers and infections, today provided a corporate

update and reported financial results for the second quarter of

2022.

“Agenus’ presentation of botensilimab/balstilimab combination

data in MSS colorectal cancer at ESMO GI was received with great

enthusiasm by many thought leaders and clinicians in the fields of

GI cancers and immuno-oncology,” said Garo Armen, PhD, Chairman and

Chief Executive Officer of Agenus. “Treatment-resistant MSS CRC

patients lack effective options, with the standard of care offering

only a 1-2% response rate and an expected median survival ranging

from 6 to 7 months. Our results could potentially change the

treatment paradigm and offer hope to a significant number of

patients with limited options. We are working closely with

regulators and advisors to expedite botensilimab’s development in

pursuit of global registrations across multiple cancers.”

Botensilimab/balstilimab data to drive rapid enrollment

in randomized trials

- Combination delivered 24% overall response rate (ORR) and 73%

disease control rate (DCR) in 41 heavily pretreated MSS CRC

patients at ESMO GI.

- Treated population verified to be unlikely to respond – low

mutational burden, no prior IO responses, largely PD-L1

negative.

- Safety profile manageable, with no grade 4 or 5 toxicities and

no hypophysitis.

- Strong enthusiasm generated amongst many leading oncologists,

given strong data and high unmet need.

- Agenus initiating Phase 2 randomized trials in MSS colorectal

cancer, melanoma, and pancreatic cancer later this year.

Clinical-stage pipeline continues to

advance

- Company to present additional Phase 1b botensilimab expansion

cohort data with longer follow-up at a major medical conference

later this year.

- Dosing underway in Phase 1 study to evaluate AGEN1571 as a

monotherapy and in combination with botensilimab and/or balstilimab

in participants with advanced solid tumors.

- Enrollment continues in Agenus directed trials, such as a

combination study involving AGEN2373 (CD137 agonist) and

botensilimab.

Company ends Q2 in a strong financial

position

- $238 million in net cash and short-term investments reflects

prudent prioritization of key programs along with capital

management strategy.

- $25 million of QS-21 STIMULON™ sales-based milestone achieved,

payments to be received in the second half of 2022 based on

royalties owed on Shingrix sales1.

- Additional potential milestone payments and business

development or financing activities may significantly enhance cash

position.

Second Quarter 2022 Financial Results

We ended our second quarter 2022 with a cash and short-term

investment balance of $238 million as compared to $263 million and

$307 million on March 31, 2022, and December 31, 2021,

respectively.

We recognized revenue of $21 million for the second quarter

ended June 30, 2022, which represents an increase of $10 million

from the $11 million reported for the same period in 2021. Revenue

for the six months ended June 30, 2022, was $47 million, an

increase of $25 million from the same period in 2021. Amounts

include revenue under our collaboration agreements, in 2022

milestones earned, and revenue related to non-cash royalties

earned. Non-cash royalties represent royalties from Shingrix sales

which are passed to HCR under our royalty purchase agreement.

For the second quarter ended June 30, 2022, our cash used in

operations was $43 million compared to $56 million for the same

period in 2021. Our net loss for the quarter ended June 30, 2022,

was $49 million or $0.17 per share compared a net loss of $84

million or $0.37 per share for the quarter ended June 30, 2021.

Non-cash operating expenses for the second quarter ended June 30,

2022, were $19 million compared to $30 million for the second

quarter of 2021.

Our cash used in operations for the six months ended June 30,

2022, was $96 million with a net loss of $100 million or $0.35 per

share compared to cash used in operations of $98 million and a net

loss for the same period in 2021 of $138 million or $0.65 per

share.

|

Select Financial Information |

|

|

|

|

|

(in thousands, except per share data) |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

December 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

$ |

238,330 |

|

|

$ |

306,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues, royalty sales milestone |

|

$ |

17,316 |

|

|

$ |

- |

|

|

$ |

17,316 |

|

|

$ |

- |

|

|

Revenues, non-cash royalty |

|

|

144 |

|

|

|

7,826 |

|

|

|

17,778 |

|

|

|

16,310 |

|

|

Revenues, research and development |

|

|

1,907 |

|

|

|

1,708 |

|

|

|

8,647 |

|

|

|

3,279 |

|

|

Revenues, other |

|

|

1,559 |

|

|

|

1,196 |

|

|

|

3,126 |

|

|

|

2,860 |

|

|

Total Revenue |

|

|

20,926 |

|

|

|

10,730 |

|

|

|

46,867 |

|

|

|

22,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

44,960 |

|

|

|

45,508 |

|

|

|

87,404 |

|

|

|

82,184 |

|

|

General and administrative expenses |

|

|

18,914 |

|

|

|

16,650 |

|

|

|

37,866 |

|

|

|

33,003 |

|

|

Cost of service revenue |

|

|

2,024 |

|

|

|

667 |

|

|

|

2,567 |

|

|

|

1,772 |

|

|

Other (income) expense |

|

|

(8,966 |

) |

|

|

1,210 |

|

|

|

(8,776 |

) |

|

|

(1,369 |

) |

|

Non-cash interest expense |

|

|

13,636 |

|

|

|

16,386 |

|

|

|

28,588 |

|

|

|

31,997 |

|

|

Non-cash contingent consideration fair value adjustment |

|

(407 |

) |

|

|

14,300 |

|

|

|

(943 |

) |

|

|

13,256 |

|

|

Net loss |

|

$ |

(49,235 |

) |

|

$ |

(83,991 |

) |

|

$ |

(99,839 |

) |

|

$ |

(138,394 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to Agenus Inc. common

stockholders: |

$ |

0.17 |

|

|

$ |

(0.37 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.65 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash used in operations |

|

$ |

(43,453 |

) |

|

$ |

(55,557 |

) |

|

$ |

(95,844 |

) |

|

$ |

(98,301 |

) |

|

Non-cash operating expenses |

|

$ |

19,407 |

|

|

$ |

30,171 |

|

|

$ |

22,842 |

|

|

$ |

41,984 |

|

| |

|

|

|

|

|

|

|

|

Conference CallTuesday, August 9, 2022, 8:30am

ETDial-in numbers: (646) 307-1963 (US-NY) or (800) 715-9871 (US

& CA)Event ID: 6683845

WebcastA live webcast and replay of the

conference call will be accessible from the Events &

Presentations page of the Company’s website at

https://investor.agenusbio.com/events-and-presentations and via

https://edge.media-server.com/mmc/p/xh3u6boi.

About AgenusAgenus is a clinical-stage

immuno-oncology company focused on the discovery and development of

therapies that engage the body's immune system to fight cancer and

infections. The Company's vision is to expand the patient

populations benefiting from cancer immunotherapy by pursuing

combination approaches that leverage a broad repertoire of antibody

therapeutics, adoptive cell therapies (through its subsidiary MiNK

Therapeutics), adjuvants (through its subsidiary SaponiQx), and

proprietary cancer vaccine platforms. The Company is equipped with

a suite of antibody discovery platforms and a state-of-the-art GMP

manufacturing facility with the capacity to support clinical

programs. Agenus is headquartered in Lexington, MA. For more

information, please visit www.agenusbio.com and our Twitter handle

@agenus_bio. Information that may be important to investors will be

routinely posted on our website and Twitter.

Forward-Looking StatementsThis press release

contains forward-looking statements that are made pursuant to the

safe harbor provisions of the federal securities laws, including

statements relating to the use of therapeutic candidates

botensilimab, balstilimab, AGEN1571, and AGEN2373, and QS-21

STIMULON, for instance, statements regarding therapeutic benefit

and efficacy, mechanism of action (including validation of

mechanism of action), potency, durability, and safety profile of

the therapeutic candidates, both alone and in combination with each

other and/or other agents (e.g., botensilimab in combination with

balstilimab); future clinical and regulatory development plans and

commercialization plans for botensilimab, balstilimab, AGEN1571,

and AGEN2373, and QS-21 STIMULON; and any other statements

containing the words "may," "believes," "expects," "anticipates,"

"hopes," "intends," "plans," "will" and similar expressions are

intended to identify forward-looking statements. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially. These risks

and uncertainties include, among others, the factors described

under the Risk Factors section of our most recent Quarterly Report

on Form 10-Q or Annual Report on Form 10-K filed with the

Securities and Exchange Commission. Agenus cautions investors not

to place considerable reliance on the forward-looking statements

contained in this release. These statements speak only as of the

date of this press release, and Agenus undertakes no obligation to

update or revise the statements, other than to the extent required

by law. All forward-looking statements are expressly qualified in

their entirety by this cautionary statement.

Contact

Ethan Lovell

Chief External Affairs & Communications Officer

339-927-1763

ethan.lovell@agenusbio.com

1 Shingrix trade-mark is owned by or licensed to the GSK group

of companies. QS-21 STIMULON trade-mark is owned by Agenus,

Inc.

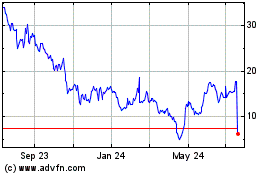

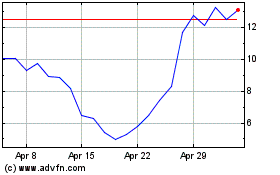

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Jul 2023 to Jul 2024